LATIN AMERICAN WIRE

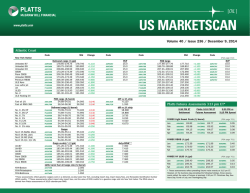

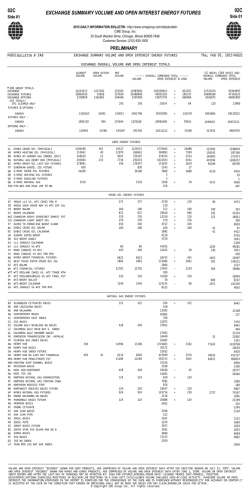

[OIL ] LATIN AMERICAN WIRE www.platts.com Volume 20 / Issue 236 / December 9, 2014 Crude ($/barrel) (PGA page 280) Diff to Diff to Futures Diff to Dated FOB Crude Mid Change WTI strip Brent strip Brent strip PCAGC0060.23–60.27 60.250 +0.305 PCAGO00-3.740AAXBS00-7.350 AAXAX00-6.190 Escalante Roncador AAQTL0058.88–58.92 58.900 +0.355 AAQTK00-5.090AAXBT00-8.700 AAXAY00-7.540 AAITD0070.87–70.91 70.890 +0.660 AAITJ006.900AAXBU003.290 AAXAZ004.450 Santa Barbara Loreto PCAGH0057.87–57.91 57.890 +0.560 PCAGQ00-6.100AAXBV00-9.710 AAXBG00-8.550 PCADE0057.62–57.66 57.640 +0.560 PCAGU00-6.350AAXBW00-9.960 AAXBH00-8.800 Oriente Napo AAMCA0052.62–52.66 52.640 +0.560 AAMCD00-11.350 AAXBX00-14.960AAXBI00-13.800 AAITF0059.38–59.42 59.400 +0.355 AAITL00-4.590AAXBY00-8.200 AAXBJ00-7.040 Marlim Castilla Blend AAVEQ0055.18–55.22 55.200 +0.355 AAVEQ01-8.790AAXBZ00-12.400AAXBK00-11.240 AAWFR0054.83–54.87 54.850 +0.355 AAWFS00-9.140AAXCA00-12.750AAXBL00-11.590 Magdalena Vasconia PCAGI0060.43–60.47 60.450 +0.355 PCAGR00-3.540AAXCB00-7.150 AAXBN00-5.990 AAITB0065.93–65.97 65.950 +0.355 AAITH001.960AAXCC00-1.650 AAXBO00-0.490 Mesa 30 Latin America WTI strip AAXBP00 63.990 Latin America Futures Brent strip AAXBQ00 67.600 Latin America Dated Brent strip AAXBR00 66.440 Mexico Crude Postings ($/barrel) Americas Maya Isthmus Olmeca Isthmus USWC (PGA page 1063) Formula Formula Value 0.4(WTS + USGC No.6 3%) + 0.1(LLS + Dated Brent) 0.4(WTS + LLS) + 0.2(Dated Brent) 0.333(WTS + LLS + Dated Brent) 0.4(WTS + LLS) + 0.2(Dated Brent) AAVLO0059.53 AAYCP00-2.80 AAVLP0065.02 AAYCQ00-0.55 AAVLQ0065.13 AAYCR001.00 AAXLZ0065.02 AAXLY00-0.30 PDATS0956.73+0.40 PDATO0964.47+0.59 PDATT0966.13+0.55 AAXKJ0064.72+0.59 Europe Maya 0.527(Brent) + 0.467(FO 3.5%) – 0.25(FO 1% – FO 3.5%) Isthmus 0.887(Brent) + 0.113(FO 3.5%) – 0.16(FO 1% – FO 3.5%) Olmeca(Brent) AAVLR0058.57 AAYXA00-5.65 AAVLS0064.02 AAYXB00-1.10 AAXNE0066.10 AAXND00-2.15 AAYXE0052.92+0.64 AAYXF0062.92+0.51 AAXNC0063.95+0.40 Asia Maya Isthmus AAVLU0063.01 AAYXC00-10.75 AAVLT0063.01 AAYXD00-4.45 AAYXG0052.26-2.55 AAYXH0058.56-2.55 (Oman + Dubai)/2 (Oman + Dubai)/2 Constant (k) Spot refined products ($/barrel) FOB Argentina Gasoline 84 Gasoil* FO 0.7%S PPASJ0067.84–67.86 67.850+1.490 POAFH0084.45–84.47 84.460+3.060 PPARI0057.27–57.29 57.280-0.140 Naphtha FO 2.2% AAWVW0052.32–52.34 52.330+1.490 PPASL0050.96–50.98 50.970-0.140 FOB Peru PAAAS0056.32–56.34 56.330+1.490 PPARJ0059.52–59.54 59.530-0.140 Naphtha FO 2.0% FO 1.6% PPARO0050.58–50.60 50.590+0.120 *Argentina gasoil is assessed CIF Buenos Aires FOB Colombia FO 1.75%S (PGA page 164) FOB Ecuador FOB Brazil FO 0.5-0.6%S PostingChange PPARL0053.36–53.38 51.470-0.140 PPARK0051.46–51.48 53.370-0.140 Market Commentary Crude Oil (PGA page 288) Colombia’s heavy sour crude, Castilla Blend, was assessed by Platts Tuesday at a more than fiveyear low on much weaker global benchmarks Brent and WTI. The 18.8 API, 1.9% sulfur crude was assessed Tuesday at $55.20/barrel, or the Latin ICE Brent strip minus $12.35/b. The last time the South American crude was assessed at these levels was in mid-May 2009, Platts price history showed. Platts assessed Castilla Blend at $54.64/b on May 19, 2009. Global benchmarks WTI and Brent have lost more than $43.00/b and $47.00/b, respectively, since mid-June, Platts data showed. The differential for Castilla Blend in 2014 has averaged at the Latin ICE strip minus $12.555/b. Castilla Blend is exported from the port of Covenas, Colombia, in Panamax-sized cargoes and occasionally in VLCC vessels. Typical buyers include US Gulf Coast refiners as a Mars alternative and European refiners as a Kirkuk alternative. Asian refiners also buy Castilla Blend when they seek a heavy sour crude. Cargoes of Castilla Blend are exported from Covenas, shipped to the Caribbean for loading on a VLCC or are shipped to Panama for transport on the Petroterminal de Panama pipeline, which crosses the Isthmus of Panama. Cargoes are then loaded out of the Pacific port of Puerto Armuelles. Castilla Blend is an alternative to Mexico’s heavy sour crude Maya, which was calculated to the Americas at $56.73/b, 40 cents/b higher than Monday. Maya has a gravity of 22 API and 3.3% sulfur. Like Castilla Blend, Maya hit a more than five-year low on Monday. LATIN AMERICAN WIRE Products (PGA page 495) Curoil, a supplier of petroleum products in the southern Caribbean, is seeking low sulfur diesel, market sources said Tuesday. Curoil is seeking 40,000 barrels of low sulfur RMG 380 fuel oil. The fuel oil should have maximum 0.95% sulfur, a flash point of 60 degrees Celsius, a vanadium content of 150 ppm, and a maximum water and sediments content of 0.5%. The cargo is set for delivery December 17-20 to the Willemstad, Curacao, port, and offers were due Tuesday. The price is based on a three-day average of the USGC waterborne spot price for No. 6 3% fuel oil as published in Platts Oilgram US Marketscan. In addition, Repsol is chartering the vessel Gulf Coral loading December 22, a shipping source said Tuesday. The vessel is loading from Cartegena to Japan carrying naphtha, the source said. Bunkers (PGA page 899) Latin American bunker fuel prices were mixed Tuesday as a result of fierce supplier competition for business at some ports and the impact of Brent crude and fuel oil values. At the ports of Callao, Peru, Valparaiso, Chile, and Cartagena, Colombia, high sulfur bunker fuel prices were assessed $3/mt lower at $471/mt delivered, $481/mt delivered and $416/mt delivered, respectively. The assessments were based on price indications that reflected a delayed reaction to Monday’s crude weakness in markets where trading was resuming Tuesday after a long weekend. In Panama, decent demand was reported, with a wide range of prices heard on both sides of the Canal. Notional offers for high sulfur bunker fuel were talked at $369-379/mt ex-wharf, with no fixtures heard done at those prices. In the low sulfur segment, a physical supplier was heard offering at $540/mt ex-wharf amid limited supplies as imports of that product into Panama are almost non-existent, ahead of the introduction of the 2015 ECA regulations on emissions. “We still have some low sulfur bunker fuel and we will sell it until it is over,” the supplier said. Based on price december 9, 2014 indications, IFO 380 CST and IFO 380 CST 1%S in Panama were assessed at $367.50/mt ex-wharf and $537.50/mt ex-wharf, respectively, both of which were 50 cents higher than on Monday. In other markets assessed by Platts in Latin America, bunker fuel prices rose as much as $5/mt based on prices indications and an increase in the Brent and fuel oil prices Tuesday. US benchmarks NYMEX Fuel oil 3%S (PGA page 1000) NYMEX January crude settled 77 cents higher at $63.82/barrel Tuesday amid a downturn in the recent surging US dollar. ICE January Brent closed 65 cents higher at $66.84/b. In products, NYMEX January ULSD settled 2.91 cents higher at $2.0840/gal. January RBOB settled up 1.70 cents at $1.7236/gal. “There really wasn’t any new bearish news today, we had it all priced in overnight,” Price Futures Group analyst Phil Flynn said. “The dollar coming was was certainly part of today’s rebound.” The US Dollar Index on ICE fell to 88.16 early on in the session, and was trading around 88.7 around the NYMEX settle. The index had rallied to 89.55 Monday, the highest since March 2009. A Bollinger Band analysis showed those levels were likely overdone, according to CQG data, triggering a slight sell off. Despite Tuesday’s slip, recent trends suggest a strong dollar is here to stay. “A combination of a strong US dollar, higher interest rates and relatively subdued growth should keep commodity prices in check in 2015,” Francisco Blanch, Bank of America Merrill Lynch’s head of Global Commodities and Derivatives Research said in the company’s 2015 outlook released Tuesday. “With OPEC giving up on its mission of ‘ensuring the stabilization of oil markets’ and allowing the market to ‘balance itself,’ the cartel has entered a new era — and we believe oil will see higher volatility and lower prices in 2015,” he said. Implied volatility in prompt NYMEX crude was around 33.7% around the NYMEX settle Tuesday, well north of the 16-17% range over much of the summer. Morgans chief economist Michael Knox said in a recent note Copyright © 2014, McGraw Hill Financial US Gulf Coast waterborne products MidChange (PGA page 156) ¢/gal Unleaded 87 No.2 Oil Jet 54 grade PGACU00161.61–161.71 161.660 +3.550 POAEE00187.05–187.15 187.100 +7.300 PJABM00189.80–189.90 189.850 -2.950 $/barrel PUAFZ0052.54–52.56 52.550+0.120 US Gulf Coast FOB cargo products (PGA page 156) ¢/gal Export ULSD Export ULSD ($/mt) AAXRV00 188.923 +0.947 New York products (PGA page 152) AAXRW00 591.141 +2.963 $/barrel Fuel oil 1%S Fuel oil 3%S PUAAO0055.24–55.26 55.250-0.140 PUAAX0054.34–54.36 54.350-0.040 NYMEX 2:30pm Eastern Settlement (PGA page 701) $/barrel Crude Oil (Feb) AAWS002 63.98 +0.770 ¢/gal Heating Oil (Feb) RBOB Unleaded (Feb) AAHS002 206.31 +2.190 AARS002 173.60 +1.640 Crudes 3:15pm Eastern (PGA page 210 & 214) $/barrel WTI 1st month WTI 2nd month Mars 1st month Mars 2nd month LLS ANS Basrah PCACG0063.76–63.78 63.770+0.660 PCACH0063.91–63.93 63.920+0.670 AAMBR0062.41–62.43 62.420+0.510 AAMBU0062.51–62.53 62.520+0.520 PCABN0066.31–66.33 66.320+0.660 PCAAD0064.68–64.72 64.700+0.670 AAEJH0059.76–59.78 59.770+0.420 Crudes at 16:30 London Bonny Light Caribbean FOB Cargoes ¢/gal Naphtha Jet Kero Gasoil (PGA page 1210) PCAIC0067.28–67.32 67.300+0.225 (PGA page 162) MidChange PAAAB10145.35–145.37 145.360 +4.05 PJAAD10192.39–192.41 192.400 -2.95 POAAU10189.89–189.91 189.900 +7.30 $/barrel Fuel oil 2.0% Fuel oil 2.8% 2 PUAAS0050.89–50.91 50.900 +0.07 PUAAV0045.89–45.91 45.900 +0.07 NEW LATIN AMERICAN WIRE december 9, 2014 Latin American Bunkers ($/mt) IFO 380 CST (PGB page 870) Mid Change IFO 180 CST Mid Change Marine diesel Mid Change Marine gasoil Mid Change Delivered Buenos Aires El Callao Valparaiso Guayaquil Libertad Cartagena Montevideo PUAYH00389.45–389.55 389.500 +0.500 PUAYG00443.45–443.55 PUAYP00470.95–471.05 471.000 -3.000 PUAYO00529.95–530.05 PUAYR00480.95–481.05 481.000 -3.000 PUAYQ00566.95–567.05 AAJOC00440.45–440.55 440.500 +0.500 AAJOE00492.45–492.55 PUAYT00439.45–439.55 439.500 +0.500 PUAYS00491.45–491.55 AAJOA00415.95–416.05 416.000 -3.000 PUBAE00458.95–459.05 PUBAQ00465.45–465.55 465.500 +0.500 PUBAR00521.45–521.55 PUBAD00367.45–367.55 367.500 +0.500 PUBAC00500.45–500.55 AAWWQ00537.45–537.55 537.500 +0.500 AAWWP00603.45–603.55 443.500+0.500PBABR001067.45–1067.551067.500+4.000 530.000+5.000PBABW001113.95–1114.051114.000+3.500 567.000-3.000 AANUA00887.95–888.05 888.000 +7.500 PBABX001066.95–1067.051067.000+7.500 492.500+0.500AAJOG001267.95–1268.051268.000+4.000 491.500+0.500PBABY001266.95–1267.051267.000+4.000 459.000-3.000PBACW00973.95–974.05 974.000 +4.000 521.500+0.500PBADA00984.95–985.05 985.000 +4.000 Ex-wharf Balboa Balboa LS 1% Cristobal Cristobal LS 1% PUAEF00367.45–367.55 367.500 +0.500 AAWWO00537.45–537.55 537.500 +0.500 500.500+0.500PBACU00798.95–799.05 799.000 -20.000 603.500+0.500 PUABJ00500.45–500.55 500.500 +0.500POABJ00798.95–799.05 799.000 -20.000 AAWWN00603.45–603.55 603.500 +0.500 Petrobras Bunker Postings ($/mt) IFO 380 CST PUAYU00366.50-367.50 Paranagua Santos PUAYK00361.50-362.50 Rio de Janeiro PUAYV00356.50-357.50 Salvador PUAYN00394.50-395.50 (PGB page 876) Mid Change IFO 180 CST 367.000 -10.000 PUAYI00385.00-386.00 362.000 -10.000 PUAYJ00383.00-384.00 357.000 -10.000 PUAYL00380.00-381.00 395.000 -10.000 PUAYM00416.00-417.00 that the price of crude will likely rebound to $100/b once the dollar surge subsides, according to The Diplomat’s Anthony Fensom. “Once the US dollar ends this major move, the oil price will go back to being driven by normal fundamentals of supply and demand,” Knox said. Meanwhile, Flynn also said that there were likely a few bulls eyeing recent cutbacks in the global oil production outlook, including ConocoPhillips’ recent decision to cut capex by 20% in 2015. Flynn said that Tuesday’s US Energy Information Administration ShortTerm Energy Outlook also likely triggered some buying, as despite expectations of higher production, sharply lower WTI crude prices in 2015 would make targeted production levels difficult to attain. The December STEO forecast that US crude oil production would average 9.32 million b/d in 2015, down from the 9.42 million b/d projected in the November STEO (See story, 1707 GMT). “There are and will be a lot of projects on hold,” Flynn said. “If you put it all together, there’s just enough news out there to give the bears some pause.” Mid Change Marine gasoil 385.500 -10.000PBABS00946.50-947.50 383.500 -10.000PBABT00936.50-937.50 380.500 -10.000PBABU00873.50-874.50 416.500 -10.000PBABV00961.50-962.50 News and Interests (PGA page 100) Exploration & Production Colombian oil patch spending likely to drop for third straight year: survey Bogota (Platts) Nearly half of the oil producers in Colombia plan on reducing their investment in the country in 2015, with a majority of those saying they expect to divert capital expenditure to other countries, mainly Mexico, according to a survey released Tuesday. According to a poll of 37 members of the Colombian Petroleum Association, the country’s biggest energy trade group, producers are scaling back their investment plans due to fears related to imminent tax reform, social unrest and delays in obtaining environmental permits for drilling. Francisco Lloreda, president of the trade group, told a briefing that the results of the survey point toward a third straight Copyright © 2014, McGraw Hill Financial Mid Change 947.0000.000 937.0000.000 874.0000.000 962.0000.000 Caribbean product postings (PGA page 466) Petrotrin (¢/gal) AAOCF09172.00 83 Mogas 92 Mogas Unl AANTB00187.00 95 Mogas Unl PTADR00196.00 Avgas 100/130 PTAHQ09650.00 Dual Purpose Kero PTAEP09211.00 Gasoil 0.5%S PTADQ09206.00 Effective Date 02-Dec-14 02-Dec-14 02-Dec-14 02-Dec-14 02-Dec-14 02-Dec-14 ($/barrel) Bunker fuel oil PTAEM09 70.00 02-Dec-14 Source: Petrotrin Brazil consumer product prices Effective: --- $/liter ARPAO001.32 Unl 80/84 Unl 94/96 ARPAP002.03 Jet Fuel ARPAQ00NA Kerosene ARPAR001.35 Diesel Oil ARPAS001.12 Heavy Fuel Oil ARPAT00NA $/kg LPG ARPAU001.46 Source: ARPEL 3 (PGA page 474) LATIN AMERICAN WIRE annual decline in Colombian oil field investment in 2015. Such a reduction in investment would complicate efforts Colombia is making to significantly increase its oil reserves, which, as of January 1, totaled 2.44 billion barrels or just 6.6 years worth of inventory at current production rates. Lloreda said 70% of the companies polled said they were unable to spend their entire Colombian capex budget in 2014 and said year-long delays in acquiring environmental permits for drilling were the main factor. “Last year, the big worry for oil companies in Colombia was the rise of [rebel] attacks on infrastructure like pipelines. This year it is delays in permitting. It’s very worrisome,” Lloreda told the briefing. In 2013, total foreign direct investment in Colombia’s oil patch totaled $4.9 billion, compared with $5.4 billion in 2012. Through the first half of 2014, the trend continued and officials have said year-on-year investment will decline in 2014 as well. Reduced investment is beginning to be reflected in Colombian production figures. Lloreda said output will likely average about 990,000 b/d in 2014, a decline of 1.7% from the 1.007 million b/d for all of 2013. This year’s projected decline in crude output will be the first year-on-year decrease since Colombia’s oil boom began in 2006. Although Lloreda said conditions exist for producers to possibly return to the 1 million b/d level next year, the poll found that 70% of companies expect to reduce or maintain current levels of production in Colombia next year while only 30% plan on increasing output from 2014 levels. The decline in output, coupled with the 30% decline in global oil prices, has been a blow to the Colombian government, which depends on oil taxes and royalties for one-fifth of its fiscal budget. The shortfall has helped create a $6 billion hole in the government’s 2015 budget that the finance ministry is trying to cover with higher corporate taxes. As it stands, the new tax proposal would raise the government “take” on oil revenues to 75% from the current 70%, a hike that Lloreda said Tuesday would damage Colombia’s competitiveness. december 9, 2014 Platts Futures Assessments 3:15 pm ET* Jan Feb Mar (PGA page 703) NYMEX light sweet crude ($/barrel) NYCRM0163.77 Jan NYCRM0263.92 Feb NYCRM0364.07 Mar NYMEX RBOB (¢/gal) NYRBM01171.96 NYRBM02173.23 NYRBM03175.31 Jan Feb Mar NYMEX NY ULSD (¢/gal) NYHOM01208.35 NYHOM02206.17 NYHOM03204.57 * These assessments reflect prevailing futures value exactly at 3:15 pm ET. However, on the business day preceding the following holidays, These assessments reflect the value of futures at precisely 1:30 pm ET: Christmas Day, New Years Day, Fourth of July, and Thanksgiving Day. US West Coast Refinery Yields and Netbacks (Winter) Effective December 9, 2014 US West Coast Crack Yield & Netback (PGA page 840) Crack Yield ANS Arab Berri Arab Light Bakken Basrah Light Escalante Kern River Line 63 Minas Oriente Mixed Light Sweet Thums TYAAD00 TYAAT00 TYACX00 TYASK00 TYAGL00 TYAKN00 TYAMV00 TYANX00 TYATC00 TYAQV00 TYARD00 TYASZ00 67.44 70.14 66.82 71.13 66.34 64.29 65.90 67.38 70.66 68.10 94.80 66.56 TDDGL00 TDDAE00 TDDAT00 TDDRT00 TDDBW00 TDDCW00 TDDCW00 TDDGN00 TDDGO00 TDDEC00 TDDGP00 TDDGQ00 Freight 0.00 3.04 3.11 13.00 3.08 7.34 1.38 0.14 5.32 3.22 2.64 0.00 Crack Netback Spot Price Crack Margin TNAAD00 67.44 PCAAD0064.700 TNAADMR 2.740 TNAAT00 67.10 AAXCT0065.820 TNAATMR 1.280 TNACX00 63.71 AAXCU0064.020 TNACXMR-0.310 TNASK00 58.13 AASRU0058.080 TNASKMR 0.050 TNAGL00 63.26 AAEJH0059.770 TNAGLMR 6.000 TNAKN00 56.95 PCAGC0060.250 TNAKNMR-3.300 TNAMV00 64.52 PCABJ0056.070 TNAMVMR 8.450 TNANX00 67.24 PCABM0063.440 TNANXMR 3.800 TNATC00 65.34 PCABO0062.110 TNATCMR 3.230 TNAQV00 64.88 PCADE0057.640 TNAQVMR 7.240 TNARD00 92.16 AALRR0056.480 TNARDMR35.680 TNASZ00 66.56 PCACD0058.070 TNASZMR 8.490 US West Coast Coke Yield & Netback Coke Yield ANS TYAAB0070.53 TDDGL00 TYAAR0071.28 TDDAE00 Arab Berri TYACV0069.30 TDDAT00 Arab Light TYAGJ0069.11 TDDBW00 Basrah Light TYAKL0070.08 TDDCW00 Escalante TYAMT0072.01 TDDGM00 Kern River TYANV0071.51 TDDGN00 Line 63 TYATA0073.70 TDDGO00 Minas TYAQT00 70.52 TDDEC00 Oriente TYARB0090.59 TDDGP00 Mixed Light Sweet TYASX00 70.16 TDDGQ00 Thums (PGA page 842) Freight Coke Netback Spot Price Coke Margin 0.00 TNAAB0070.53 PCAAD0064.700 TNAABMR5.830 3.04 TNAAR0068.24 AAXCT0065.820 TNAARMR2.420 3.11 TNACV0066.19 AAXCU0064.020 TNACVMR2.170 3.08 TNAGJ0066.03 AAEJH0059.770 TNAGJMR8.770 7.34 TNAKL0062.74 PCAGC0060.250 TNAKLMR2.490 1.38 TNAMT0070.63 PCABJ0056.070 TNAMTMR14.560 0.14 TNANV0071.37 PCABM0063.440 TNANVMR7.930 5.32 TNATA0068.38 PCABO0062.110 TNATAMR6.270 3.22 TNAQT00 67.30 PCADE0057.640 TNAQTMR 9.660 2.64 TNARB0087.95 AALRR0056.480 TNARBMR31.470 0.00 TNASX00 70.16 PCACD0058.070 TNASXMR12.090 Source: Platts and Turner, Mason & Co. LATIN AMERICAN WIRE Volume 20 / Issue 236 / December 9, 2014 Editorial: Richard Swann, Editorial Director, Americas Oil: +1-713-658-3273, Matt Cook, Senior Managing Editor, Americas Clean Products +1-713-658-3208 Client services information: North America: +1 800-PLATTS8 (+1-800-752-8878); direct: +1-212-904-3070 Europe & Middle East: +44-20-7176-6111 Asian Pacific: +65-6530-6430 Latin America: +54-11-4121-4810, E-mail: [email protected] Copyright © 2014 McGraw Hill Financial. All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a computer system or otherwise redistributed without prior written authorization from Platts. Platts is a trademark of McGraw Hill Financial. Information has been obtained from sources believed reliable. However, because of the possibility of human or mechanical error by sources, McGraw Hill Financial or others, McGraw Hill Financial does not guarantee the accuracy, adequacy or completeness of any such information and is not responsible for any errors or omissions or for results obtained from use of such information. See back of publication invoice for complete terms and conditions. Copyright © 2014, McGraw Hill Financial 4 LATIN AMERICAN WIRE Petrobras’s Rnest not to reach full capacity until May Rio de Janeiro (Platts) Brazilian state-run oil company Petrobras will not complete installation of air-pollution equipment at the new Refinaria do Nordeste, or Rnest, until May 2015, likely meaning that production limits at the 230,000 b/d refinery will remain in place for at least Subscriber notes (PGA page 1500) Platts confirms it will amend its publication schedule for Friday, December 26, 2014 and not publish any oil assessments from its offices in the US on that day in observance of the Christmas holiday. Platts had proposed waiting for feedback until December 3 prior to publishing a decision on this proposal. However, in response to widespread feedback favoring a decision before the start of the new trading month, Platts is publishing its decision before the start of December. Platts will maintain its current publication schedule for Wednesday, December 24, 2014; Wednesday, December 31, 2014 and Friday, January 2, 2015 on which days its assessment processes will close early. All assessments and Market-on-Close processes will be basis 1:30 pm Eastern time on those days. Please submit any comments to [email protected] and [email protected]. For full details of Platts publishing schedule and services affected, refer to http://www.platts.com/holiday Platts on November 24, 2014 has launched a new clean Medium Range tanker freight rate assessment reflecting flows from US Gulf Coast to North Brazil, following a proposal to do so published in October. The new assessment captures newly established supply trends of refined products out of the region following significant structural changes to the US oil industry. The new assessment reflects modern MR tonnage. The assessment is published on a Worldscale basis to reflect how this route is most commonly traded. Platts also publishes a dollars per metric ton value for this route. US GULF COAST TO NORTH BRAZIL: This assessment reflects the US Gulf Coast to North Brazil route for a clean MR december 9, 2014 Spot Tanker Rates From To Clean Medium Range Tankers West of Suez Mediterranean UK Continent Mediterranean US Atlantic Coast MediterraneanMediterranean UK Continent UK Continent UK Continent US Atlantic Coast UK Continent US Gulf Coast Black Sea Mediterranean Cargo size (kt) Worldscale $/mt (PGT page 1910) PFADCSZ30 PFACWSZ33 PFADBSZ30 PFALYSZ22 PFAMASZ37 PFAMBSZ37 PFABXSZ30 PFADC10215.00 PFACW10201.75 PFADB10205.00 PFALY00235.00 PFAMA00180.00 PFAMB00180.00 PFABX00205.00 Clean Medium Range Tankers East of Suez TCABA0029.56 TCABC0039.30 TCAAY0012.98 TCABV0015.72 TCABX0029.56 TCACA0035.09 TCAAP0025.99 (PGT page 2920) Worldscale PFABMSZ35 PFABM10177.50 Arab Gulf India PFABNSZ35 PFABN10122.50 Arab Gulf Japan PFAEBSZ30 PFAEB10118.00 SingaporeJapan Lumpsum PFAKWSZ30 PFAKW10350 Singapore Hong Kong Clean Long Range Tankers East of Suez TCAAF0014.79 TCAAH0033.98 TCABP0016.04 TCADI0011.67 (PGT page 2922) Worldscale PFAEYSZ55 PFAEY10110.00 Arab Gulf Japan PFAMTSZ75 PFAMT00103.50 Arab Gulf Japan Dirty Panamax Tankers Americas TCAAI0030.51 TCAAJ0028.71 (PGT page 1962) Worldscale PFANZSZ50 PFANZ00147.50 Caribbean US Gulf Coast Dirty Aframax Tankers West of Suez and Americas TDABA0014.17 (PGT pages 1960 and 1962) Worldscale PFALTSZ70 PFALT10112.50 Caribbean US Atlantic Coast PFAJPSZ80 PFAJP10100.00 MediterraneanMediterranean PFAJOSZ80 PFAJO1090.00 Mediterranean US Gulf Coast PFAKDSZ80 PFAKD10100.00 UK Continent UK Continent PFAKESZ80 PFAKE1092.50 UK Continent US Atlantic Coast Dirty Suezmax Tankers West of Suez TDAAY0011.34 TDABL006.54 TDABU0022.12 TDACD007.49 TDACG0014.91 (PGT page 1970) Worldscale PFAIASZ130 PFAIA1070.00 West Africa US Gulf Coast PFAHNSZ135 PFAHN1062.50 UK Continent US Gulf Coast PFAHGSZ135 PFAHG1062.50 Mediterranean US Gulf Coast Dirty VLCC Tankers Americas TDACV0017.97 TDACH0013.69 TDABS0015.36 (PGT page 1972) Lumpsum TDAFLSZ270 TDAFL008.30 CaribbeanChina TDAFNSZ270 TDAFN007.00 CaribbeanSingapore TDAFPSZ270 TDAFP006.50 Caribbean West Coast India Dirty Aframax Tankers East of Suez (PGT page 2970) Worldscale PFAJDSZ80 PFAJD10127.00 Arab Gulf East Dirty VLCC Tankers East of Suez TDAAC0028.70 (PGT page 2980) Worldscale PFAOCSZ270 PFAOC0068.00 Arab Gulf Far East PFAOGSZ280 PFAOG0032.50 Arab Gulf US Gulf Coast Copyright © 2014, McGraw Hill Financial TDAFK0030.74 TDAFM0025.93 TDAFO0024.07 5 TDAAB0015.37 TDAAN0016.01 LATIN AMERICAN WIRE Ecuador fuel oil destination Los Angeles UNITED STATES Houston Atlantic Ocean Miami BAHAMAS Havana Guadalajara Mexico City Persian Gulf crude exports face increased competition in Asian market Atlanta Gulf of Mexico MEXICO CUBA DOM. REP. JAMAICA HAITI BELIZE Caribbean Sea HONDURAS 6 NICARAGUA EL SALVADOR Caracas COSTA RICA 2 3 PANAMA VENEZUELA GUATEMALA 1 4 5 Bogota COLOMBIA Pacific Ocean ECUADOR Quito PERU BRAZIL Esmeraldas, Ecuador 1 2 3 4 5 6 december 9, 2014 Lima to Los Angeles, California La Paz to Puerto Quetzal & San Jose, Guatemala to Acajutla, El Salvador & San Lorenzo, Honduras to Corinto, Nicaragua BOLIVIA CHILE to Balboa, Panama to the Caribbean (not in Ecuadorean ships) ARGENTINA Santiago five months, the company said Monday. Rnest on Saturday started processing crude oil into diesel, LPG, naphtha and atmospheric residues that will be used in the refinery’s delayed coker. But the Brazil’s National Petroleum Agency, or ANP, and Pernambuco state environment regulators have limited production at the refinery to 64% of the first refining train’s 115,000 b/d capacity, or about 73,600 b/d, until the air-pollution equipment is installed and in perfect working condition. “The Abreu e Lima refinery is going through the start-up process, with gradual increases in production,” Petrobras said in an email response to questions. “The total capacity of Train 1 will be reached after the sulfur abatement unit, or SNOX, has entered operation in May 2015.” Petrobras officials had previously said that the refinery’s first train was expected to reach Dubai (Platts) Middle East crude exports are facing increasing competition in the Asian region, the primary regional market for Persian Gulf producers in recent years, a leading international oil analyst said Tuesday. The intensifying market pressure is being felt due to increasing flows of Latin American heavy, sour crude to Asia, combined with the large Asian capacity to process such crude, Energy Aspects Chief Oil Analyst Amrita Sen told delegates at the Platts Middle East Crude Oil Summit in Dubai. Crude volumes from Mexico and Venezuela, which used to be exported to US Gulf Coast refineries, are increasingly flowing to Asia, along with new production from Ecuador, where they are squeezing out lighter export grades of Persian Gulf crude produced particularly by Saudi Arabia, Iraq, Kuwait, the UAE, Oman and Qatar, she added. “The guys with the lighter crude actually end up being at a disadvantage,” Sen said. “The Middle East will just have to deal with this,” she added. While a number of Persian Gulf oil producers, especially Saudi Arabia, Kuwait and Oman, are seeking to advance the development of enhanced oil recovery projects aimed at extracting heavier crude, much of the future output from such projects has been ear-marked for domestic processing in new refineries due to come on stream in the next few years. International Energy Agency Director of Energy, Marketing and Security Keisuke Sadamori told delegates that Middle East crude exports are expected to decline in absolute terms over the agency’s medium-term forecast period of 2013-2019, as more crude would be consumed close to the wellhead. The IEA projects a 1.1 million b/d contraction in global crude trade over that period, he said. The IEA mid-term forecast also projects that 2.7 million b/d of new refining capacity will be added globally between 2013 and 2019, with 95% of the additions to be located in developing countries primarily in Asia, followed by the Middle East. However, with substantial global overcapacity now forecast, especially in new facilities capable of processing heavier, higher-sulfur crudes, refinery development plans are already being scaled back, Sadamori said. full production capacity by January 2015. The SNOX unit removes sulfur dioxide, nitrogen oxides and other particulate matter from refinery air emissions. The latest delays at Rnest mean that Brazilian imports of diesel and gasoline will not see as much relief as previously expected with the refinery’s startup, which had been scheduled for November 4. Petrobras had expected the start of diesel production at Rnest to cut imports of the costly fuel by one-third in the second half of 2014. Rnest was seen as an important move to reduce Brazil’s refining shortfall and ease reliance on expensive imports of diesel and gasoline needed to feed Latin America’s largest economy. Petrobras has imported hefty volumes of the two fuels to meet domestic demand, but the government forces Petrobras to sell the imports at a loss amid concerns about the impact of higher fuel prices on inflation. The government’s opaque fuel-pricing policy has cost Petrobras more than $20 billion in losses in the company’s refining division. In November, the government allowed Petrobras to raise gasoline prices 3% and diesel 5%, largely bringing domestic fuel prices in line with international benchmarks for the first time in about three years. A second 115,000 b/d refining train is expected to come onstream at Rnest in May 2015. Copyright © 2014, McGraw Hill Financial Brazil’s Petrobras finds crude oil in Amazon jungle’s Solimoes Basin Rio de Janeiro (Platts) Petrobras discovered oil in a fresh well drilled in the remote onshore Solimoes Basin in the Brazilian Amazon, data released Tuesday 6 LATIN AMERICAN WIRE by the National Petroleum Agency, or ANP, on its website. The oil discovery was made in the 4-BRSA1252-AM well drilled in the SOL-T-171 block, according to the ANP. The well was drilled by the Queiroz Galvao V rig. There were no details of the depth of the well. The SOL-T-171 block is wholly owned by Petrobras. The latest discovery in Solimoes could give a boost to plans by Petrobras, independent Brazilian oil producer HRT Participacoes em Petroleo and the local unit of Russia’s OAO Rosneft to generate cash from a series of oil and natural gas finds made in the region in recent years. In July, the three companies agreed to study the building of a natural gas liquefaction plant or gas-fired power plant in the middle of the Amazon jungle. Petrobras already has experience with the challenges involved in producing oil and natural gas in the Solimoes Basin, where the company has operated the Urucu light oil and condensate field for more than 25 years. Urucu is Brazil’s largest onshore natural gas reserve. Initially, the light oil condensate produced was transported via river barges to the Amazon city of Manaus. But river depths vary with the seasons, making access via barge tricky when water levels are low. The company eventually built a pipeline to carry natural gas from the field to market, utilizing the same techniques used to build subsea pipelines. The pipeline was completed in late 2009. It is, however, close to capacity. Building transmission december 9, 2014 Subscriber notes(PGA page 1500) tanker carrying a cargo of 38,000 mt. The assessment reflects loadings from Houston and New Orleans and discharge at ports including Manaus, Belem and Sao Luis. This new assessment is published in Platts Clean Tankerwire and Platts Tanker Alert page PGT 1912. Please send all further comments or questions to tankers@ platts.com and [email protected]. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request. Following a period of industry feedback that ended November 3, Platts confirms it will no longer publish its daily spot assessment of marine diesel oil (MDO) lines to carry electricity generated at the wellhead is an attractive alternative for Brazil. Oleo e Gas Participacoes, the financially troubled oil firm created by entrepreneur Eike Batista and formerly known as OGX, used a similar model successfully at the Gaviao Real gas field in the Parnaiba Basin. HRT and Rosneft Brasil hold rights to 19 exploration and production concessions in the Solimoes Basin. Rosneft Brasil is the operator with a 51% stake in the blocks and HRT holding the remaining 49%. Copyright © 2014, McGraw Hill Financial delivered in Valparaiso, Chile, with effect from May 1, 2015. The discontinuation, which was proposed on September 29, reflects the shift in the Chilean market away from marine diesel oil and to the consumption of marine gasoil. Platts will continue to publish a daily assessment of MGO delivered Valparaiso, Chile. The MDO assessment is currently published on Platts Global Alert page 870, in Platts Bunkerwire, and in the Platts price database under code AANUA00. Please send any further feedback to [email protected] and [email protected]. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request. News Briefs ■■ Mexico City (Platts) Salina Cruz, the only crudeloading port on Mexico’s Pacific Coast, reopened to shipping early Tuesday after being closed for two days by bad weather, the Ministry of Communications and Transportation said. All Mexico’s other oil and petrochemicals ports are on the Gulf Coast, where weather conditions posed no threat to operations. 7 Register by December 19, 2014 and SAVE $300 Traduccíon Simultânea Disponible Simultaneous Translation Available 15th Annual Information on Attending: Cynthia Rugg Tel: 781-430-2105 [email protected] Caribbean Energy Sponsorship and Exhibit Opportunities: Lorne Grout Tel: 781-730-2112 [email protected] Media Inquiries: Khushi Bhatia Tel: 781-430-2109 [email protected] Enabling Project Development— Reforms, Reality Checks, Fuel and Renewable Choices, Grid Firming www.platts.com/caribbean Benefit from the Experience of Industry Experts: Freddy Obando, AES Dominicana Jean Ballandras, Akuo Energy Vera A. Rechsteiner, Andrews Kurth LLP Don Hubbard, Antillean Gas Ltd Buddy Crill, Barrick Gold Corporation January 29-30, 2015 • El San Juan Resort & Casino • San Juan, Puerto Rico Hear Power Developers, Utility Executives, Regulators, and Advisors, including: Vahan Gevorgian, National Renewable Energy Laboratory Maxine Alexander Nestor, Organization of Eastern Caribbean States Secretariat Juan F. Alicea Flores, Puerto Rico Electric Power Authority Bruce Levy, BMR Energy Janine Migden-Ostrander, The Regulatory Assistance Project Andrew Rovito, BMR Energy Carl Kukkonen, Viaspace Inc. Justin Locke, Carbon War Room Hugo V. Hodge, Jr., Virgin Islands Water & Power Authority Allison Jean, Caribbean Electric Utility Service Corporation How to Register: www.platts.com/caribbean Toll Free: 866-355-2930 Outside the US: +1 781-430-2100 Registration Code: PC502NLI Eduardo Garcia, VITOL Marcos C. Cochón Abud, Compañía de Electricidad de Puerto Plata S.A. Rodney George, Wärtsilä Caribbean, Inc. Jed Bailey, Energy Narrative Daniel Bustos, Excelerate Energy L.P. Paul B. Smith, Wärtsilä Development & Financial Services Juan Fanjul, GE Power and Water Mark Konold, Worldwatch Institute Alexis George, Government of Dominica Robert Blenker, WRB Energy Raúl Carral, Wärtsilä North America, Inc. Maxine Nestor, OECS Bruce Levy, BMR Energy Juan Alicea Flores, PREPA Share Insights on Issues Impacting Power Development in the Region: • Enabling Project Development — Reassessing expectations, bidding processes, bureaucracy, fiscal policies, barriers to entry, credit worthiness, and opportunity costs • Need for Energy Sector Reform — Potential solutions to the problems of monopoly utilities, lack of independent regulatory oversight, inefficient operations, politicized price setting, and subsidies • Fuel Choices and Challenges — Access to supply, financing, logistics, small scale distribution, and plant conversion for LNG and LPG • Integrating Renewables — Balancing intermittent wind, solar, and hydro, baseload geothermal, ocean thermal, biomass, and hydrocarbons to achieve grid stability Freddy Obando, AES Dominicana Hugo Hodge, VI WAPA Take Away Useful Lessons from Projects in Development: • Antillean Gas — San Pedro de Macoris LNG terminal in the DR • Excelerate Energy — Aquirre floating LNG regas terminal in Puerto Rico • AES Dominicana — Transshipping LNG • VI WAPA — USVI propane conversion project • Barrick Gold — Quisqueya I conversion to flexible units in the DR • Akuo Energy — NEMO ocean thermal in Martinique •Viaspace — Contributions to biomass in US VI, Jamaica, and Guyana •Dominica — Geothermal development progress • WRB Energy — Solar/PV in Jamaica • BMR Energy — Wind farm development in Jamaica

© Copyright 2026