download full report - Liberty Capital Holdings Ghana Ltd.

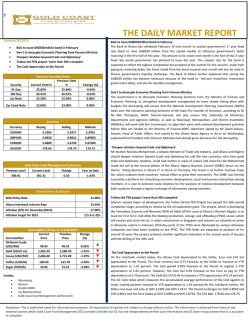

MARKET SUMMARY REPORT 30th January 2015 TABLE OF CONTENT Economy Highlight BoG to issue GHȻ630million bond in February Government to decouple Economic Planning from Finance Ministry Top Business Producer Price Inflation falls by 34.2% Tullow-led TEN project 'more than 50% complete Foreign Bids Cocoa Enters Bear Market as Chocolate Addiction Tempers Cheap Oil Burns $390 Billion Hole in Investors' Pockets Market Information Treasury Bill Rate Bank of Ghana Indicative rate GSE Summary Commodity News Investment Funds Economy Highlight BoG to issue GHȻ630million bond in February Source: Myjoyonline The Bank of Ghana has scheduled February 19 next month to auction government's 3- year fixed rate bond to raise GHȻ630 million from the capital market to refinance government's debts maturing in the first half of this year. The amount to be raised next month is the first of two 3-year fixed rate bonds government has planned to issue this year. The coupon rate for the bond is expected to reflect the highest competitive bid accepted at the auction for the security. Aside from paying its maturing debts, the funds raised from the bond issuance next month will also be used to finance government's liquidity challenges. The Bank of Ghana further explained that raising the GHȻ630 million has become necessary because of the need to "rollover maturities, restructure government debts, and also for liquidity management". Earlier this year, the Bank of Ghana revealed government's intention to borrow GHȻ25.42 billion from the domestic market within the first six months of the year: an amount that is twice the GHȻ12.72 billion it borrowed through the issuance of government securities in the same period last year. According to the government's debt issuance plan for the first half of this year, in February alone it is expected to raise about GHȻ4.15 billion through various securities including Treasury bills, 1-year and 2- year fixed notes. Government to decouple Economic Planning from Finance Ministry Source: Myjoyonline The Government is to decouple Economic Planning functions from the Ministry of Finance and Economic Planning, to strengthen development management by more closely linking plans with budgets. The decoupling will ensure that the National Development Planning Commission (NDPC) takes over the economic planning functions of the State. The transfer of functions, according to Dr. Nii Moi Thompson, NDPC Director-General, will also ensure that ultimately all Ministries, Departments and Agencies (MDAs), as well as Municipal, Metropolitan, and District Assemblies (MMDAs), will work with the Commission, to align their plans with national development priorities before they are funded by the Ministry of Finance. NDPC statement signed by Mr David Owusu-Amoah, Head of Public Affairs, and copied to the Ghana News Agency in Accra on Wednesday, explained that President John Dramani Mahama had already given directives for the decoupling. The statement said the two institutions have met several times to determine the scope and nature of the transfer. He cautioned, however, that the country’s development efforts would be futile without “extensive institutional reforms.” In this regard, he said, the Commission has incorporated “soft issues,” such as work attitudes, and “core national values,” into its medium-term development framework which are being implemented by government. According to the statement, the decoupling process was disclosed to Heads of Development Cooperation Agencies in Ghana, during a working visit to the NDPC headquarters to familiarize themselves with the work of the Commission. Top Business Producer Price Inflation falls by 34.2% Source: Ghana Web The Producer Price Inflation (PPI) rate for December 2014 fell to 34.2 per cent, down from a revised 37.6 per cent recorded in November 2014, the Deputy Government Statistician Mr Baah Wadieh said on Wednesday. The PPI measures the average change over time in the prices received by domestic producers for the production of their goods and services. Mr Wadieh said the fall in global oil prices accounted for the decline in the PPI. The rate in the petroleum subsector fell to 30.9 per cent in December from 61.1 per cent in November as a result of reduction in prices of petroleum products. The Mining and Quarrying sub-sector increased by 2.7 percentage points to 43.3 per cent over the November 2014 rate of 40.6 per cent. On the other hand, manufacturing, which constitutes more than two-thirds of total industry, fell by 6.1 percentage points to record 33.1 per cent. The utilities sub-sector recorded producer price inflation rate of 27.5 per cent, a marginal decrease of 0.1 percentage point over the November 2014 rate of 27.6 per cent. Tullow-led TEN project 'more than 50% complete Source: Ghana Web Ghana’s second major oil development, the Tullow Oil-led TEN Project has passed the 50% overall completion stage, according to release by the oil exploration giant. The project, which is developing the Tweneboa, Enyenra and Ntomme (TEN) oil fields off the coast of Ghana’s Western Region, is on track for First Oil in mid-2016. The floating production, storage and offloading (FPSO) vessel, which will receive and store the oil, is under construction in Singapore and remains on schedule to arrive in Ghanaian waters in February 2016. Key parts of the FPSO were fabricated by various Ghanaian companies and have been installed on the FPSO. The TEN fields are expected to produce oil for around 20 years. The project achieved another significant milestone in the second week of January with the drilling of the 10th well. This production well, through which crude oil will flow from the Enyenra reservoir, is the final well required for start-up in mid-2016.The drilling of the 10 start-up wells has therefore been completed ahead of the March 2015 schedule. Minister for Energy and Petroleum, Emmanuel Armah-Kofi Buah, said he was delighted to see the country's next big oil project on to achieve its mid-2016 target for first oil. “I commend Tullow and its partners on progress to date and implore them to maintain this momentum for the second half of the project”, he said. TEN Project Director, Terry Hughes, said: “It’s fantastic that we have passed these two important milestones ahead of schedule. However, we’re only halfway through and we still have a lot to do, so we will not be resting on our laurels and I am confident we will deliver the project on time for Ghana.” General Manager of Tullow Ghana, Charles Darku, reiterated the commitment of the TEN partners to ensuring the timely and complete delivery of another world class oil and gas fields to support Ghana’s socio-economic development. Foreign Bids Cocoa Enters Bear Market as Chocolate Addiction Tempers Source: Bloomberg News The world’s chocolate addiction is finally showing signs of easing, sending cocoa futures tumbling into a bear market. Slowing global economies mean that consumers are looking for ways to trim disposable spending, and that could leave chocolate off the menu, according to Jack Scoville, a vice president of Price Futures Group. Cocoa-bean processing, a gauge of demand, fell in Asia, Europe and North America in the fourth quarter, industry reports showed this month. Cocoa futures are down about 21 percent since touching a three-year high in September after an outbreak of Ebola didn’t hamper shipments from West Africa, which produces 70 percent of global supply. Three straight years of price gains are also encouraging farmers to increase output. “Demand is actually slackening, and is not nearly as good as many people had expected,” Scoville said in a telephone interview from Chicago. “The high prices are doing their job and will probably bring better-than-expected production. Next year, we may even have a surplus, and Ebola has not been much of an issue. We have a changed situation.” Cocoa for March delivery dropped 1.1 percent to settle at $2,686 a metric ton on Jan. 29 on ICE Futures U.S. in New York. The price is down 20 percent from its $3,371 settlement on Sept. 24, meeting the common definition of a bear market. Futures surged 38 percent in the previous three years as Asian consumers led global demand growth, eroding inventories. Cheap Oil Burns $390 Billion Hole in Investors' Pockets Source: Bloomberg News Investors have a message for suffering U.S. oil drillers: We feel your pain. They’ve pumped more than $1.4 trillion into the oil and gas industry the past five years as oil prices averaged more than $91 a barrel. The cash infusion helped push U.S. crude production to the highest in more than 30 years, according to data compiled by Bloomberg. Now that oil prices have fallen below $45, any euphoria over cheaper energy will be tempered by losses that are starting to show up in investment funds, retirement accounts and bank balance sheets. The bear market has wiped out a total of $393 billion since June -- $353 billion from the shares of 76 companies in the Bloomberg Intelligence North America Exploration & Production index, and almost $40 billion from high-yield energy bonds, issued by many shale drillers, according to a Bloomberg index. “The only thing people are noticing now is that gas prices are dropping,” said Sean Wheeler, the Houston-based co-chairman of the oil and gas industry team for law firm Latham & Watkins LLP. “People haven’t noticed yet that it’s also hitting their portfolios.” The money flowing into oil and gas companies around the world in the last five years came from a variety of sources. The industry completed $286 billion in joint ventures, investments and spinoffs, raised $353 billion in initial public offerings and follow-on share sales, and borrowed $786 billion in bonds and loans. Market Information Treasury Bill Rate Monday 26th January, 2015 to Friday 30th January, 2015 Period Previous Rates Discount Rates Interest Rates Weekly Change in Rate 91 - Day 25.8426% 24.2663% 25.8335% 0.0091% 182 - Day 26.4121% 23.3296% 26.4103% 0.0018% 1 – Yr. Note 22.5000% -% 22.5000% -% 2 – Yr. Fixed Rate Note 23.0000% -% 23.0000% -% Source: Bank of Ghana Bank of Ghana Indicative Rate Friday 30th January, 2015 Currency Pairs Code Buying Selling U.S Dollar USDGHS 3.2385 3.2418 Pound Sterling GBPGHS 4.8950 4.9022 Swiss Franc CHFGHS 3.5190 3.5230 Australian Dollar AUDGHS 2.5146 2.5202 Canadian Dollar CADGHS 2.5762 2.5789 Danish Kroner DKKGHS 0.4928 0.4933 Japanese Yen JPYGHS 0.0274 0.0275 New Zealand Dollar NZDGHS 2.3530 2.3580 Norwegian Kroner NOKGHS 0.4159 0.4160 Swedish Kroner SEKGHS 0.3932 0.3936 S/African Rand ZARGHS 0.2809 0.2812 Euro EURGHS 3.6689 3.6721 Chinese Reminbi CNYGHS 0.5184 0.5190 BCEAO GHSXOF 178.63 178.79 Dalasi GHSGMD 13.29 13.30 Ouguiya GHSMRO 93.73 93.82 Naira GHSNGN 58.26 58.32 Leone GHSSLL 1325.15 1326.50 WAUA WAUGHS 0.1420 0.1420 Source: Bank of Ghana GSE Summary GSE STOCK INDICES GSE-CI GSE-FSI Previous 28/1/2015 2,166.76 2,128.99 Current 29/1/2015 2,161.14 2,122.43 5.62 6.56 -4.42% -5.40% CYTD 01/01/15 -29/1/2015 Source: Ghana Stock Exchange The GSE-Composite Index (GSE –CI), the benchmark measure of performance of the Ghana Stock Exchange gained 5.62 points from 2,166.76 to close at 2,161.14, representing a year-todate gain of -4.42%. The GSE-Financial Stocks (GSE-FSI), which tracks the performance of listed financial stocks, also gained 6.56 points from 2,128.99 to close at 2,122.43 representing a year-to-date gain of 5.40%. COMMODITY FUTURES Commodity Price % Change $48.91 -0.45% $1,262.69 +0.43% CORN /BU $371.50 0.00% SUGAR /MT $384.60 -7.30% COCOA /MT $2,686.00 -1.07% CRUDE OIL (BRENT) GOLD T/OZ Source: Bloomberg Investment Funds Unit Trust and Mutual Funds Liberty Freedom Fund as at 27/01/15 Offer GHC 0.2167 Bid GHC 0.2146 Year to Date 0.69% SAS Fortune Fund as at 28/01/15 Price GHC 0.4827 Price Change GHC 0.0002 Year To Date -5.35% HFC Equity Fund as at 28/01/15 Price GHC 0.4280 Price Change GHC -0.0019 Year To Date -0.74% HFC Unit Trust as at 28/01/15 Offer GHC 0.2729 Bid GHC 0.2757 Year To Date 1.80% HFC REIT as at 28/01/15 Offer GHC 1.9417 Bid GHC 1.9613 Year To Date 1.11% M-Fund as at 28/01/15 Bid Price GHC 0.5837 Offer Price GHC 0.5895 Year To Date 1.73% BFund as at 28/01/15 Bid Price GHC 0.3486 Offer Price GHC 0.3521 Year To Date 0.32% Source: Business Ghana Excellence quote If you are going to achieve excellence in big things, you develop the habit in little matters. Excellence is not an exception, it is a prevailing attitude. Colin Powell Thank you.

© Copyright 2026