P21_Layout 1 - Kuwait Times

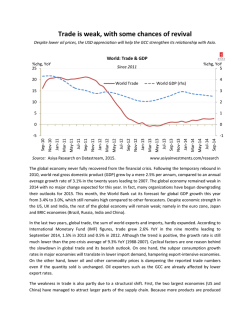

Business MENA growth to slow amid falling oil Page 22 Asian airlines slash fuel surcharges but fares to rise WEDNESDAY, JANUARY 28, 2015 Page 23 Russia attacks ‘politically motivated’ downgrade Toyota earns 2015 ‘Top Safety Pick’ awards Page 26 Page 25 RICHMOND: A flag flaps in the breeze in front of a new home for sale in Richmond, Virginia. Sales of new US homes accelerated strongly in December, a sign that home-buying may improve this year after a lackluster 2014, the Commerce Department reported yesterday. — AP Gulf Bank posts 10% rise in net profit in 2014 Net profit up to KD 35.5m • Operating profit reaches KD 106.8m KUWAIT: Gulf Bank yesterday announced an operating profit before provisions of KD 106.8 million for the year ending 2014 and a net profit at KD 35.5 million, which is a 10 percent increase over 2013. At the end of December 2014, the Bank’s total assets were KD 5,331 million. There has been a significant gain in market share in loans, mainly attributable to the 23 percent growth in retail loans. Overall, this resulted in a growth of 9 percent vs. the 6 percent market growth. The growth in low cost deposits was 16 percent increasing the total deposits at the bank to KD 4,340 million. Total shareholders’ equity increased to KD 511 million from KD 483 million in 2013. The bank maintained its positive trend of reducing the non-performing loan ratio which decreased from 6.5 percent at the beginning of the year to 3.2 percent by December 2014 and increased the total coverage ratio of non-performing loans to 266 percent. The Gulf Bank’s Board of Directors have recommended a stock dividend of 5 per cent (5 shares for every 100 shares held), for approval at the Shareholders meeting. Clear strategy Commenting on the results, Omar Kutayba Alghanim, Gulf Bank’s Chairman said: “Gulf Bank is today a great and strong bank. It has overcome the difficult times in an admirable way. The strategy is clear and the mandate of the Board is to grow. In wholesale, we will reinforce our advisory and products capabilities. In Retail, products and newer channels are being upgraded. Everything we do will be upgraded under strict risk criteria, as per our policies that have helped make Gulf Bank safe and sound.” Cesar Gonzalez-Bueno, Gulf bank’s CEO said: “I am pleased to report that we have continued the progress of previous years, even accelerat- rating to Baa1 from Baa2 and the Stand Alone Financial Strength rating to D from D-, maintaining a positive outlook. Standard Poor’s also affirmed the Bank’s long-term credit rating at BBB+ with a positive outlook. Both agencies, in their assessments, affirmed the Bank’s asset quality, capitalization, solid revenue generating capacity and sound risk management systems and practices. Omar Kutayba Alghanim ed it. The Bank’s Capital Adequacy Ratio per the new Basel III regulations is at 15.5 percent against the regulatory requirement of 12 percent. The bank is also strongly placed with a leverage ratio of 8.25 percent against the regulatory minimum of 3 percent. Our network has grown to 59 branches across Kuwait, the second largest in the country and we we’re proud to be the first bank to open a branch in the new areas of Jaber Al-Ahmad and Qairawan. This is another sign of our desire to be closer to our customers. As we move through 2015, we will maintain financial discipline and the policy of investing in the bank’s infrastructure to ensure we have robust internal controls in place at all levels of the operations.” Cesar Gonzalez-Bueno During 2014, the Bank continued the focus on its core competence of commercial and retail lending within the Kuwaiti market, and on strengthening its domestic franchise. The strategy has shifted to risk adjusted growth following a period starting in 2009 during which the focus was on strengthening the balance sheet and managing down a substantial portfolio of impaired loans. The Bank continued to make progress during 2014 in strengthening systems, controls, enhancing risk management, corporate governance and also in improving product offerings and delivery channels. This progress is also being recognized by the international credit rating agencies. During 2014, Moody’s upgraded Gulf Bank long term Global recognition Significant upgrades were made within the IT department to both improve the existing infrastructure and upgrade the technology. A strategic plan aimed at delivering a robust capability in terms of Infrastructure, Governance, Solution Delivery and Security Framework was also launched. Gulf bank continues to invest in youth, entrepreneurship and talent development in the local community through its Corporate Social responsibility initiatives by participating in programs such as INJAZ local and regional competitions, the Annual gathering of National Union of Kuwaiti Students - USA branch, as well as a wide variety of job shadowing programs. Our annual sponsorship of the memorial journey for pearl diving continues to strengthen our position as an integral part of the Kuwaiti society. Gulf Bank has numerous staff volunteers working together with our youth on various development programs throughout the year. With our relentless focus on talent; Gulf Bank places great value on its Human Resources and continuously delivers exceptional initiatives that help the progress and development of its staff. This was culminated with the launch of Durrat Al-Khaleej training center early 2014 and the recent launch of a customized Graduate Development Program in collaboration with Gulf states may need to rethink policy: Qatar CB DUBAI: Gulf Arab oil states may need to rethink longstanding economic policies, including their fixed exchange rates, over the next five to 10 years as economic cycles in the region and the United States diverge, a senior Qatar central bank official said in a research paper. The six nations in the Gulf Cooperation Council (GCC) have pegged their currencies to the US dollar or in the case of Kuwait, a peg to a basket of currencies that is believed to be dominated by the dollar - to stabilize them. But in recent years the GCC economies have moved more out of sync with the United States, as the pegs press GCC policymakers to mirror the US central bank’s decisions even if trends at home call for the contrary. As long as they have currency pegs to the dollar, the Gulf States could face destabilizing capital outflows or inflows if they allow large interest rate gaps to open up with the United States - but raising interest rates while Gulf economies are slowing could hurt growth further. GCC economies performed well during much of the global financial crisis as the US economy slumped. Now, the US economy is expanding strongly as GCC economies risk slowing because of the plunge of oil prices. Markets believe the Federal Reserve may start raising interest rates this year, and this “is coming at the wrong time for the GCC countries. There is considerable uncertainty here with the oil price and the Fed,” Khalid Alkhater, the Qatar Central Bank’s Director of Research and Monetary Policy, said in a research paper seen by Reuters. “If the low oil price persists in the medium term and the Fed starts to raise interest rates, that might contribute to economic slowdown in the GCC. But it depends on the pace of the tightening process, how fast and how persistent they will be.” Alkhater stressed in the paper, presented at the Arab Centre for Research and Policy Studies in Doha, that it represented his personal academic view as a monetary policy specialist, and not the official view of Qatar’s central bank in any way. Rate question The Brent oil price has tumbled nearly $70 since June to nearly six-year lows below $50 per barrel, clouding the outlook for the GCC states, where government income from hydrocarbon sales powers economic growth. “Low enough oil prices - below the average break-even price for GCC budgets - for a long enough period - spanning the medium term through 2017 or beyond - can aggravate the status of the cycles between the two sides i.e. widen the potential gap,” Alkhater said. Markets will watch the Fed’s interest rate-setting meeting yesterday and today this week to gauge its resolve to start raising rates mid-way through the year, as consumer prices have dropped despite strong economic momentum. “Qatar still has space over the short run to keep interest rates at the current level, even after the Fed starts to raise rates, since it kept its rate much higher than the Fed policy rate,” Alkhater said. Qatar’s central bank has kept its key overnight deposit rate at 0.75 percent since August 2011, above the Fed funds target rate of 0-0.25 percent. Alkhater said, however, that GCC central banks would ultimately follow the Fed under any scenario, as they had always done in the past. “ This more than fourdecades-old uni-instrument, uni-tool macropolicy framework, in my opinion, is no longer suitable to manage the economic c ycle in today ’s GCC economies, because we apparently keep missing the cycle. And it looks like the sync with the US is going to weaken further and further.” —Reuters the Institute of Banking Studies (IBS). The program focuses on the development of local talent and aiming at creating a pool of holistic bankers and leaders of the future During 2014, the bank was honored with prestigious awards and accolades’, including ‘Bank of the Year’ award from Arabian Business, ‘Best Retail Bank in Kuwait’ award from International Finance Magazine, the ‘Best Domestic Payments and Cash Management Bank in Kuwait’ by Asian Banker, ‘Best Domestic Retail Bank’ and ‘Best Human Resources Development’ awards for 2014 from Banker Middle East, ‘HR Professional of the Year’ award for the private sector at the 6th Annual MENA HR Excellence Awards, the ‘Best Customer Experience Overall Branch in Kuwait’ award from Ethos Integrated Solutions (Ethos) at the 10th Annual Customer Experience Benchmarking Index and STP Award from Citibank. Omar Kutayba Alghanim, Gulf Bank’s Chairman concluded: “I can confidently say that Gulf Bank has culminated its transition and has started a new path after completing its recovery. It is now time to thank our Customers, employees, Central Bank, Board of Directors, Shareholders and Public Authorities for supporting this successful turnaround that has been meticulously executed. Far seem today the difficult times when our NPL’s reached 30 percent. Now we have all the elements in place to grow better and faster, as we have started to do in 2014 when we launched significant initiatives that will mature and be announced during the course of 2015. We have the , governance, staff , financials, risk procedures, systems and clarity of ideas to execute. During 2015 Gulf Bank will culminate projects that will help us to serve our clients better, and provide better results.” Currency shifts eating into fuel-cost benefits: Emirates DUBAI: Dubai’s Emirates airline expects currency fluctuations in Europe and Russia to limit the profitability boost from lower oil prices, a senior executive said yesterday. Emirates President Tim Clark was quoted this week as saying that the drop in oil prices-down by about 60 percent since last June-would be “a huge boost” to the airline’s 2014 earnings and would offset disruption from runway work at its home airport and a decline in business with Russia. The Dubai carrier is one of the few major airlines that does not hedge its fuel bill by buying future stocks of jet fuel to minimise the effect of price spikes, meaning that it benefits from price falls immediately. “We don’t hedge and that’s helping us a lot in the short term,” Sheikh Majid Al-Mualla, the airline’s divisional senior vice president of commercial operations, said at a conference in Dubai. However, Mualla said that the benefits will be partially offset by currency fluctuations in the ruble and the euro over the longer term, without offering any specific forecasts. The ruble has almost halved against the dollar since July as oil prices fell and the West imposed sanctions on Russia over its role in the Ukraine crisis. Meanwhile, the European Central Bank’s introduction of a massive bond-buying program to stimulate the euro zone economy and worries over whether Greece’s new government will stick to the terms of the country’s bailout, pushed the euro to an 11-year low against the dollar at $1.1098 on Monday. — Reuters

© Copyright 2026