Grupo Catalana Occidente SA GCO

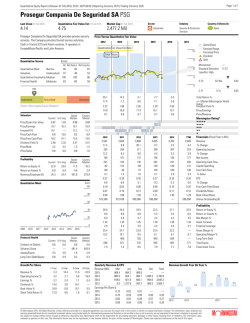

Page 1 of 1 Quantitative Equity Report | Release: 15 Apr 2016, 23:01, GMT-05:00 | Reporting Currency: EUR | Trading Currency: EUR | Exchange:XMCE Grupo Catalana Occidente SA GCO Last Close 15 Apr 2016 Quantitative Fair Value Est 15 Apr 2016 Market Cap 15 Apr 2016 Sector Industry 26.48 29.49 3,124.5 Mil y Financial Services Insurance - Property & Casualty Grupo Catalana Occidente SA operates as an insurance company in Spain. The Company is engaged in the insurance and reinsurance sectors. Its products and services are marketed through the segments Life, Non-Life and Other Activities. Quantitative Scores Country of Domicile Price Versus Quantitative Fair Value 2012 2013 2014 2015 2016 2017 Sales/Share Forecast Range Forcasted Price Dividend Split Quantitative Fair Value Estimate 50 Total Return 40 Scores Momentum: — Standard Deviation: 22.89 Liquidity: Medium All Rel Sector Rel Country Quantitative Moat None Valuation Undervalued Quantitative Uncertainty High Financial Health Strong ESP Spain 22 67 94 98 11 50 93 86 30 20 75 83 95 20 23.02 52-Wk 32.50 9.15 5-Yr 32.50 10 GCO y ESP Undervalued Fairly Valued Overvalued Source: Morningstar Equity Research Valuation Sector Median Country Median 0.98 10.8 — 8.0 9.2 3.05 1.5 0.9 0.89 12.8 10.4 8.4 9.2 3.48 1.0 2.5 0.95 16.1 12.8 8.8 13.2 3.46 1.6 1.2 Current 5-Yr Avg Sector Median Country Median 9.7 1.2 642.1 Current 5-Yr Avg Price/Quant Fair Value Price/Earnings Forward P/E Price/Cash Flow Price/Free Cash Flow Trailing Dividend Yield % Price/Book Price/Sales 0.90 11.8 — 13.8 16.4 2.44 1.4 0.9 Profitability Return on Equity % Return on Assets % Revenue/Employee (K) 12.0 2.2 540.0 14.2 2.2 510.9 Quantitative Moat 16.9 -0.8 93.1 77.7 -5.5 -1.8 36.0 36.7 -16.9 -18.8 4.14 — 8.1 0.6 2.21 — 14.8 1.1 2.54 — 11.7 0.9 2.00 — 14.0 1.2 — 2.44 11.7 0.9 Total Return % +/– Market (Morningstar World Index) Trailing Dividend Yield % Forward Dividend Yield % Price/Earnings Price/Revenue Morningstar RatingQ QQQQQ QQQQ QQQ QQ Q 2012 2013 2014 2015 TTM 2,845 1.2 2,914 2.4 3,079 5.6 3,522 14.4 3,522 0.0 328 16.0 210 336 2.3 200 353 5.0 221 382 8.2 242 415 8.8 268 415 0.0 268 Operating Income % Change Net Income 11.7 3.1 276.9 301 -29 271 9.7 241 -36 204 7.2 302 -41 261 8.9 373 -33 341 11.1 229 -36 194 5.5 229 -36 194 5.5 Operating Cash Flow Capital Spending Free Cash Flow % Sales Score 100 1.79 16.1 4.69 1.70 -4.9 1.74 1.88 10.5 1.71 2.05 9.2 1.99 2.27 10.7 2.89 2.27 0.0 1.64 EPS % Change Free Cash Flow/Share 80 0.54 12.39 120,000 0.57 11.95 117,846 0.57 13.73 117,996 0.61 17.53 117,996 0.64 18.67 — 0.64 19.49 117,996 17.8 2.3 7.5 0.30 7.6 15.0 2.1 7.0 0.30 6.8 14.0 2.2 7.6 0.29 5.9 12.4 2.3 7.9 0.29 5.2 12.0 2.2 7.6 0.29 5.8 12.0 2.2 7.6 0.29 5.8 Profitability Return on Equity % Return on Assets % Net Margin % Asset Turnover Financial Leverage — 11.7 — — 11.8 — — 12.1 — — 12.4 — — 11.8 — — 11.8 — Gross Margin % Operating Margin % Long-Term Debt 1,234 9.8 1,433 11.4 1,724 12.0 2,167 13.1 2,300 13.9 2,300 13.9 60 40 20 0 2009 2010 2011 2012 2013 2014 2015 Financial Health Current 5-Yr Avg Distance to Default Solvency Score Assets/Equity Long-Term Debt/Equity 2016 Sector Median Country Median 0.7 503.6 3.9 0.4 0.6 603.3 2.8 0.4 0.9 — 5.8 — 0.7 — 6.3 — 1-Year 3-Year 5-Year 10-Year 14.4 8.8 10.7 5.0 6.1 -5.0 7.4 7.3 10.1 4.0 17.7 18.8 7.5 8.0 8.1 14.2 15.1 13.0 6.8 6.0 -32.5 — -4.2 3.1 Growth Per Share Revenue % Operating Income % Earnings % Dividends % Book Value % Stock Total Return % Financials (Fiscal Year in Mil) Revenue % Change 2011 2,811 14.8 Quarterly Revenue & EPS Revenue (Mil) Mar 2015 858.2 2014 865.6 2013 829.7 2012 827.7 Earnings Per Share () 2015 0.59 2014 0.51 2013 0.48 2012 0.46 Dividends/Share Book Value/Share Shares Outstanding (K) Total Equity Fixed Asset Turns Revenue Growth Year On Year % Jun 525.6 446.9 626.3 599.7 Sep 1,289.0 1,173.8 937.3 943.8 Dec 849.1 592.3 521.2 473.8 Total 3,521.9 3,078.6 2,914.5 2,845.0 43.3 25.2 10.0 17.6 13.7 9.8 4.3 -0.9 0.63 0.55 0.49 0.48 0.64 0.56 0.48 0.45 0.41 0.43 0.44 0.31 2.27 2.05 1.88 1.70 -28.7 2013 2014 © Morningstar 2016. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report. 2015 ® ß

© Copyright 2026