joint announcement close of mandatory unconditional

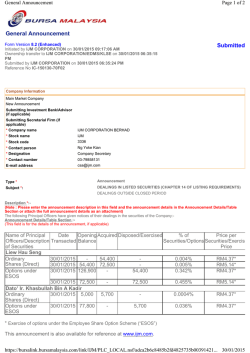

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this joint announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this joint announcement. This joint announcement appears for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for any securities of the Company. Tempus Holdings (Hong Kong) Limited OTO Holdings Limited 豪特保健控股有限公司 (Incorporated in Hong Kong with limited liability) (incorporated in the Cayman Islands with limited liability) (Stock code: 6880) JOINT ANNOUNCEMENT CLOSE OF MANDATORY UNCONDITIONAL CASH OFFERS BY QUAM SECURITIES COMPANY LIMITED ON BEHALF OF TEMPUS HOLDINGS (HONG KONG) LIMITED TO ACQUIRE ALL THE ISSUED SHARES IN THE ISSUED SHARE CAPITAL OF OTO HOLDINGS LIMITED (OTHER THAN THOSE ALREADY OWNED AND/OR AGREED TO BE ACQUIRED BY TEMPUS HOLDINGS (HONG KONG) LIMITED AND/OR PARTIES ACTING IN CONCERT WITH IT) AND FOR THE CANCELLATION OF ALL OUTSTANDING SHARE OPTIONS Financial adviser to Tempus Holdings (Hong Kong) Limited Financial adviser to OTO Holdings Limited Independent Financial Adviser to the Independent Board Committee of OTO Holdings Limited — 1 — App1A-1 App1A-5 LR8.02 LR19.05(1)(b) CLOSE OF THE OFFERS The Offeror and the Company jointly announce that the Offers were closed at 4:00 p.m. on Tuesday, 27 January 2015 and were not revised or extended by the Offeror. As at 4:00 p.m. on Tuesday, 27 January 2015, being the latest time and date for acceptance of the Offers as set out in the Composite Document, the Offeror had received (i) valid acceptances in respect of a total of 59,102,800 Offer Shares under the Share Offer (representing approximately 18.4% of the entire issued share capital of the Company as at the date of this joint announcement); and (ii) valid acceptances in respect of 897,200 Share Options under the Option Offer (representing approximately 31.38% of the total 2,858,400 Share Options subject to the Option Offer, with the remaining 1,961,200 Share Options being exercised). None of the Offeror or parties acting in concert with it had acquired or agreed to acquire any Shares or rights over the Shares during the Offer Period. Remittance in respect of (i) the cash consideration (after deducting the seller’s ad valorem stamp duty in respect of acceptance of the Share Offer) payable for the Offer Shares tendered under the Share Offer; and (ii) the cash consideration for cancellation of the Share Options tendered under the Option Offer have been, or will be despatched to the Shareholders or Optionholders accepting the Share Offer or Option Offer by ordinary post at their own risk as soon as possible, but in any event within seven business days (as define under the Takeovers Code) after the date of receipt by the Registrar (in respect of the Share Offer) or the company secretary of the Company (in respect of the Option Offer) of all relevant documents of title to render such acceptance complete and valid in accordance with the Takeovers Code. PUBLIC FLOAT Immediately after the close of the Offers, 59,604,000 Shares, representing approximately 18.5% of the entire issued share capital of the Company, are held by the public (within the meanings under the Listing Rules). Accordingly, the Company cannot fulfil the minimum public float requirement under Rule 8.08(1) of the Listing Rules An application to the Stock Exchange for a waiver from strict compliance with Rule 8.08(1) of the Listing Rules from 28 January 2015 up to and inclusive of 31 March 2015 has been made by the Company. The Offeror and the Company will take appropriate steps to restore the minimum public float as required under Rule 8.08(1) of the Listing Rules as soon as possible. — 2 — Reference are made to the composite offer and response document dated 6 January 2015 (the “Composite Document”) jointly issued by Tempus Holdings (Hong Kong) Limited (the “Offeror”) and OTO Holdings Limited (the “Company”) in respect of the mandatory unconditional cash offers by Quam Securities Company Limited, on behalf of the Offeror, to acquire all the issued Shares (other than those already owned and/or agreed to be acquired by the Offeror and/or parties acting in concert with it), and to cancel all the outstanding Share Options of the Company and the announcement of the Company (the “Announcement”) dated 16 January 2015. Capitalized terms used herein shall have the same meanings as those defined in the Composite Document and the Announcement unless the context otherwise requires. CLOSE OF THE OFFERS The Offeror and the Company jointly announce that the Offers were closed at 4:00 p.m. on Tuesday, 27 January 2015 and were not revised or extended by the Offeror. As at 4:00 p.m. on Tuesday, 27 January 2015, being the latest time and date for acceptance of the Offers as set out in the Composite Document, the Offeror had received (i) valid acceptances in respect of a total of 59,102,800 Offer Shares under the Share Offer (representing approximately 18.4% of the entire issued share capital of the Company as at the date of this joint announcement); and (ii) valid acceptances in respect of 897,200 Share Options under the Option Offer (representing approximately 31.38% of the total 2,858,400 Share Options subject to the Option Offer, with the remaining 1,961,200 Share Options being exercised). An aggregate of 1,961,200 Shares were allotted and issued by the Company in connection with the exercise of the Share Options subject to the Option Offer. None of the Offeror or parties acting in concert with it had acquired or agreed to acquire any Shares or rights over the Shares during the Offer Period. Remittance in respect of (i) the cash consideration (after deducting the seller’s ad valorem stamp duty in respect of acceptance of the Share Offer) payable for the Offer Shares tendered under the Share Offer; and (ii) the cash consideration for cancellation of the Share Options tendered under the Option Offer have been, or will be despatched to the Shareholders or Optionholders accepting the Share Offer or Option Offer by ordinary post at their own risk as soon as possible, but in any event within seven business days (as define under the Takeovers Code) after the date of receipt by the Registrar (in respect of the Share Offer) or the company secretary of the Company (in respect of the Option Offer) of all relevant documents of title to render such acceptance complete and valid in accordance with the Takeovers Code. — 3 — SHAREHOLDING STRUCTURE OF THE COMPANY Immediately before the commencement of the Offer Periodon 11 June 2014, the Offeror and parties acting in concert with it did not own, control or direct any Shares or any convertible securities, warrants or options in the Company. Immediately after the Completion but prior to the making of the Offers, the Offeror and parties acting in concert with it were interested in 179,140,000 Shares, representing approximately 56.0% of the then entire issued share capital of the Company. Immediately after the close of the Offers and exercise of the Share Options by the Optionholders, taking into account the valid acceptances in respect of 59,102,800 Offer Shares under the Share Offer, the Offeror and parties acting in concert with it are interested in an aggregate of 238,242,800 Shares, representing approximately 74% of the entire issued share capital of the Company as at the date of this joint announcement. Save for the transactions under the Share Purchase Agreements and the valid acceptances under the Offers as detailed in this joint announcement, none of the Offeror or parties acting in concert with it owned or controlled or directed any Shares, convertible securities, warrants, options of the Company or any derivatives in respect of such securities or had dealt for value in any Shares, convertible securities, warrants or options of the Company or any derivatives in respect of such securities during the Offer Period. Further, none of the Offeror or parties acting in concert with it, had borrowed or lent any relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) in the Company during the Offer Period. — 4 — Set out below is the shareholding structure of the Company (i) immediately after the Completion and before the making of the Offers; (ii) immediately after the Completion and exercise of the Share Options by the Optionholders; and (iii) immediately after the close of the Offers (subject to the completion of the transfer of those Shares acquired under the Share Offer to the Offeror) and exercise of the Share Options by the Optionholders: (iii) Immediately after the close of Offers (subject to the completion of the transfer of those Shares acquired under the Share Offer to the (ii) Immediately after the (i) Immediately after the Completion and exercise of Offeror) and exercise of the Share Options by the the Share Options by the Completion and before Optionholders Optionholders making of the Offers Approximate % Approximate % Approximate % of Shares of Shares Number of of Shares Number of Number of in issue in issue Shares held in issue Shares held Shares held Mr. Yip Chee Seng Mr. Yip Chee Lai, Charlie Mr. Yip Chee Way, David Mr. Yep Gee Kuarn The Offeror and parties acting in concert with it Other Shareholders 5,456,000 1.7% 5,774,000 1.8% 5,774,000 1.8% 5,746,000 1.8% 6,046,000 1.8% 6,046,000 1.9% 5,796,000 5,796,000 1.8% 1.8% 6,096,000 6,114,000 1.9% 1.9% 6,096,000 6,114,000 1.9% 1.9% 179,140,000 117,981,600 56.0% 36.9% 179,140,000 118,706,800 55.7% 36.9% 238,242,800 59,604,000 74.0% 18.5% 319,915,600 100.0% 321,876,800 100.0% 321,876,800 100.0% — 5 — PUBLIC FLOAT Immediately after the close of the Offers and exercise of the Share Options by the Optionholders, subject to the due registration by the Registrar of the transfer of the Offer Shares (in respect of which valid acceptances have been received), 59,604,000 Shares, representing approximately 18.5% of the entire issued share capital of the Company, are held by the public (within the meanings under the Listing Rules). Accordingly, the Company cannot fulfil the minimum public float requirement under Rule 8.08(1) of the Listing Rules. An application to the Stock Exchange for a waiver from strict compliance with Rule 8.08(1) of the Listing Rules from 28 January 2015 up to and inclusive of 31 March 2015 has been made by the Company. The Offeror and the Company will take appropriate steps to restore the minimum public float as required under Rule 8.08(1) of the Listing Rules as soon as possible. By order of the board of Tempus Holdings (Hong Kong) Limited Huang Jingkai Sole Director By order of the Board OTO Holdings Limited Zhong Baisheng Chairman Hong Kong, 27 January 2015 The sole director of the Offeror accepts full responsibility for the accuracy of the information contained in this joint announcement, other than that relating to the Vendors and the Group, and confirms that, having made all reasonable enquiries, that to the best of his knowledge, opinions expressed in this joint announcement, other than those expressed by the Vendors and the Directors, have been arrived at after due and careful consideration and there are no other facts not contained in this joint announcement the omission of which would make any statements in this joint announcement misleading. The Directors jointly and severally accept full responsibility for the accuracy of the information contained in this joint announcement, other than that relating to the Offeror, and confirm that, having made all reasonable enquiries, that to the best of their knowledge, opinions expressed in this joint announcement, other than those expressed by the sole director of the Offeror, have been arrived at after due and careful consideration and there are no other facts not contained in this joint announcement, the omission of which would make any statements in this joint announcement misleading. As at the date of this joint announcement, the sole director of the Offeror is Mr. Huang Jingkai. As at the date of this joint announcement, the Board comprises five executive Directors, namely Mr. Huang Jingkai, Mr. Yip Chee Seng, Mr. Yip Chee Lai, Charlie, Mr. Yip Chee Way, David and Mr. Yep Gee Kuarn; two non-executive Directors, namely Mr. Zhong Baisheng and Ms. Zhang Yan; and four independent non-executive Directors, namely Mr. Han Biao, Mr. Liu Yaohui, Mr. Chan Yip Keung and Ms. Lo Yee Hang. — 6 —

© Copyright 2026