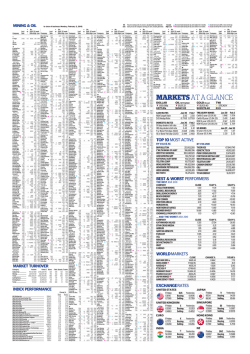

Tables 1 TOP 300 Companies