jan-dec 2014 ENG - nordnet corporate web

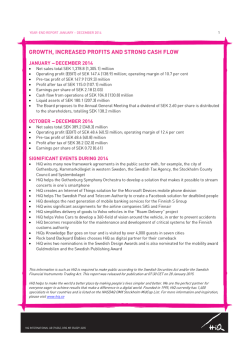

Year-end report 2014 Nordnet is a Nordic bank. We offer services that enable private individuals and companies to take control of their financial future. We target active savers in the Nordic countries. Our vision is to become the no. 1 choice for savings & investments in the Nordics. October – December 2014 Operating income increased by 8 percent to SEK 284.5 million (263.5) Profit after tax for the period rose by 26 percent to SEK 80.0 million (63.7) Earnings per share rose by 26 percent to SEK 0.46 (0.36) January – December 2014 Operating income increased by 10 percent to SEK 1,085.8 million (989.0) Profit after tax for the period rose by 18 percent to SEK 276.6 million (233.8) Earnings per share rose by 18 percent to SEK 1.58 (1.34) Highlights from the fourth quarter The Board of Directors suggests an increased dividend of SEK 1.00 per share (0.85) Launch of a new communication concept, Transparent Banking Over 30,000 savers and 10 billion SEK at Shareville Operating profit January–December Savings capital 31 December million billion SEK 337.0 (294.0) SEK 166 (136) Active customers 31 December Net savings January–December customers billion 432,600 (394,700) Trades January–December SEK 16.3 (8.7) Lending* 31 December 14,642,500 (13,565,700) SEK 5.6 (5.4) trades billion * Lending excluding pledged cash and cash equivalents, see note 5 More about Nordnet for investors, analysts and media can be found at www.nordnetab.com To become a customer, visit nordnet.se, nordnet.no, nordnet.dk or nordnet.fi January–December 2014 Ceo’s statement Since graduating from the Royal Institute of Technology in Stockholm, I have been working for some 30 years, although I have never had a job that is as much fun as the one I have now. Working in a sector involving savings in shares and mutual funds is never dull and, as usual, the financial year that recently came to an end was an eventful one. During 2014, much attention has been focused on record-low interest rates and falling oil prices, but also on the positive development on all of the Nordic exchanges, with Denmark at the fore. It is particularly pleasing that we have now begun in earnest our journey towards our vision of becoming the first choice for Nordic savers. If we begin with the financial figures for 2014, there is much to be happy about. The strong fourth quarter means we are able to present the highest level of full-year income in Nordnet’s history. This is despite the fact that interest rates in the Nordic countries are at historically low levels, meaning that our income from lending and the management of surplus liquidity has declined. Net profit after tax is record-high – ending up at SEK 277 million for the 12-month period. Our costs add up to more than SEK 700 million – a level that is deliberately higher than in recent years with the purpose of enabling investment in product and IT development and analysis of customer data. Renewal and innovation are what drive us forward, regardless of whether this involves user interfaces, products, pricing models, service, or other aspects of importance to our customers. We can never permit ourselves to not be up-to-date and relevant to Nordic savers. Our most important product innovations over the year were our super funds – four fee-free index funds – and Shareville. The super funds now have nearly SEK 1 billion in capital, and some 33,000 of our customers have invested in the funds. At the end of the year, more than 30,000 customers with total savings of SEK 10 billion had joined Shareville, making it the Nordic region’s largest social investment community. Our higher pace of innovation has had an effect in terms of stronger growth and increased customer satisfaction. Our net savings for the full-year amounted to slightly more than SEK 16 billion, which is a very strong figure. Measured in relation to savings capital at the beginning of the year, net savings amounted to 12 percent, meeting our target of double-digit growth. At the end of the year, the savings capital entrusted to us by our customers, amounted to SEK 166 billion, which was also a record. Over the year, we welcomed an additional 38,000 savers to Nordnet, representing growth of nearly 10 percent, and our customer base has grown to more than 430,000 people. Customer satisfaction also rose in 2014 – which is more important than anything else. The foremost ambassadors for Nordnet are to be found in our customer base, with six out of ten new customers finding us through recommendations from friends, colleagues or family members. Our ambassador strategy is supplemented with marketing activities and, during the quarter, we presented our new communication concept “Transparent banking” through both our own and bought channels. The concept was launched with the aid of five films that were posted on YouTube and other digital networks. The campaign gained a rapid viral spread, being viewed more than a million times on YouTube in the Nordic countries. The concept summarises what Nordnet is all about – nurturing openness, applying a transparent business model in which our customers’ success is also our success, and maintaining the belief that individuals have an independent capacity to make informed decisions about their savings. Håkan Nyberg CEO Nordnet PS. During the first quarter we will be introducing a couple of new products in the areas of loans and mobile savings – keep a lookout! 2 January–December 2014 Operations About Nordnet Nordnet’s business concept is to offer services that enable private individuals and companies to take control of their financial future. We have operations in Sweden, Norway, Denmark and Finland, where we target informed savers. Our vision is to be the first choice for savers in the Nordic region when it comes to savings and investments. Nordnet AB (publ) is listed on the Nasdaq Stockholm Mid Cap list under the NN B ticker. Nordnet’s core business consists of trading in securities via internet. Our customers can invest in shares, mutual funds, ETFs, options, certificates, structured products and they can make pension savings at low commission and without fixed charges. In the Swedish market, we also offer private loans. Most of Nordnet’s customer base consists of Nordic private individuals. Nordnet also partners with advisors and other banks who act as agents for Nordnet, bringing in new customers and acting by proxy on customers’ behalf. Market The fourth quarter was a turbulent and eventful period on the Nordic exchanges. In October, the quarter began with a substantial slump, bringing the Nordic indexes down by as much as above 10 percent from their previous peak. Geopolitical unease and weakening economic data, particularly in Europe, pulled down stock markets worldwide, including in the Nordic countries. However, most exchanges recovered just as quickly and investors quickly found their way back into the stock market, where the current low-interest climate provides few attractive investment alternatives to shares. Among the Nordic stock exchanges, Stockholm (4.4%) and Helsinki (1.7%) rose, while Copenhagen (-2.4%) and Oslo (-6.1%) fell in the fourth quarter. The decline in Oslo was driven by oil-related shares, which are suffering in the wake of declining oil prices. Oil prices fell by almost 40 percent over the last quarter of the year. Taken as a whole, 2014 ended up being quite a good year with rising indexes on all of the Nordic exchanges. Despite many storm clouds and concerns regarding the economic trend, listed companies generally had a good year with rising sales and higher profits than in the preceding year. In other regards, the year was mainly pervaded by geopolitical issues surrounding Russia and Ukraine, as well as by falling commodity prices with oil prices at the fore. Record low interest rates and deflationary tendencies in many parts of the world, as well as increasing concerns for the economy were other themes that pervaded 2014 on the stock exchanges. The Copenhagen Stock Exchange performed best of the Nordic exchanges, rising by more than 20 percent, driven largely by the continued rise in index-heavy Novo Nordisk. The weakest performance was that of the Oslo Stock Exchange, which fought headwinds in the form of falling oil prices throughout the year, although it nonetheless ended the year 4 percent up. The Stockholm Stock Exchange recorded a gain of slightly less than 10 percent and the Helsinki index rose by slightly more than 5 percent. Customers and savings The number of active customers with Nordnet as at 31 December was 432,600, corresponding to an increase of 10 percent compared with a year ago. The number of active accounts was 544,600, corresponding to an increase of 12 percent compared with the end of December 2013. Each customer has an average of 1.26 accounts. Our customers’ total savings capital amounted to SEK 166 billion, an increase of 22 percent compared with the end of December the previous year. The increase in savings capital is attributable to both positive net savings and rising stock markets. Savings capital is made up of 65 percent in shares/derivatives/bonds, 23 percent in mutual funds and 12 percent in cash. 3 January–December 2014 Net savings for the full-year 2014 totalled SEK 16.3 billion, a rise of 86 percent compared with the full-year 2013. Calculated in relation to savings capital at the end of December 2013, net savings for the past 12 months correspond to 12 percent. Nordnet customers made an average of 59,300 trades (54,700) per day during the period January-December, an increase of 8 percent compared with the full-year 2013. Lending excluding pledged cash and cash equivalents was up by 5 percent compared with 12 months ago, amounting to SEK 5.6 billion, of which SEK 2.3 billion (2.1) is private loans and SEK 3.3 billion (3.3) is securities lending (see note 5). There were approximately 92,100 accounts (82,600) within pensions and insurance as per 31 December, representing an increase of 12 percent compared with 2013. Total savings capital within this category increased by 25 percent, amounting to SEK 34.7 billion (27.7) at the end of December, of which some SEK 20.7 billion (17.9) is in the form of endowment insurance. Table: Summary of accounts and capital 31/12/2014 Number of accounts 31/12/2013 Number of accounts 31/12/2014 Savings capital (bn) 31/12/2013 Savings capital (bn) 390,400 347,900 129.5 106.5 92,100 42,200 15,400 34,500 82,600 40,400 12,700 29,500 34.7 20.7 4.3 9.7 27.7 17.9 3.0 6.8 62,100 35,400 26,700 544,600 57,300 31,100 26,200 487,800 2.1 2.1 * 166.2 1.8 1.8 * 136.0 Investments & savings Pension of which endowment insurance of which occupational pension of which other pension Bank of which sav ings accounts of which priv ate loans Total * Lending amounts to SEK 2.3 (2.1) billion. Income and expenses January – December 2014 During the period, operating income rose by 10 percent to SEK 1,085.8 million (989.0), which was attributable to an increase in net commission and a higher net result of financial transactions. Net commission rose by SEK 74.9 million. Net interest decreased by SEK 3.8 million, which was mainly attributable to low interest rates. 14.6 million (13.6) trades were made, which is an increase of 8 percent compared with the year-earlier period. Net commission per trade was SEK 25 at the end of December, compared with SEK 24 in the year-earlier period. Operating expenses before credit losses rose by 8 percent to SEK 705.8 million (656.2) compared to the full-year 2013. The increase in expenses is attributable to, among other things, investments in IT, analysis of customer data, product development and investments in occupational pensions in Sweden. Operating profit increased by 15 percent to SEK 337.0 million (294.0), and the operating margin was 31 percent (30). Profit after tax for the year rose by 18 percent to SEK 276.6 million (233.8), resulting in a profit margin of 25 percent (24). Earnings per share rose by 18 percent to SEK 1.58 (1.34). Operating income excluding transaction-related net commissions rose by 8 percent compared with the previous year. Cost coverage, i.e. operating income excluding transaction-related net commission in relation to operating expenses, amounted to 95 percent (95). October – December 2014 Compared with the fourth quarter of 2013, operating income rose by 8 percent to 284.5 million (263.5), which was attributable to an increase in net commission and a higher net result of financial transactions. Net commission rose by SEK 23.0 million and net interest fell by SEK 9.9 million. In the fourth quarter, 4.1 million (3.7) trades were made, which is an increase of 10 percent compared with fourth quarter of 2013. Net commission per trade during the quarter was SEK 26 compared with SEK 24 in the corresponding quarter last year. Operating expenses before credit losses rose by 4 percent to SEK 178.4 million (171.5). 4 January–December 2014 Operating profit increased by 14 percent to SEK 95.6 million (83.6), and the operating margin was 34 percent (32). Profit after tax for the quarter rose by 26 percent to SEK 80.0 million (63.7), mainly attributable to higher net commission. The profit margin was 28 percent (24). Earnings per share rose by 26 percent to SEK 0.46 (0.36). Development on our markets Sweden At the end of December, Nordnet Sweden had 221,800 active customers. That corresponds to an increase of 6 percent over the past 12 months. In the last quarter of the year, we welcomed approximately 2,000 fund savers from SBAB, of whom about a quarter already held a Nordnet account. Net savings for the period JanuaryDecember amounted to SEK 8.3 billion. Calculated in relation to savings capital at the end of December 2013, net savings for the past 12 months correspond to 11 percent. The number of trades among Nordnet’s Swedish customers rose by 1 percent compared to January-December 2013. In addition to services for savings and investments, Nordnet also offers private loans on the Swedish market under the Nordnet Toppenlånet and Konsumentkredit product names. At 31 December 2014, 26,700 customers (26,300) were using this product. The total lending volume was SEK 2.3 billion (2.1), with an average interest rate of about 11 percent. These operations showed good growth and profitability over the period and contributed 32 percent (30) of operating profit in Sweden for the period January–December. The recruitment process to strengthen the occupational pension sale and support team has been completed, and the team now comprises 25 people. In November, it was announced that the cooperation between Nordnet and Söderberg & Partners would decrease as a result of Söderberg & Partners having strengthened its own securities operations. In the last quarter of the year, we were rewarded for our efforts in the area of communications. In October, Sparpodden, which now has more than 30,000 listeners a week, was named Sweden’s fifth-best podcast. In December, our savings economist Günther Mårder was named Bank Profile of the Year by magazine Privata Affärer. Norway At the end of December, there were 61,900 active Nordnet customers in the Norwegian market. That corresponds to an increase of 8 percent over the past 12 months. Net savings for the period January-December amounted to SEK 2.4 billion. Calculated in relation to savings capital at the end of December 2013, net savings for the past 12 months correspond to 18 percent. Over the full-year 2014, the number of trades among Nordnet’s Norwegian customers rose by 1 percent compared with 2013. Compared to previous year the operating profit decreased for our Norwegian business, mainly due to a larger share of central costs. In the fourth quarter, we started a transfer service that helps customers to gather their savings at Nordnet. The year’s product launches, the Superfondet Norge and Shareville, continue to harvest success among our Norwegian savers. Denmark Nordnet’s rate of growth in Denmark is high. At the end of December, there were 38,500 active customers. That represents an increase of 27 percent over the past 12 months. The Danish market is a step ahead of the other Nordic countries when it comes to openness in the pension market and Nordnet represents an attractive alternative for those saving over the long term. In 2014, the number of pension customers in Denmark rose by 41 percent. Net savings for 2014 totalled SEK 5.0 billion – a record. Calculated in relation to savings capital at the end of December 2013, net savings for the past 12 months correspond to 36 percent. The end of the year also boded well for 2015, with net savings in December alone amounting to SEK 517 million. In the period January-December, the number of trades rose by 39 percent compared with the year-earlier period. The operating profit for our Danish business increased mainly due to higher commission income. Our Danish savings economist and PR profile, Per Hansen, has helped make Nordnet even better known in Denmark. Per was recently ranked as the eighth-most cited economist in Denmark. 5 January–December 2014 Finland By the end of December, we had 110,400 active customers at Nordnet in Finland, representing an increase of 13 percent compared to the same period the previous year. Net savings for the period January-December amounted to SEK 0.5 billion. Calculated in relation to savings capital at the end of December 2013, net savings for the past 12 months correspond to 2 percent. Over the year, the number of trades rose by 10 percent compared with the period January-December last year. Fund savings is a priority for Nordnet in Finland, and during 2014 the number of customers saving in funds increased by over 160 percent, thanks to the launch of Nordnet Superrahasto Suomi – the first fee-free Finnish index fund. The Super funds are continuing to attract new customers and are now included in more than 13,000 Finnish Nordnet accounts. Table: Profit per country January-December Operating income Operating expenses Sweden 2014 2013 Norway 2014 2013 Denmark 2014 2013 Finland 2014 2013 Group 2014 2013 656.8 -342.7 625.4 -332.5 131.3 -124.4 127.8 -113.8 137.4 -101.5 93.5 -85.8 160.3 -137.2 142.2 -124.2 1,085.8 -705.8 989.0 -656.2 Profit before credit losses 314.1 292.9 7.0 14.1 35.9 7.8 23.1 18.0 380.0 332.8 Credit losses -42.2 -38.4 0.1 0.1 -0.9 -0.4 0.0 0.0 -43.1 -38.8 Operating profit 271.9 254.5 7.0 14.1 35.0 7.4 23.0 18.0 337.0 294.0 41% 41% 5% 11% 25% 8% 14% 13% 31% 30% 221,800 292,500 92 6,742,100 8.3 209,600 270,400 76 6,705,300 4.3 61,900 72,800 16 2,169,400 2.4 57,100 65,900 14 2,150,700 0.7 38,500 50,500 21 2,604,900 5.0 30,400 38,700 14 1,871,100 3.1 110,400 128,800 37 3,126,100 0.5 Operating margin Number of customers Number of accounts Sav ings capital (SEK billion) Number of trades Net sav ings (SEK billion) 97,600 432,600 394,700 112,800 544,600 487,800 32 166 136 2,838,600 14,642,500 13,565,700 0.7 16.3 8.7 Financial position Nordnet has two types of lending: lending with securities as collateral and personal loans (unsecured lending). For both, Nordnet has well developed procedures for dealing with credit risks. For private loans, a tried and tested scoring model is used to assess the credit risk of private individuals applying for credit. The model assesses the risk associated with each loan application and provides the basis for approval and pricing. The credit risk in these lending operations is to be considered higher than in Nordnet’s other operations, although this is matched by higher interest margins. Nordnet’s deposit surplus is mainly invested in covered bonds, the Swedish Riksbank and the Nordic banking system. The consolidated liquid funds at year-end amounted to SEK 987.5 million (967.6), of which frozen assets were SEK 79 million (95). In addition, the Group has interest-bearing investments with a total fair value of SEK 12,094.6 million (7,632.2). The Group’s equity, excluding minority interests, amounted to SEK 1,747.6 million (1,621.0), and including minority interests equity amounted to SEK 1,751.1 (1,625.4). The equity, excluding minority interests, is divided over 175,027,886 shares at SEK 9.98 per share (9.26), or SEK 10.00 (9.29) including minority interests. As regards the financial conglomerate in which Nordnet AB (publ) is the Parent Company, the asset base amounted to SEK 1,270.3 million (1,205.0) and the total exposure amount to SEK 7,959.6 million (7,278.0). At the end of the period, the capital ratio was 16.0 percent, compared with 16.6 percent at the same time last year. 6 January–December 2014 Nordnet has two outstanding subordinated loans which amount to SEK 100 million and SEK 75 million respectively. The company intends to buy back both of the loans during 2015. Nordnet has obtained permission from the Swedish Financial Supervisory Authority to buy back the loan of SEK 100 million, which is planned to happen in February 2015. The loan of SEK 75 million is planned to be bought back during September 2015. 7 January–December 2014 Other information Parent company The Parent Company is a holding company. Operating income for the 2014 full-year amounted to SEK 7.9 million (7.7) and relates to Group-internal administrative services. The profit from financial investments totalled SEK 180.5 million (187.1) and mainly comprises anticipated dividends from subsidiaries. The Parent Company’s profit after financial items for the period January-December amounted to SEK 173.9 million (180.4). The Parent Company’s liquid funds amounted to SEK 27.1 million (2.7), and shareholders’ equity to SEK 1,420.1 million (1,220.0). Employees As of 31 December 2014, the company had 385 full-time employees (332). The average number of full-time positions for the period January-December was 354 (325). Full-time employees include temporary employees but not employees on parental or other leave. Board member Simon Nathanson resigned from his post as of November 24, 2014. Significant risks and uncertainty factors Nordnet’s operations are influenced by a number of environmental factors, the effects of which on the Group’s profit and financial position can be controlled to varying degrees. When assessing the Group’s future development, it is important to take into account the risk factors alongside any opportunities for profit growth. A description of Nordnet’s exposure to risk and handling of risks can be found under note 7 in the 2013 Annual Report. The significant change that occurred in 2014 is a 50 percent increase in deposit surplus due to more deposits compared to the previous year, which increases the company’s exposure to market risk. Closely related transactions In the last quarter of the year, similar transactions took place with closely related parties and to the same extent as previously. E. Öhman J:or AB is associated with Nordnet AB (publ) as E. Öhman J:or AB has a direct holding in Nordnet AB (publ), and the owners of E. Öhman J:or AB have a direct holding in Nordnet AB (publ). The Emric Group and its parent company Emric AB are closely related parties to Nordnet AB (publ) in that E. Öhman J:or AB is a shareholder in the company. The Emric Group administers Nordnet Bank AB’s private loans. Nordnet has a cooperation agreement with E. Öhman J:or Fonder AB. For additional information, please refer to note 6 in the 2013 Annual Report. Performance-related share programme In accordance with decisions by the Annual General Meetings of 26 April 2012, 24 April 2013 and 23 April 2014, Nordnet has established three long-range performance-related share incentive programmes: “PerformanceRelated Share Programme 2012”, “Performance-Related Share Programme 2013” and “Performance-Related Share Programme 2014”. The 2012 and 2013 programmes cover about 25 people including the CEO, and the 2014 programme covers a total of about 35 people, including the CEO. Employees who participate in “Performance-Related Share Schemes 2012” can set aside an amount corresponding to a maximum of 5 percent of their gross remuneration to buy Nordnet shares on Nasdaq Stockholm over a 12-month period from the implementation of each scheme. If the shares purchased are retained by the employee for at least three years after purchase, if the employee has been employed within the Nordnet Group during the entire three-year period and if the pre-agreed earnings-based performance targets are achieved, the employee can have the right to a compensation-free matching of those shares according to a predetermined amount. 8 January–December 2014 Employees who participate in “Performance-Related Share Schemes 2013 or 2014” can set aside an amount corresponding to a maximum of 5 percent of their gross remuneration to buy Nordnet shares on Nasdaq Stockholm Stockholm over a 12-month period from the implementation of each scheme. If the shares purchased are retained by the employee for at least three years after purchase, and if the employee has been employed within the Nordnet Group during the entire three-year period, the employee is entitled to compensation-free matching of those shares. In addition to this allocation, the above key individuals may be offered additional allocations of matching shares based on the results of three mutually independent, objective targets of equal weight and that take into account risk-adjusted performance at the individual and team levels, as well as an assessment of a number of behavioural variables linked to the Nordnet Group’s values. Due to the Performance-Related Share Programmes 2012, 2013 and 2014, the 2014 Annual General Meeting decided to authorise the Board of Directors to carry out the acquisition and transfer of shares in Nordnet AB (publ) on Nasdaq Stockholm. This authorisation may be exercised on one or more occasions before the Annual General Meeting in 2015. A maximum of 1,330,000 shares may be acquired in order to ensure delivery of shares to participants in Performance-Related Share Programmes 2012, 2013 and 2014. Of these, a maximum of 306,500 shares may be purchased and transferred in order to cover general payroll taxes and other costs related to the programmes. No shares have been bought back during 2014 and Nordnet holds no repurchased shares as of 31 December 2014. The purpose of the long-term incentive schemes is to stimulate continued loyalty and strong performance among key individuals. Additionally, the Board takes the view that the incentive schemes increase the Group’s attractiveness as an employer in preparation for future recruitment of key personnel. Future calendar events Annual report Interim Report January – March 2015 Annual General Meeting 2015 Interim Report January – June 2015 Interim report January – September 2015 20 March 2015 23 April 2015 23 April 2015 16 July 2015 20 October 2015 Annual General Meeting The Annual General Meeting will be held on 23 April 2015 at Hilton Slussen, Guldgränd 8 in Stockholm. Notification of the Annual General Meeting will be published on 23 March via the company website and in Post- och Inrikes Tidningar (official Swedish gazette). The company expects the annual report to be available at 20 March 2015 on the company’s website, www.nordnetab.com. Nordnet's operations are conducted via the internet and the annual report will therefore be made available for downloading from the company's website. Shareholders who instead wish to receive a printed copy may order one by sending an e-mail to [email protected]. Nominating committee The nominating committee consist of Claes Dinkelspiel (chairman of the Board), Johan Malm (represents E. Öhman J:or AB), chairman of the nominating committee Dick Lundqvist (represents Premiefinans K. Bolin AB) and Johan Wallin (represents Didner & Gerge Fonder AB). More information about the nominating committee at Nordnet’s corporate web www.nordnetab.com. Dividend The Board of Directors suggests a dividend of SEK 1.00 per share (0.85), corresponding to 63 percent of the earnings per share. The Board of Directors estimates that in the long-term, Nordnet will be able to distribute about 60 percent of its profit to the shareholders. 9 January–December 2014 Presentation to analysts, shareholders and the media CEO Håkan Nyberg and CFO Jacob Kaplan will be presenting the report and answering any questions on Friday, 30 January 2015 at 10.00 a.m. CET at a telephone conference. The presentation will be made in English and can also be followed online. Telephone number for participation by telephone: +46 856 642 692 (Sweden) or +44 2034 281 434 (UK) Follow the presentation at http://financialhearings.nu/150130/nordnet/ 10 January–December 2014 The information in this report is that which Nordnet AB (publ) is required to publish in accordance with the Swedish Financial Instruments Trading Act and/or the Swedish Securities Act. This information has been submitted to the market for publication on 30 January 2015 at 8.30 a.m. (CET). The board and CEO provide their assurance that the 2014 year-end report provides an accurate overview of the operations, position and earnings of the Group and the Parent Company, and that it also describes the principal risks and sources of uncertainty faced by the Parent Company and the companies within the Group. This report has not been reviewed by the company’s auditors. Bromma, 30 January 2015 Claes Dinkelspiel Chairman of the Board Anna Frick Board Member Anna Settman Board Member Bo Mattson Board Member Kjell Hedman Board Member Tom Dinkelspiel Board Member Ulf Dinkelspiel Board Member Håkan Nyberg CEO For further information, please contact CEO Håkan Nyberg, +46 8 506 330 36, + 46 703 97 09 04, [email protected], CFO Jacob Kaplan, +46 8 506 334 21, +46 708 62 33 94, [email protected]. Nordnet AB (publ) Box 14077, 167 14 Bromma Tel: +46 (0)8 506 330 30 Registered company no: 556249-1687 Visiting address: Gustavslundsvägen 141 E-mail: [email protected] Company website: nordnetab.com Become a customer: nordnet.se, nordnet.no, nordnet.dk, nordnet.fi 11 January–December 2014 Financial statements Consolidated income statement (SEK million) 3 months Oct-Dec 2014 3 months Oct-Dec 2013 12 months Jan-Dec 2014 12 months Jan-Dec 2013 125.5 -11.2 194.2 -60.5 26.2 10.4 284.5 136.8 -12.7 162.4 -51.8 20.4 8.3 263.5 528.8 -50.2 692.3 -214.1 86.4 42.6 1,085.8 532.5 -50.1 597.8 -194.4 65.3 37.9 989.0 -151.7 -15.3 -11.4 -178.4 -144.0 -17.0 -10.5 -171.5 -590.7 -71.0 -44.1 -705.8 -549.8 -66.5 -39.9 -656.2 Profit before credit losses 106.1 92.0 380.1 332.8 Net credit losses Operating profit -10.5 95.6 -8.5 83.6 -43.1 337.0 -38.8 294.0 Tax on profit for the period Group (SEK million) Note Interest income Interest expenses Commission income Commission expenses Net result of financial transactions Other operating income Total operating income General administrativ e expenses Depreciation and amortization Other operating expenses Total expenses before credit losses 2 3 4 -15.5 -19.8 -60.3 -60.2 Profit for the period 80.0 63.7 276.6 233.8 Of which, attributable to: shareholders of the Parent Company the non-controlling interest 80.4 -0.4 63.9 -0.2 278.0 -1.4 234.7 -0.9 175,027,886 0.46 175,027,886 0.46 175,027,886 0.36 175,027,886 0.36 175,027,886 1.58 175,027,886 1.58 175,027,886 1.34 175,027,886 1.34 Av erage number of shares before dilution Earnings per share before dilution Av erage number of shares after dilution Earnings per share after dilution Consolidated statement of comprehensive income (SEK million) Group (SEK million) 3 months Oct-Dec 2014 3 months Oct-Dec 2013 12 months Jan-Dec 2014 12 months Jan-Dec 2013 Profit for the period 80.0 63.7 276.6 233.8 Items that will be booked through profit or loss Change in v alue of assets av ailable for sale Tax on change in v alue of assets av ailable for sale Translation of foreign operations Total other comprehensive income -9.5 2.1 0.6 3.0 -0.7 3.4 -5.8 1.3 0.8 -7.8 1.7 0.9 -6.8 5.7 -3.7 -5.2 Total profit or loss and other comprehensive income 73.3 69.5 272.9 228.7 Of which, attributable to: shareholders of the Parent Company the non-controlling interest 73.6 -0.4 70.1 -0.6 274.3 -1.4 229.6 -0.9 12 January–December 2014 Consolidated balance sheet (SEK million) Group (SEK million) Assets Loans to credit institutions Loans to the general public Financial assets at fair v alue Financial assets av ailable for sale Financial assets - policy holders bearing the risk Intangible fixed assets Tangible fixed assets Current tax assets Other assets Prepaid expenses and accrued income Total assets Liabilities Deposits and borrowing by the public Liabilities to policyholders Other liabilities Current tax liabilities Deferred tax liabilities Accrued expenses and deferred income Subordinated liabilities Total liabilities Equity Share capital Other capital contributions Other prov isions Accrued profit including profit for the period Total shareholders' equity attributable to shareholders of the Parent Company Non-controlling interest Total equity Total liabilities and equity Note 5 6 6 31/12/2014 31/12/2013 987.5 5,785.6 8.7 12,094.6 28,868.5 434.3 32.3 1,770.3 144.7 967.6 5,455.5 13.5 7,632.2 23,764.9 447.4 33.4 99.9 1,141.0 138.9 50,126.5 39,694.2 16,500.3 28,869.3 2,660.4 13.7 51.0 104.9 175.7 12,898.6 23,765.6 1,030.4 42.1 57.1 99.4 175.7 48,375.3 38,068.8 175.0 471.8 -64.8 1,165.5 1,747.6 3.5 1,751.1 175.0 471.8 -61.1 1,035.2 1,621.0 4.4 1,625.4 50,126.5 39,694.2 12 months Jan-Dec 2014 1,625.4 278.0 -3.7 1.1 -148.8 -0.8 1,751.1 12 months Jan-Dec 2013 1,514.0 233.8 -5.2 -122.5 5.2 Consolidated changes in equity, summary (SEK million) Group (SEK million) Opening equity Profit for the period Total other comprehensiv e income Other Div idend Acquisition non-controlling interest Closing equity 1,625.4 13 January–December 2014 Consolidated cash flow statement, summary (SEK million) Group (SEK million) 3 months Oct-Dec 2014 3 months Oct-Dec 2013 12 months Jan-Dec 2014 12 months Jan-Dec 2013 147.6 118.8 420.6 224.8 952.2 1,099.8 -847.1 -728.3 4,263.7 4,684.3 1,703.0 1,927.7 13.2 -5.0 -55.6 -28.7 -1,055.8 - -4,460.2 - -1,042.5 697.2 0.1 692.3 -4,515.8 -2,263.9 -8.6 -2,301.2 - - -148.8 -122.5 57.3 -36.0 19.7 -496.0 929.6 1,004.6 967.6 1,465.0 0.5 -1.0 0.2 -1.4 987.5 967.6 987.5 967.6 Operating activities Cash flow from operating activ ities before changes in working capital Cash flow from changes in working capital Cash flow from operating activ ities Investing activities Purchases and disposals of intangible and tangible fixed assets Net inv estments in financial instruments Acquisitions of subsidiaries Cash flow from inv esting activ ities Financing activities Cash flow from financing activ ities Cash flow for the period Cash and equivalents at the start of the period Exchange rate difference for cash and equiv alents Cash and equivalents at the end of the period Parent company income statement (SEK million) 3 months Oct-Dec 2014 3 months Oct-Dec 2013 12 months Jan-Dec 2014 12 months Jan-Dec 2013 2.0 1.9 7.9 7.7 2.0 1.9 7.9 7.7 -1.4 -2.0 -0.3 -1.5 -1.4 -2.1 -0.3 -1.9 -5.7 -7.7 -1.1 -6.6 -5.7 -7.7 -1.1 -6.7 Profit from financial investments: Result from participations in affiliated companies Write-down of financial assets Other interest and similar income Interest expense and similar expense Result from financial investments 186.0 1.9 -3.2 183.1 1.8 -3.2 186.0 7.3 -12.7 193.1 -0.5 7.3 -12.8 184.6 181.8 180.5 187.1 Profit after financial items 183.1 179.9 173.9 180.4 Tax on profit for the period Profit for the period -2.2 -1.8 - - 180.9 178.1 173.9 180.4 Parent Company (SEK million) Net sales Total operating income Other external costs Personnel costs Other operating expenses Operating profit 14 January–December 2014 Parent company statement of comprehensive income (SEK million) Parent company (SEK million) Profit for the period Total other comprehensive income Total profit or loss and other comprehensive income 3 months Oct-Dec 2014 3 months Oct-Dec 2013 12 months Jan-Dec 2014 12 months Jan-Dec 2013 180.9 178.1 173.9 180.4 - - - - 180.9 178.1 173.9 180.4 Parent company balance sheet, summary (SEK million) Balance Sheet - Parent Company (SEK million) 31/12/2014 31/12/2013 Assets Financial fixed assets Current assets Cash and bank balances Total assets 1,150.4 298.3 27.1 1,475.8 1,150.4 296.5 2.7 1,449.6 Equity and liabilities Equity Long-term liabilities Current liabilities Equity and total liabilities 1,245.1 175.7 54.9 1,475.8 1,220.0 175.7 53.9 1,449.6 None None None None Memorandum items Assets pledged Contingent liabilities 15 January–December 2014 Notes, Group Note 1 Accounting principles Nordnet AB’s (publ) consolidated financial statements are compiled in accordance with International Financial Reporting Standards (IFRS) approved by the EU. This report for the Group has been compiled in accordance with IAS 34, Interim Financial Reporting. In addition, the Group complies with the Annual Accounts Act for Credit Institutions and Securities Companies (ÅRKL) and the regulations of the Swedish Financial Supervisory Authority (FFFS 2008:25). The interim report for the Parent Company has been compiled in accordance with the Annual Accounts Act. The accounting principles applied in this report are those described in the 2013 Nordnet Annual Report, Note 5, the section entitled “Accounting principles applied”. For the Group and the Parent Company, the same accounting principles and bases for calculation have been applied as in the 2013 Annual Report. Note 2 General administrative expenses (SEK million) Personnel costs Other administrativ e expenses 3 months Oct-Dec 2014 -82.2 -69.4 -151.7 3 months Oct-Dec 2013 -70.1 -73.8 -144.0 12 months Jan-Dec 2014 -316.2 -274.5 -590.7 12 months Jan-Dec 2013 -272.1 -277.7 -549.8 Note 3 Amortisation and depreciation of tangible and intangible assets (SEK million) Depreciation 3 months Oct-Dec 2014 -15.3 -15.3 3 months Oct-Dec 2013 -17.0 -17.0 12 months Jan-Dec 2014 -71.0 -71.0 12 months Jan-Dec 2013 -66.5 -66.5 3 months Oct-Dec 2014 -9.3 -2.1 -11.4 3 months Oct-Dec 2013 -9.4 -1.1 -10.5 12 months Jan-Dec 2014 -38.5 -5.7 -44.2 12 months Jan-Dec 2013 -35.1 -4.9 -39.9 Note 4 Other operating expenses (SEK million) Marketing Other operating expenses Note 5 Loans to the public As at 31 December, SEK 166.0 million (87.3) of lending to the public involves account credits that are fully covered by pledged cash and cash equivalents in endowment insurance plans and investment savings accounts (ISKs), the lending rate applied to the credits corresponds to the deposit rate on the pledged cash and cash equivalents. The remainder of lending to the public is secured by collateral in the form of securities or consists of unsecured loans. Note 6 Financial assets and liabilities and their fair values (SEK million) Financial assets Loans to credit institutions Loans to the general public Financial assets at fair v alue Financial assets av ailable for sale Financial assets - policy holders bearing the risk Other assets Accrued income Total Financial liabilities Deposits and borrowing from the general public Liabilities in the insurance business, regarding inv estment contracts Other liabilities Accrued expenses Subordinated liabilities Total 31/12/2014 Reported value 31/12/2014 Fair value 31/12/2013 Reported value 31/12/2013 Fair value 987.5 5,785.6 8.7 12,094.6 28,868.5 1,770.2 71.3 987.6 5,785.6 8.7 12,094.6 28,868.5 1,770.2 71.3 967.6 5,455.5 13.5 7,632.2 23,764.9 1,144.9 82.7 967.8 5,455.8 13.5 7,632.2 23,764.9 1,144.9 82.7 49,586.3 49,586.5 39,061.3 39,061.8 16,500.3 28,869.3 2,649.0 7.7 175.7 16,500.3 28,869.3 2,649.0 7.7 178.7 12,898.6 23,765.6 1,031.6 7.7 175.7 12,898.6 23,765.6 1,031.6 7.7 182.5 48,202.1 48,205.1 37,879.2 37,886.0 16 January–December 2014 Description of fair value measurement Loans to credit institutions The fair value of loans to credit institutions that are not payable on demand has been calculated discounting expected future cash flows, with the discount rate being set as the lending rate currently applied. The fair value of receivables payable on demand is judged to be the same as the carrying amount. Loans to the public The fair value of loans to the public with securities as collateral is judged to be equal to the carrying amount, since the receivable can be redeemed on demand. The fair value of unsecured loan receivables has been calculated discounting expected future cash flows, with the discount rate being set as the lending rate currently applied. Assets in the insurance business Fair value is based on a quoted price on an active market, or by using valuation models based on observable market data. Valuation models based on observable market data are applied for derivative instruments and certain interest-bearing securities. Forward rate agreements are valued at fair value by discounting the difference between the contracted forward rate and the forward rate available on the balance sheet date for the remaining contract period. The discount rate is the risk-free rate based on government bonds. Unlisted options are valued at fair value applying the Black-Scholes model based on underlying market data. The fair value of interest-bearing securities has been calculated by discounting anticipated future cash flows, with the discount rate being set based on the current market interest rate. Fund units not considered to be traded in an active market at listed prices are measured at fair value based on NAV (net asset value). Other assets, accrued income, non-current liabilities and accrued expenses For assets and liabilities in the balance sheet with a remaining maturity of less than six months, the carrying amount is considered to reflect the fair value. Deposits and borrowing by the public The fair value of deposits has been calculated discounting expected future cash flows, with the discount rate being set as the deposit rate currently applied. However, the fair value of a liability that is redeemable on demand is not recorded at an amount less than the amount payable on demand, but is discounted from the first date on which payment of the amount could be demanded. Liabilities to policyholders The fair value of liabilities in the insurance business follows the fair value of assets in the insurance business, with the exception of liabilities for insurance agreements that are not classified as financial liabilities. Subordinated liabilities The fair value of subordinated liabilities has been calculated at the current market price. Since the market is not deemed to be active, the holding has been placed at Level 2 in the valuation hierarchy. 31/12/2014 Level 1 Level 2 Valuation model Level 3 Estimated using Listed market based on price on active observable valuation (SEK million) Financial assets at fair value Financial assets at fair v alue Financial assets av ailable for sale Financial assets - policy holders bearing the risk Total market market data technique Total 8.7 12,094.3 13,942.9 26,045.9 14,925.6 14,925.6 0.3 0.3 8.7 12,094.6 28,868.5 40,971.8 Financial liabilities at fair value Liabilities in the insurance business, regarding inv estment contracts Total 13,942.9 13,942.9 14,926.4 14,926.4 - 28,869.3 28,869.3 Level 2 Level 3 31/12/2013 Level 1 Valuation model Listed market based on price on active observable Estimated using valuation (SEK million) Financial assets at fair value Financial assets at fair v alue Financial assets av ailable for sale Financial assets - policy holders bearing the risk Total market market data technique Total 13.2 7,632.2 12,934.4 20,579.7 10,830.6 10,830.6 0.3 0.3 13.5 7,632.2 23,764.9 31,410.6 Financial liabilities at fair value Liabilities in the insurance business, regarding inv estment contracts Total 12,934.4 12,934.4 10,831.2 10,831.2 - 23,765.6 23,765.6 17 January–December 2014 Description of valuation levels Level 1 Financial assets and financial liabilities, whose value is based solely on a quoted price from an active market for identical assets or liabilities. This category includes treasury bills, shareholdings and deposits. Level 2 Financial assets and financial liabilities valued using valuation models principally based on observable market data. Instruments in this category are valued applying: a) Quoted prices for similar assets or liabilities, or identical assets or liabilities from markets not deemed to be active; or b) Valuation models based primarily on observable market data. This category includes mutual funds, derivatives, certain interest-bearing securities and cash and cash equivalents. Level 3 This category includes un-listed shareholdings valued at cost where a reliable value cannot be calculated. Note 7 Pledged assets Assets pledged 31/12/2014 31/12/2013 1,067.3 1,022.1 1,067.3 1,022.1 Deposits with credit institutions 497.3 450.6 Deposits with clearing organisations 649.5 571.5 1,146.8 1,022.1 172.7 136.8 172.7 136.8 1,035.9 773.4 1,035.9 773.4 Assets pledged for liabilities Bonds and other interest bearing securities* The above assets are attributed to Contingent liabilities Funds managed on behalf of third parties (client funds account) Commitments Credit granted but not yet paid, unsecured loans *This amount includes blocked funds of SEK 79 million (95). Assets pledged for own liabilities consist partly of state bonds eligible as collateral, etc., which have been provided as security for customers’ security loans, and for payment to clearing organisations. Counterparties in securities lending transactions are other credit institutions. In addition to the commitments specified in the above table, there was SEK 4,839 million (4,713) in un-utilised credit facility related to the possible securities-collateralised borrowing. For each customer, the credit size is restricted by the minimum amount of credit limit, which is set individually per customer by the company, and the collateral value of security holdings. Credit agreements can be terminated with 60 days’ notice. The leverage value of a share can be changed instantly. 18 January–December 2014 Note 8 Capital requirements for the financial conglomerate Capital requirement for the financial conglomerate (MSEK) Total equity, Group 31/12/2014 31/12/2013 1,751.1 1,625.4 Subordinated liablities 140.6 175.7 Requirements for prudent v aluation -12.1 - -175.0 -148.8 Deduction for expected div idend current year Deduction for intangible fixed assets and deffered tax receiv ables Capital base -434.3 -447.4 1,270.3 1,205.0 5,650.2 4,831.0 Risk exposures Exposures credit risk Exposures market risk Exposures operational risk 18.1 211.2 1,888.6 1,828.3 Expousre other 402.7 407.5 Total exposure 7,959.6 7,278.0 16.0% 16.6% Capital ratio A capital ratio of 16.1 percent is equivalent to capital output ratio of 1.99. The table above relates to the financial conglomerate consisting of Nordnet AB (publ) and all of its subsidiaries. The capital basis of the financial conglomerate has been calculated in accordance with the consolidation method. The Group-based financial statements have been compiled in accordance with the same accounting principles as the consolidated financial statements. Nordnet AB (publ) has received permission by the Swedish Financial Supervisory Authority to include the audited profit for the year in the calculation of the capital base. Capital requirements in the consolidated situation (MSEK) Total equity Requirements for prudent v aluation Deduction for expected div idend current year Deduction for intangible fixed assets and deffered tax receiv ables Tier 1 capital Subordinated liabilities Tier 2 capital 31/12/2014 1,688.1 -12.1 -175.0 -408.1 1,092.9 140.6 140.6 Capital base 1,233.5 Risk exposures Exposure credit risk according to standardized approach Exposure market risk Exposure operational risk Total exposure 5,648.3 12.8 1,939.6 7,600.6 Capital ratio Capital requirements Credit risk according to standardized approach Market risk 16.2% 31/12/2014 451.9 1.0 Operational risk 155.2 Capital requirements 608.1 Capital ratios and buffers 31/12/2014 Common equity tier 1 ratio, % Tier 1 ratio, % 14.4% 14.4% Total capital ratio, % 16.2% Institution-specific buffer requirements, % of which capital conserv ation buffer requirement, % Total capital requirement including buffer requirement, % Common equity tier 1 capital av ailable for use as a buffer, % 2.5% 2.5% 10.5% 6.4% Information is only provided regarding the buffer requirements which have come into force. 19 January–December 2014 Financial development per quarter Financial development per quarter - Group (SEK million) Q4 14 Q3 14 Q2 14 Q1 14 Q4 13 Q3 13 Q2 13 Q1 13 Net interest Net commission - not trade related Net commission - trade related Net result of financial transactions Other income Operating income 114.2 29.3 104.4 26.2 10.4 284.5 120.7 28.6 81.3 21.2 9.2 260.9 123.3 27.8 79.9 16.5 11.3 258.6 120.4 21.6 105.4 22.6 11.7 281.8 124.2 21.5 89.1 20.4 8.3 263.5 119.9 19.1 81.3 15.0 7.9 243.2 119.5 18.0 73.0 14.9 12.9 238.2 118.9 18.0 83.2 15.0 8.8 244.0 -151.7 -15.3 -11.4 -10.5 -188.9 -145.7 -19.8 -10.0 -10.1 -185.6 -147.3 -18.5 -10.5 -11.6 -187.9 -146.0 -17.4 -12.2 -10.8 -186.4 -144.0 -17.0 -10.5 -8.5 -180.0 -136.8 -17.1 -9.0 -8.3 -171.1 -132.7 -16.5 -9.6 -11.5 -170.3 -136.3 -15.9 -10.8 -10.5 -173.6 95.6 75.3 70.7 95.3 83.6 72.1 67.9 70.4 Earnings per share before dilution Cost cov erage Return on shareholders' equity Capital cov erage ratio 0.46 95% 5% 16.0% 0.34 97% 4% 15.9% 0.33 95% 4% 13.5% 0.45 95% 5% 15.0% 0.36 97% 4% 16.6% 0.33 95% 4% 15.8% 0.31 97% 4% 15.8% 0.33 93% 4% 16.2% Quarterly statistics Q4 14 Q3 14 Q2 14 Q1 14 Q4 13 Q3 13 Q2 13 Q1 13 432,600 421,000 413,200 404,100 394,700 384,200 378,700 373,500 General administrativ e expenses Depreciation Other operating expenses Net credit losses Expenses Operating profit Number of customers at end of the period Number of accounts at end of the period Net sav ings (SEK billion) Total sav ings capital (SEK billion) Av erage sav ings capital per account (SEK) Lending excluding pledged cash and cash equiv alents Number of trades Number of trading days Number of trades per day Number of trades per account and month Net commission per trade (SEK ) 544,600 527,700 516,000 501,200 487,800 473,200 464,900 456,300 4.5 5.5 2.5 3.8 0.9 2.0 2.2 3.7 166 160 155 145 136 127 115 112 305,200 303,300 300,400 288,500 278,800 268,300 247,000 244,700 5,619.6 5,769.9 5,591.2 5,685.7 6,368.3 5,133.5 5,019.5 5,063.3 4,061,800 3,229,700 3,217,500 4,133,500 3,676,800 3,283,100 3,074,600 3,531,200 61 66 58 62 62 66 59 62 66,600 48,900 55,500 66,700 59,300 49,700 52,100 57,000 2.5 2.0 2.1 2.7 2.5 2.3 2.2 2.6 26 25 25 26 24 25 24 24 20 January–December 2014 Key figures Key figures - Group 31/12/2014 31/12/2013 Operating margin (%) Profit margin (%) Cost/income ratio Inv estments in tangible assets, SEK million Inv estments in intangible assets excl. company acquisitions, SEK million Of which, internal dev elopment expenses, SEK million Earnings per share before dilution, SEK Earnings per share after dilution, SEK Return on shareholders' equity (%) Shareholders' equity per share, SEK Div idend per share, SEK Share price, SEK Market capitalization at the end of the period, SEK million Shareholders' equity, SEK million Capital base, SEK million Capital cov erage ratio Av erage number of shares before dilution Av erage number of shares after dilution Number of shares at end of period Number of full-time employees at end of period 31% 25% 69% 15.2 40.4 7.4 1.58 1.58 16% 9.98 1.00 30% 24% 70% 16.5 13.6 5.4 1.34 1.34 15% 9.26 0.85 28.20 4,936 1,747.6 1,270.3 16.0% 175,027,886 175,027,886 175,027,886 385 26.00 4,551 1,621.0 1,205.0 16.6% 175,027,886 175,027,886 175,027,886 332 Customer related key financial figures: 31/12/2014 31/12/2013 432,600 394,700 544,600 16.3 166 305,200 21,095.9 165.5 5,785.6 5,619.6 27% 14,642,500 59,281 32.0 2.7 25 2,146,000 0.9% 2,099 -1,348 751 487,800 8.7 136 278,800 16,899.6 136.8 5,455.5 5,368.3 32% 13,565,700 54,700 32.9 2.7 24 1,925,300 0.8% 2,118 -1,391 727 Number of activ e customers Number of activ e accounts at end of the period Net sav ings, SEK billion Total sav ings capital at end of period, SEK billion Av erage sav ings capital per activ e account at end of period, SEK Cash deposits at end of period incl. cash deposits in insurance oprations, SEK million Managed Client Funds, SEK million Lending at end of period, SEK million Lending excluding pledged cash and cash equiv alents (note 5) Lending/deposits (%) Number of trades for the period Number of trades per day Number of trades per activ e trading account Number of trades per activ e trading account and month Av erage net commission rev enue per trade, SEK DART (Daily Av erage Rev enue from Trading), SEK Annual av erage income/sav ings capital (%) Av erage yearly income per account, SEK Av erage yearly operating expenses per account, SEK Av erage yearly profit per account, SEK While every care has been taken in the translation of this report, readers are reminded that the original report is the Swedish PDF version. 21

© Copyright 2026