Tipo Valor Emisora Serie Calif. / Bursatilidad Cant. Títulos Valor

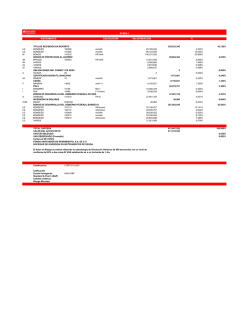

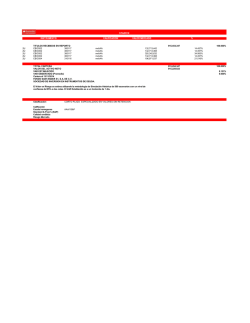

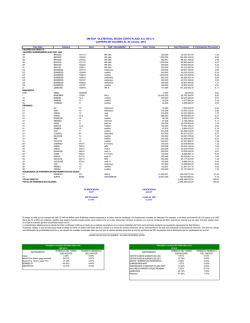

GBMM3 GBM FONDO PARA PERSONAS MORALES EXENTAS, S.A. DE C.V. CARTERA DE VALORES AL 05 febrero, 2015 Tipo Valor Emisora Serie VALORES EN DIRECTO VALORES GUBERNAMENTALES FED. NAC. BI CETES 150326 M BONOS 241205 S UDIBONO 160616 BANCARIOS CHD BANAMEX 3795519 94 BINBUR 12-2 94 BINBUR 12-4 94 BINBUR 13 94 BINBUR 13-3 94 BINBUR 13-4 94 SCOTIAB 12 94 SCOTIAB 13 94 VWBANK 12 97 HSBCCB 07 PRIVADOS D2 CONM151 351215 D2SP ARRUA25 190722 D2SP IDESA82 201218 D2SP POSA619 151118 D8 METLIFE 1-06 D8 MLMXN 1-07 D8 SANTAN 2-07 D8 SANTAN 3-07 91 ARCA 09-3 91 BACHOCO 12 91 BIMBO 09-2 91 BNPMEX 11 91 CATFIN 11 91 CATFIN 12 91 CATFIN 14 91 DAIMLER 14 91 DAIMLER 14-3 91 DALTOCB 13 91 DHIC 14 91 FACILSA 13 91 FACILSA 14 91 FUNO 13 91 GBM 14 91 GCARSO 12 91 HERDEZ 11 91 HERDEZ 13-2 91 HICOAM 07 91 HOLCIM 12 91 HOLCIM 12-2 91 HOLCIM 14 91 IBDROLA 08 91 IENOVA 13-2 91 IJETCB 13 91 INCARSO 12 91 KUO 10 91 KUO 12 91 MONTPIO 14 91 NAVISCB 13 91 NEMAK 07 91 NRF 12 91 NRF 13 91 PCARFM 12 91 SCRECB 12 91 TLEVISA 14 91 TOYOTA 14 91 URBI 11 91 VINTE 14 91 VTOSCB 13 91 VWLEASE 12 91 VWLEASE 13-2 91 VWLEASE 14 91 VWLEASE 14-2 91 ZONALCB 06U 91 ZONALCB 06-2U 91 ZONALCB 06-3U 95 CDVITOT 14U 95 CEDEVIS 04U 95 CEDEVIS 05U 95 CEDEVIS 06U 95 CEDEVIS 07U 95 CEDEVIS 10-3U 95 CEDEVIS 10-6U 95 CFECB 05 95 FEFA 14 95 FNCOT 13 95 FNCOT 14 95 FOVIHIT 09U 95 IFCOTCB 13 95 PEMEX 12 95 PEMEX 14 95 TFOVIS 13-2U 95 TFOVIS 13-3U 95 TFOVIS 14U 95 TFOVIS 14-2U 97 BRHCCB 08U EMIT. POR MUNIC. Y EDOS. SIN AVAL DEL GOB. FED. 90 PAMMCB 14U ORGANISMOS INTERNACIONALES 91 BLADEX 12 91 BLADEX 14 VALORES RESTRINGIDOS O DADOS EN GARANTIA AIM FCSTONE 0002781 AIM GBM 0777687 BI CETES 150326 EAIM FCSTONE 0002781 SERVICIOS FINANCIEROS 1C CETETRC ISHRS TOTAL DIRECTO VALORES EN REPORTO GUBERNAMENTALES LD BONDESD 171019 TOTAL REPORTO INSTRUMENTOS FINANCIEROS DERIVADOS FUTUROS FB DC24 MR15 FC PE H5 FC PE H5 FC PE H5 FC PE H5 FC PE H5 FC RX H5 FC RX H5 OPCIONES OC USH5 C15300 OC USH5 C15400 OC USH5 C15400 OC USH5 C15400 OC USH5 C15400 OC USH5 C15500 OC USH5 C15500 OD DA14200 C OD DA14800 C TOTAL DERIVADOS TOTAL DE INVERSION EN VALORES Calif. / Bursatilidad HR+1 HR AAA HR AAA mxAAA mxAAA mxAAA mxAAA mxAAA AAA(mex) AAA(mex) mxAAA mxAA+ BBB BBB Aa3 mxAAA BBB BBB+ AAA(mex) AA+(mex) AA+(mex) mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA AA(mex) AAA(mex) AAA(mex) AAA(mex) AA(mex) AA+(mex) AA(mex) AA(mex) Aaa.mx mxAAA mxAAA mxAAA mxAA+ mxAAA HR AAAA(mex) mxA mxA HR AA mxAAA mxAA mxAAA mxAAA AAA(mex) mxAAA AAA(mex) mxAAA C.mx mxA+ mxAAA mxAAA mxAAA mxAAA mxAAA AA(mex) HR A B-(mex) AAA(mex) AAA(mex) mxAAA AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) mxAAA AAA(mex) AAA(mex) AAA(mex) AAA(mex) Aaa.mx mxAAA AAA(mex) AAA(mex) AAA(mex) mxAAA B3.mx mxAAA AAA(mex) AAA(mex) HR+1 Cant. Títulos Participación Porcentual 1,680,697.17 20,458,735.65 29,835,728.69 0.03 0.39 0.57 5,319 600,000 1,029,074 2,268,650 600,000 500,000 631,257 371,325 516,853 113,000 78,580.34 60,095,119.80 103,323,819.94 227,400,780.26 60,155,667.60 50,163,808.50 63,375,600.13 37,518,640.87 51,889,160.78 2,496,558.95 0.00 1.15 1.97 4.34 1.15 0.96 1.21 0.72 0.99 0.05 1,000 1,000 1,700 5,000 2,500 25 92 68 4,396 250,000 350,000 560,000 122,084 311,079 500,000 95,180 132,072 555,005 482,000 271,863 700,000 1,379,530 1,220,000 578,928 387,872 500,000 3,012 1,139,124 460,040 589,576 6,226 475,777 20,000 574,462 553,137 300,000 450,000 389,000 903,968 107,683 900,000 300,000 506,035 350,000 500,000 40,000 281,180 700,000 894,965 450,000 700,000 500,000 10,640 4,256 6,384 214,466 182,200 31,660 14,475 214,491 138,192 35,996 1,854,821 350,000 1,106,094 500,000 1,342,693 1,078,407 1,331,000 1,100,000 100,000 277,862 116,738 90,460 72,393 11,102,615.99 13,110,455.31 25,880,955.98 70,488,883.44 26,643,490.03 24,643,457.32 92,019,026.07 100,352,403.81 478,764.10 25,287,014.25 38,751,418.65 56,050,436.40 12,225,932.48 31,202,011.04 50,059,121.00 9,546,249.04 13,217,761.01 55,523,247.43 48,353,594.60 27,274,562.77 70,210,317.80 140,643,182.83 122,100,822.02 58,265,348.27 38,878,788.99 50,496,021.50 321,052.70 114,064,913.89 46,308,704.73 59,293,615.28 679,705.74 47,627,527.17 1,407,159.46 57,957,874.45 55,986,809.65 30,402,112.50 45,398,453.85 39,076,020.17 93,539,458.31 10,797,215.15 90,324,603.90 30,091,698.60 51,143,238.96 35,149,216.55 50,169,926.50 400,000.00 27,987,475.12 70,343,985.60 89,702,868.19 45,210,828.60 70,257,782.70 50,081,521.50 4,238,601.51 1,680,864.93 2,199,926.30 105,031,955.60 11,320,751.03 2,969,259.66 2,576,665.94 47,447,459.73 8,039,474.93 11,530,031.96 9,336,551.26 35,034,361.95 110,976,590.03 50,037,839.00 73,764,752.56 108,385,990.03 133,735,748.16 109,865,943.00 43,812,545.20 130,209,989.65 60,025,006.39 46,179,194.97 3,749,584.21 0.21 0.25 0.49 1.34 0.51 0.47 1.76 1.91 0.01 0.48 0.74 1.07 0.23 0.60 0.96 0.18 0.25 1.06 0.92 0.52 1.34 2.68 2.33 1.11 0.74 0.96 0.01 2.18 0.88 1.13 0.01 0.91 0.03 1.11 1.07 0.58 0.87 0.75 1.78 0.21 1.72 0.57 0.98 0.67 0.96 0.01 0.53 1.34 1.71 0.86 1.34 0.96 0.08 0.03 0.04 2.00 0.22 0.06 0.05 0.91 0.15 0.22 0.18 0.67 2.12 0.95 1.41 2.07 2.55 2.10 0.84 2.48 1.15 0.88 0.07 165,848 98,037,542.16 1.87 513,647 1,254,005 51,467,883.98 125,974,122.02 0.98 2.40 5,213,801 6,886,250 331,283 5,609,198 5,213,801.00 6,886,832.00 3,300,120.33 5,609,198.00 0.10 0.13 0.06 0.11 85,000 8,741,400.00 4,552,382,537.57 0.17 86.85 6,923,202 690,273,295.68 690,273,295.68 13.17 13.17 630 15 121 50 9 20 11 10 189,000.00 26,592.30 214,511.22 88,641.00 15,955.38 35,456.40 7,460.44 6,782.22 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10 4 3 5 4 13 15 150 150 -30,008.67 -7,386.75 -5,540.06 -9,233.44 -7,386.75 -18,005.20 -20,775.23 -963,000.00 -279,000.00 -755,937.14 5,241,899,896.11 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -0.02 -0.01 -0.01 100.00 BAJB HR AAA Valor Razonable 168,717 150,000 53,167 CLASIFICACIÓN Discrecional CALIFICACIÓN AA/4 VaR Promedio 0.041% Límite de VaR 0.512% Para llevar a cabo la estimación del Valor en Riesgo (VaR) de mercado para las Sociedades de Inversión administradas por Operadora GBM, se acordó con la empresa Valor de Mercado (Valmer) que sea ella quien lo realice, siguiendo los criterios metodológicos aprobados por la Unidad de Administración Integral de riesgos de la Operadora. El método utilizado para la estimación del VaR es el conocido como simulación histórica, con los parámetros que se presentan a continuación: - Un periodo de muestra de un año - El nivel de confianza para el VaR fijado al 95% - El horizonte temporal para el que se estime la posible minusvalía será de 1 día _________________________________________________ Lic. José Manuel Fierro von Mohr

© Copyright 2026