WEEKLY MARKET SYNOPSIS of DHAKA STOCK

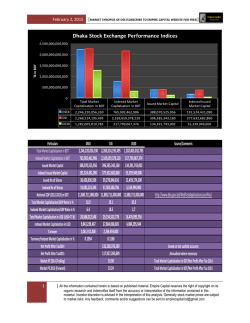

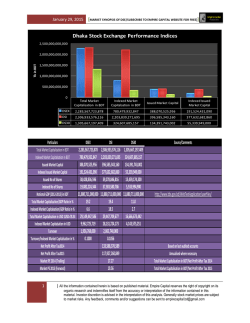

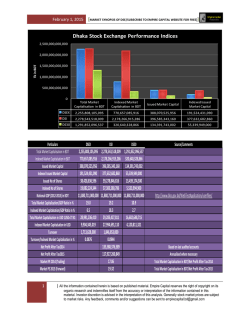

January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] WEEKLY INDEX (DSEX) 4950 4900 4850 4800 4750 4700 4650 4600 1 2 3 4 5 Series1 4716.76186 4708.33448 4757.10193 4747.63694 4724.04933 Series2 4917.3752 4867.08477 4856.94857 4783.21231 4797.9551 PARTICULARS DSEX(Current week) DSEX(Previous week) NOMINAL CHANGE -73.90577 % CHANGE -1.54% WEEKLY INDEX (DSES) 1170 1160 1150 1140 1130 1120 1110 1100 1090 1080 1 2 3 4 5 Series1 1113.84465 1110.52464 1124.17202 1122.32489 1115.69606 Series2 1162.46447 1153.27304 1150.35958 1134.3562 1136.33802 PARTICULARS DSES(Current week) DSES(Previous week) NOMINAL CHANGE -20.64196 % CHANGE -1.82% 1 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] WEEKLY INDEX (DS30) 1840 1820 1800 1780 1760 1740 1720 1700 1680 1 2 3 4 5 Series1 1745.80863 1736.36261 1755.53465 1756.80991 1747.75509 Series2 1820.70352 1803.63172 1802.07395 1774.77209 1778.80327 PARTICULARS DS30(Current week) DS30(Previous week) NOMINAL CHANGE -31.04818 % CHANGE -1.75% 2 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 Name of the Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing TOTAL Total Weekly Turnover Previous week turnover % change turnover Market Cap.(22nd January) Market Cap.(29th January) % change of MC Indicator 1334.70 1564.49 -14.69% 406,323,097,739 403,094,677,831 -0.79% BULLISH 450.94 613.17 -26.46% 200,575,200,730 197,832,526,832 -1.37% BULLISH 160.64 119.15 34.83% 22,672,724,711 22,435,286,524 -1.05% BEARISH 1438.82 1939.59 -25.82% 104,012,812,935 100,536,197,238 -3.34% BULLISH 1028.08 1183.12 -13.10% 138,483,344,818 137,619,329,627 -0.62% BULLISH 458.31 612.65 -25.19% 232,343,189,994 240,418,839,865 3.48% BEARISH 1714.52 1902.47 -9.88% 321,285,790,433 313,278,675,824 -2.49% BULLISH 225.12 284.25 -20.80% 80,713,162,595 79,321,205,009 -1.72% BULLISH 490.09 515.97 -5.02% 5,897,737,745 5,849,757,247 -0.81% BULLISH 16.19 16.96 -4.51% 836,697,200 802,874,300 -4.04% BULLISH 602.33 1076.32 -44.04% 60,675,033,399 59,878,196,530 -1.31% BULLISH 1228.67 1537.81 -20.10% 326,839,100,248 325,548,551,942 -0.39% BULLISH 562.31 598.45 -6.04% 20,786,659,724 19,868,967,241 -4.41% BULLISH 52.50 90.07 -41.71% 23,650,784,250 23,666,829,732 0.07% BEARISH 548.80 503.62 8.97% 485,706,212,294 461,024,416,965 -5.08% BEARISH 2165.37 2569.58 -15.73% 83,772,864,262 81,838,640,394 -2.31% BULLISH 129.46 172.29 -24.86% 27,469,295,241 26,814,327,721 -2.38% BULLISH 56.32 88.79 -37% 499,700,000 476,900,000 -4.56% BULLISH 12663.18 3 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] 15388.75 -17.71% 2,542,543,408,316 2,500,306,200,821 -1.66% BULLISH | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] MAJOR NEWS OF THE WEEK (25.1.2015 TO 29.01.2015) Please click on the news headings to find out more 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 4 Banks barred from sacking CEOs sans BB sanction Two leading buyers warn of business cut with Azim Group New co to manage import, usage of LNG Dhaka Central Jail to be relocated by June: PM BRAC Bank gets largest int'l syndicated loan MoF advises BSEC to protect investors' interest CSE turnover jumps 217pc on commission charge cut ECNEC okays Tk 65.04b rly project with luxury cars purchase inset Big companies urged to spend more on CSR OPEC won't cut output even at $20 a barrel: Saudi Slow progress earns WB dissatisfaction Non-elected people can't run democratic country: Speaker Minister firm on relocating tanneries to Savar by April 100mw electricity for BD from Palatana soon Amended companies act to be more business-friendly: Commerce minister Investors' rights not well-protected in listed companies Restive politics forces units to throttle back production China real estate loans see rapid growth Political unrest dilutes move to buoy up investment activity 102pc gas tariff hike move opposed BERC body rejects plea for power price hike Political troubles impede execution of dev projects Metro Rail to be launched in 2019 Stocks see significant fall amid political unrest Almost all cos complete the process of face value conversion Saif Powertec donates Tk 1.0m to DMCH Car sales crash as business bears brunt of blockade Janata asked to whittle down troubled loans BD for boosting trade among member states Facilitating border traffic more crucial than revenue collection RMG sector suffers 25pc output loss due to blockade BD's apparel exports to US decline by 5.18pc Govt approves buying 6 BSC vessels with China's money Blockade takes toll on jute spinners Cash incentives on some export items to be cut from next FY BB buys $ 11m from 2 commercial banks Trading of all kinds of treasury bonds allowed Govt pays Tk 45.72b as interest against savings instruments BSEC to formulate 'commodity exchange' rules | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] Name of the listed companies (Top Gainers of the week) SECTOR Category CP as on 22.01.2015 AZIZPIPES( Aziz Pipes ) ENGINEERING Z 18.5 CP as on 29.01.2015 % Change 21.3 15.14% BSCCL( Bangladesh Submarine Cable Company Limited ) TELECOMMUNICATION A 98.2 109.2 11.20% FAREASTLIF( Fareast Islami Life Insurance Co. Ltd. ) LIFE INSURANCE A 71.9 76.9 6.95% MONNOSTAF( Monno Jute Staf lers ) ENGINEERING A 284 302.5 6.51% BATBC( BATBC ) FOOD AND ALLIED A 2775.6 2934.4 5.72% KOHINOOR( Kohinoor Chemicals ) PHARMA AND CHEMICALS A 332.3 348.9 5.00% FAREASTFIN( Fareast Finance & Investment Limited ) FINANCIAL INSTITUTIONS N 16.2 17 4.94% FEKDIL( Far East Knit ing & Dyeing Industries Limited ) TEXTILE N 24.3 25.5 4.94% NPOLYMAR( National Poly mer ) ENGINEERING A 66.1 69.3 4.84% PRIMEBANK( Prime Bank ) BANK A 18.5 19.3 4.32% Name of the listed companies (Top Losers of the week) SECTOR Category CP as on 22.01.2015 SHYAMPSUG( Shyampur Sugar Mil s Ltd. ) FOOD AND ALLIED A GSPFINANCE( GSP Finance Company (Bangladesh) Limited ) FINANCIAL INSTITUTIONS USMANIAGL( Usmania Glass ) MISCELLENEOUS NTLTUBES( National Tubes ) CP as on 29.01.2015 % Change 9.2 8 -13.04% A 31.5 27.7 -12.06% A 112.3 99.1 -11.75% ENGINEERING A 107.1 95.2 -11.11% MODERNDYE( Modern Dyeing & Screen Printing Ltd. ) TEXTILE B 104.9 95 -9.44% MERCINS( Mercantile Insurance Co. Ltd. ) GENERAL INSURANCE A 16.8 15.3 -8.93% QSMDRYCELL( Quasem Drycells ) ENGINEERING A 63 57.4 -8.89% BIFC( Bangladesh Industrial Fin. Co. Ltd. ) FINANCIAL INSTITUTIONS A 15.9 14.5 -8.81% ALLTEX( Alltex Industries Ltd. ) TEXTILE Z 31.8 29 -8.81% PRIMELIFE( Prime Islami Life Insurance Ltd. ) LIFE INSURANCE A 62.3 57.2 -8.19% Column1 Name Top 10 Companies by turnover for this Week Column2 Category C & A Textiles Limited N 781,202,000 30796442 7.2 -4.2 Grameenphone Ltd. A 362,876,000 1088801 3.34 -5.59 Lafarge Surma Cement Z 337,175,000 2739604 3.11 -1.19 Alltex Industries Ltd. A 307,797,000 9798862 2.84 -8.81 CVO Petrochemical Refinery Limited B 295,246,000 566620 2.72 -1.92 GSP Finance Company (BD) Ltd. A 271,496,000 8756731 2.5 -12.06 Summit Alliance Port Limited A 266,642,000 4214781 2.46 -5.15 DESCO A 235,736,000 3440276 2.17 -0.29 National Feed Mill Limited N 226,921,000 6728147 2.09 -15.14 BRAC Bank A 0 Total 5 Column3 Turnover in Tk. Column4 Turnover in Vol Column5 % of total TRN Column6 % of change 206,298,000 5181120 1.9 3,291,389,000 73311384 30.33 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] TOP TEN CHEAPEST STOCK BASED ON FORW ARD PE RELATI VE TO SECTORAL PE NAME OF T HE COMPANY CMCKAMAL( CMC Kamal ) QSMDRYCELL( Quasem Dry cells ) BATBC( BATBC ) ORIONINFU( Orion Infusion Ltd. ) PADMAOIL( Padma Oil Co. ) METROSPIN( Metro Spinning GP( Grameenphone Ltd. ) BATASHOE( Bata Shoe ) PRIMEINSUR( PRIME INSURACE ) NPOLYMAR( National Poly mer ) Realtive to Sector PE most undervalued stocks Column1 BANK CEMENT EBL( Eastern Bank ) PREMIERCEM( Premier Cement Mills Limited ) EXIMBANK( Export Import (Exim) Bank of Bangladesh ) HEIDELBCEM( Heidelberg Cement Bd. ) FIRSTSBANK( First Security Islami Bank Limited ) MEGHNACEM( Meghna Cement ) CERAMIC ENGINEERING RAKCERAMIC( RAK Ceramics (Bangladesh) Limited ) NPOLYMAR( National Polymer ) FUWANGCER( Fu-Wang Ceramic ) BSRMSTEEL( BSRM Steels Limited ) GOLDENSON( Golden Son Ltd. ) FINANCIAL INSTITUITION FOOD AND ALLIED ISLAMICFIN( Islamic Finance & Investment Ltd. ) BATBC( BATBC ) BDFINANCE( Bangladesh Finance and Investment Co.Ltd ) APEXFOODS( Apex Foods ) FASFIN( FAS Finance & Investment Limited ) RDFOOD( Rangpur Dairy & Food Products Ltd. ) FUEL AND POWER GENERAL INSURANCE PADMAOIL( Padma Oil Co. ) PRIMEINSUR( PRIME INSURACE ) SPPCL (Summit Purbanchol Power Company Limited ) MERCINS( Mercantile Insurance Co. Ltd. ) BEDL( Barakatullah Electro Dynamics Ltd. ) SONARBAINS( Sonar Bangla Insurance Ltd. ) IT SECTOR MISCELLANEOUS BDCOM( BDCOM Online Ltd. ) BERGERPBL( Berger Paints Bangladesh Ltd. ) DAFODILCOM( Daffodil Computers Ltd. ) SINOBANGLA( Sinobangla Industries ) INTECH( In Tech Online Ltd. ) ARAMIT( Aramit ) PHARMA AND CHEMICALS SERVICE AND REAL ESTATE MARICO( Marico Bangladesh Limited ) SAMORITA( Samorita Hospital ) ACTIVEFINE( Active Fine Chemicals Limited ) EHL( Eastern Housing ) SALVOCHEM( Salvo Chemical Industry Limited ) TANNERY TELECOMMUNICATION APEXADELFT( Apex Adelchi Footwear Ltd. ) GP( Grameenphone Ltd. ) BATASHOE( Bata Shoe ) TEXTILE TRAVEL AND LEISURE RNSPIN( R.N. Spinning Mills Limited ) BDSERVICE( Bangladesh Services Ltd. ) SAIHAMCOT( Saiham Cotton Mills Limited ) UNITEDAIR( United Airways (BD) Ltd. PTL( Paramount Textile Limited ) 6 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 TOP TURNOVER COMPANIES % OF SCRIP FREE FLOAT Name [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] Column1 Turnover in Tk. Column2 Previous week CP Column3 Column4 This week CP Price change Column5 % of scrip free float of market cap. C & A Textiles Limited 781,202,000 Grameenphone Ltd. 362,876,000 348.80 329.30 -5.59% Lafarge Surma Cement 337,175,000 126.00 125.70 -0.24% 0.74 Alltex Industries Ltd. 307,797,000 31.80 30.09 -5.38% 36.21 CVO Petrochemical Refinery Limited 295,246,000 517.70 500.90 -3.25% 8.79 GSP Finance Company (BD) Ltd. 271,496,000 32.04 27.70 -13.55% 39.66 Summit Alliance Port Limited 266,642,000 66.00 62.60 -5.15% 5.97 DESCO 235,736,000 69.94 68.30 National Feed Mil Limited 226,921,000 BRAC Bank 206,298,000 25.10 31.40 39.50 39.50 #DIV/0! 76.86 0.75 -2.34% #DIV/0! 4.65 44.60 0.00% 2.36 Weekly View: Market is on the support zone as per the expectation. Last week, we said market may get support on 4650 to 4700. Market retained that level and closed at 4724. It is a good sign. In longer view market is on nice up channel. There is a good probability to bounce back from here and we may see up spike. For this we need confirmation. If this level is broken then the scenario will be very bad. Next support level is 4450 to 4550 and resistance 4950. Let’s hope for the best. Wishing You All Happy Trading and Investing. 7 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] NOTES DSE Indices as per „DSE Bangladesh Index Methodology‟ designed and developed by S&P Dow Jones Indices Dhaka Stock Exchange Indices The Dhaka Stock Exchange presently computes two indices, DSE Broad Index (DSEX) and DSE 30 Index (DS30). None of the DSE Indi ces include mutual funds, debentures and bonds. DSEX and DS30 Index Introduction of DSE Indices The Dhaka Stock Exchange Limited introduced DSE Broad Index (“DSEX”) and DSE 30 Index (“DS30”) as per „DSE Bangladesh Index Methodology‟ designed and developed by S&P Dow Jones Indices with effect from January 28, 2013.” DSEX” is the Broad Index of the Exchange (Benchmark Index) which reflects around 97% of the total equity market capitalization.DS30 constructed with 30 leading companies which can be said as investable Index of the Exchange. “DS30” reflects around 51% of the total equity market capitalization. The criteria taken into consideration in construction of these Indices are: Market Capitalization DS30 - Eligible stocks must have a float-adjusted market capitalization above 500 million BDT as of the rebalancing reference date. DSEX - Eligible stocks must have a float-adjusted market capitalization above 100 million BDT. Additionally, if a current index constituent falls below the 100 million BDT threshold, but is no less than 70 million BDT, then the stock remains in the index provided it also meets the other inclusion criteria. Float-Adjustment: A stock‟s weight in an index is determined by its float-adjusted market capitalization. Liquidity DS30- Stocks must have a minimum three-month average daily value traded (ADVT) of 5 million BDT as of the rebalancing reference date. Liquidity criteria can be reduced to 3 million BDT in certain circumstance to ensure there are enough constituents in the ind ex. At each semiannual rebalancing, if a current index constituent falls below 5 million BDT but is no less than 3 million BDT then the stock remains in the index provided it also meets the other eligibility criteria. DSEX - Stocks must have a minimum six-month ADVT of 1 million BDT as of the rebalancing reference date. At each annual rebalancing, if a current index constituent falls below 1 million BDT, but is no less than 0.7 million BDT, then the stock remains in the index provided it also meets the other eligibility criteria. In addition, all eligible stocks for the DSE indices are required to trade at least half of normal trading days each month for the three months prior to the rebalancing reference date. Financial Viability DS30 - Stocks must be profitable as measured by positive net income over the latest 12-month period, as of the rebalancing reference date. The figure is calculated by adding the latest four quarters of net income reported for the company. DSEX - Financial viability is not required for index membership. Sector Classification All listed DSE stocks are classified according to the DSE Industry Classification system. The number of constituents in Banks, Financial Institutions, Insurance sector and Real Estate Sub-sector of Service & Real Estate sector is capped at 5 each and 10 combined for the DS30 Index. Sector diversification rule is not applied to the DSEX. Base Date The base dates of the DSE 30 Index (DS30) and The DSE Broad Index (DSEX) are January 17, 2008. Base Value DSE 30 Index (DS30): The base value is 1000 for DS30 Index. The DSE Broad Index (DSEX): The DSE Broad index has a base value of 2951.91 on Jan 17th 2008 which was the index value of the DSE General Index on this date. The new index is a broad market index and is d esigned to refect the broad market performance. Starting the base value at 2951.91 the performance of the two indices has been linked and we maintain the continuity of the performance of the benchmark. The two indices are very close in design and we can build on the history of the older index which goes back to 2001. 8 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [WEEKLY MARKET SYNOPSIS OF DHAKA STOCK EXCHANGE] “Interim IPO additions to the DSE Broad Index (DSEX) take place quarterly on the third Thursday of April, July and October. To be considered eligible for inclusion, an IPO must fall within the top half of the ranked companies, by float-adjusted market capitalization and have at least one month of sufficient liquidity at each quarterly observation date”. After ranking the companies in accordance with “DSE Bangladesh Index Methodology” designed &developed by S&P Dow Jones Indices, following one (1) company was qualified for inclusion in the DSEX with effect from October 20, 2013. 1 Familytex (BD) Limited As a result, the total numbers of constituents in DSEX stands at 207 (Two Hundred and Seven). On January 16, 2014 new 23 companies were included to the DSEX and existing 4 companies were excluded. The new 23 companies that were included to the DSEX are Fareast Finance, Eastern Cables, Renwick Jajneswar, National Tubes, Bengal Windsor Thermoplastics, B angladesh Building Systems, AMCL (Pran), Rahim Textile, Ambee Pharma, The Ibn Sina, Libra Infusions, Global Heavy Chemicals, JMI Syring es & Medical Devices, Central Pharmaceuticals, Hakkani Pulp & Paper, Samorita Hospital, Information Services Network, Purabi General Insurance, Pragati Insurance, Prime Insurance, Sunlife Insurance, Usmania Glass and Berger Paints. On the other hand, existing four companies th at lost their eligibility to retain their position in the index are Kay & Que, Midas Finance, CVO Petrochemical and Rahima Food. As a result, the total numbers of constituents in DSEX stands at 226 (Two Hundred and twenty Six). Similarly on January 16, 2014 in the DS30, four new companies were added to the index. They are United Commercial Bank Ltd., Delta Life Insurance Ltd, Orion Pharma Ltd and Renata Ltd. The existing four companies that were excluded from the index are Beximco Ltd, Khulna Power Company Ltd, Square Textiles Ltd and Southeast Bank Ltd as they failed to meet their criteria to stay in the index. 9 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected]

© Copyright 2026