Container Market – Weekly Report

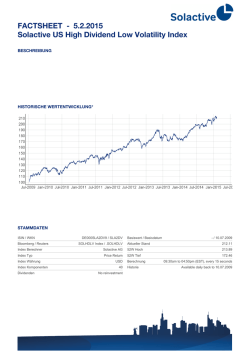

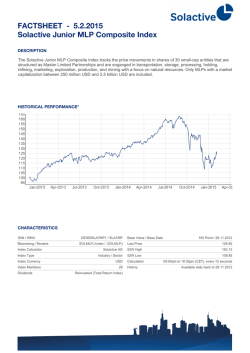

January 23, 2015 – January 30, 2015 Container Market – Weekly Report Chartering Market Fixtures Reported This Week The chartering market remained very active this week and the time charter rates in general firmed a bit more. The box rates are likewise seeing an increasing trend, especially in the US related trades due to the USWC port congestion and this is at the moment injection some general optimism in the market. Santa Barbara - Flag GEU - BLT 2012 - 92,915 DWT 7,800 TEU - 5,450/HOM - 1,365 Plugs - Santa Rita - Cellular - Gearless - 22.7 70-80 Days - Period - Far East / Europe - Yang Ming - USD 27,000.00 /Day In the post-panamax market we reported two fixtures. The 7800 TEU 'SANTA BARBARA' was taken by Yang Ming as relet from Hamburg Sued for 70-80 days at USD 27,000 and the 6900 TEU 'WASHINGTON' was extended by Maersk Line for 35-70 days at a level around USD 21,000. There are still a few uncovered very prompt requirements for short period, whereas we also are starting to see inquiries for period business with delivery in April/May. So we still expect that the time-charter rates - for both short and long term employment - will continue to move slowly upwards. The panamax segment remains extremely active caused by the demand for extra loaders to the US due to the USWC port congestion. Consequently we are seeing very firm rates for prompt delivery and short periods at levels in the USD 12,000's - subject to exact specifications of the vessel – and would not be surprised if short-term rates would go even higher. For period business, however, the rates remain lower as well as in Atlantic waters, which are still lacking behind what we see in Asia. Washington - Flag HKG - BLT 2009 - 85,760 DWT 6,969 TEU - 4,930/HOM - 600 Plugs - Hyundai 6500 - Cellular - Gearless 25.7/220.0 35-70 Days - Period - Far East / WCSA - Maersk Line - USD 21,000.00 /Day Box Queen - Flag LIB - BLT 2006 - 58,281 DWT 4,546 TEU - 3,150/HOM - 700 Plugs - Gdynia 4500 - Cellular - Gearless 24.8/152.0 20-30 Days - Period - Intra Cont - Evergreen - USD 12,100.00 /Day Barbados - Flag LIB - BLT 2010 - 52,325 DWT 4,330 TEU - 2,760/HOM - 326 Plugs - Cellular - Gearless - 24.5/133.6 3-4 Months - Period - Intra Asia - Maersk Line - USD 12,000.00 /Day Cap Henri - Flag LIB - BLT 2009 - 51,727 DWT 4,255 TEU - 3,000/HOM - 560 Plugs - Hyundai 4250 - Cellular - Gearless 24.1/130 70-80 Days - Period - Far East / WCSA - CCNI - USD 11,500.00 /Day In the 3,000-4,000 TEU segment we also registered quite some activity this week. In Asia we saw the 3,500 TEU 'HS BACH' being fixed to MSC for 6 months at a rate of USD 10,650, whereas the similar sized 'NORTHERN DIVERSITY' was taken by GSL also for 6 months at USD 10,750. Just like in the segment above, the Atlantic is lacking behind Asia and the 'HS BERLIOZ' (sister vessel to 'HS BACH') had to settle for USD 7,950 for a 4-7 months extension with CMA CGM. Overall we do, however, expect to see slightly increasing rates in the coming weeks within this segment. Northern Diversity - Flag LIB - BLT 1997 - 45,131 DWT 3,607 TEU - 2,575/HOM - 300 Plugs - Hyundai 3500III - Cellular - Gearless 22.4/121.0 6 Months - Period - Far East / West Africa - Gold Star Line - USD 10,750.00 /Day The segment between 2,000 – 3,000 TEU had a decent week in terms of activity although there hasn't been the gains we may have expected due to a tightening of prompt ships over the last week or so. The geared 2,500 types were still fixing in the region of USD 7,000 whilst the gearless 2,800 TEU types were still fetching USD 7,500-8,000 depending on the specific type and period. It does seem that some of the momentum in this segment was lost this week, although with supply of tonnage still on the slim side this could change again in the weeks ahead. The 'WEHR WARNOW' and 'BUSAN TRADER' were extended/fixed by CMA CGM for short periods at rates around USD 7,000 for short period. The Hyundai Mipo type 'LILAC' fixed with the same Charterers for a period of 8 to 11 months at USD 8,000. Hs Bach - Flag LIB - BLT 2007 - 46,318 DWT 3,586 TEU - 2,501/HOM - 625 Plugs - STX 3500 - Cellular - Gearless - 23.4/130 5-7 Months - Period - Intra Asia - MSC - USD 10,650.00 /Day Tonnage between 1,000 – 2,000 TEU had a steady week although unremarkable. Asia was particularly quiet with only a few reported fixtures reported this week. Gold Star Line extended the Hanjin 1600 type 'ARCA' for a flexible period up to 12 months at USD 8,800 which is a good improvement on last done. The rates obtainable in the Caribbean are still a lot healthier than the rest of the world, with minimum premium of USD 1,000 on offer throughout the segment. 1,100 TEU types in that region are fixing in the low USD 7,000's whilst we have seen similar sized tonnage fixing USD 6,000 in the Med and in Asia. Below 1,000 TEU we registered next to no activity and this is unlikely to improve in the coming weeks as we see many vessels available on a prompt basis and very little demand. Hs Berlioz - Flag LIB - BLT 2007 - 46,287 DWT 3,586 TEU - 2,501/HOM - 500 Plugs - STX 3500 - Cellular - Gearless - 23.4/130 4-7 Months - Extension - UKC / West Africa - CMA CGM - USD 7,950.00 /Day Barry - Flag MAI - BLT 2004 - 41,800 DWT 3,091 TEU - 2,481/HOM - 500 Plugs - B178 - Cellular - Geared - 22/105 12 Months - Period - Med - Hamburg Sued - Private Rate Lilac - Flag HKG - BLT 2005 - 39,295 DWT 2,824 TEU - 2,030/HOM - 554 Plugs - Hyundai 2800 - Cellular - Gearless 24.0/95.0 8-11 Months - Period - Intra Asia - CMA CGM - USD 8,000.00 /Day Alianca San Martin - Flag LIB - BLT 2007 - 37,213 DWT 2,785 TEU - 2,187/HOM - 432 Plugs - B178 - Cellular - Geared - 21.5/89.5 3-5 Months - Extension - ECSA / WCSA - Hamburg Sued - USD 8,500.00 /Day Busan Trader - Flag MTA - BLT 2009 - 34,567 DWT 2,664 TEU - 1,856/HOM - 400 Plugs - Cellular - Geared - 23 20-30 Days - Extension - Intra Asia - CMA CGM - USD 7,050.00 /Day Continued on page 3 Maersk Broker Time Charter Rate Index, Week 5 Average Container T/C Rates 1,800 Maersk Broker Container Index 1,600 Size 2014 2015YTD 4 Weeks MA 1,400 1,200 400-649 $4,688 $5,672 $5,672 1,000 650-899 $5,214 $5,442 $5,442 800 900-1,299 $6,915 $7,100 $7,100 600 1,300-1,999 $7,786 $7,844 $7,844 400 2,000-2,999 $7,321 $7,409 $7,409 200 3,000-3,949 $8,180 $8,502 $8,563 0 3,950-5,199 $9,228 $11,676 $11,676 December: 427 January: 424* (*4 weeks Moving Average –The index is calculated on January 30th) Trend (short term) January 23, 2015 – January 30, 2015 Sale & Purchase Newbuilding Volumes were good in both the further trading and demolition markets this week. A total of five transactions were concluded in the further trading market, and five more vessels were sold for scrap. This week, activity in the container newbuilding market was marked by another order for ultra large container vessels. Starting with the smaller sizes, the 1997 built 519 TEU ‘CARIBBEAN JADE’ was sold for an undisclosed price. Bartels Reederei disposed of their 2000 built Siestas 156 type ‘JESSICA B’ and the 2004 built 657 TEU ‘KAPPELN’ fetched USD 2.1 mill when sold from Briese Schiffahrts to Lubeca Marine. Finally, Jungerhans Maritime Services sold their 2003 built 698 TEU ‘CHARON J’. Contrary to reports in the popular press today, we can reconfirm that Soundview Maritime paid only USD 10 mill for the 2006 built 3,500 TEU ‘HELENA SCHULTE’, not the reported USD 14 mill, and therefore not representing any sharp rise in this segment. Evergreen’s ultra large container vessel order at Imabari, which was mentioned in Week 1, has been finalised, with the Japanese yard announcing in a press release that they secured the order for 11 x 20,000 TEU vessels. The vessels are going to have dimensions of approximately 400 metres in length and 59 metres in breadth; the same as other 1819,000 TEU vessels ordered by other main liners. Delivery of the vessels is expected to be from 4Q 2017 to 4Q 2018, no price have yet been disclosed while it is expected to be between USD 150-165 mill when converted. In order to accommodate the construction of the vessels, Imabari will build a large dry dock of approximately 600 metres length and 80 metres breadth which is due to be ready late 2016. Interorient Navigation sold their 2005 built 1,118 TEU ‘SEA PIONEER’ to Swire, receiving USD 4.8 mill for her. Also, Lomar bought the 2001 built 2,526 TEU ‘ULF RITSCHER’ for USD 7.9 mill and we understand that a further sister should also have gone their way. January experienced order for a total of 295,736 TEU, consisting of 20 firm vessels, consisting of a combination of feeders and ultra large vessels. In comparison this represents just 74% of the total tonnage ordered in the corresponding month in 2014 (399,070 TEU). In demolition, Icon Capital sold their 1990 and 1991 built 3,352 TEU ‘CHINA STAR’ and ‘DUBAI STAR’ for a price of USD 446 per LDT, equivalent to USD 6.5 mill for each vessel, a healthy price in a volatile market. Hapag Lloyd sold their 1994 built 4,600 TEU ‘PARIS EXPRESS’ for USD 250 per LDT, equivalent to USD 5.1 mill, the price reflects their choice of selling her for green recycling in China Moving into February, we expect container newbuilding activity to remain steady with yards seeing continued interest for large and ultra large container vessels from both major liners and non-operating owners. Estimated Second Hand Prices - 10 yrs old (USD Million) Estimated Newbuilding Prices (USD Million) 1,100 1,700 2,700 4,500 1,800 2,800 4,800 6,600 9,200 14,000 6-7 9-10 12-13 14-15 28-30* 35-37* 51-53* 64-66* 88-90* 115-120* 26-28** 33-35** 49-51** 57-59** 84-86** Price Development Since Last Week Source: Maersk Broker n.a. Price Development Since Last Week * * * * * ** ** ** ** ** * n.a. Source: Maersk Broker *based on Korean built vessel for 2016 delivery **based on Chinese built vessel for 2016 delivery Market Developments and Drivers • US: Business conditions continued to improve among US factories at the start of the year, though the rate of growth continued to cool from the extreme levels seen in the summer months. The slowdown is being led by a weakening inflow of new orders, but the good news is that demand remained strong enough to drive yet another month of robust job creation at factories. • EU: The German government expected its economy to grow by 1.5 percent in 2015, on a par with its performance in 2014. The Spanish economy is growing faster than at any time since the start of the financial crisis seven years ago, amid signs that the country’s recovery is gaining in breadth and feeding through into all parts of the economy. • China: China's factory growth likely inched up from a 1-1/2-year low in January, helped by a slight pick-up in momentum the previous month, but the bounce is not expected to last due to unsteady exports and slowing investment. The government plans to cut its growth target to around 7 percent in 2015, its lowest goal in 11 years, as policymakers try to manage slowing growth, job creation and pursuing reforms intended to make the economy more driven by market forces. • Japan: Japan's retail sales rose for a sixth straight month in December, providing evidence of a gradual recovery in private consumption as the economy climbs out of recession. Meanwhile, Japan's industrial output rose 1.0 percent in December from the previous month. January 23, 2015 – January 30, 2015 Wehr Warnow - Flag MAI - BLT 2002 - 33,691 DWT 2,524 TEU - 1,895/HOM - 481 Plugs - CV 2500 - Cellular - Geared 21.7/74.0 3-7 Months - Extension - Intra Asia - CMA CGM - USD 7,100.00 /Day E.R. Elsfleth - Flag LIB - BLT 2003 - 33,800 DWT 2,496 TEU - 1,772/HOM - 342 Plugs - SSW 25 - Cellular - Geared 22.1/87.9 6 Months - Period - Intra Asia - MSC - USD 7,000.00 /Day Arca - Flag LIB - BLT 1994 - 21,480 DWT 1,641 TEU - 1,199/HOM - 108 Plugs - Hanjin 1600 - Cellular - Geared 19.0/49.0 6-12 Months - Extension - Intra Asia - Gold Star Line - USD 8,800.00 /Day Kreta - Flag MTA - BLT 1998 - 12,238 DWT 1,145 TEU - 714/HOM - 232 Plugs - Orskov Mk VII - Cellular - Geared - 17.5/42.5 6 Months - Period - Med - Tarros - USD 6,200.00 /Day Victoria Strait - Flag ABB - BLT 2002 - 13,760 DWT 1,118 TEU - 700/HOM - 220 Plugs - CS 1100 Plus - Cellular - Geared 19,6/41,0 3-5 Months - Period - Caribs - Evergreen - USD 7,300.00 /Day Vega Saturn - Flag LIB - BLT 2008 - 13,621 DWT 1,118 TEU - 700/HOM - 240 Plugs - CV 1100 Plus - Cellular - Geared 19.5/41 IFO380 3-4 Months - Extension - Caribs - Sea Freight Line - Private Rate Dolphin Strait - Flag ABB - BLT 2003 - 13,858 DWT 1,118 TEU - 712/HOM - 220 Plugs - CV 1100 Plus - Cellular - Geared 19,6/41,0 6-9 Months - Period - Far East - CMA CGM - USD 6,100.00 /Day Reecon Whale - Flag MTA - BLT 2011 - 12,513 DWT 1,022 TEU - 607/HOM - 314 Plugs - Cellular - Geared - 19.0/33.5 7 Months - Period - Med - Italia Marittima - USD 5,950.00 /Day Leonie P - Flag ABB - BLT 1997 - 13,059 DWT 977 TEU - 700/HOM - 234 Plugs - Sietas 155-B - Cellular - Geared 18.5/42.5 2-4 Months - Period - Med - CMA CGM - USD 6,200.00 /Day Spyros - Flag MAI - BLT 2005 - 11,798 DWT 957 TEU - 604/HOM - 240 Plugs - Zhejiang 950 - Cellular - Geared 18.8/37.0 12 Months - Extension - Caribs - King Ocean - Private Rate Taipan - Flag CYP - BLT 2007 - 12,611 DWT 925 TEU - 639/HOM - 200 Plugs - Cellular - Gearless - 18.5/39.5design 14-28 Days - Period - Intra Asia - TS Lines - USD 5,700.00 /Day Vega Alpha - Flag LIB - BLT 2005 - 10,746 DWT 917 TEU - 623/HOM - 200 Plugs - Volharding 900 - Cellular - Gearless - 18/32 6-8 Months - Extension - Intra Asia - APL - USD 8,750.00 /Day The above report is based on our best knowledge of relevant market conditions and all fixtures reported are without guarantee but stated in good faith. This report is based on our knowledge of relevant market conditions. Our estimates are made on the basis of this knowledge, but other circumstances, or new circumstances, as well as general uncertainty could cause the market to develop differently. We take general reservation for misprints. © All rights reserved. No part of this publication may be reproduced in any material form (including photocopying or storing it in any medium by electronic means) without the written permission of the copyright owner. Likewise, any quoting is prohibited without the written permission of the copyright owner.

© Copyright 2026