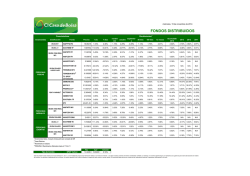

Reporte de Rendimientos

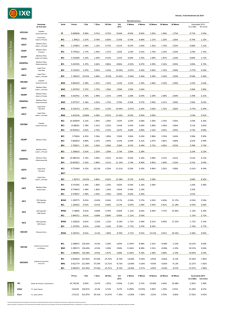

Viernes, 13 de Febrero de 2015 REPORTE DE RENDIMIENTOS PARA PERSONAS FISICAS Año Calendario Precio 1 Día En el Mes En el Año Liquidez Gubernamental F4 F3 F2 F1 F+ F 9.147541 9.446921 9.868200 10.138202 10.231154 10.705043 -0.03% -0.01% 0.59% 1.01% 1.19% 1.85% -0.05% -0.02% 0.58% 0.99% 1.17% 1.83% 0.10% 0.12% 0.72% 1.14% 1.32% 1.97% 0.16% 0.18% 0.79% 1.20% 1.38% 2.04% 0.12% 0.29% 0.94% 1.36% 1.55% 2.22% 1.67% 2.80% 4.96% 6.28% 6.85% 9.03% 0.11% 0.34% 0.99% 1.41% 1.59% 2.25% 0.55% 1.02% 1.74% 2.16% 2.34% 3.03% 1.08% 1.55% 2.27% 2.68% 2.86% 3.55% NTE-CP Corto Plazo Guber y Bancario F4 F3 F2 F1 F+ F 1.920517 2.011199 2.019753 2.042049 2.063225 2.601602 -0.02% 0.30% 0.61% 0.88% 1.19% 1.94% 0.03% 0.34% 0.63% 0.92% 1.22% 1.97% 0.17% 0.49% 0.78% 1.07% 1.36% 2.12% 0.24% 0.55% 0.84% 1.14% 1.43% 2.18% 0.39% 0.71% 1.01% 1.31% 1.60% 2.84% 3.61% 5.24% 5.65% 6.31% 7.04% 11.13% 0.45% 0.77% 1.06% 1.35% 1.65% 2.93% 1.37% 1.98% 2.04% 2.21% 2.41% 3.70% 1.90% 2.58% 2.59% 2.73% 2.91% 4.20% IXELQ Corto Plazo Guber y Privado BF1 BF2 BF3 BF4 1.785515 1.849960 1.923696 2.000311 -0.08% 0.53% 1.12% 1.71% 0.06% 0.65% 1.25% 1.84% 0.21% 0.81% 1.40% 2.00% 0.29% 0.88% 1.48% 2.07% 0.45% 1.05% 1.66% 2.27% 3.42% 5.29% 7.19% 9.13% 0.51% 1.10% 1.70% 2.31% 1.24% 1.83% 2.44% 3.04% 1.75% 2.34% 2.94% 3.55% IXECP Mediano Plazo Guber. y Privado BF1 BF2 BF3 BF4 3.215379 3.177787 3.289372 3.415326 -0.50% 0.07% 0.66% 1.25% -0.16% 0.41% 1.00% 1.60% 0.45% 1.02% 1.61% 2.21% 0.73% 1.30% 1.89% 2.49% 0.60% 1.18% 1.79% 2.40% 5.76% 7.67% 9.61% 0.67% 1.23% 1.83% 2.44% 2.00% 2.60% 3.21% 2.51% 3.11% 3.71% IXEDP Mediano Plazo Privados BF1 BF2 BF3 BF4 9.508177 9.801469 10.207507 10.451267 -0.36% 0.24% 0.83% 1.42% 0.37% 0.96% 1.56% 2.15% 0.72% 1.31% 1.91% 2.50% 0.88% 1.47% 2.07% 2.65% 0.98% 1.59% 2.20% 2.81% 5.30% 7.19% 9.14% 11.09% 1.03% 1.63% 2.24% 2.84% 1.79% 2.39% 3.00% 3.60% 2.52% 3.12% 3.72% 4.32% IXEMP Mediano Plazo Guber y Privados BF1 BF2 BF3 BF4 3.572984 3.528879 3.674963 3.752282 -0.28% 0.28% 0.87% 1.47% -1.08% -0.52% 0.08% 0.66% 1.06% 1.63% 2.23% 2.81% 2.07% 2.63% 3.23% 3.81% 1.12% 1.70% 2.31% 2.92% 6.31% 8.24% 10.16% 1.12% 1.69% 2.29% 2.89% 2.05% 2.65% 3.25% 2.67% 3.27% 3.86% 9.449474 9.719521 9.852975 9.995559 23.46% 23.76% 24.35% 24.93% -23.14% -22.84% -22.27% -21.69% 1.11% 1.41% 1.99% 2.57% 12.54% 12.85% 13.43% 14.02% 2.22% 2.54% 3.14% 3.75% 2.42% 2.73% 3.33% 3.93% 3.43% 3.74% 4.34% 4.94% 2.75% Mediano Plazo Gubernamental BF1 BF2 BF3 BF4 8.54% IXEMPM+ IXETR Largo Plazo Tasa Real BF1 BF2 BF3 BF4 0.694341 0.717072 0.741292 0.768345 71.33% 71.89% 72.51% 73.10% -23.05% -22.47% -21.88% -21.29% -3.17% -2.58% -1.99% -1.40% 6.17% 6.76% 7.36% 7.95% 2.00% 2.61% 3.22% 3.84% 5.25% 7.14% 9.06% 11.03% 2.87% 3.48% 4.09% 4.71% -0.20% 0.39% 0.98% 1.57% 4.85% 5.46% 6.07% 6.69% IXELP Largo Plazo Guber. y Privado BF1 BF2 BF3 BF4 1.712376 1.784241 1.858087 1.891453 68.39% 68.97% 69.57% 69.87% -39.92% -39.33% -38.75% -38.46% 7.27% 7.87% 8.47% 8.77% 29.76% 30.37% 30.98% 31.28% 4.56% 5.19% 5.82% 6.14% 9.47% 11.45% 13.47% 15.05% 4.29% 4.91% 5.53% 5.84% 0.67% 1.27% 1.86% 2.41% 3.93% 4.54% 5.15% 5.76% IXETR+ Largo Plazo Tasa Real BF1 BF2 BF3 BF4 1.182133 1.170916 1.203527 1.228962 279.00% 279.57% 280.17% 280.48% -56.80% -56.25% -55.67% -55.38% -1.15% -0.59% 0.00% 0.30% 25.38% 25.96% 26.56% 26.86% 6.58% 7.22% 7.54% 12.55% 14.57% 16.17% 7.40% 8.03% 8.35% -5.92% -5.37% -4.86% 13.11% 13.77% 14.43% Estrategia Balanceada Acumulados Mes Anterior IXED Deuda Mediano Plazo BF1 BF2 BF3 0.772473 0.782271 0.788169 6.34% 6.95% 7.49% -5.93% -5.36% -4.78% 0.81% 1.39% 1.97% 3.97% 4.55% 5.12% 1.96% 2.56% 3.15% IXE1 20% Capitales 80% Deuda BFM1 BFM2 BFM3 1.226179 1.238412 1.255878 0.55% 0.55% 0.56% 0.69% 0.70% 0.72% -0.02% 0.03% 0.10% -0.71% -0.67% -0.61% 2.76% 3.24% 3.84% 9.75% 11.20% 2.31% 2.78% 3.38% 2.62% 3.09% 3.69% 5.96% 6.35% IXE2 40% Capitales 60% Deuda BFM1 BFM2 BFM3 3.755692 3.800640 3.858870 1.07% 1.07% 1.07% 1.80% 1.81% 1.82% -0.15% -0.11% -0.04% -1.91% -1.88% -1.83% 3.21% 3.57% 4.17% 11.12% 12.29% 1.96% 2.32% 2.92% 3.12% 3.48% 7.66% 8.04% IXE3 60% Capitales 40% Deuda BFM1 BFM2 BFM3 1.244144 1.255505 1.273388 1.58% 1.58% 1.58% 2.92% 2.92% 2.94% -0.29% -0.27% -0.20% -3.12% -3.10% -3.05% 3.58% 3.83% 4.43% 13.77% 14.66% 1.55% 1.79% 2.38% 3.46% 3.70% 11.59% 11.95% Renta Variable Rendimientos NTE+IN Indizado F1 30.139204 2.64% 5.08% -0.46% -5.28% 4.29% 10.60% -0.50% -1.99% 16.93% IXEESP Estrategia Especial BF1 BF2 1.313782 1.393289 0.79% 0.79% 1.52% 1.55% -0.96% -0.82% -2.44% -2.34% 7.18% 8.43% 50.93% 56.29% 10.93% 12.23% 24.55% 26.01% 16.49% 17.85% IXECON Manejo Activo BFM1 BFM2 0.191099 0.197705 2.69% 2.69% 5.24% 5.25% -0.39% -0.32% -5.35% -5.30% 4.79% 5.40% 15.33% 17.36% 0.94% 1.53% 1.43% 2.02% 17.40% 18.09% NTE+SEL Empresas de Valor F1 1.890196 2.30% 4.66% -0.01% -4.46% 7.40% 17.75% 3.59% 1.01% 15.51% Horizonte de Inversión Deuda NTEGUB Serie 1 Año 3 Años 2014 2013 2012 2.24% 2.83% 3.42% Rendimientos Netos. Fondos Deuda Rendimientos Anualizados, Fondos Renta Variable Rendimientos Efectivos. Rendimientos históricos no garantizan rendimientos futuros. Dada la operación y valuación de los Fondos de Renta Variable, Fondos de Inversión Global y Fondos de Estrategia Balanceada, los rendimientos se calculan con los precios determinados al cierre del día y que son publicados al siguiente día hábil. Viernes, 13 de Febrero de 2015 REPORTE DE RENDIMIENTOS PARA PERSONAS FISICAS Rendimientos Fondos Externos Internacionales Horizonte de Inversión Serie Precio Acumulados 1 Día En el Mes En el Año Mes Anterior Año Calendario 1 Año 3 Años 2014 2013 2012 IXEUSD Cobertura Inversión en Dólares BF1 2.828691 -503.90% -9.26% 6.98% 14.06% 10.03% 10.60% 10.73% -0.31% -8.91% IXEEURO Cobertura Inversión en Euros BF1 0.925880 -196.56% 19.00% -41.63% -67.44% -7.57% -3.84% -2.48% 4.41% -7.48% NTE+USA Capitales EUA F1 0.236126 -0.49% 3.83% 1.97% -1.79% 26.12% 71.06% 24.00% 27.31% 4.54% NTE+GL Capitales Global F1 4.756503 0.21% 2.96% 2.98% 0.01% 6.01% 21.68% 1.88% 11.27% 3.40% NAFCDVI Deuda Largo Plazo Tasa Real F1 14.714647 84.34% -18.54% -1.22% 6.92% 3.05% 15.64% 3.86% 6.72% 6.34% F2 15.171850 84.93% -17.96% -0.63% 7.51% 3.66% 17.72% 4.47% 7.34% 6.96% Mercado de Deuda Global (Gubernamental) BF1 2.685865 -464.84% -464.84% 8.56% 14.14% 13.82% 24.55% 12.27% 1.22% 6.10% BF2 2.622961 -465.16% -4.50% 8.24% 13.78% 13.45% 23.32% 11.91% 0.89% 5.75% TEMGBIA Acumulados Año Calendario Mes Referencias del Mercado Precio 1 Día 5 6 En el Mes 32 33 En el Año 35 36 Anterior 1 Año 14 15 23 24 3 Años 2014 29 30 38 39 2013 41 42 2012 44 45 CETES MEX_CETES_28D Valmer 2.17% 1.91% 1.97% 1.99% 2.44% 11.01% 2.47% 3.27% 3.70% IPC Indice de Precios y Cotizaciones 43,045.51 2.65% 5.12% -0.23% -5.09% 5.79% 12.67% 0.98% -2.24% 17.88% S&P 500 E.U.A. 31,126.71 -0.46% 4.37% 1.63% -2.63% 28.46% 80.79% 26.76% 31.34% 4.70% Dólar T.C. Spot Valmer 14.9040 -509.59% -8.34% 8.90% 16.41% 11.90% 16.23% 12.53% 1.43% -7.53% Euro T.C. Spot Valmer 16.9913 -195.53% 20.17% -40.08% -65.71% -6.14% 0.58% -1.01% 5.68% -5.87% Rendimientos Netos. Fondos Deuda Rendimientos Anualizados, Fondos Renta Variable Rendimientos Efectivos. Rendimientos históricos no garantizan rendimientos futuros. Dada la operación y valuación de los Fondos de Renta Variable, Fondos de Inversión Global y Fondos de Estrategia Balanceada, los rendimientos se calculan con los precios determinados al cierre del día y que son publicados al siguiente día hábil.

© Copyright 2026