weekly review - The Financial Markets Directory

WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 WEEK ENDING 30 JANUARY 2015 HIGHLIGHTS South Africa 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. The South African Reserve Bank’s Monetary Policy Committee (MPC) decided to keep the repo rate steady at 5,75%. Nedbank Capital’s expenditure project listing counted 65 new projects worth R95,4bn in 2014 compared with 85 projects worth R187,9bn in 2013. South African big business CEOs are gloomier than their global counterparts with 80% of South African CEOs saying there were more threats to the growth of their companies today than there were three years ago according to a PwC survey. The leading indicator rose by 0,9% m/m in November to its highest level since March 2014 but was still down 0,1% y/y. The co-incident indicator slipped to a 0,9% y/y increase in October from 2,2% y/y increase in September and a 1,8% y/y rise in August. The balance of payments surplus eased to R7,927bn in the fourth quarter from R23,356bn in the third quarter. The trade weighted rand averaged 68,06 in January from 67,26 in December, 68,6 in November, 67,83 in October, 67,80 in September, 68,54 in August, 68,06 in July, 68,07 in June and 69,71 in May. The volatility in the trade weighted rand eased to 4,14% in January from 5,78% in December and 3,47% in November. The foreign trade balance swung to the largest surplus in four years in December with a R6,85bn surplus from a revised deficit of R5,27bn (R5,7bn) in November and a R21,3bn deficit in October. Daily average turnover on the South African foreign exchange market rose to US$24,114bn in December from $23,189bn in November and a record US$27,64bn in March 2014. The Crimean crisis has seen the South African rand overtake the Russian rouble as an international payments currency. Broad M3 money supply growth eased to 7,38% y/y in December from 8,31% y/y in November and 8,02% y/y in October, while narrow M0 money supply growth rose to 8,11% y/y in December from 6,16% y/y in November and 10,58% y/y in October. Producer inflation for final manufactures eased to 5,8% y/y in December from 6,5% y/y in November and 6,7% y/y in October. Government revenue only grew by 3,0% y/y in December after surging by 16,7% y/y in November, growing by 7,0% y/y in October and a 11,1% gain in the 2013/14 fiscal year, while expenditure jumped by 13,8% y/y in December after increasing by 1,0% y/y in November, a 4,6% y/y gain in October and a 8,8% rise in the previous fiscal year. The number of liquidations fell by 14,0% y/y in December to 123 after jumping by 33,1% y/y in November to 169 and falling by 12,0% y/y in October to 168. WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 16. The number of insolvencies edged up by 2,4% y/y in December to 258 after rising by 6,1% y/y in October to 280 and increasing by 7,4% y/y in September to 261. 17. The 94,3 MW Sishen solar photovoltaic (PV) plant in the Northern Cape was connected to the national grid. 18. The first estimate of maize plantings saw a 1,2% reduction to 2,656 million hectares. 19. Glencore is looking to cut coal production at its Optimum operations. 20. The Gauteng retail ULP 95 petrol price will decline by 93c/l on 4 February after being slashed by 123c/l on 7 January, a 69c/l cut on 3 December and a 45c/l drop on 5 November. 21. Pretoria received 73mm of rain in January after 239mm in December and 99mm in November. Rest of Africa 22. Sub-Saharan Africa’s (SSA) overall level of economic freedom remains low, yet the region experienced the most widespread improvement in 2014. 23. Foreign direct investment (FDI) inflows to Africa fell by 3% to around $55bn compared with an 8% fall in global inflows to an estimated $1,26 trillion. 24. Consumer inflation in Kenya eased to 5,53% y/y in January from 6,02% y/y in December and 6,09% y/y in November. 25. Consumer inflation in Uganda eased to 1,3% y/y in January from 1,8% y/y in December and 2,1% y/y in November. 26. Consumer inflation in Zambia eased to 7,7% y/y in January from 7,9% y/y in December and 8,1% y/y in November. 27. Zambia had a foreign trade deficit of ZMW81,9m in December, but the annual trade balance was still a surplus of ZMW892,9m from a ZMW2,2798bn surplus in 2013. International 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. The central bank of Albania cut its benchmark lending rate by 25 basis points to 2,0%. The central bank of Russia cut its benchmark lending rate by 200 basis points to 15%. The central bank of Trinidad and Tobago raised its benchmark lending rate by 25 basis points to 3,5%. Food affordability improved in nearly 75% of countries from September to November 2014, largely owing to a 2,8% decline in global food prices. China became the top recipient of foreign direct investment (FDI) in 2014 with $128bn compared with $86bn for the US. China’s yuan has become the world’s fifth most widely used payments currency according to the Society for Worldwide Interbank Financial Telecommunication (SWIFT). Standard & Poor's on 26 January cut Russia's sovereign credit rating to BB+, a sub-investment grade. The Freedom House annual report determined that 61 countries out of 195 became less free in 2014, while just 31 saw freedoms improve. The German IFO business confidence index rose to 106,7 in January from 105,5 in December and 104,7 in November and 103,2 in October. The US consumer confidence index rose to 102,9 in January from 93,1 in December and 91,0 in November. The Thomson Reuters/University of Michigan's consumer sentiment index rose to 98,1 in January from 93,6 in December and 88,8 in November. In their first estimate of the US GDP for the fourth quarter of 2014, the Bureau of Economic Analysis (BEA) reported that the American economy slowed to 2,6% q/q seasonally adjusted annualised increase from a 11-year best rate of 5,0% in the third quarter. WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 40. US durable goods orders dropped by 3,4% m/m in December after a revised 2,1% (0,7%) m/m decrease in November and a 0,3% m/m rise in October. 41. US new home sales jumped by 11,6% m/m in December to a seasonally adjusted annualised rate of 481 000 units. 42. The US Case-Shiller home price index for 20 cities rose by 4,3% y/y in November after a 4,5% y/y increase in October and a 4,8% y/y gain in September. 43. Consumer prices in the Eurozone showed the second consecutive y/y decline in January with a 0,6% y/y drop after December’s 0,2% y/y fall. 44. The Eurozone unemployment rate eased to 11,4% in December from 11,5% in November. 45. Spain's economy grew by 1,4% in 2014 after a 1,2% contraction in 2013. 46. Consumer inflation in Japan was steady at 2,4% y/y in December and November from 2,9% y/y in October. 47. The unemployment rate in Japan eased to 3,4% in December after being steady at 3,5% in November and October, while the job-to-applicant ratio of 1,15 was the highest since March 1992. 48. The Japanese foreign trade deficit was ¥661bn in December of 2014, almost half the ¥1307bn deficit of December 2013. 49. Consumer inflation in Pakistan eased to 3,88% y/y in January from 4,3% y/y in December from 3,96% y/y in November, 5,82% y/y in October and 7,68% y/y in September. 50. Russia sold over $15bn worth of arms to more than 60 countries in 2014. 51. Dubai’s airport saw passenger numbers rise by 6% in 2014 to 70,5 million making it the busiest international airport, pushing Heathrow into second place with 68,1 million. 52. Global international tourist arrivals rose by 4,7% in 2014 to 1,138 billion, matching the growth rate of 2013. 53. Although the growth rate of the Philippine economy slowed to 6,1% in 2014 from 7,2% in 2013, this is still the second highest growth rate in Asia. 54. The Polish economy expanded by 3,3% in 2014 from 1,7% in 2013. 55. The Taiwanese economy slowed to 3,17% y/y in the fourth quarter from 3,63% y/y in the third quarter. 56. World gold mine production grew by 2% in 2014 to a record 3 109 tons. 57. The monthly average OPEC Reference Basket (ORB) eased to $44,38 per barrel in January from $59,46 in December. South Africa 1. The South African Reserve Bank’s Monetary Policy Committee (MPC) decided to keep the repo rate steady at 5,75%. This was the consensus forecast and the indications are that the repo rate will stay at this level until the US increase interest rates in the second half of the year. If capital flows out we could see interest rates increased here, but if there is no impact on capital flows, then interest rates could be reduced due to lower inflation rates. The MPC revised downward its forecast for consumer price inflation to average 3,8% in 2015 from 5,3% forecast in November and down from 6,1% in 2014. The low point is expected to be hit in the second quarter at 3,5%. The forecast for core inflation, which excludes food, petrol and electricity, was also revised down to average 5,5% in 2015 and 5,15 in 2016 compared with previous forecasts of 5,7% and 5,3%, respectively. 2. Nedbank Capital’s expenditure project listing counted 65 new projects worth R95,4bn in 2014 compared with 85 projects worth R187,9bn in 2013. The slowdown is due to poor consumer and business confidence. Capital projects are a lagging indicator so only two or three years after the economy has started improving are we likely to see an increase in capital projects. WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 3. South African big business CEOs are gloomier than their global counterparts with 80% of South African CEOs saying there were more threats to the growth of their companies today than there were three years ago according to a PwC survey. The 18th Annual Global CEO Survey included more than 1 300 CEOs from 77 countries, in 24 different industries and companies with at least 100 employees and a minimum annual turnover of $10 million. In South Africa, interviews were held with 41 CEOs from a broad spectrum of listed and privately-owned companies. The percentage of CEOs expecting the global economy to recover dropped to 37% in 2015 from 44% in 2014, whilst among South African CEOs the percentage was only 29%. Regarding business-specific threats, 93% of CEOs in South Africa cited the availability of key skills as a concern (compared with 73% globally), while 83% worried about high or volatile energy costs (compared with 59% globally); and 76% had concerns around bribery and corruption (compared with 51% globally). 4. The leading indicator rose by 0,9% m/m in November to its highest level since March 2014 but was still down 0,1% y/y. Seven of the sub-components increased, while four decreased. The key positive support for the index came from an increase in the average number of hours worked in the manufacturing sector and an increase six-month smoothed growth rate in real M1 money supply. Negative contributors in November included the further decline in export commodity prices and a slowdown in the 12-month percentage change in the number of new passenger vehicles sold. 5. The co-incident indicator slipped to a 0,9% y/y increase in October from 2,2% y/y increase in September and a 1,8% y/y rise in August. The co-incident indicator, which is designed to track current conditions, bottomed in 2009. 6. The balance of payments surplus eased to R7,927bn in the fourth quarter from R23,356bn in the third quarter. The third quarter surplus was in part due to the issuing of government debt overseas, whereas the fourth quarter reflected “normal” trade and investment flows. 7. The trade weighted rand averaged 68,06 in January from 67,26 in December, 68,6 in November, 67,83 in October, 67,80 in September, 68,54 in August, 68,06 in July, 68,07 in June and 69,71 in May. This is the new series that has been reweighted and rebased. The weighted average exchange rate of the rand is based on trade in and consumption of manufactured goods between South Africa and its most important trading partners. As from 1 January 2010, the weighted average exchange rate of the rand is calculated against twenty currencies. The weights of the five major currencies are in brackets: Euro (29,26), Chinese yuan (20,54), US dollar (13,72), Japanese yen (6,03), British pound (5,82). The base is 2010 = 100, so the trade weighted rand has lost more than 30% of its value since then. What is remarkable is the small range around 68 that the monthly average has achieved in the second half of 2014. 8. The volatility in the trade weighted rand eased to 4,14% in January from 5,78% in December and 3,47% in November. The measure of volatility we use is to divide the monthly range by the monthly average. The rand’s weakening in October 2008 resulted in the most volatile month ever, exceeding that of December 2001. The October 2008 volatility was 28,25% compared with December 2001’s 23,22%. The May 2013 volatility of 11,61% was due to the announcement that the US Federal Reserve would start tapering its bond buying programme sometime in the future. The actual tapering started in December 2013. The most volatile month in 2014 was January at 6,7%. 9. The foreign trade balance swung to the largest surplus in four years in December with a R6,85bn surplus from a revised deficit of R5,27bn (R5,7bn) in November and a R21,3bn deficit in October. The swing was due to a 3,8% m/m rise in exports to R87,49bn, while imports fell by 9,9% m/m to R80,6bn after plunging by 18,7% m/m in November. Despite the weak rand, exports only rose by 6,6% in 2014, while imports jumped by 8,6% resulting in a record R95,3bn trade deficit from R71,36bn in 2013. This year we expect finally that export growth will exceed import growth and are forecasting a full year deficit of R76bn. WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 10. Daily average turnover on the South African foreign exchange market rose to US$24,114bn in December from $23,189bn in November and a record US$27,64bn in March 2014. In December 2014 the turnover consisted of $15,278bn ($15,177bn in November and $17,016bn in March) in swap transactions, $3,725bn ($4,041bn, $5,635bn) in third currencies, $3,31bn ($2,686bn, $3,586bn) in spot transactions and $1,802bn ($1,285bn, $1,403bn) in forward transactions. The December forward transactions are the highest since a record $2,052bn achieved in May 2011. 11. The Crimean crisis has seen the South African rand overtake the Russian rouble as an international payments currency. This is because traders fled from the Russian currency in case more Western sanctions were applied. According to the SWIFT currency tracker, the share of the rand remained stable at 0,42% between January 2013 and April 2014 before rising to 0,45% in December 2014 and a ranking of 15, while the share of the Russian rouble dropped by almost a third from 0,56% in January 2013 to 0,39% in April 2014 and in December 2014 was threatening to leave the top 20 with only a 19 ranking and a share of 0,36%. In April 2014 the rand was ranked 16th, while the rouble was ranked 17th. SWIFT provides financial messaging for more than 10 000 banks‚ securities institutions and corporate customers in 212 countries and territories. 12. Broad M3 money supply growth eased to 7,38% y/y in December from 8,31% y/y in November and 8,02% y/y in October, while narrow M0 money supply growth rose to 8,11% y/y in December from 6,16% y/y in November and 10,58% y/y in October. Total loans and advances y/y change troughed at minus 1,63% y/y in November 2009. The y/y increase eased to 7,87% y/y in December from 8,71% y/y in November and 8,72% y/y in October. 13. Producer inflation for final manufactures eased to 5,8% y/y in December from 6,5% y/y in November and 6,7% y/y in October. The consensus forecast was for 6,0% y/y, showing that a forecast 0,2 percentage points below consensus is a reasonable forecast, as it was for the consumer inflation data released last week. The inflation picture was one of two halves in 2014 with rising inflation in the first half due to the weak rand, while in the second half inflation eased due to the lower international oil price. In 2015 we see the opposite pattern with slowing inflation in the first half (we expect PPI for final manufactures to bottom near 3,5% y/y in May) before rising inflation in the second half. The annual average for producer inflation for final manufactures was 7,5% in 2014 from 6,0% in 2013. This compares with the annual average for overall consumer inflation, which was 6,1% in 2014 from 5,7% in 2013. 14. Government revenue only grew by 3,0% y/y in December after surging by 16,7% y/y in November, growing by 7,0% y/y in October and a 11,1% gain in the 2013/14 fiscal year, while expenditure jumped by 13,8% y/y in December after increasing by 1,0% y/y in November, a 4,6% y/y gain in October and a 8,8% rise in the previous fiscal year. The October and September data pointed to a better fiscal picture if it can be maintained for the rest of the fiscal year and that seems to be the case with the excellent November data, but December disappointed as expenditure jumped, while revenue growth was subdued. 15. The number of liquidations fell by 14,0% y/y in December to 123 after jumping by 33,1% y/y in November to 169 and falling by 12,0% y/y in October to 168. The full year decline was 13,1% y/y. The number of liquidations totalled 2064 in 2014 from 2 374 in 2013, in 2012 they were 2 716 and the recent peak was 4 133 in 2009. 16. The number of insolvencies edged up by 2,4% y/y in December to 258 after rising by 6,1% y/y in October to 280 and increasing by 7,4% y/y in September to 261. The 11 month decline was 3,5% y/y. In 2013, the number of insolvencies totalled 3 189, in 2012 they were 3 855 and the recent peak was 6 078 in 2009 WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 17. The 94,3 MW Sishen solar photovoltaic (PV) plant in the Northern Cape was connected to the national grid. The plant consists of 319 600 PV modules, mounted on 470 single-axis trackers. The plant was built by Spanish firm Acciona and commissioned by Spanish consulting firm Enertis. 18. The first estimate of maize plantings saw a 1,2% reduction to 2,656 million hectares. Given the good rains in December and January the 2014/15 maize crop could still be larger than the 2013/14 crop, which was the second largest, only surpassed by the 1981 crop. 19. Glencore is looking to cut coal production at its Optimum operations. This could reduce its overall South African production by at least five million tons of coal a year and affect more than 1 000 employees. Optimum produces 10 million tons of saleable coal a year from opencast and underground mines, half of it bought domestically by State-owned power utility Eskom and half of it exported. Optimum intends retaining the underground mining operations as well as sufficient processing capacity at Optimum to ensure the continued supply of coal to Eskom’s coal-fired Hendrina power station. 20. The Gauteng retail ULP 95 petrol price will decline by 93c/l on 4 February after being slashed by 123c/l on 7 January, a 69c/l cut on 3 December and a 45c/l drop on 5 November. The y/y change moved into negative territory for the first time since November 2009 with a 5,5% y/y decline in December after a 1,1% y/y increase in November. In January the y/y fall was 17,2 and it was 26,1% y/y in February. For diesel the y/y change will be in negative territory for the sixth consecutive month with a 28,4% y/y plunge in February after a 20,1% y/y slump in January, a 9,8% y/y decrease in December, a 4,8% y/ decline in November, a 1,1% y/y drop in October and a 0,2% y/y fall in September. 21. Pretoria received 73mm of rain in January after 239mm in December and 99mm in November. After a slow start in October, the summer rainfall area saw above normal rain in November and December before a return to below normal in January. Belfast in Mpumalanga had 119mm in January from 240mm in December and 135mm in November. Ermelo had 82mm in January from 115mm in December and 106mm in November. The “Maize Capital”, Bothaville in the Free State received only 36mm (or 45% of the January average) in January from 139mm in December and 113mm in November. Bethlehem received 96mm in January from 144mm in December and 179mm in November. Cedara had 117mm in January from 116mm in December and 119mm in November. Rest of Africa 22. Sub-Saharan Africa’s (SSA) overall level of economic freedom remains low, yet the region experienced the most widespread improvement in 2014. This is according to the ‘Index of Economic Freedom’, published by The Wall Street Journal and The Heritage Foundation. In their view, SSA lacks a “free” economy, and is home to only one (Mauritius) classified as “mostly free”. A majority of the region’s economies are either “mostly unfree” or “repressed.” But six of the world’s 10 biggest score improvements (São Tomé and Príncipe, Democratic Republic of Congo, Togo, Senegal, Burundi and Zimbabwe) occurred in SSA in 2014, and the region continues to move improve. 23. Foreign direct investment (FDI) inflows to Africa fell by 3% to around $55bn compared with an 8% fall in global inflows to an estimated $1,26 trillion. The United Nations Conference on Trade and Development (Unctad) attributed Africa’s decline largely to a decrease in FDI to North Africa, with other sub-regions, including sub-Saharan Africa, experiencing similar inflows to those experienced in 2013. FDI into North Africa declined by 17% to $12,5bn. WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 24. Consumer inflation in Kenya eased to 5,53% y/y in January from 6,02% y/y in December and 6,09% y/y in November. This is the lowest y/y rate since June of 2013, as transport cost eased due to a fall in oil prices. Transport inflation slowed to 5,3% y/y in January from 8,8% y/y in December. The annual average inflation rate was 6,9% in 2014 from 5,7% in 2013. 25. Consumer inflation in Uganda eased to 1,3% y/y in January from 1,8% y/y in December and 2,1% y/y in November. The annual average was 4,3% in 2014 compared with 5,5% in 2013, 14,0% in 2012, 18,7% in 2011and only 4,0% in 2010. The 2011 average was the highest average annual inflation rate since 1992 when it was 54,5%. 26. Consumer inflation in Zambia eased to 7,7% y/y in January from 7,9% y/y in December and 8,1% y/y in November. Lower global oil prices are favourable for the inflation backdrop, while pass-through from the sharp increase in electricity prices in July remains limited. We expect an easing in the inflation rate in coming months. Food inflation slipped to 7,4% y/y in January from 7,5% y/y in December and 7,3% y/y in November, while non-food inflation eased to 8,0% y/y in January from 8,4% y/y in December and 8,9% y/y in November. The annual average for 2014 was 7,8% compared with 7,0% in 2013, 6,6% in 2012, 8,7% in 2011 and 8,5% in 2010. 27. Zambia had a foreign trade deficit of ZMW81,9m in December, but the annual trade balance was still a surplus of ZMW892,9m from a ZMW2,2798bn surplus in 2013. Exports slipped to ZMW5,2681bn in December from ZMW2,943bn in November, while imports grew to ZMW5,35bn from ZMW5,24bn. International 28. The central bank of Albania cut its benchmark lending rate by 25 basis points to 2,0%. The central bank signalled that although it had cut its policy rate by 75 basis points last year to stimulate the economy, it was unlikely to reduce rates further. Albania's inflation rate fell to 0,7% y/y in December from 1,7% y/y in November, mainly due to low food prices and continuing drop in oil prices against a backdrop of sluggish demand. 29. The central bank of Russia cut its benchmark lending rate by 200 basis points to 15%. In its statement, the central bank emphasized that inflation and rouble depreciation expectations stabilised following the emergency rate hike in December. On 15 December, the central bank unexpectedly hiked the rate to 17,0% from 10,5%, just a week after raising it by 100 basis points. The hikes were aimed at limiting the slide in the rouble and risks to inflation, the bank had said. Interest rates were raised six times last year and the policy rate was 5,5% in January 2014. 30. The central bank of Trinidad and Tobago raised its benchmark lending rate by 25 basis points to 3,5%. This was the third increase in a row, and the central bank said it was "prepared to further position its monetary policy stance to address any challenges that may arise from unanticipated changes in global energy markets." 31. Food affordability improved in nearly 75% of countries from September to November 2014, largely owing to a 2,8% decline in global food prices. This is according to the Economist Intelligence Unit’s (EIU’s) latest Global Food Security Index (GFSI). The GFSI showed record production levels of maize, wheat and soybeans, and falling global oil prices, had resulted in improved food security outlooks for 79 of the 109 countries in the index. Hungary and Botswana experienced the greatest rank improvements in the food affordability category since the last quarterly update in August – rising six and five places respectively. The EIU expected prices for the major food crops to continue falling this year, with the average yearly price of corn and soybeans expected to decrease by between 10% and 15% compared with 2014. Wheat prices were also expected to decline this year, but by a more modest 7%. WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 32. China became the top recipient of foreign direct investment (FDI) in 2014 with $128bn compared with $86bn for the US. The US was the top recipient in 2013. FDI flows to developing economies remained resilient in 2014, reaching more than $700bn accounting for 56% of global FDI flows. The increase was driven mainly by developing Asia, with four of the top five FDI recipients in the world from developing economies. By contrast, FDI flows to developed countries fell by 14% to an estimated $511bn. 33. China’s yuan has become the world’s fifth most widely used payments currency according to the Society for Worldwide Interbank Financial Telecommunication (SWIFT). The yuan reached a record high share of 2,17% in global payments by value in 2014 and is not far behind the yen’s 2,69% share. The US dollar, euro and British pound remain the top three world payment currencies. SWIFT provides financial messaging for more than 10 000 banks‚ securities institutions and corporate customers in 212 countries and territories. 34. Standard & Poor's on 26 January cut Russia's sovereign credit rating to BB+, a sub-investment grade. The last time Russia’s rating was this low was in 2004. The downgrade reflected Russia’s growing economic problems, such as the collapse in the value of its oil exports and the impact of Western sanctions. Investors pulled $152bn out of Russia in 2014 compared with an average of $57bn annually during 2009 to 2013. Foreign currency reserves have dropped below $400bn for the first time since August 2009. 35. The Freedom House annual report determined that 61 countries out of 195 became less free in 2014, while just 31 saw freedoms improve. The report said terrorism had a devastating impact in the Middle East and West Africa, with groups massacring both security forces and civilians, taking foreigners hostage and killing or enslaving religious minorities. Syria, where a civil war is in its fourth year and the Islamic state terrorist group has extended its reach, was ranked among the world's worst countries. 36. The German IFO business confidence index rose to 106,7 in January from 105,5 in December and 104,7 in November and 103,2 in October. The Munich-based Ifo economic institute surveyed 7 000 German companies. The IFO index adds to signs that the German economy gained momentum at the start of 2015 after a bout of weakness during the middle of 2014. 37. The US consumer confidence index rose to 102,9 in January from 93,1 in December and 91,0 in November. The confidence index averaged 73,3 in 2013, the highest since 2007. In 2009 it averaged only 45,2. The present situation i ndex surged up to 98,6 in December from 93,7 in November, reaching its highest level since February of 2008. The expectations index however slipped to 88,5 in December from 89,3 in November. 38. The Thomson Reuters/University of Michigan's consumer sentiment index rose to 98,1 in January from 93,6 in December and 88,8 in November. This is the highest reading in eleven years as steady job and wage gains boosted current expectations. The index averaged 85,1 from 1952 until 2014, reaching a record high of 111,4 in January of 2000 and a record low of 51,7 in May of 1980.The current economic conditions index increased to 109,3 in January from 104,8 in December. The expectations index rose to 91,0 in January from 86,4 in December. 39. In their first estimate of the US GDP for the fourth quarter of 2014, the Bureau of Economic Analysis (BEA) reported that the American economy slowed to 2,6% q/q seasonally adjusted annualised increase from a 11-year best rate of 5,0% in the third quarter. The first estimate was 3,5% for the third quarter and the second estimate was 3,9% from the second quarter growth rate of 4,6%, so there could still be a significant revision to the fourth quarter estimate. Relative to the third quarter, consumption for goods and services improved in the fourth quarter as lower oil prices boosted WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 personal consumption, but the stronger US dollar meant that the foreign trade balance worsened. An inventory surge added 0,8% to GDP, so final sales, which excludes changes in inventories, grew by only 1,8% q/q saa, while a drop in defence spending pulled down government spending. 40. US durable goods orders dropped by 3,4% m/m in December after a revised 2,1% (0,7%) m/m decrease in November and a 0,3% m/m rise in October. The consensus forecast was for a 0,5% m/m rise. The unexpected drop in durable goods orders was partly due to a pullback in orders for transportation equipment, which plunged by 9,2% m/m in December after falling by a revised 3,9% (1,2%) m/m in November and jumping by 3,3% m/m in October. Excluding orders for transportation equipment, durable goods orders still fell by 0,8% m/m in December after a revised 1,3% (0,4%) m/m drop in November after edging down by 0,1% m/m in October. 41. US new home sales jumped by 11,6% m/m in December to a seasonally adjusted annualised rate of 481 000 units. This is still well below what is considered a ‘healthy’ level of around 700,000 units. The series is subject to large revisions. The median price of new houses sold in December rose by 8,2% y/y to $298 100. The housing inventory represents 5,5 months of supply at the current sales rate from 6,0 months in November and 5,7 months of supply in October. 42. The US Case-Shiller home price index for 20 cities rose by 4,3% y/y in November after a 4,5% y/y increase in October and a 4,8% y/y gain in September. The October 2013 gain of 13,8% y/y was the highest y/y rate since February 2006, the high point in the housing bubble. House price appreciation continued to trend lower on a y/y basis. 43. Consumer prices in the Eurozone showed the second consecutive y/y decline in January with a 0,6% y/y drop after December’s 0,2% y/y fall. The decline in consumer prices in January was driven by the fall in the cost of energy with a 8,9% y/y fall compared with a 6,3% y/y decline in December. 44. The Eurozone unemployment rate eased to 11,4% in December from 11,5% in November. This is the lowest rate since August 2012. The number of unemployed decreased by 157 000 from November and 693 000 from December 2013. The youth unemployment rate was at 23% versus 23,9% in December 2013. In the European Union, the jobless rate slid to 9,9% in December from 10,0% in November. This was the first time the rate has fallen below 10% since October 2011. 45. Spain's economy grew by 1,4% in 2014 after a 1,2% contraction in 2013. The expansion of 0,7% q/q in the fourth quarter was the fastest since the fourth quarter of 2007. GDP gained 0,5% q/q each in the third quarter and the second quarter. On a year ago basis, GDP grew by 2,0% in the fourth quarter compared with 1,6% in the third quarter. Despite the 2014 recovery, the economy is still 6% below its 2008 peak. 46. Consumer inflation in Japan was steady at 2,4% y/y in December and November from 2,9% y/y in October. Japan has been battling with deflation for more than two decades and the Bank of Japan had set a target of 2% within two years of January 2013. 47. The unemployment rate in Japan eased to 3,4% in December after being steady at 3,5% in November and October, while the job-to-applicant ratio of 1,15 was the highest since March 1992. The number of employed people in December 2014 was 63,57 million, an increase of 380 000 or 0.6% from the previous December. The number of unemployed people in December 2014 was 2,1 million, a decrease of 150 000 or 6,7% from the previous December. 48. The Japanese foreign trade deficit was ¥661bn in December of 2014, almost half the ¥1307bn deficit of December 2013. Exports grew by 12,9% y/y in December to ¥6896bn, the largest monthly exports since October 2008. Sales to Asia, which account for more than half of the country's total exports, rose 11% y/y in December after a 5,9% y/y gain in WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 November. Exports to the US surged by 23,7% y/y in December, while to Western Europe exports rose by 6,8% y/y. Imports rose by 1,9% y/y in December to ¥7557bn. For 2014, the trade deficit swelled by 11,4% to a record ¥12781bn. This was the worst since comparable records began in 1979. 49. Consumer inflation in Pakistan eased to 3,88% y/y in January from 4,3% y/y in December from 3,96% y/y in November, 5,82% y/y in October and 7,68% y/y in September. The January y/y rate was the lowest rate since October of 2003 and was due to a fall in prices of transport and fresh food. 50. Russia sold over $15bn worth of arms to more than 60 countries in 2014. “Russia will expand its presence on such prospective markets and the Asia-Pacific region, Africa, Latin America and the Caribbean,” Russian Vladimir Putin told a meeting at the Kremlin. 51. Dubai’s airport saw passenger numbers rise by 6% in 2014 to 70,5 million making it the busiest international airport, pushing Heathrow into second place with 68,1 million. Hartsfield-Jackson Atlanta International Airport remains the world's busiest passenger airport overall. Dubai’s new 20-gate concourse purpose-built to handle the double-decker Airbus A380 opened in 2013, while another new concourse is under construction as part of a wider $7,8bn expansion plan. 52. Global international tourist arrivals rose by 4,7% in 2014 to 1,138 billion, matching the growth rate of 2013. The Americas and Asia saw the strongest growth in international visitor numbers, while Europe continued to be the most visited region, according to the UN World Tourism Barometer. Visitor numbers to sub-Saharan Africa appear not to have been affected by the Ebola disease outbreak with a 3,4% increase after a 4,2% rise in 2013. The number of people travelling from Russia saw a 6% decline. The UNWTO expects 3% to 4% growth in global tourism in 2015. 53. Although the growth rate of the Philippine economy slowed to 6,1% in 2014 from 7,2% in 2013, this is still the second highest growth rate in Asia. Only China’s 7,4% increase is higher. Investor perceptions of the country have improved under the government of President Benigno Aquino III, who was elected in 2010 with promises to combat endemic graft and poverty. Business process outsourcing was one of the contributors to the expansion of services. Outsourcing currently employs 1,052 million Filipinos and the industry is targeting 1,3 million employees and $25bn in revenue by 2016. 54. The Polish economy expanded by 3,3% in 2014 from 1,7% in 2013. This was despite the impact of sanctions on Russia and retaliatory sanctions by Russia on Polish fresh food exports. 55. The Taiwanese economy slowed to 3,17% y/y in the fourth quarter from 3,63% y/y in the third quarter. The quarterly growth however rose to 1,17% in the fourth quarter from 0,66% in the third quarter helped by a recovery in electronics exports. 56. World gold mine production grew by 2% in 2014 to a record 3 109 tons. Global scrap supply declined almost 11% according to GFMS to an estimated 1 122 tons. Jewellery fabrication fell by 11% to an estimated 2 133 tons. Industrial demand fell by 5% to an estimated 389 tons owing to continued substitution in the electronics industry and weak economic recovery in some regions. 57. The monthly average OPEC Reference Basket (ORB) eased to $44,38 per barrel in January from $59,46 in December. The annual average was $96,63 in 2014 from $105,87 in 2013, a record $109,45 per barrel in 2012, $107,46 in 2011 and $77,45 in 2010. In 2008 the price averaged $94,45. We said at the start of 2014 (wf030114) that we expect the WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 oil price to ease to $90 per barrel provided there is no military action with Iran and no major hurricane damage to US Gulf oil facilities. This is because new oil supply should exceed new oil demand in 2104. What we did not anticipate was the volatility in the second half of 2014 with the oil price falling from a 2014 peak of $110,48 on 20 June to a low of $54,44 on 29 December. We expect low prices in the $40 to $60 range to continue for some time. SA Leading Indicator 2.0% 4.0% 1.0% 2.0% 0.0% -1.0% 0.0% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov -2.0% -2.0% -4.0% -3.0% -6.0% m/m (LHS) y/y (RHS) SA Co-incident Indicator 5% % change y/y 4% 3% 2% 1% 0% Jan -1% Mar May Jul Sep Nov Jan Mar May Jul Sep WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 Trade-weighted Rand since May 2014 71 70 100= 2010 69 68 67 66 65 May Jun Jul Aug Sep Oct Nov Dec Jan Money Supply since January 2010 18 16 % change y/y 14 12 10 M0 8 M3 6 4 2 0 -2 Jan May Sep Jan May Sep Jan May Sep Jan May Sep Jan May Sep WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 Producer Inflation Rates starting January 2014 14% 12% % change y/y 10% 8% 6% 4% 2% 0% -2% -4% Jan Feb Mar Apr May Jun Final Manufactures Jul Aug Intermediate Sep Oct Nov Mining Dec Farming Petrol ULP 95 Diesel 0.05% S Jan Oct Jul Apr Jan-14 Oct Jul Apr Jan-13 Oct Jul Apr Jan-12 Oct Jul Apr Jan-11 Oct Jul Apr Jan-10 Oct Jul Apr 1500 1400 1300 1200 1100 1000 900 800 700 600 500 Jan-09 c/l Gauteng Petrol and Diesel Prices since Jan 2009 WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 Kenya Inflation starting January 2011 25 % change y/y 20 15 10 5 0 2011 2012 2013 2014 2015 Source: KNBS Uganda Consumer Inflation since January 2009 35% 30% % change y/y 25% 20% 15% 10% 5% 0% JanApr Jul OctJanApr Jul OctJanApr Jul OctJanApr Jul OctJanApr Jul OctJanApr Jul OctJan WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 Zambia Consumer Inflation since January 2008 18% 16% % change y/y 14% 12% 10% 8% 6% 4% 2% 0% 2008 2009 2010 2011 2012 2013 2014 2015 WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157 % change Tourism: World vs Sub-Saharan Africa 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 2012 2013 2014 World 4.1% 4.7% 4.7% SSA 3.4% 4.2% 3.3% WEEKLY REVIEW Forecaster Ecosa cc PO Box 693 Sunninghill 2157

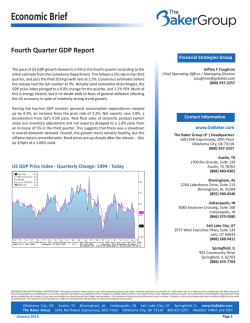

© Copyright 2026