The Ins and outs of Estate Planning 2015

winter 2015 | ISSUE 1 | VOLUME 12 P E R S P E C T I VE what’s the next move for energy equities? Market Commentary deflation or not? Focus on Fiduciary the ins and outs of estate planning 2015 On Investing on the way to better outcomes in this edition MESSAGE FROM THE PRESIDENT Elizabeth F. Lunney B.Comm., CFA President and Chief Executive Officer Portfolio Manager Roland Chalupka B.Comm., CFP, CFA Chief Investment Officer Thomas E. Junkin TEP Senior Vice President Personal Trust Services Sajjad Hussain B.Comm., CFP Vice President Private Wealth Counsellor Giles D. Marshall B.Sc., FCSI, CIMA Vice President Portfolio Manager Stephen E. Reichenfeld B.Sc., CFP, PFP Vice President Private Wealth Counsellor c ontri b u tors Passing Time Over the holidays, I took time to sit by a lovely fire, enjoy a pot of tea and read David Bissett’s business biography, Fully Invested–A Life in the Markets. It is a heartwarming insight into the man, his strength of conviction with respect to business ethics, his consistent application of long-term, proven investment principles, and his commitment to giving back to community. It prompted me to reflect on the great impact David has had on the lives of so many clients who remain loyal to his investment philosophy and teachings. We recently circulated an email update entitled Deciding to be Different. The accompanying video spoke to the origins of Fiduciary Trust Canada, which began with over 30 years of history helping individuals and families meet their wealth management objectives, and our decision to include trust and estate capabilities 10 years ago. Viewed through the lens of David’s career, ours was not so much a decision to be completely different, but rather a choice to build on the foundation of private wealth management as practised at the turn of the century, when independent Canadian trust companies helped steward the wealth of prominent Canadian families from one generation to the next. It is a proud vocation that we look to carry forward. The new year has brought some comings and goings for us. We are pleased to introduce Diane Tom, who joined the Toronto office in early December as Vice President, Personal Trust Services. Diane graduated from the Faculty of Law, Queen’s University in 2001, articled with the Ontario Office of the Public Guardian and Trustee, and has since built a wealth of knowledge and experience at Canada’s largest trust company. We welcome Diane to the team and look forward to introducing her to clients and colleagues in early 2015. Later in this Perspective, you will see Leaving Home penned by Stephen Reichenfeld, Vice President and Private Wealth Counsellor. As it turns out, Stephen speaks from first-hand knowledge when he addresses the challenges of travelling or moving abroad. Stephen has made the difficult, but exciting decision to retire and embark on a series of sailing and travel adventures in 2015. We wish him safe passage and look forward to his updates from exotic locales. As you read this note, the new year will have taken a firm hold. Our hope for your family and you is a year of opportunities, adventures large and small, and the fortitude to answer challenges along the way. In a shrinking world punctuated by complex and volatile themes, some things remain simple and steadfast. One is our commitment to you. We look forward to our conversations throughout 2015. Scott Guitard B.Admin., CFA Vice President Portfolio Manager Kellie A. MacIntyre B.A., TEP Personal Trust Officer Personal Trust Services Diane Tom LL.B. Vice President Personal Trust Services The information presented herein is considered reliable at the present time; however, we do not represent that it is accurate or complete, or that it should be relied upon as such. Perspective is intended to provide information and commentary to Fiduciary Trust Canada clients. Articles should not be relied upon for investment, tax or legal advice and readers should not act on the basis of this information without first consulting their wealth counsellor, financial planner, tax advisor or lawyer who will provide advice with respect to the reader’s specific situation. Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Please read the Franklin Templeton Investments prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Franklin Bissett Investment Management is part of Franklin Templeton Investments Corp. (“FTIC”). Fiduciary Trust Canada is a business name used by Fiduciary Trust Company of Canada. Fiduciary Trust Company of Canada and FTC Investor Services are wholly owned subsidiaries of FTIC. Franklin Equity Group is part of Franklin Resources, Inc. (“FRI”), which operates globally as Franklin Templeton Investments. FTIC and Templeton Investment Counsel, LLC are indirect, wholly owned subsidiaries of FRI. market c ommentar y Deflation or Not? By Roland Chalupka Deflation is a term that causes unease, regardless of whether or not you can pinpoint its meaning. Whatever it is, it does not sound good. Despite deflation having been a regular part of global financial commentary for some time, a nagging question remains: Are we truly headed towards a time of persistently falling prices, or are we watching something else unfold? As investors, we think about the possible effects of either scenario on various asset classes in a diversified portfolio. A Word About Deflation In general, deflation is the falling price of goods and services usually associated with deteriorating corporate profits and high unemployment. It is dreaded because: a)Deflation shrinks the ability of financial intermediaries (i.e., banks) to create credit and increase the real value of credit previously granted to borrowers. b) It can become a vicious circle where consumers delay spending, anticipating increasingly cheaper goods and services. Business profits drop, which translates into reduced wages and the circle goes round and round. The 1930s was clearly a deflationary period. It is important to note deflation is not the same as falling inflation. A falling rate of inflation is known as disinflation and represents an environment where prices rise more slowly. Investors have been in a disinflationary environment for many years and it has been very supportive of both equity and fixed income markets. According to the Facts Looking at how recent developments measure up against the deflation definition produces interesting results. • Rising employment: Global labour markets are improving based on the number of job openings and a decrease in part-time workers. Even the Eurozone seems to be stabilizing and showing marginal improvement. • Contracting money supply: Since 2008, central bankers worldwide have made avoiding a credit contraction a top priority and continue to encourage banks to lend. The U.S. Federal Reserve’s tone remains dovish, while the European Central Bank continues to assure market participants of its “whatever it takes” initiative. The Bank of China has already introduced a couple of easing rounds, contributing to a 36.8% rise in the Shanghai Composite in the fourth quarter of 2014.1 •Growing economic activity: The world’s largest economies, the United States and China, are growing at a better than expected pace and consumer incomes in those markets are expanding. Also, recent declines in energy prices are expected to further expand consumer purchasing power in the near term. Little of the above information supports a strong deflation theme. In addition, recent economic data points more in the direction of disinflation. For instance, highlights from around the world show that as of September 30, 2014, India’s Consumer Price Index (CPI) was 2.4%, the United States and China showed 1.7% and 1.6% CPI growth, respectively, while the Euro block posted 0.3% annual inflation.2 The numbers, weaker by historical measures, nonetheless confirm rising prices for goods and services. Our View With current information in hand, we believe investors are facing a prolonged disinflationary environment as central bankers around the world manage the economic slack in certain large economies, such as the Eurozone and Japan. Guided by this view, we think a balanced portfolio, reflecting your personal circumstances, will work to protect capital while delivering strong, risk-adjusted returns. Allocating assets for proper sector/geographical diversification is also important to generating a sustainable return on invested capital as the economic fortunes of various regions diverge. 1. Factset Database, December 8, 2014. 2. Bloomberg Database, January 2, 2015. Fiduciary Trust Canada 1 asset allo c ation strateg y Investing in the Upside By Elizabeth F. Lunney Equity markets, which enjoyed relative calm and satisfactory appreciation for the first three quarters of 2014, did an aboutface in Q4. The crude oil surplus and ongoing slow, global growth prompted a steady decline in world oil prices and a renewed round of deflationary pressures in some parts of the world. Depending on your perspective, this development has been viewed with trepidation or a renewed call for optimism. We believe: • In time, energy supplies will self-correct as producers temper capital spending, contributing to a view that individual stock prices may have overshot on the downside. • In light of energy sector weakness and an overextended housing market, the Bank of Canada will likely hold on rate increases. • The pace of global growth, US$ appreciation and the recovering U.S. labour market will determine the path and timing of U.S. Federal Reserve rate increases. • Canadian/U.S. exchange rate weakness is benefiting portfolios diversified beyond domestic markets. • Europe appears set to join Japan and China in attempting to reflate their respective economies, while the United States appears poised for ongoing growth. Investment strategy For some time, we have favoured a neutral fixed income/ equity weighting in client portfolios. Likewise, we have preferred U.S. and International equity markets over Canada. This strategy began to pay off in fall 2014 and continued through year-end. In the early part of 2015, we will move to reverse limited tax-loss selling trades executed in the final weeks of 2014. We expect to take advantage of equity market weakness, Active Asset Mix Strategy (%) Versus Balanced Growth Benchmark Portfolio Fixed Income 0.0% U.S. Equity 1.0% Global Equity 1.0% key performance drivers Our more cautionary portfolio stance proved fruitful in Q4 2014. On balance, portfolio returns remained positive through the period and generated strong, single-digit performance for the year. Asset allocation decisions across balanced portfolios added slightly to relative returns due primarily to our long-standing underweight position in Canadian equities. Looking at specific markets, despite some underperformance at the underlying portfolio manager level, U.S. equity performance was double that of Canadian markets. Canadian and International holdings were positive contributors to overall portfolio returns, outperforming their respective indices. Fixed income performance surprised on the upside as yields pressed downwards despite lingering concerns over an eventual rise in U.S. central bank interest rates. Amid strong absolute performance, the fixed income asset class saw some negative relative performance due to our more defensive, shorter duration holdings. Allocation Process • This next phase in the bull equity market will be more volatile and return expectations moderate as compared to recent years. rebalancing positions and averaging down in oversold markets and sectors. Canadian Equity -2.0% Our investment strategy, including asset allocation decisions, is the result of ongoing discussion within our Private Client Investment Strategy Committee. We begin this process by making strategic investment decisions against an internal benchmark, for example the Balanced Growth Benchmark Portfolio, which is based on a neutral asset mix, a balanced portfolio and near-perfect market conditions.1 The difference between our investment strategy and the benchmark portfolio reflects our active commitment to effectively manage risk and generate superior long-term returns. In updating our investment strategy, we review our investment portfolio and benchmark and complete any required trades. Market Performance (%) Q4 2014 1-Year 5-Year S&P/TSX Composite Index -1.5 10.6 7.5 S&P 500 Index (CDN$) 8.7 24.2 17.7 MSCI EAFE Index (CDN$) 0.0 4.4 7.8 FTSE TMX Canada Universe Bond Index 2.7 8.8 5.5 -8.6 -2.0 CDN$ Versus US$ -4.0 -3.0 -2.0 -1.0 0.0 1.0 2.0 3.0 4.0 1. The Balanced Growth Benchmark Portfolio is comprised of 40% fixed income assets and 60% equity assets. fiduciarytrust.ca 2www.fiduciarytrust.ca 5.0 -3.7 The above Index reviews are calculated from external sources and, where applicable, reflect total returns. All figures are in Canadian dollars and are as of December 31, 2014. on investing On the Way to Better Outcomes How do you boost consumers’ knowledge of financial products and services so as to help improve decision making? Giles Marshall recently participated in a panel discussion focusing on that issue. Hosted at the Investment Funds Institute of Canada (IFIC) annual meeting, panellists included Jane Rooney, Financial Literacy Leader, Financial Consumer Agency of Canada; Tom Hamza, President, Investor Education Fund; and moderator Jan Dymond, Director, Public Affairs, IFIC. We asked Giles for his thoughts on the themes facing investors and the industry. Q: With senior members of Canada’s investment management community in the audience, why a session called “Behavioural Economics—Nudge, Push, or Control—Response Options in the Canadian Context?” Giles Marshall: This discussion is a natural part of a long-term conversation about protecting consumers of financial products and services. Private sector firms have spent decades analyzing investor behaviour, including the difference between stated preferences and intentions, and actual behaviour. Recently, Canadian public policy-makers have taken an interest in behavioural economics and how key findings might be applied to effect changes in consumer decisions— changes deemed to be in the public interest. For example, today the impact of behavioural biases—such as loss aversion, overconfidence, herding, etc.—on decision making is widely acknowledged. In turn, financial regulators are asking: Is the current full disclosure of material facts, plus financial education sufficient to overcome systematic decision-making biases and errors? Q: What do you think? Giles Marshall: The disclosure model says that if you give people the information they need via a prospectus, offering memorandum, relationship disclosure document, etc., then they will be able to make an informed decision. Anyone who has ever read such documents knows they can be intimidating given the necessary detail and technical nature of the material. As a result, relatively few investors review them in any depth. The disclosure model, despite being the right thing to do, ironically runs the risk of being both overly informative and insufficient at the same time. Regulators can enforce information disclosure, but they cannot enforce consumer education. Some consumers do educate themselves, while others rely on professional financial advisors. However, for various reasons a great number of consumers do not develop an understanding of financial services products. I believe education is important, should be presented in an engaging manner, and be available to people starting at a relatively early age. Canada is the first OECD country to appoint a Financial Literacy Leader in Jane Rooney, a co-panellist at the IFIC conference. Q: Is it fair to say that disclosure and education may be helpful but not sufficient? Giles Marshall: Clearly the limitations of the current approach are a concern. In many developed countries, financial services regulators are looking at how “nudging” consumers towards making sound decisions relating to items such as banking and investing might work.1 Some behavioural economics findings could be useful. Framing choices or questions in certain ways, for example, may well have a positive impact on consumer outcomes and public policy. Practically speaking, we have a number of antidotes to behavioural biases in place. Most consumers, certainly long-term investors, can benefit from working with a qualified financial advisor. Preparing and implementing an Investment Policy Statement, as well as the process of rebalancing a portfolio once or twice a year, can be an effective way of overcoming various biases such as herding, anchoring and loss aversion. Such measures have always been part of how we work with clients. 1. The term “nudge” is taken from the influential book Nudge by Richard Thaler and Cass Sunstein, professors of economics and law, respectively, which defends the idea that consumers may need to be gently pushed (“Libertarian Paternalism” as they call it) into making sound decisions in certain important areas of life. Fiduciary Trust Canada 3 the fid u c iar y ro u ndta b le What’s the Next Move for Energy Equities? Oil is a big, complex story. How does this latest chapter in energy sector investing look from a bottom-up perspective? For answers, we look to experts with long-term experience. Fred Fromm in California, along with Les Stelmach and Nancy Grant in Calgary, share their views on manoeuvring through this “time” in the oil patch. Les E. Stelmach CFA Senior Vice President Portfolio Manager Franklin Bissett Investment Management Frederick G. Fromm CFA Vice President Portfolio Manager/ Research Analyst Franklin Equity Group Nancy J. Grant CFA Consultant to Fiduciary Trust Company of Canada Q: What is your sense of the current environment? Les Stelmach: No one can predict the exact path of oil prices, how long this will last, or when markets will begin recovering. But a few things are clear. The downturn of 2008-2009, for instance, remains fresh in investors’ minds. Unlike then, we are not experiencing a global financial crisis or concurrent economic recession. Nonetheless, the market response to the supply surplus has been extremely swift to the negative side. Our footing is grounded in fundamentals, analysis and our investment discipline. Fred Fromm: With 23 years in this business, I agree the speed and depth of price and market declines have appeared to be outpacing the deterioration of physical market characteristics. To some extent, this situation seems to reflect an investment environment that has become shorter-term oriented and influenced by market participants that prefer to “sell now and ask questions later.” We believe investors’ perception of risk has increased markedly while the balance between supply and demand is not extremely mismatched—certainly not as much as it was in the 1980s. When you see such wide swings in commodity markets and commodity-linked equities, some of that story is real and some of it is not. The immediate challenge is sorting out which is which. across the board, but Nancy Grant: I suggest looking at the current price of oil and your portfolio in a broader context. We live in an oil and gas driven world economy at a time when the growing demand for energy by emerging middle classes in countries like India and China is not going to disappear. How do you want to be positioned as the price of oil and oil-related equities resume an upward path? Now is a good time to take a holistic view of a welldiversified portfolio. What sectors and companies will benefit from lower oil prices and input costs, a softer Canadian dollar, the potential for increased consumer spending and a strengthening U.S. economy? Where might you see dividends rising, buoying overall income levels in your portfolio through this period? we are carefully picking Q:Where do you see investor sentiment superseding fundamentals? “...there are opportunities our spots.” - Les Stelmach Fred Fromm: In the current dynamic, many investors seem focused on high-level screens, eliminating, in broad strokes, investment options that appear to carry a high level of debt or are operating in what are considered to be higher cost regions. This creates opportunities for investors willing to dig deeper, looking at the management, capital structures and resource holdings of companies that have been unduly punished. For example, all corporate debt does not present the same risk. One company that comes to mind has a relatively healthy balance sheet and will likely be successful in working through the current situation. Although their debt level appears relatively high, the firm recently issued a bond that is not due until 2022 and carries a relatively low interest rate of near 6%. Yet the stock has been caught up in the wave of extreme pessimism about debt. Les Stelmach: From another angle, we are mindful of income-oriented investors’ concerns about dividend cuts and, over the past few months, have seen energy stocks hammered on the expectation of such measures. We evaluate whether a company is worth more than the current share price and whether we are willing to withstand some of the volatility that 4 fiduciarytrust.ca might arise due to cuts. The reality is a dividend payment by itself does not determine the value of the business. They are separate concepts. The market’s meshing of the two is creating opportunities for us. Q: How are you approaching the market? Fred Fromm: Rather than focusing on a specific commodity price, we use intrinsic value ranges (i.e., for the past five years, we applied a range of $80 to $100/bbl of oil) as a gauge to help determine stocks’ relative attractiveness. It also helps us turn down market “noise,” remove emotional influences and focus on long-term fundamentals. We begin buying when stocks appear to be reflecting a value near the bottom of our intrinsic value range and sell when they trade above the range. Les Stelmach: We value energy investments based on what we see in the current environment, not what we hope the price of oil might be at some future point. We draw on the least biased estimate of the future as evidenced in the forward curve of oil prices. We make investment decisions based on the intrinsic value of companies and their ability to move through cycles, not whether oil is at $100 a barrel. Q: Where are you finding opportunities? Les Stelmach: We view this as a period of creative destruction in the energy sector, where low prices are forcing companies to reflect on how they can do the best job for shareholders, and where they can find efficiencies and cut costs. We expect this process to drive an increase in merger and acquisition activity in the coming months. Right now, there are opportunities across the board, but we are carefully picking our spots. We have been directing more of our buying attention to oil and gas producers and to oilfield service companies, across size and market cap. We have also seen our energy infrastructure holdings maintain their value relatively well. Fred Fromm: We focus primarily on U.S. producers and oilfield equipment and service providers. For us, exploration and production companies currently present the most compelling opportunities, as many are reflecting commodity prices below the low end of our intrinsic value range. Some can grow in a low oil price environment. Our portfolios include assets of all capitalization levels. However, we believe the sweet spot is with mid-cap producers whose share prices have declined, who have staying power in a world with increased commodity price volatility, and who have the ability to generate healthy long-term performance. There has been little media mention of those companies that are both conventional and unconventional (shale) producers. When operated efficiently, we see these businesses as a risk management opportunity—offering investors some downside protection. These firms do not need $60 to $100/bbl oil to carry on, or be profitable. Q: Where do we go from here? Nancy Grant: Investors can easily lose sight of the fact that they do not own the market, which is a snapshot of what things are worth at any given moment. As an investor, you own a series of stocks selected for their respective merit based on the research, analysis and discipline of a portfolio management team. Those stocks are issued by businesses with management teams and boards of directors specializing in this field. It sounds basic, but I believe the basics are an effective anchor in the steady swirl of instant information. Les Stelmach: As active managers working with diversified portfolios, we will continue trimming equities that have performed very well (likely outside of energy) and buy equities that have underperformed, but which we believe still represent good value based on a longer-term view, their fundamentals and ability to move through all stages of a business cycle. In the face of pessimism, we will continue to buy energy companies. Fred Fromm: We currently expect oil markets to stabilize over the next several quarters as demand improves and production growth slows to a more manageable pace. However, trends are fluid and timing is uncertain. Despite the uber-bear view that has had the loudest market voice of late, we continue to invest in high-quality companies that are currently very attractively valued. We do so keeping in mind that commodity-linked equities can provide investors with exposure to long-term global consumption trends. As is clearer today, commodity-linked equities often display a lower correlation rate with other asset classes. It is diversification at work. This is important in times like these. It is important any time. Fiduciary Trust Canada 5 F o c u s on fid u c iar y The Ins and Outs of Estate Planning 2015 By Thomas E. Junkin From the Farmers’ Almanac to political pundits, this time of year features a plethora of predictions on the year ahead. We asked Tom Junkin, Senior Vice President, for his observations on estate-planning trends and traps that families will likely face in 2015. Q:What are the key estate-planning challenges facing clients these days? Tom Junkin: I will divide them into two parts: Practical challenges and planning challenges. Looking at the practical side, these days there is a YouTube video on just about anything and that is symptomatic of a broader do-it-yourself theme at play. I understand it, but when it comes to a do-it-yourself will, health care directive or power of attorney, the implications of errors can be far-reaching, complex and costly. There are, for example, small but essential formalities (varying province to province) about executing a will. We have seen situations where a will leaves a bequest to a friend or family member, but that same person has witnessed the will. The will may be valid but the bequest will fail, as no one who witnesses a will is eligible to receive anything from it. Or for instance, after a will has been typed, the testator and all witnesses must initial any subsequent changes to the document. Everyone signing must be present at the same place at the same time. We run into documents where the person has updated their wishes in pen and initialled the changes. However, the witnesses have not initialled the document, or they have not done so in the correct fashion. When the time comes, the changes are void. I see similar situations arising with other documents such as health care directives, which may be updated in haste and without professional advice. It is hard when people find themselves in stressful situations, only to discover small details are suddenly barriers to life unfolding as intended. I think today’s do-it-yourself bias puts a lot of added pressure on individuals who expect to quickly learn the ins and outs of professions that people spend lifetimes learning. 6 fiduciarytrust.ca Q:What do you see from a planning perspective? Tom Junkin: I encourage people to think about what they wish to achieve in their wills and what is practical. Sometimes people aim for perfection. This can stall the process, leaving them without a will altogether. Or, they will create situations that are unrealistic for executors, trustees and beneficiaries to “live with over time.” I also encourage clients to recognize how longevity may figure in their intentions for beneficiaries. How much is enough to leave your spouse who may live decades longer and require round-the-clock care for many years? Experience prompts us to raise discussion points aimed at helping reach a balance between one’s wishes and what is workable. From another angle, a number of popular government programs, such as Registered Education Savings Plans, Tax-Free Savings Accounts and Registered Disability Savings Plans, have some technical traps related to estate planning. Again, these are lesser known and can come as a surprise at the wrong time. I like to make clients aware so that they can make informed decisions and take any necessary steps. I also hear people expressing concerns about impermanent relationships, commenting: “My child is married, but I am unsure how long it will last.” Relationships have evolved over the last several decades. Divorce is common and there are now laws protecting common-law spouses in much the same way as legally married spouses. As people live longer, we are also seeing a growing number of later-life relationships, which can change the estate-planning dynamic. In keeping with this evolution, we are doing more trust-focused planning rather than outright estate distributions. Trusts can help protect assets from professional and personal claims against an estate. Blended families are a natural part of the evolution in relationships. As with any family situation, we spend time listening and learning about the distinct dynamics. However, blended families prompt different questions and specific estate-planning concerns. For instance, where there are children from a first marriage and a new spouse later in life, there is no guaranteed affection between step-parents and children. There are no guarantees they will provide for each other. Or, it can happen that the parent developing a will has an equally strong relationship with both their stepchildren and their natural-born children. How is this best reflected in the estate plan? A large age difference between spouses, which may put stepchildren and a step-parent close in age, raises a unique set of considerations. These are all concrete, human factors that are part of our work. We simply live in a more complex world where geographic distance also plays a growing role in estate planning. Q:Can you elaborate? Tom Junkin: For younger generations particularly, the world is truly their oyster. Whether arising out of education, travel or relationships, we see more parents, children or grandchildren building lives in different countries. This raises a number of cross-border wealth transfer and tax issues. If this resonates with you, Stephen Reichenfeld also raises some pertinent points in Leaving Home on page eight. From my perspective, a U.S. beneficiary was a rarity for the first 20 years of my career. Now, helping Canadian clients appreciate and work through the complexities of U.S. estate and gift taxes is a normal part of our work. We are fortunate to have a close partnership with our sister company, Fiduciary Trust Company International, to assist with these plans. Q:Are there any new issues on the horizon? Tom Junkin: There are important developments reflecting changing relationships, such as estate-planning equality for same-sex partners. One theme affecting everyone on a daily basis, which is often ignored in terms of estate planning, is how to handle digital assets. Consider all things digital in your life: from bank account passwords, to music libraries, to shopping or transaction accounts, to social media accounts. What happens to those accounts when you die? What happens to all the digital music and movies you may have purchased? Do family members know passwords or what to do? The digital world is currently frontier territory, with no consistent rules or regulations. When a person dies, spouses and/or family are often locked out and face a complicated and sometimes impenetrable process to undo digital accounts. We do our best to help clients plan for their digital assets, but in the long run our legal system needs to catch up. Q:As some things change, do some things remain the same? Tom Junkin: Yes, people are people with busy lives and family matters that can be challenging. Looking at the year ahead, if I could change one thing for clients, procrastination would top the list. Take time to build or close the gaps in your estate plan. Concerns are solvable. Sometimes an outside view can help create a way out of a long-standing problem. Ensure your existing documents match how life is today. We have created Reasons to Review Your Estate Plan, which features over 40 triggers for updating your will. You can find it at www.fiduciarytrust.ca.1 We find people are often surprised by the small changes that can have a significant impact on your estate plan. Above all, make thinking and talking about the future a priority for your family and you in 2015. Another cutting-edge area in estate planning is that of assisted reproductive technology. Who owns genetic material left behind when a person dies? What planning techniques are possible? 1. Here is the link to this information: www.fiduciarytrust.ca/ca/ftcc/en/pdf/servicing/ ReasonstoReviewYourEstatePlan.pdf Fiduciary Trust Canada 7 the b igger pi c t u re Leaving Home By Stephen E. Reichenfeld Anyone who has survived a lifetime of Canadian winters understands the potential appeal of living at least part of the year in a warmer climate. Many of us take advantage of opportunities to live abroad, pursuing a range of objectives including work, study, volunteer activities and retirement. No doubt moving to a foreign country is exciting; however, it can also be fraught with immediate and long-term surprises and challenges. Though planning ahead sounds less than glamorous, it can generate great dividends as life unfolds. Planning for Day-to-Day Life Before committing to a part- or full-time move, be honest with yourself about the challenges you face. Consider: •Your medical coverage options. For example, if you are planning a snowbird lifestyle, recognize that provincial health care programs will not cover many expenses of medical care in foreign countries, or emergency air evacuation if that is required.1 •Any potential implications on your disability and life insurance. • Whether your documents such as health care directives and power of attorney are recognized in the new country. • That reliable communication via email, phone and other means can be a challenge in many places. • The freedom and safety Canada generally affords. This is not always true in some parts of the world and it is important to be aware of local customs and practices. • The local language, which can present challenges and opportunities. If you are uncomfortable with trying a foreign language or working to communicate with local people, then choose a destination with English in mind. • How visitor-friendly your new location will be. • Contacting other expats in your new location as soon as possible. They can provide a great support network.2 Planning for the Future Near and Far In choosing your next move, give priority to wealth management factors such as portfolio management, taxes, property and estate-planning considerations. Here are some questions to help start important conversations with your professional advisors: • Will there be any changes to your Investment Policy Statement as a result of your intended move? What will regular communication with your portfolio manager or investment advisor look like? Do that country’s regulations allow your advisors to work with you? • What are the regulations around income and property tax? What investment management and banking accounts would be subject to reporting and tax obligations? •Does Canada have a tax treaty with the country(ies) you are considering? • What are the implications for your estate plan? Will you need to draw up a new will related to assets in your new homeland? What if you are a part-time resident? • Will all, or part, of your estate be subject to the tax of that country? • Who is eligible to be an executor in the new country? Will your current executor(s) want that job? • What should your beneficiaries be aware of, given your new home address? Working with experienced advisors can help make the process less daunting and far more rewarding for all concerned, now and well into the future. A proactive look may also help make your selection of a new full- or part-time destination easier. It will certainly help make for a warmer welcome. 1. Government of Canada, “Living abroad—A Canadian guide to working, studying, volunteering, or retiring in a foreign country,” www.travel.gc.ca 2. InterNations Expat Magazine, www.interNations.org/magazine 8www.fiduciarytrust.ca a ri c her life The Right Stuff “In all chaos there is cosmos, in all order there is secret order.” – Carl Jung There is a little secret that popular magazines, bloggers and organizational experts do not want us to know: Having stuff can make us happy. It is a complicated thing, our relationship with material items. On the one hand, we are wired to collect, a holdover from our distant past as gatherers.1 On the other hand, some psychologists suggest we are also hard-wired to live in neat, clean environments.2 Some studies suggest clutter raises stress levels, increasing cortisol production.3 Others say surrounding ourselves with bric-a-brac boosts creativity.4 We often think of the excess of “stuff” as a modern invention. After all, our ancestors did not have DVD collections, reams of mail, magazine subscriptions, or more than one pair of shoes. But the Victorian esthetic, for instance, is famous for its tchotchkes and embellishments— or, as we think of it now, clutter. The Victorians, enchanted with their new affluence and ability to fashion new creations from an ever-expanding list of materials, filled their interiors with swags, patterns, tassels and scrolls.5 The start of the 20th century swept that aside in favour of a cleaner, brighter esthetic. Elsie de Wolfe, often considered the first interior designer, introduced North Americans to brighter colours, fewer knick-knacks, and cleaner lines.6 Her influence helped spur the modernist movement, and a clean, uncluttered standard to which we all still aspire, in spite of our need to manage exponentially more stuff. Now, we are confronted at every turn with advice on how to “manage” our things. In many cases this means ways to stash it out of sight or get rid of it altogether. “A cluttered desk is the sign of a cluttered mind,” we say. But is it really? Modern-day geniuses such as Albert Einstein, Steve Jobs and Mark Zuckerberg all produced history-changing work in offices crowded with books, papers and personal effects. Their accomplishments fly in the face of the popular notion that clutter keeps us from success. In fact, a University of Minnesota study found that “disorder produces creativity” while “physical order produces healthy choices, generosity and conventionality.”7 Writer Jonathan Foyle suggests the day we give up our quest for spotless houses and return instead to the Victorian ideal of “exquisite clutter” is just around the corner.8 But while It is a complicated thing, our relationship with material items. he and others advocate the lived-in, low-stress look, no one is suggesting we fill our homes with junk. Rather, that we embrace the notion of having things around us that we love. The idea appeals to the minimalists too—professional “declutterer” Marie Kondo advises her clients to only keep items that “spark joy.”9 And psychologist Don Hughey suggests “joy,” or at the very least, sentiment, can be attached to the most worn or mundane of items—the worn chair used by a beloved spouse, for example, or a concert ticket stub.10 In the face of all the conflicting theories about whether to keep our stuff on display or swept under the rug (or in an appropriately labelled plastic tub), there is really only one thing to do: whether you are a minimalist or a collector, embrace it. After all, science has proven both are signs of admirable qualities. 1. Sandra Eckstein, “The Culture of Clutter: Healthy Living, www.dunwoodypsychologists.com 2.Ibid. 3. Jack Feuer, “The Clutter Culture,” UCLA Magazine, July 2, 2012. 4. Jonathan Foyle, “Why we should embrace (and be inspired by) our untidy homes,” Financial Times, May 2014. 5. Carol Vogel, “Home Design: Clutter that is meant to decorate,” The New York Times Magazine, January 6, 1985. 6. Katherine Webster, “A Decorator’s Life: Elsie de Wolfe,” Canadian Interior Design. 7. Contentverse, “10 Messy Desks of Successful People,” www.contentverse.com 8.Foyle. 9. Penelope Green, “Kissing Your Socks Goodbye: Home Organization Advice from Marie Kondo,” The New York Times, October 22, 2014. 10.Eckstein. Fiduciary Trust Canada 9 a s s e t a l l o c at i o n s t r at e g y T H E WAY A H E A D Getting Smarter about Smartphones By Sajjad Hussain It is hard to escape a new smartphone launch. Aided by a grand launch event and the latest advertising buzz, we soak up the reviews, test out the bells and whistles, and determine whether it is time to upgrade to the latest and greatest. We have come to expect an ongoing stream of advancing models. Companies like Apple and Samsung do not disappoint, as a new edition smartphone is introduced in North America, on average, every 265 days.1 Beyond North America, a relative newcomer to the smartphone business is shaking things up. Chinese manufacturer Xiaomi sold its first smartphone in 2011 and is already ranked as a top-five vendor worldwide.2 If the Mi3 sounds unfamiliar, it is because Xiaomi has been focusing on gaining great ground at home and expanding in emerging markets like India, Brazil, Russia, plus countries throughout Asia and Africa.3 These markets all share significant expansion opportunities with an emerging middle class that wants such products, but cannot quite afford the top brands. Amid commentary about Xiaomi’s look-alike technology and challenges, it is worth noting why their business model is proving disruptive in this highly competitive arena. For instance, they are selling phones with high-end features at low prices—an estimated 60% lower.4 Operating on minimargins, Xiaomi uses time to build profits, launching a new product every two years. Where big-name companies gain their highest profits on new model introductions, this firm thrives on falling component prices over the model’s longer shelf life. Xiaomi is also not committed to ongoing new feature development and, as a result, does not share the same cost burden as its competitors.5 The firm has also made a concert ticket approach part of its sales mix. Appealing to a large segment of its market (teenagers), Xiaomi asks customers to preregister online for a brief sales opportunity, in essence “lining up” for hours before the actual two-hour sale starts. The first 20,000 registrants, for example, get the chance to buy a phone.6 Clearly the majors, such as Apple and Samsung, are not about to wave a white flag, but for investors and consumers alike, Xiaomi’s model raises interesting questions. Will customers in developed countries, who may already have an affinity for a particular brand, be inclined to abandon it for better (or equal) technology at a lower price? Will they wait longer for new technology releases? How will the major brands respond to Xiaomi over time? While a lot remains to be seen, Xiaomi is driving change, redefining what “new” means in a smartphone world. 1. Juan Pablo Vazquez Sampere, “Xiaomi, Not Apple, is Changing the Smartphone Industry,” Harvard Business Review, October 14, 2014. 2. Gordon G. Chang, “Apple, Be Afraid: China’s Xiaomi Going Global,” Forbes, April 27, 2014. 3.Ibid. 4.Sampere. 5.Ibid. 6.Ibid. For your information: Certain statements in this newsletter are forward-looking. Forward-looking statements are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” or “should,” or other similar expressions. Forward-looking statements are not guarantees of future performance. Any number of factors could contribute to differing results including, among other things, general economic, political and market factors, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings and catastrophic events. This list of factors is not exhaustive. Investors should not place undue reliance on forward-looking information and should be aware that Franklin Templeton Investments may not update any forward-looking statements whether as a result of new information, future events or otherwise. Fiduciary Trust Canada www.fiduciarytrust.ca Calgary 350 Seventh Avenue SW, Suite 3000 Calgary, Alberta, Canada T2P 3N9 tel (800) 574-3822 Toronto 200 King Street West, Suite 1500 Toronto, Ontario, Canada M5H 3T4 tel (800) 574-3822 Fiduciary Trust Canada is a member of the Franklin Templeton Investments family of companies. © 2013 Fiduciary Trust Canada. All rights reserved. fiduciarytrust.ca 10 iiwww.fiduciarytrust.ca FTCC NL 01/15

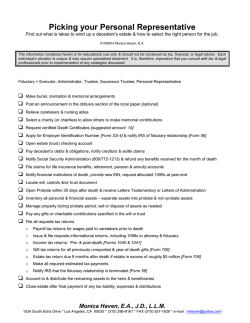

© Copyright 2026