P21_Layout 1 - Kuwait Times

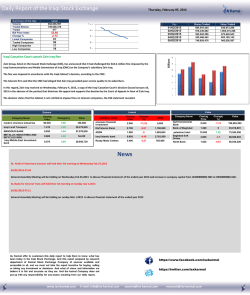

Business Greece on European charm offensive for debt relief Page 23 World’s central banks diverge MONDAY, FEBRUARY 2, 2015 Page 25 KAMCO wins ‘Kuwait Asset Manager of the Year’ Award Page 26 Page 22 Middle East leads G 63 AMG 6x6 sales worldwide ST PETERSBURG: People prepare a sled in the form of the Russian ruble during the Winter Sledge festival in St Petersburg, yesterday. Net capital outflows from Russia more than doubled in 2014 to $151.5 billion, prompted by the Ukraine crisis and the plunging value of the ruble, according to statistics from the central bank. — AFP Zain Group generated $4.3bn revenues for 2014 Group recorded net income of $685 million for full-year KUWAIT: Zain Group, the pioneer of mobile telecommunications across the Middle East and Africa, announces its consolidated financial results for the year 2014 and fourth quarter ended 31 December, 2014. Zain served 44.3 million customers at the end of the period, reflecting a 4 percent decline year-on-year (Y-o-Y). Zain is the market leader by customer base in six of its eight operations. For the year 2014, Zain Group generated consolidated revenues of $4.3 billion. Consolidated EBITDA for the period reached $1.8 billion, reflecting a healthy EBITDA margin of 41.8 percent. Consolidated net income amounted to $685 million, reflecting Earnings Per Share of $0.18. The Board of Directors of Zain Group recommended a cash dividend of $0.14 (KD 0.040) per share subject to the Annual General Assembly and regulatory approvals. Additionally, shareholders’ equity stood at $5.6 billion (KD 1.6 billion) as at 31 December, 2014. Fourth quarter For the fourth quarter of 2014, Zain Group recorded consolidated revenues of $1.0 billion. EBITDA for the quarter reached $406 million, reflecting a healthy EBITDA margin of 40.4 percent. Net income for the quarter reached $115 million. Key Operational Notes: 1. Group data revenues (excluding SMS and VAS) witnessed a healthy 13 percent growth during 2014, accounting for 16 percent of the Group’s consolidated revenues. 2. The recent appreciation of the US dollar against the Kuwaiti Dinar, along with foreign currency revaluation losses predominantly in the Republic of Sudan and Iraq, cost the Group $152 million (KD 43 million) in net income for the full year 2014, substantially higher than $88 million (KD 25 million) for the full year 2013. Excluding the currency variance and FX translation impact, net income would have been relatively stable for the full-year 2014. 3. Specifically for the fourth quarter of 2014, currency variance losses cost the company USD 41 million (KD 12 million) in net income, higher than $34 million (KD 10 million) in the fourth quarter of 2013. 4. Customer base decline is a result of two major circumstances; one, a new definition of an “active customer” implemented by the regulator in Iraq and second, due to the new registration policy implemented by Sudan’s regulator. 5. The escalation of political instability in Iraq during the second half of 2014 has seen several million people displaced internally. Additionally Zain Iraq endured frequent temporar y network interruptions and associated higher network operational costs. These unavoidable occurrences had a drastic effect on Zain Iraq’s and consequently Zain Group’s overall key financial metrics. 6. Zain Iraq entered into an agreement with Iraq’s Communication and Media Commission (CMC) on November 10, 2014, earning the right to utilize 3G spectrum following an installment payment of $76.8 million representing 25 percent of the total $307 million spectrum fee. Zain Iraq made its first 3G call on New Year’s Eve, 2014. 7. Political unrest in South Sudan also affected Zain Group’s results as the country also witnessed significant displacement of its people, with access to and repair of many network sites in parts of the country proved to be difficult, causing frequent interruptions and higher maintenance costs. 8. As mandated by its mobile operating license, Zain Bahrain completed an Initial Public Offering of 15 percent of its share capital and listed on the Bahrain bourse on 4 December, 2014. This milestone was the first IPO in Bahrain since 2010. Additionally Zain Bahrain completed its $100 million revamp of the network and now offers nationwide 4G ser vices across the Kingdom. 9. Heavy investment in 3G and 4G Zain Group Chairman Asaad Al-Banwan Zain Group CEO Scott Gegenheimer network upgrades and expansion across operations sees CAPEX spend for the year amount to $730 million (excluding Saudi Arabia), reflecting 17 percent of Group revenues. 10. In November 2014, the Board of Zain Saudi Arabia recommended a reduction of the company ’s share capital and awaits final approval by the general assembly and respective authorities. This proposed capital reduction is one of several positive steps being taken by the company to improve its financial position as part of a comprehensive transformation plan, which has been ongoing since the beginning of 2014. Commenting on the results, the Chairman of the Board of Directors of Zain Group, Asaad Al-Banwan said “Despite geo-political challenges and unavoidable currency issues in sever- al markets that have had a dramatic effect on our 2014 financial results, the Board remains confident that management is implementing the right strategy in driving the business for ward in this ever- evolving telecommunications industry. We are closely aligned with management in transforming the operating model of all Zain operations in order to cope with and overcome increased levels of competition from rival operators and OTT players combined, implementing numerous initiatives aimed at extracting more synergies between our operations and optimizing efficiency”. The Chairman continued, “ We have invested significantly in our infrastructure, launching state-oft h e - a r t n e t wo r k s a c ro s s a l l o u r markets in order to improve the m o b i l e e x p e r i e n c e fo r o u r c u s tomers. Our investment in capital expenditure reached $730 million which represents 17 percent of our revenues, reflecting Zain’s commitment to innovation and quality of ser vice. I remain proud that we have been able to maintain our leadership position in the majority of the markets we operate in, testament to our valued brand reputation”. Zain G ro u p C E O, Scott Gegenheimer said “Due to number factors beyond Zain’s control, the year proved to be especially challenging and it is disappointing to report declining financial results for the full year considering the sound operational progress and transformation we have undertake n a c ro s s a l l o u r m a r k e t s. Nevertheless we remain focused on grow i n g t h e b u s i n e s s i n a l l o u r markets and we are committed to our strategy that will take advan- tage of our competencies, which include our people, brand, quality networks and geographic coverage, while looking to develop new areas and becoming a diversified and innovative digital operator”. G e g e n h e i m e r re i t e r a t e d t h e promising growth opportunities in the mobile broadband area for all of Zain’s operations. “Our digital traffic and revenues continue to a d v a n c e s t ro n g l y, re c o rd i n g a h e a l t hy 1 3 p e rce n t a n n u a l r i s e, with data now reflecting 16 percent of all Zain Group’s service revenues. With Zain Iraq rolling out 3G services in January 2015 and Zain Jordan rolling out 4G services during the first quarter of 2015, coupled with healthy growth expected in our other 4G operations in Bahrain, Kuwait and Saudi Arabia, the Group will continue to foster and develop this key area of the business and expects it to reflect positively in our future financial metrics”. With regard to year-on-year key operational highlights across Zain’s footprint, Gegenheimer noted: Kuwait: The cornerstone of Zain Group continues to perform exceptionally well with customer growth of 6 percent to reach 2.7 million at the end of 2014, maintaining its market leadership. For the year, Zain Kuwait revenues rose by 2 percent to $1.2 billion. EBITDA and net income increased by 1 percent and 3 percent respec tively. The operator reported a healthy EBITDA margin of 48 percent for the year 2014. Notably, with the attraction of its nationwide 4G LTE network, data revenues (excluding SMS & VAS) formed 31 percent of total re ve n u e s, re f l e c t i n g a n a n n u a l growth rate of 11 percent. Group Key Performance Indicators (USD and KD) for the full year 2014

© Copyright 2026