MTABSCDMEXT017405 - MTA | Business Service Center

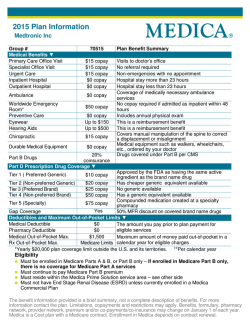

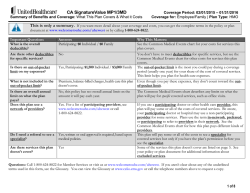

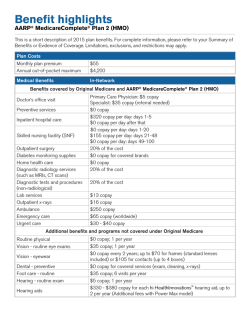

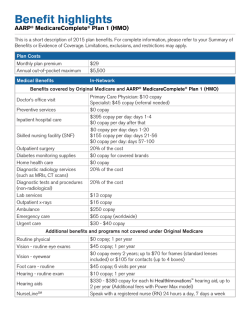

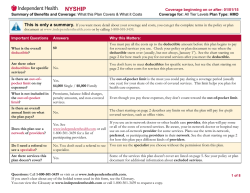

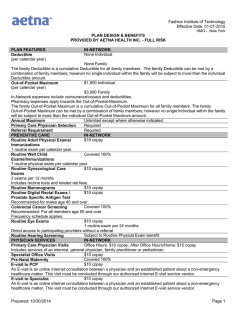

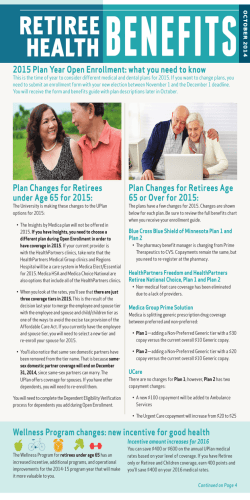

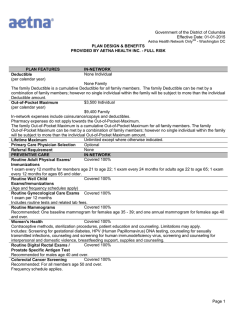

2015 Annual Open Enrollment/Change Form Active ATU 726 HR-BEN-369B Section 1 - Information and Instructions The purpose of this form is to enroll in or change health insurance, effective February 1, 2015. Please email a signed copy of the form to [email protected] or fax to 212-852-8700 or drop off at the 180 Livingston Street Walk-in Center 8:30 a.m. to 5 p.m., Monday – Friday. If you have any questions, please contact the Business Service Center (BSC) at 646-376-0123. Section 2 - Employee Information BSC ID Print Name Last Phone (H) First M.I. Suffix Pass # Email Phone (W) If your address on your pay stub is incorrect, contact the Business Service Center OR log onto www.mtabsc.info and change your address online OR complete HR-HRIS-012 Employee Data Change Form. An incorrect address will delay receipt of your new health insurance cards. Section 3 – Coverage Election – Effective February 1, 2015 Medical Individual Family Check One EMPIRE BLUECROSS BLUESHIELD BASIC OPTION EMPIRE BLUECROSS BLUESHIELD HIGH OPTION (Bi-weekly pre-tax required contribution of $13.17 for Individual Coverage and $26.34 for Family Coverage) UNITEDHEALTHCARE CHOICE OPTION (Live/work in the 5 boroughs of NY, the New York counties of Duchess, Nassau, Orange, Putnam, Rockland, Suffolk, Sullivan, Ulster and Westchester and the States of New Jersey, Pennsylvania, Connecticut and Delaware) OPT-OUT PROGRAM (for Medical/Hospital/Prescription Drugs) I agree to the Terms and Conditions of the Opt-Out Program on the back of this form. Alternate medical information must be provided below. Name of Policyholder: Policy #: Name of Insurance Carrier: Employer of Policyholder: Dental Individual Relationship: SS# of Policyholder: Date of Birth of Policyholder: Family Check one of the following dental plans ONLY if you did not enroll in the EmpireBCBS High Option, which includes dental coverage. DENTCARE/HEALTHPLEX (DMO) GHI SPECTRUM DENTAL (PPO) Section 4 – Dependent Information If you are found to be covering an ineligible dependent, coverage will be terminated retroactive to the date of the ineligibility and NYC Transit will pursue financial restitution for claims and/or premiums for the ineligible dependent. 1. Please fill in all information for new dependents you wish to enroll and submit required documentation (see Section 6). 2. Please fill in all information for any dependents you wish to delete. 3. Please contact the Business Service Center for the Domestic Partnership Package if you wish to enroll a domestic partner. NOTE: Your domestic partner will not be enrolled in health coverage unless an application is submitted and approved by the Benefits Department. Check One - Indicate (A) Add or (D) Delete A D Name SSN Check One - Relationship Spouse Domestic Partner Gender Child F M Date of Birth Mo Day Section 5 - Authorization My signature and date on this form certifies and warrants that all dependent eligibility information is true, correct, and current. I also certify that dependent children from age 19 to 26 that I have enrolled in coverage are not eligible for another employer-sponsored coverage. Employee Signature Business Service Center Last Revised: 08/15/2014 Date Creation Date: 04/01/2012 Year 2015 Annual Open Enrollment/Change Form Active ATU 726 HR-BEN-369B Section 6 – Dependent Required Documentation 1. For a Spouse A copy of Marriage Certificate, Social Security card, and, if your date of marriage is more than one year old: Your most recent Tax Return—Federal or State (including Puerto Rico Returns) o Your most recent tax return showing “Married Filing Jointly” or “Married Filing Separately”. Your spouse’s name must appear on the tax form on the line provided after the “married filing separately” status (or vice versa). o Only submit page 1 of the tax return. This should include the 1040 form, eFile Confirmation page, Tax Preparer’s Summary, or Federal Return Recap. o Eliminate all financial information. OR Proof of Joint Ownership Both the enrollee’s and spouse’s name must be listed on the documentation of joint ownership and be dated within the past 90 days. Examples include a copy of: Homeowners/Renters Insurance Policy Mortgage Statement Credit Card Statement Property Tax Document Loan Obligation Rental/Lease Agreement Bank Account Statement Utility/phone/internet/cable bills Pension/life insurance/will designating spouse as beneficiary If you are not able to provide the required documentation, complete and sign the affidavit enclosed in this package. Have it notarized and return it with your Enrollment form. 2. For Children For a Natural-Born Child, a copy of: Birth Certificate showing employee’s name Social Security card For a Stepchild, or Legally Adopted Child, a copy of: Birth Certificate Social Security card Legal documentation concerning adoption 3. Dependent Children Coverage between ages 19 and 26 To enroll a dependent child from age 19 to 26 in your medical, hospital, and prescription drug coverage, add the child’s name on this form, submit required documentation, and affirm by signing this form that your child is not eligible for other employer-sponsored coverage. Those who enroll in the High Option are not required to submit student verification from age 19 to 21 to cover dependent children in dental coverage. Section 7 – The Opt-Out Program Terms and Conditions Incentive for Opt-Out You may opt out of medical coverage and receive a lump sum incentive payment. Opting out of medical coverage means that you elect not to participate in medical, hospital, and prescription drug coverage. You will however retain coverage in dental and vision plans. To be eligible, you must document that you will be covered by another medical plan sponsored by: a spouse or domestic partner’s employer another employer armed forces Lump Sum Incentive Payment Payment of the lump sum incentive will be made at the end of the Opt-Out year in the following amount: $550 for an employee who receives medical coverage through spouse/domestic partner who is also employed $550 if you opt-out of individual medical coverage $1,100 if you opt-out of family medical coverage by NYC Transit or another MTA agency If you participate in the Opt-Out Program and either re-enroll or retire during that same year, you will not be eligible to receive any part of the incentive payment. Terms of Agreement I understand that this election will be effective from January 1 st through December 31, 2015 unless I am no longer allowed by law or as a result of a qualifying event or such other events as the Authority determines will permit a change or revocation of an election. I understand that the lump sum payment will be subject to all applicable Federal, State and Local taxes. I also understand that these monies will not be considered income for pension purposes and will not be included in any calculation therein. This agreement is subject to the terms of the employer's plan, as amended from time to time in effect, shall be governed by and construed in accordance with applicable laws, shall take effect as a sealed instrument under applicable laws and revokes any prior election and compensation agreement relating to such plan. The health benefits waiver will be administered as permissible under IRS section 125. Business Service Center Last Revised: 08/15/2014 Creation Date: 04/01/2012 ATU Local 726 Health Plan Highlights 1 MEDICAL Bi-Weekly Pre-Tax Deductions Monthly Pre-Tax Deductions Type of Plan Office Visit Specialist Office Visit Diagnostic Service Hospital Service Well-Child Care Visits up to Chiropractic Outpatient Mental Health Inpatient Alcohol and Substance Abuse Physical Therapy PRESCRIPTION DRUGS for all medical plans Retail Generic Name Brand Formulary Name Brand Non-Formulary Mail Order2 Generic Name Brand Formulary Name Brand Non-Formulary Empire BlueCross BlueShield Basic Option Empire BlueCross BlueShield High Option United HealthCareChoice United HealthCareChoice Plus Not Open to New Enrollees $0 $13.17 Individual, $26.34 Family $0 NA NA NA NA $25.00 In-Network and Out-of-Network In-Network Highlights 1 $15 copay $15 copay $15 copay $50 deductible, Up to 120 days $0 copay $15 copay In-Network and Out-of-Network In-Network Highlights 1 In-Network and Out-of-Network Highlights1 $15 copay $15 copay $15 copay $50 deductible, Up to 365 days $0 copay $15 copay HMO In-Network only Highlights1 $0 copay $0 copay $0 copay $0 deductible 365 days $0 copay $0 copay $20 copay, 60 visits per year $20 copay, 60 visits per year No copay, 60 visits per year $20 copay, 20 visits $0 copay, 5 days per year $0 copay, 5 days per year $0 copay, 7 days per year $300 copay $15 copay, 8 visits per year $15 copay, 8 visits per year $0 copay, 90 visits per year $20 copay, 60 consecutive visits OPTUM RX Up to 30 days supply $0 copay $10 copay $15 copay Up to 90 days supply $0 copay $20 copay $30 copay OPT-OUT PROGRAM Coverage Opt-out Retain Incentive Individual Family Medical, Hospital and Prescription Drugs Dental and Vision Lump sum at end of year $550 $1,100 $15 copay $20 copay $20 copay $300 copay $0 copay $20 copay ATU Local 726 Health Plan Highlights 1 DENTAL HealthPlex/Dentcare Type of Plan Deductible Yearly Maximum Orthodontics Oral Examination & Diagnosis X-Rays Prophylaxis (cleaning) Filling Root Canal Crowns and Bridges VISION Every 12 months Eye Exam Frames Lenses Single Vision Kryptok Bifocal Trifocal Dependent Coverage when coverage ends MEDICAL PPO Basic/High Option and HMO Vision In-Network/Out-ofNetwork/DME Medical/Hospital High Option Dental/Vision/Out-of-Network /DME PRESCRIPTION Optum RX DENTAL HealthPlex/Dentcare 3 GHI Spectrum Plus Dental 1 DMO In-Network only GHI Spectrum Plus Dental PPO In-Network and Out-of-Network Highlights1 $0 None In-Network Highlights1 $0 None $950 copay-Up to 24 months Covered in full Covered in full Covered in full Covered in full Covered in full $50 copay on bridges Not Covered Covered in full Covered in full Covered in full Covered in full Covered in full Covered in full High Option Dental (this is the only dental choice for those enrolled in High Option medical plan) PPO In-Network and Out-of-Network In-Network Highlights1 $50 per person, per year $1,200 $1,500 lifetime max Covered in full Covered in full Covered in full 80% 80% 50% UHC In-Network (General Vision Service) Covered in full Up to $100 Out-of-Network Maximum Reimbursement $40 See below Covered in full Covered in full $73.00 (includes frames & exam) $81.00 (includes frames & exam) Covered in full $89.00 (includes frames & exam) Age 19 Age 21 Age 26 N/A N/A End of Month End of Month N/A N/A N/A End of Month End of Month N/A N/A N/A End of Month N/A N/A N/A N/A N/A N/A N/A N/A For detailed information on In-Network and Out-of-Network coverage, please refer to your Summary Plan Description (SPD). If you are on a maintenance medication that has been filled two times at a retail pharmacy (original prescription plus one refill), mail order is mandatory. 3 If Full-time student verification is submitted, coverage continues to end of year they reach age 23. 2

© Copyright 2026