Management Discussion And Analysis

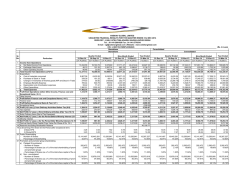

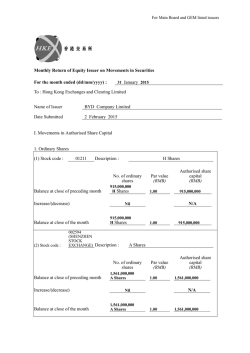

SEASHORE ORGANIC MEDICINE INC. QUARTERLY REPORT for the six months ended October 31, 2014 MANAGEMENT DISCUSSION AND ANALYSIS 1.1 Date of Report: December 19, 2014 The following management’s discussion and analysis should be read together with the financial statements and accompanying notes for the three months ended October 31, 2014 and related notes hereto, which are prepared in accordance with International Financial Reporting Standards (“IFRS”). All amounts are stated in Canadian dollars unless otherwise indicated. This management discussion and analysis includes certain statements that may be deemed “forwardlooking statements”. Although the Company believes the expectations expressed in such forwardlooking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. 1.2 Overall Performance Nature of Business and Overall Performance Seashore Organic Marijuana Corp. (the “Company” or “Seashore”) was incorporated on May 14, 2014 under the Business Corporation Act of British Columbia. The head office of the Company is 101 – 5682 Wharf Street, Sechelt, BC V0N 3A0. On September 22, 2014 the Company changed its name from Seashore Organic Marijuana Corp. to Seashore Organic Medicine Inc. On August 12, 2014, the Company commenced trading on the Canadian Securities Exchange (“CSE”) under the trading symbol “SOM”. Plan of Arrangement On May 14, 2014 an Arrangement Agreement (“Arrangement”) was entered into among Sechelt Organic Marijuana Corp. (“Sechelt”), Noor Energy Corporation. (“Noor”) and Seashore, then a whollyowned subsidiary of Noor, which was incorporated on May 14, 2014 for the sole purpose of the Arrangement. This transaction was approved and completed on August 7, 2014, the date of the reverse acquisition. The parties agreed to reorganize their business by way of a plan of arrangement to be carried out under the provisions of the Business Corporations Act (British Columbia). As a part of the Arrangement Agreement, the following transactions occurred: i) Sechelt acquired from Noor all of the issued and outstanding shares of Seashore (the “Purchase Shares”) for consideration of $15,000 (paid). ii) Seashore and the shareholders of Sechelt completed a one-for-one share exchange pursuant to which Sechelt became a wholly-owned subsidiary of Seashore. Seashore Organic Medicine Inc. For the six months ended October 31, 2014 – Page 2 iii) Noor issued 5,000 of its common shares to Seashore and received in exchange 350,000 shares of Seashore. Noor will dividend the 350,000 Seashore shares to its shareholders. iv) The Purchase Shares were cancelled. On August 12, 2014, the Company commenced trading on the CSE. As a result of the Arrangement, the shareholders of Sechelt will own a majority of the issued and outstanding shares of Seashore. Accordingly, Seashore’s results of operations have been included from August 7, 2014 onward. Background In 2000, the Ontario Court of Appeal ruled that the Federal Government of Canada must make medical marijuana available to those patients in need of it. In July 2001, Canada implemented a government-run program for medical marijuana access, authorized and regulated under the Marijuana Medical Access Regulations (“MMAR”). Under the MMAR guidelines, patients could purchase medical marijuana from the government, grow it themselves or have it grown by a third party. According to Health Canada, in a press release issued on June 10, 2013, the number of authorized persons under the MMAR had grown from 500 in 2001 to over 30,000 as of the date of the press release. Due in part to this rapid increase and the resulting unintended health, safety and security consequences, Health Canada issued a new set of regulations in June 2013 that will replace the MMAR, with the primary result of eliminating production in homes and transferring it to highly secure and regulated commercial operations. The Company has plans to become an emerging producer and distributor of medical marijuana (“Product”),and has applied to Health Canada (HC) for a medical marijuana production and distribution license under the new Marijuana for Medical Purposes Regulations (“MMPR”) (a “Production License” or “License”)), which became law as of April 1, 2014. We are seeking to begin Phase 1 and start the construction of our growing facility under a “Ready to Build” approval. Cultivation and the distribution of organic marijuana for medical consumption under an MMPR license is expected to constitute the principal business activity of the Company for years to come. Investment in Cannevert Therapeutics Ltd. The Company entered into an agreement dated October 9, 2014 with Cannevert Therapeutics Ltd. (“Cannevert”) to subscribe for subscription shares such that the Company will acquire up to a 70% equity and voting interest in Cannevert. Cannevert shall conduct research and license to the Company resultant intellectual property from proceeds of the Subscription based on the terms and conditions of a license agreement to be entered into concurrently with this agreement. The Company shall purchase and subscribe for a total of 971,428 Cannevert shares for proceeds of $1,500,000 as follows: (a) within 10 days of the Company receiving the Proceed to Build Notice, the Company shall subscribe for 104,082 Subscription Shares for $250,000. (b) on or before six months from the date of the first private placement the Company shall subscribe for 74,344 Subscription Shares for $250,000, (c) on or before 12 months from the date of the first private placement the Company shall subscribe for 99,125 Subscription Shares for $250,000, (d) on or before 18 months from the date of the first private placement the Company shall subscribe for 138,775 Subscription Shares for $250,000, Seashore Organic Medicine Inc. For the six months ended October 31, 2014 – Page 3 (e) on or before 24 months from the date of the first private placement the Company shall subscribe for 208,163 Subscription Shares for $250,000, (f) on or before 30 months from the date of the first private placement the Company shall subscribe for 346,939 Subscription Shares for $250,000. The Company has advanced a non-refundable deposit of $25,000 which will be applied towards the purchase price. Cannevert, located on the University of British Columbia campus in Vancouver, B.C., was created by three emeritus professors and another scientist. Its aim is to identify which marijuana cultivars are most appropriate for the treatment of those disorders which have been provisionally identified as benefiting from treatment with marijuana and to aid SOM in the development of cultivars with the best therapeutic indices. The four co-founders, Dr. Michael J.A. Walker, Dr. Ernie Puil, Dr. Thomas Stokes and Dr. Bernard A. MacLeod have significant experience in the science of drug discovery in the areas of brain, heart and lung, and in working with natural products, and thus have experience in the analysis of the chemical constituents of plants while being able to assess the potential therapeutic potential of extracts and related materials. They have also had experience in the biotech area of drug discovery. Dr. Walker is a founder of both public as well private biotech companies, including Cardiome Pharma Corp. and Verona Pharma PLC. Other private biotech companies in which they have co-operated together include TherExcell Pharma. Dr. MacLeod practised anesthesiology for many years at Vancouver General and University hospitals, the B.C. Cancer Agency, as well as conducting research in the department of pharmacology, specializing in clinical trials and pain. Dr. Puil is a neuropharmacologist with experience and expertise in drugs which have actions on the brain. He is the CEO of TherExcell Pharma, which has developed a novel analgesic. Dr. Walker has over 40 years of experience as a pharmacologist and, in his search for new drugs, has created public and private biotech companies over the last 25 years with success in early clinical trials with four different drugs in the area of pain, the heart and lungs. Dr. Stokes is an experienced chemist with extensive corporate experience, primarily in implementing biological methodologies for enhancing yields in traditional industries. This partnership with Cannevert has created the opportunity to characterize, produce and optimize the massive potential of medical marijuana using the state-of-the-art molecular and biochemical tools and trades. 1.4 Results of Operations The Company has not generated revenues to date and has experienced minimal operating cash flow and incurred a net loss of $240,313 for the three month period ended October 31, 2014 and $409,766 for the six month period ended October 31, 2014. The majority of the expenses relates to Consulting, Cost of going public and Legal fees all incurred in connection with the arrangement agreement and listing of the Company on the Canadian Stock Exchange which was completed on August 7, 2014 and commenced trading on August 12, 2014. There are no comparative figures as the Company was incorporated on April 16, 2014 1.5 Summary of Quarterly Results The following is a summary of the Company’s financial results for the eight most recently completed quarters: Q1 July 31 2014 Q2 Oct 31 2014 Seashore Organic Medicine Inc. For the six months ended October 31, 2014 – Page 4 Total revenues $ - Net income (loss) for the period: Total Per share Per share, fully Diluted $(169,454) $ (0.01) $ (0.01) $ - $(240,313) $ (0.02) $ (0.02) There are no quarterly results to report prior to April 16, 2014 as the Company was incorporated on April 16, 2014. The quarter ended July 31, 2014 have been restated to that of Sechelt Organic Marijuana Corp as a result of the reverse acquisition. The increase in the total loss from the quarter ended July 31, 2014 to October 31, 2014 is mainly due to the cost incurred of going public as the Company became public in the quarter ended October 31, 2014. 1.6 Liquidity The Company has total assets of $633,163 consisting of $269,764 in cash and intangible asset of $280,000 and a working capital of $289,128. The Company has not pledged any of its assets as security for loans, or otherwise and is not subject to any debt covenants. Management believes that the Company will require additional working capital to meet its primary business objectives over the next 12 months. Since the Company will not be able to generate cash from its operations in the foreseeable future, the Company will have to rely on the funding through future equity issuances and through short term borrowing in order to fund ongoing operations and to meet its obligations. The ability of the Company to raise capital will depend on market conditions and it may not be possible for the Company to issue shares on acceptable terms or at all. During the period ended October 31, 2014, the Company has issued an aggregate of 6,200,000 common shares for total proceeds of $650,000 and has issued 50,000 common shares to settled debt of $5,000. 1.7 Capital Resources The Company does not have any commitments for material capital expenditures. 1.8 Off Balance Sheet Arrangements There is no off-balance sheet arrangements to which the Company is committed. 1.9 Transactions with Related Parties Related party transactions are in the ordinary course of business and are measured at the exchange amount. During the three and six months period ended October 31, 2014 the Company incurred consulting fees to a director of the Company in the amount of Nil and $54,500 respectively. 1.10 N/A Fourth Quarter Seashore Organic Medicine Inc. For the six months ended October 31, 2014 – Page 5 1.12 Critical Accounting Estimates The preparation of financial statements in accordance with IFRS requires the Company to make estimates and assumptions concerning the future. The Company’s management reviews these estimates and underlying assumptions on an ongoing basis, based on experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Revisions to estimates are adjusted for prospectively in the period in which the estimates are revised. Information about critical judgements in applying accounting policies that have the most significant effect on the amounts recognized in the condensed interim financial statements is the assumption that the Company is a going concern and will continue in operation for the foreseeable future and at least one year is a judgement. The factors considered by management are disclosed in the financial statements. 1.13 Changes in Accounting Policies Accounting standards issued but not yet applied The following new standards and interpretations are not yet effective and have not been applied in preparing these financial statements. The Company is currently evaluating the potential impacts of these new standards and does not anticipate any material changes to the financial statements upon adoption of this new and revised accounting pronouncement. • IFRS 9 – Financial Instruments (effective January 1, 2018) introduces new requirements for the classification and measurement of financial assets, and will replace IAS 39. IFRS 9 uses a single approach to determine whether a financial asset is measured at amortized cost or fair value, replacing the multiple classification options available in IAS 39. 1.14 Financial Instruments and Other Instruments The Company’s financial instruments consist of cash, amount receivable and accounts payable and accrued liabilities. The Company’s financial instruments are exposed to the following risks: Credit risk The Company has not experienced any significant credit losses and believes it is not exposed to any significant credit risk. Interest rate risk Interest rate risk is the risk the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. Financial assets and liabilities with variable interest rates expose the Company to cash flow interest rate risk. The Company does not hold any financial liabilities with variable interest rates. The Company does maintain bank accounts which earn interest at variable rates but it does not believe it is currently subject to any significant interest rate risk. Liquidity risk The Company’s ability to continue as a going concern is dependent on management’s ability to raise required funding through future equity issuances and through short-term borrowing. The Company manages its liquidity risk by forecasting cash flows from operations and anticipating any investing and financing activities. Management and the Board of Directors are actively involved in the review, planning and approval of significant expenditures and commitments. Seashore Organic Medicine Inc. For the six months ended October 31, 2014 – Page 6 The Company intends to meet its current obligations in the following year with funds to be raised through private placements, shares for debt, loans and related party loans. Fair value Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are: Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and Level 3 – Inputs that are not based on observable market data. 1.15 Other MD&A Requirements Disclosure of Outstanding Share Data i) Authorized: Unlimited common shares without par value ii) Common Shares Issued: Number Balance, October 31, 2014 Balance, December 19,2014 Amount 19,900,000 $ 891,000 _19,900,000 $ 891,000 As at December 19, 2014, there are: 1,800,000 share purchase options outstanding exercisable at $0.10 per share for a period of five years.( June 16, 2019) 6,000,000 warrants have an exercise price of $0.50 per share for a period of one year after the closing date or at $0.75 per share for a period of one year after the Company gives notice to exercise its right to increase the exercise price of the warrants. 5,000,000 warrants will expire on May 14, 2015 and 1,000,000 will expire on June 18, 2015. 200,000 warrants have an exercise price of $0.75 per share expiring on July 4, 2015. Approved and authorized by the Directors of the Company on December 19, 2014: “Leonard Werden”_____________ Leonard Werden “Alexander Polevoy”_______________ Alexander Polevoy

© Copyright 2026