to see our latest Market Watch

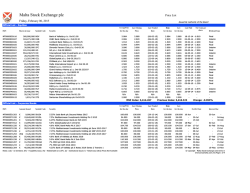

February 6, 2015 Global Markets Research Daily Market Highlights . Key Takeaways Overnight Economic Data MA US Investors turned to risk-off mode following ECB’s announcement to cut funding to debt-stricken Greece. The EU commission, ECB and IMF-collectively known as the troika- did not come to an agreement with Greece’s new government on conditions of the bailout. ECB will no longer take Greek bonds as collateral for cash. No surprises from BOE as the central bank maintained interest rate at 0.5% and asset purchase target at £375B.On the local front, Malaysia’s exports staged a surprised pick-up to increase 2.7% yoy in Dec, contributed by higher E&E exports and rebound in LNG shipment. Imports jumped 4.2% in Dec versus 0.1%, bringing trade balance to RM 9.2bn. EU UK Government Bond Yield USD weakened against 9 G10s overnight while the Dollar Index slipped to a 2-week low of 93.52, impacted by strong rallies in European majors, particularly EUR. We expect USD to stay soft going into employment data, with scope for a moderate / strong rally if US data outperforms. MYR weakened 0.33% to 3.5742 against USD on the back of renewed decline in oil prices, but narrowed its losses following better than expected Malaysian exports data. Overnight weaker USD should allow MYR to appreciate in early trading but we set sights on some weakness in later trading on paring of positions going into the weekend. MYR Govvies trading volume fell to about RM 4.8b with most benchmarks offered as sentiment remained dampened by sagging overnight markets. The 10y yield was traded higher by 1bp to 3.75% while yields on the 5y, 15y and 20y also gained 1bp each to 3.63%, 4.08% and 4.33% respectively. We expect yields to likely stay on the uptrend on expectations of MYR weakness tracking sliding oil prices as well as some position offloading going into the weekend. UST 3-year 3.49 5-year 3.63 7-year 3.68 10-year 3.75 15-year 4.08 20-year 4.33 30-year 4.59 2-year 0.52 5-year 1.30 10-year 1.82 30-year 2.43 Daily Supports - Resistances What’s Coming Up Next Major Data MA foreign reserves US change in nonfarm payroll, unemployment rate UK trade balance JP leading index S2 S1 Indicative R1 R2 Outlook EURUSD 1.1423 1.1460 1.1466 1.1478 1.1500 USDJPY 117.00 117.30 117.38 117.54 117.74 GBPUSD 1.5370 1.5320 1.5330 1.5344 1.5350 AUDUSD 0.7743 0.7800 0.7818 0.7825 0.7850 EURGBP 0.7442 0.7450 0.7478 0.7482 0.7500 USDMYR 3.5330 3.5421 3.5465 3.5550 3.5671 Major Events Nil EURMYR 4.0500 4.0575 4.0654 4.0707 4.0785 JPYMYR 3.0388 3.0127 3.0213 3.0310 3.0388 Bond Tender GBPMYR 5.4230 5.4332 5.4377 5.4400 5.4443 SGDMYR 2.6355 2.6380 2.6386 2.6410 2.6460 AUDMYR 2.7600 2.7696 2.7735 2.7800 2.7850 NZDMYR 2.6200 2.6233 2.6278 2.6300 2.6340 Nil = above 0.1% gain = above 0.1% loss Name Last Price DoD % YTD % 1803.0 1.2 2.4 17673.0 0.0 -0.8 WTI oil ($/bbl) S&P 500 2041.5 -0.4 -0.8 Brent oil ($/bbl) FTSE 100 6860.0 -0.2 4.5 Shanghai 3174.1 -1.0 24679.8 3417.6 KLCI Dow Jones Ind. Hang Seng STI Source: Bloomberg 1 Name CRB Index = less than 0.1% gain / loss Last Price DoD % YTD % 220.5 -3.0 -4.1 48.5 -8.7 -9.1 -5.5 54.2 -6.5 Gold (S/oz) 1264.8 -0.4 7.4 -1.9 CPO (RM/tonne) 2125.5 -2.6 -7.5 0.5 4.6 Copper ($/tonne) 5705.0 0.3 -9.4 0.3 1.6 Rubber (sen/kg) 365.0 1.4 -3.3 Macroeconomics Economic Data MA Exports YoY US Initial Jobless Claims US Trade Balance EU Markit Eurozone Retail PMI UK BOE Asset Purchase Target UK Bank of England Bank Rate UK Halifax House Price 3Mths/Year AU AiG Perf of Construction Index MA Exports YoY US Initial Jobless Claims US Trade Balance For Actual Last Survey Dec 31-Jan Dec Jan Feb 5-Feb 2.7% 278K -$46.6B 46.6 £375B 0.5% 2.1% 265K -$39.0B 47.6 £375B 0.5% 1.0% 290K -38.0B -£375B 0.5% Jan 8.5% 7.8% 7.7% Jan 45.9 44.4 Dec 31-Jan Dec 2.7% 278K -$46.6B 2.1% 265K -$39.0B 1.0% 290K -38.0B US data release were less upbeat today, as the number of newly unemployed climbed to 278,000 in the week ended 31 Jan compared to 265,000 in the previous week. Trade deficit widened to $46.6B in Dec from $39.0B in Nov, as imports grew due to the stronger USD. Data from UK mostly came with no surprises yesterday. The central bank will maintain the £375B asset purchase target, the same since July 2012. Also in line with expectation, BOE kept interest rate unchanged and accommodative at 0.5% as concern with low inflation persisted. To add to the string of recent solid data, house prices jumped 8.5% in Jan, beating the forecasted 7.7% and previous reading of 7.8%. ECB cut funding to Greece, pushing the burden of supporting the country’s banks back to Athens, as the central bank refuse to accept Greek bonds as collaterals for cashas Greece and the troika fail to come to an agreement on bailout terms. Separately, ECB highlighted falling oil prices as catalyst for growth in the latest economic bulletin, while some of the key challenges towards recovery of the 19 nation bloc were high unemployment, underutilized capacity and the necessary balance sheet adjustments in the private and public sectors. Market’s focus was on the troika and Greece, overshadowing eurozone’s modest Jan retail PMI of 46.6 as it declined against the 47.6 print recorded in Dec. Australia’s performance of construction index was up 45.9 in Jan versus 44.4 in Dec. The increase was contributed by higher employment (47.5 in Jan, 39.9 in Dec) and selling prices (46.0 in Jan, 42.5 in Dec) while slightly offset by the decline in capacity utilization (66.5 in Jan, 72.5 in Dec). Back home, exports staged a surprised pick-up to increase 2.7% yoy in Dec, contributed by higher E&E exports and rebound in LNG shipment. Imports increased at a much faster pace of 4.2% in Dec versus 0.1% in Nov, bringing trade balance to a narrower RM 9.2bn. Shipment to China contracted for six consecutive months but was offset by higher exports to the US (+RM1.3bn), EU (+RM1.2bn), South Korea. Spike in imports on consumption goods was likely boosted by seasonal demand. Source: Bloomberg Economic Calendar Release Date Country Date Event MA 02/06 Foreign Reserves US 02/06 Reporting Period Survey Prior Revised 30-Jan -- $111.2B -- Change in Nonfarm Payrolls Jan 230K 252K -- Unemployment Rate Jan 5.60% 5.60% -- 02/07 Consumer Credit Dec $15.000B $14.081B -- EU 02/09 Sentix Investor Confidence Feb -- 0.9 -- UK 02/06 Visible Trade Balance GBP/Mn Dec -£9100 -£8848 -- JP 02/06 Leading Index CI 02/09 Trade Balance CH 02/08 2 Dec -£1700 -£1406 -- Dec P 105.4 103.9 -- BoP Current Account Balance Dec ¥379.4B ¥433.0B -- Consumer Confidence Index Jan -- 38.8 -- Eco Watchers Survey Outlook Jan -- 46.7 -- Exports YoY Jan 5.5% 9.70% -- Forex Source: Bloomberg FX Table MYR Name Last Price DoD % High Low YTD % EURUSD 1.1477 1.16 1.1499 1.1304 -5.2 USDJPY 117.53 0.21 117.6 117.02 -1.9 GBPUSD 1.5328 0.96 1.5344 1.5167 -1.6 AUDUSD 0.7798 0.58 0.7825 0.7734 -4.6 EURGBP 0.7487 0.18 0.75104 0.7450 -3.6 USDMYR 3.5742 0.33 3.5915 3.5615 2.2 EURMYR 4.0652 -0.40 4.0717 4.0334 -4.4 JPYMYR 3.0415 0.13 3.0644 3.0363 4.1 GBPMYR 5.4417 0.77 5.4493 5.4055 -0.1 SGDMYR 2.6508 0.14 2.6622 2.6427 0.1 AUDMYR 2.7863 0.13 2.7901 2.7628 -2.8 NZDMYR 2.6396 0.00 2.6466 2.6199 -3.7 MYR depreciated 0.33% against the USD to 3.5742 yesterday, reversing gains from previous trading session supported by the rebound in oil price. Weakness of MYR persisted particularly against major currencies, with the exception of EUR. MYR strengthened against the USD in today’s open but we opine that reversal will likely take place in later trading session amid paring of positions ahead of the week’s close and US data tonight. USD USD weakened against 9 G10 on the back of rally in European majors, particularly that of EUR. The Dollar Index closed at its lowest in 2 week at 93.52, sliding through all sessions, most in European trading. Expect USD to soften up ahead of US employment data, carrying a slight overnight downside momentum; we caution that there is potential for a moderate / strong rally if US data outperforms. EUR EUR strengthened against 8 G10 and 1.16% against USD to 1.1477, led by improved sentiment in Greece following agreement by ECB to extend funding to Greek banks, potentially preventing an onset of another crisis. EURUSD is expected to carry an upside bias heading into European and MYR vs Major Counterparts (% DOD) EUR -0.40 JPY 0.13 AUD 0.13 SGD 0.14 USD HKD MYR Appreciated CHF MYR Depreciated 0.33 0.38 GBP strengthened 0.96% against a sliding USD to 1.5328, near 5-week high and advanced against 6 G10s on improved European sentiment. GBPUSD is slightly bullish in our view going into European and US trading, but we caution that solid US data would quickly dampen current strength. 0.57 CNY 0.00 GBP 0.33 GBP -0.50 US trading tonight but we caution that current optimism stemming from Greece is likely to be brief. Solid US data would quickly overturn EURUSD gains. 0.77 0.50 1.00 JPY JPY normalized 0.21% against USD to 117.53 and fell against all G10s following a decline in refuge demand as Europe rallied. We expect JPY to trade slightly bearish, as demand for the currency is likely to ebb following the cheer in Europe. AUD AUD rebounded to level seen in the beginning of the week at 0.7798, up 0.58% against a weak USD but was mixed against the G10s, outperformed by European majors. We expect AUD to trend slightly higher against a soft USD heading into US employment data. SGD SGD closed 0.26% higher against a soft USD yesterday but weakened against 8 G10, mostly offset by gains in European majors. We expect SGD to be slightly bearish as risk aversion will likely pick-up ahead of US employment data. 3 Fixed Income US T T e nure C lo s ing ( %) 2-yr UST 0.52 C hg ( bps ) -4 5-yr UST 1.30 -5 10-yr UST 1.82 -7 30-yr UST 2.43 -8 M GS US Treasuries G II* T e nure C lo s ing ( %) 3-yr 3.49 C hg ( bps ) 0 C lo s ing ( %) 3.71 C hg ( bps ) 0 5-yr 3.63 1 3.89 0 7-yr 3.68 0 3.98 0 10-yr 3.75 1 4.08 0 15-yr 4.08 1 4.36 0 20-yr 4.33 1 4.57 0 30-yr 4.59 0 MGS * M arket indicative levels M Y R IR S Le v e ls IR S C lo s ing ( %) 1-yr 3.71 2 3-yr 3.72 2 5-yr 3.80 1 7-yr 3.91 1 10-yr 4.00 4 UST rallied with following on the back of continued decline in oil prices as well as some refuge demand ahead of US employment data tonight. The 30y yield dropped 8bps, the most amongst the benchmark, to 2.43% while the 10y yield fell 7bps to 1.82%. The 2y and 5y benchmarks also gained, with yields settling at 1.30% (-5bps) and 0.52% (-4bps) respectively. Expect USTs to likely be supported ahead of US data. C hg ( bps ) Govvies trading volume fell to about RM 4.8b with most benchmarks offered as sentiment remained dampened by sagging overnight markets. The 10y yield was traded higher by 1bp to 3.75% while yields on the 5y, 15y and 20y also gained 1bp each to 3.63%, 4.08% and 4.33% respectively. We expect yields to likely stay on the uptrend on expectations of MYR weakness tracking sliding oil prices as well as some position offloading going into the weekend. So urce : B lo o mberg PDS/Sukuk Daily Trades Government Bonds Securities MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS MGS GII GII GII GII GII MGS GII 02/15 10/15 07/16 09/16 02/17 03/17 09/17 10/17 02/18 03/18 09/18 10/19 11/19 03/20 07/20 07/21 09/21 08/22 03/23 07/24 05/27 04/30 06/31 04/32 04/33 09/43 05/24 07/22 04/19 12/28 11/17 02/24 11/16 Closing Vol Previous YTM (RM mil) YTM 3.276 3.326 3.373 3.364 3.482 3.428 3.524 3.495 3.585 3.590 3.609 3.630 3.656 3.663 3.720 3.772 3.664 3.788 3.769 3.718 4.007 4.079 4.240 4.259 4.257 4.607 4.027 3.949 3.803 4.304 3.673 4.208 3.670 236 62 398 159 0 10 19 227 9 58 3 731 14 41 3 17 102 4 122 255 0 227 1 11 1 32 1042 891 60 40 20 80 10 4885 3.248 3.282 3.343 3.387 3.495 3.458 3.504 3.495 3.548 3.659 3.623 3.632 3.623 3.739 3.690 3.702 3.669 3.772 3.769 3.750 4.053 4.097 4.147 4.236 4.261 4.588 4.050 3.959 3.853 4.304 3.658 4.231 3.650 Source : BPAM 4 Previous Trade Date (dd/mm/yyyy) 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 04/02/2015 27/01/2015 04/02/2015 04/02/2015 29/01/2015 30/01/2015 Chg (bp) 3 4 3 -2 -1 -3 2 0 4 -7 -1 0 3 -8 3 7 0 2 0 -3 -5 -2 9 2 0 2 -2 -1 -5 0 2 -2 2 Trading volume remained thin with only RM 244m dealt, mostly unchanged. Gains were seen in Malaysia Airport Holdings’ 24, which fell 7bps to 5.53%, while IJM’ 20 shed 4bps to 4.52%. Other notable gainers include Danainfra’ 24 (-3bps to 4.34%) and Sarawak Energy’ 24 (-2bps to 4.75%), with other trades closing unchanged. Daily Trades: PDS / Sukuk Securities Rating Berjaya Land Berhad 12/17 AAA (FG) Silver Sparrow Berhad 04/16 AAA (BG) Cagamas MBS Berhad 05/22 AAA Mecuro Properties Sdn Berhad 07/15 AAA TNB Western Energy Berhad 01/30 AAA Malaysia Airports Capital Berhad 12/22 AAA Aquasar Capital Sdn Berhad 07/16 AAA Aquasar Capital Sdn Berhad 07/29 AAA CIMB Bank Berhad 09/18 AA1 Malayan Banking Berhad 01/19 AA1 Sarawak Energy Berhad 06/16 AA1 Sarawak Energy Berhad 07/24 AA1 Anjung Bahasa Sdn Berhad 06/15 AA1 CIMB Islamic Bank Berhad 09/17 AA+ Hong Leong Bank Berhad 06/19 AA2 PBFIN Berhad 06/19 AA2 Malaysia Airport Holdings Berhad 12/24 AA2 Golden Assets International Finance Limited 11/17 AA2 CIMB Thai Bank Public Company Limited 07/19 AA3 Hong Leong Bank Berhad 09/19 AA3 Prominic Berhad 05/16 AA3 CIMB Group Holdings Berhad 04/20 AA3 IJM Corporation Berhad 04/20 AA3 BGSM Management Sdn Berhad 12/15 AA3 Gamuda Berhad 03/18 AA3 Jimah Energy Ventures Sdn Berhad 11/20 AA3 Malakoff Power Berhad 12/15 AATropicana Corporation Berhad [fka Dijaya Corporation 11/17 Berhad]AA2 (BG) Projek Lebuhraya Usahasama Berhad 01/24 AAA Aman Sukuk Berhad 05/24 AAA Perbadanan Tabung Pendidikan Tinggi Nasional 03/24 GG Malaysia Debt Ventures Berhad 08/20 GG Pengurusan Air SPV Berhad 11/20 GG DanaInfra Nasional Berhad 07/24 GG Perbadanan Tabung Pendidikan Tinggi Nasional 08/21 GG Closing YTM 4.60 4.11 4.58 3.98 4.96 4.60 4.02 4.86 4.88 4.95 3.98 4.75 3.98 4.96 5.22 5.37 5.53 4.80 5.00 4.92 3.72 5.50 4.52 4.15 4.38 4.91 4.20 4.56 4.52 4.57 4.40 4.12 4.13 4.34 4.18 Vol (RM mil) Previous YTM 5 10 5 5 1 10 5 5 1 1 10 10 5 1 2 1 10 1 1 1 1 1 20 14 10 3 10 5 25 15 20 10 10 5 5 244 4.600 4.112 4.583 3.975 4.959 4.598 4.019 4.859 4.880 4.950 3.980 4.768 3.983 4.961 5.223 5.366 5.600 4.800 5.001 4.922 3.718 5.500 4.558 4.150 4.377 4.907 4.199 4.555 4.518 4.570 4.398 4.115 4.130 4.370 4.179 Previous Trade Date (dd/mm/yyyy) 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 28/01/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 26/01/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 26/01/2015 05/02/2015 04/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 05/02/2015 04/02/2015 05/02/2015 Chg (bp) 0 0 0 0 0 0 0 0 0 0 0 -2 0 0 0 0 -7 0 0 0 0 0 -4 0 0 0 0 0 0 0 0 0 0 -3 0 Spread Against IRS** 88 40.2 67.3 26.5 78.9 67.8 30.9 68.9 112 119 27 74.9 27.3 124.1 146.3 160.6 152.9 108 124.1 112.7 0.8 170.5 72.3 44 65.7 107.7 48.9 83.5 59.8 57 39.8 28.5 30 34 26.9 ** spread against nearest indicative tenured IRS Source : BPAM Market/Corporate News: What’s Brewing Construction based company Fututech Bhd will acquire a private construction company belonging to its executive chairma Tee Eng Ho for RM 400mil. The deal will be financed with shares and cash. Future profit for the next three years is forecasted to be RM 150million while order book will increase by RM 2 billion. Fututech provides products and services for construction and property sectors. Counting SP Setia Bhd and Eco World Development Bhd among their existing clients, the company was a former associate company of Eastern & Oriental Bhd. (Source: The Star Online) YNH Property Berhad entered into a memorandum of understanding (MoU) with Hilton Worldwide Manage Ltd, with the latter to manage a hotel at Menara YNH and would be branded “Hilton Kuala Lumpur City Centre and Residences”. YNH acquired a 1.2 ha freehold commercial site for RM 63 mill in July 2004. After two lapsed agreements, one with Singapore CapitaLand Ltd in Dec 2006 and the other with Kuwait Finance House (M) Bhd in Jan 2008, YNH latest development project would comprise of a hotel, offices, and retail outlets with gross development value of RM 3.4billion, according to the report on The Star. (Source: The Star Online) 5 Rating Actions Issuer PDS Description YTL Corporation Berhad Sources: RAM 6 Rating/Outlook Action RM 500m MTN programme (2004 / 2019) AA1 / Stable Reaffirmed for both Up to RM 2b MTN programme (2013 / 2038) AA1 / Stable Hong Leong Bank Berhad Fixed Income & Economic Research, Global Markets Level 6, Wisma Hong Leong 18, Jalan Perak 50450 Kuala Lumpur Tel: 603-2773 0469 Fax: 603-2164 9305 Email: [email protected] DISCLAIMER This report is for information purposes only and does not take into account the investment objectives, financial situation or particular needs of any particular recipient. The information contained herein does not constitute the provision of investment advice and is not intended as an offer or solicitation with respect to the purchase or sale of any of the financial instruments mentioned in this report and will not form the basis or a part of any contract or commitment whatsoever. The information contained in this publication is derived from data obtained from sources believed by Hong Leong Bank Berhad (“HLBB”) to be reliable and in good faith, but no warranties or guarantees, representations are made by HLBB with regard to the accuracy, completeness or suitability of the data. Any opinions expressed reflect the current judgment of the authors of the report and do not necessarily represent the opinion of HLBB or any of the companies within the Hong Leong Bank Group (“HLB Group”). The opinions reflected herein may change without notice and the opinions do not necessarily correspond to the opinions of HLBB. HLBB does not have an obligation to amend, modify or update this report or to otherwise notify a reader or recipient thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. HLB Group, their directors, employees and representatives do not have any responsibility or liability to any person or recipient (whether by reason of negligence, negligent misstatement or otherwise) arising from any statement, opinion or information, expressed or implied, arising out of, contained in or derived from or omission from the reports or matter. HLBB may, to the extent permitted by law, buy, sell or hold significantly long or short positions; act as investment and/or commercial bankers; be represented on the board of the issuers; and/or engage in ‘market making’ of securities mentioned herein. The past performance of financial instruments is not indicative of future results. Whilst every effort is made to ensure that statements of facts made in this report are accurate, all estimates, projections, forecasts, expressions of opinion and other subjective judgments contained in this report are based on assumptions considered to be reasonable as of the date of the document in which they are contained and must not be construed as a representation that the matters referred to therein will occur. Any projections or forecasts mentioned in this report may not be achieved due to multiple risk factors including without limitation market volatility, sector volatility, corporate actions, the unavailability of complete and accurate information. No assurance can be given that any opinion described herein would yield favorable investment results. Recipients who are not market professional or institutional investor customer of HLBB should seek the advice of their independent financial advisor prior to taking any investment decision based on the recommendations in this report. HLBB may provide hyperlinks to websites of entities mentioned in this report, however the inclusion of a link does not imply that HLBB endorses, recommends or approves any material on the linked page or accessible from it. Such linked websites are accessed entirely at your own risk. HLBB does not accept responsibility whatsoever for any such material, nor for consequences of its use. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This report is for the use of the addressees only and may not be redistributed, reproduced or passed on to any other person or published, in part or in whole, for any purpose, without the prior, written consent of HLBB. The manner of distributing this report may be restricted by law or regulation in certain countries. Persons into whose possession this report may come are required to inform themselves about and to observe such restrictions. By accepting this report, a recipient hereof agrees to be bound by the foregoing limitations. 7

© Copyright 2026