SIERRA VISTA AZ AREA - Real Market Reports

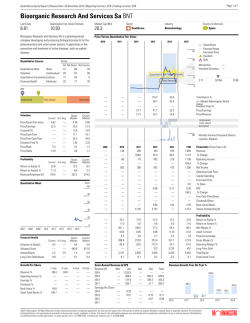

REAL ESTATE MARKET REPORT SIERRA VISTA AZ AREA Su M Tu W Th F Sa 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Sunday, February 1 2015 TABLE OF CONTENTS Charts and Commentary ……………………………………………….. Market Summary Table ……………………………………………….. Glossary ………………………………………………………………... The Sonny Lee Home Selling Team Your Realtors 122 N. 7th Street Sierra Vista, Arizona 85635 www.SonnyLee.com [email protected] 520*452*0400 Real Market Reports RealMarketReports.com Pages 1-2 Page 3 Page 4 REAL ESTATE MARKET REPORT SIERRA VISTA AZ AREA Sunday, February 1, 2015 The Sonny Lee Home Selling Team Your Realtors [email protected] 520*452*0400 Let's take a look The pending ratio indicates the supply & demand of the market. Specifically, a high ratio means that listings are in demand and quickly going to contract. Alternatively, a low ratio means there are not enough qualified buyers for the existing supply. at the real estate market. Currently there are 43 sales pending in the market overall, leaving 465 listings still for sale. The resulting pending ratio is 8.5% (43 divided by 508). So you might be asking yourself, that's great... but what exactly does it mean? I'm glad you asked! "Current inventory is described as somewhat slow." Taking a closer look, we notice that the $100K - $150K price range has a relatively large number of contracts pending sale. We also notice that the $150K - $200K price range has a relatively large inventory of properties for sale at 123 listings. The median list price (or asking price) for all properties in this market is $189,900. Number of Listings For Sale vs. Pending Contract Properties For Sale Contracts Pending Sierra Vista AZ Area 140 Updated on 2/1/2015, RealMarketReports.com Copyright © The Sonny Lee Home Selling Team 120 100 80 60 40 20 Num Sold vs. Off-Market (Last 6 mos.) Sold Off-Market Sierra Vista AZ Area 300 Updated on 2/1/2015, RealMarketReports.com Copyright © The Sonny Lee Home Selling Team 250 200 150 100 50 Real Market Reports RealMarketReports.com 1 $700K $650K $600K $550K $500K $450K $400K $350K $300K $250K $200K $150K $100K $50K $0K 0 $700K $650K $600K $550K $500K $450K $400K $350K $300K $250K $200K $150K $100K $50K $0K 0 A total of 328 contracts have closed in the last 6 months with a median sold price of $154,000. Breaking it down, we notice that the $150K - $200K price range contains the highest number of sold listings. Alternatively, a total of 1033 listings have failed to sell in that same period of time. Listings may fail to sell for many reasons such as being priced too high, having been inadequately marketed, the property was in poor condition, or perhaps the owner had second thoughts about selling at this particular time. The $150K - $200K price range has the highest number of off-market listings at 278 properties. Market Dashboard REAL ESTATE MARKET REPORT SIERRA VISTA AZ AREA Sunday, February 1, 2015 The Sonny Lee Home Selling Team Your Realtors [email protected] 520*452*0400 Looking at the chart to the right, you might be wondering why average days on market (DOM) is important. This is a useful measurement because it can help us to determine whether we are in a buyer's market (indicated by high DOM), or a seller's market (indicated by low DOM). Active listings (properties for sale) have been on the market for a median time of 113 days. Median Days on Market (DOM) Sold For Sale Sierra Vista AZ Area 500 Updated on 2/1/2015, RealMarketReports.com Copyright © The Sonny Lee Home Selling Team 450 400 350 300 250 200 150 Analysis of sold properties for the last six months reveals a median sold price of $154,000 and 119 days on market. Notice that properties in the $350K - $400K price range have sold quickest over the last six months. 100 50 The recent history of sales can be seen in the two charts below. The median sold price for the last 30 days was $154,000 with a DOM of 126 days. "The median list-to-sales ratio for this area is 94.2%." Ratios are simple ways to express the difference between two values such as list price and sold price. In our case, we typically use the list-to-sale ratio to determine the percentage of the final list price that the buyer ultimately paid. It is a very common method to help buyers decide how much to offer on a property. Since the recent DOM is greater than the median DOM for the last 6 months, it is a negative indicator for demand. It is always important to realize that real estate markets can fluctuate due to many factors, including shifting interest rates, the economy, or seasonal changes. Median Sold Prices Sep Real Market Reports RealMarketReports.com Nov Dec Jan $700K $650K $600K $550K $500K $450K $400K Sierra Vista AZ Area 160 140 120 100 80 60 40 20 0 Copyright © The Sonny Lee Home Selling Team Updated on 2/1/2015, RealMarketReports.com Oct Analysis of the absorption rate indicates an inventory of 8.5 months based on the last 6 months of sales. This estimate is often used to determine how long it would take to sell off the current inventory of properties if all conditions remained the same. It is significant to mention that this estimate does not take into consideration any additional properties that will come onto the market in the future. Median Days on Market (Sold) Sierra Vista AZ Area $162K $160K $158K $156K $154K $152K $150K $148K $146K $144K $350K $300K $250K $200K $150K $100K $50K $0K 0 Feb 2 Copyright © The Sonny Lee Home Selling Team Updated on 2/1/2015, RealMarketReports.com Sep Oct Nov Dec Jan Feb Market Dashboard REAL ESTATE MARKET REPORT SIERRA VISTA AZ AREA Sunday, February 1, 2015 The Sonny Lee Home Selling Team Your Realtors [email protected] 520*452*0400 43 MARKET SUMMARY TABLE A = Average Value M = Median Value N/A = Not Available Price Range 465 Low High Num # $0 $49,999 9 $50,000 $99,999 42 $100,000 $149,999 87 $150,000 $199,999 123 $200,000 $249,999 74 $250,000 $299,999 59 $300,000 $349,999 27 $350,000 $399,999 18 $400,000 $449,999 10 $450,000 $499,999 7 $500,000 $549,999 0 $550,000 $599,999 6 $600,000 $649,999 1 $650,000 $699,999 1 $700,000 + 1 Market Totals 1033 PENDING [2] 328 ACTIVE [1] Days on Market Current List Price A 116 $ 37,257 M 142 $ 39,900 A 137 $ 81,938 M 121 $ 87,950 A 111 $ 127,871 M 82 $ 125,000 A 124 $ 176,169 M 108 $ 178,000 A 134 $ 227,717 M 99 $ 229,000 A 170 $ 277,412 M 141 $ 277,367 A 133 $ 322,924 M 71 $ 320,000 A 253 $ 371,829 M 161 $ 371,750 A 209 $ 427,040 M 211 $ 429,450 A 303 $ 479,257 M 168 $ 475,000 A 144 $ 580,933 M 139 $ 575,000 A 78 $ 649,900 M 78 $ 649,900 A 450 $ 680,000 M 450 $ 680,000 A 297 $ 880,000 M 297 $ 880,000 465 OFF-MARKET (last 6 mos) [3] Num # Pend Ratio Num # Num # 2 18% 15 24 9 18% 53 58 13 13% 160 73 13 10% 278 74 6 8% 220 51 0 135 32 0 75 12 0 48 2 0 16 1 0 13 1 0 6 0 0 3 0 0 5 0 0 1 0 0 5 0 1,033 328 43 8% ABSORPTION RATE (months of inventory) SOLD/CLOSED (last 6 months) [4] Days on Market Original List Price Final List Price Sold/ Closed Price ListSale Ratio A 136 $ 78,811 $ 72,549 $ 30,511 42% M 92 $ 53,950 $ 44,900 $ 35,750 80% A 148 $ 90,357 $ 77,065 $ 73,284 95% M 119 $ 89,000 $ 77,000 $ 70,750 92% A 138 $ 175,569 $ 130,755 $ 125,650 96% M 126 $ 140,000 $ 129,999 $ 126,900 98% A 157 $ 189,678 $ 179,977 $ 174,244 97% M 105 $ 189,000 $ 178,450 $ 175,000 98% A 177 $ 238,083 $ 229,312 $ 221,383 97% M 131 $ 235,000 $ 229,900 $ 223,450 97% A 168 $ 290,591 $ 283,643 $ 276,072 97% M 146 $ 289,900 $ 284,950 $ 275,000 97% A 143 $ 352,958 $ 346,864 $ 328,697 95% M 131 $ 352,708 $ 344,900 $ 332,897 97% A 50 $ 366,500 $ 359,500 $ 350,750 98% M 50 $ 366,500 $ 359,500 $ 350,750 98% A 182 $ 445,000 $ 424,900 $ 405,000 95% M 182 $ 445,000 $ 424,900 $ 405,000 95% A 126 $ 499,000 $ 499,000 $ 450,000 90% M 126 $ 499,000 $ 499,000 $ 450,000 90% 2.3 4.3 7.2 10 8.7 11.1 13.5 54 60 42 8.5 Market Averages 141 $ 211,874 153 $ 187,008 $ 169,668 $ 160,594 95% Market Medians 113 $ 189,900 119 $ 176,053 $ 163,500 $ 154,000 94% Date Range (Off-Market & Sold) = 08/03/2014 to 02/01/2015 Data believed to be accurate but not guaranteed. Est. Mos. Favors Sellers Favors Buyers Status = [1] A; [2] P; [3] L, E; [4] C Zip Code = 85650, 85616, 85615, 85635 Dwelling = Single Family Res Real Market Reports RealMarketReports.com 3 Market Summary Table REAL ESTATE MARKET REPORT SIERRA VISTA AZ AREA Sunday, February 1, 2015 The Sonny Lee Home Selling Team Your Realtors [email protected] 520*452*0400 1. PROPERTIES FOR SALE (ACTIVE) a. Number Active: The number of listings for sale which are currently being marketed but do not yet have a purchase agreement. b. Days on Market (DOM): The marketing period of currently active listings. This does not account for some listings which have had a previous listing period, but were re-entered as a new listing. c. Current List Price: The price that a property seller is currently asking. 2. CONTRACTS PENDING a. Number Pending: The number of current listings for which a contract has been signed but has not yet closed. b. Pending Ratio: Sometimes called a “list-to-pending ratio”. This is a measure of how fast properties are going under contract vs. how fast they are being listed. Pending Ratio = P (Number of Pending Listings) A+P (Number of Active + Pending) (P) represents properties that buyers have chosen (A+P) represents the entire pool from which they have chosen 3. OFF-MARKET a. Number Off-Market: The number of listing agreements that have failed to close in the last 6 months. Some owners may choose to re-offer their property for sale. 4. PROPERTIES SOLD (CLOSED CONTRACT) a. Number Sold: The number of properties that have gone to a closing in the last 6 months. b. Days on Market (DOM): The marketing time it has taken properties to sell in the last 6 months. c. Original List Price: The price at which a sold property was originally marketed. d. Final List Price: The price at which a sold property was marketed just prior to selling. e. Sold/Closed Price: The price for which a property sold. f. List to Sales Ratio: The percentage of the list price that the buyer ultimately paid for the property. List to Sales Ratio = Sold Price Final List Price 5. ABSORPTION RATE / MONTHS OF INVENTORY a. Absorption Rate / Months of Inventory: An estimate of how fast listings are currently selling measured in months. For example, if 100 properties sell per month and there are 800 properties for sale - there is an 8 month supply of inventory before counting the additional properties that will come on the market. Real Market Reports RealMarketReports.com 4 Glossary

© Copyright 2026