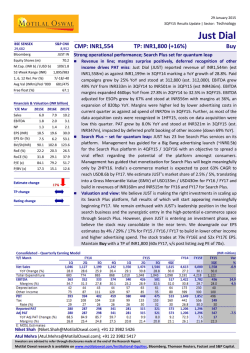

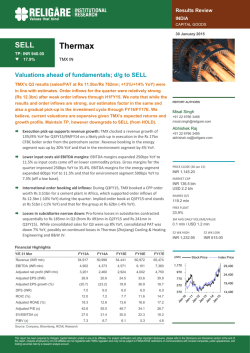

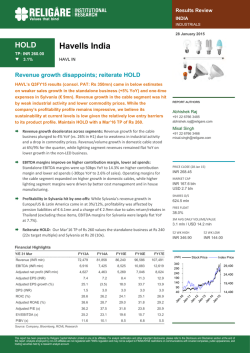

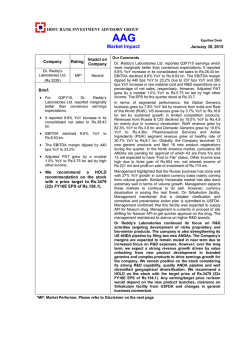

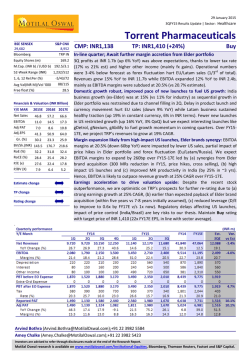

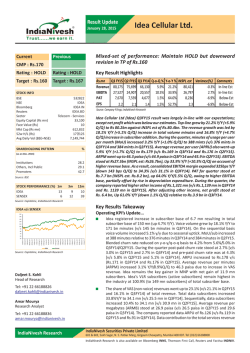

NiveshDaily - 28 January 2015.pmd