MARKET INSIGHTS - 2TradeAsia.com

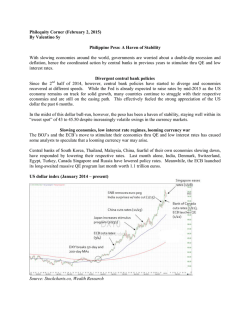

MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange T--BILL RATES Rates (as of 02 February 2015) Volume 06 February 2015 NEW YORK Dow Jones 91-day (+12.5bps) 182-day (-1.3bps) 364-day (+1.1bps) 1.541 1.758 8.00 6.00 Nasdaq Comp. S&P 500 1.947 6.00 Gold (US$/oz) Copper (c/lb) SLF (US$) PLDT (US$) Total Vol. Chg FOREX (Pbn) 20.00 Nym. crude ($/bl) 17,884.88 +211.86 Close 44.14 4,765.10 2,062.52 +48.40 +21.01 Open 44.14 1,263.90/1,264.40 -0.50 Average 44.13 261.20 unch. High 44.17 598,689 -0.03 Low 44.10 112,482 -1.26 32.90 (P1,452.21) 50.48 (P2,228.19) 50.48 +2.03 Vol.($mn) 621.50 P P MARKET COMMENTARY FOR 05 February 2015 Market Outlook for 06 February 2015 PSEi down @7,657 The local market pulled back after closing in the green in the previous session as it track Southeast Asian bourses in reacting to ECB’s tightening of Greek credit lines. PSEi fell 58 points at 7,657 (-0.76% day-on-day), led lower by property (-1.63%); industrials (-0.87%) & holdings (-0.77%). Among the day's actively-traded decliners were SM (-P9 at P896); TEL (-P4 at P3,082) & ALI (-P0.60 at P35.40). Declines edged out advancers 96-78 on P8bn turnover. Net foreign selling was P33mn. Positive developments abroad, such as the easing of concerns over Greece & the euro zone may support bullish sentiment in the market. Wall Street's overnight climb (Dow +211 points, Nasdaq +48) may spur some buying into local shares, easing concern aggressive bets made in previous sessions was overdone. Shares will continue to benefit from the low-cost oil environment as it remains in the $50/barrel area, providing continued reinforcement to the Philippine economic growth story. Immediate support is at 7,600, resistance is at 7,700. Asian equities down on Greek worry Asian equities fell as investors weighed the European Central Bank's (ECB) tightening of the terms of Greece's bailout. ECB restricted access to direct liquidity lines, citing concerns about the country's commitment to existing bailout pledges. China reduced the amount of cash banks must set aside as reserves by 50 basis points, joining more than a dozen global counterparts in easing monetary policy. China (Shanghai Comp -1.02% day-on-day, Shenzhen SE Comp -0.19%) led the region in declines, followed by Japan (-0.98%). CSI 300 Index (Shanghai Comp) Japan's Nikkei 225 Jakarta Composite Index Philippine Composite Index South Korea Composite Index Thailand Stock Exchange Singapore STI Index Shenzhen SE Composite Kuala Lumpur Composite Index Taiwan Stock Exchange Hong Kong Hang Seng Index 04 February Points Chg. 05 February 3,366.95 3,401.77 -34.82 17,504.62 17,678.74 -174.12 5,272.43 5,315.28 -42.85 7,674.24 7,716.06 -41.82 1,952.84 1,962.79 -9.95 1,592.57 1,599.81 -7.24 3,403.08 3,417.57 -14.49 1,526.11 1,529.04 -2.93 1,802.38 1,803.02 -0.64 9,512.05 9,513.92 -1.87 24,710.68 24,679.76 +30.92 %Change -1.02 -0.98 -0.81 -0.54 -0.51 -0.45 -0.42 -0.19 -0.04 -0.02 +0.13 Wall Street rallied US equities rallied as energy shares bounced with oil prices, while some euro zone concerns eased. Greece proposed a bridging program until the end of May to allow time for debt talks, vowing to do everything in its power to avoid default. Meanwhile, Pfizer would buy Hospira for $15bn to boost its portfolio of generic injectable drugs & copies of biotech medicines. Dow Jones Industrial Average (DJIA) closed 211 points higher at 17,884 (+1.20%). Nasdaq Composite added 48 points at 4,765 (+1.03%). The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange 06 February 2015 Crude up West Texas Intermediate (WTI) for March delivery rose $2.03 to $50.48/barrel on Nymex, showing volatile trading for the commodity after the Organization of Petroleum Exporting Countries (OPEC) decided in November to let rival products deal with a global surplus that is pegged at 2mn barrels/day. January inflation @ 2.4% Philippine Statistics Authority (PSA) said January inflation reached 2.4% against 2.7% in December & 4.2% in January last year. The lower inflation figure is attributed to a contraction in prices of housing, water, electricity, gas & other fuels, as well as transport. DOE plans to roll out Batman I before election season The Department of Energy (DoE) aims to bid out the construction of the natural gas pipeline Batman I, before the election ban on public spending by next year. The project will be under the Public-Private Partnership (PPP) scheme, & would depend on the recommendation from the feasibility study of the Japan International Cooperation Agency (JICA) on the Liquefied Natural Gas (LNG) industry. Batman I involves laying down 105km-long pipelines, to distribute gas from LNG terminals in Batangas to industrial customers in Manila. MNTC to finish NLEX-SCTEX integration by November Metro Pacific Investments (MPI) unit Manila North Tollways Corporation (MNTC) said it plans to start work on the integration of the North Luzon Expressway (NLEX) & the Subic-Clark Tarlac Expressway (SCTEX) next month, due November. MNTC will spend P650mn for the integration project, which will allow motorists to stop twice for toll payment, down from the existing 5 stops. TEL, via Smart, extended free internet PLDT (TEL) wireless service unit, Smart Communications, extended its free internet promo until 28 February. The promo allows pre-paid subscribers to access the internet without data charges, of up to 30MB daily, & was expanded to include video streaming. GLO to set up 4,300 sites Globe Telecom (GLO) is set to activate 4,300 cellular sites equipped with Long Term Evolution (LTE) technology, to beef up its mobile infrastructure in the country. GLO is continuously upgrading its network & expanding its LTE-Time Division Duplex (LTE-TDD) and LTEFrequency Division Duplex (LTE-FDD) footprint, to enhance the speed of data transfer, lower latency & increased overall network capacity. GLO earmarked $650mn for 2015 capex, with another $200mn spill over from last year’s capex. PSE officials on the road to market local businesses Christian Brothers Investment Services hosted Philippine Stock Exchange (PSE) chair Jose T. Pardo at a forum in Rome, attended by 80 superior generals & treasurers from Catholic institutions. They are interested in rebalancing their portfolios to include equities listed in Asia & ASEAN, including the Philippines. Philippine Corporate Day in Japan co-organized by PSE & DBP-Daiwa Capital Markets Philippines saw investor turnout increase 37% with fund houses present growing 58%. PBB with 116 branches for 2014 Philippine Business Bank (PBB) plans to continue its aggressive branch expansion program for 2015, after completing 116 branches (+16% year-on-year) for 2014. PBB will use unutilized branch licenses to increase coverage of the Small & Medium Enterprise (SME) market. The Bank is also looking for potential acquisitions as part of its inorganic growth strategy. CHIB to buy shares of Savings unit The board of China Banking Corp (CHIB) authorized the acquisition of 194 common & 100 preferred shares of unit, China Bank Savings, via negotiated transactions with interested selling shareholders, subject to compliance with the bank’s other requirements. VVT unit entered construction & commissioning deal for 6MW Hydro plant Vivant-Malogo Hydropower Inc (VMHI) signed a Contract for Engineering, Procurement, Construction & Commissioning (EPCC) with O. Sarmiento Construction Inc, for the 6MW run-of-the river Hydroelectric Power Plant, in Negros Occidental. VMHI is 67% owned by Vivant Corporation (VVT) unit, Vivant Energy. Unaudited Full Year 2014 (Pmn) Company Globe Telecom (GLO) RFM Corporation (RFM) Dividend Declaration Company Globe Telecom (GLO) 2014 14,500.00 863 Cash Div. P20.75 Stock Div. 2013 11,600.00 Ex – Date 13-Feb-15 % change +25.00 +10.00 Record Date 18-Feb-15 Date Payable 04-Mar-15 The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein.

© Copyright 2026