Market Synopsis 02022015

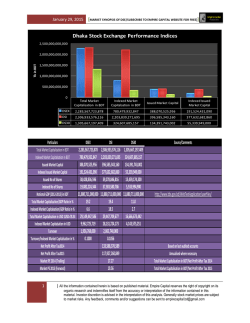

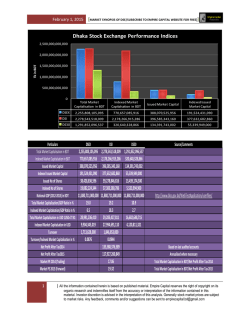

February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Dhaka Stock Exchange Performance Indices 2,500,000,000,000 Tk in BDT 2,000,000,000,000 1,500,000,000,000 1,000,000,000,000 500,000,000,000 0 Total Market Capitalisation in BDT Indexed Market Capitalsation in BDT Issued Market Capital Indexed Issued Market Capital DSEX 2,246,220,056,330 765,902,462,906 388,070,525,956 191,524,431,090 DSI 2,268,514,195,495 2,169,659,378,120 396,585,343,160 377,632,682,860 DS30 1,282,005,010,785 317,799,067,374 134,391,743,002 55,339,949,000 Particulars Total Market Capitalisation in BDT Indexed Market Capitalsation in BDT Issued Market Capital Indexed Issued Market Capital Issued No of Shares Indexed No of Shares National GDP (2012-2013) in BDT Total Market Capitalisation/GDP Ratio in % Indexed Market Capitalsation/GDP Ratio in % Total Market Capitalisation in USD 1USD=77.81 Indexed Market Capitalsation in USD Turnover Turnover/Indexed Market Capitalisation in % Net Profit After Tax2014 Net Profit After Tax2015 Market PE 2014 (Trailing) Market PE 2015 (Forward) 1 DSEX DSI DS30 2,246,220,056,330 765,902,462,906 388,070,525,956 191,524,431,090 38,428,836,596 19,082,224,344 11,880,711,000,000 18.9 6.4 28,868,012,548 9,843,239,467 2,061,912,000 0.1054 2,268,514,195,495 2,169,659,378,120 396,585,343,160 377,632,682,860 39,278,846,816 37,383,580,786 11,880,711,000,000 19.1 18.3 29,154,532,778 27,884,068,605 2,269,459,000 0.1160 133,588,376,589 117,927,260,849 16.98 19.24 1,282,005,010,785 317,799,067,374 134,391,743,002 55,339,949,000 13,439,174,300 5,533,994,900 11,880,711,000,000 10.8 2.7 16,476,095,756 4,084,295,944 Source/Comments http://www.bbs.gov.bd/WebTestApplication/userfiles/ Based on last audited accounts Annualised where necessary Total Market Capitalisation in BDT/Net Profit After Tax 2014 Total Market Capitalisation in BDT/Net Profit After Tax 2015 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 SECTOR YDAY MARKET CAP Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing TOTAL EQUITY MARKET CAP MARKET CAP 399,714,028,668 194,423,091,420 21,668,140,525 98,228,022,049 136,264,003,919 238,782,064,148 307,873,210,461 77,873,009,687 5,723,735,948 769,357,800 58,764,225,395 318,624,566,202 19,208,975,317 23,539,744,461 455,924,010,886 77,636,898,752 26,216,233,161 456,000,000 2,461,689,318,800 INDEX DSEX DSES DS30 TOTAL MARKET CAPITALIZATION 2 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] 399,886,519,660 190,954,012,056 21,610,451,496 96,730,206,396 136,630,573,178 234,702,188,412 305,535,438,079 76,960,260,882 5,726,721,658 749,402,500 58,763,328,156 318,343,509,542 19,106,703,069 23,487,611,190 455,714,453,083 79,142,530,384 25,758,866,761 442,700,000 2,450,245,476,503 % CHANGE MARKET CAP% OF TOTAL MARKET CAPYDAY TURNOVER(in mn) TURNOVER(in mn) 0.04% -1.78% -0.27% -1.52% 0.27% -1.71% -0.76% -1.17% 0.05% -2.59% 0.00% -0.09% -0.53% -0.22% -0.05% 1.94% -1.74% -2.92% -0.46% 16.32% 7.79% 0.88% 3.95% 5.58% 9.58% 12.47% 3.14% 0.23% 0.03% 2.40% 12.99% 0.78% 0.96% 18.60% 3.23% 1.05% 0.02% 100.00% 189.066 107.571 26.953 168 93.492 79.532 240.719 24.106 100.288 0.759 75.911 194.331 70.077 5.911 72.053 254.303 21 10.556 1734.628 253.471 98.737 26.285 212.626 162.1 130.493 315.871 30.264 73.719 0.905 86.846 214.852 67.207 20.104 124.12 236.35 27.072 7.962 2088.984 % CHANGE TURNOVER 34.06% -8.21% -2.48% 26.56% 73.38% 64.08% 31.22% 25.55% -26.49% 19.24% 14.41% 10.56% -4.10% 240.11% 72.26% -7.06% 28.91% -24.57% 20.43% YESTERDAY TODAY % CHANGE 4654.95482 4618.43083 -0.7846% 1099.45732 1091.27505 -0.7442% 1732.54522 1705.62102 -1.5540% 3140826.931 3127861.333 -0.41% | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Market Capitalisation Composition Market Turnover Composition 3 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing Total Market Cap.(DSEX) Total Market Cap.(DSI) Total Market Cap.(DS30) Turnover 372,346,837,207 372,346,836,903 93,486,152,425 190,954,016,996 190,954,016,996 166,348,489,720 19,549,323,349 19,790,305,547 80,088,265,290 80,449,005,315 30,693,327,390 135,575,560,224 136,423,454,116 15,711,430,928 203,978,012,411 213,450,388,831 199,569,072,540 258,698,430,423 259,049,610,492 195,708,216,397 73,022,134,350 74,278,101,841 23,944,833,128 5,032,542,205 5,032,542,177 253,572,000 730,082,000 58,675,055,064 58,740,516,598 14,894,808,059 278,190,814,614 285,317,256,175 44,785,384,575 13,739,736,849 13,739,736,818 23,279,713,800 23,476,825,800 455,714,453,088 455,714,453,088 455,714,453,088 54,294,184,462 55,727,821,249 18,764,138,536 22,384,704,000 22,850,541,548 22,384,704,000 442,700,000 442,700,000 - % Turnover of TMC(DSEX) % Turnover of TMC(DSI) % Turnover of TMC(DS30) 253.471 0.0681% 0.0681% 0.2711% 98.737 0.0517% 0.0517% 0.0594% 26.285 0.1345% 0.1328% 0.0000% 212.626 0.2655% 0.2643% 0.6927% 162.1 0.1196% 0.1188% 1.0317% 130.493 0.0640% 0.0611% 0.0654% 315.871 0.1221% 0.1219% 0.1614% 30.264 0.0414% 0.0407% 0.1264% 73.719 1.4648% 1.4648% 0.0000% 0.905 0.3569% 0.1240% 0.0000% 86.846 0.1480% 0.1478% 0.5831% 214.852 0.0772% 0.0753% 0.4797% 67.207 0.4891% 0.4891% 0.0000% 20.104 0.0864% 0.0856% 0.0000% 124.12 0.0272% 0.0272% 0.0272% 236.35 0.4353% 0.4241% 1.2596% 27.072 0.1209% 0.1185% 0.1209% 7.962 1.7985% 1.7985% 0.0000% Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing Indexed Market Cap.(DSEX) Indexed Market Cap.(DSI) Indexed Market Cap.(DS30) Turnover 195,519,219,681 372,208,882,995 45,683,002,459 82,195,975,142 179,883,691,996 73,596,561,456 5,174,715,834 19,790,305,547 30,137,728,561 66,564,865,843 10,993,503,087 59,374,677,511 132,312,241,818 5,020,176,265 42,855,543,155 212,723,207,543 35,436,323,952 73,179,615,907 239,016,688,189 57,483,591,347 32,505,744,461 60,145,155,243 8,350,786,025 3,694,056,339 4,554,516,921 93,821,640 730,082,000 16,861,302,414 55,962,669,383 11,766,898,341 106,081,279,169 279,197,738,486 5,993,000,303 4,995,566,805 13,739,736,818 8,706,830,286 23,476,825,800 47,946,084,587 447,051,045,253 47,946,084,587 24,612,137,000 45,815,745,149 8,717,945,313 6,811,194,240 10,358,106,062 6,811,194,240 151,359,130 442,700,000 - % Turnover of IMC(DSEX) % Turnover of IMC(DSI) % Turnover of IMC(DS30) 253.471 0.1296% 0.0681% 0.5548% 98.737 0.1201% 0.0549% 0.1342% 26.285 0.5080% 0.1328% 0.0000% 212.626 0.7055% 0.3194% 1.9341% 162.1 0.2730% 0.1225% 3.2290% 130.493 0.3045% 0.0613% 0.3682% 315.871 0.4316% 0.1322% 0.5495% 30.264 0.0931% 0.0503% 0.3624% 73.719 1.9956% 1.6186% 0.0000% 0.905 0.9646% 0.1240% 0.0000% 86.846 0.5151% 0.1552% 0.7381% 214.852 0.2025% 0.0770% 3.5850% 67.207 1.3453% 0.4891% 0.0000% 20.104 0.2309% 0.0856% 0.0000% 124.12 0.2589% 0.0278% 0.2589% 236.35 0.9603% 0.5159% 2.7111% 27.072 0.3975% 0.2614% 0.3975% 7.962 5.2603% 1.7985% 0.0000% 4 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power General Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Sectoral PE 10.00 33.93 32.12 24.34 14.59 30.51 10.84 10.98 18.71 198.59 29.04 22.10 38.42 23.52 21.11 13.08 14.33 Market Capitalisation Negative Earnings excluded 399,886,519,660 ICBIBNK 190,954,012,056 21,610,451,496 SPCERAMICS, 96,730,206,396 AZIZ PIPES, KAY&QUE, 136,630,573,178 ILFSL, MIDASFIN 234,702,188,412 CVOPRL, FINEFOODS, GEMINISEA, MEGHCONMILK, RAHIMAFOOD, ZEAL BANGLA 305,535,438,079 34,687,473,358 5,726,721,658 INTECH 749,402,500 JUTESPIN 58,763,328,156 318,343,509,542 IMAMBUTTON 19,106,703,069 23,487,611,190 455,714,453,083 79,142,530,384 DULAMIACOT, SONARGAON, MODERNDYE 25,758,866,761 TOP 10 GAINERS BASED ON YCP AND CLOSE PRICE Instr Code AIBL1STIMF BERGERPBL 8THICB DUTCHBANGL ICB RUPALIINS AAMRATECH GREENDELMF MBL1STMF GLAXOSMITH YCP TOP 10 LOSERS BASED ON YCP AND CLOSE PRICE Instr Code MODERNDYE RAHIMAFOOD SHURWID SPCL NFML PRAGATILIF NORTHERN EASTRNLUB NITOLINS CVOPRL YCP 5 High 5.1 1392.2 64 94.8 1320.8 19.8 37.1 4.2 4.2 1476.8 Low 5.6 1435 66.1 98.5 1365 20.4 38.7 4.5 4.3 1515 High 86.5 34.2 24.8 195.2 29.1 90.6 239.4 371.8 24.8 485.2 CLOSE 5.2 1419 62.3 93.9 1315 19 36.6 4.2 4.2 1466.6 Low 86 35 24.6 197 29.2 91 239 380 24.3 486.1 5.6 1432.8 65.8 97.4 1356 20.3 38 4.3 4.3 1509.2 CLOSE 80 31.2 23 177.7 27.3 85.1 223 351 22.9 458.9 81 32.1 23.4 184.6 27.6 86 227.3 353.3 23.6 462.2 %CHG 9.804 2.916 2.813 2.743 2.665 2.525 2.426 2.381 2.381 2.194 %CHG -6.358 -6.14 -5.645 -5.43 -5.155 -5.077 -5.054 -4.976 -4.839 -4.74 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Lowest Forward PE Companies Forward PE GENNEXT( Generation Next Fashions Limited 5.23 FAMILYTEX( Familytex (BD) Limited ) 5.69 SOUTHEASTB( Southeast Bank ) 5.94 TRUSTBANK( Trust Bank Limited ) 6.28 ABBANK( AB Bank Limited ) 6.93 UNITEDAIR( United Airways (BD) Ltd. 7.01 ASIAPACINS( Asia Pacific General Insurance Co. Ltd. ) 7.35 STANDARINS( Standard Insurance Limited ) 7.39 IFIC( IFIC Bank ) 7.43 UTTARAFIN( Uttara Finance ) 7.64 Highest Forward PE Comapnies ECABLES( Eastern Cables ) Forward PE 1683.24 ATLASBANG( Atlas Bangladesh ) 559.61 MONNOSTAF( Monno Jute Stafflers ) 251.91 BAYLEASING( Bay Leasing & Investment Limited ) 238.20 BEACONPHAR( Beacon Pharmaceuticals Limited ) 159.73 SONALIANSH( Sonali Aansh ) 156.53 GEMINISEA( Gemini Sea Food ) 156.52 BXSYNTH( Beximco Synthetics ) 138.11 RENWICKJA( Renwick Jajneswar & Co (Bd) ) 121.22 EASTRNLUB( Eastern Lubricants ) 113.28 Highest Dividend Yield Companies Dividend Yield RSRMSTEEL( Ratanpur Steel Re-Rolling Mills Limited ) 9.43% FIRSTSBANK( First Security Islami Bank Limited ) 9.26% DHAKABANK 8.67% SIBL( Social Islami Bank Limited ) 8.57% DHAKAINS( Dhaka Insurance Limited ) 8.44% SOUTHEASTB( Southeast Bank ) 8.21% STANDBANKL( Standard Bank Limited ) 8.13% PRIMEFIN( Prime Finance & Investment Ltd. ) 7.98% PHOENIXFIN( Phoenix Finance and Investments Ltd. ) 7.97% DELTASPINN( Delta Spinners Ltd. ) 7.81% 6 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] TOP TEN CHEAPEST STOCK BASED ON FORWARD PE RELATIVE TO SECTORAL PE NAME OF THE COMPANY BATASHOE( Bata Shoe ) PRIMEINSUR( PRIME INSURACE ) GP( Grameenphone Ltd. ) METROSPIN( Metro Spinning GHAIL( Golden Harvest Agro Industries Ltd. ) ORIONINFU( Orion Infusion Ltd. ) BEXIMCO( BEXIMCO ) RAKCERAMIC( RAK Ceramics (Bangladesh) Limited ) FUWANGCER( Fu-Wang Ceramic ) APEXFOODS( Apex Foods ) Realtive to Sector PE most undervalued stocks Column1 BANK CEMENT EBL( Eastern Bank ) PREMIERCEM( Premier Cement Mills Limited ) EXIMBANK( Export Import (Exim) Bank of Bangladesh ) HEIDELBCEM( Heidelberg Cement Bd. ) FIRSTSBANK( First Security Islami Bank Limited ) MEGHNACEM( Meghna Cement ) CERAMIC ENGINEERING RAKCERAMIC( RAK Ceramics (Bangladesh) Limited ) NPOLYMAR( National Polymer ) FUWANGCER( Fu-Wang Ceramic ) BSRMSTEEL( BSRM Steels Limited ) GOLDENSON( Golden Son Ltd. ) FINANCIAL INSTITUITION FOOD AND ALLIED ISLAMICFIN( Islamic Finance & Investment Ltd. ) BATBC( BATBC ) BDFINANCE( Bangladesh Finance and Investment Co.Ltd ) APEXFOODS( Apex Foods ) FASFIN( FAS Finance & Investment Limited ) RDFOOD( Rangpur Dairy & Food Products Ltd. ) FUEL AND POWER GENERAL INSURANCE PADMAOIL( Padma Oil Co. ) PRIMEINSUR( PRIME INSURACE ) SPPCL (Summit Purbanchol Power Company Limited ) MERCINS( Mercantile Insurance Co. Ltd. ) BEDL( Barakatullah Electro Dynamics Ltd. ) SONARBAINS( Sonar Bangla Insurance Ltd. ) IT SECTOR MISCELLANEOUS BDCOM( BDCOM Online Ltd. ) BERGERPBL( Berger Paints Bangladesh Ltd. ) DAFODILCOM( Daffodil Computers Ltd. ) SINOBANGLA( Sinobangla Industries ) INTECH( In Tech Online Ltd. ) ARAMIT( Aramit ) PHARMA AND CHEMICALS SERVICE AND REAL ESTATE MARICO( Marico Bangladesh Limited ) SAMORITA( Samorita Hospital ) ACTIVEFINE( Active Fine Chemicals Limited ) EHL( Eastern Housing ) SALVOCHEM( Salvo Chemical Industry Limited ) TANNERY TELECOMMUNICATION APEXADELFT( Apex Adelchi Footwear Ltd. ) GP( Grameenphone Ltd. ) BATASHOE( Bata Shoe ) TEXTILE TRAVEL AND LEISURE RNSPIN( R.N. Spinning Mills Limited ) BDSERVICE( Bangladesh Services Ltd. ) SAIHAMCOT( Saiham Cotton Mills Limited ) UNITEDAIR( United Airways (BD) Ltd. PTL( Paramount Textile Limited ) 7 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] NOTES DSE Indices as per „DSE Bangladesh Index Methodology‟ designed and developed by S&P Dow Jones Indices Dhaka Stock Exchange Indices The Dhaka Stock Exchange presently computes two indices, DSE Broad Index (DSEX) and DSE 30 Index (DS30). None of the DSE Indi ces include mutual funds, debentures and bonds. DSEX and DS30 Index Introduction of DSE Indices The Dhaka Stock Exchange Limited introduced DSE Broad Index (“DSEX”) and DSE 30 Index (“DS30”) as per „DSE Bangladesh Index Methodology‟ designed and developed by S&P Dow Jones Indices with effect from January 28, 2013.” DSEX” is the Broad Index of the Exchange (Benchmark Index) which reflects around 97% of the total equity market capitalization.DS30 constructed with 30 leading companies which can be said as investable Index of the Exchange. “DS30” reflects around 51% of the total equity market capitalization. The criteria taken into consideration in construction of these Indices are: Market Capitalization DS30 - Eligible stocks must have a float-adjusted market capitalization above 500 million BDT as of the rebalancing reference date. DSEX - Eligible stocks must have a float-adjusted market capitalization above 100 million BDT. Additionally, if a current index constituent falls below the 100 million BDT threshold, but is no less than 70 million BDT, then the stock remains in the index provi ded it also meets the other inclusion criteria. Float-Adjustment: A stock‟s weight in an index is determined by its float-adjusted market capitalization. Liquidity DS30- Stocks must have a minimum three-month average daily value traded (ADVT) of 5 million BDT as of the rebalancing reference date. Liquidity criteria can be reduced to 3 million BDT in certain circumstance to ensure there are enough constituents in the ind ex. At each semiannual rebalancing, if a current index constituent falls below 5 million BDT but is no less than 3 million BDT then the stock remains in the index provided it also meets the other eligibility criteria. DSEX - Stocks must have a minimum six-month ADVT of 1 million BDT as of the rebalancing reference date. At each annual rebalancing, if a current index constituent falls below 1 million BDT, but is no less than 0.7 million BDT, then the stock remains in the index provided it also meets the other eligibility criteria. In addition, all eligible stocks for the DSE indices are required to trade at least half of normal trading days each month for the three months prior to the rebalancing reference date. Financial Viability DS30 - Stocks must be profitable as measured by positive net income over the latest 12-month period, as of the rebalancing reference date. The figure is calculated by adding the latest four quarters of net income reported for the company. DSEX - Financial viability is not required for index membership. Sector Classification All listed DSE stocks are classified according to the DSE Industry Classification system. The number of constituents in Banks, Financial Institutions, Insurance sector and Real Estate Sub-sector of Service & Real Estate sector is capped at 5 each and 10 combined for the DS30 Index. Sector diversification rule is not applied to the DSEX. Base Date The base dates of the DSE 30 Index (DS30) and The DSE Broad Index (DSEX) are January 17, 2008. Base Value DSE 30 Index (DS30): The base value is 1000 for DS30 Index. The DSE Broad Index (DSEX): The DSE Broad index has a base value of 2951.91 on Jan 17th 2008 which was the index value of the DSE General Index on this date. The new index is a broad market index and is d esigned to refect the broad market performance. Starting the base value at 2951.91 the performance of the two indices has been linked and we maintain the continuity of the performance of the benchmark. The two indices are very close in design and we can build on the history of the older index which goes back to 2001. “Interim IPO additions to the DSE Broad Index 8 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] February 2, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] (DSEX) take place quarterly on the third Thursday of April, July and October. To be considered eligible for inclusion, an IPO must fall within the top half of the ranked companies, by float-adjusted market capitalization and have at least one month of sufficient liquidity at each quarterly observation date”. After ranking the companies in accordance with “DSE Bangladesh Index Methodology” designed &developed by S&P Dow Jones Indices, following one (1) company was qualified for inclusion in the DSEX with effect from October 20, 2013. 1 Familytex (BD) Limited As a result, the total numbers of constituents in DSEX stands at 207 (Two Hundred and Seven). On January 16, 2014 new 23 companies were included to the DSEX and existing 4 companies were excluded. The new 23 companies that were included to the DSEX are Fareast Finance, Eastern Cables, Renwick Jajneswar, National Tubes, Bengal Windsor Thermoplastics, Bangladesh Building Systems, AMCL (Pran), Rahim Textile, Ambee Pharma, The Ibn Sina, Libra Infusions, Global Heavy Chemicals, JMI Syring es & Medical Devices, Central Pharmaceuticals, Hakkani Pulp & Paper, Samorita Hospital, Information Services Network, Purabi General Insurance, Pragati Insurance, Prime Insurance, Sunlife Insurance, Usmania Glass and Berger Paints. On the other hand, existing four companies th at lost their eligibility to retain their position in the index are Kay & Que, Midas Finance, CVO Petrochemical and Rahima Food. As a result, the total numbers of constituents in DSEX stands at 226 (Two Hundred and twenty Six). Similarly on January 16, 2014 in the DS30, four new companies were added to the index. They are United Commercial Bank Ltd., Delta Life Insurance Ltd, Orion Pharma Ltd and Renata Ltd. The existing four companies that were excluded from the index are Beximco Ltd, Khulna Power Company Ltd, Square Textiles Ltd and Southeast Bank Ltd as they failed to meet their criteria to stay in the index. 9 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected]

© Copyright 2026