Download PDF - PineBridge Investments

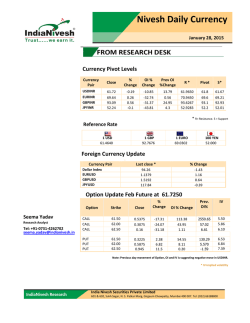

Emerging Market Debt: Fear Creates Opportunities But Pick Your Spots January 2015 STEVE COOK Managing Director, Senior Corporate Portfolio Manager, Emerging Markets Fixed Income A cocktail of uninspiring emerging market (EM) growth outlook and a strong US dollar means hard currency bonds are set to outperform local currency in 2015 even though the starting point is much more attractive for the latter. In an environment of moderately increasing US Treasury rates, the lower duration and higher spread cushion of EM corporates may help them to outperform ANDERS FAERGEMANN Managing Director, Senior Sovereign Portfolio Manager, Emerging Markets Fixed Income NATASHA SMIRNOVA Vice President, Product Specialist, Emerging Markets Fixed Income sovereigns where uncertainty over a number of special situations, including Ukraine, Venezuela, Argentina as well as exposure of some exporting nations, particularly in Africa, to lower commodity prices may weigh on returns. Ultimately though, getting China, Brazil and Russia developments right will be the biggest sway factor to return expectations and outperformance. Starting With Low Expectations In many ways 2015 does not offer a lot of promise for emerging markets. However, if we reflect on the outcome of 2014, that should leave us with a lot of hope. The main theme for 2015 should be structural reform but apart from Mexico, India and, we hope, Indonesia, the starting point for the market’s expectations for significant reforms is very low – leaving room for plenty of upside surprises. Countries such as India, Indonesia and Turkey saw considerable improvements in their current accounts. Although further improvements are needed, the market has already turned its focus to other issues, partly driven by the fact that inflows into emerging markets have been led by institutional investors with longer investment horizons than the retaildriven outflows of 2013. We expect this trend to continue in 2015 as the post-election political situation has improved in many EM countries. The reform drive and its relative success will determine each country’s attractiveness to foreign investors. India, and, to an even larger extent, Mexico have taken the lead in this particular race, although we do not underestimate the desire of new Indonesian President Jokowi to ruffle a few establishment feathers. Turkey is not on the list of potential reformers but Brazil has been added. The new economics team is yet to convince investors, but the first indication of policy moves towards adjusting deteriorating fiscal accounts are encouraging, much more is expected though. Controversially, even Russia may be pushed into the reform mode to diversify away from the oil sector that has maintained a steady 20-25% share of GDP over the last decade. External Factors To Drive Performance The external backdrop is likely to remain the main driver of EM returns. Yet, it has become increasingly clear that EM investors are able to distinguish This material must be read in conjunction with the disclosure statement. Any views represent the opinion of the manager and are subject to change. Past Performance is not indicative of future results. Figure 1 EM Currencies Have Weakened Substantially But Will Offer Value As Growth Recovers 10.00 127 9.00 8.00 117 7.00 6.00 107 Figure 2 70% 97 3.00 2.00 87 1.00 77 0.00 0303 04 04 05 05 06 06 0707 08 08 09 09 10 10 11 11 1212 13 13 1414 1515 1616 EM GDP growth, yoy % (right scale) EM FX Index* Index weight of net oil exporting/importing countries 60% 44.70% 36.90% 40% 30% 20% 64.00% 55.20% 50% 5.00 4.00 Net Oil Importers Dominate EM Universe 30.50% 14.30% 18.50% 17.80% 18.20% 10% 0% exporters neutral importers exporters neutral importers exporters neutral importers EM sov. credit EM corp/quasi credit EM local Source: J.P. Morgan, The IMF, WEO update. Data as of January 2015. Source: Barclays, The EM Quarterly. Data as of December 2014. between unjustified fears of a total meltdown related to the potential interest rate normalisation in the US, which mired EM returns in 2013 and the idiosyncratic country flare-ups that dominated EM returns in 2014. recovers more widely and is matched by the potential for Last year’s recovery by EM hard currency bonds was nothing short of remarkable, even though it was marred by a bout of risk aversion in December. The bounce-back may effectively cap any potential for another surprise outperformance in 2015. Instead, the focus will be on alpha generation from country selection and on timing a re-entry into local bond markets that offer attractive yields but volatile exchange rates. economic reform, we expect more demand for EM assets and EM currencies. This may happen in the second half of 2015 or we may have to wait for firmer evidence in 2016. Lower Commodity Prices ≠ EM Crisis Downside risks remain centred around the inability of the Chinese economy to grow above 7% without targeted policy measures and that a number of EM countries will lose a reliable anchor for their commodity exports, leading to a more secular drop in commodity prices. Even though the impact of lower commodity prices on EM growth is positive on aggregate as net oil importers US dollar strength, driven by divergence in forces of dominate the universe (Figure 2), it will polarise monetary policy normalisation between the US and the economies. The 50% drop in oil prices since the middle of last year will push some oil producers into recession, but it will create large savings for oil importers. These will be largest in emerging Asia and Central and Eastern Europe, which leaves these regions poised for significant positive terms of trade effects. A strong disinflationary environment will be pervasive across all EM economies, allowing centrals banks more room to accommodate weaker exchange rates. Ultimately, EM countries will, at large, need to substitute some of the reliance on external support with a more focused drive towards structural reform. rest of the world since late summer, may well continue into 2015 boosting with it the USD-based EM spread products unless the Fed starts paying more attention to the frailty of the global economic recovery or the currency adjustment among EM countries (Figure 1) start to pay dividends in the form of improved terms of trade. Attractive Yet Scary FX The exchange rates of a number of large EM countries have fallen by 25-40% versus their 2012 averages - the sort of adjustment economists would consider appropriate in a currency crisis. Thankfully, the falls have occurred in an orderly fashion as part of a world of flexible exchange rates and independent central banks. We anticipate a boost to export growth from the weaker currencies with a 6-9 months lag, eventually enabling these currencies to recover some lost ground. Once economic growth 2 Corporates To Shine In the EM corporates universe, 2014 was another relatively predictable year in terms of trends with fundamentals remaining stable, technicals and supply remaining strong with a third straight year of record gross issuance of over US $300 billion. Total returns exceeded all initial expectations even as December proved a rough month as risk aversion increased on the back of the sharp falls in returns is an inexact science. It is a tough ask to develop energy prices and currency weakness. The broad strong convictions about return expectations for a benchmark spreads, at over 430bp versus the US complex asset class which is 70% investment grade and Treasury, are now trading wider that during the 2013 EM 30% high yield, spread across 49 countries, over 500 confidence crisis and cheapened up versus both issuers and more than 40 industry sectors. developed markets investment grade and high yield offering, on average, 180bp in spread pickup in the BBB Certain aspects are clear, the EM corporate default rates category and 250bp in the BBs, both are pretty much at will remain relatively benign, spreads are still attractive the top of their five-year trading ranges. With the larger versus developed market, investor base continues to spread cushion and lower duration versus its sovereign broaden and deepen, the EM versus DM growth peers EM corporates may well claim the top spot in EMD differential is still in place, and the asset class has a low returns in 2015, barring the repeat of the last year’s sensitivity to US Treasuries. Consequently, we expect scenario where longer-duration sovereign assets were demand for EM corporates to remain as strong as it has major beneficiaries of lower US yields, not quite what was been over the past three years, providing the search for anticipated at the start of the year. high quality risk assets continues and US Treasury rates creep higher, rather than suddenly spike aggressively. We The market will re-focus on fundamentals once the dust also anticipate corporates to continue decorrelating from settles. We expect to see a recovery, although it may start EM sovereigns and to converge more with its developed slowly as investors remain rather cautious. From the market credit peers. As the global investor base searches corporate fundamentals perspective, we expect recent for global multi-sector solutions, we expect EM generic trends and new issuance levels to be maintained corporates to be viewed as an integral part of the global but, as always, forecasting of EM corporate supply and fixed income. Disclosure Statement 16 June 2014 1007044 PineBridge Investments is a group of international companies that provides investment advice and markets asset management products and services to clients around the world. PineBridge Investments is a registered trademark proprietary to PineBridge Investments IP Holding Company Limited. For purposes of complying with the Global Investment Performance Standards (GIPS®), the firm is defined as PineBridge Investments Global. Under the firm definition for the purposes of GIPS, PineBridge Investments Global excludes some alternative asset groups and regional legal entities that may be represented in this presentation, such as the assets of PineBridge Investments. Readership: This document is intended solely for the addressee(s) and may not be redistributed without the prior permission of PineBridge Investments. Its content may be confidential. PineBridge Investments and its subsidiaries are not responsible for any unlawful distribution of this document to any third parties, in whole or in part. Opinions: Any opinions expressed in this document may be subject to change without notice. We are not soliciting or recommending any action based on this material. Risk Warning:All investments involve risk, including possible loss of principal.Past performance is not indicative of future results.If applicable, the offering document should be read for further details including the risk factors.Our investment management services relate to a variety of investments, each of which can fluctuate in value.The investment risks vary between different types of instruments.For example, for investments involving exposure to a currency other than that in which the portfolio is denominated, changes in the rate of exchange may cause the value of investments, and consequently the value of the portfolio, to go up or down.In the case of a higher volatility portfolio, the loss on realization or cancellation may be very high (including total loss of investment), as the value of such an investment may fall suddenly and substantially.In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved. Information is unaudited, unless otherwise indicated, and any information from third party sources is believed to be reliable, but PineBridge Investments cannot guarantee its accuracy or completeness. PineBridge Investments Europe Limited is authorised and regulated by the Financial Conduct Authority (“FCA”).In the UK this communication is a financial promotion solely intended for professional clients as defined in the FCA Handbook and has been approved by PineBridge Investments Europe Limited.Should you like to request a different classification, please contact your PineBridge representative. Approved by PineBridge Investments Ireland Limited.This entity is authorised and regulated by the Central Bank of Ireland. In Australia, this document is intended for a limited number of wholesale clients as such term is defined in chapter 7 of the Corporations Act 2001 (CTH).The entity receiving this document represents that if it is in Australia, it is a wholesale client and it will not distribute this document to any other person whether in or outside of Australia. In Hong Kong, the issuer of this document is PineBridge Investments Asia Limited, licensed and regulated by the Securities and Futures Commission (“SFC”).This document has not been reviewed by the SFC.PineBridge Investments Asia Limited holds a Representative Office license issued by the Central Bank of the UAE and conducts its activities in the UAE under the trade name PineBridge Investments Asia Limited– Abu Dhabi.This document has not been reviewed by the Central Bank of the UAE nor the SFC.In the UAE, this document is issued by PineBridge InvestmentsAsia Limited – Abu Dhabi Representative Office. PineBridge Investments Singapore Limited is licensed and regulated by the Monetary Authority of Singapore (the ”MAS”).In Singapore, this material may not be suitable to a retail investor and is not reviewed or endorsed by the MAS. PineBridge Investments Middle East B.S.C.(c) is regulated by the Central Bank of Bahrain as a Category 1 investment firm.This document and the financial products and services to which it relates will only be made available to accredited investors of PineBridge Investments Middle East B.S.C. (c ) and no other person should act upon it.The Central Bank of Bahrain takes no responsibility for the accuracy of the statements and information contained in this document or the performance of the financial products and services, nor shall it have any liability to any person, an investor or otherwise, for any loss or damage resulting from reliance on any statement or information contained therein. 3 pinebridge.com

© Copyright 2026