STATUTORY INSURANCES IN FINLAND

1 (4)

International Services

January 2015

To whom it may concern

With over 40 years’ experience in pension insurance, we want to make things easy

and convenient for you. We are the biggest provider of statutory earnings-related

pension insurance TyEL in Finland. We provide reliable and efficient service. As our

customer, you will benefit from our client bonus system which has been proven to

be most generous.

This brochure contains information of the statutory insurance policies, contributions

and benefits which are applicable to all employers who have employees with a local

contract (special rules apply to posted workers). According to Finnish Law the

employer is obliged to insure all employees working in Finland. Finnish Social

Security might also be applicable to internationally mobile employees who are

subject to Finnish Social Security either by a bilateral Social Security Agreement,

EU Regulation or based on Finnish national legislation.

Statutory insurance policies in Finland

According to Finnish law, an employer is obligated to provide statutory Social

Security coverage for its employees in Finland. The statutory social security consists

of:

- National Pension

- National Health/Social Security Insurance

- Earnings-related pension insurance TyEL

- Workers' compensation insurance/Accident at work

- Unemployment insurance

- Group life assurance for employees

When and how to take out the statutory insurance policies

Since the responsibility to provide statutory insurances lies on employer, the

contributions shall be paid by the employer and the employee's share is deducted

when paying the salary. Arrangements where the employee would receive a lump

sum from the employer and take care of the employer's responsibilities are strongly

discouraged.

Note for employers in an EU/EEC member state:

You can authorize an employee to sign the statutory earnings-related pension

insurance and workers' compensation insurance for you. Please refer to this link

for a model form.

TyEL pension insurance: Insurance policy shall be taken within one month after

the first salary payment.

Accident at work: The insurance must be valid on the onset day of first

employment.

Unemployment insurance: For prescription of provisional payments, please

contact the Unemployment Insurance Fund (TVR).

Social Security Insurance: The contribution is due the 12th day of the month that

follows the salary payment month. (If a company is taxed in Finland, the National

Pension contribution is paid together with the company taxes.)

Varma Mutual Pension Insurance Company

P.O. Box 1, FIN-00098 VARMA, FINLAND

Visiting address and domicile

Salmisaarenranta 11, Helsinki

Telephone

Fax

+358 10 244 0

+358 10 244 4752

Business ID 0533297-9

www.varma.fi

2 (4)

International Services

January 2015

To take out statutory earnings-related pension insurance TyEL, please fill in, print

out and send the signed application form as well as employee information to Varma.

TyEL policy can also be arranged by contacting our co-operating partner If plc

(website in Finnish), which provides worker's compensation insurance as well as

group life assurance.

Unemployment insurance policy shall be signed by contacting TVR.

In regard to the Social Security Insurance contribution, please file the periodic tax

return.

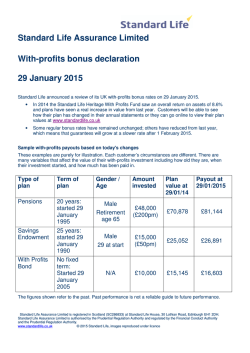

Contributions 2015

The contributions are annually determined by the Ministry of Social Affairs and

Health. The contributions are fixed for small scale employers with payroll less than

MEUR 1.9. The employer shall withhold the employee's share of the contribution

(TyEL and unemployment) from the insured person’s gross salary.

Main rule is that the Pensionable Salary is, with few exceptions, same as the

taxable salary. Employer pays the gross contribution to the respective policy

provider.

Employer

TyEL pension insurance

Accident at work insurance average

Unemployment insurance

Group Life Assurance

19.00% / 17.50%*

1.00% (varies btw 0.10%-7.00%)

0.80%

0.07%

Employee (withhold from salary)

TyEL pension insurance

Unemployment insurance

5.70% / 7.20%*

0.65%

Total cost for the employer is 21.52%** + SOTU-maksu (see below) 2.08% =

23.60% and for the employee 6.35% / 7,85%* (tax-deductible in private taxation)

* for those of age 53 and older; additional contribution lowers employer’s contribution

** 20.02%, if employee of age 53 and older

Both domestic and foreign employers are obliged to pay the Social Security

Contribution ("SOTU-maksu") to the State. The total contribution is 2.08 % of salary.

Further information is available from the tax authorities.

Taking care of insurance policies

TyEL policy holders can choose between two reporting methods - annual notification

or monthly notification.

• If you choose annual notification you will pay provisional contributions

according to your choice 1-12 times a year based on estimated payroll and

declare once a year, in January, the actually paid salaries from the last

calendar year.

• Monthly notification method means that you will have to report the paid

salaries once a month (by the 20th of the month following salary payment).

Monthly notification requires a password to our in-logged service which is

available either in Finnish or in Swedish.

3 (4)

International Services

January 2015

Workers' compensation and Unemployment insurance contributions are based on

estimated payroll. Once a year in January you will have to return a declaration of

paid salaries in the previous calendar year for the final calculation.

Benefits

1 National Pension - National Health/Social Security Insurance

The National Pension and Health Insurance are administered by the Social

Insurance Institution (Kela) and its local offices.

The Health Insurance covers sickness allowance, rehabilitation, reimbursement of

medicine costs, subsidised hospital fees and handicap benefits. Other Social

security covers family benefits, housing allowance etc.

National Pension provides a means tested flat rate pension for persons without

earnings-related pension or with a very low earnings-related pension. Full national

pension requires 40 years of residency between the ages of 16 and 65 years. More

information on www.kela.fi

2 Earnings-related pension, TyEL

The TyEL Scheme is administered by authorised private pension insurance

companies. The Finnish Centre for Pensions (ETK) governs the register of

employment and vested pension rights under the private sector pension schemes.

The TyEL contributions are affected by the technical rate of interest as well as client

bonus. Technical rate of interest is determined by the Ministry of Social Affairs and

Health. If the annual contributions are paid before July 1st the interest is calculated

in the employer's favour.

We at Varma have provided our clients highest bonuses over the last 5 years by

being an efficient pension provider and by getting a high rate of return to funds and

investments.

2.1 Benefits

-

Old-age pension flexibly from the age of 63 to 68 years

Part time pension from the age of 61 years

Vocational rehabilitation

Disability pension

Survivor’s pension

The pension right is fully vested immediately after the start of employment. There

are no salary ceilings either for the contributions or benefits.

You will find more information about the pension benefits on our website

www.varma.fi

4 (4)

International Services

January 2015

3 Workers' Compensation Insurance

The workers' compensation insurance is administered by separate private non-life

insurance companies, such as If P&C Insurance Company Ltd.

If a person has been injured at work (even on the way to/from work or on a business

trip) or acquires a work related illness, he/she is covered by workers' compensation

insurance.

The insurance covers the following benefits:

Full reimbursement of necessary hospital care, medicine, travel expenses and

medical equipment

Sickness allowance (daily allowance equals to annual earnings/360)

Pension (85% of the salary in case of full disability up to 65 years of age.

Thereafter the compensation rate is 70%)

Handicap indemnity

Survivor’s pension to spouse or common law spouse if common children and

children up to the age of 21 years

Need supplement

Rehabilitation

Funeral grant

4 Unemployment insurance

Unemployment insurance covers basic unemployment benefit (flat rate). Entitlement

to earnings-related unemployment coverage requires a membership in an

unemployment fund or alternatively with a trade union.

5 Group life insurance

The group life insurance is based on Trade Union negotiations. The insurance

contribution decreases with increasing age. Contributions for the group life

insurance are charged together with the workers' compensation insurance. Please

read more on www.retro.fi

Good to know

A. Occupational Health Coverage

Under the Occupational Health Act, employers are required to arrange, at their own

expense, professional-level occupational health services for their employees in

order to prevent work-related health risks.

Employers can purchase occupational health services for their employees from a

municipal health centre or other organisation offering occupational health services,

such as a private medical centre. Employers can also operate an occupational

health unit by themselves or in cooperation with other employers.

B. Voluntary pension arrangements in Finland

Collective pension agreements are non-existent due to lack of earnings ceiling in the

statutory pension schemes. Usually only the management group and/or key persons

might have improved benefits.

© Copyright 2026

![[7.1.2] Compensation Payments in respect of Personal Injuries](http://s2.esdocs.com/store/data/000502603_1-53ac1a989b68853ba6f6b00260848dd2-250x500.png)