Employee Benefit Options Guide for Plan Year 2015

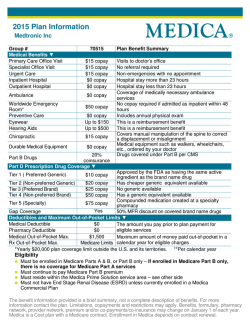

3140 Employees Group Insurance Division Office of Management and Enterprise Services Monthly Premiums for Current Employees Plan Year Jan. 1 through Dec. 31, 2015 HEALTH PLANS MEMBER HealthChoice High HealthChoice High Alternative HealthChoice Basic HealthChoice Basic Alternative HealthChoice High Deductible Health Plan (HDHP) HealthChoice USA CommunityCare HMO GlobalHealth HMO $ 499.42 $ 499.42 $ 391.52 $ 391.52 $ 338.02 $ 764.44 $ 711.34 $ 469.02 DISABILITY (Employee only) SPOUSE CHILD $ 676.28 $ 676.28 $ 501.74 $ 501.74 $ 430.60 $ 764.44 $ 1,036.16 $ 769.22 $ 253.56 $ 253.56 $ 215.94 $ 215.94 $ 186.80 $ 251.06 $ 362.30 $ 247.18 CHILDREN $ 391.20 $ 391.20 $ 342.74 $ 342.74 $ 295.24 $ 387.16 $ 579.68 $ 394.04 $9.10 (Limited county participation only) DENTAL PLANS MEMBER SPOUSE HealthChoice Dental Assurant Freedom Preferred Assurant Heritage Plus with SBA (Prepaid) Assurant Heritage Secure (Prepaid) Cigna Dental Care Plan (Prepaid) Delta Dental PPO Delta Dental PPO Plus Premier Delta Dental PPO — Choice $ 32.00 $ 28.82 $ 11.74 $ 7.20 $ 9.26 $ 33.64 $ 47.98 $ 15.06 VISION PLANS $ 32.00 $ 28.66 $ 8.86 $ 5.98 $ 6.06 $ 33.62 $ 47.98 $ 34.18 MEMBER SPOUSE Humana/CompBenefits VisionCare Plan Primary Vision Care Services (PVCS) Superior Vision UnitedHealthcare Vision Vision Care Direct Vision Service Plan (VSP) $ 7.14 $ 9.00 $ 7.40 $ 8.18 $ 14.16 $ 9.50 LIFE HealthChoice Basic Life ($20,000) $4.00 $ 12.46 $ 8.00 $ 7.36 $ 5.78 $ 8.50 $ 6.36 CHILD $ 27.40 $ 21.50 $ 7.60 $ 5.20 $ 7.08 $ 29.26 $ 41.76 $ 34.44 CHILD $ 10.90 $ 8.00 $ 6.96 $ 4.58 $ 8.50 $ 6.12 CHILDREN $ 68.20 $ 57.80 $ 15.20 $ 10.38 $ 15.32 $ 74.04 $ 105.66 $ 83.60 CHILDREN $ 11.84 $ 11.00 $ 14.30 $ 6.98 $ 12.00 $ 13.72 First $20,000 of Supplemental Life $4.00 SUPPLEMENTAL LIFE — Age Rated Cost Per $20,000 Unit < 30 -------- $ 0.80 40 - 44 ---- $ 1.20 55 - 59 ---- $ 6.00 70 - 74 ---- $19.20 DEPENDENT LIFE Spouse Child (live birth to age 26) 30 - 34 45 - 49 60 - 64 75+ Low Option $2.60 $6,000 of coverage $3,000 of coverage ------------- $ 0.80 $ 2.00 $ 6.80 $29.60 Standard Option $4.32 $10,000 of coverage $ 5,000 of coverage Dependent Life does not include Accidental Death and Dismemberment (AD&D). 35 - 39 ---- $ 0.80 50 - 54 ---- $ 4.00 65 - 69 ---- $11.20 Premier Option $8.64 $20,000 of coverage $10,000 of coverage EGID Mission, Vision, Values and Behaviors Statements Mission Statement In an ever-changing environment, we are committed to serving the State of Oklahoma by providing, with the highest degree of efficiency, a wide range of quality insurance benefits that are competitively priced and uniquely designed to meet the needs of our defined population. Vision Statement To protect the participant’s health, wellness and financial futures by leveraging technology and industry best practices to administer innovated insurance plans. Values and Behaviors Customer Service To provide prompt and professional interaction with each individual and entity and require the same for each contracted vendor. Confidentiality To protect confidential information. Teamwork To encourage a collaborative effort throughout the Division to achieve common goals. Continuous Improvement Keeping competitive by improving skills, innovative technology, and utilizing creative approaches. Communication Striving for transparency, accuracy and clarity in all communications. This publication was printed by the Office of Management and Enterprise Services as authorized by Title 62, Section 34. 20,000 copies have been printed at a cost of $13,630.75. A copy has been submitted to Documents.OK.gov in accordance with the Oklahoma State Government Open Documents Initiative (62 O.S. 2012, § 34.11.3). This work is licensed under a Creative Attribution-NonCommercial-NoDerivs 3.0 Unported License. A fully accessible version of this guide is available on the EGID website at www.sib.ok.gov or www.healthchoiceok.com. TABLE OF CONTENTS Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . i 2015 Plan Changes and Important Reminders. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 General Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Health Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Dental Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Vision Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 HealthChoice Life Insurance Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 HealthChoice Disability Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 American Fidelity Health Savings Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Oklahoma Tobacco Helpline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Enrollment Periods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Eligibility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9 HMO ZIP Code Lists . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Comparison of Network Benefits for Health Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 Comparison of Benefits for Dental Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . .24 Comparison of Benefits for Vision Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26 Contact Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .29 This information is only a brief summary of the plans. All benefits and limitations of these plans are governed in all cases by the relevant plan documents, insurance contracts, handbooks and Administrative Rules of the Employees Group Insurance Division of the Office of Management and Enterprise Services. The rules of the Oklahoma Administrative Code, Title 260, are controlling in all aspects of plan benefits. No oral statement of any person shall modify or otherwise affect the benefits, limitations or exclusions of any plan. www.sib.ok.gov or healthchoiceok.com INTRODUCTION The Office of Management and Enterprise Services Employees Group Insurance Division (EGID) produced this guide as a summary of the benefits offered by the health, dental, vision, life and disability plans available for eligible new and current education and local government employees. Refer to the Monthly Premium Chart and Comparison of Benefits charts to determine your costs under each plan. Helpful Hints for Option Period ♦ Review Section B of your pre-printed Option Period Enrollment/Change Form listing your most current coverage. ♦ Contact your Insurance Coordinator (IC) if you have questions about your current coverage. ♦ Review the plan changes for 2015 beginning on page 1 of this guide. ♦ Ask your IC if you should return your form even if you are not making changes. ♦ Use the following additional resources to help you choose coverage for next year: ● Plan provider directories; ● Summaries of Benefits and Coverage; ● Your Insurance Coordinator; and ● Contact Information on page 29 ♦ Complete your Option Period Enrollment/Change Form and return it to your IC by the deadline set by your Insurance Coordinator. ♦ Review your Confirmation Statement (CS) when you receive it in the mail to verify your coverage is correct. ♦ Contact your IC right away if your CS is incorrect. If you do not make changes to your coverage and you are not automatically enrolled in one of the HealthChoice Alternative Plans (refer to page 1), you will not receive a CS from EGID. Keep a copy of your Option Period Enrollment/Change Form as verification of your insurance coverage. Helpful Hints for New Employees ♦ ♦ ♦ ♦ Use the above additional resources to help you choose coverage. Complete your Insurance Enrollment Form and return it to your IC. Review your CS when you receive it in the mail to verify your coverage is correct. Contact your IC right away if your CS is incorrect. i 2015 PLAN CHANGES AND IMPORTANT REMINDERS Plan changes are indicated by bold text in the Comparison of Benefits charts. HealthChoice Basic Plans ♦ The calendar year deductible for the HealthChoice Basic Plan is increasing from $500 to $1,000 for an individual and from $1,000 to $1,500 for a family. The out-of-pocket maximum is decreasing from $5,500 to $4,000 for an individual and from $11,000 to $9,000 for a family. ♦ The calendar year deductible for the HealthChoice Basic Alternative Plan is increasing from $750 to $1,250 for an individual and from $1,500 to $1,750 for a family. The out-of-pocket maximum is decreasing from $5,750 to $4,000 for an individual and from $11,500 to $9,000 for a family. HealthChoice High Deductible Health Plan (formerly S-Account) ♦ The name of the HealthChoice S-Account is changing to the HealthChoice High Deductible Health Plan. ♦ The annual maximum contribution amounts are changing from $3,300 to $3,350 for an individual and from $6,550 to $6,650 for a family. CommunityCare HMO ♦ CommunityCare has made changes to the network of providers available for state, education and local government members in 2015. Please review the updated provider directory on the website at state.ccok.com to confirm the status of your provider(s). Reminder – All Health Plans ♦ Review your plan’s 2015 formulary, excluded medications list, and any prior authorization or quantity limit lists by visiting the plan’s website. Reminder To complete your HealthChoice tobacco-free Attestation, log on to HealthConnect at https://gateway.sib.ok.gov/ Attestation. The Attestation is open from Aug. 1, 2014, through Nov. 14, 2014, and is required for all members who are tobacco-free starting their second plan year on the HealthChoice High or Basic Plan (first plan year is waived). If you cannot complete the tobacco-free Attestation because you or your covered dependents are not tobacco-free, you can still qualify for the HealthChoice High or Basic Plan if you can provide one of the following Reasonable Alternatives: ♦ Show proof of an attempt to quit using tobacco by enrolling in the quit tobacco program available through the Oklahoma Tobacco Helpline and Alere Wellbeing AND completing three coaching calls by Nov. 14, 2014; or ♦ Provide a letter from your doctor by Nov. 14, 2014, indicating it is not medically advisable for you or your covered dependents to quit tobacco. If you do not complete the tobacco-free Attestation or complete one of the Reasonable Alternatives as defined above, you will automatically be enrolled in the HealthChoice High Alternative or Basic Alternative Plan, and your annual deductible and out-of-pocket maximum will be $250 higher. For more information on tobacco cessation products and resources to help you quit, go to http://www.ok.gov/sib/Tobacco_Free.html. 1 If you have questions about any of the plan changes or need additional information, please contact the plan directly. Refer to Contact Information on page 29. 2 GENERAL INFORMATION Your employer determines which benefits are available to you and may not participate in all the benefits explained in this guide. Ask your IC which benefits are available to you. The benefits you select will be in effect Jan. 1, 2015, or for new employees, the effective date of your coverage, through Dec. 31, 2015, or your termination date if earlier. After enrollment, the plans you selected will provide more information about your benefits. Contact the plan directly with your benefit questions. Once enrolled in any of the plans, it is your responsibility to review your benefits carefully so you know what is covered, as well as the plan’s policies and procedures, before you use your benefits. HEALTH PLANS There are eight health plans available: ♦ HealthChoice High and High Alternative Plans ♦ HealthChoice USA Plan ♦ HealthChoice Basic and Basic Alternative Plans ♦ CommunityCare HMO ♦ HealthChoice HDHP ♦ GlobalHealth HMO Refer to the Comparison of Network Benefits for Health Plans on pages 16-23 for specific benefit information. ♦ There are no preexisting condition exclusions or limitations applied to any of the health plans. ♦ You can become tobacco-free at any time, but HealthChoice High or Basic Plan enrollees must complete the Attestation or a Reasonable Alternative during Option Period, unless the grace period applies to you. Visit www.sib.ok.gov or www.healthchoiceok.com. ♦ The HealthChoice USA Plan is designed for employees who receive a work assignment of 90 or more consecutive days outside of Oklahoma and Arkansas. ♦ HealthChoice contracts with American Fidelity Health Services Administration to make establishing and keeping a health savings account (HSA) easier and more convenient for HealthChoice HDHP members. For more information about HSAs, refer to page 6. ♦ You must live or work within an HMO’s ZIP code service area to be eligible. Post office box addresses cannot be used to determine your HMO eligibility. Refer to pages 12-15 for the HMO ZIP Code Lists. ♦ If you select an HMO, you must use the provider network designated by that plan for Oklahoma. ♦ All health plans coordinate benefits with other group insurance plans you have in force. DENTAL PLANS There are eight dental plans available: ♦ Assurant Freedom Preferred ♦ Delta Dental PPO ♦ Assurant Heritage Plus with SBA (Prepaid) ♦ Delta Dental PPO Plus Premier ♦ Assurant Heritage Secure (Prepaid) ♦ Delta Dental PPO – Choice ♦ CIGNA Dental Care Plan (Prepaid) ♦ HealthChoice Dental Refer to the Comparison of Benefits for Dental Plans on pages 24-25 for specific benefit information. 3 VISION PLANS There are six vision plans available: ♦ Humana/CompBenefits VisionCare Plan ♦ Primary Vision Care Services (PVCS) ♦ Superior Vision ♦ UnitedHealthcare Vision ♦ Vision Care Direct ♦ Vision Service Plan (VSP) Refer to the Comparison of Benefits for Vision Plans on pages 26-27 for specific benefit information. ♦ Verify your vision provider participates in a vision plan’s network by contacting the plan, visiting the plan’s website or calling your provider. ♦ All vision plans have limited coverage for services provided by out-of-network providers. If your provider leaves your health, dental or vision plan, you cannot change plans until the next annual Option Period; however, you can change providers within your plan’s network as needed. Retiring and Changing Plans If you are retiring on or before Jan. 1, 2015, go to www.sib.ok.gov or www.healthchoiceok.com for the appropriate Option Period materials. Select the Option Period button, then select according to your status as of Jan. 1 – Pre-Medicare or Medicare. Your Insurance Coordinator can assist you and must also provide you the required Application for Retiree/Vested/Non-Vest/Defer Insurance. If you and/or your dependent(s) will be Medicare eligible by Jan. 1, an additional form will be required for Part D. You can also call EGID Member Services. Refer to Contact Information on page 29. HEALTHCHOICE LIFE INSURANCE PLAN ♦ As a new employee, you can elect life insurance coverage within 30 days of your employment or initial eligibility date. You can enroll in Guaranteed Issue, in addition to Basic Life, without a Life Insurance Application. Guaranteed Issue is two times your annual salary rounded up to the nearest $20,000. All requests for supplemental coverage above Guaranteed Issue require an approved Life Insurance Application. ♦ As a current employee, if you did not enroll when first eligible, you can enroll with an approved Life Insurance Application: ● During the annual Option Period (enroll in or increase life coverage); or ● Within 30 days of a midyear qualifying event, such as birth of a child or marriage. As a current employee, you can enroll in life insurance coverage within 30 days of the loss of other group life coverage. You are eligible to enroll in the amount of coverage you lost rounded up to the next $20,000 unit without an approved Life Insurance Application. Proof of loss is required. Basic Life Insurance. . . For You ♦ Basic Life pays a benefit of $20,000 to your beneficiary in the event of your death. ♦ Basic Life includes Accidental Death and Dismemberment (AD&D) coverage, which pays an additional $20,000 to your beneficiary if your death is due to an accident. It also pays benefits if you lose your sight or a limb due to an accident. Supplemental Life Insurance . . . For You ♦ You can enroll in Supplemental Life in units of $20,000. The maximum amount of Supplemental Life coverage available is $500,000. You must complete a Life Insurance Application to apply for coverage. ♦ The first $20,000 of Supplemental Life provides an additional $20,000 of AD&D coverage. 4 Beneficiary Designation For Basic and Supplemental Life benefits, you must name your beneficiary(ies) when you enroll. Your designation can be changed at any time. For a Beneficiary Designation Form or more information, contact your IC. This form is also available at www.healthchoiceok.com or www.sib.ok.gov. Life insurance benefits are paid according to the information on file. Dependent Life Insurance . . . For Your Eligible Dependents ♦ If you are enrolled in Basic Life insurance, you can elect Dependent Life for your spouse and other eligible dependents during your initial enrollment, the annual Option Period, or within 30 days of the loss of other group life insurance or other midyear qualifying event without a Life Insurance Application. ♦ Each eligible dependent must be enrolled in Dependent Life. Regardless of the number of dependents, the monthly premium is a flat amount. Benefits are paid only to the member. Below are the three levels of coverage: DEPENDENT LOW OPTION STANDARD OPTION Spouse $6,000 of coverage Child (live birth to age 26) $3,000 of coverage Dependent Life does not include AD&D coverage. $10,000 of coverage $ 5,000 of coverage PREMIER OPTION $20,000 of coverage $10,000 of coverage HEALTHCHOICE DISABILITY PLAN The HealthChoice Disability Plan provides partial replacement income if you are unable to work due to an illness or injury. Disability coverage is not available to dependents. Eligibility Enrollment in the Disability Plan begins the first day of the month following your employment date or the date you become eligible. You become eligible for disability benefits after 31 consecutive days of employment. During that time, you must continuously perform all of the material duties of your regular occupation. Any claim for disability benefits must be filed within one year of the date your disability began. 5 HEALTH SAVINGS ACCOUNTS A Health Savings Account (HSA) is an individually owned savings account that allows you to set aside money for health care tax-free whenever you select an HSA qualified High Deductible Health Plan (HDHP). Money left in the account can accumulate interest tax-free and money used to pay for qualified medical expenses can be made tax-free. Through your employers Section 125 plan, you can contribute pre-tax amounts up to the yearly maximum allowed. SOME HIGHLIGHTS OF HSAs HSA contributions are tax-free. Interest may be tax-free. Interest earned is applied to your account starting with first dollar contribution. Withdrawals are not taxed when funds are used for qualified medical expenses. You decide when and how to use your money. No “use it or lose it” requirement meaning whatever deposits you make each year can be left on deposit to earn interest and to be available to pay for future medical expenses. ♦ You can pay for qualified medical expenses on yourself, and your spouse or your tax dependents regardless of whether or not they are on your health plan. ♦ No matter where you go, your account follows you. Even if you change jobs, change medical coverage, become unemployed, move to another state, or change your marital status, your HSA goes with you. You own it! ♦ If you do not remain a qualified individual, you can continue to earn interest and pay for qualified medical expenses as long as there are funds in your account. ♦ ♦ ♦ ♦ ♦ ♦ CONTRIBUTIONS You can contribute up to the annual maximum amount allowed by law in any given tax-year. The IRS establishes the maximum amounts on an annual basis. The 2014 maximum allowable is $3,300 for an individual or $6,550 for a family. The 2015 maximum allowable contribution is $3,350 for an individual or $6,650 for a family. If your HDHP is effective other than January 1 and you wish to make the maximum contribution, you must meet certain requirements. Go to www.afhsa.com for more information. If you are age 55 and older, you are eligible to make a catch-up contribution of $1,000. HSAs are owned by one individual, so if you and your spouse are covered under the family HDHP and both of you are age 55 or older, only you as the owner of the account can make the catch up contribution. Your spouse would be required to establish his or her own HSA to make catch-up contributions. QUALIFIED MEDICAL EXPENSES There are many expenses that qualify for tax-free distributions. For a listing, you can refer to the HSA Eligible Expenses listed on www.afhsa.com. If you use funds for any expenses that are not eligible, then the funds withdrawn are subject to income taxes and a 20% additional tax penalty. The non-qualified distributions must be reported on your annual income tax return. Additional information on eligible expenses can be found in IRS Publication 502 at www.irs.gov. Even though Publication 502 is a valuable resource on what qualifies as a medical expense, it addresses only what expenses are deductible. It does not describe the different rules for reimbursing medical expenses under an HSA. MAKING WITHDRAWALS FROM YOUR HSA You can withdraw funds from your account in three ways: 1. HSA Debit Card; 2. On-Line Distribution Request; 3. Distribution Form. You can use the money from your HSA as follows: 1. You can only use the funds that have been deposited. 2. You can withdraw funds for qualified medical expenses incurred after the date your account is established. 3. You may elect to make withdrawals from your HSA when the expenses are incurred, or you may make withdrawals for these expenses anytime in the future. There is no time limit. SB-22136 0512(State of Oklahoma)-513 6 The IRS requires that you keep receipts to prove that your HSA funds were used to pay for qualified medical expenses in order to receive the tax benefit. Although you are not required to send your receipts with your tax returns, keeping your receipts with your tax information is an excellent way to ensure proper documentation. You will receive two forms each year as a result of having an HSA: 1) a 1099-SA which shows the total distributions from your account will be mailed by January 31, and 2) a 5498-SA which shows total contributions to your account will be mailed by May 31. Each of these forms will be sent to the IRS. ELIGIBILITY REQUIREMENTS To be eligible to establish and contribute to an HSA, you must meet the following requirements: ♦ You must have an HSA qualified HDHP. ♦ You cannot be claimed as a dependent on anyone else’s tax return. ♦ You cannot be covered under a non-HDHP coverage other than “permitted coverage” or “permitted insurance” and/or preventative care. Products such as Cancer, Accident, Long Term Care, and Disability Income are usually considered permitted coverage/insurance. Check with your employer or the insurance provider to be sure. ♦ You cannot have a general purpose Health FSA-Medical Reimbursement Account or a general purpose Health Reimbursement Account (HRA). However, you can have a Limited Purpose Health FSA or HRA which allows for dental and vision reimbursement only should your employer offer this benefit. Note: If you are covered under your spouse’s general purpose Health FSA or HRA, then you are not eligible to establish and contribute to an HSA. In addition, your eligibility may be affected if you have access to the following: Employer’s on-site clinic, VA benefits, Tri-Care or an Indian Clinic. ♦ You cannot be enrolled in Medicare. INTEREST & ACCOUNT FEES HSA funds are deposited into an interest bearing FDIC insured account. The more you save the more you earn. Monthly maintenance and transaction fees may apply and will be deducted from your account. Check with your employer for the interest/fee schedule. If you seek higher returns or value security, we do not charge transaction fees or broker commissions when we give you access to investment fund options that cover the spectrum of investment risks. (Fees associated with certain mutual funds may be incurred. Review the mutual funds prospectus for additional information when you are ready to invest.) SUMMARY HSAs give you the savings potential, flexibility, portability, and tax savings unlike any other savings account. By enrolling in a qualified HDHP, you save on premiums. By investing those savings into an HSA, you can save for medical expenses in the future. Individuals who elect an HSA with us will receive a welcome packet outlining all the information associated with the account. This flyer is meant to provide you high level information on HSAs. For more information on HSAs visit our website at www.afhsa.com. There you will find an overview specific to employees/individuals along with other helpful information. CONTACT INFORMATION American Fidelity Health Services Administration 2000 N. Classen Blvd., Suite 7E Oklahoma City, OK 73106 (405) 523-5699 Local Number Toll-free 1-866-326-3600 Fax (405) 523-5072 Web site - www.afhsa.com Email - [email protected] American Fidelity Health Services Administration and its affiliates do not provide legal or tax advice and the information provided is general in nature and should not be considered legal or tax advice. You should consult with an attorney or tax professional regarding legal or tax advice. 7 SB-22136 0512(State of Oklahoma)-513 What is the Oklahoma Tobacco Helpline? The Helpline is a highly effective tobacco cessation program that provides a series of one-on-one coaching sessions over the telephone. Once enrolled in the program, most participants also receive nicotine replacement products such as patches, gum or lozenges. The Helpline has been proven to work for Oklahomans, and similar Helplines have been proven to work for people all over the country. How does telephone coaching work? Identify yourself as a HealthChoice participant when you call the Helpline at 1-800-QUIT-NOW. You’ll speak with a helpful registration assistant who will gather basic contact information and ask a few questions about your reason for calling. Then, a Helpline Quit Coach™ will work with you to determine your readiness to quit, discuss your options for using nicotine replacement products or other cessation aids, and assist you in developing a quit plan that is right for you. The Quit Coach will also schedule up to four follow-up sessions throughout your quitting process and you can call in to speak with a coach as needed between scheduled calls. Who is eligible to receive Helpline services? Anyone living in Oklahoma age 13 or older can call the Helpline and receive services at no charge up to twice per year. Helpline specialists assist tobacco users, health care professionals, and concerned family members and friends. The level of services available will depend on an individual’s age and insurance status. Do HealthChoice participants have to be tobacco-free? To remain enrolled in the HealthChoice High or HealthChoice Basic Plan, participants must attest that they and their covered dependents are tobacco-free. For participants who can’t complete the tobaccofree Attestation and would like to remain on the HealthChoice High or Basic Plan, they can still qualify by completing one of the following Reasonable Alternative options: 1. Enrolling in the quit tobacco program as mentioned on this flyer and completing three coaching calls prior to the deadline within the calendar year of their Option Period. 2. Providing a letter from their physician prior to the deadline. What are the Oklahoma Tobacco Helpline hours? The Helpline is available 24 hours a day, 7 days a week. Do HealthChoice members receive additional Helpline benefits? HealthChoice members enrolled in the Helpline program can receive up to 12 weeks of nicotine replacement products up to twice per year with no copay or deductible. The products are mailed directly to your home. 8 ENROLLMENT PERIODS Option Period Enrollment – Coverage effective Jan. 1, 2015 This is the time when eligible employees can: ● Enroll in coverage; ● Change plans or drop coverage; ● Increase or decrease life coverage; or ● Add or drop eligible dependents from coverage. ♦ You can enroll in health, dental, life and/or vision coverage for yourself and/or your dependent(s) during the annual Option Period, as long as you have not dropped that coverage within the past 12 months. If you have dropped coverage within the past 12 months without a midyear qualifying event, limitations and/or exceptions may apply. ♦ Keep a copy of your Option Period Enrollment/Change Form for your records. Initial Enrollment – Coverage effective the first of the month following your employment date or the date set by your employer This is the time when new employees are eligible to: ● Enroll in coverage; ● Enroll eligible dependents; and ● Enroll in Guaranteed Issue life or apply for greater coverage by submitting a Life Insurance Application. As a new employee, you have 30 days from your employment or eligibility date to enroll in coverage. If you do not enroll within 30 days, you cannot enroll until the next annual Option Period, unless you experience a qualifying event. Check with your IC for more information. You have 30 days following your eligibility date to make changes to your original enrollment. Keep a copy of your Insurance Enrollment Form for your records. Midyear Changes – Coverage generally effective the first of the month following a qualifying event Midyear plan changes are allowed only when a qualifying event, such as birth, marriage or loss of other group coverage, occurs. You must complete an Insurance Change Form within 30 days of the event. Your IC has more information. ELIGIBILITY Members ♦ Your employer must participate in the plans offered through EGID. ♦ You must be a current education employee eligible to participate in the Oklahoma Teachers Retirement System working a minimum of four hours per day or 20 hours per week, or a current local government employee regularly scheduled to work at least 1,000 hours a year, and not classified as temporary or seasonal. ♦ You must be enrolled in a group health plan to enroll in dental and/or life insurance. 9 Dependents ♦ If one eligible dependent is covered, all eligible dependents must be covered. Exceptions apply (refer to Excluding Dependents from Coverage below). ♦ Eligible dependents include: ● Your legal spouse (including common-law); ● Your daughter, son, stepdaughter, stepson, eligible foster child, adopted child or child legally placed with you for adoption up to age 26, whether married or unmarried; ● A dependent, regardless of age, who is incapable of self-support due to a disability that was diagnosed prior to age 26. Subject to medical review and approval; and ● Other unmarried dependent children up to age 26, upon completion and approval of an Application for Coverage for Other Dependent Children. Guardianship papers or a tax return showing dependency can be provided in lieu of the application. ♦ If your spouse is enrolled separately in one of the EGID plans, your dependents can be covered under either parent’s health, dental and/or vision plan (but not both); however, both parents can cover dependents under Dependent Life. ♦ Dependents who are not enrolled within 30 days of your eligibility date cannot be enrolled until the next annual Option Period, unless a qualifying event such as birth, marriage or loss of other group coverage occurs. Dependents can be dropped midyear with a qualifying event. Otherwise, the 12-month requirement applies before reinstatement is possible during the next annual Option Period. ♦ Dependents can be enrolled only in the same types of coverage and in the same plans you elect. ♦ To enroll your newborn, an Insurance Change Form must be provided to your IC within 30 days of the birth. This coverage is effective the first of the birth month. If you do not enroll your newborn during this 30-day period, you cannot do so until the next annual Option Period. Direct notification to a plan will not enroll your newborn or any other dependents. The newborn’s Social Security number is not required at the time of initial enrollment, but must be provided once it is received from Social Security. Insurance premiums for the month the child was born must be paid. Under the HealthChoice Plans, a separate deductible and coinsurance applies. ♦ Without enrollment, newborns are covered only for the first 48 hours following a vaginal birth or the first 96 hours following a cesarean section birth under HealthChoice. Deductible and coinsurance may apply. ♦ CommunityCare and GlobalHealth HMO - A newborn is covered for 31 days without an additional premium. Excluding Dependents from Coverage ♦ You can exclude your spouse from health and/or dental coverage while covering other dependents on these benefits. Your spouse must sign the Spouse Exclusion Certification section of the enrollment or change form. ♦ You can exclude dependents who do not reside with you, are married, are not financially dependent on you for support, have other group coverage or are eligible for Indian or military health benefits. Note: Your spouse cannot be excluded from vision coverage if your other dependents are covered unless your spouse has proof of other group vision coverage. You must always provide proof of other group coverage to your Insurance Coordinator when excluding a dependent for that reason. Confirmation Statement (CS) ♦ You are mailed a CS when you enroll or make changes to your coverage. Your CS lists the coverage you are enrolled in, the effective date of your coverage and the premium amounts. ♦ Always review your CS to verify your coverage is correct. Corrections to your coverage must be submitted to your IC within 60 days of your election. Corrections reported after 60 days are effective the first of the month following notification. 10 ♦ Section B of your Option Period Enrollment/Change Form lists your most current coverage. If you don’t make changes and you are not automatically enrolled in one of the HealthChoice Alternative Plans, you will not receive a CS from EGID. Keep a copy of your Option Period Enrollment/Change Form as verification of your coverage. Transfer Employee ♦ You can keep your coverage continuous when you move from one participating employer to another as long as there is no break in coverage that lasts longer than 30 days. Premiums must be paid upon reporting to work. ♦ Benefit options vary from employer to employer. Changes to your coverage must be made within the first 30 days of your transfer. Your IC has more information. Termination of Coverage ♦ Coverage will end the last day of the month in which a termination event occurs. such as: ● Loss of employment; ● Reduction in hours; ● Loss of dependent eligibility; ● Non-payment of premiums; or ● Death. COBRA – Temporary Continuation of Coverage ♦ The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows you and/or your dependents to continue health, dental and/or vision insurance coverage after your employment terminates or after your dependent loses eligibility. Certain time limits apply to enrollment. Contact your IC immediately upon termination of your employment, or when changes to your family status occur, to find out more about your COBRA rights. Be aware, dropping dependent coverage during Option Period is not a COBRA qualifying event. 11 CommunityCare ZIP Code List 2 0 1 5 H M O Z I P C O D E L I S T S 74001 74009 74016 74023 74033 74041 74048 74056 74066 74074 74082 74104 74114 74126 74133 74146 74155 74171 74189 74332 74342 74352 74361 74368 74422 74430 74438 74447 74457 74464 74471 74523 74546 74557 74565 74633 74738 74880 74936 74944 74953 74962 74002 74010 74017 74027 74034 74042 74050 74058 74067 74075 74083 74105 74115 74127 74134 74147 74156 74172 74192 74333 74343 74353 74362 74369 74423 74431 74440 74450 74458 74465 74472 74526 74547 74558 74567 74637 74743 74901 74937 74945 74954 74964 74003 74011 74018 74028 74035 74043 74051 74059 74068 74076 74084 74106 74116 74128 74135 74148 74157 74182 74193 74335 74344 74354 74363 74370 74425 74432 74441 74451 74459 74466 74477 74528 74548 74559 74570 74650 74756 74902 74939 74946 74955 74965 74004 74012 74019 74029 74036 74044 74052 74060 74070 74077 74085 74107 74117 74129 74136 74149 74158 74183 74194 74337 74346 74355 74364 74401 74426 74434 74442 74452 74460 74467 74501 74529 74549 74560 74571 74652 74759 74930 74940 74947 74956 74966 12 74005 74013 74020 74030 74037 74045 74053 74061 74071 74078 74101 74108 74119 74130 74137 74150 74159 74184 74301 74338 74347 74358 74365 74402 74427 74435 74444 74454 74461 74468 74502 74536 74552 74561 74574 74653 74760 74931 74941 74948 74957 74006 74014 74021 74031 74038 74046 74054 74062 74072 74080 74102 74110 74120 74131 74141 74152 74169 74186 74330 74339 74349 74359 74366 74403 74428 74436 74445 74455 74462 74469 74521 74543 74553 74562 74577 74727 74761 74932 74942 74949 74959 74008 74015 74022 74032 74039 74047 74055 74063 74073 74081 74103 74112 74121 74132 74145 74153 74170 74187 74331 74340 74350 74360 74367 74421 74429 74437 74446 74456 74463 74470 74522 74545 74554 74563 74578 74735 74845 74935 74943 74951 74960 GlobalHealth ZIP Code List 73001 73008 73015 73022 73029 73037 73045 73053 73061 73068 73075 73084 73095 73103 73110 73117 73124 73131 73140 73147 73154 73163 73173 73190 73425 73437 73444 73455 73481 73505 73526 73533 73541 73549 73556 73564 73571 73625 73641 73650 73661 73669 73002 73009 73016 73023 73030 73038 73047 73054 73062 73069 73077 73085 73096 73104 73111 73118 73125 73132 73141 73148 73155 73164 73177 73194 73430 73438 73446 73456 73487 73506 73527 73534 73542 73550 73557 73565 73572 73626 73642 73651 73662 73673 73003 73010 73017 73024 73031 73040 73048 73055 73063 73070 73078 73086 73097 73105 73112 73119 73126 73134 73142 73149 73156 73165 73178 73195 73432 73439 73447 73458 73488 73507 73528 73536 73543 73551 73558 73566 73573 73627 73644 73654 73663 73701 73004 73011 73018 73025 73032 73041 73049 73056 73064 73071 73079 73089 73098 73106 73113 73120 73127 73135 73143 73150 73157 73167 73179 73196 73433 73440 73448 73459 73491 73520 73529 73537 73544 73552 73559 73567 73601 73628 73645 73655 73664 73702 73005 73012 73019 73026 73033 73042 73050 73057 73065 73072 73080 73090 73099 73107 73114 73121 73128 73136 73144 73151 73159 73169 73184 73401 73434 73441 73449 73460 73501 73521 73530 73538 73546 73553 73560 73568 73620 73632 73646 73658 73666 73703 13 73006 73013 73020 73027 73034 73043 73051 73058 73066 73073 73082 73092 73101 73108 73115 73122 73129 73137 73145 73152 73160 73170 73185 73402 73435 73442 73450 73461 73502 73522 73531 73539 73547 73554 73561 73569 73622 73638 73647 73659 73667 73705 73007 73014 73021 73028 73036 73044 73052 73059 73067 73074 73083 73093 73102 73109 73116 73123 73130 73139 73146 73153 73162 73172 73189 73403 73436 73443 73453 73463 73503 73523 73532 73540 73548 73555 73562 73570 73624 73639 73648 73660 73668 73706 2 0 1 5 H M O Z I P C O D E L I S T S GlobalHealth ZIP Code List 2 0 1 5 H M O Z I P C O D E L I S T S 73716 73726 73734 73742 73753 73760 73770 73834 73844 73858 73937 73947 74004 74013 74020 74029 74036 74044 74052 74060 74070 74077 74084 74106 74116 74128 74135 74148 74157 74182 74331 74340 74349 74360 74367 74421 74429 74437 74445 74455 74462 74470 74525 73717 73727 73735 73743 73754 73761 73771 73835 73848 73859 73938 73949 74005 74014 74021 74030 74037 74045 74053 74061 74071 74078 74085 74107 74117 74129 74136 74149 74158 74186 74332 74342 74350 74361 74368 74422 74430 74438 74446 74456 74463 74471 74528 73718 73728 73736 73744 73755 73762 73772 73838 73851 73860 73939 73950 74006 74015 74022 74031 74038 74046 74054 74062 74072 74079 74101 74108 74119 74130 74137 74150 74159 74187 74333 74343 74352 74362 74369 74423 74431 74439 74447 74457 74464 74477 74529 73719 73729 73737 73746 73756 73763 73773 73840 73852 73901 73942 73951 74008 74016 74023 74032 74039 74047 74055 74063 74073 74080 74102 74110 74120 74131 74141 74150 74169 74192 74335 74344 74354 74363 74370 74425 74432 74440 74450 74458 74465 74501 74530 14 73720 73730 73738 73747 73757 73764 73801 73841 73853 73931 73944 74001 74010 74017 74026 74033 74041 74048 74056 74066 74074 74081 74103 74112 74121 74132 74145 74153 74170 74193 74337 74345 74355 74364 74401 74426 74434 74441 74451 74459 74467 74521 74531 73722 73731 73739 73749 73758 73766 73802 73842 73855 73932 73945 74002 74011 74018 74027 74034 74042 74050 74058 74067 74075 74082 74104 74114 74126 74133 74146 74155 74171 74301 74338 74346 74358 74365 74402 74427 74435 74442 74452 74460 74468 74522 74533 73724 73733 73741 73750 73759 73768 73832 73843 73857 73933 73946 74003 74012 74019 74028 74035 74043 74051 74059 74068 74076 74083 74105 74115 74127 74134 74147 74156 74172 74330 74339 74347 74359 74366 74403 74428 74436 74444 74454 74461 74469 74523 74534 GlobalHealth ZIP Code List 74535 74547 74557 74565 74576 74631 74643 74653 74724 74733 74741 74753 74764 74821 74831 74840 74850 74859 74869 74881 74932 74942 74949 74959 74536 74549 74558 74567 74577 74632 74644 74701 74726 74734 74743 74754 74766 74824 74832 74842 74851 74860 74871 74883 74935 74943 74951 74960 74538 74552 74559 74569 74578 74633 74646 74702 74727 74735 74745 74755 74801 74825 74833 74843 74852 74864 74872 74884 74936 74944 74953 74962 74540 74553 74560 74570 74601 74636 74647 74720 74728 74736 74747 74756 74802 74826 74834 74844 74854 74865 74873 74901 74937 74945 74954 74963 74543 74554 74561 74571 74602 74637 74650 74721 74729 74737 74748 74759 74804 74827 74836 74845 74855 74866 74875 74902 74939 74946 74955 74964 74545 74555 74562 74572 74604 74640 74651 74722 74730 74738 74750 74760 74818 74829 74837 74848 74856 74867 74878 74930 74940 74947 74956 74965 74546 74556 74563 74574 74630 74641 74652 74723 74731 74740 74752 74761 74820 74830 74839 74849 74857 74868 74880 74931 74941 74948 74957 74966 2 0 1 5 H M O Z I P C O D E L I S T S 15 2 0 1 5 H E A L T H P L A N C O M P A R I S O N COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS HealthChoice Your Costs for High, High Alternative and Network Services USA Plans High and USA Plans $500 individual $1,500 family Calendar Year Deductible High Alternative Plan $750 individual $2,250 family Calendar Year Out-of-Pocket Maximum High and USA Plans* Copays apply $3,300 Network individual $8,400 Network family $3,800 non-Network individual $9,900 non-Network family, plus amounts over Allowed Charges High Alternative Plan* Copays apply $3,550 Network individual $8,400 Network family $4,050 non-Network individual $9,900 non-Network family, plus amounts over Allowed Charges HealthChoice Basic and Basic Alternative Plans HealthChoice HDHP Basic Plan $1,000 individual $1,500 family Applies after Plan pays first $500 of Allowed Charges Basic Alternative Plan $1,250 individual $1,750 family Applies after Plan pays first $250 of Allowed Charges $1,500 individual $3,000 family The individual deductible does not apply if two or more family members are covered The combined medical and pharmacy deductible must be met before benefits are paid Basic Plan $4,000 individual $9,000 family $3,000 individual $6,000 family Pharmacy copays apply Non-Network charges do not apply Basic Alternative Plan $4,000 individual $9,000 family Copays do not apply $30 copay/physician office All covered services, benefits, visit** $50 copay/specialist office visit exceptions, limitations and conditions are identical to the HealthChoice High Plan Basic Plan $0 of the first $500 of Allowed Diagnostic X-Ray 20% of Allowed Charges after Charges deductible and Lab 100% of the next $1,000 of Allowed 20% of Allowed Charges after Charges (deductible). Only Allowed Charges count toward the deductible deductible Hospital 50% of the next $6,000 of Allowed Additional $300 copay per Inpatient non-Network admission (does Charges Basic Alternative Plan Admission not apply to out-of-pocket $0 of the first $250 of Allowed maximum) Charges 100% of the next $1,250 of Allowed 20% of Allowed Charges after Hospital Charges (deductible). Only Allowed deductible Outpatient Visit Charges count toward the deductible $0 copay; no deductible (Refer 50% of the next $5,500 of Allowed Well Child Charges to Preventive Services list for Both Basic Plans Care Visit more information) $0 of Allowed Charges over the individual or family out-of-pocket No charge for well child and maximum adult immunizations and No deductible for well child care visit Immunizations administration $30/$50 office visit copay may You can use non-Network providers, but it will be more costly apply Office Visit (Professional Services) You pay 100% of Allowed Charges until deductible is met $30/$50** office visit copay applies after deductible 20% of Allowed Charges after deductible 20% of Allowed Charges after deductible Additional $300 copay per non-Network admission 20% of Allowed Charges after deductible $0 copay; no deductible applies No charge for well child and adult immunizations and administration $30/$50 office visit copay may apply *Emergency room and office visit copays apply. Coinsurance applies until the out-of-pocket maximum is met. **The $30 copay applies to general practitioners, internal medicine physicians, OB/GYNs, pediatricians, physician assistants and nurse practitioners. Plan changes are indicated by bold text. 16 COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS Your Costs for Network Services CommunityCare HMO GlobalHealth HMO No deductible No deductible Calendar Year Deductible $4,000 individual $8,000 family Includes all paid medical and pharmacy copays and coinsurance for covered services Calendar Year Out-of-Pocket Maximum Office Visit (Professional Services) $35 copay/PCP $50 copay/specialist and Lab Hospital Outpatient Visit Well Child Care Visit Immunizations Includes all copays and coinsurance paid on covered services, prescriptions and durable medical equipment $25 copay/PCP $50 copay/specialist No additional copay for laboratory services or outpatient radiology Diagnostic X-Ray $200 copay per MRI, CAT, MRA or PET scan Hospital Inpatient Admission $3,000 individual $5,000 family $0 copay for x-ray and lab $250 copay per scan in a free-standing/low-cost facility $750 per scan in a hospital facility Specialty scans: MRI, MRA, PET, CAT and nuclear scans $750 copay Preauthorization required $250 copay per day $750 maximum per admission Preauthorization required $500 copay $250 copay in a free-standing/low-cost facility $750 copay in a hospital facility $0 copay $0 copay ages 0 – 21 $0 copay ages birth through age 18 years $0 copay ages 19 and over When medically necessary $0 copay birth through age 18 years $0 copay ages 19 and over when appropriate following the recommendation of ACIP Office visit copay may apply Plan changes are indicated by bold text. This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29 . 17 2 0 1 5 H E A L T H P L A N C O M P A R I S O N 2 0 1 5 H E A L T H P L A N C O M P A R I S O N COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS HealthChoice Your Costs for High, High Alternative and Network Services USA Plans $0 copay for one preventive service office visit per calendar year for members and dependents ages 20 and older HealthChoice Basic and Basic Alternative Plans $0 copay for one preventive service office visit per calendar year for members and dependents ages 20 and older Periodic Health Exams One mammogram per year at no One mammogram per year at no charge for women ages 40 and charge for women ages 40 and older older Copays do not apply All covered services, benefits, exceptions, limitations and conditions are identical to the 20% of Allowed Charges after HealthChoice High Plan deductible Basic Plan Allergy $0 of the first $500 of Allowed Treatment and Limit of 60 tests every 24 Charges Testing months 100% of the next $1,000 of Allowed Charges (deductible). Only Allowed Charges count toward the deductible 20% of Allowed Charges after 50% of the next $6,000 of Allowed deductible Emergency Charges Health Care Basic Alternative Plan Additional $100 ER copay – $0 of the first $250 of Allowed Facility Visit waived if admitted Charges 100% of the next $1,250 of Allowed 20% of Allowed Charges after Charges (deductible). Only Allowed deductible Charges count toward the deductible After Hours 50% of the next $5,500 of Allowed Urgent Care $30/$50 office visit copay may Charges apply Both Basic Plans $0 of Allowed Charges over the 20% of Allowed Charges after individual or family out-of-pocket Mental Health or deductible maximum Substance Abuse No deductible for well child care Inpatient No limit on the number of days visit. Admission per year You can use non-Network providers, but it will be more costly. 20% of Allowed Charges after deductible Mental Health or Substance Abuse Limit of 15 services per Outpatient Visit calendar year without HealthChoice HDHP $0 copay for one preventive service office visit per calendar year for members and dependents ages 20 and older One mammogram per year at no charge for women ages 40 and older 20% of Allowed Charges after deductible Limit of 60 tests every 24 months 20% of Allowed Charges after deductible Additional $100 ER copay – waived if admitted 20% of Allowed Charges after deductible 20% of Allowed Charges after deductible No limit on the number of days per year 20% of Allowed Charges after deductible Limit of 15 services per calendar year without certification certification 20% of Allowed Charges after deductible for purchase, rental, Durable Medical repair or replacement 20% of Allowed Charges after deductible for purchase, rental, repair or replacement Equipment (DME) Plan changes are indicated by bold text. This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29. 18 COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS Your Costs for Network Services CommunityCare HMO GlobalHealth HMO $0 copay/PCP $0 copay/PCP/routine physical exam Limit of one per year $0 copay well-woman exam and preventive services Periodic Health Exams Allergy Treatment and Testing Emergency Health Care Facility Visit $35 copay/PCP $50 copay/specialist $30 serum and shots including a 6-week supply of antigen $25 copay/PCP $50 copay/specialist $30 serum and shots including a 6-week supply of antigen and administration $200 copay; waived if admitted $300 copay; waived if admitted $50 copay per visit $50 copay $750 copay $250 per day $750 maximum per admission Must be preauthorized by MHNet After Hours Urgent Care Mental Health or Substance Abuse Inpatient Admission $35 copay/PCP/specialist $25 copay Must be preauthorized by MHNet 20% coinsurance initial device 20% coinsurance repair and replacement 20% coinsurance for purchase, rental, repair or replacement Must be preauthorized and obtained from network provider Mental Health or Substance Abuse Outpatient Visit Durable Medical Equipment (DME) Plan changes are indicated by bold text. This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29. 19 2 0 1 5 H E A L T H P L A N C O M P A R I S O N 2 0 1 5 H E A L T H P L A N C O M P A R I S O N COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS HealthChoice Your Costs for High, High Alternative and Network Services USA Plans Occupational and Speech Therapy Visits 20% of Allowed Charges after deductible Occupational therapy* Limit of 20 visits per year without certification Speech therapy* For ages 17 and younger, certification required For ages 18 and older, certification not required *Maximum of 60 visits per year 20% of Allowed Charges after deductible Physical Limit of 20 visits per year Therapy/Physical without certification Medicine Visit Maximum of 60 visits per year Chiropractic therapy 20% of Allowed Charges after deductible Limit of 20 visits per year Chiropractic and without certification Maximum of 60 visits per year Manipulative Manipulative therapy Therapy Visit Refer to Physical Therapy/ Physical Medicine above Maternity Pre and Post Natal Care Hearing Screening and Hearing Aid HealthChoice Basic and Basic Alternative Plans Copays do not apply All covered services, benefits, exceptions, limitations and conditions are identical to the HealthChoice High Plan Basic Plan $0 of the first $500 of Allowed Charges 100% of the next $1,000 of Allowed Charges (deductible). Only Allowed Charges count toward the deductible 50% of the next $6,000 of Allowed Charges Basic Alternative Plan $0 of the first $250 of Allowed Charges 100% of the next $1,250 of Allowed Charges (deductible). Only Allowed Charges count toward the deductible 50% of the next $5,500 in Allowed Charges Both Basic Plans $0 of Allowed Charges over the individual or family out-of-pocket maximum No deductible for well child care visit. HealthChoice HDHP 20% of Allowed Charges after deductible Occupational therapy* Limit of 20 visits per year without certification Speech therapy* For ages 17 and younger, certification required For ages 18 and older, certification not required *Maximum of 60 visits per year 20% of Allowed Charges after deductible Limit of 20 visits per year without certification Maximum of 60 visits per year Chiropractic therapy 20% of Allowed Charges after deductible Limit of 20 visits per year without certification Maximum of 60 visits per year Manipulative therapy Refer to Physical Therapy/ Physical Medicine above 20% of Allowed Charges after deductible Includes one postpartum home visit - criteria must be met 20% of Allowed Charges after deductible Includes one postpartum home visit - criteria must be met $30 copay/primary care physician** $50 copay/specialist Basic hearing screening Limit of one per year $30/$50** copay after deductible Basic hearing screening Limit of one per year Hearing aids are covered as durable medical equipment for children up to age 18 Certification required Hearing aids are covered as durable medical equipment for children up to age 18 Certification required Plan changes are indicated by bold text. **The $30 copay applies to general practitioners, internal medicine physicians, OB/GYNs, pediatricians, physician assistants and nurse practitioners. 20 COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS Your Costs for Network Services CommunityCare HMO GlobalHealth HMO No copay inpatient $50 copay outpatient therapy Limit of 60 days per illness No copay inpatient $50 copay per outpatient therapy Limit of 60 combined inpatient and outpatient visits per acute illness or injury for physical, occupational or speech therapy or any combination of all three Occupational and Speech Therapy Visits Physical Therapy/Physical Medicine Visit No copay inpatient $50 copay outpatient therapy Limit of 60 days per illness No copay inpatient $50 copay per outpatient visit Limit of 60 combined inpatient and outpatient visits per acute illness or injury for physical, occupational or speech therapy or any combination of all three $50 copay Limit of 15 visits per year $20 copay Must be preauthorized $35 copay for initial visit $750 copay per hospital admission $0 copay for prenatal care $25 copay for delivery and all postnatal care $250 per day, $750 maximum per hospital admission Hearing screening $0 copay Limit of one per year Hearing screening $0 copay children birth – age 21 $25 copay ages 22 and over Limit of one per year Hearing aids 20% coinsurance for children up to age 18 Hearing aids 20% coinsurance For children up to age 18 Chiropractic and Manipulative Therapy Visit Maternity Pre and Post Natal Care Hearing Screening and Hearing Aid Plan changes are indicated by bold text. This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29. 21 2 0 1 5 H E A L T H P L A N C O M P A R I S O N COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS Your Costs for Network Services 2 0 1 5 P H A R M A C Y HealthChoice High, High Alternative, Basic, Basic Alternative, HDHP and USA Plans Prescription Medications 30-Day Supply 31- to 90-Day Supply Generic Drugs Up to $10 Up to $25 Preferred Drugs Up to $45 Up to $90 Non-Preferred Drugs Up to $75 Up to $150 Specialty Drugs* ♦ Preferred drugs – $100 copay ♦ Non-Preferred drugs – $200 copay Copays are up to a 30-day supply *Specialty medications are covered only when ordered through Accredo Health. Plan changes are indicated in bold text. HEALTHCHOICE HIGH, HIGH ALTERNATIVE, BASIC, BASIC ALTERNATIVE AND USA PLANS Pharmacy out-of-pocket maximum – $2,500 per person ($4,000 family) using Preferred products at Network Pharmacies, then you pay $0 for the rest of the calendar year. HEALTHCHOICE HDHP Pharmacy benefits are available only after the combined health and pharmacy deductible ($1,500 individual/$3,000 family) has been met. ALL HEALTHCHOICE PLANS All Plan provisions apply. Some medications are subject to prior authorization and/or quantity limits. If you choose a brand-name medication when a generic is available, you are responsible for the difference in the cost in addition to the copay. HealthChoice covers tobacco cessation medications at 100% when filled at a Network Pharmacy. Visit the Be Tobacco-Free page at www.healthchoiceok.com or www.sib.ok.gov for details. CDC vaccinations, such as for Shingles, are covered at 100% when using a Network Pharmacy. (Note: These can also be covered under the health benefit if provided by a Network recognized health provider, such as a physician or health department.) 22 COMPARISON OF NETWORK BENEFITS FOR HEALTH PLANS Your Costs for Network Services Pharmacy Benefits CommunityCare HMO GlobalHealth HMO Tier 1: $10 Tier 2: $40 Tier 3: $65 Tier 1: $10 Tier 2: $50 Tier 3: $75 $0 copay for selected generics $4 copay for selected generics Up to $65 non-formulary (nonpreferred) 30-day supply 30-day supply Certain medications may have restricted quantities Certain medications have restricted quantities These copays apply to the maximum out-of-pocket Convenient mail-order is available; contact CommunityCare for details Home delivery and extended supply are available; contact GlobalHealth for details Prescription copays apply to the out-of-pocket maximum 90-day for two copays This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29. Plan changes are indicated in bold text. 23 2 0 1 5 P H A R M A C Y COMPARISON OF BENEFITS FOR DENTAL PLANS 2 0 1 5 D E N T A L P L A N C O M P A R I S O N HealthChoice Dental Annual Deductible Diagnostic and Preventive Care (cleanings, routine oral exams) Allowed Charges Apply Basic Care (extractions, oral surgery) Allowed Charges Apply Major Care (dentures, bridge work) Allowed Charges Apply Orthodontic Care Allowed Charges Apply Plan Year Maximum Filing Claims Assurant Employee Benefits Freedom Preferred Assurant Employee Benefits Heritage Plus and Heritage Secure Network: $25 Basic and Major services combined Non-Network: $25 Preventive, Basic and Major services combined plus amounts above Allowed Charges Network: $0 Non-Network: $0 of Allowed Charges after deductible $25 per person, per policy year, waived for in-Network preventive services No deductibles Network: $0 Plan pays 100% of negotiated fee No deductible Non-Network: $0 Plan pays 100% of usual and customary Deductible applies No charge for routine cleaning (once every 6 months) No charge for topical fluoride application (up to age 18) No charge for periodic oral evaluations Network: 15% Non-Network: 30% plus amounts above Allowed Charges Deductible applies Network: 15% Plan pays 85% of usual and customary Non-Network: 30% Plan pays 70% of usual and customary Deductible applies Fillings Minor oral surgery Refer to the copay schedule for each plan Network: 40% Non-Network: 50% plus amounts above Allowed Charges Deductible applies Network: 40% Plan pays 60% of usual and customary Deductible applies Non-Network: 50% Plan pays 50% of usual and customary Deductible applies Root canal Periodontal Crowns Refer to the copay schedule for each plan Network: 50% Non-Network: 50% plus amounts above Allowed Charges 12-month waiting period applies No lifetime maximum Covered for members under age 19 and members age 19 and older with TMD Network: 40% Plan pays 60% of negotiated fee Non-Network: 50% Plan pays 50% of usual and customary – deductible applies Network and Non-Network: $2,000 lifetime maximum Coverage only for dependent children under age 19 12-month waiting period may apply 25% discount Adults and children Network and non-Network: $2,500 per person, per year $2,000 per person, per policy year No annual maximum for general dentist Network: No claims to file Member/provider must file claims Non-Network: You file claims No claims to file Plan changes are indicated by bold text. This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29. 24 COMPARISON OF BENEFITS FOR DENTAL PLANS CIGNA Dental Care Plan (Prepaid) Delta Dental PPO In-Network and Out-of-Network Delta Dental PPO Plus Premier In-Network and Out-of-Network Delta Dental PPO – Choice PPO Network No deductible or plan maximum $5 office copay applies $25 per person, per year, applies to Basic and Major Care only $50 per person, per year, applies to Diagnostic, Preventive, Basic and Major Care $100 per person, per year, applies to Major Care only (Level 4) Sealant: $17 per tooth No charge for routine cleaning once every 6 months No charge for topical fluoride application (through age 18) No charge for periodic oral evaluations $0 of allowable amounts No deductible applies $0 of allowable amounts after deductible Schedule of covered services and copays Copay examples: Routine cleaning $5 Periodic oral evaluation $5 Topical fluoride application (up to age 19) $5 Amalgam: One surface, 15% of allowable Basic Care permanent teeth $23 amounts after (extractions, oral deductible surgery) Allowed Charges Apply 30% of allowable amounts after deductible Root canal, anterior: 40% of allowable $375 amounts after Periodontal/scaling/root deductible planing 1-3 teeth (per quadrant): $75 50% of allowable amounts after deductible Schedule of covered services and copays Copay example: Amalgam - one surface, primary or permanent tooth $12 Schedule of covered services and copays Copay examples: Crown - porcelain/ ceramic substrate $241 Complete denture maxillary $320 Annual Deductible Diagnostic and Preventive Care (cleanings, routine oral exams) Allowed Charges Apply Major Care (dentures, bridge work) Allowed Charges Apply Orthodontic Care $2,472 out-of-pocket for children through age 18 $3,384 out-of-pocket for adults Allowed Charges 24-month treatment excludes orthodontic Apply treatment plan and banding Plan Year Maximum Filing Claims 40% of allowable amounts, up to lifetime maximum of $2,000 No deductible No waiting period Orthodontic benefits are available to the employee, their lawful spouse and eligible dependent children 40% of allowable amounts, up to lifetime maximum of $2,000 No deductible No waiting period Orthodontic benefits are available to the employee, their lawful spouse and eligible dependent children You pay amounts in excess of $50 per month Lifetime maximum up to $1,800 No deductible No waiting period Orthodontic benefits are available to the employee, their lawful spouse and eligible dependent children No maximum $2,500 per person, per $3,000 per person, per $2,000 per person, per year year year No claims to file Claims are filed by participating dentists Claims are filed by participating dentists Claims are filed by participating dentists Plan changes are indicated by bold text. This is only a sample of the services covered by each plan. For services that are not listed in this comparison chart, contact each plan. Refer to Contact Information on page 29. 25 2 0 1 5 D E N T A L P L A N C O M P A R I S O N 2 0 1 5 V I S I O N P L A N C O M P A R I S O N COMPARISON OF BENEFITS FOR VISION PLANS Humana/CompBenefits VisionCare Plan In-Network Eye Exams $10 copay One exam for eyeglasses or contacts every calendar year Plan pays up to $0 copay $35; one exam No limit to every calendar frequency year Plan pays up to $15 copay $40 One exam for Limit one exam eyeglasses or contacts every calendar year Plan pays up to $40 One exam every calendar year $25 copay for single/multifocal lenses Plan pays up to: $25 single $40 bifocals $60 trifocals $100 lenticular You pay wholesale cost with no limit on number of pairs You pay normal doctor’s fee, reimbursed up to $60, for one set of lenses and frames annually $15 copay Single, bifocals, trifocals lenticular lenses paid in full Progressive lenses paid up to $115 Plan pays up to: $30 single $45 bifocals $55 trifocals $75 lenticular $60 progressive $25 copay, up to plan limits One set of frames every calendar year Plan pays up to You pay $45 wholesale cost No limit to number of frames $0 copay $160 frame allowance Plan pays up to $35 $130 allowance for conventional or disposable lenses and fitting fee in lieu of all other benefits every calendar year Medically necessary contacts, plan pays 100% $130 allowance for contacts and fitting fee in lieu of all other benefits You pay normal doctor’s fees, reimbursed up to $60, for one set of lenses and frames per year Limit of one set annually in lieu of eyeglasses You pay normal doctor’s fees reimbursed up to $60 $160 allowance for conventional or disposable lenses $80 allowance for conventional or disposable lenses $250 allowance for medically necessary contacts $80 allowance for medically necessary contacts Members can access information on providers through the website or by calling customer service No benefit 15% discount No benefit Frames Contact Lenses Laser Vision Correction In-Network You pay wholesale cost for annual supply of contacts Medically necessary contacts, plan pays up to $210 Out-ofNetwork Vision Care Direct Covered Services Lenses Per Pair Out-ofNetwork Primary Vision Care Services Discount No benefit offered through nJoy Vision in OKC and Tulsa; previous TLC locations $1,000 savings between June 1 – Sept. 30, 2015 Call PVCS for details 26 In-Network Out-ofNetwork COMPARISON OF BENEFITS FOR VISION PLANS Superior Vision Covered Services In-Network $10 copay Out-ofNetwork UnitedHealthcare Vision In-Network Out-ofNetwork Plan pays: $10 copay $34 Ophthalmologist $26 Optometrist Reimbursed up to $40 Lenses Per Pair $25 copay Standard Progressive: $25 copay Refer to notes on the next page Plan pays: Single up to $26 Bifocals up to $39 Trifocals up to $49 Lenticular up to $78 Standard Progressive: Up to $49 $25 copay Standard single vision, lined bifocal & trifocal lenses covered in full Scratch resistant, UV coating, tints and polycarbonate lenses are also covered in full Single up to $40 Bifocals up to $60 Trifocals up to $80 Lenticular up to $80 Plan pays up to $68 Frames $25 copay then plan pays up to $125 retail $25 copay Reimbursed $130 retail frame up to $45 allowance $0 copay Plan pays up to $120 all contacts Medically necessary contacts covered in full (Contact lens fit copay: Standard $25, after copay, covered in full; specialty $25, after copay, plan pays up to $50) $0 copay Plan pays up to $100 all contacts; $210 medically necessary contacts (Contact lens fit copay: Standard not covered; specialty not covered) $25 copay on covered-in-full qualifying lenses $150 contact lens benefit applies to the fitting/ evaluation fees and purchase of contact lenses 20-50% Discount No benefit 15% discount No benefit off the usual and customary price, 5% off promotional price at any Laser Vision Network of America provider Eye Exams Contact Lenses Laser Vision Correction 27 Reimbursed up to $150 elective contact lenses; $210 medically necessary contact lenses Vision Service Plan (VSP) In-Network $10 copay $25 copay applies to lenses or frames Single vision, lined bifocal and trifocal lenses covered in full Out-ofNetwork $10 copay Plan pays up to $35 $25 copay then plan pays: Single up to $25 Bifocals up to $40 Trifocals up to $55 Lenticular up to $80 $25 copay $25 copay then plan pays then plan pays up to $120 up to $45 $0 copay Plan pays up to $120 conventional or disposable; $25 copay on medically necessary contact lenses $0 copay Plan pays up to $105 conventional or disposable; $210 medically necessary contacts after $25 copay 15% average off usual and customary price or 5% off the laser center’s promotional price No benefit 2 0 1 5 V I S I O N P L A N C O M P A R I S O N Vision Plan Notes Humana/CompBenefits VisionCare Plan: The contact lens benefit provides a $130 yearly allowance for the annual vision exam to evaluate eye health, contact lens exam for fitting and evaluation, and the purchase of either conventional or disposable contacts. If a member prefers contact lenses, the plan provides the contact lens allowance in lieu of all other benefits. Instead, if a member opts for lenses and frames during the plan year, a $25 copay applies for these two material items. More than 23,000 frames are covered in full by the $25 copay with in-network providers. Exams, lenses and frame benefits are provided once every 12 months. Oklahoma City LASIK Plus Traditional Intralase (bladeless) with a one-year plan with insurance discount is $695 per eye equals $1,390. Traditional Intralase (bladeless) with a lifetime plan with insurance discount is $1395 per eye equals $2,790. CustomVue Intralase (bladeless) with lifetime plan with insurance discount is $1,784.15 per eye; equals $3,568.30. PVCS: The only Oklahoma owned and operated vision care plan with unlimited in-network services. Member selects either in-network or out-of-network for entire year. Out-of-network services are limited (one eye exam, one set of eyeglasses or contacts) to once annually. A $50 service fee applies to soft contact lens fittings; a $75 service fee applies to rigid or gas permeable contact lens fittings; and a $150 service fee applies to hybrid contact lens fittings. Simple replacements are not assessed with these fees. Limitations/Exclusions include the following: 1) Medical eye care, 2) Vision therapy, 3) Non routine vision services and tests, 4) Luxury frames (wholesale cost of frame exceeds $100), 5) Premium prescription lenses, and 6) Non prescriptive eye wear. For more information, call 1-888-357-6912. Superior Vision: Materials copay applies to lenses and/or frames. Discounts for lens add-ons will be given by contracted providers with “Accepts Discounts” in their listing. Online, in-network contact lens materials available at www.svcontacts.com. Exams, lenses and frames are provided once per calendar year. Progressive lenses (no-line bifocals) – you pay the difference between the retail price of the selected progressive lens and the retail price of the provider’s lined trifocal. The difference may also be subject to a discount. Standard contact lens fitting applies to an existing contact lens user who wears disposable, daily wear or extended wear lenses only. Specialty contact lens fitting applies to new contact lens wearers and/or members who wear toric, gas permeable or multifocal lenses. UHC Vision: For either glasses or contact lenses, there is a one-time $25 materials copay. In lieu of lenses and frames, you may select contact lenses. Covered contact lens benefit includes the fitting/evaluation fee, contact lenses and up to two follow-up visits. If covered disposable contact lenses are chosen, up to six boxes (depending on prescription) are included when obtained from a network provider. It is important to note that UHC covered contact lenses may vary by provider. Should you choose contact lenses outside the covered selection, a $150 allowance will be applied toward the fitting/evaluation fees and purchase of contact lenses (material copay does not apply). Toric and gas permeable contact lenses are examples of contact lenses that are outside of our covered contacts. Necessary contacts are covered-in-full after applicable copay. Exams, lenses and frame benefits provided once every calendar year. Vision Care Direct: Our plan offers low copays for your exam and lenses. There are NO COPAYS for contacts or frames. We have a $160 frame or contact allowance and have removed all the restrictions such as minimum prescriptions. We are an Oklahoma based company and are NOT an insurance company. We are an association of optometrists committed to providing a better patient care. We have a new option available in 2015. If you want hidef polycarbonate lenses and both anti-reflected coating and scratch protection but don’t want to pay extra for it, then you can choose from our VCD line of frames (60 to choose from); you pay nothing out of pocket, only your copay. If you work on a computer all day, ask about iBlue Coat, it will reduce the strain on your eyes and can be added to your lenses; ask your doctor for pricing. We also have special pricing if you purchase a pair of glasses or order a year’s supply of contacts, you are eligible for discounts for a backup pair of glasses. Be sure to ask your doctor about special pricing on a second pair of glasses. For more information, call 1-855-918-2020 or email us at vco@visioncaredirect. com. Locate one of our local independent optometrists at www.visioncaredirect.com. VSP: Exam, lenses and frame benefit provided annually. The $25 materials copay applies to lenses or frames, but not to both. Copays/prices listed are for standard lens options. Premium lens options will vary. If you choose a frame valued at more than your allowance, you’ll save 20% on your out-of-pocket costs when you use a VSP doctor. Contact lenses are in lieu of spectacle lenses and frame. The $120 in-network allowance applies to the contact lenses. With a VSP provider, the contact lens exam (fitting and evaluation) is covered in full after a copay up to $60. The $105 outof-network allowance applies to the contacts and contact lens exam. Your contact lens exam is performed in addition to your routine eye exam to check for eye health risks associated with improper wearing or fitting of contacts. Both the exam and materials copay apply with medically necessary contacts. Prescription glasses - 30% off additional complete pairs of glasses and sunglasses, including lens options, from the same VSP doctor on the same day as your WellVision Exam, or get 20% off from any VSP doctor within 12 months from your last WellVision Exam. Contact VSP or visit www.vsp.com to learn about retail chain affiliate providers. 28 Contact Information Dental Plans HealthChoice Assurant Inc. Dental PPO Freedom Preferred 1-800-442-7742 Prepaid Heritage Plans 1-800-443-2995 www.assurantemployeebenefits.com CIGNA Prepaid Dental All Areas 1-800-244-6224 Toll-free Hearing Impaired Relay 1-800-654-5988 www.cigna.com Delta Dental Oklahoma City Area 1-405-607-2100 All Other Areas 1-800-522-0188 www.DeltaDentalOK.org Health, Dental and Life Claims, Benefits, Eligibility and ID Cards Oklahoma City Area 1-405-416-1800 All Other Areas 1-800-782-5218 TDD Oklahoma City Area 1-405-416-1525 TDD All Other Areas 1-800-941-2160 www.healthchoiceok.com or www.sib.ok.gov Pharmacy Claims, Formulary and ID Cards All Areas TDD All Areas 1-800-903-8113 1-800-825-1230 Member Services/Provider Directory Vision Plans Oklahoma City Area 1-405-717-8780 All Other Areas 1-800-752-9475 TDD 1-405-949-2281 or All Areas 1-866-447-0436 Humana/CompBenefits VisionCare Plan All Areas 1-800-865-3676 TDD All Areas 1-877-553-4327 www.compbenefits.com/custom/stateofoklahoma Primary Vision Care Services (PVCS) All Areas 1-888-357-6912 TDD All Areas 1-800-722-0353 www.pvcs-usa.com Superior Vision All Areas 1-800-507-3800 TDD 1-916-852-2382 www.superiorvision.com UnitedHealthcare Vision All Areas 1-800-638-3120 TDD All Areas 1-800-524-3157 www.myuhcvision.com Vision Care Direct All Areas 1-877-488-8900 TDD All Areas 1-877-488-8900 visioncaredirect.com Vision Service Plan (VSP) All Areas 1-800-877-7195 TDD All Areas 1-800-428-4833 www.vsp.com HealthChoice USA Customer Service & Claims 1-800-782-5218 Provider Information 1-877-877-0715 TDD All Areas 1-800-941-2160 www.choicecarenetwork.com American Fidelity Health Services Administration Health Savings Account (HSA) Oklahoma City Area All Areas www.afhsa.com 1-405-523-5699 1-866-326-3600 HMO Plans All Areas TDD All Areas CommunityCare 1-800-777-4890 1-800-722-0353 state.ccok.com GlobalHealth Inc. Oklahoma City Area 1-405-280-5600 All Other Areas 1-877-280-5600 TDD All Areas 1-800-522-8506 www.globalhealth.com 29 EGID 3545 N.W. 58th St., Ste. 110 Oklahoma City, OK 73112 E D I U G D O 5 I 1 R 0 E 2 P R N A E O I Y T P N O PLA

© Copyright 2026