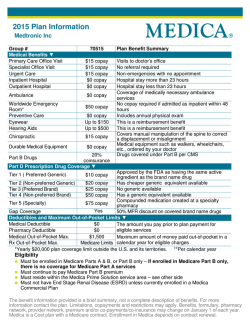

Benefits Summary 2015

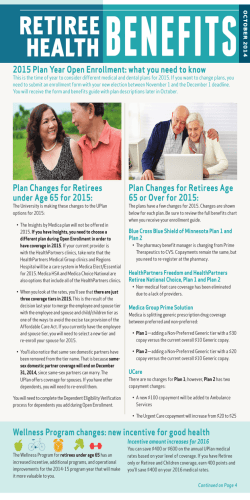

Benefit Highlights Guide 2015 Contents Enrollment.......................................................................... 2 When can I enroll? ............................................................ 2 How do I enroll? ............................................................... 2 Eligible dependents.......................................................... 3 Who can I cover? ............................................................... 3 Dependent verification ..................................................... 3 What if things change?...................................................... 3 The cost of your benefits ................................................. 4 Medical, dental and vision costs for 2015 ...................... 4 How it works ...................................................................... 5 Medical benefits summary ...........................................5-7 Opting out of medical coverage....................................... 8 Helpful terms ..................................................................... 8 Prescription drug benefits summary ............................. 9 Eligibility for the lowest-cost OHSU benefits ............. 10 Finding network providers ............................................ 11 Wellness benefits ............................................................ 12 Healthy TEAM Healthy U.............................................. 12 HealthySteps ..................................................................... 12 Weight Watchers .............................................................. 12 Tobacco cessation ............................................................ 12 Dental benefits ................................................................ 13 Vision benefits ................................................................. 14 Income protection insurance ........................................ 15 Core life insurance .......................................................... 15 Voluntary life insurance and accidental death and dismemberment coverage ......................................... 15 Disability insurance......................................................... 15 Life and disability rates ............................................. 15-17 OHSU knows how important it is to have good, affordable health and welfare benefits. That’s why we offer competitive benefits that can provide protection, peace of mind and savings. From health care to income protection and other benefits, we’ve got you covered. Use this overview of your benefit choices and how to enroll to help you select the coverage that is right for you and your family. Enrollment When can I enroll? New employees As a new employee, you have 60 days from your date of hire to enroll in benefits. Your benefits will go into effect on the 1st of the month following the date you make your benefit elections. If you do not make elections during those 60 days, you will be enrolled by default for employee-only coverage in OHSU PPO medical, Moda Health dental and VSP core vision. Default coverage will remain in effect until the end of the plan year, unless you experience a qualifying life event such as a marriage or a birth. (In that case, you can elect benefits relevant to the qualifying life event.) Our benefit plan year runs from Jan. 1 through Dec. 31. Open Enrollment As a benefits-eligible employee, you have an opportunity once each year to enroll in or make changes to your benefit plans during the Open Enrollment period. Open Enrollment is typically held in the fall. Open Enrollment for your 2015 benefits is Oct. 27 through Nov. 21, 2014, with elections effective Jan. 1, 2015. Note: If you make no changes during Open Enrollment, your current benefit elections will remain in place through 2015— with the exception of flexible spending accounts. FSA elections do not carry over from year to year. If you want an FSA, you must actively enroll in one during Open Enrollment. Additional benefits ......................................................... 18 Flexible spending accounts ............................................ 18 Employee Assistance Program....................................... 19 Travel assistance............................................................... 19 You have a voice— the Employee Benefits Council ..................................... 19 Your rights ........................................................................ 19 Health Care Reform Notice............................................ 19 Where to learn more ....................................................... 19 Contact information ....................................................... 20 2 How do I enroll? All benefit enrollments are completed online at http://benefits. ohsu.edu. Use your OHSU user name and password to log on to the system. Before logging on, have a list of your benefit choices and changes, as well as the names, Social Security numbers, birthdates and addresses of those you wish to designate as beneficiaries or enroll as dependents. If you are enrolling new dependents on your medical plan, you will be required to provide documents verifying them as your dependent (e.g., marriage license, birth certificate). https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Eligible dependents Who can I cover? You can enroll yourself in the benefits listed in this guide if you are a 0.5 FTE or greater and are working in a benefits-eligible position. For more detailed information on employee and dependent eligibility, visit the Benefits website at https://o2.ohsu. edu/benefits. If you participate in OHSU benefits, you may also enroll: • Your spouse (opposite or same sex) or domestic partner (opposite or same sex; registered or unregistered). • Your child(ren) (including child(ren) of a domestic partner or spouse) up to age 26. This applies regardless of the child’s marital or student status. • Your child(ren) of any age who is incapable of supporting himself or herself due to a mental or physical disability and who is totally dependent on you. • Your child(ren) by adoption or court-ordered judgment who otherwise meets these dependent eligibility requirements. Please contact the OHSU Benefits team for additional information. Dependent verification When adding a new dependent to your benefits, you will be required to provide documents verifying your relationship to the dependent (e.g., marriage license, birth certificate). You’ll be provided a list of the specific document(s) required once you enroll your dependent. What if things change? The benefits you choose will be effective through the end of the calendar year. You cannot make changes to your coverage during the year, unless you have a qualifying life event, including: • Marriage, establishment of a domestic partnership, legal separation, divorce or termination of a domestic partnership. • Birth, legal adoption of a child or placement of a child with you for legal adoption. • Death of your spouse/domestic partner or dependent child. • Change in residence (only if your current coverage isn’t available in the new location or if you are offered an option that you were not previously offered). To make a change due to a qualifying life event, you must complete your enrollment change online within 31 days of the event, in most cases. You have 60 days if you, your spouse/domestic partner or eligible dependent child loses coverage under Medicaid or a state Children’s Health Insurance Program (CHIP) or becomes eligible for state-provided premium assistance. Only certain changes to benefits are allowed during a qualifying life event. OHSU Benefits will review your request and determine whether the change you are requesting is allowed. For a complete description of allowable benefit changes, go to https://o2.ohsu.edu/ benefits You will be required to provide verification of your qualifying life event upon making enrollment changes. https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 3 The cost of your benefits OHSU provides benefits-eligible employees with “benefit dollars” to apply toward the cost of benefits. Your benefit dollars are a set amount of monthly funds based on your employee representation group (AFSCME, ONA or unclassified), the coverage level you select (the number of dependents you cover on your medical plan) and whether you are a part-time or full-time employee. The funds are first applied to the cost of the medical, vision and dental benefit options you choose to enroll in. If your benefit dollars do not cover the complete cost of all the benefits you choose, you will pay the difference. The difference will be deducted from your pay semi-monthly (24 times a year). Below are the benefit dollars that OHSU will contribute to your benefit selections for 2015. Benefit dollars for 2015 OHSU’s monthly benefit contribution Unclassified ONA-represented AFSCME-represented Full-time (.75 – 1.0) Part-time (.50 – .74) Full-time (.70 – 1.0) Part-time (.50 – .69) Full-time (.75 – 1.0) Part-time (.50 – .74) Employee only $674.02 $505.52 $674.02 $505.52 $674.02 $505.52 Employee & spouse/ domestic partner $971.20 $728.40 $971.20 $728.40 $971.20 $728.40 Employee & child(ren) $796.94 $597.72 $796.94 $597.72 $796.94 $597.72 $1,073.70 $805.28 $1,073.70 $805.28 $1,073.70 $805.28 $100 $50 $50 $50 $50 $0 Employee & family Medical opt out* *The medical opt-out rate reflects the contribution amount employees will receive and can use for dental, life and optional coverage. Employees must attest that they currently have equivalent health coverage in order to qualify to opt out of OHSU’s medical coverage. Medical, dental and vision costs for 2015 The rates listed below are the monthly costs for the medical, dental and vision plans by coverage level (number of dependents) you choose. The benefit dollars paid to you by OHSU (shown above) help you pay for these premiums, along with other benefits you select. Monthly medical premiums Employee only Employee & spouse/ domestic partner Employee & child(ren) Employee & family OHSU PPO $626.00 $1,000.00 $792.00 $1,054.00 Regional Medical Home $770.00 $1,234.00 $974.00 $1,346.48 National* $770.00 $1,234.00 $974.00 $1,346.48 Kaiser Permanente** $943.00 $1,405.06 $1,103.32 $1,471.08 Employee only Employee & spouse/ domestic partner Employee & child(ren) Employee & family Moda Health $43.10 $93.80 $104.74 $151.84 Kaiser Permanente $87.08 $174.18 $156.76 $261.26 Willamette Dental Group $45.40 $88.50 $80.30 $137.50 Monthly dental premiums *You are only eligible for the National plan if you or a covered dependent live outside Oregon and southwest Washington, or live in Klamath Falls. **Available only to certain long-term employees (see page 7). 4 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Monthly vision premiums Employee only Employee & spouse/ domestic partner Employee & child(ren) Employee & family Core vision $4.92 $9.84 $8.86 $14.27 Premium vision $6.89 $13.78 $12.40 $19.98 Tobacco surcharge Employees who use tobacco products or cover dependents who use tobacco are required to pay a $50 per month surcharge. You will be asked whether you or your dependents use tobacco products when you enroll for benefits. If you use tobacco and would like to quit, OHSU Benefits wants to provide support and resources to assist you. See page 12 for information on tobacco cessation. Wellness requirements surcharge Employees who haven’t completed the wellness requirements (see page 10) for the prior year will pay a surcharge of five percent of the medical/pharmacy premium. Wellness requirements are waived for new employees during their first year. How it works These two examples illustrate how benefit dollars are applied to your benefit selections and what is deducted from your pay. Example 1—Maria Maria is a single, full-time, unclassified employee. She’s selected the OHSU PPO medical plan, Moda Health dental plan and the core vision plan for 2015. Maria has completed the wellness requirements listed on page 10 and does not use tobacco products. Employee-only benefit premiums (monthly) • OHSU PPO medical (employee only): $626.00 • Moda Health dental (employee only): $43.10 • Core vision (employee only): $4.92 OHSU benefit contribution: $674.02 Maria’s cost: $0. ($626.00 + $43.10 + $4.92) - $674.02 = $0 Example 2—Alex Alex is a married, full-time, AFSCME-represented employee. He and his wife both smoke. He has chosen the Regional Medical Home plan, Moda Health dental plan and is opting out of vision coverage for himself, his wife and three children. Alex did not complete the wellness requirements listed on page 10. Employee & family benefit premiums (monthly) • Regional Medical Home medical (employee & family): $1,346.48 • Moda Health dental (employee & family): $151.84 Tobacco surcharge: $50.00 Wellness requirements surcharge: $67.32 ($1,346.48 x 0.05) OHSU benefit contribution: $1,073.70 Alex’s cost: $541.94 monthly ($1,346.48 + $151.84 + $50.00 + $67.32) - $1,073.70 = $541.94 Medical benefits summary When choosing a medical plan, it is important to consider whether the primary hospitals, clinics or providers you and your family use today will be covered. Both the OHSU PPO and Regional Medical Home plans have two networks of providers; one at a higher coverage level and one at a lower coverage level. For more on learning about which providers are covered at which level, see page 11. The following table summarizes medical benefits. For full plan summaries detailing coverage information, limitations and exclusions, visit the plan websites—www.modahealth.com or www.kp.org—or https://o2.ohsu.edu/benefits. You are responsible for any coinsurance or copays shown in this table. 5 Medical benefits summary Key features OHSU PPO OHSU PPO Network Networks Requirements Community Care Network Non-contracted provider Must complete wellness requirements (see page 10). Employees who didn’t participate in wellness programs in 2014 will pay a 5% wellness requirements surcharge on their medical premium in 2015. Annual calendar year deductible Medical out-of-pocket (OOP) maximum (includes deductible) $250/person or $750/family $1,600/person or $3,250/family Lifetime maximum $3,500/person or $7,000/family $4,250/person or $8,750/family Unlimited Home and doctor’s office visits $25 copay $40 copay Medical home primary office visits Specialists 40% of allowable charges N/A $25 copay $40 copay 40% of allowable charges No charge, not subject to deductible; frequency limitations apply No charge, not subject to deductible; frequency limitations apply 40% of allowable charges; frequency limitations apply 20% 30% 40% of allowable charges Hospital services Inpatient (per admission) 20% 30% 40% of allowable charges Outpatient 20% 30% 40% of allowable charges Preventive care Lab and X-ray services (in a hospital outpatient facility) Emergency care (waived if admitted) $150 copay, then 20% of allowable charges * You must see a provider from your preselected medical home for the $25 copay to apply. ** Oregon residents enrolled in the National plan may access the ODS Plus/Connexus network at the higher coverage level. 6 $500/person or $1,500/family https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Regional Medical Home Synergy/ Summit Connexus (ODS Plus) Non-contracted provider If you select the Regional Medical Home plan, each dependent covered under your plan will need to choose a medical home. Each dependent can choose a different medical home, if they desire. If you use a medical home facility or provider for primary care who is not part of your preselected home, you will receive a lower benefit level. Must complete wellness requirements (see page 10). Employees who didn’t participate in wellness programs in 2014 will pay a 5% wellness requirements surcharge on their medical premium in 2015. $400/person or $1,200/ family $3,500/person or $7,000/family $500/person or $1,500/family $4,250/person or $8,750/family Unlimited Kaiser Permanente Network provider only Available only to AFSCME represented employees hired before 10/1/1998 and ONA represented and unclassified employees hired before 1/1/1998. All care must be received by a participating Kaiser Permanente facility except for true emergencies. None $1,000/person or $2,000/family National Non-contracted provider PHCS** Available only to employees living outside Oregon and SW Washington (based on ZIP code) or whose dependent(s) reside outside Oregon and SW Washington, or residents of Klamath Falls. Must complete wellness requirements (see page 10). Employees who didn’t participate in wellness programs in 2014 will pay a 5% wellness requirements surcharge on their medical premium in 2015. $500/person or $1,500/family $3,500/person or $7,000/family Unlimited $3,500/person or $7,000/family Unlimited $25 copay $40 copay $15 copay $25 copay $25 copay*/ $40 copay $40 copay N/A N/A $25 copay $40 copay N/A $25 copay 40% of allowable charges No charge, not subject to deductible; frequency limitations apply 40% of allowable charges; frequency limitations apply No charge No charge 40% of allowable charges; frequency limitations apply 20% 40% of allowable charges No charge 20% 40% of allowable charges 20% 40% of allowable charges $200 copay per visit for hospital/ facility charge 20% 40% of allowable charges 20% 40% of allowable charges 20% 40% of allowable charges $150 copay, then 20% of allowable charges $75 copay (waived if admitted) https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 40% of allowable charges 20% 7 Opting out of medical coverage You must enroll in medical coverage unless you have coverage under another group medical plan. When opting out, you will be required to attest that you currently have other coverage at a comparable level. If you choose to opt out, you will receive reduced benefit dollars, as shown on page 4. Note: If you lose coverage under your other plan during the year, you must enroll in OHSU medical coverage within 31 days after losing coverage. Helpful terms Coinsurance: A percentage of costs you pay “out of pocket” for covered expenses after you meet the deductible. Copay (copayment): A fee you pay “out of pocket” for certain services, such as a doctor’s office visit or prescription drug. If you must pay a copay for a service, this means that you will not be required to meet your deductible or pay coinsurance for that service. Deductible: The amount you pay “out of pocket” before the health plan will start to pay its share of covered expenses. Extra billing (or balance billing): When a provider bills you for the difference between the provider’s charge and the allowed amount that your insurance will cover. For example, if the provider’s charge is $800 and your insurance’s allowed amount is $500, the provider may bill you for the remaining $300, in addition to coinsurance you owe. You may be subject to extra billing if you see a non-contracted provider. Medical home: A “home base” for your medical care. Primary care providers work with specialists to coordinate your care within a defined network of providers. Medical home plans require you to designate your medical home with the insurance provider (Moda). Network: Doctors, pharmacists and other health care providers who make up the plan’s preferred providers. When you use network providers, you pay less because they have agreed to negotiated pricing. For more on finding network providers, see page 11. Out-of-pocket maximum: The most you pay each year out of your own pocket for covered expenses. Once you’ve reached the out-of-pocket maximum, the health plan pays 100 percent for covered expenses. With the OHSU plans, you have separate out-of-pocket maximums for medical and pharmacy. 8 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Prescription drug benefits summary All OHSU medical plans provide pharmacy coverage, which is included in the cost of your medical premium. The Kaiser plan provides coverage through Kaiser pharmacies. The OHSU PPO, Regional Medical Home and National plans have networks of pharmacies. Most major pharmacies—except Walgreens—are in network. You can search for network pharmacies at www.modahealth.com; more detailed instructions are on page 11. Key features OHSU PPO, Regional Medical Home, National Networks NW Prescription Drug Consortium Network (non-OHSU pharmacies) OHSU pharmacies Prescription out-of-pocket (OOP) maximum Retail prescription drug (30-day supply) Value $1,500/person or $2,500/family $4 Select 20%, $100 max 25%, $10 min & $100 max Preferred 30%, $100 max 35%, $10 min & $100 max Brand 50%, $150 max 50%, $10 min & $150 max Mail-order prescription drug (90-day supply) $6 Select 15%, $200 max Preferred 25%, $200 max Brand 50%, $300 max Network pharmacy only Included in medical OOP max $2 Value Kaiser Permanente Not covered $15 copay per formulary prescription Specialty prescription drug (30-day supply)* Value N/A Select 25%, $100 max Preferred 25%, $100 max Brand 50%, $150 max *Specialty medications must be accessed through the exclusive specialty pharmacy https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 9 Eligibility for the lowest-cost OHSU benefits By participating in several wellness programs, you can lower your monthly costs on the OHSU PPO, Regional Medical Home and National plans. Employees who haven’t completed the wellness requirements for 2014 will pay a wellness requirements surcharge in 2015. The surcharge is five percent of the medical/pharmacy premium. Employees who participate in the OHSU wellness programs will not pay the wellness surcharge during the next plan year. Note: New employees automatically do not pay the wellness surcharge during their first year but must participate in the OHSU wellness programs to continue not paying the surcharge in the following year. To avoid paying the wellness surcharge during the 2016 plan year, you must complete the following requirements by Sept. 30, 2015: A. Join the Healthy TEAM Healthy U program and earn at least 2,000 points. —Or— B. Complete two of the following programs: 1. Complete the OHSU Benefits network provider activity. (This online activity can help you learn which providers in your plan’s network are covered at a higher level and which are covered at a lower level.) 2. Receive a flu vaccine by Nov. 30, 2014 at: • An Occupational Health influenza vaccination clinic or site visit, or from an Event Manager in your work area; or • A location of your choice. If receiving a vaccination from a provider other than Occupational Health or an Event Manager, including an OHSU clinical provider, please create or access your ReadySet account at ohsu.readysetsecure.com and complete the seasonal flu immunization survey indicating that you received the vaccination elsewhere. Occupational Health no longer accepts the Influenza Attestation/Declination paper form from previous years. Please note: Vaccinations received before Aug. 1, 2014, do not count toward this year’s influenza vaccination program. Declining the flu vaccine does not fulfill this wellness requirement. You must receive the flu vaccine to meet this requirement. If you have questions, contact Occupational Health at 503 494-5271. 3. Earn 1,000 points in the HealthySteps program. 4. Complete the OHSU-sponsored tobacco cessation program. Start by calling 866-784-8454 or visit www.quitnow.net. Note: This wellness program is also available to your covered dependents over age 18. 5. Complete the OHSU-sponsored weight management program with Weight Watchers. Start by calling 800-8-AT-WORK. Employees are welcome to participate in any of the wellness activities listed above at no cost. See page 12 for more information. Employees not meeting these requirements will pay the five percent surcharge in 2016. 10 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Finding network providers 5. Finally, narrow your search to hone in on specific networks or providers: Before you see a provider, find out which network he or she is in. This will help you avoid being surprised when you receive the bill. Your plan may offer several provider networks or tiers: • To see all providers in a specific network, open the Network/networks drop-down box. Check one or more networks. Scroll back up and click Close to shut the drop-down box. Enter your location information and then click Search. • For the OHSU PPO, Regional Medical Home or National plans, you can choose from several network tiers that provide different levels of coverage (see pages 6-7). • For Kaiser, you can choose only Kaiser providers (except for emergencies). • Similarly, to see a specific provider and his or her associated networks, type their name in the Provider or facility name field and click Search. To search for providers and their networks for the OHSU PPO, Regional Medical Home and National plans: • To find medical homes in your area, open the Provider type drop-down box and select Care Providers & Doctors. Under Network/networks, select either the Synergy or Summit network. Enter your location information and then click Search. 1. Go to www.modahealth.com. You do not need to be a Moda member. You may be asked to enter your state. 2. In the top right, click Find Care to search for a physician, dentist, pharmacy or clinic. 3. Choose Search as a guest to search for providers in networks outside your current plan, such as Synergy/ Summit. Click Go. 4. Next, select the type of provider you are seeking— medical, dental or pharmacy. • To find a network pharmacy, click Pharmacy. Then be sure to choose the network for OHSU plans: NW Prescription Drug Consortium network. Enter your desired search criteria and then click Search. The search results will give you both a map and an alphabetical list. 2015 plan networks OHSU PPO Regional Medical Home (formerly known as 250 PPO) National Non-Contracted* Non-Contracted* Non-Contracted* Community Care Network (CCN) ODS Plus/ Connexus OHSU PPO Synergy/ Summit Network * Member will be balance billed for charges above Moda / PHCS’ reimbursement determination **Oregon residents enrolled in the National plan may access the ODS Plus/Connexus network at the higher coverage level. < Medical Home National Network (PHCS)** (participants outside of the State of Oregon and SW-WA or in Klamath Falls, eligibility determined based on ZIP codes at time of enrollment) https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 11 Wellness benefits Healthy TEAM Healthy U Healthy TEAM Healthy U can help you achieve and maintain a healthier lifestyle. This behavior-based program, designed by OHSU faculty and staff—and refined by your feedback—capitalizes on the power of employees working together. Numerous benefits have been documented, including reduced blood pressure, lower body weight among those who were overweight, improved diet and exercise behaviors, and feeling healthier. Employees also felt less depressed, missed less work and reported being happier after participating in HTHU. For more information, including how to register, visit O2.ohsu.edu and search for Healthy TEAM Healthy U. HealthySteps HealthySteps is an OHSU website where you can track and record your wellness activities. Being physically active, controlling your body weight, attending health-related seminars, giving blood and other activities can all be tracked on the website. This individualinitiated employee wellness program is offered by OHSU Benefits and managed by the Division of Health Promotion and Sports Medicine. For more information, including how to register, visit O2.ohsu.edu and search for HealthySteps. Weight Watchers Benefits-eligible employees can participate in Weight Watchers at no cost. You can choose to attend a community Weight Watchers meeting or coordinate a meeting at your worksite with your colleagues. You can also participate independently in the Weight Watchers online program. For more information, including how to register, visit O2.ohsu.edu and search for Weight Watchers. Tobacco cessation If you use tobacco and would like to quit, OHSU Benefits has support and resources to assist you. OHSU has partnered with the American Cancer Society to provide free resources to employees and their dependents age 18 and older who want to stop using tobacco. Resources include unlimited toll-free access to Quit Coaches, free nicotine replacement therapy (patch or gum) mailed directly to your home and other tools to assist you in your goal. For more information on available cessation resources, please call the American Cancer Society’s Quit For Life program at 866-784-8454 or enroll online at https://www.quitnow.net. 12 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Dental benefits summary Dental coverage is key to your overall health and wellness. You can enroll yourself and your family in dental benefits with Moda Health, Kaiser Permanente or Willamette Dental Group. For Kaiser and Willamette Dental, you choose providers only at those facilities. For Moda Health, you choose providers from a network (see page 11 for instructions). You are responsible for any coinsurance amounts shown in the chart below. Waiting period If you previously declined dental coverage for yourself or a dependent, you will have a 12-month waiting period for anything other than preventive services on the Moda Health dental plan. Moda (ODS)* Kaiser Permanente Willamette Dental Group Annual deductible $50 per person or $150 per family None None Preventive and diagnostic services No charge, not subject to deductible No charge No charge $1,500** None None Routine fillings 20% after deductible is met No charge No charge Root canals 20% after deductible is met No charge No charge Prosthodontic care (crowns, bridges and dentures) 50% after deductible is met $75 copay per procedure/ unit; $25 copay for relines and rebases $75 copay per procedure/unit Orthodontia services 50% ($1,500 lifetime maximum) Not covered $150 copay for preorthodontia; $1,200 copay for comprehensive orthodontia (no lifetime maximum) Key features Annual maximum benefit *A non‐participating dentist or dental care provider has the right to bill the difference between Moda’s maximum plan allowance and the actual charge. This difference will be the member’s responsibility. **Preventive services count towards the annual maximum benefit for Moda Dental. https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 13 Vision benefits summary If you are enrolled in the Kaiser medical plan, your vision plan will be automatically covered through Kaiser at no additional cost to you. If you are enrolled in the OHSU PPO, Regional Medical Home or National plans, OHSU offers you two vision options: a core vision plan and a premium vision plan. You can choose either option or opt out of vision coverage. This information is only a summary of vision coverage. For more information, visit www.vsp.com or www.kp.org. Key features Providers Exam Core Non-VSP provider VSP provider No charge Plan reimburses up to $50 Lenses and frames 14 Premium Non-VSP provider VSP provider No charge $25 copay Plan reimburses up to $50 $25 copay Single vision covered after copay Plan reimburses up to $50 covered after copay Plan reimburses up to $50 Lined bifocal covered after copay Plan reimburses up to $75 covered after copay Plan reimburses up to $75 Lined trifocal covered after copay Plan reimburses up to $100 covered after copay Plan reimburses up to $100 Lens options 35-40% off N/A 35-40% off N/A Progressives 35-40% off Plan reimburses up to $75 covered in full after $30 copay Plan reimburses up to $75 A/R coating 35-40% off N/A covered in full after $30 copay N/A Frames Plan reimburses up to $150 or $80 at Costco Plan reimburses up to $70 Plan reimburses up to $200 or $110 at Costco Plan reimburses up to $70 Contacts Plan reimburses up to $140 for elective contacts in lieu of glasses Plan reimburses up to $140 for elective contacts and contact lens exam in lieu of glasses Plan reimburses up to $200 for elective contacts in lieu of glasses Plan reimburses up to $185 for elective contacts and contact lens exam in lieu of glasses Contact lens exam Up to $60 copay Up to $60 copay Frequency Exam Every 12 months Every 12 months Lenses Every 24 months Every 12 months Frames Every 24 months Every 12 months Contacts in lieu of glasses Every 24 months Every 12 months https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Income protection insurance OHSU provides eligible employees with a variety of plans to provide replacement income to you or your beneficiaries in the event of disability, accident or death. This information is a summary of coverage only. Refer to your certificates of coverage for more detail. The Hartford provides all life and accidental death and dismemberment insurance for OHSU employees. Core life insurance OHSU provides all benefits-eligible employees with a core life insurance policy in the amount of $25,000 at no cost to you. Voluntary life insurance and accidental death and dismemberment coverage You can also choose to purchase additional life and AD&D insurance for yourself, your spouse/domestic partner and child(ren): • Yourself (voluntary employee life insurance): In increments of $25,000, up to a maximum of $975,000. • Your spouse/domestic partner (voluntary spouse/domestic partner life insurance): In increments of $25,000, up to a maximum of $500,000. Evidence of insurability For new hires and newly benefits-eligible employees, evidence of insurability (medical certification) is required for life insurance policies above $300,000 for yourself and above $50,000 for a spouse or domestic partner. • Dependent life insurance: For any eligible dependent, available in the amount of $4,000 per dependent. This is separate from and in addition to spouse/domestic partner life insurance. AD&D coverage is different from life insurance in that it pays benefits if you are killed or seriously injured (such as losing a limb) in an accident. You may elect Employee AD&D insurance to cover yourself or Family AD&D to cover all eligible members of your household. Both policies are available in increments of $50,000, up to $500,000. Monthly costs for voluntary life insurance and AD&D coverage are on pages 16-17. Disability insurance Disability insurance is provided through The Standard. You can buy short-term disability and long-term disability insurance. STD is designed to cover you during a disability that’s shorter than 180 days. It is frequently used to provide replacement income during maternity leaves. LTD is designed to cover you during a disability lasting longer than 180 days. Current benefits-eligible employees have a one-time opportunity during Open Enrollment for 2015 benefits to increase life insurance coverage without evidence of insurability. At all other times, increases or changes to life insurance amounts must be approved by The Hartford before they can go into effect. Disability costs for 2015 Percent of salary Example of monthly premiums for $50,000 annual salary STD 8 day 1.290% $53.75 STD 30 day 0.306% $12.75 STD 90 day 0.080% $3.33 STD 1/15 day 1.082% $45.08 LTD 180 day 0.381% $15.88 Disability premiums are based on your annual compensation as of Oct. 1, 2014. This “frozen” compensation amount and your premium will be visible in the online enrollment system. The premium does not change throughout the calendar year, regardless of income or job changes. The “frozen” compensation amount will be updated each October for the following calendar year. (If you are hired after Oct. 1, your compensation amount will be your annual salary as recorded in Oracle.) Disability payments also are based on your “frozen” compensation up to a maximum annual salary of $100,000. Premiums will be charged to employees only up to that annual salary amount. Continued on page 18 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 15 Voluntary employee life insurance costs for 2015 (monthly) Age <30 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75+ $25,000 $0.43 $0.53 $0.78 $1.20 $1.95 $3.23 $4.55 $6.48 $10.35 $18.15 $22.35 $50,000 $0.85 $1.05 $1.55 $2.40 $3.90 $6.45 $9.10 $12.95 $20.70 $36.30 $44.70 $75,000 $1.28 $1.58 $2.33 $3.60 $5.85 $9.68 $13.65 $19.43 $31.05 $54.45 $67.05 $100,000 $1.70 $2.10 $3.10 $4.80 $7.80 $12.90 $18.20 $25.90 $41.40 $72.60 $89.40 $125,000 $2.13 $2.63 $3.88 $6.00 $9.75 $16.13 $22.75 $32.38 $51.75 $90.75 $111.75 $150,000 $2.55 $3.15 $4.65 $7.20 $11.70 $19.35 $27.30 $38.85 $62.10 $108.90 $134.10 $175,000 $2.98 $3.68 $5.43 $8.40 $13.65 $22.58 $31.85 $45.33 $72.45 $127.05 $156.45 $200,000 $3.40 $4.20 $6.20 $9.60 $15.60 $25.80 $36.40 $51.80 $82.80 $145.20 $178.80 $225,000 $3.83 $4.73 $6.98 $10.80 $17.55 $29.03 $40.95 $58.28 $93.15 $163.35 $201.15 $250,000 $4.25 $5.25 $7.75 $12.00 $19.50 $32.25 $45.50 $64.75 $103.50 $181.50 $223.50 $275,000 $4.68 $5.78 $8.53 $13.20 $21.45 $35.48 $50.05 $71.23 $113.85 $199.65 $245.85 $300,000 $5.10 $6.30 $9.30 $14.40 $23.40 $38.70 $54.60 $77.70 $124.20 $217.80 $268.20 $325,000 $5.53 $6.83 $10.08 $15.60 $25.35 $41.93 $59.15 $84.18 $134.55 $235.95 $290.55 $350,000 $5.95 $7.35 $10.85 $16.80 $27.30 $45.15 $63.70 $90.65 $144.90 $254.10 $312.90 $375,000 $6.38 $7.88 $11.63 $18.00 $29.25 $48.38 $68.25 $97.13 $155.25 $272.25 $335.25 $400,000 $6.80 $8.40 $12.40 $19.20 $31.20 $51.60 $72.80 $103.60 $165.60 $290.40 $357.60 $425,000 $7.23 $8.93 $13.18 $20.40 $33.15 $54.83 $77.35 $110.08 $175.95 $308.55 $379.95 $450,000 $7.65 $9.45 $13.95 $21.60 $35.10 $58.05 $81.90 $116.55 $186.30 $326.70 $402.30 $475,000 $8.08 $9.98 $14.73 $22.80 $37.05 $61.28 $86.45 $123.03 $196.65 $344.85 $424.65 $500,000 $8.50 $10.50 $15.50 $24.00 $39.00 $64.50 $91.00 $129.50 $207.00 $363.00 $447.00 $525,000 $8.93 $11.03 $16.28 $25.20 $40.95 $67.73 $95.55 $135.98 $217.35 $381.15 $469.35 $550,000 $9.35 $11.55 $17.05 $26.40 $42.90 $70.95 $100.10 $142.45 $227.70 $399.30 $491.70 $575,000 $9.78 $12.08 $17.83 $27.60 $44.85 $74.18 $104.65 $148.93 $238.05 $417.45 $514.05 $600,000 $10.20 $12.60 $18.60 $28.80 $46.80 $77.40 $109.20 $155.40 $248.40 $435.60 $536.40 $625,000 $10.63 $13.13 $19.38 $30.00 $48.75 $80.63 $113.75 $161.88 $258.75 $453.75 $558.75 $650,000 $11.05 $13.65 $20.15 $31.20 $50.70 $83.85 $118.30 $168.35 $269.10 $471.90 $581.10 $675,000 $11.48 $14.18 $20.93 $32.40 $52.65 $87.08 $122.85 $174.83 $279.45 $490.05 $603.45 $700,000 $11.90 $14.70 $21.70 $33.60 $54.60 $90.30 $127.40 $181.30 $289.80 $508.20 $625.80 $725,000 $12.33 $15.23 $22.48 $34.80 $56.55 $93.53 $131.95 $187.78 $300.15 $526.35 $648.15 $750,000 $12.75 $15.75 $23.25 $36.00 $58.50 $96.75 $136.50 $194.25 $310.50 $544.50 $670.50 $775,000 $13.18 $16.28 $24.03 $37.20 $60.45 $99.98 $141.05 $200.73 $320.85 $562.65 $692.85 $800,000 $13.60 $16.80 $24.80 $38.40 $62.40 $103.20 $145.60 $207.20 $331.20 $580.80 $715.20 $825,000 $14.03 $17.33 $25.58 $39.60 $64.35 $106.43 $150.15 $213.68 $341.55 $598.95 $737.55 $850,000 $14.45 $17.85 $26.35 $40.80 $66.30 $109.65 $154.70 $220.15 $351.90 $617.10 $759.90 $875,000 $14.88 $18.38 $27.13 $42.00 $68.25 $112.88 $159.25 $226.63 $362.25 $635.25 $782.25 $900,000 $15.30 $18.90 $27.90 $43.20 $70.20 $116.10 $163.80 $233.10 $372.60 $653.40 $804.60 $925,000 $15.73 $19.43 $28.68 $44.40 $72.15 $119.33 $168.35 $239.58 $382.95 $671.55 $826.95 $950,000 $16.15 $19.95 $29.45 $45.60 $74.10 $122.55 $172.90 $246.05 $393.30 $689.70 $849.30 $975,000 $16.58 $20.48 $30.23 $46.80 $76.05 $125.78 $177.45 $252.53 $403.65 $707.85 $871.65 Amount 16 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Voluntary spouse life insurance costs for 2015 (monthly) Age <30 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75+ $25,000 $0.58 $0.78 $1.18 $1.35 $2.33 $3.70 $5.25 $7.58 $13.60 $24.88 $24.88 $50,000 $1.15 $1.55 $2.35 $2.70 $4.65 $7.40 $10.50 $15.15 $27.20 $49.75 $49.75 $75,000 $1.73 $2.33 $3.53 $4.05 $6.98 $11.10 $15.75 $22.73 $40.80 $74.63 $74.63 $100,000 $2.30 $3.10 $4.70 $5.40 $9.30 $14.80 $21.00 $30.30 $54.40 $99.50 $99.50 $125,000 $2.88 $3.88 $5.88 $6.75 $11.63 $18.50 $26.25 $37.88 $68.00 $124.38 $124.38 $150,000 $3.45 $4.65 $7.05 $8.10 $13.95 $22.20 $31.50 $45.45 $81.60 $149.25 $149.25 $175,000 $4.03 $5.43 $8.23 $9.45 $16.28 $25.90 $36.75 $53.03 $95.20 $174.13 $174.13 $200,000 $4.60 $6.20 $9.40 $10.80 $18.60 $29.60 $42.00 $60.60 $108.80 $199.00 $199.00 $225,000 $5.18 $6.98 $10.58 $12.15 $20.93 $33.30 $47.25 $68.18 $122.40 $223.88 $223.88 $250,000 $5.75 $7.75 $11.75 $13.50 $23.25 $37.00 $52.50 $75.75 $136.00 $248.75 $248.75 $275,000 $6.33 $8.53 $12.93 $14.85 $25.58 $40.70 $57.75 $83.33 $149.60 $273.63 $273.63 $300,000 $6.90 $9.30 $14.10 $16.20 $27.90 $44.40 $63.00 $90.90 $163.20 $298.50 $298.50 $325,000 $7.48 $10.08 $15.28 $17.55 $30.23 $48.10 $68.25 $98.48 $176.80 $323.38 $323.38 $350,000 $8.05 $10.85 $16.45 $18.90 $32.55 $51.80 $73.50 $106.05 $190.40 $348.25 $348.25 $375,000 $8.63 $11.63 $17.63 $20.25 $34.88 $55.50 $78.75 $113.63 $204.00 $373.13 $373.13 $400,000 $9.20 $12.40 $18.80 $21.60 $37.20 $59.20 $84.00 $121.20 $217.60 $398.00 $398.00 $425,000 $9.78 $13.18 $19.98 $22.95 $39.53 $62.90 $89.25 $128.78 $231.20 $422.88 $422.88 $450,000 $10.35 $13.95 $21.15 $24.30 $41.85 $66.60 $94.50 $136.35 $244.80 $447.75 $447.75 $475,000 $10.93 $14.73 $22.33 $25.65 $44.18 $70.30 $99.75 $143.93 $258.40 $472.63 $472.63 $500,000 $11.50 $15.50 $23.50 $27.00 $46.50 $74.00 $105.00 $151.50 $272.00 $497.50 $497.50 Amount Employee AD&D costs for 2015 (monthly) Family AD&D costs for 2015 (monthly) Amount Premium Amount Premium $50,000 $0.60 $50,000 $1.20 $100,000 $1.20 $100,000 $2.40 $150,000 $1.80 $150,000 $3.60 $200,000 $2.40 $200,000 $4.80 $250,000 $3.00 $250,000 $6.00 $300,000 $3.60 $300,000 $7.20 $350,000 $4.20 $350,000 $8.40 $400,000 $4.80 $400,000 $9.60 $450,000 $5.40 $450,000 $10.80 $500,000 $6.00 $500,000 $12.00 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 17 • Short-term disability insurance: This benefit pays 65 percent of your salary (up to an annual salary maximum of $100,000) for up to 180 days from the date of disability (some limitations apply). You may choose an 8-day, 30-day or 90-day waiting period; longer periods mean lower premiums. The waiting period is the amount of calendar days you will be required to wait before receiving a disability payment. It’s important to note that you also are required to exhaust your sick time before receiving a disability payment. If you have a lot of sick time, you might consider a longer waiting period, which will be a less expensive premium. The 180 days of coverage include your waiting period. OHSU also offers the 1/15 short-term disability plan. This plan has two waiting periods for disability payments. If you are disabled as the result of an accident, you will have no waiting period. If you are disabled as the result of anything but an accident, your waiting period will be 15 days. This plan may be a good choice if you are concerned about immediate income needs in the face of an unexpected accident, and you have very little sick time Pre-existing conditions These disability plans do not accrued. provide coverage for pre-existing conditions (including • Long-term disability insurance: This benefit pays 65 percent pregnancy). If you have a condition and are planning to of your salary (up to an annual salary maximum of $100,000), enroll in or change disability coverage for that condition, coordinated with other income and benefits, after you have you should consult The Standard or the Benefits team to been disabled for 180 days (some limitations apply). determine if that condition is likely to be covered. Disability payments are not taxable to you upon payment. Additional benefits Flexible spending accounts OHSU offers two types of flexible spending accounts that can help you save for out-of-pocket expenses. Both FSAs can be used with all OHSU-offered medical plans. Contributions to FSAs are deducted from your paycheck semi-monthly (24 times a year). Deductions are made pre-tax, which helps to lower your taxable income and allows you to use FSA dollars tax free on eligible expenses. • Use the Health Care FSA for eligible health care expenses for yourself and your eligible dependents such as deductibles, copays, coinsurance, prescription drugs, dental and vision expenses. Each year, you can contribute up to $2,500 to a Health Care FSA. • Use the Dependent Care FSA for eligible child and elder care expenses so you (and your spouse, if married) can work or go to school. Each year, you can contribute up to $5,000 to a Dependent Care FSA. Visit www.benefithelpsolutions.com for a current list of eligible expenses, claims filing deadlines and other information about your accounts. It’s important to carefully estimate your contributions. Both FSA options feature a grace period, which allows you to incur and pay for FSA claims until March 15 in the following calendar year using funds from your prior year’s FSA. Any unused funds in your FSA account from the prior calendar year will be forfeited after March 15. Household maximum Maximums for Dependent Care FSAs are per household. If you and your spouse both can enroll, the maximum total for both of your accounts is $5,000. Contributing over the annual maximum for your household will have tax implications. Eligible dependents Not all dependents are eligible for FSA coverage. Domestic partners are not considered to be eligible dependents by the IRS, but they are allowed on OHSU benefits. Because FSAs are regulated by the IRS, you cannot use your FSA dollars toward expenses for domestic partners or children of domestic partners. 18 https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 Employee Assistance Program OHSU’s Employee Assistance Program services are provided by Moda Health. The EAP is available to all benefits-eligible employees and their dependents, regardless of the medical plan you choose. The EAP provides you and eligible members of your household with access to confidential counseling to help you address issues such as relationships, drug and alcohol abuse, financial hardship and general stress or depression. Your EAP benefits include three free visits (no copay or other out-of-pocket cost to you) with a counselor for you and/or your dependents. Many issues can be addressed directly with your EAP professional; in some cases, you may be referred to other resources. The EAP is available 24 hours, seven days a week by visiting http://www.modaeap.com or calling 800-826-9231. Travel assistance Whether you are travelling for business or pleasure, travel assistance services are available to you through The Hartford beginning Jan. 1, 2015. The services apply if you are more than 100 miles away from home for 90 days or less. Services include items such as emergency medical assistance (including but not limited to medical referrals, medical evacuation and repatriation), pre-trip information and identify theft programs. Please visit https://o2.ohsu.edu/benefits for additional information. You have a voice—the Employee Benefits Council The EBC is a unique and valuable group that functions on the idea of “by the people, for the people.” The council is made up of your fellow employees to discuss important benefit topics—like what medical plans you are offered—and to make decisions on how to move forward with your needs in mind. OHSU believes you know yourself best and should have a voice in the benefits available to you. It’s important that you and your family have excellent, affordable health, welfare and income-protection benefits. The EBC represents you to make sure you have an array of health, wellness and financial components available for your total compensation and rewards at OHSU. For more information about the EBC, visit https://o2.ohsu.edu/benefits. Your rights Health Care Reform Notice OHSU believes the Kaiser Permanente medical plan is a “grandfathered health plan” under U.S. Health Care Reform legislation (Patient Protection and Affordable Care Act, or the Affordable Care Act). As permitted by the Affordable Care Act, a grandfathered health plan can preserve certain basic health coverage that was already in effect when that law was enacted. Being a grandfathered health plan means that your plan may not include certain consumer protections of the Affordable Care Act that apply to other plans, for example, the requirement for the provision of preventive health services without any cost sharing. However, grandfathered health plans must comply with certain other consumer protections in the Affordable Care Act, for example, the elimination of lifetime limits on benefits. Questions regarding which protections apply and which protections do not apply to a grandfathered health plan and what might cause a plan to change from grandfathered health plan status can be directed to the plan administrator at www.kp.org. You may also contact the U.S. Department of Health and Human Services at www.healthreform.gov. Where to learn more Please visit the OHSU Benefits website at https://o2.ohsu.edu/benefits or contact OHSU Benefits for additional information and full notices on: • Women’s Health and Cancer Rights Act • Medicaid and the Children’s Health Insurance Program (CHIP) • Health Insurance Portability and Accountability Act (HIPAA) of 1996 • Medicare Part D Creditable Coverage Notice • Other additional important notices about your rights https://o2.ohsu.edu/benefits | [email protected] | 503 494-7617 19 Contact information Refer to the chart below for additional contact information about your OHSU benefit options. For individual benefits… Contact ... Call... Visit... OHSU PPO, Regional Medical Home, and National plans Medical: Moda Health Group #10001819 1-855-232-6898 www.modahealth.com Prescription: Moda Health Group #10001819 1-866‐939‐1660 www.modahealth.com Vision: VSP Group #12157430 1-800-877-7195 www.vsp.com Kaiser Permanente HMO (medical, prescription and vision) Kaiser Permanente Group #8553 In Portland: 503-813-2000 Outside Portland: 1-800-813-2000 www.kp.org Dental options Moda Health Group #10001819 In Portland: 503-265-2965 Outside Portland: 1-888-217-2365 www.modahealth.com Kaiser Permanente Group #8553 In Portland: 503-813-2000 Outside Portland: 1-800-813-2000 www.kp.org Willamette Dental Group Group #OR102 1-855-433-6825 www.willamettedental.com Life insurance options (for plans Jan. 1, 2015 and onward) The Hartford Group #402741 1-888-563-1124 www.thehartford.com Life insurance options (for plans until Jan. 1, 2015) The Standard Group #631050 1-800-378-2390 www.standard.com Disability options The Standard Group #631050 1-800-378-2390 www.standard.com Flexible Spending Accounts (HFSA and/or DFSA) BenefitHelp Solutions In Portland: 503-219-3679 Outside Portland: 1-888-398-8057 www.benefithelpsolutions.com EAP Moda Health 1-800-826-9231 www.modaeap.com COBRA BenefitHelp Solutions 1-800-556-3137 www.benefithelpsolutions.com Leaves of absence The Standard 1-800-378-2390 www.standard.com For all benefits… Contact ... Call... Email or visit... General benefit questions OHSU Benefits 503-494-7617 [email protected] https://o2.ohsu.edu/benefits About this guide This guide highlights your benefits. Official plan and insurance documents govern your rights and benefits under each plan. For more details about your benefits, including covered expenses, exclusions and limitations, please refer to the individual summary plan descriptions (SPDs), plan document or certificate of coverage for each plan. If any discrepancy exists between this guide and the official documents, the official documents will prevail. OHSU reserves the right to make changes at any time to the benefits, costs and other provisions relative to benefits. 10/14 (400)

© Copyright 2026