FOMC: Steady Helm Despite Some Choppy Waters

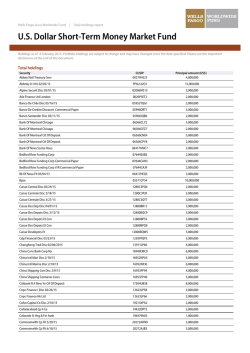

January 28, 2015 Economics Group John E. Silvia, Chief Economist [email protected] ● (704) 410-3275 FOMC: Steady Helm Despite Some Choppy Waters In the face of “nearly balanced risks,” the helm at the FOMC keeps a steady course waiting for new weather signals. Future indications from the labor market, inflation and global growth will provide the signals. Unemployment Forecast Nearly Balanced Risks: On the Plus Side Economic activity picked up in the second half of 2014 and labor market conditions continue to improve. Total nonfarm payroll employment expanded faster than generally expected and the unemployment rate fell more quickly than expected (top graph). Job openings have also improved, suggesting further gains ahead. Our outlook is for real economic activity to continue to improve at a 2.5 percent-plus pace for the first half of 2015 and thereby lead to further improvements in the labor market. Our mid-2015 unemployment rate forecast is for 5.4 percent, which is in line with many estimates of full employment. Given these gains in jobs and aggregate wages & salaries, along with home prices and consumer confidence, the consumer is on the upswing as the economy starts 2015. Moreover, government spending is now adding to growth in the economy. Fed Central Tendency Forecast vs. Wells Fargo Forecast 11% 11% 10% 10% 9% 9% 8% 8% 7% 7% 5.7% 5.2% 6% 5% 4.8% 4% 3% Lest We Forget: The Global Outlook? The Dollar? While the FOMC did not specifically note global economic conditions as a risk, it did by de facto when adding “international developments” onto its list of information to take account of when raising rates. Economic weakness in the Eurozone, accompanied by uncertainty surrounding the Greek election, indicates continued downside risk for the international outlook. The sharp drop in oil prices prompted a cut in rates by the Bank of Canada. Trade and capital flow concerns prompted action by the Swiss National Bank and the Monetary Authority of Singapore. Trade concerns are reinforced by the increase in the dollar’s value, although today’s statement made no note of the dollar’s recent strengthening. This rise reduces the competitiveness of U.S. exports but also increases the debt burden for foreign borrowers who have borrowed in dollars. Net? Fed Moves in June Our outlook remains for a Fed move in the funds rate in June. However, at the March FOMC meeting, new targets for the funds are likely to be lowered for year-end 2015 as well as for 2016. We expect the move to a flatter yield curve to persist in 2015. We will watch inflation carefully, though, as that remains the primary risk to a later liftoff. 2% Central Tendency Forecast Range Historical Unemployment Rate 1% 4% 3% Q4 Average, FOMC Dec. Forecast 2% 1% Wells Fargo Economics Forecast 0% 0% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 But What About Inflation? Are We Watching the Core? The key FOMC phrase is “inflation declined further below the Committee’s longer-run objective.” Measures of inflation, such as the PCE deflator, illustrated in the middle graph, continue to run below the 2 percent target. Significantly, the recent weakness in oil prices will lower the overall PCE deflator initially, but will also exert some downward pressure on the core over time. To what extent should the markets and the Fed weigh the overall versus the core deflator? In addition, how much of the decline in oil prices specifically is considered a more permanent change? 6% 5% PCE Deflator Forecast Fed Central Tendency Forecast vs. Wells Fargo Forecast 4.5% 4.5% Central Tendency Forecast Range 4.0% Q4-over-Q4 Percent Change Historical PCE Deflator FOMC Dec. Forecast Wells Fargo Economics Forecast 3.5% 3.0% 4.0% 3.5% 3.0% 2.5% 2.5% 2.1% 2.0% 2.0% 1.4% 1.5% 1.0% 1.1% 0.5% 1.5% 1.0% 0.5% 0.0% 0.0% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Yield Curve U.S. Treasuries, Active Issues 4.5% 4.5% 4.0% 4.0% 3.5% 3.5% 3.0% 3.0% 2.5% 2.5% 2.0% 2.0% 1.5% 1.5% 1.0% 1.0% January 26, 2015 0.5% December 29, 2014 0.5% January 27, 2014 0.0% 0.0% Source: Federal Reserve Board, U.S. Depts. of Commerce and Labor, Bloomberg LP and Wells Fargo Securities, LLC Wells Fargo Securities, LLC Economics Group Diane Schumaker-Krieg Global Head of Research, Economics & Strategy (704) 410-1801 (212) 214-5070 [email protected] John E. Silvia, Ph.D. Chief Economist (704) 410-3275 [email protected] Mark Vitner Senior Economist (704) 410-3277 [email protected] Jay H. Bryson, Ph.D. Global Economist (704) 410-3274 [email protected] Sam Bullard Senior Economist (704) 410-3280 [email protected] Nick Bennenbroek Currency Strategist (212) 214-5636 [email protected] Eugenio J. Alemán, Ph.D. Senior Economist (704) 410-3273 [email protected] Anika R. Khan Senior Economist (704) 410-3271 [email protected] Azhar Iqbal Econometrician (704) 410-3270 [email protected] Tim Quinlan Economist (704) 410-3283 [email protected] Eric Viloria, CFA Currency Strategist (212) 214-5637 [email protected] Sarah Watt House Economist (704) 410-3282 [email protected] Michael A. Brown Economist (704) 410-3278 [email protected] Michael T. Wolf Economist (704) 410-3286 [email protected] Zachary Griffiths Economic Analyst (704) 410-3284 [email protected] Mackenzie Miller Economic Analyst (704) 410-3358 [email protected] Erik Nelson Economic Analyst (704) 410-3267 [email protected] Alex Moehring Economic Analyst (704) 410-3247 [email protected] Donna LaFleur Executive Assistant (704) 410-3279 [email protected] Cyndi Burris Senior Admin. Assistant (704) 410-3272 [email protected] Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S broker-dealer registered with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corp. Wells Fargo Securities, LLC, distributes these publications directly and through subsidiaries including, but not limited to, Wells Fargo & Company, Wells Fargo Bank N.A., Wells Fargo Advisors, LLC, Wells Fargo Securities International Limited, Wells Fargo Securities Asia Limited and Wells Fargo Securities (Japan) Co. Limited. Wells Fargo Securities, LLC. ("WFS") is registered with the Commodities Futures Trading Commission as a futures commission merchant and is a member in good standing of the National Futures Association. Wells Fargo Bank, N.A. ("WFBNA") is registered with the Commodities Futures Trading Commission as a swap dealer and is a member in good standing of the National Futures Association. WFS and WFBNA are generally engaged in the trading of futures and derivative products, any of which may be discussed within this publication. Wells Fargo Securities, LLC does not compensate its research analysts based on specific investment banking transactions. Wells Fargo Securities, LLC’s research analysts receive compensation that is based upon and impacted by the overall profitability and revenue of the firm which includes, but is not limited to investment banking revenue. The information and opinions herein are for general information use only. Wells Fargo Securities, LLC does not guarantee their accuracy or completeness, nor does Wells Fargo Securities, LLC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sales of any security or as personalized investment advice. Wells Fargo Securities, LLC is a separate legal entity and distinct from affiliated banks and is a wholly owned subsidiary of Wells Fargo & Company © 2015 Wells Fargo Securities, LLC. Important Information for Non-U.S. Recipients For recipients in the EEA, this report is distributed by Wells Fargo Securities International Limited ("WFSIL"). WFSIL is a U.K. incorporated investment firm authorized and regulated by the Financial Conduct Authority. The content of this report has been approved by WFSIL a regulated person under the Act. For purposes of the U.K. Financial Conduct Authority’s rules, this report constitutes impartial investment research. WFSIL does not deal with retail clients as defined in the Markets in Financial Instruments Directive 2007. The FCA rules made under the Financial Services and Markets Act 2000 for the protection of retail clients will therefore not apply, nor will the Financial Services Compensation Scheme be available. This report is not intended for, and should not be relied upon by, retail clients. This document and any other materials accompanying this document (collectively, the "Materials") are provided for general informational purposes only. SECURITIES: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE

© Copyright 2026