Fact Sheets Merge

Vanguard®

Australian Shares

Index ETF

ETF

VAS

ASX Code: VAS

At a glance

Features, benefits & risks

As at 31 December 2014

Diversification

Invests in around 300 of the largest Australian

companies and property trusts listed on ASX.

Tax-effective

returns

A buy and hold approach takes advantage of

capital gains discounts and the deferral of capital

gains liabilities, which may result in effective

after-tax returns.

Capital growth

potential and taxeffective income

Includes exposure to companies offering franking

benefits that can offset income tax quarterly

distributions and offers long-term capital growth

potential through its diversified portfolio of

Australian shares.

Risks

High - the potential for higher returns than lower

risks investments, however there is the higher

potential for below-average returns and/or some

loss of capital. Please see Product Disclosure

Statement for further details.

ETF name

ASX code

ISIN

Benchmark

Management costs

Distribution frequency

®

Vanguard Australian Shares Index ETF

VAS

AU000000VAS1

S&P/ASX 300 Index

0.15% p.a.

Quarterly

Distribution reinvestment plan

ETF listed on ASX

Underlying fund

Underlying fund

commencement date

Yes

8 May 2009

Vanguard ® Australian Shares Index Fund

30 June 1997

Objective

The fund seeks to track the return (income and capital appreciation) of the S&P/ASX

300 Index before fees, expenses & tax.

Strategy

The fund is managed to closely track the risk characteristics of the index, while

minimising transaction costs and effectively managing index changes. Through a buy

and hold investment strategy the fund offers a tax-efficient solution for investors

seeking to gain broad exposure to the Australian share market at low cost.

Vanguard ETF Product Profile

®

Vanguard Australian Shares Index ETF

Dated 31 December 2014

Holdings6

Overview

Size (AUD)

Inception date

Management costs

No. of securities

Benchmark

Underlying fund

ETF

Underlying fund

$854.2 million

4 May 2009

0.15% p.a

299

$8,309.2 million

30 June 1997

S&P/ASX 300 Index

Vanguard Australian Shares Index Fund

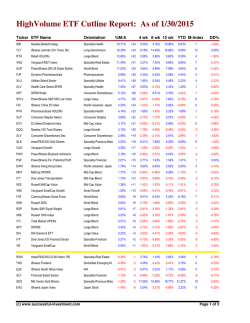

Performance return1,2,3 (%)

1 month

3 months

6 months

1 year

3 years (pa)

5 years (pa)

10 years (pa)

Inception (pa)

ETF

Gross

Bmk

ETF

Total

Dist

Growth

2.04

2.95

2.39

5.35

14.72

6.51

n/a

10.61

2.04

2.94

2.37

5.30

14.70

6.48

n/a

10.58

2.03

2.91

2.31

5.19

14.55

6.31

n/a

10.39

1.12

1.12

2.57

4.15

4.90

4.61

n/a

4.72

0.91

1.79

-0.26

1.04

9.65

1.70

n/a

5.67

Top 10 holdings

1 CBA

2 Westpac

3 BHP Billiton

4 ANZ

5 NAB

6 Telstra

7 Wesfarmers

8 CSL

9 Woolworths

10 Woodside Petroleum

The Top 10 holdings represent 53.3% of the total underlying fund

Sector allocation6 (%)

5.1

5.1

Energy

15.0

15.0

Materials

7.4

7.4

Industrials

Year to year franking levels and gross return 1,2,3 (%)

Dec - Dec

ETF

YTD

2014

2013

2012

2011

5.35

5.35

19.67

19.74

-10.90

Bmk

5.30

5.30

19.68

19.74

-10.98

June - June

ETF

2.39

17.28

21.89

-7.00

11.93

Franking

2.37

17.25

21.90

-7.01

11.90

92.7

77.6

77.5

78.0

78.2

Prices4

5.9

5.9

Health Care

39.4

39.3

Financials ex Property

7.0

7.0

Net asset value

31 December 2014

$69.0859

Income distribution5

31 December 2014

7.4

7.4

Consumer Staples

Property Trusts

Month ended

Quarter ended

4.1

4.1

Consumer Discretionary

Bmk

Information Technology

1.0

1.0

5.8

5.9

Telecom. Services

Amount (CPU)

Reinvestment price

75.7108

$68.3288

Utilities

1.9

1.9

Notes

1. Past performance is not an indication of future performance

2. Returns assume reinvestment of all distributions. Returns for periods longer than 1 year are

annualised. ETF gross returns are before management costs and taxes, but after transaction and

operational costs. ETF total return is the ETF gross return less management costs. Index returns do not

allow for taxes, management, transaction and operational costs.

3. Returns assume that an investor purchased shares at Net Asset Value (NAV) and does not reflect the

transaction costs imposed on the creation and redemptions of ETF Units, brokerage or the bid ask spread

that investors pay to buy and sell ETF securities on the Australian Securities Exchange.

4. Month end cumulative-distribution

5. Past distributions are not an indication of future distributions

6. Figures as per underlying fund

Further information

Personal investors can transact in Vanguard ETFs through their financial adviser or stockbroker.

Connect with VanguardTM > vanguard.com.au > 1300 655 888

In preparing the above information, individual cirumstances, for example tax implications, have not been taken into account and it may therefore not be applicable to an individual's situtation. Before making an investment decision, you should consider

your or your clients' circumstances and whether the above information is applicable to your or your clients' situation. © 2015 Vanguard Investments Australia Ltd (ABN 72 072 881 086/AFS Licence 227263)("Vanguard") is the issuer of the Vanguard®

Australian Shares Index ETF. Vanguard ETFs will only be issued to Authorised Participants, that is persons who have been authorised as trading participants under the ASX Operating Rules ("Eligible Investors"). Retail investors can transact in Vanguard

ETFs through a stockbroker or financial adviser on the secondary market. Investors should consider the Product Disclosure Statement in deciding whether to acquire Vanguard ETFs. Retail investors can only use the Product Disclosure Statement for

informational purposes only. You can access the Product Disclosure Statement on our website.

Standard & Poors® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"), and ASX® is a registered trademark of the Australian Securities Exchange Limited ("ASX"). These trademarks have been licensed for use by The

Vanguard Group, Inc. Vanguard's ETF(s) is not sponsored, endorsed, sold or promoted by S&P, or ASX. S&P and ASX make no representation, warranty or condition regarding the advisability of buying, selling or holding units/shares in the Vanguard ETF(s)

© Copyright 2026