Dr. Reddys Labs Ltd. - Market Impact Q3FY15

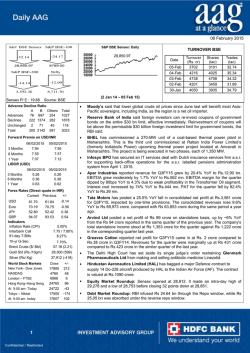

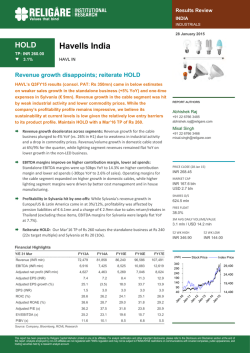

HDFC BANK INVESTMENT ADVISORY GROUP AAG Market Impact Company Rating Dr. Reddy's Laboratories Ltd. (Rs.3228) MP* Impact on Company Neutral Brief: For Q3FY15, Dr. Reddy’s Laboratories Ltd. reported marginally better than consensus earnings expectations. It reported 8.8% YoY increase in its consolidated net sales to Rs.38.43 bn. EBITDA declined 8.6% YoY to Rs.8.93 bn. The EBITDA margin dipped by 440 bps YoY to 23.2% Adjusted PAT grew by a modest 1.0% YoY to Rs.5.75 bn led by high other income. We recommend a HOLD recommendation on the stock with a price target to Rs.3479 (22x FY16E EPS of Rs.158.1). Equities Desk January 30, 2015 Our Comments Dr. Reddy’s Laboratories Ltd. reported Q3FY15 earnings which were marginally better than consensus expectations. It reported 8.8% YoY increase in its consolidated net sales to Rs.38.43 bn. EBITDA declined 8.6% YoY to Rs.8.93 bn. The EBITDA margin dipped by 440 bps YoY to 23.2% due to 237 bps YoY and 280 bps YoY increase in raw material cost and R&D expenditure as a percentage of net sales, respectively. However, Adjusted PAT grew by a modest 1.0% YoY to Rs.5.75 bn led by high other income. The EPS for the quarter stood at Rs.33.7. In terms of segmental performance, the Global Generics business grew by 7.8% YoY led by revenue from India and Rest of the World (RoW). US revenues grew by 3.7% YoY to Rs.16.8 bn led by sustained growth in limited competition products. Revenues from Russia & CIS declined by 10.0% YoY to Rs.4.8 bn mainly due to currency devaluation. RoW revenue grew by 82.3% YoY to Rs.3.8 bn and Domestic Generics grew by 10.6% YoY to Rs.4.3bn. Pharmaceutical Services and Active Ingredients (PSAI) segment revenue grew at healthy rate of 20.7% YoY to Rs.6.1 bn. Globally, the Company launched 13 new generic products and filed 18 new product registrations during the quarter. In the North America market, cumulative 68 ANDAs are pending for approval of which 43 are Para IVs and 13 are expected to have “First to File” status. Other Income was high due to forex gain of Rs.604 mn, net interest income of Rs.221 mn and profit on sale of investment of Rs.174 mn. Management highlighted that the Russia business has done well with 27% YoY growth in constant currency basis mainly coming from volume growth. Similarly Venezuela market has also done extremely well in terms of volume growth. Management expects these markets to continue to do well. However, currency devaluation is posing the real threat. On Srikakulam facility, Management mentioned that a detailed clarification and corrective and preventative action plan is submitted to USFDA. Management confirmed that this facility was expected to supply API for Nexium drug. Management is currently in process of site shifting for Naxium API to get quicker approval on the drug. The management maintained its stance on higher R&D spends. Dr Reddy’s Laboratories continued its focus on R&D activities targeting development of niche proprietary and bio-similar products. The company is also strengthening its US ANDA pipeline by filing two new ANDAs. The Company’s margins are expected to remain muted in near term due to increased focus on R&D expenses. However, over the long term, we expect a strong revenue growth driven by value unlocking from new product development in branded generics and complex products to drive earnings growth for the company. We remain positive on the stock considering its strong R&D capability, quality ANDA pipeline and well diversified geographical diversification. We recommend a HOLD on the stock with the target price of Rs.3479 (22x FY16E EPS of Rs.158.1). Any earning/target price revision would depend on the new product launches, clearance on Srikakulam facility from USFDA and changes in general business momentum. *MP: Market Performer, Please refer to Disclaimer on the next page Source: Bloomberg Disclaimer: This communication is being sent by the Investment Advisory Group of HDFC Bank Ltd., registered under SEBI (Investment Advisors) Regulations, 2013 This note has been prepared exclusively for the benefit and internal use of the recipient and does not carry any right of reproduction or disclosure. Neither this note nor any of its contents maybe used for any other purpose without the prior written consent of HDFC Bank Ltd, Investment Advisory Group. In preparing this note, we have relied upon and assumed, without any independent verification, accuracy and completeness of all information available in public domain or from sources considered reliable. This note contains certain assumptions and views, which HDFC Bank Ltd, Investment Advisory Group considers reasonable at this point in time, and which are subject to change. Computations adopted in this note are indicative and are based on current market prices and general market sentiment. No representation or warranty is given by HDFC Bank Ltd, Investment Advisory Group as to the achievement or reasonableness or completeness of any idea and/or assumptions. This note does not purport to contain all the information that the recipient may require. Recipients should not construe any of the contents herein as advice relating to business, financial, legal, taxation, or other matters and they are advised to consult their own business, financial, legal, taxation and other experts / advisors concerning the company regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this note and should understand that statements regarding future prospects may not be realized. It may be noted that investments in equity and equity-related securities involve a degree of risk and investors should not invest any funds unless they can afford to take the risk of losing their investment. Investors are advised to undertake necessary due diligence before making an investment decision. For making an investment decision, investors must rely on their own examination of the Company including the risks involved. Investors should note that income from investment in such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Neither HDFC Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. This note does not constitute an offer for sale, or an invitation to subscribe for, or purchase equity shares or other assets or securities of the company and the information contained herein shall not form the basis of any contract. It is also not meant to be or to constitute any offer for any transaction. HDFC Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein. HDFC Bank may at any time solicit or provide commercial banking, credit, advisory or other services to the issuer of any security referred to herein. Accordingly, information may be available to HDFC Bank, which is not reflected in this material, and HDFC Bank may have acted upon or used the information prior to, or immediately following its publication. Disclosures: Research analyst or his/her relatives or HDFC Bank or its associates may have financial interest in the subject company in ordinary course of business. Research analyst or his/her relatives does not have actual/ beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: HDFC Bank or its associates may have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. Subject company may have been client of HDFC Bank or its associates during twelve months preceding the date of publication of the research report. HDFC Bank or its associates may have received compensation from the subject company in the past twelve months. HDFC Bank or its associates may have managed or co-managed public offering of securities for the subject company in the past twelve months. HDFC Bank or its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months. HDFC Bank or its associates may have received compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months. HDFC Bank or its associates has not received compensation or other benefits from the subject company or third party in connection with the research report. Research analyst has not served as an officer, director or employee of the subject company. Neither research analyst nor HDFC Bank has been engaged in market making activity for the subject company. Three year price history of the daily closing price of the securities covered in this note is available at www.nseindia.com and www.bseindia.com.

© Copyright 2026