Canadian Research at a Glance - Investor Village: Stock Message

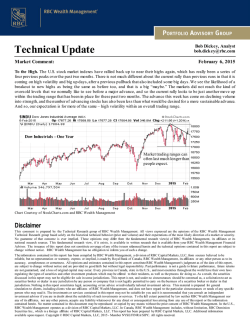

EQUITY RESEARCH CANADIAN RESEARCH AT A GLANCE January 30, 2015 Ratings Revisions ! Dorel Industries Inc. Summary Revising estimates lower on F/X headwinds; Rating to Sector Perform Summary Hunkering Down Summary Battening Down the Hatches Summary Fundamentals intact although risk has increased Summary Too early to step in Summary Temiscaming upgrade is done with full benefits expected in March Summary Another solid round of drill results from Buritica Summary HBI reported in-line Q4 results; positive read-through for the retail channel Summary Optimized Halilaga PEA focused on returns Summary Mixed Q4/14 results as expected Summary Fully financed even with higher capex Summary Production/reserve additions outweighed by oil price outlook Summary Guiding lower on weak capex Summary Entering the Transition Year Summary Highlights of the Canada Transportation Act review meeting Summary Railroad news + Weekly carload data Summary LUPE; PRE; DNO; RDSB Summary Upgrading our sector view Summary Airfreight & Surface Transportation Summary Technology and Consumer ideas contrasted to Financials and Energy Price Target Revisions ! Canadian Oil Sands Limited ! Cenovus Energy Inc. ! Eldorado Gold Corporation ! Methanex Corp. ! Tembec Inc. First Glance Notes ! Continental Gold Limited ! Gildan Activewear Inc. ! Pilot Gold ! Rogers Communications Inc. ! Torex Gold Resources Inc. Company Comments ! BlackPearl Resources Inc. ! JDS Uniphase Corporation ! Rogers Communications Inc. Industry Comments ! RBC Compass ! RBC Compass ! RBC International E&P Daily ! Solar ! The Weekly Haul Technical Research ! Equity Indexes Range Bound WITH Small-caps Improving ! - Action-Oriented Research Priced as of prior day's market close, EST (unless otherwise noted). For Required Non-U.S. Analyst and Conflicts Disclosures, see Page 16. EQUITY RESEARCH U.S. RESEARCH AT A GLANCE January 30, 2015 Ratings Revisions ! Cameron International Corp. ! JA Solar Holdings Co., Ltd. ! SunPower Corporation ! Trina Solar Ltd. Summary Downgrading to Sector Perform Summary Upgrade to Outperform and raise PT to $13 Summary Raise PT to $36 and upgrade to Outperform Summary Upgrade to Outperform from Sector Perform, Raising PT to $13 Summary A Monetization Miss, But Still Strong Fundamentals Summary The future dims somewhat Summary Underlying Profitability Better Than Thought Summary Lowering FY15/FY16 Estimates; Reducing Price Target to $74 Summary 2 significant upside TAM opportunities; we're (still) very bullish - OP Summary Core business stronger than expected, no one asleep at switch at BRCM Summary Rx Segment drives strong 2Q/15; raising estimates and price target Summary A good 4Q but 2015 guided a bit lower Summary Lots of Growth Options, but It's About Consistency Summary Reducing EPS Post Call Summary Fundamentals intact although risk has increased Summary Transition Continues; Hit Snooze Till March-10. Maintain OP. Summary Raising NAV estimate, price target driven by 50 bps drop in cap rate; Reiterate SP Summary High Quality Miss Q4…Reiterate Outperform Summary M&A Poised to Be a More Meaningful Driver Summary Equity flows fade. Fortunately, IVZ's got so much more Summary Too early to step in Summary More of the Same: 4Q14 Earnings Recap Summary 4Q14 – Strong revenues drive beat Summary 2015 Cash Flow Outspend Looking More Concerning With DCP Issues Summary Robust Quarter; Strong Growth Story Remains On Track Summary Maintaining momentum; Proofpoint remains a favorite of ours Summary 4Q14 Earnings Review Summary Executing Ahead of Grantley Refresh Cycle Summary A return to organic revenue growth but M&A and cost-cutting drive results Summary 4Q14 – The Price of Growth Summary Good Q4 with plenty of runway left; Outperform Summary Good report, in-line guide Price Target Revisions ! Alibaba Group Holding Limited ! Anglo American plc ! Autoliv Inc. ! Baxter International Inc. ! Biogen Idec Inc. ! Broadcom Corporation ! Cardinal Health, Inc. ! Chubb Corporation ! CMS Energy Corp. ! Core Laboratories ! Eldorado Gold Corporation ! EMC Corporation ! General Growth Properties, Inc. ! Google Inc. ! IDEX Corporation ! Invesco Ltd. ! Methanex Corp. ! NetSuite Inc. ! Northrop Grumman Corp. ! Phillips 66 ! Phillips 66 Partners LP ! Proofpoint Inc. ! PulteGroup, Inc. ! QLogic Corporation ! Quest Diagnostics, Inc. ! Raytheon Company ! Robert Half International, Inc. ! Swift Transportation Company 2 EQUITY RESEARCH ! The Blackstone Group LP ! The Dow Chemical Company ! The Wendy's Company ! Triumph Group, Inc. ! Umpqua Holdings Corp. ! Valero Energy Corporation ! Valero Energy Partners, LP ! WESCO International Inc. Summary 4Q/14: Updating Model Summary Specialty Portfolio Showing Margin Resilience Summary Perspectives, strategy, and valuation Summary F3Q15 – More than 99 problems Summary 4Q14: Softer Trends But Set to Bounce Back in 1Q15 Summary Walking The Path Of The Righteous Summary Dropdowns accelerated; increasing price target given high-conviction growth Summary Misses 4Q14 on Margins; Reaffirms 2015 with FX Caveats Summary A penny ahead on sound quarter; Guidance increased; Balance sheet strengthens Summary HBI reported in-line Q4 results; positive read-through for the retail channel Summary Breakthrough Therapy granted...signals FDA positively disposed on OCA - Outperform Summary Turn the Page: Cranes/Foodservice to split (finally) Summary Optimized Halilaga PEA focused on returns Summary Still the most defensive major, but more definition needed Summary Solid Q4 beat Summary Strong Underlying Growth Ahead for 2015 Summary It’s Prime Time… Summary 4Q14 – Setting Up 2015 Summary F2Q15 – Revenue vs. Bookings Summary Modest 4Q14 EPS Miss, Story Stays the Same Summary The road to $150? We said 2020 guidance could come...here's what else could come Summary Going on Offense Summary RWA trajectory uncertain Summary Widespread volume decline persists Summary Fibre Channel Better than Feared... But Growth Remains Elusive Summary An easy MLP to own in a difficult energy market Summary Low Riding Expectations Summary Reducing Estimates Post Call Summary Guiding lower on weak capex Summary 4Q14 – Low tax rate helps Summary Rolling along Summary Aggressively Cuts 2015 Onshore Spending; Production Growth Likely Negative In 2016 Summary 2Q15: Telfer better, but Lihir slow to improve driving minor downgrades Summary 4Q14: Stuck in a holding pattern First Glance Notes ! Boston Properties, Inc. ! Gildan Activewear Inc. ! Intercept Pharmaceuticals, Inc. ! Manitowoc Co., Inc. ! Pilot Gold ! Royal Dutch Shell, plc ! Selective Insurance Group Company Comments ! Abbott Laboratories ! Amazon.com ! B/E Aerospace, Inc. ! CACI International Inc. ! Capstead Mortgage Corporation ! Celgene Corp. ! Check Point Software ! Deutsche Bank ! Diageo PLC ! Emulex Corporation ! Enterprise Products Partners ! Harley-Davidson, Inc. ! Helmerich & Payne Inc. ! JDS Uniphase Corporation ! L-3 Communications Holdings ! Landstar Systems, Inc. ! Murphy Oil Corporation ! Newcrest Mining Limited ! N.Y. Community Bancorp 3 EQUITY RESEARCH ! NextEra Energy Inc. ! Nokia Oyj ! Occidental Petroleum Corporation ! PDC Energy Inc. ! PTC Inc. ! Rogers Communications Inc. ! SAP SE ! TCF Financial Corp. ! The Hershey Company ! The Medicines Company ! Valley National Bancorp ! Visa Inc. ! Werner Enterprises, Inc. Summary Continued Growth Visibility, Reiterate Outperform Summary Steady march towards monetization Summary Balance Sheet Preservation Is Top Priority; Cutting 2015 CapEx Budget 33% YoY Summary 4Q14 Production Lags Our Expectations On Weather & Midstream Issues Summary Lots of moving parts as the journey begins to a more ratable model Summary Entering the Transition Year Summary S4HANA: SAP's Next Big Thing Summary 4Q core EPS ~$0.29 - Decent core trends. Putting TDRs in the rear view mirror. Summary Trimming estimates; Sector Perform Summary Raplixa PDUFA extension possible; Point is 3-4 US approvals following 3 in the EU Summary 4Q14: Several one-time items fail to illuminate the road ahead Summary A good quarter essentially “as advertised” Summary No real surprises Industry Comments ! Ciccarelli's Check Points ! Mining equipment: Weekly news & Summary ! ! RBC Compass ! RBC European Industrials Daily ! RBC International E&P Daily ! Solar ! The Weekly Haul ! US Oilfield Services Summary Approaching Stock Valuations from Another Angle Summary Highlights of the Canada Transportation Act review meeting Summary CNH cutting Ag inventory, mixed mining messages Summary LUPE; PRE; DNO; RDSB Summary Upgrading our sector view Summary Airfreight & Surface Transportation Summary Subsea Report – More Headwinds than Tailwinds Summary Technology and Consumer ideas contrasted to Financials and Energy data nuggets Picture of the Week Vol. 5 Summary Technical Research ! Equity Indexes Range Bound WITH Small-caps Improving 4 EQUITY RESEARCH UK & European Research at a Glance January 30, 2015 Price Target Revisions ! Anglo American plc ! Core Laboratories ! Flughafen Zuerich AG ! Henderson Group Plc ! TeliaSonera AB Summary The future dims somewhat Summary Reducing EPS Post Call Summary Changing non-Aviation estimates for FX Summary Q4/14 mark-to-markets result in immaterial changes; maintain Sector Perform Summary B is Mightier than the C Summary Still the most defensive major, but more definition needed Summary Well placed to weather out low prices Summary RWA trajectory uncertain Summary Widespread volume decline persists Summary Steady march towards monetization Summary Signs of improvement in French Life Summary Searching for yield First Glance Notes ! Royal Dutch Shell, plc Company Comments ! Aquarius Platinum Limited ! Deutsche Bank ! Diageo PLC ! Nokia Oyj Industry Comments ! European Insurance ! RBC European consumer staples Find our Research at: RBC Insight (www.rbcinsight.com): RBC's global research destination on the web. Contact your RBC Capital Markets' sales representative to access our global research site, or use our iPad App "RBC Research" Thomson Reuters (www.thomsononeanalytics.com) Bloomberg (RBCR GO) SNL Financial (www.snl.com) FactSet (www.factset.com) 5 Ratings Revisions Dorel Industries Inc.(TSX: DII.B; 37.20) Sabahat Khan (Analyst) (416) 842-7880; [email protected] 42.00 52 WEEKS 07FEB14 - 26JAN15 Rating: Price Target: Sector Perform (prev: Outperform) 40.00 ▼ 42.00 40.00 Revising estimates lower on F/X headwinds; Rating to Sector Perform 38.00 We are revising our 2015 EPS forecasts lower on the expectation of F/X headwinds related to the strengthening dollar and reducing our rating to Sector Perform (Outperform previously) to reflect: 1) modest Y/Y earnings growth in 2015; and, 2) risk of further negative impact on 2015 earnings from continued appreciation of the USD. 36.00 34.00 32.00 400 200 F M A M Close J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks EPS, Ops Diluted Prev. 2012A 3.33 2013A 2.34 2014E 2.66↓ 2.67 2015E 2.75↓ 3.14 P/E 8.9x 12.6x 11.1x 10.7x All market data in CAD; all financial data in USD. • Revising rating to Sector Perform (Outperform previously); target to C$40 (C$42 previously). Our price target is based on ~8x our F2015E EBITDA of $205MM ($224MM previously). Our Sector Perform rating reflects our expectation of modest earnings growth through our forecast horizon (+3% Y/Y in 2015), and the potential for further negative impact on 2015 earnings from continued appreciation of the USD. DII will have to address these challenges while the company continues to integrate the Lerado acquisition. • Strengthening USD to be a headwind... Recall that DII generates over 50% of its revenues outside the U.S. with the largest portion coming from Europe (~25-30% of total company sales). The negative F/X impact results from DII's international divisions purchasing in USD and selling in local currencies, and the results from the international divisions also being translated back into USD for reporting purposes. • ... but, lower input costs/potential pricing to partially offset. At Q3 reporting, DII management noted that material costs for a number of inputs (metals, plastics, synthetics, etc.) had become increasingly favorable, which we expect will help partially offset the negative impact of the stronger USD. The lower crude price is also expected to benefit through lower freight costs. We note that DII is also working with its retail partners to pass-through price increases to offset some of the impact. • 2015 EPS forecasts revised lower. Our 2015 EBITDA and EPS forecasts are now $204.8MM and $2.75, respectively, versus $223.6MM and $3.14 previously. Price Target Revisions Canadian Oil Sands Limited(TSX: COS; 6.84) Greg Pardy, CFA (Analyst) (416) 842-7848; [email protected] Franz Hargo Muljo, CA (Associate) 416 842 8588; [email protected] 24.00 22.00 20.00 18.00 16.00 14.00 Rating: Price Target: 52 WEEKS 07FEB14 - 26JAN15 Underperform 10.00 ▼ 11.00 Hunkering Down Canadian Oil Sands' fourth-quarter CFPS of $0.43 was essentially in-line with our outlook and street consensus of $0.42. As expected, the company announced a 75% dividend cut to $0.05 per share attributable to the first-quarter of 2015. 12.00 4Q Results. COS' fourth-quarter synthetic oil sales of 108,139 b/d and oil realizations of $81.32/b were similar to our outlook of 107,500 b/d and $79.49/b, respectively, while its operating costs of $44/b came in 11% above our expectations. Cash taxes of $45 million exceeded our $30 million estimate. 10.00 8.00 30000 20000 10000 F M A Close 2013A 2014E 2015E M J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks CFPS Diluted Prev. 2.78 2.28 1.33↑ 0.85 P/CFPS 2.5x 3.0x 5.1x In-Line Dividend Cut. COS announced a 75% dividend cut to a quarterly run rate of $0.05 per share attributable to 1Q-2015, reflective of the current oil price environment. Our annual dividend outlook for COS remains unchanged at $0.20 in 2015 and 2016. 6 2016E 1.67↑ 1.51 Cost Reduction Initiatives. On a positive note, COS’ updated 2015 guidance reflects a 20% ($113 million) cut to its capital program, which now stands at $451 million. Syncrude’s major projects are nearing an end with the new Mildred Lake mine trains commencing operations in 4Q-2014, and completion of the Centrifuge Tailings Management project expected in 2015. The company has also taken steps to reduce its 2015 operating costs by 12% ($5.50/b) to $40.19/b, reflective of lower energy costs (25% lower) and non-energy costs (10.5% lower). Syncrude’s operating costs should benefit from its move to reduce contract workers (and overtime), while deferrals of its reclamation and pre-stripping activities may be somewhat temporary in nature. 4.1x All values in CAD unless otherwise noted. Cenovus Energy Inc.(TSX: CVE; 22.94; NYSE: CVE) Greg Pardy, CFA (Analyst) (416) 842-7848; [email protected] Franz Hargo Muljo, CA (Associate) 416 842 8588; [email protected] 34.00 32.00 30.00 28.00 26.00 Rating: Price Target: 52 WEEKS 07FEB14 - 26JAN15 Outperform 28.00 ▼ 30.00 Battening Down the Hatches Cenovus Energy announced a $700 million (27%) reduction to its 2015 capital program yesterday to a mid-point of $1.9 billion in order to protect its balance sheet amid challenging oil market conditions. The shift had little impact on its midpoint 2015 production of 276,500 boe/d (down only 1%), but will impact its future production. 24.00 22.00 20.00 25000 20000 15000 10000 5000 F M A M Close J 2014 J A S CFPS Diluted Prev. 4.77 4.83 2.61↓ 2.72 2.86↓ 3.87 2013A 2014E 2015E 2016E O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks P/CFPS 4.8x 4.7x 8.8x 8.0x All values in CAD unless otherwise noted. Eldorado Gold Corporation(NYSE: EGO; 5.57; TSX: ELD) Dan Rollins, CFA (Analyst) (416) 842-9893; [email protected] Mark Mihaljevic (Associate) (416) 842-3804; [email protected] 8.50 8.00 7.50 52 WEEKS • Reducing Capital. Cenovus’ revised 2015 capital program, now ranging from $1.8–$2.0 billion (vs. $2.5–$2.7 billion previously), will be directed towards maintaining current production from its oil sands assets. Christina Lake’s optimization program and Phase F expansion (25,000 b/d net) are sheltered from this cut, along with Phase G (15,000 b/d net) at Foster Creek. Conversely, Cenovus’ conventional drilling program in southern Alberta and Saskatchewan has largely been suspended. Longer-dated oil sands expansions, including Foster Creek Phase H (15,000 b/d net), Christina Lake Phase G (25,000 b/d net), and Narrows Lake Phase A (22,500 b/d net), along with greenfield oil sands projects have also been deferred. On the labour front, Cenovus plans to reassign employees to core business areas and reduce the size of its contract workforce in the coming weeks. • Production Impacts. Cenovus’ revised 2015 mid-point production guidance of 276,500 boe/d (265,000 – 288,000 boe/d range) is down only 1% from a previous mid-point of 278,500 boe/d (-3% growth). At the same time, we have trimmed our 2016 production outlook by 9% to 274,000 boe/d (-1% growth) in connection with natural production declines. Rating: Price Target: 07FEB14 - 26JAN15 Outperform 7.50 ▼ 8.50 Fundamentals intact although risk has increased We maintain our Outperform rating on Eldorado as the company's strong underlying fundamentals remain intact. However, the recent election of the Syriza party in Greece in conjunction with lower production from Kisladag, has at the moment, increased the overall level of risk associated with the company's shares. 7.00 6.50 6.00 5.50 Long-term fundamentals remain intact 5.00 While Eldorado released weaker than expected guidance for 2015, we believe the company's long-term fundamentals remain intact, driven by start-up of its low cost Eastern Dragon, Olympias II and Skouries projects. 40000 20000 F M A Close M J 2014 J A S O Rel. S&P 500 EPS, Adj Diluted Prev. 2013A 0.28 2014E 0.21↑ 0.20 N D J MA 40 weeks P/E 20.0x 27.0x • Production expected to rebound in 2016 • Cash costs expected to decline as new projects come on line • Free cash flow to materially improve 7 2015E 2016E 0.02↓ 0.23↓ 0.17 0.41 Political risk elevated following Greek elections 24.1x We believe the election of the Syriza party in Greece heightens the political risk associated with Eldorado's Greek assets given uncertainty around the policies/ mandates of the new government and its view towards business and mining. Given the increased uncertainty, we now apply a 10% discount rate to the company's Greek assets, up from 7% previously. All values in USD unless otherwise noted. Given Syriza's intent to restore public/social spending after ~5 years of austerity, we believe the government could look to bolster revenues by increasing taxes/ royalties. With Eldorado employing over 2,000 people and Greece's unemployment rate around 25%, we would expect local communities and labour unions to be supportive of the projects. Outperform rating maintained We maintain our Outperform rating on Eldorado Gold given the company’s strong underlying fundamentals and attractive risk/reward opportunity, although we note the elevated risk may not be suitable for all investors. As a result of lower nearterm cash flow and lower NAV, we have reduced our price target on Eldorado to $7.50 from $8.50. Methanex Corp.(NASDAQ: MEOH; 44.39; TSX: MX) Robert Kwan, CFA (Analyst) (604) 257-7611; [email protected] Michelle Zuliani (Associate) 604 257 7064; [email protected] Rating: Price Target: 52 WEEKS 07FEB14 - 26JAN15 70.00 Sector Perform 57.00 ▼ 69.00 Too early to step in While we continue to like management's positive actions in terms of capital allocation, we believe that it is too early to step into the stock due to concerns about falling methanol prices (and more broadly, oil prices). Further, while not particularly material in isolation, a combination of wider discounts, unplanned outages and continued gas supply issues are expected to also weigh on sentiment. 65.00 60.00 55.00 50.00 45.00 12000 10000 8000 6000 4000 2000 F M A Close 2013A 2014A 2015E 2016E M J 2014 J A S Rel. S&P 500 EPS, Adj Basic Prev. 4.95 4.17↓ 4.24 3.22↓ 5.53 5.16↓ 6.41 All values in USD unless otherwise noted. Paul C. Quinn (Analyst) (604) 257-7048; [email protected] Hamir Patel (Analyst) (604) 257-7145; [email protected] O N D J MA 40 weeks • Too early to step in. While we continue to like management's positive actions in terms of capital allocation, we believe that it is too early to step into the stock due to concerns about falling methanol prices (and more broadly, oil prices). Further, while not particularly material in isolation, a combination of wider discounts, unplanned outages and continued gas supply issues are expected to also weigh on sentiment. • Reducing estimates to primarily reflect lower methanol prices. We have reduced our 2015 and 2016 normalized basic EPS estimates to $3.22 and $5.16, respectively (down from $5.53 and $6.41, respectively). The reduction primarily reflects a decrease in methanol pricing (more reflective of the current pricing environment) as well as a moderation in 2015 forecast sales volumes along with a wider discount to the posted price in Q1/15 . • Valuation: reducing price target to $57.00 (down from $69.00). We have reduced our price target primarily to reflect lower forecast EBITDA due to a moderation in our pricing forecast more reflective of the current price environment. We continue to use a 6.5x EV/EBITDA multiple as part of our valuation. Tembec Inc.(TSX: TMB; 2.74) Rating: Price Target: Outperform 3.25 ▼ 3.50 Temiscaming upgrade is done with full benefits expected in March Reiterating our Outperform rating but trimming our target to $3.25 (from $3.50). We expect Tembec to benefit from FCF improvement in 2015/16 due to its Temiscaming project (and reduced Capex). While we expect specialty DP prices to 8 3.40 52 WEEKS 07FEB14 - 26JAN15 3.20 fall again in 2016 (down ~3% following the ~8% decline in 2015E), Tembec's leverage will drop on the weakened C$, higher lumber pricing and solid paperboard markets. 3.00 2.80 2.60 2.40 6000 4500 3000 1500 F M A M Close J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks EPS, Adj Diluted Prev. 2013A 0.13 2014A (0.26)↓ (0.05) 2015E 0.03↓ 0.52 2016E 0.17↓ 1.04 P/AEPS 21.1x NM NM 16.1x All values in CAD unless otherwise noted. • The company is expecting its specialty dissolving pulp prices to decline 8% in 2015 with volumes of certain specialty grades to come under pressure – We note that this guidance is in line with Rayonier AM's guidance for a 7-8% y/y decline. In addition, the company is likely to reduce specialty shipments by 10K tonnes while boosting viscose/fluff production by 20K tonnes in 2015. We have factored in a further 3.5% specialty DP price drop in 2016. • Management outlook – FQ215 earnings: Management estimates that, if energy prices and FX stay at their current levels, Tembec will experience an uptick in earnings in the fiscal second quarter (consistent with our forecast). Dissolving pulp (DP): TMB sees no near-term improvement for commodity viscose and expects the oversupply to persist throughout 2015. Lumber: Mgmt expects higher lumber prices as we enter the normally stronger spring/summer months. High-yield pulp: Anticipates marginal profitability until the market absorbs new hardwood capacity. Paperboard: US markets remain stable and demand expected to continue to grow with US GDP. Newsprint: Mgmt anticipates continued downward pressure on price given weak market conditions. • Revising estimates – CQ115E EBITDA from $29MM to $22MM, CY15 from $140MM to $111MM and CY16 from $192MM to $133MM. First Glance Notes Continental Gold Limited(TSX: CNL; 2.10) Dan Rollins, CFA (Analyst) (416) 842-9893; [email protected] Mark Mihaljevic (Associate) (416) 842-3804; [email protected] 52 WEEKS Rating: Outperform Risk Qualifier: Speculative Risk 07FEB14 - 26JAN15 5.00 4.00 3.00 2.00 12000 8000 4000 F M A M Close J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks All market data in CAD; all financial data in USD. • Overall, we expect Continental’s shares to modestly outperform their peers this morning given another solid round of drilling results from Veta Sur, one of two primary deposits at the company’s flagship Buritica project in Colombia. Given continuing positive results, Continental expects to deliver further growth in M&I resources when an updated resource estimate is completed in late Q2/15. • Key results from in-fill drilling of master veins in central Veta Sur that encountered better grades and/or thicknesses than currently modeled. • The company also continued to extend known mineralization with drilling in central/western Veta Sur extending vertical and lateral extents of the northern vein families, which is located in the proximity of planned mining development. • In addition, Continental identified veins families that are not currently modeled in northern Veta Sur as well as far western extensions of Yaragua. Gildan Activewear Inc.(NYSE: GIL; 58.57; TSX: GIL.TO) Sabahat Khan (Analyst) (416) 842-7880; [email protected] 62.00 Another solid round of drill results from Buritica Rating: 52 WEEKS 07FEB14 - 26JAN15 60.00 Outperform HBI reported in-line Q4 results; positive read-through for the retail channel Read-throughs for GIL: 58.00 56.00 54.00 52.00 50.00 6000 4500 3000 1500 F M A Close M J 2014 J A S Rel. S&P 500 All values in USD unless otherwise noted. O N D J MA 40 weeks • Retail environment continues to remain “choppy” but positive. The sell-through at retail during November and December was strong versus October, and the strength continued into the first few weeks of January, according to HBI management. These trends provide a positive read-through for GIL's Branded segment during the October–December quarter • Retail inventories "well positioned" entering the new year. HBI management noted that inventories at retail are in a good position coming out of holiday selling season. This was driven by the positive sales trends noted above and careful inventory management by retailers to match sell-through. This implies a favorable starting position for suppliers (such as GIL) heading into the new year. 9 • Cotton is trending lower, but other inflationary pressures exist. In line with previous commentary, HBI management indicated that they expect lower cotton costs in H2 2015, but they are also experiencing cost inflation in other areas such as labor. This is in line with our expectations for GIL over the next year and is consistent with GIL management’s previous commentary. 2015 guidance largely in line with consensus. HBI's 2015 guidance is for sales of $5,775–5,825MM (+9% y/y) vs. consensus of $6,029MM and EPS of $6.30–6.50 (+11-15% y/y) vs. consensus of $6.45. Q4 results largely in line with forecasts. Q4 revenues of $1,523MM were up 18% y/y and slightly below consensus of $1,556MM. Adjusted diluted EPS of $1.46 was up 49% versus prior year and slightly above consensus of $1.44. Pilot Gold(TSX: PLG; 1.15) Dan Rollins, CFA (Analyst) (416) 842-9893; [email protected] Mark Mihaljevic (Associate) (416) 842-3804; [email protected] 52 WEEKS Rating: Outperform Risk Qualifier: Speculative Risk 07FEB14 - 26JAN15 1.60 1.40 1.20 1.00 0.80 2500 2000 1500 1000 500 F M A Close M J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks All market data in CAD; all financial data in USD; dividends paid in CAD. Drew McReynolds, CFA, CA (Analyst) (416) 842-3805; [email protected] Jie He (Associate) 416 842 4123; [email protected] Haran Posner (Analyst) (416) 842-7832; [email protected] Optimized Halilaga PEA focused on returns • Pilot released an optimized PEA on its Halilaga project in Turkey (Pilot 40%/Teck 60%) which, in our view, improves the underlying return potential of the project and ability to withstand lower metal prices and/or more conservative operating/ capital estimates. We also believe the new study paves the way for a potential divestiture or eventual development in conjunction with a new partner. • Improved economics relative to prior PEA • Overall, the optimized PEA outlines a more robust project than previously envisioned by targeting the high-grade core of the deposit. Given the optimizations, Pilot has increased the estimated after-tax IRR of the project to 43% from 20% previously (at $1,200/oz gold and $2.90/lb copper) while significantly reducing the upfront capital hurdle. At $1,100/oz gold and $2.25/lb copper, the project's IRR is estimated at 20%. • The new PEA estimates average annual payable copper and gold production of 57.2 Mlb and 67.9 Koz at by-product cash costs of $1.08/lb, based on a 25,000 tpd mill. Upfront capital is estimated at $346 million with LOM sustaining capital of $213 million. • Key differences between new and old PEA: • Smaller mine size • Use of contractor mining • Addition of CIL circuit • Government incentives • In addition, we note the project economics could potentially benefit further if it were built as part of a regional development plan, including Pilot's TV Tower project. Rogers Communications Inc.(TSX: RCI.B; 44.55; NYSE: RCI) Rating: Sector Perform Mixed Q4/14 results as expected • Mixed Q4/14 financial results were largely in line with expectations. Consolidated revenue and EBITDA were $3,366MM (+3.8% YoY) and $1,233MM (+5.7% YoY), respectively, versus our estimates of $3,390MM and $1,186MM (consensus was $3,360MM and $1,180MM). The positive EBITDA variance was mainly due to media ($78MM versus our $39MM estimate). Consolidated EBITDA margins of 36.6% (+65bps YoY) were above our 35.0% estimate due mainly to stronger media margins (14.3% versus 7.0%). Adjusted EPS was $0.57 versus our estimate of $0.62 (consensus $0.64). • What to look for on the 8:00am ET call (#416-644-3414). (i) an update on progress with key Rogers 3.0 initiatives; and (ii) the extent to which postpaid ARPU growth is now sustainably positive. 10 52 WEEKS 07FEB14 - 26JAN15 46.00 44.00 42.00 7500 6000 4500 3000 1500 F M A M Close J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks All values in CAD unless otherwise noted. Torex Gold Resources Inc.(TSX: TXG; 1.47) Dan Rollins, CFA (Analyst) (416) 842-9893; [email protected] Mark Mihaljevic (Associate) (416) 842-3804; [email protected] 1.80 52 WEEKS Rating: Outperform Risk Qualifier: Speculative Risk 07FEB14 - 26JAN15 Fully financed even with higher capex First impression 1.60 • We expect Torex's shares could slightly underperform its peers today's as the market digests higher capital costs at the company's El Limon-Guajes project as well as the potential for further cost pressures related to contractor costs, given ongoing social unrest in Mexico's Guerrero State. Capital costs for El Limon-Guajes project have risen $75 million 1.40 1.20 1.00 60000 40000 20000 F M A Close M J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks All values in CAD unless otherwise noted. • Torex announced this morning that the capital cost estimate for its El LimonGuajes project is now estimated at $800M, up from the previous forecast of $725M. The increase was driven by a number of factors including: • Development of North Nose • Scope changes/inflationary pressures Project remains fully funded and relatively on schedule • With a strong balance sheet and access to additional capital, development of El Limon-Guajes remains fully financed. With production expected to start in Q3/15, the company should gradually begin to benefit from pre-commercial cash flow. Security/social challenges in Guerrero warrant watching • As highlighted within the Q3 MD&A, social/security challenges in Guerrero continue to present a risk for the company. Today, Torex noted the social unrest in the state has affected "the willingness of construction contractors and their employees to come to the state". • In our view, these challenges could lead to incremental costs in order to compensate contractors for the perceived risk. To date, Torex has not had any challenges with its employees, with the site remaining secure and productive. Company Comments Mark J. Friesen, CFA (Analyst) (403) 299-2389; [email protected] Luke Davis (Associate) 403 299 5042; [email protected] BlackPearl Resources Inc.(TSX: PXX; 0.89) Rating: Underperform Risk Qualifier: Speculative Risk Price Target: 1.25 Production/reserve additions outweighed by oil price outlook While we view the company's strong Q4/14 production positively at the margin, we believe weak oil prices will continue to overshadow operational developments. In addition, the company requires material financing before 11 3.15 2.70 52 WEEKS 07FEB14 - 26JAN15 proceeding with future development, which reduces the value of incremental reserve bookings, in our view. 2.25 1.80 1.35 0.90 25000 20000 15000 10000 5000 F M A M Close J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks Prod (boe/d) Prev. 9,494 9,039↑ 8,815 8,065 10,672 2013A 2014E 2015E 2016E • Positive reserves update; financing required for development. The company announced reserve additions in each of its three core areas, bringing total corporate 2P reserves to 297 mmboe, up 2% over last year. While directionally positive, we highlight that the company cannot move forward with development of Blackrod SAGD, its largest planned project, without material financing or a JV partner. Given current market conditions, we do not view this as probable for the foreseeable future. • Q4/14 production 10% above our expectation. Fourth quarter production of 9,639 boe/d was 10% higher than our estimate of 8,750 boe/d. The difference was primarily attributable to our assumption of higher production declines at Onion Lake. • NAV largely unchanged. We have rolled over our NAV model to reflect the company's updated reserves. All values in CAD unless otherwise noted. JDS Uniphase Corporation(NASDAQ: JDSU; 13.26) Mark Sue (Analyst) (212) 428-6491; [email protected] Spencer Green (Associate) 212 858 7153; [email protected] Ameet Prabhu (Associate) (212) 618-3330; [email protected] Rating: Price Target: Guiding lower on weak capex 52 WEEKS 07FEB14 - 26JAN15 14.00 13.00 12.00 11.00 40000 20000 F M A Close M J 2014 J A S O Rel. S&P 500 EPS, Ops Diluted Prev. 2013A 0.56 2014A 0.56 2015E 0.53↓ 0.57 2016E 0.73↑ 0.72 Outperform 17.00 N D J MA 40 weeks P/E 23.7x 23.7x 25.0x 18.2x All values in USD unless otherwise noted. Drew McReynolds, CFA, CA (Analyst) (416) 842-3805; [email protected] Jie He (Associate) 416 842 4123; [email protected] Haran Posner (Analyst) (416) 842-7832; [email protected] JDSU guided to our Street-low March quarter, which explains the stock action today. There’s a value-unlocking split coming, encouraging 100G trends, and promised opex savings. Despite the weak capex environment, we're staying the course. Optical seems solid while pricing is holding. Some improving trends in SE, although NE needs work. Our $17 price target is 2.0x CY16E revenues; SOTP gets us higher. • Capex uncertain...yet again. Slow carrier spending impacted JDSU’s revenues and the conservative guide implies that the weak environment persists. JDSU delivered results below expectations with weakness mostly in NE (-15% YoY) while SE grew +17% YoY. CCOP was flat QoQ, -4% YoY, with optical -5% YoY offset by strong +67% YoY growth in lasers, meaning that CCOP GM/OM improved 110/70 bps YoY. Book-to-bill finished the quarter >1 across segments aside from OSP at <1. • Outlook below...yet again. The outlook for F3Q15 is now $408–428M, the $418M midpoint implying revenues -4% QoQ, flat YoY. We remain conservative at $416M considering 1H capex outlook and seasonality in commercial lasers. Beyond current capex headwinds, metro, submarine, Web 2.0, and next-gen lasers may help offset the NE headwinds while SE is still targeting break-even by F4Q15. Rogers Communications Inc.(TSX: RCI.B; 44.86; NYSE: RCI) Rating: Price Target: Sector Perform 44.00 Entering the Transition Year Mixed Q4/14 financial results and 2015 guidance were largely in line with our expectations. 2015 will be a transition year as Rogers 3.0 initiatives gain traction. We would remain patient for more attractive and/or timely entry points. Our $44 target is unchanged. • Medium-term set-up remains attractive. Notwithstanding greater wireless competition and/or higher bond yields, we see a stronger floor under the stock reflecting renewed postpaid ARPU growth. However, we believe it is too early to overweight the stock reflecting: (i) the likelihood of a stronger recapitalized 12 52 WEEKS 07FEB14 - 26JAN15 46.00 44.00 42.00 7500 6000 4500 3000 1500 F M A Close 2013A 2014A 2015E 2016E M J 2014 J A S O N D J Rel. S&P/TSX COMPOSITE INDEXMA 40 weeks Revenue Prev. 12.7 12.9 13.3↓ 13.4 13.5 All values in CAD unless otherwise noted. fourth national wireless player emerging; and (ii) the timing of a return to NAV growth that is comparable to large-cap peers. Over the medium-term, we continue to believe the set-up for Rogers looks very attractive reflecting: (i) eventual market share stabilization; (ii) a superior asset mix; and (iii) the likely monetization of Rogers 3.0 initiatives, particularly with respect to customer service and business market penetration. • 2016 focus to shift to improved subscriber growth following a “transition year” in 2015. With now an improving revenue trajectory and with management setting modest subscriber expectations for 2015 and reiterating that the turnaround “will take time”, we believe the investor focus in 2016 will increasingly shift to evidence that initiatives under Rogers 3.0 are translating to real improvement. The key metrics in 2016 that we believe should encapsulate many of Rogers 3.0 initiatives are postpaid churn and cable RGU growth, particularly the initiatives around customer service improvement, network differentiation (i.e., shomi, NHL GameCentre LIVE / GamePlus and VICE programming with more to come in 2015) and increased business market penetration (i.e., SMB). Industry Comments Walter Spracklin, CFA (Analyst) (416) 842-7877; [email protected] RBC Compass Erin Lytollis, CFA (Associate) (416) 842-7862; [email protected] • We were invited to attend a closed-door meeting in Ottawa as part of the Canada Transportation Act (CTA) Review consultation process. The meeting was hosted by the Canadian Transportation Research Forum (CTRF), and attended by David Cardin, an Advisor on the Review committee. • Committee is balanced. We are encouraged by the committee membership, which is balanced with representation of the shipper, rail, port/marine, airline, and public policy point of view. Accordingly, we are confident that the views of each stakeholder will be given fair consideration. • Process provides adequate time for input, analysis and recommendation. Unlike Bill C-30, which was put together in haste during a period of high rail congestion, cold temperatures (and hot tempers), the CTA review is an 18-month process that is taking into account hundreds of submissions and consultations. Accordingly, we expect the recommendations to be based on more researchbased analysis than was the case with Bill C-30. • Our view: We do not expect forthcoming recommendations to affect our thesis on the railroads. At this stage, we do not see any major recommendations emerging that would fundamentally alter the railroads' operating profile. Based on the thorough process outlined above, we expect the Review panel to produce fact-based recommendations and we believe that emphasis will be placed on mandating the provision of information and producing a framework for performance monitoring. Safety will also be a component, but nothing that would be very damaging to network fluidity. All values in CAD unless otherwise noted. Highlights of the Canada Transportation Act review meeting Walter Spracklin, CFA (Analyst) (416) 842-7877; [email protected] RBC Compass John Barnes (Analyst) (804) 782-4020; [email protected] • Volume gains boosted by easy comparisons. Total freight traffic transported by the Class 1 railroads jumped +6%Y/Y in the week ending January 24th. While yearover-year gain have been impacted by volatile comparisons year-to-date, we are encouraged by the positive absolute volume trend through Week 3. Progress on dwell performance. Average train velocity reported by the Class 1 railroads (excluding CP) was flat sequentially and slightly stronger compared to prior year results. Average terminal dwell for this group improved by 2% sequentially, but remained 2% weaker than prior year performance. Year-overyear improvements are fueled by easy comparisons for CNR, CP and BNSF. CSX releases details of $2.5B capital program. CSX has posted the details of its capital budget to its website. This $2.5B plan includes: 200 new locomotives; Mike Fountaine (Associate) (804) 782-4013; [email protected] Erin Lytollis, CFA (Associate) (416) 842-7862; [email protected] All values in CAD unless otherwise noted. Railroad news + Weekly carload data 13 95 locomotives rebuilt; 1,000 new containers; 3,300 new / rebuilt rail cars; 200 bridge repairs; 425 miles cleared for double-stack; 500 track miles replaced; and 3.2MM ties replaced. Twenty-nine projects were identified including beginning construction on double-stacking the Virginia Avenue Tunnel and starting work on an intermodal facility in Pittsburgh. Nathan Piper (Analyst) +44 131 222 3649; [email protected] RBC International E&P Daily Al Stanton (Analyst) +44 131 222 3638; [email protected] LUPE.SS: Newsflow Surge; PRE.TO: Delay to Caribbean LNG; RDSB.L: What are the big boys doing - Key takeaways from Shell's FY13 results and presentation; Mexico - Data rooms opening; Saudi Arabia announces government changes; Week Ahead Haydn Rodgers, CA (Associate) +44 131 222 4911; [email protected] LUPE; PRE; DNO; RDSB Victoria McCulloch, CA (Analyst) +44 131 222 4909; [email protected] All values in USD unless otherwise noted. Mahesh Sanganeria, CFA (Analyst) (415) 633-8550; [email protected] Solar Shawn Yuan (Associate) 415 633 8565; [email protected] • Solar stocks have significantly underperformed the broader market since Q1/14 due to a huge decline in oil and natural gas prices, concern about China and Japan demand, expectation of rise in interest rates, expiration of ITC in the US, and International trade disputes/tariffs especially US/China. • We expect a reversal in sentiment and rerating of the sector as the companies deliver strong earnings growth and rational capacity expansion despite these concerns. • We believe installation can grow in low to mid teens over next five years as declining policy support is offset by cost reductions. • We expect companies with strong balance sheet to expand capacity to capture profitability from incremental demand while maintaining a supply demand balance. • We are upgrading Trina Solar (TSL), JA Solar Holdings (JASO), and SunPower Corp. (SPWR) to Outperform, maintaining SunEdison (SUNE) at Outperform and Yingli Green Energy (YGE) and First Solar (FSLR) at Sector Perform. All values in USD unless otherwise noted. Upgrading our sector view John Barnes (Analyst) (804) 782-4020; [email protected] The Weekly Haul Mike Fountaine (Associate) (804) 782-4013; [email protected] • In this week's Feature Commentary, we discuss rail capex and why it may not translate into better rail service. • Takeaways from the news include: ILWU, PMA reach tentative chassis agreement, but broader issues remain; E-retailers struggling with cost of delivery and logistics investment; more than 1,000 Mexican carriers held authority to operate in US before border opened; trailer orders reach near high in December; DeFazio blasts DOT over failure to finalize Tank Car Rule, calls for PHMSA Audit; and Class I employment gains in December. • Next week we expect 4Q/14 results from HTLD, UPS, R, CHRW, ARCB, HUBG, CNW, and ODFL. • Key macro data points for the week ahead include MDI, OHD & ISM Manufacturing on Monday, Factory Orders & Auto Sales on Tuesday, ISM NonManufacturing on Wednesday, RBC COI on Thursday, and Employment Report on Friday. Todd Maiden (Associate) (804) 782-4014; [email protected] All values in USD unless otherwise noted. Airfreight & Surface Transportation Technical Research Robert Sluymer, CFA (Analyst) (212) 858-7066; [email protected] Anna Drotman (Associate) Equity Indexes Range Bound WITH Small-caps Improving Technology and Consumer ideas contrasted to Financials and Energy 14 (212) 858-7065; [email protected] • US equity indexes continue to see-saw in a narrow range this week, stalling at the January highs (S&P 2065) and bouncing from the January/December lows near 200-dma’s (S&P 1972). A resolution of the January trading ranges, in either direction, should signal the next important tactical trend shift for US equity indexes. • Small-cap indexes remain important to monitor in the coming weeks given they have been consolidating in the upper half of a 12-month trading range and have potential to ‘break-out’. The improving relative performance ‘trend’ for smallcaps vs. large caps remains encouraging. • Sector and group themes remain far more important than the market ‘call’ – We highlight our bottom up relative performance trend tables as one technical tool that has continued to prove useful for allocating capital between sectors within the equity market. Financials, Industrials and Technology relative breadth declining – Our relative performance table, on page 11, illustrates an incremental deterioration in the number of stocks ‘working’ within Financials, Industrials and Technology. (+/-) Technology – Haves & have-nots. Continue to add to accelerating leadership: AAPL, CTSH. Reduce: QCOM, MSI. (+/-) Consumer – Remain selective favoring accelerating profiles: SBUX, UA, TAP, DNKN. Reduce exposure: CMCSA/TWC. (-) Financials – Performance has stalled, Insurance bellwethers: AIG, TMK, MET and PRU are at key ‘make-or-break’ levels. (-) Energy – Integrateds (XOM, CVX) have been sector defensive safe havens BUT are on the cusp of breaking key support. 15 Required disclosures Non-U.S. analyst disclosure Mark J. Friesen;Luke Davis;Greg Pardy;Franz Hargo Muljo;Robert Kwan;Michelle Zuliani;Sabahat Khan;Paul C. Quinn;Hamir Patel;Drew McReynolds;Jie He;Haran Posner;Dan Rollins;Mark Mihaljevic;Nathan Piper;Al Stanton;Haydn Rodgers;Victoria McCulloch;Walter Spracklin;Erin Lytollis (i) are not registered/qualified as research analysts with the NYSE and/or FINRA and (ii) may not be associated persons of the RBC Capital Markets, LLC and therefore may not be subject to FINRA Rule 2711 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. Conflicts disclosures This product constitutes a compendium report (covers six or more subject companies). As such, RBC Capital Markets chooses to provide specific disclosures for the subject companies by reference. To access current disclosures for the subject companies, clients should refer to https://www.rbccm.com/GLDisclosure/PublicWeb/DisclosureLookup.aspx?entityId=1 or send a request to RBC CM Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7. Please note that current conflicts disclosures may differ from those as of the publication date on, and as set forth in, this report. The analyst(s) responsible for preparing this research report received compensation that is based upon various factors, including total revenues of the member companies of RBC Capital Markets and its affiliates, a portion of which are or have been generated by investment banking activities of the member companies of RBC Capital Markets and its affiliates. Distribution of ratings For the purpose of ratings distributions, regulatory rules require member firms to assign ratings to one of three rating categories - Buy, Hold/Neutral, or Sell - regardless of a firm's own rating categories. Although RBC Capital Markets' ratings of Top Pick(TP)/ Outperform (O), Sector Perform (SP), and Underperform (U) most closely correspond to Buy, Hold/Neutral and Sell, respectively, the meanings are not the same because our ratings are determined on a relative basis (as described below). Distribution of ratings RBC Capital Markets, Equity Research As of 31-Dec-2014 Rating BUY [Top Pick & Outperform] HOLD [Sector Perform] SELL [Underperform] Count 897 686 112 Percent 52.92 40.47 6.61 Investment Banking Serv./Past 12 Mos. Count Percent 290 32.33 137 19.97 6 5.36 Conflicts policy RBC Capital Markets Policy for Managing Conflicts of Interest in Relation to Investment Research is available from us on request. To access our current policy, clients should refer to https://www.rbccm.com/global/file-414164.pdf or send a request to RBC Capital Markets Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7. We reserve the right to amend or supplement this policy at any time. Dissemination of research and short-term trade ideas RBC Capital Markets endeavors to make all reasonable efforts to provide research simultaneously to all eligible clients, having regard to local time zones in overseas jurisdictions. RBC Capital Markets' equity research is posted to our proprietary website to ensure eligible clients receive coverage initiations and changes in ratings, targets and opinions in a timely manner. Additional distribution may be done by the sales personnel via email, fax, or other electronic means, or regular mail. Clients may also receive our research via third party vendors. RBC Capital Markets also provides eligible clients with access to SPARC on the Firms proprietary INSIGHT website, via email and via third-party vendors. SPARC contains market color and commentary regarding subject companies on which the Firm currently provides equity research coverage. Research Analysts may, from time to time, include short-term trade ideas in research reports and / or in SPARC. A short-term trade idea offers a short-term view on 16 how a security may trade, based on market and trading events, and the resulting trading opportunity that may be available. A short-term trade idea may differ from the price targets and recommendations in our published research reports reflecting the research analyst's views of the longer-term (one year) prospects of the subject company, as a result of the differing time horizons, methodologies and/or other factors. Thus, it is possible that a subject company's common equity that is considered a long-term 'Sector Perform' or even an 'Underperform' might present a short-term buying opportunity as a result of temporary selling pressure in the market; conversely, a subject company's common equity rated a long-term 'Outperform' could be considered susceptible to a short-term downward price correction. Short-term trade ideas are not ratings, nor are they part of any ratings system, and the firm generally does not intend, nor undertakes any obligation, to maintain or update short-term trade ideas. Short-term trade ideas may not be suitable for all investors and have not been tailored to individual investor circumstances and objectives, and investors should make their own independent decisions regarding any securities or strategies discussed herein. Please contact your investment advisor or institutional salesperson for more information regarding RBC Capital Markets' research. Analyst certification All of the views expressed in this report accurately reflect the personal views of the responsible analyst(s) about any and all of the subject securities or issuers. No part of the compensation of the responsible analyst(s) named herein is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the responsible analyst(s) in this report. Disclaimer RBC Capital Markets is the business name used by certain branches and subsidiaries of the Royal Bank of Canada, including RBC Dominion Securities Inc., RBC Capital Markets, LLC, RBC Europe Limited, RBC Capital Markets (Hong Kong) Limited, Royal Bank of Canada, Hong Kong Branch and Royal Bank of Canada, Sydney Branch. The information contained in this report has been compiled by RBC Capital Markets from sources believed to be reliable, but no representation or warranty, express or implied, is made by Royal Bank of Canada, RBC Capital Markets, its affiliates or any other person as to its accuracy, completeness or correctness. All opinions and estimates contained in this report constitute RBC Capital Markets' judgement as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Nothing in this report constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation to clients and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The investments or services contained in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about the suitability of such investments or services. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. RBC Capital Markets research analyst compensation is based in part on the overall profitability of RBC Capital Markets, which includes profits attributable to investment banking revenues. Every province in Canada, state in the U.S., and most countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their residents, as well as the process for doing so. As a result, the securities discussed in this report may not be eligible for sale in some jurisdictions. RBC Capital Markets may be restricted from publishing research reports, from time to time, due to regulatory restrictions and/ or internal compliance policies. If this is the case, the latest published research reports available to clients may not reflect recent material changes in the applicable industry and/or applicable subject companies. RBC Capital Markets research reports are current only as of the date set forth on the research reports. This report is not, and under no circumstances should be construed as, a solicitation to act as securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. To the full extent permitted by law neither RBC Capital Markets nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means without the prior consent of RBC Capital Markets. Additional information is available on request. To U.S. Residents: This publication has been approved by RBC Capital Markets, LLC (member FINRA, NYSE, SIPC), which is a U.S. registered broker-dealer and which accepts responsibility for this report and its dissemination in the United States. Any U.S. recipient of this report that is not a registered broker-dealer or a bank acting in a broker or dealer capacity and that wishes further information regarding, or to effect any transaction in, any of the securities discussed in this report, should contact and place orders with RBC Capital Markets, LLC. To Canadian Residents: This publication has been approved by RBC Dominion Securities Inc.(member IIROC). Any Canadian recipient of this report that is not a Designated Institution in Ontario, an Accredited Investor in British Columbia or Alberta or a Sophisticated Purchaser in Quebec (or similar permitted purchaser in any other province) and that wishes further information regarding, or to effect any transaction in, any of the securities discussed in this report should contact and place orders with RBC Dominion Securities Inc., which, without in any way limiting the foregoing, accepts responsibility for this report and its dissemination in Canada. To U.K. Residents: This publication has been approved by RBC Europe Limited ('RBCEL') which is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority ('FCA') and the Prudential Regulation Authority, in connection with its distribution in the United Kingdom. This material is not for general distribution in the United Kingdom to retail clients, as defined under the rules of the FCA. However, targeted distribution may be made to selected retail clients of RBC and its affiliates. RBCEL accepts responsibility for this report and its dissemination in the United Kingdom. To Persons Receiving This Advice in Australia: This material has been distributed in Australia by Royal Bank of Canada - Sydney Branch (ABN 86 076 940 880, AFSL No. 246521). This material has been prepared for general circulation and does not take into account the objectives, financial situation or needs of any recipient. Accordingly, any recipient should, before acting on this material, consider the appropriateness of this material having regard to their objectives, financial situation and needs. If this material relates to the acquisition or possible acquisition of a particular financial product, a recipient in Australia should obtain any relevant disclosure document prepared in respect of that product and consider that document before making any decision about whether to acquire the product. This research report is not for retail investors as defined in section 761G of the Corporations Act. 17 To Hong Kong Residents: This publication is distributed in Hong Kong by RBC Capital Markets (Hong Kong) Limited and Royal Bank of Canada, Hong Kong Branch (both entities which are regulated by the Hong Kong Monetary Authority ('HKMA') and the Securities and Futures Commission ('SFC')). Financial Services provided to Australia: Financial services may be provided in Australia in accordance with applicable law. Financial services provided by the Royal Bank of Canada, Hong Kong Branch are provided pursuant to the Royal Bank of Canada's Australian Financial Services Licence ('AFSL') (No. 246521). RBC Capital Markets (Hong Kong) Limited is exempt from the requirement to hold an AFSL under the Corporations Act 2001 in respect of the provision of such financial services. RBC Capital Markets (Hong Kong) Limited is regulated by the HKMA and the SFC under the laws of Hong Kong, which differ from Australian laws. To Singapore Residents: This publication is distributed in Singapore by the Royal Bank of Canada, Singapore Branch, a registered entity granted offshore bank licence by the Monetary Authority of Singapore. This material has been prepared for general circulation and does not take into account the objectives, financial situation, or needs of any recipient. You are advised to seek independent advice from a financial adviser before purchasing any product. If you do not obtain independent advice, you should consider whether the product is suitable for you. Past performance is not indicative of future performance. If you have any questions related to this publication, please contact the Royal Bank of Canada, Singapore Branch. Royal Bank of Canada, Singapore Branch accepts responsibility for this report and its dissemination in Singapore. To Japanese Residents: Unless otherwise exempted by Japanese law, this publication is distributed in Japan by or through RBC Capital Markets (Japan) Ltd., a registered type one financial instruments firm and/or Royal Bank of Canada, Tokyo Branch, a licensed foreign bank. .® Registered trademark of Royal Bank of Canada. RBC Capital Markets is a trademark of Royal Bank of Canada. Used under license. Copyright © RBC Capital Markets, LLC 2015 - Member SIPC Copyright © RBC Dominion Securities Inc. 2015 - Member CIPF Copyright © RBC Europe Limited 2015 Copyright © Royal Bank of Canada 2015 All rights reserved 18

© Copyright 2026