Previos Timestrales 4T14

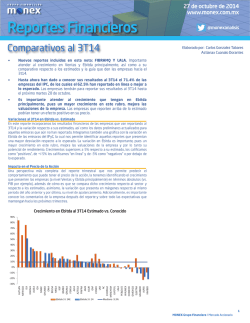

10 de febrero de 2015 www.monex.com.mx Preliminares @monexanalisis Reportes al 4T14 Elaborado por: Dirección de Análisis y Estrategia Bursátil 80% 60% Crecimiento en Ebitda 40% 20% Mediana 10.9% 0% -20% -40% SIMEC ICH OMA IENOVA ALSEA BIMBO ELEKTRA PE&OLES MEXCHEM ICA MFRISCO BOLSA ALFA MEGA KIMBER TLEVISA AMX AC FEMSA COMERCI KOF ASUR GAP CHDRAUI AZTECA LALA LIVEPOL WALMEX LAB SORIANA GRUMA PINFRA AUTLAN ALPEK OHLMEX -60% 1 MONEX Grupo Financiero / Mercado Accionario Mercado Accionario La mediana de cremiento en Ventas se espera del 6.8%, mientras que el crecimiento promedio se ubica en 7.9%. 45% 35% Crecimiento en Ventas 25% Mediana 6.8% 15% 5% -5% -15% ALSEA ASUR MFRISCO AUTLAN IENOVA ELEKTRA MEXCHEM ICH SIMEC BOLSA ALFA BIMBO OMA AZTECA AMX ICA FEMSA KOF TLEVISA GAP WALMEX KIMBER CHDRAUI LALA LIVEPOL MEGA LAB AC SORIANA COMERCI PINFRA PE&OLES GRUMA ALPEK OHLMEX -25% 60% 40% 20% Mediana 10.9% 0% -20% -40% -60% SIMEC ICH OMA IENOVA ALSEA BIMBO ELEKTRA PE&OLES MEXCHEM ICA MFRISCO BOLSA ALFA MEGA KIMBER TLEVISA AMX AC FEMSA COMERCI KOF ASUR GAP CHDRAUI AZTECA LALA LIVEPOL WALMEX LAB SORIANA GRUMA PINFRA AUTLAN ALPEK OHLMEX La mediana de cremiento en Ebitda se espera del 10.9%, mientras que el promedio ponderado se ubica en 9.8% Crecimiento en Ebitda MONEX Grupo Financiero / Mercado Accionario 2 Mercado Accionario Reportes Preliminares al 4T14 Ventas Margen Operativo Utilidad Neta 15,308 15,754 3,073 4T14e vs. 4T13 3,407 10.9% ALFA M 18-feb 50,018 56,910 13.8% 5,701 6,455 13.2% ALPEK M 18-feb 20,931 16,656 -20.4% 1,718 1,164 -32.3% ALSEA M 27-feb 4,417 7,875 78.3% 614 1,016 AMX M 10-feb 204,120 228,698 12.0% 63,615 ASUR C 23-feb 1,478 2,092 41.5% 762 AUTLAN M 27-feb 926 1,216 31.2% AZTECA C 24-feb 3,806 4,267 12.1% BIMBO C 26-feb 46,476 52,504 13.0% BOLSA M 17-feb 574 660 15.1% CHDRAUI C 19-feb 18,433 19,380 COMERCI T 25-feb 11,916 ELEKTRA T 27-feb FEMSA M GAP C GRUMA ICA ICH IENOVA AC Tipo Fecha Est. Reporte C 18-feb Ebitda 4T14e vs. 4T13 2.9% Emisora Margen EBITDA 1,356 1,595 4T14e vs. 4T13 17.7% 15.9% 16.4% 20.1% 21.6% 1,026 - 3,808 -471.2% 6.4% 7.2% 11.4% 11.3% 117 286 344.2% 4.2% 4.9% 8.2% 7.0% 65.5% 275 339 23.5% 8.3% 7.3% 13.9% 12.9% 70,959 11.5% 17,177 19,371 12.8% 18.2% 19.0% 31.2% 31.0% 824 8.1% 645 536 -16.9% 44.3% 52.7% 51.5% 39.4% 204 183 -10.5% 68 27 139.5% 14.0% 8.9% 22.1% 15.0% 1,428 1,517 6.3% 763 1,069 40.1% 33.5% 24.2% 37.5% 35.6% 3,978 6,461 62.4% 1,391 1,970 41.6% 5.6% 6.0% 8.6% 12.3% 277 315 13.8% 149 202 35.5% 45.8% 45.0% 48.3% 47.7% 5.1% 1,125 1,200 6.7% 452 434 -4.0% 4.3% 4.7% 6.1% 6.2% 12,019 0.9% 939 1,026 9.2% 2,246 948 -57.8% 5.5% 6.2% 7.9% 8.5% 18,963 22,798 20.2% 2,049 3,113 52.0% 1,863 267 -85.7% 6.1% 9.5% 10.8% 13.7% 26-feb 70,490 76,761 8.9% 12,467 13,787 10.6% 6,754 7,246 26-feb 1,341 1,417 5.7% 845 909 7.6% 896 430 C 25-feb 13,666 12,389 -9.3% 1,811 1,807 -0.2% 2,156 M 27-feb 7,729 8,500 10.0% 1,262 1,501 18.9% 1,082 - M 19-feb 6,349 7,466 17.6% 26 159 513.6% 265 - C 25-feb 2,047 2,662 30.0% 708 1,195 68.7% 4T13 4T14e 4T13 4T14e 4T13 - - 4T14e 4T13 4T14e 4T13 4T14e 7.3% 13.8% 14.1% 17.7% 18.0% -52.0% 46.3% 45.4% 63.0% 64.1% 782 -63.7% 10.1% 8.9% 13.3% 14.6% 650 -160.1% 10.5% 12.7% 16.3% 17.7% 194 -173.1% -3.5% -1.3% 0.4% 2.1% 70 594 754.1% 24.7% 28.8% 34.6% 44.9% 30.2% KIMBER C 22-ene 7,263 7,667 5.6% 2,067 2,317 12.1% 1,115 1,194 7.0% 23.5% 24.3% 28.5% KOF M 25-feb 43,240 46,174 6.8% 8,554 9,335 9.1% 3,135 3,362 7.2% 15.3% 15.6% 19.8% 20.2% LAB C 27-feb 3,678 3,834 4.3% 1,341 1,381 3.0% 858 837 -2.5% 36.0% 25.9% 36.5% 36.0% LALA C 26-feb 11,092 11,657 5.1% 1,367 1,446 5.7% 724 840 16.0% 10.2% 9.8% 12.3% 12.4% LIVEPOL C 19-feb 26,121 27,442 5.1% 5,576 5,893 5.7% 3,646 3,779 3.6% 19.6% 14.6% 21.3% 21.5% MEGA C 17-feb 2,959 3,106 5.0% 1,180 1,330 12.7% 395 593 50.0% 27.3% 26.3% 39.9% 42.8% MEXCHEM M 25-feb 16,643 19,914 19.7% 2,280 2,769 21.5% - 207 748 460.5% 5.7% 10.1% 13.7% 13.9% MFRISCO M 27-feb 2,554 3,373 32.1% 1,158 1,339 15.6% - 140 252 279.8% 21.1% 16.3% 45.4% 39.7% OHLMEX M 18-feb 9,485 3,896 -58.9% 7,420 3,515 -52.6% 2,574 1,500 -41.7% 76.4% 85.8% 78.2% 90.2% OMA C 23-feb 933 1,047 12.2% 284 486 71.0% 532 259 -51.3% 25.0% 35.4% 30.5% 46.4% PE&OLES M 27-feb 14,943 14,410 -3.6% 2,684 3,516 31.0% 152 903 492.7% 8.2% 13.4% 18.0% 24.4% PINFRA C 27-feb 1,681 1,664 -1.0% 1,077 1,061 -1.5% 837 626 -25.3% 59.6% 57.9% 64.1% 63.8% SIMEC M 19-feb 5,533 6,499 17.5% -7 113 1691.3% 151 30 -79.9% -3.9% -2.3% -0.1% 1.7% SORIANA C 27-feb 28,702 29,119 1.5% 2,177 2,224 2.1% 565 1,260 122.8% 5.9% 5.3% 7.6% 7.6% TLEVISA C 26-feb 21,443 22,824 6.4% 7,887 8,827 11.9% 3,858 3,075 -20.3% 24.8% 25.4% 36.8% 38.7% WALMEX M 17-feb Mediana IPC Prom. Ponderado 98,977 104,505 9,141 9,572 5,044 789,148 857,154 149,241 156,791 163,731 172,122 4.7% 10.9% 9.7% 9.8% 5,148 730,390 794,235 5.6% 6.8% 8.0% 7.9% 59,074 61,724 51,820 55,744 -2.0% 7.0% -12.3% -9.7% 7.1% 14.0% 13.8% 13.4% 6.9% 14.1% 13.9% 13.4% 9.2% 19.8% 20.4% 19.7% 9.2% 20.2% 20.7% 20.1% 4T14e 4T13 Grupos Financieros Tipo Fecha Est. Reporte GENTERA M 24-feb Emisora Ingresos por Intereses 4T14e vs. 4T14e 4T13 3,069 3,515 14.5% 4T13 Fibras Emisora DANHOS Ingresos Totales Tipo Fecha Est. Reporte M 25-feb 4T13 4T14e 4T14e vs. 4T13 0.2% Margen Financiero 4T14e vs. 4T14e 4T13 9,930 12,152 22.4% 4T13 Ingreso Neto Operativo (NOI) 4T14e vs. 4T14e 4T13 323 316 -2.2% 4T13 4T13 4T13 Utilidad Neta 491 4T14e 655 ROA 4T14e vs. 4T13 33.4% Utilidad Neta 4T14e Margen NOI 32.9% 26.7% Margen FFO 4T14e vs. 4T13 12.1% 77.6% 75.8% 67.6% 75.6% 47.7% 81.7% 75.4% 63.2% 50.9% 4T13 4T14e 4T13 4T14e 416 417 1,183 2,168 83.3% FIBRAMQ M 26-feb 477 586 22.8% 426 504 18.1% 233 297 27.2% 89.4% 86.0% 48.9% 50.6% TERRA M 19-feb 490 516 5.2% 404 465 15.0% 232 297 27.6% 82.4% 90.0% 47.4% 57.5% 27.4% 82.1% 80.9% 56.0% 54.2% 2,566 3,687 43.7% 2,120 2,919 37.7% 1,213 1,697 39.9% 82.6% 79.2% 47.3% 46.0% Mediana Prom. Ponderado 14.0% 315 9.8% 26-feb 69.0% 1,104 65.1% 4T14e M 1,635 281 ROE FUNO 967 747 4T13 16.6% Cifras Nominales en Millones de MXN$ C: Estimados de Consenso; T: Estimados por tendencia; M: Estimados Monex; P: Resultados Preliminares; R: Reportó. Fuente: Monex con base en Thomson Reuters, Economática y Bloomberg MONEX Grupo Financiero / Mercado Accionario 3 Mercado Accionario Directorio Dirección de Análisis y Estrategia Bursátil Carlos A. González Tabares Director de Análisis y Estrategia Bursátil T. 5231-4521 [email protected] Eduardo Ávila Vargas Subdirector de Análisis Económico T. 5231-0489 [email protected] Daniela Ruíz Zárate Analista Económico T. 5231-0489 [email protected] Fernando E. Bolaños S. Analista Bursátil / Industrial, Minero y Petroquímico T. 5230-0200 Ext. 0720 [email protected] J. Roberto Solano Pérez Analista Bursátil / Construcción, Vivienda y Fibras T. 5230-0200 Ext. 4451 [email protected] Verónica Uribe Boyzo Analista Bursátil / Alimentos y Bebidas T. 5230-0200 Ext. 4782 [email protected] Giselle N. Mojica Plascencia Analista Bursátil T. 5230-0200 Ext. 4451 [email protected] Laura Villanueva Ramírez Analista Bursátil T. 5230-0200 Ext. 0720 [email protected] Stephany Ramírez Rojas Analista Deuda Corporativa T. 5230-0200 Ext. 4262 [email protected] J. Francisco Caudillo Lira Analista Técnico Sr. T. 5231-0016 [email protected] Astianax Cuanalo Dorantes Analista Sr. de Sistemas de Información T. 5230-0200 Ext. 4790 [email protected] MONEX Grupo Financiero / Mercado Accionario 4 Mercado Accionario Disclaimer MONEX Grupo Financiero / Nota de Empresa 5

© Copyright 2026