prosegur , cia. de seguridad, s.a.

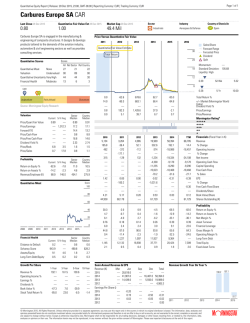

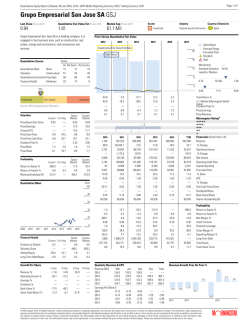

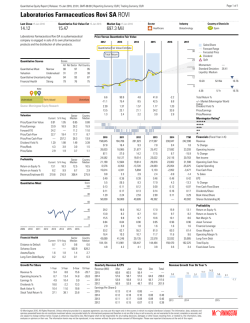

Page 1 of 1 Quantitative Equity Report | Release: 01 Feb 2016, 23:01, GMT-06:00 | Reporting Currency: EUR | Trading Currency: EUR Prosegur Compania De Seguridad SA PSG Last Close 01 Feb 2016 Quantitative Fair Value Est 01 Feb 2016 Market Cap 01 Feb 2016 Sector Industry 4.14 4.75 2,477.2 Mil p Industrials Security & Protection Services Prosegur Compania De Seguridad SA provides private security services. The Company provides Overall service solutions, Cash in Transit (CIT) and Alarm systems. It operates in Europe&Asia-Pacific and Latin America. Country of Domicile ESP Spain Price Versus Quantitative Fair Value 2012 2013 2014 2015 2016 2017 Sales/Share Forecast Range Forcasted Price Dividend Split Quantitative Fair Value Estimate 10 Total Return Quantitative Scores 8 Scores Momentum: — Standard Deviation: 17.27 Liquidity: High All Rel Sector Rel Country Quantitative Moat Narrow 95 Valuation Undervalued 47 Quantitative Uncertainty Medium 100 Financial Health Moderate 63 92 48 100 60 6 87 52 96 59 4 3.73 52-Wk 5.63 2.71 5-Yr 5.63 2 PSG ESP p Undervalued Fairly Valued Overvalued Source: Morningstar Equity Research Valuation Sector Median Country Median 1.03 15.3 — 13.6 41.1 2.33 3.5 0.8 0.86 16.1 12.2 9.3 15.5 2.47 1.5 0.8 0.88 15.9 11.7 8.6 13.6 3.41 1.5 1.0 Current 5-Yr Avg Sector Median Country Median 11.0 4.6 457.8 Current 5-Yr Avg Price/Quant Fair Value Price/Earnings Forward P/E Price/Cash Flow Price/Free Cash Flow Dividend Yield % Price/Book Price/Sales 0.87 15.7 10.1 8.8 18.2 2.58 3.2 0.6 Profitability Return on Equity % Return on Assets % Revenue/Employee (K) 22.0 6.0 24.3 23.8 6.9 24.4 Quantitative Moat 35.1 17.4 14.3 -1.2 -3.1 0.6 -7.7 -7.1 -2.0 3.8 2.22 14.9 0.7 1.88 16.8 0.8 2.26 17.4 0.7 2.39 16.1 0.7 2.58 15.7 0.6 Total Return % +/– Market (Morningstar World Index) Dividend Yield % Price/Earnings Price/Revenue Morningstar RatingQ QQQQQ QQQQ QQQ QQ Q Financials (Fiscal Year in Mil) Revenue % Change 2010 2011 2012 2013 2014 TTM 2,567 17.4 2,820 9.9 3,669 30.1 3,695 0.7 3,783 2.4 3,949 4.4 263 12.2 160 284 8.2 167 311 9.6 172 298 -4.4 156 307 3.2 159 319 3.9 177 Operating Income % Change Net Income 10.3 2.9 275.9 201 -82 120 4.7 163 -123 40 1.4 136 -99 37 1.0 287 -138 150 4.1 247 -139 108 2.9 283 -147 136 3.4 Operating Cash Flow Capital Spending Free Cash Flow % Sales Score 100 0.27 6.8 0.19 0.28 6.0 0.05 0.30 5.1 0.06 0.27 -9.3 0.08 0.26 -2.3 0.10 0.26 0.0 0.20 EPS % Change Free Cash Flow/Share 0.07 0.00 573,398 0.10 1.08 573,439 0.12 1.28 598,368 0.09 1.21 598,368 0.11 1.40 — 0.10 1.29 598,368 26.0 9.0 6.3 1.44 2.9 24.6 8.0 5.9 1.35 3.3 24.5 6.8 4.7 1.45 3.9 22.5 5.4 4.2 1.28 4.4 21.1 5.4 4.2 1.28 3.5 22.0 6.0 4.5 1.34 3.7 Profitability Return on Equity % Return on Assets % Net Margin % Asset Turnover Financial Leverage 25.4 10.2 — 24.7 10.1 460 23.9 8.5 720 23.4 8.1 848 23.2 8.1 694 — 8.1 — Gross Margin % Operating Margin % Long-Term Debt 690 7.5 671 7.4 732 8.5 655 7.9 853 7.7 771 7.8 Total Equity Fixed Asset Turns 80 Dividends/Share Book Value/Share Shares Outstanding (K) 60 40 20 0 2009 2010 2011 2012 2013 2014 2015 Financial Health Current 5-Yr Avg Distance to Default Solvency Score Assets/Equity Long-Term Debt/Equity 2016 Sector Median Country Median 0.6 491.4 1.8 0.2 0.6 643.9 2.6 0.3 0.6 — 3.5 0.8 0.6 — 3.8 0.9 1-Year 3-Year 5-Year 10-Year 2.4 3.2 -2.2 14.0 24.8 -13.9 10.4 2.7 -2.4 3.0 6.8 0.0 11.6 5.6 1.1 10.7 10.1 1.6 -10.8 -19.9 -3.4 — 3.5 8.1 Growth Per Share Revenue % Operating Income % Earnings % Dividends % Book Value % Stock Total Return % Quarterly Revenue & EPS Revenue (Mil) Mar Jun 2015 968.4 984.2 2014 885.5 924.1 2013 918.6 921.9 2012 0.0 1,757.9 Earnings Per Share () 2015 0.10 0.03 2014 0.70 -0.59 2013 0.06 0.05 2012 0.08 0.04 Revenue Growth Year On Year % Sep 989.9 966.7 860.1 942.7 Dec — 1,006.3 994.6 968.5 Total — 3,782.6 3,695.2 3,669.1 0.07 0.09 0.09 0.08 — 0.06 0.07 0.10 — 0.26 0.27 0.30 12.4 9.4 6.5 2.7 0.2 2.4 1.2 -3.6 -8.8 2013 2014 © Morningstar 2016. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report. 2015 ® ß

© Copyright 2026