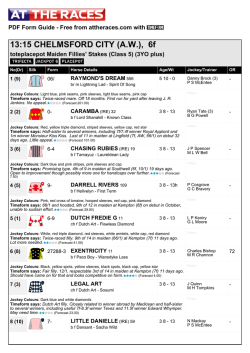

Our 2015 Plan

Our 2015 Plan Robert McMillan General Manager Regulation 15 August 2014 Our 2015 Plan • Responds to changes occurring in the gas market • Is built on the feedback and knowledge gained through our customer and stakeholder engagement • Is long term in focus (beyond next 5 years) • Promotes the long term interests of our customers – Safety and service levels that customers value – Puts downward pressure on retail gas prices and supports further customer growth and cost efficiency – Prices efficiently, equitably and sensibly – Supports improved customer participation in energy markets, and supports vulnerable customers 2 Our 2015 Plan: Safety and service levels • Customer feedback: – Value high levels of safety – Value current service levels, and would value equality of service levels across the network • Our 2015 Plan: – Remaining proactive in managing safety (designing and operating network, improving public awareness etc.) – Maintaining current levels of service (amenity, responsiveness, reliability etc.) – Invest to provide a universal level of service levels across the network 3 Our 2015 Plan: Costs • Customer feedback: – Focus on efficiency, put downward pressure on retail prices – Attract new customers to lower average costs • Our 2015 Plan: – Passes on lower funding costs – Includes a 5% efficiency saving over the period and reduction in operating expenditure – Proposes an Efficiency Benefit Sharing Scheme (EBSS) to incentivise further efficiencies – Involves attracting over 150,000 new customers – Resulting in reductions in average cost per customer 4 Our 2015 Plan: Lower costs per customer • Our annual ‘building block’ cost per customer will decrease by 4.6% from $433 to $413 – Lower funding costs (8.67%, down from 10.41%) – Increased customers (more than 150,000 new customers) Changes in our required revenue per customer per year ($ 2015) 5 Source: Jemena, real expenditure $ 2015, 2016-20 Our 2015 Plan: Expenditure forecast • Operating cost efficiency is evident – with more assets, more regulatory obligations to meet, and 150,00 more customers to look after our operating costs are only rising by a modest 0.4% pa. RY11-15 Actual/Forecast - $802M (Real 2015 dollars) RY16-20 - $797M (Real 2015 dollars, exc debt raising costs) Operations and maintenance Information technology (IT) Operations and maintenance Information technology (IT) Administration and overheads Administration and overheads Government levies Government levies Marketing Marketing UAG UAG Carbon costs Carbon costs 6 Source: Jemena, real expenditure $ 2015, 2016-20 Our 2015 Plan: Expenditure forecast • Capital expenditure will increase from 2010-15 levels RY11-15 Actual/Forecast - $958M (Real 2015 dollars) RY16-20 - $1,149M (Real 2015 dollars) Market Expansion Market Expansion Reinforcement, renewal and replacement Reinforcement, renewal and replacement Non-network Non-network 7 Source: Jemena, real expenditure $ 2015, 2016-20 Our 2015 Plan: Continued growth in customers • We are focused on attracting gas customers – Over 30,000 per annum or 150,000 over the period – Continued growth in new residential dwellings 25,000 New customer connections per year 20,000 Electricity to Gas conversions 15,000 New homes 10,000 Medium density and 'High Rise' 5,000 Industrial and Commerical - 8 Source: Jemena, Core Energy 2014-20 Our 2015 Plan: Prices • Customer feedback: – Put downward pressure on network prices in a way that promotes stable retail prices (address wholesale cost shock) – Minimise fixed charges for residential customers – Recognise changes in operating characteristics of industrial customers • Our 2015 Plan: – Lower prices for residential and small business customers (reduces wholesale cost shock), continues stable price path for industrial customers – Continues low fixed charges to incentivise connections – Resets levels of CD for large industrial customers 9 Our 2015 Plan: Reduction in average prices Real % change (excl. inflation) 2015/16 2016/17 2017/18 2018/19 2019/20 Total -4.00% -2.70% -2.70% -2.70% -2.70% -14.8% -0.40% -0.07% -1.43% -1.22% -1.25% -1.25% -1.25% -1.25% Electricity networks* *Indicative price path proposed by NSW electricity networks (real) 10 Our 2015 Plan: Changes in customer bills • Changes in our prices over the 5 year period for typical customers (excluding the impact of inflation) Real % change (excl. inflation) 2015/16 2016/17 2017/18 2018/19 2019/20 Cumulative impact on bills Residential (15 GJ pa) -6.4% -3.7% -3.7% -3.8% -3.8% -19.7% Commercial (2000 GJ pa) -0.4% -2.7% -2.7% -2.7% -2.7% -10.8% Industrial (CD of 402; DC1) +2.5% +2.5% +2.5% +2.5% +2.5% +13.1% 11 Our 2015 Plan: Improving customer participation in the energy market • Customer feedback: – Energy market is complex and this can be barrier to participation – Accommodating market changes is important (benefits from new technologies like cogeneration) but ‘customer experience’ is valued • Our 2015 Plan: – Simplifies our tariffs to reduce complexity and barriers to energy market participation – Simplifies disconnection charges, reduces charges for special meter reads, and reduces barriers to reconnection – Provides reference tariffs for energy intermediaries onselling gas, hot water and electricity to facilitate new technologies – Advocates for choice in individual metering and billing to protect customer experience 12 Our 2015 Plan: Assisting vulnerable customers • Customer feedback: – Some customers may be vulnerable to rising retail gas prices and will need assistance – Jemena (amongst others) has a role to assist customers • Our 2015 Plan: – assists vulnerable customers to upgrade old gas appliances (through partnerships with NSW public housing and through becoming a partner of NILS NSW) – provides clear, accessible information for customers to make it easier for them to manage their bills – advocates for additional Government programs to assist vulnerable gas customers (for example, by providing rebates for larger gas bills, and conducting energy audits) 13 Overall: Our 2015 Plan 14

© Copyright 2026