AAG - HDFC Bank

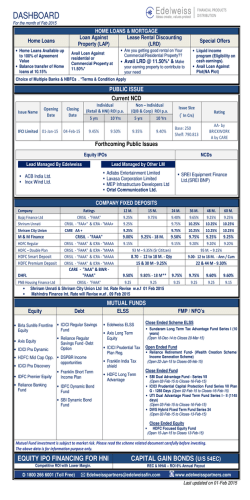

06 February 2015 S&P BSE Sensex S&P BSE Sensex: Daily S&P BSE-100 -32.14 -24.17 28,850.97 8789.00 30000 28000 26000 24000 22000 20000 18000 . . 2 S&P BSE-200 Nifty 3,592.36 Sensex P/ E : 19.68 Total 1027 1878 118 3023 05/02/2015 7.95 7.57 7.12 06/02/2015 0.26 0.36 0.63 05/02/2015 0.26 0.36 0.62 10-yr G-Sec 04-Feb 4216 4025 35.34 03-Feb 4738 4706 34.32 02-Feb 4201 3459 31.89 30-Jan 4050 3935 34.79 Moody’s said that lower global crude oil prices since June last will benefit most AsiaPacific sovereigns, including India, as the region is a net oil importer. Reserve Bank of India said foreign investors can re-invest coupons of government bonds on the entire $30 bn limit, effective immediately. Reinvestment of coupons will be above the permissible $30 billion foreign investment limit for government bonds, the RBI said. BHEL has commissioned a 270-MW unit of a coal-based thermal power plant in Maharashtra. This 10/08/2012 is the third unit commissioned at Rattan India Power Limited’s 03/ 17/08/2012 13/08/2012 09/08/2012 08/08/2012 07/08/2012 06/08/2012 (formerly 7.30 Indiabulls Power) upcoming thermal power project located at Amravati 7.34 7.10 7.09 7.05 7.14 in Maharashtra. The project is being executed in two phases, each of 1,350 MW. Forex Rates (Direct quote in INR) Current Previous +/Euro JPY GBP Indicators Inflation Rate (CPI) Interbank Call 91-day T-Bills Trades (lac) 32.74 06/02/2015 7.94 3 Months 7.55 6 Months 7.07 1 Year LIBOR (USD) 61.84 70.75 52.42 93.53 Shares (lac) 3101 (2 Jan 14 – 05 Feb 15) Source: BSE Forward Premia on USD/INR 61.70 70.19 52.80 94.07 05-Feb Turnover (Rs. cr) 3702 Date 8,711.70 Advance Decline Ratio A B Others Advances 76 697 254 Declines 222 1374 282 Unchanged 2 71 45 Total 300 2142 581 USD 28,850.97 -12.00 -14.14 3 Months 6 Months 1 Year TURNOVER BSE 5.00% 7.75 / 7.80% 8.27% 7.35 6.69 6.66 6.54 6.71 Infosys BPO Dutch insurance 6.12 has secured 6.82 an IT services 5.98 deal with5.94 5.88services firm 6.01a.s.r. for supporting back-office operations for the a.s.r. labelled pensions administration system from April 1, 2015. Apar Industries reported revenue for Q3FY15 grew by 20.4% YoY to Rs.12.90 bn. EBITDA grew moderately by 1.7% YoY to Rs.562 mn. EBITDA margin for the quarter dipped by 80bps YoY to 4.3% due to weak profitability in the Transformer Oil segment. Interest cost increased by 74% YoY to Rs.444 mn. PAT for the quarter fell by 82.4% YoY to Rs.26 mn. Tata Motors has posted a 25.5% YoY fall in consolidated net profit at Rs.3,581 crore for Q3FY15, impacted by one-time provisions. The consolidated revenues rose 9.6% YoY to Rs 69,973 crore, compared with Rs 63,853 crore during the same period a year ago. -0.14 -0.56 0.38 0.54 6.85 Arvind Ltd posted a net profit of Rs 99 crore on standalone basis, up by ~6% YoY from the Rs 94 crore reported in the same quarter of the previous year. The company's 4.38%total standalone income stood at Rs 1,353 crore for the quarter against Rs 1,222 crore 8.45 / in 8.50% the corresponding quarter last year. 8.35 % Greaves Cotton reported net profit for Q3FY15 came in at Rs. 2 crore compared to 7.70% 57.16 (2.21) 7.93%Rs.38 crore in Q3FY14. Revenues for the quarter were marginally up at Rs 431 crore 59.38 compared (-1.86) to Rs 423 crore in the similar quarter of the last year. Gold Std (Rs./10gm) 28,300 (599) Silver (Rs/ Kg) 37,912 (-418) 26,790 (-164) -397 Court has set aside its single judge’s order restraining Glenmark The Delhi High 36,535Pharmaceuticals (-200) Ltd from making and selling antibiotic medicine Linezolid. Brent Crude ($/ Bbl) World Stock Markets New York– Dow Jones NASDAQ London – FTSE Hong Kong–Hang Seng At 9.00 am- Today Tokyo – Nikkei At 9.00 am today 1 Close +/- 17885 4765 6866 24765 24722 17505 17607 212 48 6 86 -43 -174 102 Hindustan Aeronautics Limited (HAL) has bagged a major Defence contract to supply 14 Do-228 aircraft produced by HAL to the Indian Air Force (IAF). The contract is valued at Rs.1090 crore. Equity Market Roundup: Sensex opened at 28,912. It made an intra-day high of 29,278 and a low of 28,753 before closing 32 points down at 28,851. Debt Market Roundup: RBI infused Rs 24.64 bn through the Repo window, while Rs 25.05 bn was absorbed under the reverse repo window. Disclaimer: This communication is being sent by the Investment Advisory Group of HDFC Bank Ltd., registered under SEBI (Investment Advisors) Regulations, 2013 This note has been prepared exclusively for the benefit and internal use of the recipient and does not carry any right of reproduction or disclosure. Neither this note nor any of its contents maybe used for any other purpose without the prior written consent of HDFC Bank Ltd, Investment Advisory Group. In preparing this note, we have relied upon and assumed, without any independent verification, accuracy and completeness of all information available in public domain or from sources considered reliable. This note contains certain assumptions and views, which HDFC Bank Ltd, Investment Advisory Group considers reasonable at this point in time, and which are subject to change. Computations adopted in this note are indicative and are based on current market prices and general market sentiment. No representation or warranty is given by HDFC Bank Ltd, Investment Advisory Group as to the achievement or reasonableness or completeness of any idea and/or assumptions. This note does not purport to contain all the information that the recipient may require. Recipients should not construe any of the contents herein as advice relating to business, financial, legal, taxation, or other matters and they are advised to consult their own business, financial, legal, taxation and other experts / advisors concerning the company regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this note and should understand that statements regarding future prospects may not be realized. It may be noted that investments in equity and equity-related securities involve a degree of risk and investors should not invest any funds unless they can afford to take the risk of losing their investment. Investors are advised to undertake necessary due diligence before making an investment decision. For making an investment decision, investors must rely on their own examination of the Company including the risks involved. Investors should note that income from investment in such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Neither HDFC Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. This note does not constitute an offer for sale, or an invitation to subscribe for, or purchase equity shares or other assets or securities of the company and the information contained herein shall not form the basis of any contract. It is also not meant to be or to constitute any offer for any transaction. HDFC Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein. HDFC Bank may at any time solicit or provide commercial banking, credit, advisory or other services to the issuer of any security referred to herein. Accordingly, information may be available to HDFC Bank, which is not reflected in this material, and HDFC Bank may have acted upon or used the information prior to, or immediately following its publication. Disclosures: Research analyst or his/her relatives or HDFC Bank or its associates may have financial interest in the subject company in ordinary course of business. Research analyst or his/her relatives does not have actual/ beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: HDFC Bank or its associates may have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. Subject company may have been client of HDFC Bank or its associates during twelve months preceding the date of publication of the research report. HDFC Bank or its associates may have received compensation from the subject company in the past twelve months. HDFC Bank or its associates may have managed or co-managed public offering of securities for the subject company in the past twelve months. HDFC Bank or its associates may havereceived compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months. HDFC Bank or its associates may have received compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months. HDFC Bank or its associates has not received compensation or other benefits from the subject company or third party in connection with the research report. Research analyst has not served as an officer, director or employee of the subject company. Neither research analyst nor HDFC Bank has been engaged in market making activity for the subject company. Three year price history of the daily closing price of the securities covered in this note is available at www.nseindia.com and www.bseindia.com. 2

© Copyright 2026

![Quarterly Commentary [PDF]](http://s2.esdocs.com/store/data/000473889_1-199d98d24dff63e8b8cda114308c276e-250x500.png)