Manual de conmutador panasonic 206

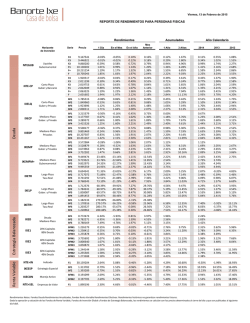

Viernes, 14 de Noviembre de 2014 Rendimientos Deuda Personas Morales Deuda Personas Físicas Horizonte de Inversión Precio 1 Día 7 Días 28 Días Oct 2014 3 Meses 6 Meses 12 Meses 24 Meses 36 Meses Acumulado 2014 En el Mes En el Año NTEGUB Liquidez Gubernamental F2 9.849696 0.90% 0.71% 0.72% 0.64% 0.65% 0.85% 1.05% 1.48% 1.75% 0.71% 1.02% IXELQ Corto Plazo Guber y Privado BF2 1.84622 1.07% 0.78% 0.85% 0.76% 0.76% 0.98% 1.17% 1.59% 1.85% 0.79% 1.15% IXECP Mediano Plazo Guber. y Privado BF2 3.170843 1.69% 1.13% 0.77% 0.51% 0.67% 1.06% 1.33% 1.76% 2.03% 0.88% 1.31% IXEDP Mediano Plazo Privados BF2 9.774022 1.77% 1.44% 1.71% 1.65% 1.53% 1.61% 1.73% 2.16% 2.50% 1.59% 1.73% IXEMP Mediano Plazo Guber y Privados BF2 3.515006 5.15% 1.39% 0.72% 1.41% 0.69% 1.45% 1.69% 1.97% 2.18% 0.80% 1.71% IXEMPM+ Mediano Plazo Gubernamental BF1 9.431505 1.27% 3.64% 0.86% 8.86% -0.53% 2.67% 2.49% 3.16% 2.83% 1.06% 2.72% IXETR Largo Plazo Tasa Real BF2 0.715325 3.37% 9.35% 5.13% 10.44% -0.57% 2.26% 3.63% 1.72% 2.83% -4.77% 3.34% IXELP Largo Plazo Guber. y Privado BF2 1.762223 32.31% 5.69% -0.52% 14.42% -0.56% 3.26% 4.39% 3.16% 3.39% 0.94% 5.30% IXELQM Liquidez Gubernamental BM2 9.824529 1.58% 1.31% 1.32% 1.24% 1.24% 1.45% 1.66% 2.10% 2.38% 1.31% 1.63% IXECP Mediano Plazo Guber. y Privado BM2 3.247943 2.27% 1.72% 1.36% 1.09% 1.26% 1.65% 1.46% 1.90% IXEMP Mediano Plazo Guber y Privado BM2 3.610761 5.74% 1.98% 1.31% 1.99% 1.28% 2.04% 2.29% 2.58% 2.80% 1.39% 2.31% IXEMPM+ Mediano Plazo Gubernamental BM2 9.977537 2.16% 4.54% 1.75% 9.76% 0.36% 3.57% 3.40% 4.11% 3.80% 1.96% 3.63% IXETR Largo Plazo Tasa Real BM2 0.714753 3.37% 9.35% 5.13% 10.44% -0.57% 2.25% 3.63% 1.72% 2.82% -4.77% 3.34% IXELP Largo Plazo Guber. y Privado BM2 1.811236 32.88% 6.28% 0.07% 15.02% 0.02% 3.85% 5.00% 1.53% 5.91% BE2 10.356649 2.21% 1.94% 1.94% 1.87% 1.87% 2.08% 2.30% 2.76% 3.05% 1.93% 2.26% BE3 10.88301 2.78% 2.51% 2.52% 2.44% 2.45% 2.66% 2.89% 3.36% 3.68% 2.51% 2.85% BE4 10.915912 3.01% 2.74% 2.75% 2.67% 2.68% 2.89% 3.12% 3.61% 3.94% 2.74% 3.08% BE2 3.70636 6.32% 2.56% 1.89% 2.58% 1.86% 2.63% 2.88% 3.19% 3.44% 1.98% 2.90% BE3 3.802833 6.89% 3.13% 2.46% 3.15% 2.44% 3.21% 3.47% 3.81% 4.08% 2.55% 3.49% BE4 3.792611 7.12% 3.36% 2.69% 3.38% 2.67% 3.44% 3.71% 4.05% 4.33% 2.78% 3.73% BE2 3.266616 2.91% 2.35% 1.99% 1.73% 1.89% 2.28% 2.10% 2.52% BE2 10.383744 2.72% 5.09% 2.31% 10.32% 0.92% 4.14% 3.98% 4.71% 4.41% 2.51% 4.21% BE4 10.855812 3.52% 5.89% 3.11% 11.13% 1.73% 4.96% 4.82% 5.60% 5.33% 3.31% 5.04% BE3 0.773484 4.52% 10.51% 6.29% 11.61% 0.59% 3.43% 4.84% 2.92% 4.08% -3.61% 4.54% BE2 1.82743 33.42% 6.84% 0.62% 15.58% 0.57% 4.42% 5.58% 2.08% 6.50% BF1 0.771095 1.45% 1.80% 1.35% 3.82% 0.44% 2.16% 2.40% 1.20% 2.48% BM1 0.778443 1.48% 1.80% 1.36% 3.82% 0.44% 2.16% 1.20% BE1 0.778457 1.99% 2.33% 1.56% 3.83% 0.50% 2.20% 1.61% BFM1 1.229775 0.01% -0.42% 0.44% 0.17% -0.54% 1.57% 4.52% 6.40% 11.17% -0.55% 2.59% BE1 1.230262 0.01% -0.41% 0.46% 0.17% -0.53% 1.58% 4.54% 6.41% 11.18% -0.54% 2.60% 3.78836 0.01% -0.88% 0.79% 0.00% -1.12% 2.02% 6.40% 7.77% 13.40% -1.13% 2.70% BE1 3.846721 0.01% -0.88% 0.80% 0.00% -1.11% 2.03% -1.12% 2.71% BFM1 1.262636 0.01% -1.35% 1.13% -0.19% -1.72% 2.46% 8.21% -1.71% 2.76% BE1 1.271055 0.01% -1.34% 1.14% -0.19% -1.71% 2.47% 8.22% -1.70% 2.77% BFM1 0.195761 0.01% -2.14% 1.80% -0.70% -2.71% 3.91% 12.15% 9.41% 20.23% -2.68% 3.00% BF1 2.598075 136.42% -4.53% 5.38% 2.84% 13.44% 8.98% 2.31% -0.08% -1.32% 30.15% 3.06% BM1 2.599173 136.40% -4.53% 5.38% 2.84% 13.44% 8.98% 2.31% -0.08% -1.32% 30.15% 3.06% BE1 2.686065 136.58% -4.35% 5.57% 3.08% 13.65% 9.16% 2.48% 0.08% -1.19% 30.29% 3.23% BF1 0.930646 313.92% 37.58% -25.72% -8.73% -13.48% -9.18% -4.93% -0.66% -4.13% 25.26% -7.82% BM1 0.911779 313.96% 37.59% -25.71% -8.73% -13.48% -9.18% -4.93% -0.66% -4.13% 25.27% -7.82% BE1 0.962074 313.93% 37.58% -25.71% -8.72% -13.48% -9.17% -4.92% -0.64% -4.07% 25.27% -7.80% 1 Día 7 Días 28 Días Oct 3 Meses 6 Meses 12 Meses 24 Meses 36 Meses 2014 14 15 0.09% 17 18 -2.19% 20 21 3.57% 23 24 10.00% 26 27 6.49% 29 30 16.48% En el Mes En el Año IXELQM No Sujetos a Retención de Impuestos Serie IXEMP Liquidez Gubernamental Mediano Plazo IXECP Mediano Plazo Guber. y Privado IXEMPM+ Mediano Plazo Gubernamental IXETR Largo Plazo Tasa Real BE4* IXELP Estrategia Balanceada IXED IXE1 IXE2 Internacionales Renta Variable IXE3 Largo Plazo Guber. y Privado Mediano Plazo Balanceado 20% Capitales 80% Deuda 40% Capitales 60% Deuda 60% Capitales 40% Deuda IXECON Manejo Activo IXEUSD Cobertura Inversión en Dólares IXEEURO Cobertura Inversión en Euros BFM1 Precio Referencias del Mercado 5 6 IPC Indice de Precios y Cotizaciones Dólar T.C. Spot Valmer Euro T.C. Spot Valmer 17.32% Acumulado 2014 0.00% -2.47% 11 12 1.95% 13.6235 138.47% -3.13% 6.74% 4.27% 14.89% 10.59% 3.90% 1.59% 0.25% 31.39% 4.67% 17.0123 315.87% 39.41% -24.37% -7.36% -11.90% -7.69% -3.52% 0.70% -2.80% 27.02% -6.42% 43,743.80 8 9 8.99% Fondos Deuda Rendimientos Anualizados, Fondos Renta Variable Rendimientos Efectivos. Rendimientos históricos no garantizan rendimientos futuros. Dada la operación y valuación de los Fondos de Renta Variable, Fondos de Inversión Global y Fondos de Estrategia Balanceada, los rendimientos se calculan con los precios determinados al cierre del día y que son públicados al siguiente día hábil. 32 33 -2.85% 35 36 2.38%

© Copyright 2026