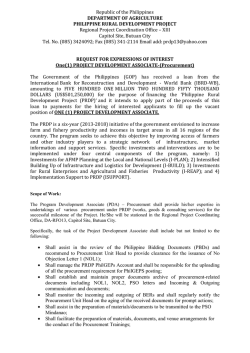

Disclosure in - Search