Investment markets and key developments over the past week

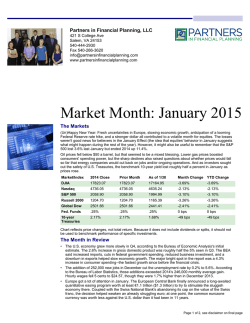

30 January 2015 Investment markets and key developments over the past week Share markets have had a mixed week with messy US earnings, soft US GDP data and worries about the Fed and Greece weighing on US shares (-2.8%) and Eurozone shares (-0.6%), Chinese stocks continuing to go through a bit of a correction (with a 3.9% fall) but Japanese shares (+0.9%) and Australian shares (+1.6%) seeing gains. Bond yields mostly fell. Oil had a bounce from oversold levels suggesting a base may have been formed around $US45 a barrel for now. Heightened talk of an RBA rate cut pushed the $A below $US0.78 for the first time since 2009. January saw last year’s share market winners, namely the US (-3.1% in January) and China (-0.8% in January), give up some of their gains with investors rotating into Europe (+7.1%), Japan (+1.3%) and Australia (+3.3%). China aside, there is clearly a bit of investor rotation at play here along with central bank action, notably the ECB and the Bank of Japan in easing mode and hopefully the RBA too, but the Fed edging towards tightening. Is the negative January in US shares (-3.1% for the S&P 500) a bad sign for the year as a whole? While the January barometer, "as goes January, so goes the year", has sent a bad signal, it’s not that reliable when it comes to negative January's going on to negative years. In fact, since 1980 the hit rate of a negative January going on to a negative year has only been 38% in the US. The most recent failure on this front was last year when US shares fell 3.6% in January but rose 11.4% in 2014 as a whole. So a negative January doesn't mean much for the rest of the year as a whole. It’s not an issue for Australian shares of course which have had a positive January (up 3.3%), and where since 1980 positive Januarys have seen positive gains for the year as a whole 75% of the time. In Europe, its early days in terms of the new Greek Government and the Troika (of the IMF, EU and ECB) reaching an agreement on the Greek austerity and reform program. While the rest of Europe looks prepared to grant Greece a bit of relief it’s unlikely at this stage to include another debt write down, except in maybe extending the term or further lowering the interest rate. Rather most of the pressure will be on the Syriza led Greek Government to back down. Faced with the economic chaos that would result from no deal – as Troika funding would immediately end and ECB funding for Greek banks would end leading to an immediate banking crisis, capital flight and a return to depression – the Greek Government is likely to back down. However, there is so far no sign of this and the process could take months and there is likely to be several hair-raising moments along the way. The better state of other Eurozone peripheral countries and the ECB’s quantitative easing program should help prevent much contagion to the rest of Europe during the negotiation period and beyond if Greece does end up on a path to exit the Euro. In the US the Fed continues to indicate that it can be patient in raising rates. However, while it has clearly become a bit more sensitive to international developments it also upgraded its assessment of the US economy to “solid” and sees the fall in inflation as largely transitory leaving the overall impression that it sees itself on track to raise interest rate around June. Markets – which are factoring in a later tightening – were clearly hoping for something more dovish. For what’s it’s worth, our view remains for a June first tightening by the Fed, but the risks are that a further fall in core inflation towards 1% year on year in the US will see this delayed and the Fed’s reference to monitoring international developments have given it an off ramp if it decides to delay. Outside the US the predominant trend globally is still towards easing and this is putting massive pressure on the RBA to do the same. Singapore is the latest country to ease in the face of massive quantitative easing programs in Europe and Japan that are forcing other smaller countries to ease unless they want to see their currencies go higher. This should really be characterised as “easing wars” as opposed to “currency wars” and to the extent it is forcing monetary easing around the world it adds to confidence that sustained deflation can be avoided. Australia is not immune. If the RBA wants to see a continued broad based decline in the value of the $A it will have to join the easing party lest the $A rebounds again on the back of our still relatively high interest rates. December quarter inflation data in Australia was not low enough to provide a smoking gun to justify an RBA rate cut. However, it was benign enough to provide plenty of scope for the RBA to cut in order to provide a boost to the economy. Headline inflation has fallen below the 2-3% target and is likely to fall to just 0.9% year on year in the current quarter, underlying inflation is low at 2.2% year on year and there are plenty of signs of price discounting in areas like clothing, furniture, household equipment and motor vehicles. Major global economic events and implications Timely US data was mostly strong with consumer confidence at a seven year high, jobless claims down sharply and strong readings for new home sales, home prices and the Markit services PMI. However, December quarter GDP growth at 2.6% annualised was weaker than expected and durable goods orders were disappointingly soft for the fourth month in a row. Falling energy company capex may be weighing here, but it highlights that while the US economy is strong it’s not taking off. Employment costs rose modestly in the December quarter, with no sign of further acceleration. US December quarter earnings are a bit messy. So far 78% of companies have beaten on earnings and 55% have beaten on sales, but there have been some high profile misses indicating that the strong $A is impacting and earnings growth for the year to the December quarter is running at just 2.7%. In the Eurozone there was some good news, with economic sentiment up, credit growth improving, German unemployment down and Spain growing for a sixth consecutive quarter. Price deflation continued to intensify in December though. Japanese data for December was mixed with a fall in unemployment, a rise in job vacancies to applicants, stronger industrial production but by less than expected and falling household spending. Core inflation remains weak once the impact of the sales tax hike is removed. Australian economic events and implications Apart from the December quarter inflation data, other Australian data over the past week was mostly soft with a slight fall in business conditions and business confidence remaining subdued according to the December NAB survey, skilled vacancies falling for the third month in a row in December and the terms of trading falling further although by less than expected. Private credit growth remained around the same modest 6% annualised pace seen through most of last year, with investor housing credit still growing around 10% pa, personal credit remaining weak and business credit perking up a bit. It’s too early to expect APRA’s macro prudential measures aimed a capping investor housing credit at 10% growth to have much impact. Producer price inflation also remains weak. What to watch over the next week? In the US, expect to see a slight fall in the ISM manufacturing conditions index (Monday) but leaving it at a still strong reading of 55, continued strength in the nonmanufacturing ISM (Wednesday) and another strong jobs report (Friday). January payrolls are expected to rise by a strong 235,000 with unemployment remaining at 5.6%. However, the focus in the jobs report is likely to be on wage earnings which were surprisingly weak in December but are likely to have bounced back in January. The annual growth rate in wage earnings is still likely to be just below 2% though. Productivity and trade data will also be released. US December quarter earnings results will continue to flow. In the Eurozone, final January business conditions PMIs (Monday and Wednesday are likely to confirm the slight improvements already reported in preliminary estimates. In Australia, the RBA should cut interest rates by 0.25% on Tuesday. Growth is too low, confidence is subdued, prices for key commodities like iron ore and energy have collapsed resulting in a much bigger hit to national income than expected a year ago, the $A remains too high on a trade weighted basis and is set to bounce if the RBA fails to cut soon and benign inflation provides plenty of flexibility for the RBA to move. It’s not that I am bearish on the Australian economy. But rather it makes sense for the RBA to take out some insurance to make sure growth improves. However, it’s a close call as to whether the Reserve will actually cut on Tuesday or wait till March as it may prefer to prepare the way for a cut by dropping the reference in its post meeting Statement to a “period of stability in interest rates” being prudent and by lowering its inflation forecasts in its Statement of Monetary Policy to be released Friday. Ultimately it doesn’t matter a lot whether it’s in February or March, but the key is that interest rates need to come down and I expect they will either on Tuesday or if not then in March. But it would be easier to get the first cut out of the way now and hence avoid a short term bounce back up in the $A. Beyond the first cut there is a 50/50 chance of another cut taking the cash rate to 2% around May. Meanwhile, expect the TD Securities/MI Inflation Gauge (Monday) to show a further fall in inflation in January on further fuel price declines, a 3% pull back in building approvals (Tuesday) after November’s surge and a modest rise in December retail sales (Thursday) but good quarterly growth in real terms. Data for home prices (Monday), business conditions PMIs and the trade balance (Tuesday) will also be released. Outlook for markets Uncertainties associated with the impact on energy producers from the plunge in oil prices, negotiations with Greece and the Fed’s move towards a rate hike could result in a volatile first half in share markets with the risk of a 10-15% correction at some point along the way. However, the broad trend in shares is likely to remain up as: valuations, particularly against bonds, are good; economic growth is continuing; and monetary policy is set to remain easy with further easing in Europe, Japan, China and Australia and only a gradual tightening in the US. As such share markets are likely to see another year of reasonable returns. The Australian share market is likely to do better than in 2014 as growth continues to rebalance away from resources helped by low interest rates and the fall in the $A. However, it will probably continue to lag global shares as commodity prices remain in a long term downtrend. Expect the ASX 200 to rise to around 5700 by end 2015. Commodity prices may see a bounce from very oversold conditions, but excess supply for many commodities is expected to see them remain in a long term downtrend. Low bond yields point to soft medium term returns from sovereign bonds, but it’s hard to get too bearish in a world of too much saving, spare capacity and deflation risk. The downtrend in the $A is likely to continue as the $US trends up and reflecting the long term downtrend in commodity prices and Australia’s relatively high cost base. Expect a fall to around $US0.75, with the risk of an overshoot. However, the $A is likely to be little changed against the Yen and Euro. Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

© Copyright 2026