Plan Changes for Retirees Age 65 or Over for 2015: Plan Changes

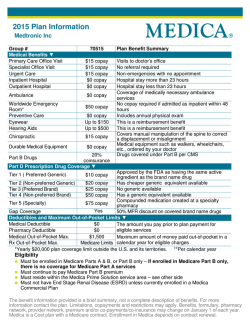

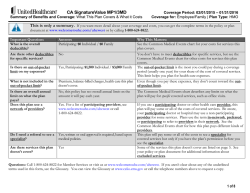

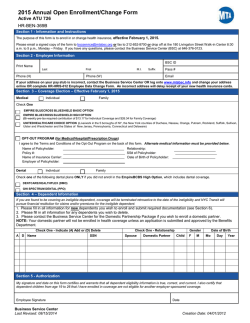

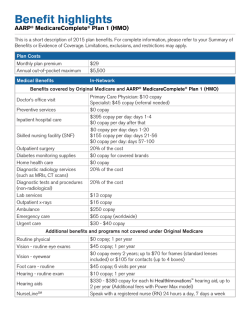

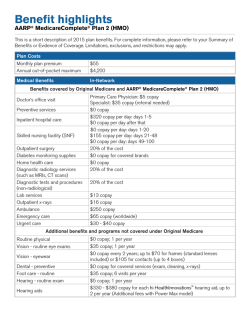

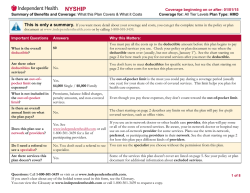

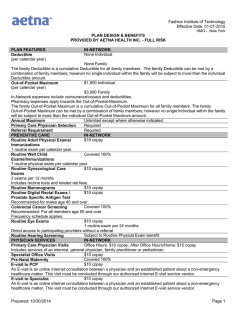

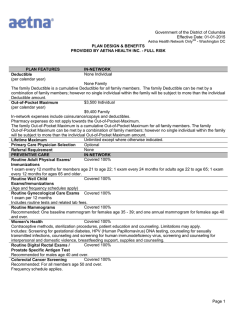

OCTOBER 2014 2015 Plan Year Open Enrollment: what you need to know This is the time of year to consider different medical and dental plans for 2015. If you want to change plans, you need to submit an enrollment form with your new election between November 1 and the December 1 deadline. You will receive the form and benefits guide with plan descriptions later in October. Plan Changes for Retirees under Age 65 for 2015: The University is making these changes to the UPlan options for 2015: • The Insights by Medica plan will not be offered in 2015. If you have Insights, you need to choose a different plan during Open Enrollment in order to have coverage in 2015. If your current provider is with the HealthPartners clinics, take note that the HealthPartners Medical Group clinics and Regions Hospital will be a care system in Medica Elect/Essential for 2015. Medica HSA and Medica Choice National are also options that include all of the HealthPartners clinics. • When you look at the rates, you’ll see that there are just three coverage tiers in 2015. This is the result of the decision last year to merge the employee and spouse tier with the employee and spouse and child/children tier as one of the ways to avoid the excise tax provision of the Affordable Care Act. If you currently have the employee and spouse tier, you will need to select a new tier and re-enroll your spouse for 2015. • You’ll also notice that same-sex domestic partners have been removed from the tier name. That is because samesex domestic partner coverage will end on December 31, 2014, since same-sex partners can marry. The UPlan offers coverage for spouses. If you have other dependents, you will need to re-enroll them. You will need to complete the Dependent Eligibility Verification process for dependents you add during Open Enrollment. Plan Changes for Retirees Age 65 or Over for 2015: The plans have a few changes for 2015. Changes are shown below for each plan. Be sure to review the full benefits chart when you receive your enrollment guide. Blue Cross Blue Shield of Minnesota Plan 1 and Plan 2 • The pharmacy benefit manager is changing from Prime Therapeutics to CVS. Copayments remain the same, but you need to re-register at the pharmacy. HealthPartners Freedom and HealthPartners Retiree National Choice, Plan 1 and Plan 2 • Non-medical foot care coverage has been eliminated due to a lack of providers. Medica Group Prime Solution Medica is splitting generic prescription drug coverage between preferred and non-preferred: • Plan 1—adding a Non-Preferred Generic tier with a $30 copay versus the current overall $10 Generic copay. • Plan 2—adding a Non-Preferred Generic tier with a $20 copay versus the current overall $10 Generic copay. UCare There are no changes for Plan 1; however, Plan 2 has two copayment changes: • A new $100 copayment will be added to Ambulance Services • The Urgent Care copayment will increase from $20 to $25 Wellness Program changes: new incentive for good health Incentive amount increases for 2016 The Wellness Program for retirees under age 65 has an increased incentive, additional programs, and operational improvements for the 2014-15 program year that will make it more valuable to you. You can save $400 or $600 on the annual UPlan medical rates based on your level of coverage. If you have Retiree only or Retiree and Children coverage, earn 400 points and you’ll save $400 on your 2016 medical rates. Continued on Page 4 2015 Monthly Premium — Retirees Age 65 or Over (Includes premium for Medicare Part D) Medical Plan Cost per person* Blue Cross Blue Shield: U of M Retiree Plan Group Platinum BlueSM Plan C Plan 1: $290.00 Plan 2: $168.25 HealthPartners Freedom Plan and HealthPartners Retiree National Choice Plan 1: $256.50 Plan 2: $153.50 Medica Group Prime Solution Plan 1: $267.00 Plan 2: $158.00 UCare for Seniors Plan 1: $271.00 Plan 2: $142.00 *Retiree, spouse, surviving spouse age 65 or over, and participant on disability status with Medicare Part A and Part B Medical: 2015 Monthly Rates — Retirees under Age 65/ Participants on Disability Status Total Cost UPlan Wellness Achievement Rates Total Cost UPlan Standard Rates Base Plan: Medica Elect/Essential: Twin Cities & Duluth $605.91 $630.91 Base Plan: Medica Choice Regional: Greater Minnesota $605.91 $630.91 Medica ACO Plan: Twin Cities only $584.05 $609.05 Medica Choice National $671.02 $696.02 Medica HSA $544.11 $569.11 Total Cost UPlan Wellness Achievement Rates Total Cost UPlan Standard Rates Base Plan: Medica Elect/Essential: Twin Cities & Duluth $1,068.67 $1,093.67 Base Plan: Medica Choice Regional: Greater Minnesota $1,068.67 $1,093.67 Medica ACO Plan: Twin Cities only $1,028.82 $1,053.82 Medica Choice National $1,179.15 $1,204.15 $945.73 $970.73 Retiree only; Spouse under age 65 only; Surviving Spouse only; or One Dependent Child only Retiree and Children; Spouse under age 65 and Children; Surviving Spouse and Children; or Two or more Dependent Children only Medica HSA Total Cost UPlan Wellness Achievement Rates Total Cost UPlan Standard Rates Base Plan: Medica Elect/Essential: Twin Cities & Duluth $1,602.42 $1,635.75 Base Plan: Medica Choice Regional: Greater Minnesota $1,602.42 $1,635.75 Medica ACO Plan: Twin Cities only $1,546.02 $1,579.35 Medica Choice National $1,771.03 $1,804.36 Medica HSA $1,479.95 $1,513.28 Retiree and Spouse with or without Children Come to an Employee Health & Benefits Fair Plan to attend the fair and meet with representatives of the health and retirement plans. Walk around and talk to the representatives from your medical or dental plan, the pharmacy benefits manager, the retirement investment plans, and more. Flu shots funded by the UPlan Wellness Program are offered at no cost to you at all of the fair locations. 2 November 5 Bede Ballroom Crookston, Noon to 2 p.m. November 6 Kirby Student Center Ballroom Duluth, 10 a.m. to 2:30 p.m. November 10 Oyate Hall, UMM Student Center Morris, 11 a.m. to 1 p.m. November 11 Great Hall. Coffman Memorial Union Minneapolis, 10 a.m. to 3:30 p.m. November 12 North Star Ballroom, Student Center St. Paul, 10 a.m. to 3:30 p.m. Flu shots are in the Cherrywood Room Examples of Plan Differences for Age 65 or Over Outpatient Surgery Physician Office Visit Urgent Care Visit BCBS Plan 1 100% after Medicare Part B annual deductible 100% after Medicare Part B annual deductible 100% after Medicare Part B annual deductible BCBS Plan 2 100% after $75 copay 100% after $20 copay 100% after $20 copay HealthPartners Plan 1 100% coverage 100% after $15 copay 100% after $15 copay 100% after $20 copay for primary care; $30 copay for specialty care 100% after $30 copay 100% after $15 copay 100% after $15 copay 100% after $20 copay for primary care; $30 copay for specialty care 100% after $30 copay HealthPartners Plan 2 100% after $75 copay Medica Plan 1 100% coverage Medica Plan 2 100% after $50 copay UCare Plan 1 100% coverage 100% after $15 copay 100% after $20 copay UCare Plan 2 100% after $200 copay 100% after $20 copay 100% after $25 copay Dental: 2015 Monthly Rates — Retirees of All Ages/ Participants on Disability Status Retiree only; Spouse under age 65 only; Surviving Spouse only; or One Dependent Child only Total Cost Base Plan: Delta Dental PPO: Twin Cities & Duluth $34.00 Base Plan: Delta Dental Premier: Greater Minnesota $41.69 University Choice $47.97 Delta Dental Premier $41.69 HealthPartners Dental $37.72 HealthPartners Dental Choice $41.06 Retiree and Children; Spouse under age 65 and Children; Surviving Spouse and Children; or Two or more Dependent Children only Total Cost Base Plan: Delta Dental PPO: Twin Cities & Duluth $81.40 Base Plan: Delta Dental Premier: Greater Minnesota $99.32 University Choice $114.83 Delta Dental Premier $99.32 HealthPartners Dental $92.91 HealthPartners Dental Choice $100.90 Retiree and Spouse with or without Children Base Plan: Delta Dental PPO: Twin Cities & Duluth Total Cost $94.42 Base Plan: Delta Dental Premier: Greater Minnesota $115.68 University Choice $133.58 Delta Dental Premier $115.68 HealthPartners Dental $104.89 HealthPartners Dental Choice $113.90 3 Employee Benefits 200 Donhowe 319 15th Avenue SE Minneapolis, MN 55455-0103 Explore wellness programs and activities in your plan All of the medical plan options for retirees age 65 or over offer a variety of wellness programs and activities ranging from fitness programs to smoking cessation support to discounts on services. Look into programs based on your interests and needs from this sample of options. The complete list is available through the plan and on the Employee Benefits website at www.umn.edu/benefits/retirees.wellness. Blue Cross Blue Shield of Minnesota: U of M Retiree Plan - Plan 1 and Group Platinum Blue Plan C - Plan 2 • Fitness discount program with participating fitness centers Retirees under age 65–Continued from Page 1 • 24-hour Nurse Advice Line If your coverage level is Retiree and Spouse with or without Children, you’ll save $600 on your 2016 medical rates when you earn 600 points. • Stop-Smoking Support • Discounts for Weight Watchers, eyeglasses, and more HealthPartners Freedom and HealthPartners Retiree National Choice Plans 1 & 2 To achieve the new reductions, you will find increases in the number of points for some existing activities, along with new activities. • Fitness club membership at most major clubs for just $25 per year Increase in points awarded • Free 24/7 access to CareLine nurse line and virtuwell.com We recommend you first take the wellness assessment, and then take the biometric health screening. Each of those activities has increased to 150 points. That’s 300 points right there. And if you have your spouse covered, he or she can take the wellness assessment and also earn 150 points. Spouses will be able to earn a total of 200 points. • Free stop smoking program • Healthy discounts on eye wear, hearing aids, and much more Medica Group Prime Solution Plans 1 & 2 • Partnered fitness program provides a health club membership for an annual fee of $25 The programs that support you in managing your health— health coaching for lifestyle change, condition management health coaching, face-to-face health coaching, and the tobacco cessation program—have all increased by 50 points. • Personal Health Advocate to navigate the healthcare system and provide access to nurses 24/7 • Free tobacco treatment program to help quit the use of all forms of tobacco Friendlier online experience UCare for Seniors Plans 1 & 2 StayWell launched a new website on October 1 that is easier to navigate and will be mobile friendly. The StayWell site is accessible from the University’s website—wellness.umn.edu. • Silver Sneakers Fitness Program provides fully paid membership to health clubs including YMCA, Snap Fitness, Anytime Fitness • Health Connections—24-Hour Nurse Line, Community Education Class reimbursement, My Health Decisions Online Tool The University is an equal opportunity educator and employer. Alternate print format of this newsletter is available upon request. Please call the Office of Human Resources, Employee Benefits at 612-624-8647 or 800-756-2363. © 2014 Regents of the University of Minnesota. All rights reserved. • Quit Smoking, plus Disease and Case Management Programs 4

© Copyright 2026