Woori Daily Jan 29 2015.pub

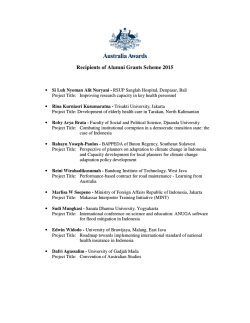

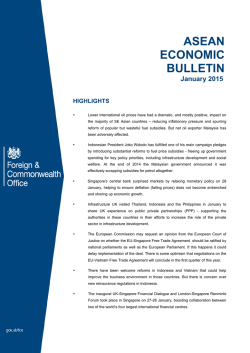

Thursday January 29 2015 Morning Brief Daily IHSG (Jakarta Composite Index) January 28 5268.85 Chg ‐8.30 pts (‐0.16%) Volume (bn shares) 5.83 Value (IDR tn) 5.59 Adv 152 Dec 301 Unc 99 Untr 151 Indonesian Market Daily Foreign Transac on (IDR bn) 2,327 Buy 2,751 Sell (424) Net Buy (Sell) Top Net Buy NB Val. Top Net Sell NS Val. BBNI 87.2 BBRI 105.2 BMRI 45.1 PGAS 61.9 ASII 37.3 TLKM 37.5 INTP 24.3 INDF 35.8 SMRA 22.8 BBTN 18.9 LQ‐45 Index Top Gainers & Losers Gainers SMRA LPPF WIKA PTBA BBTN % 2.8% 2.0% 1.2% 1.1% 1.0% Losers BSDE BDMN TAXI TBIG AALI % ‐5.2% ‐4.5% ‐4.2% ‐3.6% ‐2.5% Government Bond Yield & FX Tenor: 10 year USD/IDR KRW/IDR Last Chg. 7.1605% ‐0.58% 12,487.00 11.51 0.14% ‐0.29% Global Indexes Index Last Chg. % Dow Jones 17,191.37 (195.84) ‐1.13% S&P 500 2,002.16 (27.39) ‐1.35% Nasdaq 4,637.99 (43.50) ‐0.93% FTSE 100 6,825.94 14.33 0.21% CAC 40 4,610.94 (13.27) ‐0.29% DAX 10,710.97 82.39 0.78% Nikkei 17,795.73 27.43 0.15% Hang Seng 24,861.81 54.53 0.22% S&P/ASX 200 5,547.23 45.41 0.83% CSI 300 3,525.32 (49.61) ‐1.39% KOSPI 1,952.40 16.72 0.86% Source: Win Direct Pro JCI ‐ daily charts Source: Win Direct Pro Indonesian Market Recap: JCI closed slightly lower yesterday as the investor cau ously waited for FOMC mee ng. Top losers: Finance (‐0.70%), Agri (‐0.54%), Consumer (‐0.49%). Today’s Outlook For today we expect JCI to move slightly lower within support range 5228‐5244 and resistance range 5281‐5303. JCI on the short‐term period is in sideways pa ern, moving in window gap area of 5268‐5281. It seems that JCI will wait for significant catalyst domes cally or globally to move far from the window gap area. For today we an cipate oil prices decline to below USD per barrel will de‐ press JCI, especially commodi es sector. Global Market United States US market ended lower last night as energy sector led the losses a er crude oil hit lowest level since March 2009. Europe European market closed mixed yesterday with pressure came from slump in Greek banking stocks, as an impact of Syriza party won in elec on. Asia Asian market ended mixed yesterday as investor focused on the US Federal Re‐ serve’s mee ng, to obtain hint about me of interest rate hike. Daily Recommenda on (details on the next page) Trading Buy: TLKM, SMRA, LPCK Daily News SSIA AALI KLBF LPKR : Targe ng IDR 4.1 trillion of new contracts : CPO produc on grows 13 percent in 2014 : Will construct Biotechnology Factory : Started project valued IDR 200 trillion Supplements BKPM: 2014 investment realiza on at IDR 463.1 trillion The Fed will remain be pa ent Indonesia Economic Data Commodity Price Commodity JCI ‐ Intraday Last Chg. % Monthly Indicator Gold ($/troy oz.) 1,284.49 (7.85) ‐0.61% BI Rate Crude Oil ($/bbl) 44.45 (1.78) ‐3.85% Gas ($/mmbtu) 2.84 (0.09) Last Prev. Quarterly Indicator Last Prev. 7.75% 7.75% FX Reserve (USD bn) 111.86 111.14 Real GDP 5.01% 5.12% Current Acc (USD bn) (6.84) (8.69) ‐3.17% Trd Balance (USD bn) ‐0.43 0.02 Govt Spending Yoy 4.37% ‐0.71% Exports Yoy ‐14.57% ‐2.23% FDI (USD bn) 5.48 5.00 107.24 106.00 116.50 119.80 Nickel LME ($/MT) 14,993 262.50 1.78% Tin LME ($/MT) 19,201 (70.00) ‐0.36% Imports Yoy ‐7.31% ‐2.21% Business Confidence CPO (MYR/Ton) 2,178 6.00 0.28% Infla on Yoy 8.36% 6.23% Cons. Confidence PT Woori Korindo Securi es Indonesia — Daily Morning Brief | www.woorisec.com Page 11 Stocks Recommenda on TLKM Analysis We see white candles ck a er long‐legged hammer candles ck, indica ng confirmed bull‐ ish reversal. Price rebound near its MA50 and MA100 line. Range 2820‐2905 Ac on Trading buy as price above 2795 Source: Win Direct Pro SMRA Analysis We see white candles ck a er spinning can‐ dles ck, indica ng confirmed bullish reversal. Price rebound on its MA20 or middle bollinger line. Range 1605‐1715 Ac on Trading buy as price above 1605 Source: Win Direct Pro LPCK Analysis We see white candles ck, a er three consecu‐ ves small candles ck, formed three black crows pa ern, indica ng bullish con nua on possibility. Stochas c shows golden cross. Range 11125‐11850 Ac on Trading buy as price above 11125 Source: Win Direct Pro Daily News SSIA : Targe ng IDR 4.1 trillion of new contracts Industrial estate developer and construc on company, PT Surya Semesta Internusa, Tbk is targe ng IDR 4.1 trillion of new contracts this year. This new contracts target is also considering contracts from its subsidiary. The company es ‐ mated that this target is 28.39 percent higher than last year new contracts at IDR 3.2 trillion. Last year new contracts was 31 percent lower than 2013 new contracts due to elec on event that hampered construc on demand. AALI : CPO produc on grows 13 percent in 2014 CPO producer, PT Astra Agro Lestari, Tbk reported that its produc on output grows 13 percent in 2014. Total produc‐ on in 2014 is reported at 1.74 million ton, higher than 2013 realiza on at 1.54 million ton. Biggest contribu on comes from Kalimantan area that grows 16.8 percent into 2.35 mil‐ lion ton. KLBF : Will construct Biotechnology Factory Pharmacy producer, PT Kalbe Farma will construct biotech‐ nology factory valued IDR 400 billion. The company now is focusing to decide factory’s loca on and produc on capaci‐ ty. This new factory will supply raw materials from living cell such as from human, animals, and plant. The company sees that demand for products from biotechnology is promising in the future. LPKR : Started project valued IDR 200 trillion Property developer, PT Lippo Karawaci, Tbk started its first phase of mega project called Millenium Village‐The Global Smart City. This project is located in central business district (CBD) in Township Lippo Village, Karawaci, Tangerang. This project is valued IDR 200 trillion with the concept is integrat‐ ed city with green environment balancing high‐rise building. PT Woori Korindo Securi es Indonesia — Daily Morning Brief | www.woorisec.come 2 Page 22 Technical Indicators Ticker IHSG Support S3 S2 Resistance S1 R1 R2 R3 5,295 5,246 5,255 5,262 5,279 5,288 AALI 22,825 23,250 23,575 24,325 24,750 LSIP 1,778 1,801 1,818 1,858 1,881 SMA 5 MACD STOCHASTIC RSI LOWER MIDDLE UPPER BOLLINGER BAND BOLLINGER BAND BOLLINGER BAND POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 5,123 5,211 5,299 25,075 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 23,312 24,635 25,958 1,810 1,923 2,035 1,059 Agriculture 1,898 NEGATIVE NEGATIVE OVERSOLD NEAR OVERBOUGHT Mining ADRO 975 985 990 1,005 1,015 1,020 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 927 993 HRUM 1,633 1,644 1,653 1,673 1,684 1,693 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 1,662 1,721 1,780 ITMG 14,838 14,994 15,163 15,488 15,644 15,069 15,824 15,813 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 14,314 INCO 3,500 3,528 3,550 3,600 3,628 3,650 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 3,324 3,505 3,686 TINS 1,158 1,164 1,168 1,178 1,184 1,188 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 1,158 1,189 1,221 Basic Industries CPIN 3,955 3,965 3,980 4,005 4,015 4,030 POSITIVE POSITIVE OVERBOUGHT NEAR OVERBOUGHT 3,694 3,850 4,006 MAIN 2,123 2,139 2,153 2,183 2,199 2,213 POSITIVE POSITIVE OVERBOUGHT NEAR OVERBOUGHT 1,905 2,049 2,194 JPFA 855 870 880 905 920 930 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 872 918 963 INTP 22,663 22,769 22,888 23,113 23,219 21,659 23,766 25,873 23,338 SMCB 1,923 1,941 1,963 2,003 2,021 SMGR 14,288 14,356 14,413 14,538 14,606 14,663 WTON 1,320 1,333 1,340 1,360 1,373 1,380 7,663 7,719 7,788 7,913 7,969 POSITIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 2,043 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 1,868 2,083 2,299 13,728 15,390 17,052 NEAR OVERBOUGHT 1,258 1,313 1,368 8,038 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 6,746 7,386 8,026 POSITIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT POSITIVE POSITIVE OVERBOUGHT Misc. Industries ASII Consumer AISA 1,980 2,010 2,085 2,190 2,220 ICBP 13,863 14,181 14,363 14,863 15,181 INDF 7,238 7,319 7,363 7,488 7,569 ROTI 1,370 1,380 1,395 1,420 1,430 56,163 56,606 56,813 57,463 57,906 GGRM KLBF 1,810 1,828 1,840 1,870 1,888 UNVR 34,788 35,006 35,263 35,738 35,956 2,295 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 2,012 2,098 2,184 11,849 13,434 15,019 7,613 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 6,868 7,348 7,827 1,445 NEAR OVERBOUGHT 1,240 1,332 1,424 58,113 POSITIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 54,550 59,590 64,630 1,900 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 15,363 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT POSITIVE POSITIVE 36,213 NEGATIVE POSITIVE OVERBOUGHT OVERBOUGHT NEAR OVERBOUGHT 1,761 1,814 1,867 30,882 33,630 36,378 Property ASRI 568 576 583 598 606 613 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 555 582 608 BEST 695 703 710 725 733 740 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 706 731 756 BSDE 1,873 1,911 1,938 2,003 2,041 2,068 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 1,824 1,981 2,138 CTRA 1,410 1,415 1,425 1,440 1,445 1,455 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 1,272 1,392 1,512 CTRP 808 811 818 828 831 LPKR 1,050 1,063 1,075 1,100 1,113 PWON ADHI 481 483 486 491 493 3,548 3,579 3,603 3,658 3,689 838 NEGATIVE NEGATIVE 1,125 NEAR OVERBOUGHT 804 842 880 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT OVERSOLD 974 1,038 1,102 457 503 550 3,713 496 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT POSITIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 3,409 3,547 3,685 POSITIVE NEGATIVE PTPP 3,703 3,726 3,758 3,813 3,836 3,868 NEAR OVERBOUGHT 3,513 3,677 3,840 TOTL 1,083 1,091 1,098 1,113 1,121 1,128 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT OVERBOUGHT 1,065 1,121 1,176 WIKA 3,535 3,573 3,610 3,685 3,723 3,760 POSITIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 3,524 3,622 3,719 WSKT 1,578 1,599 1,618 1,658 1,679 1,698 POSITIVE POSITIVE OVERBOUGHT OVERBOUGHT 1,352 1,481 1,609 POSITIVE POSITIVE OVERBOUGHT Infrastructure EXCL 4,830 4,860 4,890 4,950 4,980 5,010 NEAR OVERBOUGHT 4,340 4,688 5,037 TLKM 2,798 2,811 2,828 2,858 2,871 2,888 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 2,794 2,850 2,906 PGAS 5,150 5,175 5,200 5,250 5,275 5,300 NEGATIVE NEGATIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 5,064 5,600 6,136 JSMR 6,938 6,981 7,038 7,138 7,181 7,238 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 6,905 7,024 7,143 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 13,306 Finance BBCA 12,963 13,056 13,138 13,313 13,406 13,488 BBNI 6,025 6,100 6,150 6,275 6,350 6,400 BBRI 11,438 11,556 11,688 11,938 12,056 BBTN 970 985 995 1,020 1,035 BMRI 10,763 10,869 10,963 11,163 11,269 12,856 13,081 NEAR OVERBOUGHT 5,910 6,069 6,228 12,188 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 11,372 11,706 12,040 POSITIVE POSITIVE 1,045 NEGATIVE NEGATIVE OVERBOUGHT OVERSOLD OVERSOLD 11,363 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 969 1,134 1,298 10,535 10,884 11,232 Trade AKRA 4,530 4,563 4,585 4,640 4,673 4,695 POSITIVE POSITIVE OVERBOUGHT NEAR OVERBOUGHT 4,221 4,502 4,783 UNTR 17,838 17,944 18,063 18,288 18,394 18,513 POSITIVE POSITIVE OVERBOUGHT NEAR OVERBOUGHT 16,598 17,323 18,047 ACES 718 726 743 768 776 793 ERAA 1,165 1,183 1,195 1,225 1,243 1,255 LPPF 14,613 14,906 15,163 15,713 16,006 16,263 MPPA 3,500 3,525 3,555 3,610 3,635 3,665 POSITIVE POSITIVE OVERBOUGHT OVERBOUGHT 920 945 970 1,020 1,045 1,070 POSITIVE POSITIVE OVERBOUGHT 3,428 3,469 3,508 3,588 3,629 TELE SCMA BHIT BMTR 273 277 280 287 291 1,740 1,770 1,810 1,880 1,910 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 675 753 832 POSITIVE POSITIVE NEAR OVERBOUGHT 988 1,103 1,217 POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 13,789 14,835 15,881 2,706 3,082 3,459 NEAR OVERBOUGHT 876 928 979 3,668 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 3,147 3,409 3,670 294 OVERBOUGHT POSITIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 268 281 295 1,950 NEGATIVE POSITIVE NEAR OVERBOUGHT NEAR OVERBOUGHT 1,283 1,699 2,114 PT Woori Korindo Securi es Indonesia — Daily Morning Brief | www.woorisec.come 3 Page 33 Fundamental Ra os Ticker 12 Month Consensus Return Target Price Potential IHSG 5,635 6.96% Market Cap (trillion IDR) PE (x) PBV (x) ROE (%) DER 52 Week High 52 Week Low YTD Return (%) 1 Year Return 4,981.4 23.3 2.4 12.59% 0.67 5,325 4,294 0.80% 21.36% 0.27 29,850 19,250 ‐2.37% 10.50% 2,480 1,600 ‐2.38% 12.84% Agriculture AALI 27,170 14.76% 37.3 13.4 3.4 28.06% LSIP 2,193 18.85% 12.6 12.3 1.8 15.44% ‐ Mining ADRO 1,209 21.54% 31.8 9.5 0.9 9.64% HRUM 1,319 ‐21.04% 4.5 14.6 1.2 8.02% 0.70 1,390 880 ‐4.33% 6.42% ‐ 2,565 1,410 0.60% ‐30.85% ITMG 21,333 38.52% 17.4 6.6 1.4 21.63% INCO 4,513 26.77% 35.4 22.9 1.5 6.78% 0.13 ‐ 30,250 14,275 0.16% ‐40.19% 4,575 2,230 ‐1.79% TINS 1,445 22.98% 8.8 12.6 1.8 14.88% 49.89% 0.28 1,595 848 ‐4.47% 34.27% CPIN 4,434 11.26% 65.3 32.1 6.0 MAIN 2,734 25.68% 3.9 210.1 3.3 19.85% 0.29 4,500 3,690 5.42% ‐0.38% 1.71% 1.13 3,715 1,910 2.11% ‐34.09% ‐35.38% Basic Industries JPFA 1,211 35.32% 9.5 61.3 2.0 3.19% 1.45 1,705 875 ‐5.79% INTP 25,361 10.27% 84.7 16.5 3.6 22.85% 0.01 27,500 20,000 ‐8.00% 8.24% SMCB 2,310 17.56% 15.1 16.3 1.7 10.64% 0.42 3,100 1,880 ‐10.07% ‐10.07% SMGR 16,588 14.60% 85.9 15.5 3.8 26.70% 0.19 17,400 13,500 ‐10.65% 3.39% 7,555 ‐3.46% 316.8 15.5 3.5 24.35% 0.61 8,100 6,225 5.39% 22.75% Misc. Industries ASII Consumer AISA 2,900 36.15% 6.9 18.3 2.4 14.12% 0.72 2,620 1,540 1.67% 35.67% ICBP 12,782 ‐13.05% 85.7 35.1 6.3 18.95% 0.15 16,050 9,800 12.21% 37.70% INDF 8,210 10.95% 65.0 18.0 2.6 15.11% 0.72 7,800 6,325 9.63% 6.47% ROTI 1,558 11.30% 7.1 35.6 7.8 24.50% 0.83 1,480 1,000 1.08% 35.92% GGRM 63,938 11.83% 110.0 21.4 3.5 17.14% 0.44 64,250 39,700 ‐5.81% 39.45% KLBF 1,786 ‐3.96% 87.2 42.2 9.9 24.94% 0.07 1,880 1,355 1.64% 32.38% UNVR 30,914 ‐12.92% 270.9 51.0 49.5 96.71% 0.23 36,275 27,000 9.91% 28.16% ASRI 606 1.81% 11.7 14.1 2.0 15.07% 0.86 680 430 6.25% 19.00% BEST 749 4.00% 6.9 12.8 2.5 21.87% 0.22 770 409 ‐1.37% 67.44% BSDE 2,165 8.79% 36.6 9.7 2.5 30.69% 0.31 2,185 1,330 10.25% 44.20% CTRA 1,431 0.07% 21.7 18.8 3.1 17.68% 0.28 1,540 805 14.40% 75.46% Property CTRP 820 0.00% 5.0 16.4 1.2 7.52% 0.45 905 650 ‐2.96% 23.31% LPKR 1,222 12.07% 25.2 18.1 1.7 10.10% 0.55 1,295 885 6.86% 16.58% 553 12.76% 23.6 15.2 4.7 36.08% 0.43 555 297 ‐4.85% 61.72% 3,518 ‐3.36% 6.6 20.0 4.3 23.12% 0.94 3,775 1,680 4.60% 112.24% 195.72% PWON ADHI PTPP 3,842 1.10% 18.4 37.4 8.6 25.07% 0.77 3,850 1,245 6.29% TOTL 1,108 ‐0.20% 3.8 23.4 5.0 22.11% 0.11 1,210 650 ‐0.89% 65.67% WIKA 3,616 ‐1.60% 22.6 38.8 5.4 16.60% 0.37 3,895 1,840 ‐0.14% 97.58% WSKT 1,349 ‐17.77% 16.0 41.7 6.6 16.77% 0.68 1,660 505 11.56% 218.45% 33.58% Infrastructure TLKM 3,006 5.64% 286.8 19.0 4.3 23.94% 0.24 3,010 2,095 ‐0.70% PGAS 6,324 21.03% 126.7 11.6 3.9 32.86% 0.39 6,225 4,390 ‐12.92% 13.59% JSMR 7,526 5.63% 48.5 33.4 4.9 15.37% 1.06 7,250 4,750 1.06% 38.35% BBCA 13,171 ‐0.79% 327.3 20.3 4.4 23.71% 0.11 13,575 9,700 1.14% 32.75% BBNI 6,553 6.12% 115.2 11.4 2.1 19.95% 0.59 6,300 4,125 1.23% 42.61% BBRI 12,837 9.72% 288.6 11.9 3.0 27.43% 0.59 12,200 8,050 0.43% 43.12% BBTN 1,195 18.36% 10.7 8.5 0.9 11.02% 1.63 1,525 890 ‐16.18% 12.22% BMRI 11,880 8.25% 256.1 12.9 2.6 22.19% 0.45 11,375 8,150 1.86% 32.63% Finance Trade AKRA 5,076 9.87% 18.1 25.6 3.5 14.17% 0.96 5,825 3,950 12.14% 10.26% UNTR 20,368 11.91% 67.9 10.9 1.9 18.46% 0.11 25,350 16,425 4.90% ‐2.67% ACES 884 17.06% 12.9 22.8 5.9 29.04% 0.02 1,025 675 ‐3.82% 2.03% ERAA 1,233 2.34% 3.5 12.0 1.2 10.49% 0.43 1,665 950 10.55% 7.11% MPPA 3,478 ‐2.32% 19.1 40.1 7.2 16.43% 0.02 3,665 1,900 16.72% 80.25% TELE 1,083 6.20% 7.2 17.7 3.0 17.74% 1.05 1,020 670 9.68% 47.83% SCMA 3,590 1.12% 51.9 35.9 16.8 49.24% 0.00 4,200 2,410 1.43% 38.94% BMTR 2,113 15.75% 25.9 37.0 2.3 6.35% 0.32 2,500 1,375 28.07% ‐0.27% PT Woori Korindo Securi es Indonesia — Daily Morning Brief | www.woorisec.come 4 Page 44 Global Economic Calendar Date Monday 26‐Jan Tuesday 27‐Jan Hour Event Jakarta JPN 6:50 AM Trade Balance (JPY Tn) GER 4:00 PM Ifo Business Climate Euroope All Day Eurogroup Mee ngs Country CHN GBR Europe USA USA USA USA 9:00 AM 4:30 PM All Day 8:30 PM 8:30 PM 10:00 PM 10:00 PM CB Leading Index Preliminary GDP ECOFIN Mee ngs Core Durable Goods Orders Durable Goods Orders CB Consumer Confidence New Home Sales (in '000) Wednesday 28‐Jan GER 2:00 PM GfK German Consumer Climate Thursday 29‐Jan USA USA JPN GER USA USA 2:00 AM 2:00 AM 6:50 AM All Day 8:30 PM 10:00 PM FOMC Statement Federal Funds Rate Retail Sales German Preliminary CPI Unemployment Claims Pending Home Sales JPN JPN JPN Europe Europe Europe Europe USA USA USA 6:30 AM 6:30 AM 6:50 AM 2:00 PM 5:00 PM 5:00 PM 5:00 PM 8:30 PM 9:45 PM 9:55 PM Household Spending Tokyo Core CPI Preliminary Industrial Produc on German Retail Sales CPI Flash Es mate Core CPI Flash Es mate Unemployment Rate Advance GDP Chicago PMI Revised UoM Consumer Sen ment Friday 30‐Jan ‐0.71 106.7 Consen‐ sus ‐0.74 106.7 ‐0.93 105.5 Dec q4 14 1.1% 0.50% 0.60% 0.80% 0.70% m/m m/m Index m/m Dec Dec Jan Dec ‐0.80% ‐3.40% 102.9 481 0.60% 0.60% 95.7 452 ‐0.70% ‐0.90% 92.6 438 Index Jan 9.3 9.2 9.0 Period Actual m/m Index Dec Jan m/m q/q 8x a year m/m Dec m/m Jan w/w w4 Jan m/m Dec m/m m/m m/m m/m y/y y/y m/m q/q Index Index Dec Jan Dec Dec Jan Jan Dec q4 14 Jan Jan Prev < 0.25% < 0.25% 1.10% 0.50% ‐0.80% 0.00% 301 307 0.60% 0.80% ‐2.30% ‐2.50% 2.20% 2.30% 1.30% ‐0.60% 0.40% 1.00% ‐0.50% ‐0.20% 0.60% 0.70% 11.50% 11.50% 3.10% 5.00% 58.1 58.3 98.5 98.2 Supplement: Global & Local Events BKPM: 2014 investment realiza on at IDR 463.1 trillion Indonesia Investment Coordina ng Board Official (Badan Koordinasi Penanaman Modal or BKPM) reported that investment realiza on for the period of January to December 2014 at IDR 463.1 trillion (USD 37.09 billion). This number exceed the target at IDR 456.6 trillion, and also grew 16.2 percent compared to 2013 realiza on. Domes c investment realiza on in 2014 reached IDR 156.1 trillion, 21.8 percent higher than previous year, while foreign investment reached IDR 307 trillion, increased 13.5 per‐ cent. Franky Sibarani, chief of BKPM stated that although the realiza on exceeded the target, but this number was not overly encouraging as in 2014 investor was on wait and see due to elec on event. The Fed will remain be pa ent From the Federal Open Market Commi ee (FOMC) statement released last night, the US Federal Reserve indicated that it would be pa ent on raising rates and assessed that US economy going stronger. FOMC said that the Commi ee judges that it can be pa ent in beginning to normalize the stance of monetary policy. This language essen ally was the same as the previous month’s statement, but it “dropped considerable me” words. The Fed also stated that infla on may con nue decline, but it expected to improve in the medium term as the improved labor market and declining energy prices. PT Woori Korindo Securi es Indonesia — Daily Morning Brief | www.woorisec.come 5 Page 55 Disclaimer & Contacts Research Team: Reza Priyambada Bagus Permadi [email protected] [email protected] Raphon Prima [email protected] DISCLAIMER This report, and any electronic access to it, is restricted to and intended only for clients of PT Woori Korindo Securi es Indonesia or a related en ty to PT Woori Korindo Securi es Indonesia. This document is for informa on only and for the use of the recipient. It is not to be reproduced or copied or made available to others. Under no circumstances is it to be considered as an offer to sell or solicita on to buy any security. Any recommenda on contained in this report may not to be suitable for all investors. Moreover, although the informa on con‐ tained herein has been obtained from sources believed to be reliable, its accuracy, completeness and reliability cannot be guaranteed. We expressly disclaim any responsibility or liability (express or implied) of P.T. Woori Korindo Securi es Indonesia, its affiliated companies and their respec ve employees and agents whatsoever and howsoever arising (including, without limita on for any claims, proceedings, ac on, suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of ac ng in reliance upon the whole or any part of the contents of this report and neither PT Woori Korindo Securi es Indonesia, its affiliated companies or their respec ve employees or agents accepts liability for any errors, omissions or misstatements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. All rights reserved by PT Woori Korindo Securi es Indonesia PT. Woori Korindo Securi es Indonesia Member of Indonesia Stock Exchange Head Office : Wisma Korindo 7th Floor Jl. M.T. Haryono Kav. 62 Pancoran, Jakarta 12780 Indonesia Telp: +62 21 7976202 Fax : +62 21 7976206 Branch Office Pluit: Jl. Pluit Kencana Raya Blok O No. 79 B‐C, Pluit Penjaringan Jakarta 14450 Indonesia Telp : +62 21 66675088 Fax : +62 21 66675092 Branch Office Solo : Jl. Ronggowarsito No. 8 Kota Surakarta Jawa Tengah 57111 Indonesia Telp: +62 271 664763 Fax : +62 271 661623 A Member of NongHyup Financial Group Seoul | New York | London | Hong Kong | Singapore | Shanghai | Beijing | Hanoi | Ho Chi Minh City | Jakarta PT Woori Korindo Securi es Indonesia — Daily Morning Brief | www.woorisec.com Page 66

© Copyright 2026