here - CanadianGolfer.com

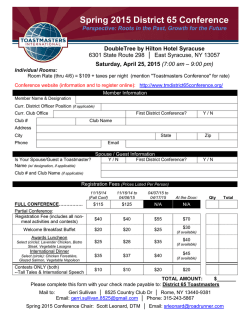

NOTICE OF MEETING YORK DOWNS GOLF & COUNTRY CLUB January 29, 2015 7:00 pm FLATO MARKHAM THEATRE 171 Town Centre Blvd., Markham, ON A Town Hall Meeting of the members of the York Downs Golf & Country Club will be held at the Markham Theatre located at the corner of Hwy #7 and Warden Avenue, starting at 7:00 pm on Thursday January 29, 2015. Real time access to the meeting will be available through the Internet, including the ability to ask questions via e mail, for members unable to attend in person. The meeting is called for the purpose of providing members with a report on the recently completed bid solicitation process, information concerning the Agreement which has been signed for the sale of the Club’s lands, and information on the future options available to the Club. The purpose of the Town Hall Meeting is only to share information. Members will not be asked to vote. Accompanying this Notice is a letter from the President and information which will be presented and discussed at the Town Hall Meeting. By Order of the Board January 15, 2015 January 15, 2015 Dear Fellow Member, In the near future you will be asked to vote on the sale of all of the Club’s land. As communicated in November 2014 at the AGM, the Board of Directors has entered into an Agreement of Purchase and Sale of the Club’s land with a development syndicate. This Agreement is subject to approval of the Membership in accordance with the Club’s by laws. I have no doubt that the decision to accept or reject this Agreement will be highly personal and based on a variety of factors specific to one’s individual situation. Therefore, prior to such a vote occurring, the Board has called a Town Hall Meeting to be held on January 29, 2015 to inform you of all aspects of this Agreement and allow for a fulsome discussion. In preparation for the Town Hall, you will find attached, materials providing the details of the process, the Agreement, the alternatives, possible consequences, and the likely paths forward following either a Yes or No vote. As this vote represents a defining moment in our history as a Club, we respectively encourage each member to fully acquaint themself with the contents of this information package and to participate in the Town Hall Meeting. The Board has worked diligently and tirelessly over the past year to fulfil the mandate given to them by the Membership at the Town Hall Meeting in February 2014 to take the property to market. In the Board’s view, the Agreement of Purchase and Sale is the best offer resulting from a very rigorous bid solicitation process. Please note that this is an all cash offer and does not include a relocation provision. In closing, may I once again encourage you to review this document and join us on Thursday, January 29th at the Flato Markham Theatre. My Board colleagues and I look forward to seeing you at the meeting to share information, exchange views, discuss next steps, and answer any questions you may have about the Agreement or process. Yours truly, Mark Lievonen President Table of Contents Executive Summary ………………………………………………………………………………..… p. 1 1. The Process How We Arrived at This Point …………………………………………..…. p. 2 1.1 1.2 1.3 York Downs Unsolicited Offer Procedure The Bid Solicitation Process Summary of the Bids 2. The Agreement – Details of the Agreement of Purchase and Sale ………..…… p. 4 3. The Options – What You Need to Consider ……………………………………..……….. p. 6 3.1 3.2 Vote to Approve the Agreement of Purchase and Sale 3.1.1 What Approving the Agreement Means 3.1.2 Shareholdings 3.1.3 Distribution of Funds 3.1.4 Taxation and Timing Considerations 3.1.5 Dissolution of the Club Vote to Reject the Agreement (Continue at Current Location) 3.2.1 What Not Approving the Agreement Means 3.2.2 Current York Downs Financial Model 3.2.3 Funding the Club’s Future Requirements 3.2.4 Share Capital Structure 3.2.5 Summary 4. The Purchasers’ Environmental Investigation – A Precondition to Vote ….. p. 10 5. The Vote – What You Will be Asked and When ………………………………………. p. 10 5.1 5.2 6. Timelines The Question Questions & Answers …………………………………………………………………………..… p. 12 Appendices I. II. III. IV. V. VI. VII. Guidelines and Procedures to Handle Unsolicited Bids to Purchase Some or All of the York Downs Lands Request for Proposals – Manager, Solicitation Process Summary of Offers The Purchasers York Downs By laws Section 7.08 York Downs Land Sale Financial Model Current 20 Year Capital Plan Executive Summary January 15, 2015 On behalf of York Downs, the Board of Directors has entered into an Agreement of Purchase and Sale (the Agreement) for the Club’s lands with a syndicate led by Metropia Inc., a leading national real estate development company. This Agreement calls for an all cash purchase price of $412 million paid out over time with 40% due on Closing. The basic terms of the Agreement are described in the attached document. It is important to note that execution of this Agreement is subject to only two Closing conditions: (1) an environmental assessment (recently concluded and being reviewed) to the satisfaction of the Purchasers; and (2) approval by at least two thirds ( ) of votes cast at a Special Meeting of the Members, in accordance with Club By law 7.08. It is the Board’s intention to call such a Special Meeting following completion of the environmental assessment, subject to satisfaction of this condition by the Purchasers. The Agreement anticipates Closing by June 30, 2015 with a provision to extend to November 30, 2015 by mutual agreement to enable remediation of any environmental issues identified in the environmental assessment. As background, the process leading to the Agreement was initiated in February 2014 following a Town Hall Meeting to discuss an unsolicited bid to purchase the Club’s lands for $274.5 million. This Offer included a relocation provision. The Club’s Members directed the Board in February, by a vote of 86%, to seek competitive bids for the sale of the Club’s lands. Relocation of the Club was not a precondition set by the Members. Accordingly, the Board immediately sought and selected expert advisors and gave them the mandate to initiate and lead a rigorous bid solicitation process. Over the ensuing months, the Board received and carefully reviewed 11 offers; triaged the offers based on a host of criteria; and ultimately identified the Offer from the Metropia syndicate as the best of the offers. This process and the offers are fully described in the attached document. At the upcoming Town Hall Meeting, our advisors, Colliers International, will be on site to present to and meet directly with the Membership. They will review the entire process including the 11 individual bids and negotiations leading to the Agreement. In addition, the Board will specifically address the timing for and the next steps following a vote on the Agreement. The attached document also addresses potential implications and what may transpire under either a Yes or No vote. As this vote represents a defining moment in our history as a Club, each Member is encouraged to fully acquaint themself with the contents of this information package and to participate in the Town Hall Meeting on January 29th. 1 1. The Process – How We Arrived at This Point 1.1 York Downs’ Unsolicited Offer Procedure In May 2013, the Club received an unsolicited offer to purchase the Club’s lands for $228,750,000 and to relocate the Club to a new golf course and clubhouse to be constructed by the prospective purchasers on lands relatively near the current location. Subsequent negotiations resulted in the purchase price being increased to $274,500,000. The Board believed that the Offer deserved consideration largely because the Offer presented York Downs with the opportunity to replicate what had been done in 1968 and thereby perpetuate the York Downs’ legacy. Therefore, in accordance with the Guidelines and Procedures for Handling Unsolicited Bids (Appendix I), a Town Hall Meeting was convened on February 20, 2014 to update the Members about the Offer and to determine the Members’ interest in proceeding further to solicit competitive bids. At the Town Hall Meeting, the Members expressed a strong preference (86%) to have the Board solicit competitive bids. It was clear that by inviting competitive bids, the Club could expect to receive offers providing only for payment of cash as well as offers providing for the relocation of the Club. 1.2 The Bid Solicitation Process Following the Town Hall Meeting, the Club invited nine (9) real estate firms to submit proposals to manage the solicitation process. A copy of the Request for Proposals – Manager, Solicitation Process (RFP) is attached as Appendix II. Seven firms responded and submitted proposals. From those, three firms were short listed and interviewed. All of the finalists made excellent presentations. In the end, Colliers International was the unanimous choice to act as the Manager and assist the Board with the solicitation of competitive bids. No limitations or restrictions were placed on Colliers’ mandate. They were encouraged to go to the market and invite bids and proposals of any kind – with or without a relocation component. Throughout the process, all bids were presented to the entire Board and all decisions were made by the Board acting as a whole. Ultimately, the process led to four bidders and then finally to one prospective purchasing group (the Purchasers) with which a Letter of Intent was signed on October 27, 2014. An Access Agreement was also signed with the Purchasers to allow their environmental investigations to begin. To ensure that the Membership would be presented with a clear, unambiguous and firm Offer, the Board insisted upon entering into an Agreement of Purchase and Sale with the only condition open to the Purchasers being a satisfactory environmental investigation with the Club retaining the option of remediating any contamination at its own cost. The Purchasers agreed to this approach and an Agreement of Purchase and Sale (the Agreement) was executed on November 24, 2014. The details of the Agreement are found in Section 2 of this document. Through the negotiation process, the Club has been greatly assisted by Mr. Chris Huband of Blake Cassels and Graydon LLP, one of Canada’s leading law firms. 2 1.3 Summary of the Bids The Offering Memorandum issued by Colliers did not prescribe specific requirements with respect to variables such as closing date, deposit structure, financing terms, leaseback options, vendor take back mortgage, etc. It provided interested parties with the flexibility to structure offers as they deemed appropriate. As a result, the terms and conditions of the initial 11 offers, including the gross purchase price, varied significantly. The Board instructed Colliers to introduce terms intended to maximize value and minimize risks for York Downs. As additional terms were introduced, a number of prospective purchasers chose to remove themselves from the process. The process resulted in four (4) bids that the Board deemed worthy of further consideration. The four finalists agreed to jointly engage a consulting firm to conduct environmental and geo technical assessments of the property. While the assessments were being done, the bidders were to complete any other due diligence they wished to perform. As the consulting firm was being selected, one of the finalists presented a “firm” proposal subject only to completion of the environmental assessment and with the Club having the option of remediating at its cost any contamination that might be found. The other finalists were presented with the same opportunity, the outcome of which was a joint bid by two purchasing groups. Details of all of the bids and the process of selection and de selection of the various bids can be found in Appendix III. At the Town Hall Meeting, Mr. Gord Cook, Executive Vice President of Colliers International will review the process which led to the Agreement. 3 2. The Agreement – Details of the Agreement of Purchase and Sale A summary of the offers that were received is set out in Appendix III. You will notice that the bids vary widely in price and terms. Throughout the evaluation process, the Board’s primary objectives were always to maximize the value and minimize the risks for York Downs. These objectives were reached with four finalists and ultimately the Purchasers presented the Offer that best met these objectives. The Agreement provides for the sale of the Club’s lands subject to the results of the Purchasers’ environmental investigation and the sale being approved by at least two thirds ( ) of the votes cast by the voting Members of the Club at a Special Meeting of the Members duly called for the purpose of approving the proposed sale. The Purchasers began their environmental investigation in November 2014. It has now been completed and their report was submitted to the Club on January 14th. The Club’s environmental advisors are in the process of reviewing the findings, the recommendations and the conclusions of the report. Members of the Board are scheduled to meet with them and then, with the Purchasers prior to the Town Hall to assess the situation and determine a course of action. The results of these discussions could impact the transaction or the final sale price. The Board will be in a position to provide more information about this report and the consequences to the Club and the transaction at the Town Hall Meeting. Following are the basic terms and details of the Agreement for Purchase and Sale: Purchasers: Metropia Inc., The Sorbara Group Inc., PFG Land Corp, PAD Investments Ltd. carrying on business as Empire Communities and Pace Group Investments (see Appendix IV). Purchase Price: $412 million. The price is subject to possible upward adjustment for any increase in the developable acreage over 297.70 developable acres. There is no price adjustment if the number of developable acres is less. Payments: $20 million as a deposit payable within five (5) business days after Membership approval of the Agreement. 40% of the purchase price, approximately $165 million (less the deposit), is payable in cash at Closing. The balance of the purchase price of approximately $247 million is payable by a vendor take back (VTB) mortgage held by the Club. The principal of the mortgage becomes payable at the end of the term. Closing: The Closing is set for June 30, 2015, subject to the environmental investigation and Membership approval, but not later than November 30, 2015. Details of the VTB Mortgage: Principal is the balance of the purchase price (approximately $247 million); Term is five (5) years subject to being extended for one (1) further year if the lease (see below) is extended from five (5) to six (6) years; 4 Interest free during the first year; interest at the rate of 4% per annum calculated semi annually and payable quarterly during the remainder of the term; Jointly and severally guaranteed by the Purchasers; Pre payable at any time, in whole or in part, by the Purchasers; The Purchasers may obtain a partial discharge of the VTB Mortgage with respect to all or part of the approximately 80 acres of land not currently being used as golf course (East Lands) by prepaying a portion of the principal; and The balance of the mortgage becomes due and payable at the end of the term. Conditions: The Purchasers’ obligation to purchase is conditional upon the Purchasers being satisfied with the results of their environmental due diligence. Any contamination of the site by hazardous substances which the Purchasers are not willing to accept, the Club has the right, but not the obligation, to elect to remediate or remove the hazardous substances at the Club’s cost. The Club’s obligation to sell is conditional upon the Members approving the transaction in accordance with the Club’s By laws, Section 7.08. The sale must be approved by at least two thirds ( ) of the votes cast at a Special Meeting of the Class B Shareholders duly called for the purpose. (see Appendix V) Lease: At Closing, the Club will lease the golf course for a term of up to five (5) years at an annual rent of $1.00 plus taxes, insurance, maintenance and utilities. The Club has the right to extend the lease for a further year upon six (6) months’ notice and, in that event, the VTB mortgage will be extended for a further year. The Club may terminate the lease at any time after the second anniversary of the lease upon six (6) months’ notice. All Cash Offer and No Relocation Option The unsolicited offer which led to the February 2014 Town Hall Meeting included an opportunity to relocate York Downs. Some bids included a relocation component, but for a variety of reasons, none of those were deemed acceptable. As a result, the Agreement does not provide a relocation option for the Club. Nevertheless, the Board considered it to be the best offer resulting from the bid solicitation process. 5 3. The Options – What You Need to Consider 3.1 Vote to Approve the Agreement of Purchase and Sale 3.1.1 What Approving the Agreement Means If the voting Members approve the transaction in accordance with the Club By laws, Section 7.08, the lands will be sold pursuant to the Agreement and then there will be two options available: 1. The Members could decide to use a portion of the net proceeds to acquire another site, whether an existing golf course or vacant land upon which to build a new course, and relocate York Downs. A portion of the net proceeds could also be distributed among the shareholders. OR 2. The Members could decide to distribute all of the net proceeds among the Shareholders and dissolve the Club. If the Members approve the Agreement and the lands are sold, it will then be up to the Members to decide the next course of action. The Board plans to consult with the Members to determine how they wish to proceed. Until that decision is made, the Club will continue to operate in the same manner and with the same standard of service as it has in the past. During that time it will be extremely important that York Downs continues to provide Members and their guests with the same excellent course conditions and food and beverage service as they have been provided with to date. This will necessitate taking pro active steps to retain our key staff. It could also require devoting funds to maintain service levels in order to defray increasing dues which might result from a decline in Membership levels. As a matter of principle, the Board believes it is essential that what might be termed the “York Downs’ golfing experience” must not be compromised during the lease period. 3.1.2 Shareholdings It is important to know that, while only holders of Class B Shares are entitled to vote, Class A and Class B Shares rank equally with respect to dividends. As of the end of the last fiscal year, November 30, 2014, the Club’s unaudited, fully diluted Share position would be 937 Class B Shares (voting) and 18,760 Class A Shares (non voting). It is estimated that approximately 48% of the outstanding issued Shares of the Club (combined Class A and Class B Shares) are held by non members (former Members, estates and beneficiaries of former Members). The Class A and Class B Shares rank equally with respect to dividends or other distributions. Accordingly, Non Members would be entitled to receive approximately 48% of any dividend that might be declared or any distribution upon the dissolution of the Club. 6 The financial model in Appendix VI was prepared based upon the best available information, including what is known about the number of issued Shares of each Class. The amount of the net proceeds potentially available for distribution among the Shareholders will depend principally upon how the proceeds are taxed. The portion of the net proceeds potentially distributable per Share will depend upon the number of Shares issued and outstanding. Before a dividend is declared or a distribution is made, the accuracy of this information would need to be confirmed. 3.1.3 Distribution of Funds If the Members approve the sale, the Club may: Distribute a portion of the proceeds among the Class A and Class B Shareholders and, subject to the approval of the Members, use a portion of the proceeds to purchase a new location to which the Club would relocate before the expiry of the lease; or With the approval of the Membership, vote to dissolve the Club, following the expiry of the lease and distribute all of the net proceeds to the Shareholders. 3.1.4 Taxation and Timing Considerations According to the financial model set out in Appendix VI, the net sale proceeds are estimated to be $381.8M. This is based upon certain assumptions concerning anticipated expenses and as to how the proceeds will be taxed. The actual amount of the Club’s income tax liability will not be known until the income tax return has been filed and assessed by Canada Revenue Agency (CRA) and the period for re assessment has expired. If the transaction closes before November 30, 2015, it will be reported and included in the Club’s income tax return that must be filed by February 29, 2016, according to subsection 149(5) of the Income Tax Act (the Act). Once that return is filed it will be assessed by CRA and a notice of assessment could be expected sometime in late 2016. Once the income tax treatment of the transaction has been confirmed, the Club, with the assistance of its tax advisors at KPMG, will be in a position to determine the most advantageous method of distributing proceeds to the Shareholders. In this regard, it will be particularly important for the Club to determine the amount of its capital dividend account (CDA). Simply stated, a company’s CDA is made up of the undistributed balance of the excess of a company’s capital gains over its taxable capital gains. In order to compute its capital dividend account, York Downs will have to make the appropriate election under subsection 83(2) of the Act to validate its capital dividend payment. Under the Act, a company may elect to pay dividends out of its CDA. Such dividends are received tax free by the Canadian resident Shareholders. However, the ability to elect and pay such dividends is strictly limited to the actual amount of the company’s CDA and any excess election is subject to payment of a severe tax penalty. Our advisors have calculated the CDA based upon their interpretation of the Act. However, the amount of the CDA has not been confirmed by CRA. It will be very important for the Club to accurately determine the amount of its CDA before electing and paying out a capital dividend to the Shareholders. The timing is uncertain and will depend upon the CRA. In short, the financial model is premised upon certain assumptions as to how the proceeds of the sale will be taxed. Therefore, Members need to appreciate that if the lands are sold there will likely be little, if any, distribution of proceeds to the Shareholders until 7 there is certainty concerning the tax treatment of the sale and the amount of the Capital Dividend Account. That could take several years. 3.1.5 Dissolution of the Club Dissolution of the Club requires the approval of a minimum of two thirds ( ) of the votes cast by the Class B Shareholders at a Special Meeting duly called for the purpose. See Section 7.09 of the Club By laws, Appendix V. If dissolution were approved, the net proceeds would be distributable among the Shareholders. It is likely that the Club would need to hold back some additional amount from the proceeds to meet expenses and potential liabilities, including taxes. 3.2 Vote to Reject the Agreement (Continue at Current Location) 3.2.1 What Not Approving the Agreement Means If the Members do not approve the Agreement, the Club will carry on at its current location. This Section outlines what it means to do so. 3.2.2 Current York Downs Financial Model Annual Operating Expenses The Club’s annual operating expenses (2015 budget is approximately $4 million) are funded by Members’ annual dues. Historically, annual Membership attrition has been offset by the recruitment of new Members. For example, in 2014, in spite of the disruption due to the golf course improvement plan and the freeze on issuing new shares, the Club welcomed 30 new Trial Members and reached the budgeted playing cap. For planning purposes, it has been assumed that new Members will continue to be attracted to York Downs and that annual dues will continue to be sufficient to fund operating expenses. Annual Capital Expenses Historically, the Club’s annual capital expenses have been funded by new Member entrance fees. Over the last number of years, it has become apparent that this model is no longer sustainable. This reality was a key driver of the recent sale of the 7.5 acres at the southeast corner of the property. As a result of that land sale, the Club’s cash reserves are healthy. Current reserves, combined with entrance fees currently receivable, will fund the Club’s capital requirements through the 2020 season. At that time, the Club’s cash balance will essentially be reduced to zero and projected new member entrance fees will not be sufficient to fund capital requirements in subsequent years. A certain level of capital spending will be required simply to maintain the aging infrastructure of the buildings and the golf course. The current 20 year Capital Plan (Appendix VII) estimates $22 million in capital expenditures will be required over that period. The plan includes projects such as the replacement of the irrigation system and the renovation of the greens (2021), but does not include major renovation or potential replacement of the clubhouse. The decision to proceed or not with such projects will 8 ultimately be up to the Membership. As per the Club’s by laws, any capital expenditure in excess of $500,000 requires the approval of the Membership. As with the recently completed golf course improvement plan, major projects could involve a level of disruption to Club operations. 3.2.3 Funding the Club’s Future Requirements The Club has more than 80 acres of excess land along Kennedy Road (the East Lands). This land can be sold without encroaching on the golf property. During the bid solicitation process, the Club received an offer for the East Lands. The offer price of $122.2 million or $1.35 million per developable acre, illustrates that the Club’s capital requirements could be fulfilled through the sale of all or some of the East Lands. Sale of the excess 80 acres would cover all projected capital expenses well into the future. 3.2.4 Share Capital Structure Shortly after the receipt of the original unsolicited offer, the Club froze the issuance of new Shares. A re organization of the Club’s Share capital structure may be required to enable the Club to admit new members. Although the Board has not determined a definitive restructuring model, one key element would be to enshrine the current value of the Club’s lands with the outstanding Shares. This would ensure that the value of the Shares held by current Shareholders would not be diluted by the introduction of new Members and would also enable new Members to be admitted and charged an acceptable entrance fee. Alternatively, changes could be made to Membership requirements in order to permit new Members to be admitted. Whatever method is used, the admission of new Members can be facilitated without undue difficulties. 3.2.5 Summary Continuing at the current site is both operationally and financially viable. 9 4. The Purchasers’ Environmental Investigation – A Precondition to Vote As noted, the Agreement is conditional upon the Purchasers being satisfied with the results of their environmental investigation. The investigation started in November, 2014 and was completed recently. The Purchasers delivered a copy of their environmental consultant’s report to the Club on January 14, 2015. The Board has started the review process of the findings, the recommendations and the conclusions with its own advisors. Members of the Board will meet with the advisors and the Purchasers prior to the Town Hall Meeting. A further update on this critical matter will be provided to the Members at the Town Hall Meeting. 5. The Vote – What You Will be Asked and When 5.1 Timelines At the Town Hall Meeting, you will have the opportunity to discuss the options and hear the views of your fellow Members. When will you vote? At this time, it is not possible to determine a precise date for a vote. The simple reason is that the Agreement is subject to the Purchasers being satisfied with the results of their environmental investigation. While the assessment is now completed, the Board is reviewing the findings, the recommendations and the conclusions of the report with the Club’s advisors. Members of the Board will then meet with the Purchasers to assess the situation. No date will be set for the Shareholders’ Meeting until after there is clarity concerning the results of the discussions on the environmental investigation and the estimated costs to the Club of remediating any contamination. A notice of this Special Shareholders Meeting (with proxy) will be sent out well in advance of the meeting to allow every Shareholder to attend and vote at the meeting or by proxy. According to the Club’s By laws Section 7.08 (Appendix V), the sale must be approved by at least two thirds ( ) of the votes cast by the holders of Class B voting Shares. 5.2 The Question At a Special Meeting of the Membership, you will be asked to cast a vote whether or not to approve the sale of the Club’s lands pursuant to the terms and conditions of the Agreement. 10 6. Questions and Answers Below you will find a list of questions and answers provided to help clarify the Agreement and implications for the Membership. This is by no means an exhaustive list and it is expected that additional questions will be tabled at the Town Hall Meeting on January 29, 2015. Who is eligible to attend the Town Hall in person or virtually? While all Shareholders will receive notice of the Town Hall Meeting, only Class B Shareholders are eligible to attend the Town Hall Meeting in person or via the Internet. Who is eligible to vote? Only Class B Shareholders are eligible to vote at the Special Meeting of Shareholders that will be called by the Board. Class A Shareholders are NOT eligible to attend or vote at the Meeting, but will be notified of the Meeting. When will the vote occur? A vote to approve or reject the Agreement will occur at a Special Meeting of Shareholders called by the Board. The Meeting will take place after there is clarity concerning the results of the discussions on the environmental investigation and the estimated costs to the Club of remediating any contamination. What if I’m unable to attend the Special Shareholders’ Meeting? A notice of the Special Shareholders Meeting (with proxy) will be sent out well in advance of the Meeting to every Class B Shareholder. Members will be able to vote in person or by proxy. To approve the sale of Club land, is a YES vote required from two thirds of Shareholder votes cast at the Special Meeting of Shareholders or from two thirds of ALL class B Shareholders? The sale must be approved by at least two thirds (2/3) of the votes cast at the Special Meeting of Shareholders. Criteria for the disposition of Club lands is outlined in Section 7.08 of current Club By laws and also referenced in Appendix I. How do I verify how many Shares I have? All Shareholders should have signed documentation indicating the type and number of Shares he or she maintains. If you have a question concerning your Shares, you should submit it in writing addressed to the Club to the attention of Michael Stubbs, Manager of Membership. If there is a sale of land and distribution of proceeds, how much money will I receive and when? Appendix VI outlines a potential distribution that is based on a variety of assumptions outlined in Section 3. There are a variety of factors that will influence the timing of a potential distribution, such as determining the tax treatment. This information is also covered in Section 3. 11 Why didn’t the Board bring forward a relocation offer? Although the unsolicited offer that triggered the process involved relocating the Club, the Colliers’ team was encouraged to go to the market and invite bids and proposals of any kind – with or without a relocation component. As shown in Appendix III, a few of the bids received did include a relocation component, but none were deemed acceptable by the Board for a variety of reasons. If the recent bid solicitation process did not yield a successful relocation option, what makes the Board think a viable property will be attainable in the near future? The golf industry is ever changing and the private club sector is experiencing significant shifts. While the current bid process did not bring about an acceptable relocation option, if the Agreement is approved by Members, a future Board may wish to explore potential land purchases throughout the lease period. As always, it will be up to the Board and Membership to determine if this course of action is desirable. Why didn’t the Board solicit bids to purchase a portion of Club land such as the East Lands? The Board was acting on the mandate it received from the Members at the February 2014 Town Hall meeting to solicit competitive bids to purchase all of the Club’s lands consistent with the Offer that triggered the process. It should be noted, however, that during the bid solicitation process, the Club did receive an Offer to purchase the excess land along Kennedy Road that is commonly referred to as the East Lands. The price was $122.2 million or $1.35 million per developable acre. What commission will Colliers International receive if the Club accepts the Agreement? Should Members vote to accept the Agreement, Colliers will receive a commission of 0.25 per cent. There will be no commission nor a fee for service provided to Colliers should the sale of Club lands be rejected by the Members. How will the Club retain staff during the five year lease? The Board believes it is vital that the level of service that York Downs Members have come to know be maintained throughout the lease period. Solutions to retain the Club’s valued staff are already a key priority of the Board and will remain so should the Agreement be accepted by Members 12 APPENDIX I Guidelines and Procedures to Handle Unsolicited Bids to Purchase Some or All of the York Downs Lands June 2013 All offers to purchase (lease, rent or in any other manner acquire access to) York Downs lands, will be handled as per the existing Club bylaws. All offers will go to the Board of Directors prior to any discussion or disclosure to the membership at large. The Board will, on an ongoing basis, remain aware of the current value ($/acre) of comparable real estate in the area. Responsibility for this will reside within the Land Strategy Committee. Under no circumstances will York Downs sell any substantial portion of its lands without going to competitive bid. (However, parcels up to one acre in size can be sold without competitive bids. In this case, the bylaws permit the Board, acting in the best interests of the Club, to sell without involving the membership. The Board, if it deems appropriate, will execute the transaction and then notify all Class B shareholders.) When an offer of any kind is received it will first be presented to the Executive Committee and subsequently to the Board, which will conduct such negotiations and make such inquires as to the Board considers necessary or advisable in order for the Board to determine whether or not the offer should, subject to the approval of the membership, be accepted by the Club. If the offer is rejected by the Board (i.e. two thirds of the members do not vote in favour of further consideration) a decision must be made as to whether or not the membership will be made aware of the offer. In the case of a (rejected) offer which the Board considers to be a frivolous offer, no immediate communication will be made to the membership. Similarly, solicitations from real estate agents wishing to act on behalf of the Club or other such offers will not be communicated. In all cases, the membership is not being updated solely because the offers are not serious and there is no intention to proceed. They are not worthy of the cost to mail a notice, and the membership does not need to be “bothered” by a succession of mailings which are for information only. The membership will be updated on an annual basis (e.g. during the President’s report to the AGM) on any offers which were received and rejected. In the case of a (rejected) offer which valued the land at greater than 80% of current value (as determined by the Land Strategy Committee) and which the Board considers to be a legitimate offer, the Board will consider and decide whether or not to notify the membership that the offer was received and that the Board rejected it. A mailing (email if/when possible) to the voting members (i.e. Class B shareholders) will explain the offer and the Board’s reasons for rejecting it. Appendix I – Page 1 of 3 If an offer is received which the Board would be prepared to consider (i.e. two thirds of the Board vote in favour of acceptance) a process will be triggered, potentially leading to a request for proposals from other potential bidders. The first step in this process will be to notify, via a mailing, all Class B shareholders of the receipt of a potentially viable offer. The mailing will explain that an offer has been received which the Board may be willing to accept with the concurrence of the membership, but that a manager (broker or committee of members) is to be selected, as the Club will not sell without going to bid. It is likely that little detail of the offer itself will be provided due to confidentiality restrictions, but the Board’s objectives will be explained. The mailing will also confirm that the manager will not solicit bids until after a Town Hall Meeting of the membership which confirms a level of interest in selling the property. The manager will prepare briefing material for distribution before and use at the Town Hall meeting. At this meeting, the situation will be explained and questions answered. A vote of Class B shareholders present will be taken to assess the membership’s interest in proceeding to solicit bids. (If numbers warrant, multiple meetings and votes may be held. A special General Meeting may also be called to collect votes from the entire membership, including by proxy). Following the Town Hall meeting(s) the Board will again consider the situation in light of the input received from the membership. If two thirds of the Board vote in favour, the process will proceed to the next step and all members will be notified by a mailing. The manager will solicit and receive offers. Once offers have been received and assessed, the best offer will be presented to the Board of Directors. As per Section 7.08 of the current Club By laws, the offer must first receive approval of two thirds of the members of the Board. If this approval is gained a special General Meeting will be called to vote on the sale. All Class B shareholders will be eligible to attend and/or vote by proxy. All Class A shareholders will be notified of the meeting. As per the Club bylaws, section 7.08, the proposed disposition must receive the approval of at least two thirds of the votes cast by Class B shareholders at this meeting. If it does, the transaction will proceed. All shareholders and bidders will be notified. If the proposed disposition is rejected (i.e. does not receive two thirds approval) at any stage following the Town Hall meeting(s), all shareholders and bidders will be notified that no sale is to be made. Appendix I – Page 2 of 3 Appendix I – Page 3 of 3 APPENDIX II REQUEST FOR PROPOSAL Manager, Solicitation Process MARCH, 2014 BACKGROUND The York Downs Golf & Country Club (the “Club”) received an unsolicited offer to purchase the Club’s lands (which consist of approximately 413 acres of which recent professional advice indicates approximately 302 acres are net developable) and to relocate the Club to a new site within a reasonable proximity of its present location. The Board considered the Offer to be worthy of further consideration and the Members have expressed their preference to have the Club proceed further with the Offer and solicit competitive bids. The policies and by laws of the Club require a sale to be approved by two thirds of the Board and by the vote of two thirds of the voting Members at a meeting called for the purpose of approving the transaction. Given the differing interests of the Members, it is quite possible that at the end of the entire process no sale will be approved. . REQUIREMENTS As an initial step, the Club requires the assistance of a firm to manage the design and implementation of the process for soliciting competitive bids from other prospective purchasers and with the evaluation of such bids. The firm should have demonstrated experience with the management of projects of this kind and magnitude involving requests for quotations in real estate development and/or construction. The Club will also look to the manager for advice as to how the solicitation should be presented to the market. Interested firms are requested to provide an outline of their recent experience with RFQ projects of this size and prestige. The proposal should identify the individual with primary responsibility for this engagement with his/her specific qualifications and experience. Additional supporting staff should also be identified with their qualifications and expertise. The proposal should outline, in general terms, the firm’s approach and estimated timing for carrying out the engagement, The proposal should also outline the firm’s expectations for compensation. Since this is a circumstance where there is no certainty of a sale, the Club is open to considering compensation on either a fee basis or fee for success basis or a combination thereof. Proposals should be delivered or sent by email to the Club, to the attention of Mr. Leonardo De La Fuente, GM/COO, [email protected] , by 4:00 pm, April ___ 2014. All submissions will be reviewed while only a short list of firms will be selected for interviews. Appendix II – page 1 of 1 APPENDIX III Summary of Offers to Purchase York Downs Property The purpose of this section is to provide more detailed information about the process the Board, assisted by Colliers, progressing from the Offering Memorandum to the Offer under consideration. Colliers conducted a comprehensive marketing plan that was global in scope. Responses to the Offering Memorandum included bids from local and international developers. Prospective purchasers are identified as P 1, P 2, etc. Confidentiality provisions do not permit identification of the firms. Round 1 – July 9, 2014 Eleven (11) bidders submitted formal responses to the Offering Memorandum. Of those, eight (8) firms offered an outright purchase of the York Downs property with no option to relocate the Club. Below, Fig. 1 shows the gross purchase price from each bidder. One firm submitted two (2) bids, identified in Fig. 1 as P 7 and P 7a. Fig.1: Summary of Round 1 Submissions Purchase Price [$ millions] Terms & Conditions [Descending Order by Purchase Price] P1 $ 411.0 P2 $ 401.0 P3 $ 382.5 P4 $ 370.8 P5 $ 366.0 P6 $350.0 P7 $ 300.0 P 7a $ 330.0 P8 $ 330.0 P9 * * P 9, P 10 and P 11 did not submit an “acquisition only” offer in P 10 * Round 1 or in Round 2. Their bids included a re location option and are discussed later in this section. P 11 * The Offering Memorandum issued by Colliers did not prescribe specific requirements with respect to variables such as closing date, deposit structure, financing terms, leaseback options, vendor take back mortgage, etc. It provided interested parties with the flexibility to structure offers as they deemed appropriate. As a result, terms and conditions of the initial offers, including the gross purchase price, varied significantly. Subsequent steps in the process focused the prospective purchasers on terms intended to maximize value and minimize risks for York Downs. Round 1 – Summary Subsequent to the receipt and review of the initial submissions, the Board, with the assistance and advice of Colliers, developed a response unique to each bidder seeking clarification of the bid and/or specific York Downs preferences. The York Downs’ position reflected a blend of Colliers’ view of industry best practices, such as deposits and financing terms, and York Downs’ desire to minimize risk and enable continued use of the property. Continued use of the property was a function of both 1) the Club’s desire to enable a turn key situation in the event a re location option was ultimately pursued, and 2) purchaser feedback that it would take a minimum of 2 to 3 years for them to secure approvals necessary to commence development. This step was intended to both standardize the offers to enable a more objective, apples to apples comparison and to cause prospective purchasers to opt out of the process if they were unwilling to meet certain conditions. Appendix III – page 1 of 4 Round 2 – July 28, 2014 Fig.2: Summary of Round 2 Submissions Bids are listed in descending order by Net Present Value (NPV) Notes to Figure 2: P 6: withdrew from process after Round 1 P 8: was not invited to participate in Round 2 because: Initial submission was late Proposed gross purchase price and payment schedule were linked to their sales volumes and closing dates of units sold Financing terms were 9% cash and 91 % vendor take back mortgage Purchase Price Cash / VTB mortgage York Downs Leaseback Conditions York Downs Preferences 100% cash or VTB 60% Maximum of 3 years Minimized risk $ 412.0 40% / 60% yes [$ millions] Descending by Net Present Value (NPV) P2 P3 $ 382.5 33% / 67% yes P4 $ 372.1 27% / 73% yes P1 $ 416.8 100%, phased 2 years, then TBD P5 $ 375.0 50% / 50% TBD P 7a $ 300.0 100% / 0% Min 1 year, max 3 P 7b $ 350.0 35% / 65% Min 1 year, max 3 NPV $ 397.7 Bidders took significantly different positions with respect to closing conditions. The duration and terms of the due diligence process yielded the highest degree of risk and uncertainty for York Downs. $ 373.6 $ 369.2 $ 364.7 $ 362.4 $ 300.0 $ 339.5 Round 2 Summary P 1: P 2: P 4: P 5: increased purchase price from $411 million to $416.8 million highest purchase price in Rounds 1 and 2 4th highest NPV bid due to phased closing schedule increased purchase price from $401 million to $412 million 2nd highest purchase price in Round 1 highest NPV bid increased purchase price from $370.8 million to $372.1 million increased purchase price from $366 million to $375 million Appendix III – page 2 of 4 Round 3 – August 12, 2014 Fig.3: Summary of Round 3 Submissions Notes to Figure 3: P 1, P 3 and P 4: withdrew from the process after Round 2 *P 9, P 10 and P 11: disconnected the re location aspect of their initial bids and submitted acquisition only bids. Purchase Price [$ millions] Descending by Net Present Value (NPV) York Downs Preferences Cash / VTB mortgage York Downs Leaseback 100% cash or VTB 60% Maximum 5 years Conditions NPV Subject only to environmental assessment P 9* $ 427.0 40% / 60% yes $ 419.0 P2 $ 412.0 40% / 60% yes $ 404.0 P 10* $ 368.0 100% / 0% yes P5 $ 375.0 50% / 50% TBD P 11* $ 350.0 40% / 60% 3 years, min & max P 7a $ 300.0 100% / 0% Min 1 year, max 3 $ 300.0 P 7b $ 350.0 35% / 65% Min 1 year, max 3 $ 338.2 Considerable variance with respect to duration of due diligence period. $ 368.0 $ 362.4 $ 338.3 Round 3 Summary Subsequent to the Round 3 submissions, the Board, along with Colliers, established a shortlist of the top four conforming bidders. A subcommittee of the Board, along with Colliers, conducted detailed interviews with each finalist, focusing on their corporate experience and capabilities as well as the details of their respective proposals. Due diligence was a common issue for all finalists and to optimize cost and time, they agreed to jointly engage a consulting firm to conduct environmental and geo technical assessments of the YD property. While the assessments were being done, the bidders were to complete any other due diligence they wished to perform. While that process was getting underway, one of the finalists presented a “firm” proposal subject only to completion of an environmental assessment. The other finalists were presented with the same opportunity, the outcome of which was a joint bid by P 2 and P 9. That is the bid being presented for Members’ consideration. Appendix III – Page 3 of 4 Offers to Purchase York Downs Property and Re locate the Club Four (4) prospective purchasers submitted bids to acquire the York Downs property and re locate the Club. P 9, P 10 and P 11 were originally in this group offering a relocation option. They subsequently removed the relocation element and submitted acquisition only bids. In each case, the proposed re location site was an existing golf course. In addition, Colliers pro actively performed an inventory of area golf clubs that, based on proximity to the current YD site and to the residency of Club members, might be deemed acceptable locations for a re located York Downs. Colliers also explored the respective club owners’ interest in a potential sale of their property. In evaluating the relocation options, the Board considered a number of factors including: economics (purchase price plus projected cost to renovate the golf course and/or clubhouse), proximity to current York Downs site, ability to accommodate 27 holes, playability and walkability. The Board was also very mindful of the membership’s feedback to the unsolicited TACC / Fieldgate proposal which triggered the bid solicitation process. The economics – specifically, the cost to acquire a property and construct or renovate the golf course and the cost to construct or renovate a clubhouse – are such that the Board is not presenting or recommending a relocation option at this time. As the golf industry continues to evolve, a re location scenario could become more attractive at a future date. Confidentiality provisions in the offers received, along with non disclosure agreements that apply to Colliers’ discussions with club owners, prevent identifying the re location sites that were evaluated. Appendix III – Page 4 of 4 APPENDIX IV Kylemore Communities/Angus Glen Development is headquartered in Markham. Since 1997, the company has developed a reputation for being an industry innovator and builder of superior quality homes. Through the current management team, including President Patrick O’Hanlon and Vice President Frank Spaziani, the company has evolved to also become a sought after partner and land acquisition expert. With an ability to understand the nuances of the development approvals’ process, the company has a track record for creating highly desirable communities. Throughout its history, Kylemore Communities/Angus Glen Development has sought to acquire new land holdings that offer a unique opportunity for the company to apply its extensive talent to create the finest residential and mixed use communities in the Greater Toronto Area and beyond. Today Kylemore is working hand in hand with the third generation of the Stollery family represented by Cailey Stollery and Lindsay Stollery Jephcott, and is preparing to deliver approximately $1 billion in new communities and almost 8,000 residences over the next decade. In Angus Glen Community, Markham, Kylemore Communities has sold and built more than 1,000 homes. Angus Glen Community surrounds the 36 holes of Angus Glen Golf Club, one of Canada’s premier golf courses. The community was awarded the prestigious 2013 “Places to Grow, Community of the Year” from the Building Industry and Land Development Association (BILD). In 2014, Angus Glen Community received a Markham Design Excellence Award which recognizes and promotes excellence in urban design. Patrick O’Hanlon is a graduate of Ryerson University’s Urban and Regional Planning. His career started in planning for a government agency. He later honed his skills in the private sector, spearheading award winning development. In 1997, Markham landowner Gordon Stollery invited Patrick to bring his expertise to create a master plan for Angus Glen Community. Patrick is past president of BILD, and had a pivotal role in establishing the Centre for Urban Research and Land Development. In 2014, he received the Alumni Achievement Award, presented to Ryerson graduates who have excelled in their careers and have made a significant contribution to their profession, their community and their country. He is currently Chair of the Unionville Home Society and Chair of the fundraising committee for The University of Toronto Goldring Centre. Patrick along with his wife and three children are proud residents of Angus Glen Community. Frank Spaziani is a professional engineer and graduate of University of Toronto and University of Ottawa. Formerly a senior representative of Graywood Developments, Frank has developed numerous lands across Metro Toronto for single family uses. Prior to joining Graywood, Frank was vice president and division manager of Bramalea Inc.’s Western Toronto Division where he was responsible for the successful land development, sales, construction and financing of several 100 homes. He has over 30 years of experience in land development, residential low and high rise, commercial construction, sales and financing. Frank and his family are long standing Angus Glen Community residents. Cailey Stollery is the President of Angus Glen Golf Club, host venue for Toronto 2015 Pan Am Games. Cailey’s extensive business experience includes being the owner/operator of Nine Plus Nine Golf Clothing for Women, and Sales and Marketing Director for Kylemore Communities. Cailey holds degrees from the University of King’s College and the Rotman School of Management, University of Toronto. She is a member of the board of the Golf Canada Foundation, and is also a Director of Kylemore Communities, the Markham Stouffville Hospital Foundation, the Angus Glen Foundation, and is a Board Member Governor of the Character Community Foundation of York Region. Cailey, her husband and three children reside in Angus Glen. Lindsay Stollery Jephcott is a graduate from the University of Dalhousie and holds a Masters of Business Administration from the Rotman School of Management. Lindsay has 8 years of capital markets experience and is currently a portfolio manager for a resource based small cap fund and a private equity fund. She is certified with the Institute of Corporate Directors (IOD), and is completing her certificate with the Institute of Corporate Directors (ICD.C). Lindsay is currently on the board of Clearview Resources, Canada Fluorspar and Canada Company and also is a director of Kylemore Communities. APPENDIX IV Metropia was founded in 2009 and has become a leading national real estate development company focusing on urban renewal and design innovation. Our communities offer a wide range of housing options with an emphasis on affordability and a responsibility to the environment. Metropia has over 5,600 residential units under development to date. Howard Sokolowski, a graduate of York University, is CEO and founder of Metropia. As the former Chief Executive Officer of Tribute Communities, Howard earned a stellar reputation as one of the largest homebuilders in Canada, having built more than 30,000 low rise homes in the Greater Toronto Area. Under Howard’s leadership, Tribute won numerous community and development awards from J.D. Power, the Ontario Home Builders Association and Toronto’s Building Industry and Land Development Association (BILD) including Project of the Year, Community of the Year and Builder of the Year. Howard Sokolowski is an active member of his community. He is a member of the Foundation Board of the Mount Sinai Hospital Foundation and is a leading benefactor of the Art Gallery of Ontario, the Foundation Board of York University, Rouge Valley Health System, the Ontario Institute of Technology, Soulpepper Theatre, the McMichael Gallery, the National Ballet School and the Canadian Foundation for AIDS Research. Howard was awarded Ontario’s highest honor, the Order of Ontario, in January 2011. He is married to the writer Senator Linda Frum and together they have five children. Empire Communities is a leading builder developer of some of the most successful master planned communities in North America. Founded in 1986 by three partners with roots in civil engineering and excavation contracting, the firm was incorporated as Empire Communities in 1993. Each Empire community is meticulously planned and designed to match the lifestyle and priorities of their homeowners, while Empire’s signature condominiums are distinguished by outstanding locations, chic urban design and inspired recreational amenities. In the last 20 years, the Company has built over 6,300 houses and 3,200 high rise condominium units in Southern Ontario and the Greater Toronto Area. The Company has an active development pipeline and expects to build over 16,000 additional houses and condominium units in the next 10 years. Empire has won over 90 domestic and international awards and is recognized as a leader in the homebuilding industry in Canada. Empire Communities has an experienced management team with over 150 years of combined experience in real estate development, construction and real estate brokerage services. Daniel Guizzetti, P.Eng is the Co founder, President, and CEO of Empire Communities and has been actively involved in residential, commercial, and industrial real estate developments in North America for over 25 years. His areas of expertise include investment strategy, land development, and construction, as well as acquisitions and divestures. Daniel has overseen the development and construction of more than 10,000 houses, condo units and 20 towers built by Empire. He graduated from the University of Waterloo with a bachelor degree in Applied Sciences & Civil Engineering and is a member of the Professional Engineers Ontario. APPENDIX IV PACE Developments is a fully integrated, multi disciplinary development/construction building company with headquarters in Richmond Hill. With over 30 years of combined building experience, PACE Developments has been able to integrate a sophisticated methodology with a keen sense of artisanship and a passionate commitment to customer satisfaction. The company’s building profile ranges from luxury built homes to single family subdivisions, as well as commercial, office, and retail. PACE recently added The Mark to their extensive portfolio, representing their inaugural launch into high rise development. As a family run business, PACE Developments is dedicated to the continuous evolution that leads to homes of lasting beauty and exceptional value for today’s families. Dino Sciavilla graduated from Seneca College with a Construction Management Degree and started his building career in 1984. He has 31 years of building experience under different groups of names (i.e. Pace Developments Inc., Eldin Building Corporation, Swallows Nest Homes, Baron Homes, Thornwillow Homes, Sound Homes, Lionheart Homes, etc.). He is currently the CEO of Pace Developments. Under the various corporations just mentioned, Dino Sciavilla has built over 3,800 homes and is an ongoing member of BILD, CFIB & CHBA. His award winning history speaks to his dedication and commitment in receiving the Urban Design Condo Category Award for his Idle Creek Development in Kitchener, as well as the Markham Builder’s Excellence Award 3 consecutive years in a row. He was Finalist in the Tarion Awards in Mississauga, as well as a Finalist in the recent BILD Awards. APPENDIX V Extracts from Club By laws Section 7.07 (b) – LIMITATION OF DIRECTORS (b) Subject to paragraph (c) of this section, the Board of Directors shall submit any single project or proposal which is contemplated to involve total expenditures of more than $500,000 to the members for their approval at an annual or general meeting of members called for the purpose. If a project or proposal is required to be submitted to the members pursuant to this paragraph (b), the Board of Directors shall not commence to implement or make any commitments in connection with the implementation of the project or proposal until approval of the members has been received. Section 7.08 – DISPOSITION OF CLUB LANDS (a) Subject to paragraph (b) of this section, no disposition of any lands of the Club shall be made unless the proposed disposition has received the approvals set forth in this paragraph (a). The proposed disposition must first receive the approval of two thirds of the members of the Board of Directors. If the Board gives the requisite approval, the approval shall not be effective until the Board submits the proposed disposition to the voting members of the Club at an annual or general meeting of members called for the purpose of approving the proposed disposition and it receives the approval of at least two thirds of the votes cast at such meeting. Until the proposed disposition receives the requisite approval of the voting members, the Board shall not make any commitments in connection with the implementation of carrying out of the proposed disposition. If two thirds of the members of the Board of Directors do not approve the proposed disposition, then the Board shall not be required to submit it to the voting members of the Club for their consideration. (b) Notwithstanding paragraph (a) of this section, if a proposed disposition of lands of up to one acre is approved by two thirds of the members of the Board of Directors, the Board shall have the authority to implement or carry out the proposed disposition without having to submit it to the voting members of the Club for their approval; provided that the proposed disposition is not connected or related to other dispositions of lands of the Club of one acre or less and provided that the Board determines that the proposed disposition does not constitute or is not part of the disposition of a substantial part of the undertaking of the Club. (c) For purposes of this section the term “disposition” includes a sale, transfer, assignment, lease, joint venture, development agreement or other alienation or action by virtue of which the Club relinquishes control and/or ownership, either in whole or in part, of the lands of the Club. (added by By law No. 12, enacted on November 22, 2001) Section 7.09 – DISSOLUTION OR SALE OF UNDERTAKING OF CLUB No resolution approving the dissolution of the Club or the sale of all or a substantial part of the undertaking of the Club shall be effective until it is approved by two thirds of the members of the Board of Directors and is confirmed by two thirds of the votes cast by the voting members of the Club at a meeting of such members duly called for the purpose. (added by By law No. 12, enacted on November 22, 2001) Appendix V – page 1 of 1 YORK DOWNS LAND SALE FINANCIAL MODEL APPENDIX VI CLUB IMPACT: Gross Sale Proceeds: 412,000,000 Less: Wind Up Costs: Expenses directly associated with Sale: (10,000,000) (3,000,000) Net Proceeds: Estimated Taxes Payable (Capital Gain): Net Sale Proceeds After Tax: 399,000,000 (17,156,410) $ 381,843,590 Plus: 39,725,785 12,774,623 Interest Earned from Mortgage : Interest Earned on Cash Balance : Total Interest Earned: Estimated Taxes Payable (Interest): 52,500,408 (20,249,247) Total After Tax Proceeds from Sale: $ 414,094,751 Potential Distribution: Net Proceeds available: # of Shares (fully diluted): 414,094,751 19,697 Approximate Net Proceeds per Share: $ 21,023 Approximate # of Shares/Member: 11 Approximate Proceeds/Member BEFORE Tax: $ 231,256 MEMBER IMPACT M Capital Dividend (Non Taxable): Taxable Dividend: Estimated Taxes Payable (Shareholder): Estimated Shareholder Proceeds AFTER Tax: 34% 112,834 118,422 (40,263) $ 190,992 Appendix VI – page 1 of 1 APPENDIX VII Current 20-Year Capital Plan 2015 TO 2035 CAPITAL BUDGET PROJECTIONS Year 2014 2015* 2016* 2017* 2018* 2019* 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Beginning Bank Balance 7,463,964 4,372,001 3,743,267 2,136,928 1,765,595 1,259,051 769,786 384,123 (3,109,370) (5,039,041) (5,856,858) (6,223,380) (7,097,826) (7,738,973) (8,425,976) (8,976,873) (9,679,319) (11,859,467) (12,360,528) (12,935,152) (13,473,612) Cash Reserve + Entrance Fee - Essential Operational + / - Cash Flow Available EOY After Revenue Capital Projects Cash Flow from Land Sale Essential Capital [1] [2] [3] [4] Projects 734,325 (2,983,755) (171,000) (671,533) 4,372,001 416,872 (1,045,605) 3,743,267 365,718 (1,972,057) 2,136,928 299,118 (670,451) 1,765,595 251,999 (758,543) 1,259,051 41,441 (530,706) 769,786 (385,663) 384,123 (3,493,493) (3,109,370) (1,929,671) (5,039,041) (817,817) (5,856,858) (366,522) (6,223,380) (874,446) (7,097,826) (641,147) (7,738,973) (687,003) (8,425,976) (550,897) (8,976,873) (702,446) (9,679,319) (2,180,148) (11,859,467) (501,061) (12,360,528) (574,624) (12,935,152) (538,460) (13,473,612) (2,746,513) (16,220,125) 20 year totals: 1,375,147 (21,967,272) 5 year totals: 1,375,147 (4,977,362) [1] Entrance Fee Revenue projections are based on existing Entrance Fee Revenue Installments oustanding. No new membership entrance fee revenue has been reflected here. [2] Capital Spending Projections for years 2015 - 2019 are provided on the basis of requirements for the operations of the Club in its current state and location. They do not include adjustments for any potential impact of the unsolicited land sale offer. The 2015 budget includes “must-have” items only pending a decision on the land sale offer. [3] Changes to Operational Cash Flow are driven by ongoing club Working Capital requirements (ie. Increases to Member Receivables, decreases to Accounts Payable, etc.), as well as Operational "Gaps" due to the GCIP construction period which will be funded by the Capital Fund, not Operations (Annual Dues). [4] Cash Flow from Land Sales in 2014 reflects the Capital Gains tax paid for the taxable portion of the PFG land sale, which was accrued in the 2013 statements but not paid until 2014. Appendix VII page 1 of 1

© Copyright 2026