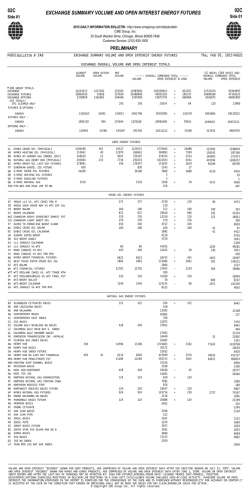

US Marketscan and Platts