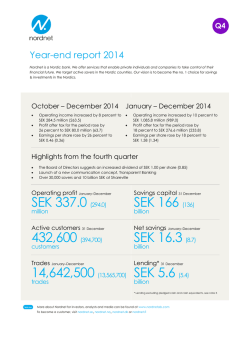

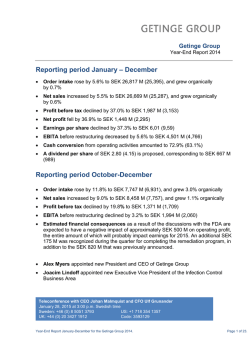

Download Report