Precious Metals

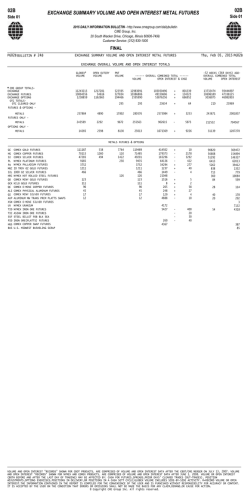

Page 1 of 3 DAILY METALS COMMENTARY Friday February 06, 2015 312-462-4533 PRECIOUS METALS COMMENTARY 02/06/15 Waning safe haven leaves gold vulnerable to profit taking OVERNIGHT CHANGES THROUGH 6:05 AM (CT): GOLD +2.60, SILVER +5.90, PLATINUM +3.60 London Gold AM Fix $1,264.00, +$.25 from prior AM LME Copper Stocks 284,750 tons -150 tons Shanghai copper stocks +2,354 tons OUTSIDE MARKET DEVELOPMENTS: Global equity markets were mixed during the overnight and early morning hours as they braced for today's US Non-Farm Payroll report. The bright spot overnight was a nearly 1% gain in the Japanese Nikkei helped by the prospect for easier monetary policy should inflation fall into negative territory. Meanwhile, China's Shanghai Composite slipped 2% and down to the lowest level in six week's as traders positioned for a wave on initial public offerings in coming week. European shares were lower across the board, with an added drag coming on a better than 10% drop in the shares of Tate & Lyle on profit warnings. US equity markets were marginally higher ahead of the US Jobs data, with January Non-Farm Payrolls expected in the range of 230,000 to 250,000 jobs added and a steady employment rate at 5.6%. GOLD / SILVER Gold and silver chopped around both sides of unchanged on Thursday, but one gets the sense that several safe haven themes are becoming a little stale. While we would not rule a dramatic deterioration in Greece's relations with the EU, there does seem to be an effort to work out a compromise but the Greeks are seething from the rejection of collateral earlier in the week and that could make a quick deal unlikely. The focus of the market turns toward the US non-farm payrolls with the press trumpeting the prospects of the 12th straight month of jobs gains above 200,000. With the Dollar falling down consistently this week, equities turning positive for the year and economic data from the Euro zone re-storing some macro-economic confidence, the US payroll reading could bring about a very critical junction for gold and silver prices. Holding back gold this morning is news of a 5.5% rise in Chinese annual gold production for 2014 especially since that news was joined by the realization that Chinese gold demand in 2014 failed to match the explosive 2013 gold record demand pace. Gold derivative holdings rose by 195,403 ounces, while silver holdings increased by 962,571 ounces. PLATINUM Not surprisingly, PGM prices managed to catch a distinct lift in the wake of the return to a "risk on" mentality Thursday. It is also possible that PGM prices benefited from fresh Russian supply concerns as talk of additional sanctions and hardline comments from the US Secretary of State toward Russian border aggression might result in a backlash from President Putin. In conclusion, the PGM complex this week has seen improved demand conditions and it might also be seeing some speculative buying from favorable chart action and beneficial currency market action. However, it might be premature to suggest that physical supply issues contributed to the rally on Thursday but we won't rule that out until the situation in the Ukraine is dramatically wound-down. We are seeing some initial divergence between platinum and palladium prices today and there was apparently a very large outflow from a platinum derivative instrument overnight of 476,592 ounces, which was effectively 43% of the holdings in that particular instrument! PGM bulls need a middle of the road payroll result, not to strong and not too weak, so the Dollar weakens, equities rise and physical commodities are put back in vogue. TODAY'S MARKET IDEAS: The bear camp has a slight edge today unless big-picture sentiment deteriorates, deflationary sentiment rears file:///C:/Users/Bill/AppData/Local/Temp/Low/D8IRV8B9.htm 2/6/2015 Page 2 of 3 its head again and or the Dollar sees a definitive downside breakout. In our opinion, the most likely bull track today is a downside extension in the Dollar, but we aren't sure that currency-related support is capable of offsetting classic safe haven liquidation pressures. In fact, a middle of the road US Non-Farm Payroll result (not too strong and not too weak) could temper safe haven interest and not provide significant downside in the Dollar. Consolidation support in April Gold this morning is seen initially at $1,255.80 and then not until the $1,252 level. Just in case, a series of technical support levels are violated, the 100-day moving average is seen all the way down at $1,217.60. Initial support and a critical pivot point in March Silver is seen at the 100-day moving average today of $16.87. We remain bullish to PGM relative to gold and silver prices. NEW RECOMMENDATIONS: None. PREVIOUS RECOMMENDATIONS: None. COPPER COMMENTARY 02/06/15 Short term overbought and bulls need definitive risk-on news GENERAL: The bull camp has to come away from Thursday's action emboldened, as a massive singleday rise in LME copper exchange stocks, a lack of sustained optimism following the Chinese RRR cut and residual uncertainty toward Greece and the Ukraine wasn't able to apply fresh pressure to copper prices. For the time being, macroeconomic sentiment toward the Euro zone has seemingly improved, but it is also possible that noted upside gains in US equities have helped overall market sentiment improve this week. The bull camp might be partially emboldened by a trend breaking minor decline in LME copper stocks of 150 tons overnight but that supportive supply news was countervailed by news of a weekly rise in Shanghai copper stocks of 2,354 tons. Unfortunately it could take even more near-term gains in global equities and more Dollar weakness to put copper prices into an upside breakout. MARKET IDEAS: The bias is up, but the short-covering impetus is built on somewhat suspect fundamental optimism. Up-trend channel support is seen at $2.5505 early today but more significant consolidation support isn't seen until $2.5390. We think the bulls need a really distinct risk-on vibe from the US payroll report to extend the recent short covering pattern and therefore the risk to the bull camp is rather high to start this morning. NEW RECOMMENDATIONS: None. PREVIOUS RECOMMENDATIONS: Long a March Copper $3.00 put from 860 and long March Copper futures from $3.05. *Bought back a March Copper $2.70 call for 150 from an original sale point of 500*. Previously we bought back a March Copper $3.15 call at 175 from the original sale point of 350. * Sell March copper $2.63 calls for 500. METALS TECHNICAL OUTLOOK: Note: Technical commentary is based solely on statistical indicators and does not necessarily correspond to any fundamental analysis that may appear elsewhere in this report. COMEX GOLD (APR) 02/06/2015: Momentum studies trending lower at mid-range should accelerate a move lower if support levels are taken out. A negative signal for trend short-term was given on a close under the 9-bar moving average. The market has a slightly positive tilt with the close over the swing pivot. The next downside objective is now at 1247.4. The next area of resistance is around 1275.5 and 1284.3, while 1st support hits today at 1257.1 and below there at 1247.4. file:///C:/Users/Bill/AppData/Local/Temp/Low/D8IRV8B9.htm 2/6/2015 Page 3 of 3 COMEX SILVER (MAR) 02/06/2015: A negative indicator was given with the downside crossover of the 9 and 18 bar moving average. Stochastics trending lower at midrange will tend to reinforce a move lower especially if support levels are taken out. The market's short-term trend is negative as the close remains below the 9-day moving average. The market's close below the pivot swing number is a mildly negative setup. The next downside target is 16.665. The next area of resistance is around 17.570 and 17.825, while 1st support hits today at 16.990 and below there at 16.665. COMEX PLATINUM (APR) 02/06/2015: Declining momentum studies in the neutral zone will tend to reinforce lower price action. The cross over and close above the 18-day moving average indicates the intermediate-term trend has turned up. The outside day up is somewhat positive. The market setup is supportive for early gains with the close over the 1st swing resistance. The next downside objective is 1222.23. The next area of resistance is around 1268.85 and 1276.82, while 1st support hits today at 1241.55 and below there at 1222.23. COMEX COPPER (MAR) 02/06/2015: Momentum studies are rising from mid-range, which could accelerate a move higher if resistance levels are penetrated. The market's short-term trend is positive on the close above the 9-day moving average. With the close higher than the pivot swing number, the market is in a slightly bullish posture. The near-term upside objective is at 2.65. The next area of resistance is around 2.63 and 2.65, while 1st support hits today at 2.56 and below there at 2.51. DAILY TECHNICAL STATISTICS CLOSE METALS COMPLEX GCAJ5 1266.3 SIAH5 17.280 PLAJ5 1255.20 CPAH5 2.59 9 DAY RSI 14 DAY RSI 14 DAY SLOW STOCH D 14 DAY SLOW STOCH K 4 DAY M AVG 9 DAY M AVG 18 DAY M AVG 45 DAY M AVG 60 DAY M AVG 51.00 46.34 55.03 53.05 54.30 50.10 54.13 46.64 59.47 49.01 41.36 40.15 48.12 38.68 40.62 55.73 1267.00 17.29 1239.48 2.56 1273.73 17.48 1243.47 2.52 1272.04 17.54 1253.76 2.56 1230.04 16.78 1231.76 2.73 1219.08 16.63 1227.24 2.80 Calculations based on previous session. Data collected 02/05/2015 Data sources can & do produce bad ticks. Verify before use. DAILY SWING STATISTICS Contract METALS COMPLEX GCAJ5 COMEX Gold SIAH5 COMEX Silver PLAJ5 COMEX Platinum CPAH5 COMEX Copper Support 2 Support 1 Pivot Resist 1 Resist 2 1247.3 16.665 1222.22 2.50 1257.0 16.990 1241.55 2.55 1265.8 17.245 1249.52 2.58 1275.5 17.570 1268.85 2.63 1284.3 17.825 1276.82 2.65 Calculations based on previous session. Data collected 02/05/2015 Data sources can & do produce bad ticks. Verify before use. ***This report includes information from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the express written consent of Stratis Financial is strictly prohibited. Violators are subject to a $15,000 fine per violation. file:///C:/Users/Bill/AppData/Local/Temp/Low/D8IRV8B9.htm 2/6/2015

© Copyright 2026