General Motors Corporate News General Motors Product News

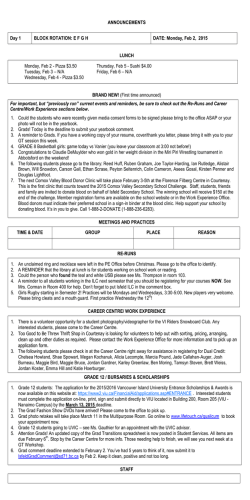

Canadian Auto News Watch - Thursday February 5, 2015 General Motors Corporate News Letting the clock run out Permalink: www.oshawaexpress.ca... oshawaexpress.ca - Thu Feb 5 2015 GM rises as profit tops analysts' estimates; pickup sales rise Byline: David Welch, Source: Bloomberg News, With A File From Reuters, Page: FP6, Edition: National National Post - Thu Feb 5 2015 Recalls put dent in GM's 2014 earnings Byline: Tom Krisher, Source: The Associated Press, Page: C7, Edition: First Waterloo Region Record - Thu Feb 5 2015 General Motors beats 4Q earnings expectations, misses revenue forecasts; GM tops 4Q profit forecasts Canadian Press - Wed Feb 4 2015 General Motors, Sony, Walt Disney, Gilead Sciences and Staples are big market movers; General Motors and Sony are big market movers Canadian Press - Wed Feb 4 2015 Ontario gains $1.1B for selling last GM stake; Go to public works Source: The Canadian Press, Page: A4, Edition: All_but_Toronto National Post - Thu Feb 5 2015 Ontario sells remainder of GM shares acquired through bailout deal Byline: ADRIAN MORROW, GREG KEENAN, Page: A4, Edition: Ontario The Globe and Mail - Thu Feb 5 2015 Ontario sells its GM shares; Deal reaps $1.1 billion for province Source: The Canadian Press, Page: B5, Edition: Early Windsor Star - Thu Feb 5 2015 General Motors shares unloaded by Ontario government Byline: CBC News CBC.CA News - Wed Feb 4 2015, 7:15pm ET In Brief Byline: News services, Page: A15, Edition: First Hamilton Spectator - Thu Feb 5 2015 GM adds less expensive models to U.S. lineup; Canada next? Car News | Auto123 Permalink: www.auto123.com... auto123.com - Thu Feb 5 2015 GM adds cheaper base models ; is Canada next? Permalink: www.msn.com... msn.com - Thu Feb 5 2015 The impact of auto industry's decline; Job losses particularly devastating for young families, McMaster study finds Byline: Steve Arnold The Hamilton Spectator, Page: A15, Edition: First Hamilton Spectator - Thu Feb 5 2015 Column: Brother, can you spare a Cadillac? Byline: Joe Chidley, Source: Financial Post, Page: D4, Edition: Final Vancouver Sun - Thu Feb 5 2015 Return to top General Motors Product News Equinox tries to be everything to everyone Note: Also in Northumberland Today.com, The Belleville Intelligence, Ottawa Sun, The Kingston Whig-Standard, The Welland Tribune, Brockville Recorder and Times. Byline: GLEN WOODCOCK , [email protected], AUTONET, Page: C1, Edition: Final The Owen Sound Sun Times - Thu Feb 5 2015 GMC Canyon rolls out fresh new look Byline: Justin Pritchard, Source: The Canadian Press, Page: A35, Edition: Final Prince George Citizen - Thu Feb 5 2015 2015 Buick Encore - The Car Guide Permalink: www.guideautoweb.com... guideautoweb.com - Thu Feb 5 2015 2015 Chevrolet Sonic | Autobytel.com Permalink: www.autobytel.com... autobytel.com - Thu Feb 5 2015 Brief: Drawing Board Source: The Citizen, Page: A33, Edition: Final Prince George Citizen - Thu Feb 5 2015 Return to top General Motors Corporate News Letting the clock run out oshawaexpress.ca Thu Feb 5 2015 View original item at www.oshawaexpress.ca...» Return to top GM rises as profit tops analysts' estimates; pickup sales rise National Post Thu Feb 5 2015 Page: FP6 Section: Financial Post Byline: David Welch Dateline: DETROIT Source: Bloomberg News, With A File From Reuters General Motors Co. shares rallied Wednesday after the automaker reported fourth-quarter profit that beat analysts' estimates as cheaper gasoline helped vehicle sales, especially of its more-lucrative light trucks. Adjusted earnings per share jumped to US$1.19, topping the average analyst estimate for US83¢, from US67¢ a year earlier, the largest U.S. automaker said in a statement. GM's North American unit posted its sixth straight quarter of improved profit margins, resulting in profit-sharing cheques for union workers of as much as US$9,000. GM's stock added 5.4% to close at US$35.83. Analysts were projecting stronger results after the company signalled at a conference last month that results from Mary Barra's first full year as chief executive would be better than the company had anticipated. Low interest rates and gasoline prices that have tumbled more than 40% since April continue to push auto sales up, and GM's profits have followed. "A strong fourth quarter helped us deliver very good core operating results in 2014 despite significant challenges we and the industry faced," Ms. Barra said in the statement. GM will consider returning more cash to shareholders later this year, on top of a planned 20% dividend increase announced Wednesday, the company's chief financial officer, Chuck Stevens, told Reuters. The company said sales were US$39.6 billion, compared with the average analyst forecast of US$40.3 billion and US$40.5 billion in the fourth quarter of last year. Sales of GM's Chevrolet Silverado rose 10% last year, gaining ground on Ford Motor Co.'s F-Series truck line, which lost production as the Dearborn, Michigan-based automaker retooled factories to convert to an aluminum-bodied version of its F-150. GM's pickup was redesigned a couple of years ago and was named North American Truck of the Year at the 2014 Detroit auto show. GM's results were announced just hours after Toyota Motor Corp., the world's largest automaker, beat analyst estimates for quarterly profits and raised its fiscal-year forecast to record 2.13 trillion yen in part because the yen has weakened against the dollar. Expenses for its ignitionswitch recall should be taken care of after booking US$2.8 billion in charges for 2014, chief financial officer Chuck Stevens said last month in a presentation to journalists. GM recalled 2.59 million vehicles after the ignition switch failed. So far, 51 deaths have been linked to the failed switch. © 2015 Postmedia Network Inc. All rights reserved. Illustration: • Chris Ratcliffe, Bloomberg News / Mary Barra, CEO of General Motors Co., cited a strong fourth quarter for the surge. Edition: National Story Type: News Length: 375 words Return to top Recalls put dent in GM's 2014 earnings Waterloo Region Record Thu Feb 5 2015 Page: C7 Section: BUSINESS Byline: Tom Krisher Source: The Associated Press If it weren't for the recalls, 2014 would have been a stellar year for General Motors. Even with $2.8 billion (all figures US) in pre-tax costs to fix more than 30 million recalled vehicles and $400 million set aside for death and injury claims, GM still managed to turn a $2.8-billion profit. That's because otherwise, most of the stars lined up well for the Detroit automaker. Gas prices dropped. The economy in the United States gained steam. Cheap credit was abundant. Combined, they sent buyers to GM's newly redesigned and lucrative pickup trucks and large SUVs in North America, the company's most profitable market. At the same time, chief competitor Ford's truck plants were down much of the year while it switched to a new pickup with a risky aluminum body. Sales in China grew faster than the market. Worldwide sales were up two per cent to 9.9 million vehicles, a record. Things were so good, GM decided to increase its dividend next quarter by 20 per cent, to 36 cents, pending board approval. Yes, there was trouble in Europe, Russia and Latin America, but by and large, GM had a good year. The company's full-year earnings amounted to $1.65 per share. Net income was down 26 per cent from $3.8 billion in 2013. But excluding one-time items, GM made $3.05, beating Wall Street's expectation of $2.64, according to FactSet. Revenue rose slightly to $155.9 billion, beating the analysts' prediction of $150.6 billion. "We're really going to carry the positive momentum into 2015," chief financial officer Chuck Stevens said. "We expect both aggregate earnings and profit margins to improve in all of our automotive regions." Stevens said the company's core earnings performance for the year was strong when recall costs are excluded. The company earned $6.5 billion before interest and taxes last year, and that would have been more than $9 billion without the recalls, he said. Recalls, he said, cost the company about $1.10 per share. In North America, GM's most profitable region, the company made $6.6 billion before taxes, 11 per cent below 2013. © 2015 Torstar Corporation Edition: First Length: 324 words Return to top General Motors beats 4Q earnings expectations, misses revenue forecasts; GM tops 4Q profit forecasts Canadian Press Wed Feb 4 2015 Section: Business DETROIT - General Motors Co. (GM) on Wednesday reported fourth-quarter profit of $1.99 billion. The Detroit-based company said it had net income of 66 cents per share. Earnings, adjusted for non-recurring costs, were $1.19 per share. The results surpassed Wall Street expectations. The average estimate of analysts surveyed by Zacks Investment Research was for earnings of 85 cents per share. The automaker posted revenue of $39.62 billion in the period, which did not meet Street forecasts. Analysts expected $40.01 billion, according to Zacks. GM shares have fallen nearly 3 per cent since the beginning of the year, while the Standard &Poor's 500 index has stayed nearly flat. The stock has declined nearly 4 per cent in the last 12 months. _____ This story was generated by Automated Insights (automatedinsights.com») using data from Zacks Investment Research. Access a Zacks stock report on GM at http://www.zacks.com/ap/GM _____ Keywords: General Motors, Earnings Report, Priority Earnings Copyright © 2015 The Canadian Press Length: 148 words Return to top General Motors, Sony, Walt Disney, Gilead Sciences and Staples are big market movers; General Motors and Sony are big market movers Canadian Press Wed Feb 4 2015 Section: Business NEW YORK, N.Y. - Stocks that moved substantially or traded heavily Wednesday on the New York Stock Exchange and the Nasdaq Stock Market: NYSE General Motors Co., up $1.85 to $35.83 The automaker reported better-than-expected fourth-quarter profit despite the high cost of recalled vehicles and claims. The Walt Disney Co., up $7.18 to $101.28 The entertainment company reported better-than-expected fourth-quarter profit on a mix of revenue from films, parks and products. Sony Corp., up $2.55 to $25.94 The entertainment and electronics company trimmed its forecast of losses and sees no significant harm from recent cyberattacks. AbbVie Inc., down $4.74 to $56.91 The drug developer's arthritis treatment Humira could face competition from a biosimilar version being made by Amgen Inc. Nasdaq Gilead Sciences Inc., down $8.75 to $98.43 The biotechnology company reported better-than-expected profit but will offer discounts on its revenue-driving hepatitis C drugs. Staples Inc., down $2.28 to $16.73 The office supplies company said it plans to buy rival Office Depot Inc. for $6.3 billion in a cash-and-stock deal. Myriad Genetics Inc., down $3.50 to $34.62 The diagnostics company cut its fiscal year forecast because of reimbursement delays and said CEO Peter Meldrum is retiring. Cognizant Technology Solutions Corp., up $2.78 to $57.88 The information technology and consulting company reported better-than-expected fourth-quarter profit and revenue. Copyright © 2015 The Canadian Press Length: 199 words Return to top Ontario gains $1.1B for selling last GM stake; Go to public works National Post Thu Feb 5 2015 Page: A4 Section: Canada Dateline: TORONTO Source: The Canadian Press Ontario has sold its remaining interest in General Motors Co. and plans to invest the proceeds in infrastructure. The Ontario government says it will gain approximately $1.1 billion from the sale, adding that the money will be invested to help build a "new generation" of public infrastructure. Both Ottawa and the Ontario government acquired GM shares in 2009 after providing about $10.6 billion in aid to the automaker. Ontario made $4.8 billion in financial assistance available to GM and Chrysler, in partnership with the federal government. The provincial government says the gain on the sale of the shares exceeds the $900-million target included in the 2014 budget for 2014-15 net revenue gains from asset optimization. Finance Minister Charles Sousa says Wednesday's sale marks an important step in unlocking the value of the province's assets to grow the economy and invest in public infrastructure. "The Ontario government is proud to have been able to play an important role in protecting thousands of jobs across the province through its support of the auto sector in 2009," Mr. Sousa said in a news release. Ontario said last April that it planned to sell its GM stake over the next year or so. If it weren't for the recalls, 2014 would have been a stellar year for GM. Even with $2.8 billion in pretax costs to fix more than 42 million recalled vehicles worldwide and $400 million set aside for death and injury claims, GM still managed to turn a $2.8-billion profit. It plans to raise the quarterly dividend. GM shares rose 5.4% Wednesday. The gain could be the largest one-day increase since July 3, 2012, when the stock closed up 5.6%. © 2015 Postmedia Network Inc. All rights reserved. Edition: All_but_Toronto Story Type: News Length: 264 words Return to top Ontario sells remainder of GM shares acquired through bailout deal The Globe and Mail Thu Feb 5 2015 Page: A4 Section: News Byline: ADRIAN MORROW, GREG KEENAN Dateline: TORONTO The Ontario government has unloaded the last of its shares in General Motors as it looks for cash to build public transit and highways. The sale, announced hours after the markets closed Wednesday, is expected to reap $1.1-billion. Finance Minister Charles Sousa's office said all of that money will be placed in the Trillium Trust, a fund dedicated to paying for the $29-billion worth of transportation infrastructure the province plans to build in the next decade. Mr. Sousa's office did not provide any further information on the transaction Wednesday, such as the number of shares sold or the sale price. A report from the fall of 2013 said the province had ownership at that time of a little fewer than 37 million shares of GM common stock and 5.4 million shares of GM series A preferred stock. The government received the stock as part of a bailout deal with GM in 2009, at the height of the recession. The province contributed $3.62-billion to the deal, along with $7.23-billion from the federal government, in exchange for stock worth about 12 per cent of the auto maker's shares. Ontario has previously sold some stock, and received repayments from GM. But the sale is likely to raise some hackles. Unifor, the union that represents workers at GM factories in Oshawa, Ingersoll and St. Catharines, Ont., has urged the federal and Ontario governments to hang on to their stake. Unifor president Jerry Dias believes the governments should use their ownership position as a lever to encourage GM to invest in its Oshawa operations. There are no new or redesigned vehicles allocated to the two Oshawa assembly plants, which means they are in danger of closing later this decade. GM Canada president Stephen Carlisle said last week that a decision on new vehicles would be made late next year. GM's move will depend heavily on the results of negotiations with Unifor on a new contract, he said. Last fall, the federal AuditorGeneral pointed out that, if the governments sold their stake at current prices, they would likely never recover about $4-billion of the bailout dollars. Advocates of the bailout, however, point to the economic benefit of having high-productivity auto jobs stay in the province as well as the tax revenue the corporations have paid the government. The federal government still has 73.4 million shares of company stock. Based on GM's closing share price of $35.83 (U.S.) on the New York Stock Exchange on Wednesday, Ottawa's remaining shares are worth $2.63billion. © 2015 The Globe and Mail Inc. All Rights Reserved. Edition: Ontario Length: 409 words Return to top Ontario sells its GM shares; Deal reaps $1.1 billion for province Windsor Star Thu Feb 5 2015 Page: B5 Section: Business Dateline: TORONTO Source: The Canadian Press Ontario has sold its remaining interest in General Motors Company and plans to invest the proceeds in infrastructure. The Ontario government says it will gain approximately $1.1 billion from the sale, adding that the funds will be invested to help build a "new generation" of public infrastructure. Both Ottawa and the Ontario government acquired GM shares in 2009 after providing about $10.6 billion in aid to the automaker. Ontario made $4.8 billion in financial assistance available to GM and Chrysler, in partnership with the federal government. The provincial government says the gain on the sale of the shares exceeds the $900 million target included in Ontario's 2014 budget for 2014-15 net revenue gains from asset optimization. Finance Minister Charles Sousa says Wednesday's sale marks an important step in unlocking the value of the province's assets to grow the economy and invest in public infrastructure. "The Ontario government is proud to have been able to play an important role in protecting thousands of jobs across the province through its support of the auto sector in 2009," Sousa said in a news release. © 2015 Postmedia Network Inc. All rights reserved. Edition: Early Story Type: News Length: 174 words Return to top General Motors shares unloaded by Ontario government CBC.CA News Wed Feb 4 2015, 7:15pm ET Section: Toronto Byline: CBC News Ontario has sold all of its remaining shares in General Motors, a move that is expected to net the province an estimated $1.1 billion. The province issued a news release after the close of markets on Wednesday about the transaction.It said the gain on the shares it sold was more than the $900-million target it had previously set. The release said the proceeds from the sale will be directed to the Trillium Trust, which in turn will invest the money "to help build a new generation of public infrastructure that will improve the province's long-term competitiveness and the well-being of all Ontarians." The provincial government had obtained the shares after making an investment in GM during the last recession. At that time, the province had partnered with the federal government to make billions of dollars in financial assistance available to both GM and Chrysler. In a statement on Wednesday, Finance Minister Charles Sousa said the provincial government "is proud to have been able to play an important role in protecting thousands of jobs across the province through its support of the auto sector in 2009." With files from The Canadian Press © 2015 CBC. All Rights Reserved. Length: 190 words Return to top In Brief Hamilton Spectator Thu Feb 5 2015 Page: A15 Section: Business Byline: News services AUTOMOTIVE Ontario sells remaining GM shares for $1.1 billion TORONTO Ontario has sold its remaining interest in General Motors Company and plans to invest the proceeds in infrastructure. The Ontario government says it will gain approximately $1.1 billion from the sale, adding that the funds will be invested to help build a "new generation" of public infrastructure.The provincial government says the gain on the sale of the shares exceeds the $900 million target included in the 2014 budget for 2014-15 net revenue gains from asset optimization. Both Ottawa and the Ontario government acquired GM shares in 2009 after providing about $10.6 billion in aid to the automaker. FORESTRY Rainforest reaches deal with Resolute MONTREAL Resolute Forest Products has reached a truce with the Rainforest Alliance, a third-party group that conducts audits of compliance with Forest Stewardship Council (FSC) standards. The Montreal-based company settled a lawsuit it filed in May that sought $400,000 in damages over audits of its forests in Northern Ontario. Resolute spokesperson Seth Kursman declined to say if any money will be paid as part of the deal, but said the company is pleased that a new independent audit will be completed. The company claimed last year's audits that resulted in the suspension of FSC certificates in two forests were biased interpretations that contained errors and omissions. INSURANCE Intact Financial hiking dividend by 10 per cent TORONTO Intact Financial Corp. raised its quarterly dividend by 10 per cent Wednesday following a big jump in profit last year. The quarterly dividend will increase to 53 cents per share beginning with the March 31 payment, up from 48 cents. The Toronto-based insurer earned $205 million or $1.52 per share in the fourth quarter, up from $107 million or 77 cents per share a year earlier. Intact operates under various banners including Intact, Belairdirect, Grey Power and BrokerLink. CLOTHING Gildan Activewear to acquire Comfort Colors MONTREAL Gildan Activewear is paying $100 million US in cash to acquire the leading supplier of garmentdyed T-shirts and sweatshirts for the North American printwear market. The Montreal-based company said the purchase of Vermont's Comfort Colors, which has $95 million US of annual sales, is expected to close this quarter. Gildan also said Wednesday that it lost $41.2 million US in the fourth quarter, missing analyst expectations. Sales decreased 13.5 per cent to $390.6 million US as lower revenues from T-shirts sold to printers was partially offset by 20 per cent growth in Gildan-branded products. ELECTRONICS Sony Pictures hack won't affect bottom line TOKYO Sony Corp. trimmed its forecast of losses on Wednesday and said it doesn't expect the hack at Sony Pictures to hurt its finances overall. The entertainment and electronics giant had delayed the announcement of its earnings for the October-December quarter, citing internal difficulties arising from the hack at Sony Pictures Entertainment. But it issued new earnings forecasts for the year ending in March and said it was benefiting from strong sales of gaming consoles, other devices and network services. © 2015 Torstar Corporation Edition: First Length: 476 words Return to top GM adds less expensive models to U.S. lineup; Canada next? Car News | Auto123 auto123.com Thu Feb 5 2015 View original item at www.auto123.com...» Return to top GM adds cheaper base models ; is Canada next? msn.com Thu Feb 5 2015 View original item at www.msn.com...» Return to top The impact of auto industry's decline; Job losses particularly devastating for young families, McMaster study finds Hamilton Spectator Thu Feb 5 2015 Page: A15 Section: Business Byline: Steve Arnold The Hamilton Spectator A new study finds job losses in Canada's struggling auto industry are costing the federal and provincial governments almost $7 billion a year in lost taxes. The study, by McMaster University's Automotive Policy Research Centre, says the 53,000 industry jobs that have disappeared since 2001 have hit auto-dependent communities such as Oshawa, Windsor, St. Catharines, Kitchener and London especially hard. The effects also extend to Hamilton. Ford of Canada's Oakville Assembly Complex and the GM plant in St. Catharines employ many local residents. In addition, major companies such as Stackpole, Tiercon Industries, Orlick Industries and Taylor Steel are among 29 local suppliers to the industry. That's before adding in the fact U.S. Steel and ArcelorMittal Dofasco send about a third of their annual production to auto customers. Brendan Sweeney, project manager for the auto policy centre, said Hamilton's exposure to the auto industry isn't well known. "We're assembling a database of parts suppliers that has 700 companies in it right now and people would be surprised to learn how many of them are in Hamilton," he said. "It includes everything from mom-and-pop metal stamping shops to electronics makers." The study shows the impact of job losses in assembly and parts plants can be devastating for families and the communities in which they live. Windsor, the report notes, lost almost 12,000 auto jobs between 2001 and 2013. For young families between ages 25 and 35 that meant a drop of $18,000 in average income over the period. Workers under age 25 saw their incomes fall by a third in the same period. In another measure, the report shows median family income in Windsor fell to roughly $81,550 in 2012 from more than $91,500 in 2000. Those figures reflect research in 2012 by McMaster labour studies professor Sam Vrankulj who found displaced factory workers faced wage cuts of up to $10 an hour, if they're lucky enough to find a new job at all. "That is one of the most striking findings of the study," Sweeney said. "It is certainly a reality that is happening right now." Charlotte Yates, lead investigator for the APRC, said the research points to a serious problem that demands solutions. "It's clear that automotive manufacturing plays a significant role in determining the quality of life for families in this province," she said. "The APRC brings together industry, academia and government to help us examine how policy might ensure a competitive and sustainable industry. We are committed to investigating the impact of automotive policy-making in Canada, and this report helps illustrate that the families who depend on the industry for employment suffer real economic loss if these issues are ignored, particularly young families." Proposing solutions will be the subject of coming reports in the series to deal with, among others, the impact of free trade agreements and the thorny problem of using public money to entice private investment. The last time Ontario made such an investment was to provide $142 million to Ford of Canada toward a $700million retooling of the Oakville Assembly Complex. The payoff for that investment was 1,000 new jobs announced last October. The full report, Local and Regional Labour Market Trends in the Canadian Automotive Manufacturing Industry, can be downloaded from the APRC website. APRC faculty member Dan Irvine was the lead author of the report. [email protected] 905-526-3496 @arnoldatTheSpec © 2015 Torstar Corporation Illustration: • Ancaster's Stackpole, a company that manufactures powertrain parts, is one of many local companies that supply the auto industry in Ontario. Hamilton Spectator file photo Edition: First Length: 539 words Return to top Brother, can you spare a Cadillac? Vancouver Sun Thu Feb 5 2015 Page: D4 Section: Business Byline: Joe Chidley Column: Animal Spirits Source: Financial Post James Robertson's Honda Accord quit on him 10 years ago, and since then he's been unable to afford a car. He lives in Detroit, but works in Rochester Hills, Mich., about 23 miles away. How does he get there? Well, the bus takes him part of the way, but he has to walk the rest of the commute to get to his US$10-an-hour job. He schleps a total of 21 miles a day. Every workday. And has for 10 years. But not for much longer. Mr. Robertson, 56, became something of a media star earlier this week when a friend launched an online fundraising campaign to help him buy a car to get to work. The campaign's target was US$5,000. By the middle of this week, Americans had donated more than US$250,000. That should save Mr. Robertson a lot of money in shoes. Besides being a testament to their philanthropic urges, the story of Mr. Robertson's benefactors is also proof of Americans' strongly held belief that owning an automobile is a necessity of life and just how willing they are to pony up for it. The question is: are they willing to spend on other stuff, too? Amid plummeting oil prices and so-so corporate earnings south of the border, U.S. auto sales have been a real bright spot. This week, General Motors Co., Ford Motor Co., Fiat Chrysler Automobiles NV and Toyota Motor Corp. all reported strong growth for January, and industry projections are for a 15% increase in U.S. sales over January 2014. For investors, of course, this matters - and not just for those who own stock in GM or Ford, or maybe Canadian auto-parts manufacturers such as Magna International Inc. or Linamar Corp., which have all been on an upward trend in recent weeks. Beyond the obvious, strong auto sales matter for investors because they may be a bellwether of the spending intentions of American consumers, who account for more than two-thirds of the GDP of Canada's largest trading partner. A resurgent American consumer, even in this age of global trade, could be very good news for Canadians, especially those who work for or invest in companies that earn revenue in the U.S., or supply the raw materials for American homes, cars and luxury goods. After several post-recession years of being unemployed, underpaid and underwater on their mortgages, the American consumer is suddenly back in the saddle - depending on how you look at it, of course. There are indeed lots of positive signs. Job growth has been strong: the unemployment rate fell 0.2 percentage points to 5.6% in December, and posted a 1.1 percentage point decline through 2014. Consumers are feeling pretty darned good about the economy, too. The Conference Board's Consumer Confidence Index in January reached its highest level since August 2007 (oh, those were the days), and the number expecting business conditions to improve in the next six months rose as well. Americans might be on pace to buy more automobiles than they have in a decade, but housing prices are also on the rise, albeit modestly, and builders began construction on more than a million new homes and apartments in 2014, the most in nine years, according to real estate data provider CoreLogic Inc. Meanwhile, relief at the gas pumps is putting more money in Americans' pockets - and people who have money usually spend it, right? Maybe all this augurs a new age of American consumerism. But there's a bit of a spanner in the works, and that's wage growth. The U.S. economy has been creating jobs at a decent pace, but average hourly earnings actually fell in December, and only rose by an anemic 1.65%, or about US40¢ an hour, through 2014. Here's a scenario, if you will, for what's going on in a typical American consumer's head. She's got a job, and that's good. Her home is worth more than it was. Credit conditions have eased, and interest rates remain at historic lows. Our theoretical consumer, with a stronger balance sheet and cheap money, can get a loan and buy that car to get to work (and maybe even pledge a few bucks to the well-travelled Mr. Robertson). But she hasn't yet felt the impact of that job and that strong economy where it matters most: in her pocketbook. As a result, she hasn't been spending. The U.S. Commerce Department earlier this week released numbers showing that consumer spending dropped in December, and it was the biggest monthly decline since 2009. Yes, some of that had to do with our model consumer paying less for gasoline, but there's no indication she was spending it elsewhere. To do more of that, she needs a raise. The U.S. Bureau of Labor Statistics releases employment data for January, including wage growth, on Feb. 6. Watch it closely. © 2015 Postmedia Network Inc. All rights reserved. Edition: Final Story Type: Column Length: 794 words Return to top General Motors Product News Equinox tries to be everything to everyone The Owen Sound Sun Times Thu Feb 5 2015 Page: C1 Section: Autonet Byline: GLEN WOODCOCK , [email protected], AUTONET Column: TEST DRIVE: 2015 Chevrolet Equinox general motors noted on Thu Feb 5 2015 5:56 am ET Also in Northumberland Today.com, The Belleville Intelligence, Ottawa Sun, The Kingston Whig-Standard, The Welland Tribune, Brockville Recorder and Times. I don't quite know what to make of the 2015 Chevrolet Equinox -- at least in the LTZ AWD trim of this week's test car. Equinox is a right-sized crossover, about halfway between a compact and a midsize, with good people and cargo space. With a wheelbase of 2,858 mm and an overall length of 4,770 mm it's bigger overall than the Ford Escape or Flex and a little smaller than Ford Explorer. But as tested, our Equinox is trying to be too many things, trying to please too many people. For one thing, its as-tested price of $41,030 is a long way from the base MSRP of $28,155 for the front-wheel drive version. That's because it's loaded with upscale goodies such as two-tone leather upholstery, forward collision alert, and Chevrolet MyLink radio with navigation. But if it wants to appeal to more affluent buyers, why is it equipped with the 182 horsepower four-cylinder engine rather than the optional 301 hp V6? In this size vehicle, weighing 1,871 kg, the four-cylinder engine has to work too hard to be economical and it doesn't have the bigger engine's acceleration or trailering ability. The ride, however, is quite good and handling is light and predictable aided by electric rack and pinion steering and four-wheel independent suspension. Allwheel drive is standard on LTZ and, combined with StabiliTrak, traction control and anti-lock disc brakes, provides a feeling of security even on icy or snow-covered roads. The spacious interior has the same clean, straight lines as the exterior and looks especially good in our tester's Jet Black and Brownstone leather upholstery. At this level both driver and front passenger seats are heated and powered, but I find them to be a little flat and unyielding. Controls are user-friendly and laid out well, with knobs for the audio and HVAC systems that make them easy to operate even while wearing gloves in winter. A nice touch is the hood that extends over the 7-inch display screen that helps make it more readable on a sunny day. An optional extra on our test car is a $1,750 DVD-based rear entertainment system with wireless headphones and screens tucked into the front seatbacks. Once, when our girls were young, this may have appealed to me. Maybe it will again when grandson Max is a little bigger. Right now, though, for that kind of money I'd rather have a heated steering wheel and a sunroof, but neither of those items is available, as part of a package or as stand-alone options. Because they didn't try to cram in a third row of seats, cargo space is generous, even when the rear seats are upright. When those seats are lowered, cargo space expands from 892 litres to 1,804 litres. When equipped with the latest version of OnStar, Equinox also offers a Wi-Fi hotspot and our LTZ comes with Bluetooth wireless audio streaming. Features such as heated outside mirrors, a rear-view camera, automatic climate control, and rear park assist are now expected at this price point but the power lift-gate with programmable opening height is a nice, and unexpected, touch. Equinox is made in Ingersoll, Ont., on the same line that produces the GMC Terrain, and reliability is above average. --FACT FILE: 2015 Chevrolet Equinox Trim level: LTZ AWD Price as tested (before taxes): $41,030 Options on test vehicle: Rear DVD entertainment system with wireless headphones ($1,750), MyLink with navigation ($795), White Diamond tricoat ($695), trailer towing package ($420) Configuration: front engine/ allwheel drive Engine/transmission: 2.4L inline-four/six-speed automatic Power/torque: 182 hp/172 lb.-ft. Fuel (capacity): regular gas (71L) Fuel economy ratings (L/100 km): 11.5 city, 8.2 highway Observed fuel economy (L/100 km): 10.8 over 460 km Warranties: 3 years/60,000 km comprehensive; 5 years/160,000 km powertrain Competitors: Ford Edge, GMC Terrain, Honda Pilot, Hyundai Santa Fe, Jeep Cherokee, Kia Sorento, Mazda CX-9, Nissan Pathfinder, Toyota Highlander Strengths: secure handling, roomy rear seat, cargo space Weaknesses: hard and flat front seats, no available sunroof Report card (out of 10) Fuel economy: 5 -Nothing to brag about. Equipment level: 8 -Lacks a few items such as a heated steering wheel. Price: 6 -Expensive for a fourbanger. Styling: 7 -This Chevy plays it safe. Comfort (front): 7 -Hard, flat seats; easy-to-use controls. Comfort (rear): 8 -Excellent use of space. Storage: 9 -Big cargo bay. Handling: 8 -Solid and predictable. Performance: 6 -A tad underpowered, but a V6 is optional. Overall: 7 -A good fit for active families. © 2015 Osprey Media Group Inc. All rights reserved. Illustration: • AUTONET Edition: Final Length: 712 words Return to top GMC Canyon rolls out fresh new look Prince George Citizen Thu Feb 5 2015 Page: A35 Section: Drivers Seat Byline: Justin Pritchard Source: The Canadian Press Does being the newest truck on the block make the just re-launched GMC Canyon the best? Maybe so, maybe no. But, being a new model does enable the promise of great fuel efficiency with the most modern power-train lineup in the segment, as well as hazard-detection safety systems yet unseen in the competition. Plus, there's OnStar, and connected-car technology with smartphone control, meaning you can start your Canyon in the Park N Fly the second your plane lands, or look up a cool attraction on your phone and send it to the truck's navigation system. Slick. All Canyon engines use the latest fuel saving technology, like direct injection and six-speed transmissions, to go further on every tank. The tester got the noteworthy V6: a 3.6 litre unit with a big-for-itssize 305 horsepower. A 2.5 litre four-cylinder with 200 horsepower is standard. Like selection? Pick two-or fourwheel drive, two or four doors, four-or six-cylinder power, several bed and body combinations and a bunch of trim levels to fine-tune beyond that. Helping you with truck-guy things are features like the torsion-rod equipped tailgate, which opens without slamming, making nearby folks think your angry, or accidentally whacking your offspring in the noggin. The rear bumper has integrated corner steps, easing the climb when you've got truck-guy things to do in the back. And, if your truck-guy things involve towing, Canyon can haul up to 7,000 pounds. Ahead of the box, the second seating row offered up adequate room for two adults, and some extra floor space and shallow storage bins beneath with the seat bottoms flipped up. The area beneath the seat bottoms is shaped awkwardly, seems to waste a fair bit of space, and made your writer wonder why it's not just flat, a la Honda Ridgeline, which would seem handier. Up front, the cabin is trimmed nicely, offers a bit of stitching and displays some upscale materials for a touch of sophistication. The seats look fantastic with a faux carbon-fibre weave and All Terrain embossment. There's a touch of high-tech flair too, thanks to the full-colour touch-screen display in the centre console, the premium-looking climate controls with integrated digital readouts, and the smaller full-colour driver computer display in the instrument cluster. There's also a boatload of storage on board for your things of all shapes and sizes: gloves, wallets, pens, change, beverages, sunglasses and pocket-sized technology of all sorts. In the tester, numerous charge ports, USB or otherwise, were in immediate reach, and, in what's probably the best feature ever seen in a pickup-truck ever, there's a card holder just behind left side of the steering for your Timmies coffee card so you never lose it. You'll love this feature, and you'll love the remote start that pre-heats the seats for you when it's cold, too. The tester's All Terrain package sees a suspension calibration that's tough and rugged and feels like it's giving potholes a punch to the jaw: drive over even really rough roads, and it feels like the road is getting the lousy end of the deal. On smooth highways, the suspension is relaxed, working with the long wheelbase and commanding driving position for a comfortable confidence. If you're checking out a model with the All Terrain package, be sure to testdrive it on the roughest roads you can find, noting whether you find the ride to feel tough and solid, not jarring or uncomfortable. Noise levels seem about average for the segment. Your writer hoped this next-generation Canyon would have the same eerily-quiet ride I noted of its nextgeneration big-brother, the Sierra, but that's not the case. Further, it's a good thing the 3.6 litre V6 sounds decent, since if you're on the throttle, its raspy warble is always there. With the locking rear differential included, drivers patient with their right foot and not afraid of a touch of slippage here and there will rarely have to use the four-wheel drive, even in deep snow. With hill start assist, which prevents roll-back on icy hills for easier uphill starts with minimal fuss, I rarely had issues with traction other than excessive stopping distances on snow, since the tester wasn't wearing winter tires. When more traction is required for getting moving, the automatic four-wheel drive setting sends power to all four wheels in milliseconds when needed. Gripes? Aside from the oddlyshaped rear under-seat floor area, and the higher-than-expected noise levels, I was left with just one: the wish for a display in the fancy driver computer to check which four-wheel drive mode is engaged, if at all. The mode is indicated via the selector dial's position, though it's blocked by the steering wheel. Ultimately, this truck has a power, feature content and technology advantage over the competition, along with nice touches and a fresh look throughout. The new Canyon should move from dealer lots with ease. Check one out, along with proven mid-size truck performers from Toyota, Nissan and Honda. Illustration: • Canadian Press Photos / The new GMC Canyon looks good on the outside and the inside. Plus, the truck is loaded with technology and has ample storage space. • Canadian Press Photos / (See hardcopy for photo) Edition: Final Story Type: News Length: 816 words Return to top 2015 Buick Encore - The Car Guide guideautoweb.com Thu Feb 5 2015 View original item at www.guideautoweb.com...» Return to top 2015 Chevrolet Sonic | Autobytel.com autobytel.com Thu Feb 5 2015 View original item at www.autobytel.com...» Return to top Drawing Board Prince George Citizen Thu Feb 5 2015 Page: A33 Section: Drivers Seat Column: Auto Almanac Source: The Citizen 2016 Buick Cascada: It has been some time since Buick had a convertible in the lineup. However thanks to General Motors' German Opel division, it will soon have one. The Cascada's cloth soft top lowers and raises in 17 seconds at vehicle speeds up to 50 km/h. Under the hood resides a turbocharged 1.6-litre four-cylinder producing 200 horsepower and 221 poundfeet of torque. Illustration: • / (See hardcopy for photo) Edition: Final Story Type: Brief Length: 59 words Return to top

© Copyright 2026