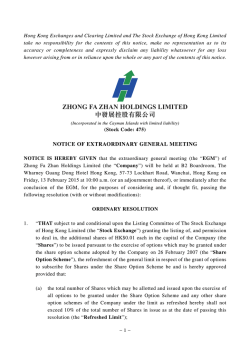

offer document relating to conditional mandatory