FACTSHEET - Modulor Low Risk Index 30.1.2015

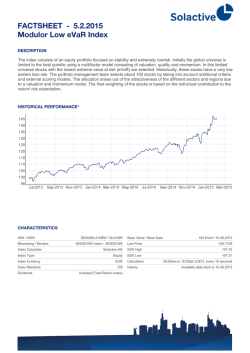

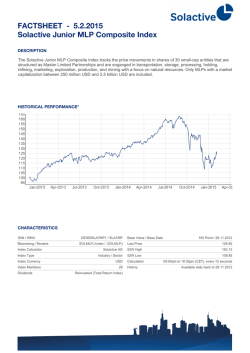

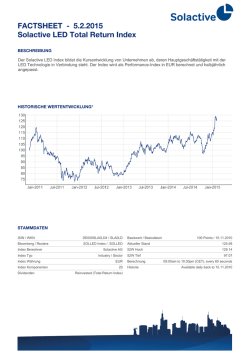

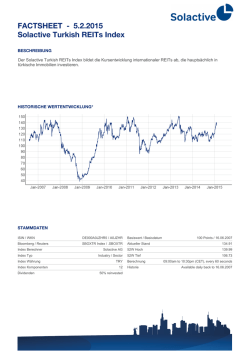

FACTSHEET - 5.2.2015 Modulor Low Risk Index DESCRIPTION The index consists of an equity portfolio focused on valuation and risk diversification. Initially the global universe is limited to low-risk stocks using a risk filter. The remaining stocks are ranked by sector according to a multifactor model consisting of valuation, quality and momentum. The portfolio management team then selects about 50 stocks from this pool by taking into account additional criteria and external scoring models. The allocation arises out of the attractiveness of the different sectors and regions due to a valuation and momentum model. The final weighting of the stocks is based on the individual contribution to the return/ risk expectation. HISTORICAL PERFORMANCE* CHARACTERISTICS ISIN / WKN Bloomberg / Reuters Index Calculator Index Type Index Currency Index Members Dividends DE000SLA1MD0 / SLA1MD Base Value / Base Date 100 Point / 31.12.2012 MODLR Index / .MODLR Last Price 161.8572 Solactive AG 52W High 163.31 Equity 52W Low EUR 50 Included (Total Return Index) Calculation History 118.92 09:00am to 10:30pm (CET), every 15 seconds Available daily back to 31.12.2012 FACTSHEET - 5.2.2015 Modulor Low Risk Index STATISTICS in EUR Performance Performance (p.a.) YTD Since Inception 34.9% 9.9% 61.9% 35.4% 159.9% 25.8% 30D 90D 180D 360D 11.0% 14.0% 24.6% 254.1% 70.4% 55.8% Volatility (p.a.) 16.0% 14.6% 13.4% 11.1% 15.5% 10.4% High 163.31 163.31 163.31 163.31 163.31 163.31 Low 145.88 137.81 129.26 120.02 145.88 99.96 Sharpe Ratio 15.85 4.82 4.16 3.17 10.29 2.46 Max. Drawdown -1.7% -5.8% -8.2% -8.2% -1.7% -9.9% VaR 95 \ 99 17.2% \ 9.6% 8.7% \ 1.6% CVaR 95 \ 99 12.5% \ 5.8% 4.4% \ -1.9% CURRENCY EXPOSURE COUNTRY EXPOSURE TOP COMPONENTS Ticker Currency Country Company Weight SCMN VX Equity CHF CH SWISSCOM AG 2.65% TLS AT Equity AUD AU TELSTRA CORP LTD 2.62% BT/A LN Equity GBP GB BT GROUP PLC 2.58% ANTM UN Equity USD US ANTHEM INC 2.57% AET UN Equity USD US AETNA INC 2.56% DPS UN Equity USD US DR PEPPER SNAPPLE GROUP 2.56% BLL UN Equity USD US BALL CORP 2.54% T UN Equity USD US AT&T 2.47% PEG UN Equity USD US PUBLIC SVC ENTERPRISE 2.43% NG/ LN Equity GBP GB NATIONAL GRID PLC 2.36% LLY UN Equity USD US ELI LILLY & CO 2.36% YAR NO Equity NOK NO YARA INTL ASA 2.26% HCA UN Equity USD US HCA HOLDINGS INC 2.22% KR UN Equity USD US KROGER CO 2.15% SECUB SS Equity SEK SE SECURITAS AB 2.13% FACTSHEET - 5.2.2015 Modulor Low Risk Index For more information, please visit www.solactive.com. * Past performance is no guarantee of future results and may be lower or higher than current performance. Index returns are no guarantee for any returns of financial products linked to the index. Any performance information regarding financial products linked to the index can reflect temporary waivers of expenses and/or fees and does not include insurance/annuity fees and expenses. This info service is offered exclusivley by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: All our activities as an aquisition agent and investment adviser (in accordance with § 1 Article 1a No. 1, 1a and 2 of the German Banking Act / KWG) in the capacity of a "contractbound agent" are subject to the liability of Exclusive Private Finance GmbH, Gaisbergstrasse 40, 69115 Heidelberg, Germany (§ 2 Article 10 German Banking Act / KWG). This document is for the information and use of professional advisers only. Remember, the information in this document does not constitute tax, legal or investment advice and is not intended as a recommendation for buying or selling securities. The information and opinions contained in this document have been obtained from public sources believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and it should not be relied upon as such. Solactive AG and all other companies mentioned in this document will not be responsible for the consequences of reliance upon any opinion or statement contained herein or for any omission. | © Solactive AG, 2013. All rights reserved.

© Copyright 2026