DASHBOARD

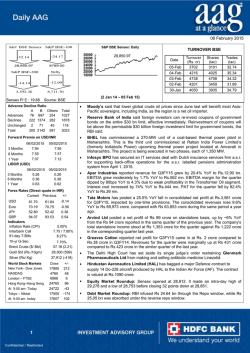

DASHBOARD For the month of Feb 2015 HOME LOANS & MORTGAGE Loan Against Lease Rental Discounting Property (LAP) (LRD) Home Loans • Home Loans Available up to 100% of Agreement Value • Balance transfer of Home loans at 10.15% Special Offers • Are you getting good rental on Your Commercial/Residential Property?? • Avail LRD @ 11.50%* & Make your earning property to contribute to your need Avail Loan Against residential or Commercial Property at 11.50%* • Liquid income program (Eligibility on cash earnings). • Avail Loan Against Plot(NA Plot) Choice of Multiple Banks & NBFCs . *Terms & Condition Apply PUBLIC ISSUE Current NCD Issue Name IFCI Limited Opening Date 01-Jan-15 Individual (Retail & HNI) ROI p.a. 5 yrs 10 Yrs Closing Date 04-Feb-15 9.45% 9.50% Non – Individual (QIB & Corp) ROI p.a. 5 yrs 10 Yrs 9.35% Issue Size Rating (` In Crs) AA- by BRICKWORK A by CARE Base: 250 Shelf: 790.813 9.40% Forthcoming Public Issues Equity IPOs NCDs Lead Managed By Edelweiss Lead Managed by Other LM ACB India Ltd. Inox Wind Ltd. Adlabs Entertainment Limited Lavasa Corporation Limited MEP Infrastructure Developers Ltd Ortel Communication Ltd. SREI Equipment Finance Ltd.(SREI BNP) COMPANY FIXED DEPOSITS Company Bajaj Finance Ltd Shriram Unnati Shriram City Union Ratings CRISIL - "FAAA" CRISIL - "FAA+" & ICRA - "MAA+ CARE AA + 12 M. 9.25% 9.25% 9.25% 15 M. 9.75% 24 M. 9.40% 9.75% 9.75% 36 M. 9.65% 10.25% 10.25% 48 M. 9.25% 10.25% 10.25% 60 M. 9.25% 10.25% 10.25% CRISIL - "FAAA" 9.00% 9.25% - 18 M. 9.50% 9.75% 9.25% 9.25% - "FAAA" - "FAAA" - "FAAA" - "FAAA" 9.15% 9.15% 93 M – 9.35% (Sr Cititzen) 9.20% M & M Finance HDFC Regular HDFC – Double Plan HDFC Smart Deposit HDFC Premium Deposit CRISIL CRISIL CRISIL CRISIL & ICRA - "MAAA & ICRA - "MAAA & ICRA - "MAAA & ICRA - "MAAA CARE - "AAA" & BWR "FAAA" DHFL 9.20% 9.20% 95 M. – 9.15% 9.00- 12 to 18 M. - Ann / Cum 8.70 - 12 to 18 M. - Qty 15 & 30 M - 9.25% 9.50% 9.80% - 18 M** PNB Housing Finance Ltd CRISIL - "FAAA" 9.25 9.25 • Shriram Unnati & Shriram City Union Ltd Int. Rate Revise w.e.f 01 Feb 2015 • Mahindra Finance Int. Rate will Revise w.ef . 09 Feb 2015 22 & 44 M - 9.30% 9.75% 9.75% 9.60% 9.60% 9.25 9.25 9.25 9.15 MUTUAL FUNDS Equity Debt • Birla Sunlife Frontline Equity • ICICI Regular Savings Fund • Axis Equity • Reliance Regular Savings Fund -Debt Option • ICICI Pru Dynamic • HDFC Mid Cap Opp. • DSPBR Income opportunities • ICICI Pru Discovery • Franklin Short Term • IDFC Premier Equity Income Plan • Reliance Banking Fund ELSS FMP / NFO’s • Edelweiss ELSS • Axis Long Term Equity • ICICI Prudential Tax Plan Reg. • Franklin India Tax shield • HDFC Long Term Advantage • IDFC Dynamic Bond Fund • SBI Dynamic Bond Fund Close Ended Scheme ELSS • Sundaram Long Term Tax Advantage Fund Series I (10 years) (Open 18-Dec-14 to Closes 20-Mar-15) Open Ended Fund • Reliance Retirement Fund- (Wealth Creation Scheme/ Income Generation Scheme) (Open 22-Jan-15 to Closes-05-feb-15) Close Ended Fund • SBI Dual Advantage Fund - Series VII (Open 02-Feb-15 to Closes-16-Feb-15) • ICICI Prudential Capital Protection Fund Series VII Plan G - 1285 Days (Open 02-Feb-15 to Closes-16-Feb-15) • UTI Dual Advantage Fixed Term Fund Series I - II (1145 days) (Open 03-Feb-15 to Closes-16-Feb-15) • DWS Hybrid Fixed Term Fund Series 34 (Open 02-Feb-15 to Closes-13-Feb-15) Close Ended Equity • HDFC Focused Equity Fund (Open 15-Jan-15 to Closes 13-Feb-15) Mutual Fund investment is subject to market risk. Please read the scheme related document carefully before investing. The above data is for information purpose only. EQUITY IPO FINANCING FOR HNI CAPITAL GAIN BONDS (U/S 54EC) Competitive ROI with Lower Margin. REC & NHAI – ROI 6% Annual Payout 1800 266 6001 (Toll Free) [email protected] www.edelweisspartners.com Last updated on 01-Feb 2015

© Copyright 2026