View / Download

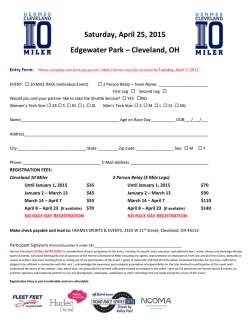

47 Innovation EXITS SINCE 2002 Start-Up Activity An ever-growing pipeline of funded start-up companies demonstrates the vibrant biomedical environment in the region. Regional biomedical companies attract funding from venture capital, private equity, and strategic sources as well as state and federal programs. The rich pipeline has drawn the notice of larger strategic firms as shown by the increasing number of company exits in recent years. 40 43 35 33 31 25 28 22 21 13 16 135 125 68 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2014 2013 2012 2011 2010 2009 2007 2006 2008 companies funded Source: Midwest Healthcare Growth Capital Report 18 2013 2012 2011 2010 2009 2008 16 20 22 21 25 24 2007 2006 2005 18 20 23 19 2004 2003 15 76 74 72 91 73 72 82 84 21 47 55 68 50 20 25 27 23 19 19 22 23 2000 2001 34 13 15 Clayton Dubilier & Rice/Goldman Sachs Predictive Biosciences Hyland Software Mercer HealthPro Rehabilitation Carefx Edgepark Surgical Noteworthy Medical Homecare Collection Services Theken Spine NDI Medical (product line) Whole Health Management Invacare Integra LifeSciences Medtronic Walgreen 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 companies funded cleveland Biomedical Innovation Destination OncoDiagnostic Labs Computer Systems Company Innovative Process Administration Therapy Partners IntellisEPM (product line) 2009 CompuGroup 2005 Nuvasive RSB Spine (product line) 2004 Merry X-Ray SourceOne Healthcare Technologies 2003 Enpath Medical BIOMEC Cardiovascular Merge Healthcare RIS Logic Cardiac Sciences Complient 2002 GE Medical Systems St. Jude Medical Omnicare 2003 2002 2013 2012 2011 2010 2009 2008 2007 2006 2005 2010 Trek Diagnostics Cleveland BioLabs 3 2004 Amresco Lexi-Comp Trek Diagnostic Systems Intelect Medical Data Management Ganeden Biotech (product line) Cell Targeting 2006 Magellan Biosciences Initial Public Offering companies funded 6 7 14 VWR International Wolters Kluwer Thermo Fisher Scientific Boston Scientific MedData Schiff Nutrition BioTime MemberHealth Wellcorp Athersys USB BIOMEC Hygenic Corporation Over $200 Million and 800 Deals from Regional Tech Transfer 2003 2011 2007 Universal American Nationwide Initial Public Offering Affymetrix Greatbatch Cortec Group Source: National Institutes of Health 2002 Performance Health & Wellness Holdings OrthoHelix U.S. Endoscopy Research Organics 10 2012 2011 14 16 11 2010 2009 2008 2007 13 16 18 2006 13 2005 13 10 2004 2003 Gridiron Capital Tornier NV Steris Sigma-Aldrich 2008 Millions of Dollars 2001 2012 2013 Over $100 Million in SBIR Grants to Regional Start-Ups 2000 Ricerca ChanTest Directed Medical Systems MedData Simbionix Bedford Laboratories 50 398 227 203 242 165 171 87 61 2005 32 2004 2003 Millions of Dollars Source: Association for University Technology Managers Target 2014 Main Market Partners Charles River Labs COMS Interactive MEDNAX 3D Systems Hikma Pharmaceuticals 2013 TPG Envision Pharmaceutical Holdings Tenex Capital Management Roscoe Medical Cardinal Health AssuraMed Over $2 Billion Invested in 350 Start-up Companies Millions of Dollars Acquirer USA Instruments Cardiac Assist Devices NCS Healthcare 700 biomedical companies • 36 Cleveland-area biomedical investors • $2 billion invested in 350 start-up companies • 47 Exits • 85 national investors in Cleveland companies • $5.6 billion biomedical sector This Report is supported by the Fund For Our Economic Future, the Cleveland Foundation and the Burton D. Morgan Foundation. bioenterprise.com 216.658.3999 @BioECorp Linkedin.com/company/bioenterprise themedicalcapital.com @MedicalCaptial 36 85 medical capital Clinical & Research Institutions Critical Mass Internationally recognized clinical and research institutions provide the platform for Cleveland’s biomedical industry. Together these organizations conduct over $713 million in annual sponsored research and are nationally ranked in all medical specialty areas. The region’s industry collaborates closely with these institutions to advance innovation. Cleveland Clinic Nationally ranked in 13 specialties, including #1 heart and heart surgery for 20 years in a row; #1 in urology; #2 in diabetes & endocrinology, rheumatology, and nephrology* University Hospitals Nationally ranked in 12 specialties for third year in a row, including cancer, ear nose and throat, gastroenterology and GI surgery, and orthopedics* Summa Health System Nationally ranked in 2 specialties, including diabetes & endocrinology, and gastroenterology & GI surgery* Case Western Reserve School of Medicine ranked Top 23 in research; Biomedical Engineering department ranked Top 15* Northeast Ohio institutions have been awarded over $500 million to develop centers of innovation in cardiovascular therapies, biomaterials, neurostimulation, medical imaging, and regenerative medicine. *U.S. News & World Report, 2014-15 Global Center for Health Innovation The Global Center for Health Innovation showcases healthcare innovation, education, and commerce through state-of-the-art showrooms on four themed floors. The Global Center highlights the latest innovations of individual companies and also features collaboratively-executed themed multi-organizational spaces. Tenants include HIMSS, GE Healthcare, Philips Healthcare, Siemens, Cardinal Health, STERIS, and other global healthcare firms. HealthTech Corridor Located in the heart of Cleveland, the HealthTech Corridor is a 1,600 acre, three mile thoroughfare reserved for biomedical, healthcare and technology companies looking to take advantage of close proximity to world-class healthcare institutions, including Cleveland Clinic and University Hospitals, business incubators, academic centers, including Case Western Reserve University, and more than 120 high-tech companies engaged in the business of innovation. Access to world-class research, clinical facilities, and personnel has spurred an impressive biomedical industry in parallel to the institutions. Cleveland’s biomedical industry has grown from 300 companies in 2002 to over 700 companies in 2015. Medical device companies make up half of the total and include firms such as Philips, Hitachi, Steris, Siemens, and GE Healthcare. Biopharmaceutical companies Oakwood Labs, Ricerca, WIL Research Laboratories, and Affymetrix are located in the region. A growing number of healthcare IT and services companies, including Hyland Software, Explorys, COMS, CoverMyMeds, and Lexi-Comp complete the industry composite. Talent The strength of executive management leading Cleveland biomedical companies is a key driver of the region’s success. Entrepreneurial talent thrives in a network of deep assets and extensive resources within a culture of collaboration. Serial entrepreneurs leverage the region’s innovation platform of private and public funding, business assistance, and institutional collaboration. Clusters Imaging Cleveland is a global leader in medical imaging, the largest and fastest growing cluster within the region’s biomedical industry. Multinational imaging corporations - Siemens, Toshiba, Hitachi, Philips and GE, as well as more than 50 start-up companies, pioneer new imaging technologies in Northeast Ohio. Orthopedics Northeast Ohio is a hub of innovation and opportunity and a recognized leader in the orthopedics sector. Anchored by world-class research and clinical excellence, and augmented by local talent developed at early orthopedics companies, a nucleus of orthopedics start-ups have flourished. Successful exits include OrthoHelix Surgical Designs, acquired by Tornier NV, and The Theken Family of Companies, acquired by Integra. Neurostimulation Northeast Ohio is rich in neurostimulation research and clinical assets. Case Western Reserve University and Cleveland Clinic have spun out several neurodevice companies, including NDI Medical and its multiple spin outs, Neuros Medical, Neurotech’s “Most Promising Start Up,” and Intelect Medical, acquired by Boston Scientific. Regenerative Medicine Cleveland’s reputation in regenerative medicine stems from the 1980s when researchers conducted the first hematopoietic stem cell transplant in Ohio. That research eventually grew into the internationally recognized National Center for Regenerative Medicine and an emerging regenerative medicine industry that includes Athersys, Juventas Therapeutics, and the Cleveland Cord Blood Center. Biomaterials Anchored by world-class research and talent from University of Akron, Kent State University and Case Western Reserve University, and enriched by collaborations with polymer industry powerhouses Goodyear, Firestone and Goodrich, Northeast Ohio has tremendous expertise in developing biomaterials used to repair, restore or replace lost bodily function. Several Northeast Ohio corporations, exploring the business of biomaterials, have launched initiatives to take advantage of the growing industry. Parker Hannifin, for instance, recently founded a Polymer Innovation Center, and Lubrizol invested $30 million in an Advanced Materials facility expansion. Cardiovascular The excellence of Cleveland’s cardiovascular sector is understood worldwide. The sector is supported by one of the largest concentrations of prestigious research hospitals and academic institutions in the United States. The research and technologies discovered at these institutions have enabled a nascent industry that includes companies such as CardioInsight, Cleveland HeartLab and Arteriocyte. Biosensors Cleveland is home to an emerging biosensor industry, propelled by multiple public-private partnerships supporting innovation and commercialization. Intellirod Spine, Valtronic and Zin Technologies are a few examples of Northeast Ohio companies utilizing sensor technologies to detect, prevent and manage disease. Health IT Northeast Ohio has experienced rapid growth in the health information technology sector. In the past five years, more than $790 million has been invested in health IT and services companies in the Cleveland region. The health IT industry continues to produce a significant number of jobs and impact critical areas such as healthcare cost reduction and improvement of patient care. Cleveland’s biomed industry, a $5.6 billion sector, grew 59% from 2000-2014. Cleveland-area Biomedical Investors National Investors in Cleveland Companies Venture Capital & Growth Equity Funds Midwest West Coast New York Area Allos Ventures ABS Capital Partners Accipiter Capital Management Arboretum Ventures Arsenal Venture Partners Blue Point Capital Bridge Investment Fund Chrysalis Ventures Downing Partners Draper Triangle Ventures Early Stage Partners Edison Partners Edgewater Capital Everett Partners Frantz Medical Ventures Glengary Ventures Hopen Life Science Ventures Kadima Partners Kirtland Capital Partners Luxemburg Capital Morgenthaler Mutual Capital Partners NDI Healthcare Fund Primus Capital RIK Enterprises Riverside Company RiverVest Ventures Roulston Ventures Aspire Capital The Compass Group Aisling Capital Baird Capital Partners DW Healthcare Partners Amphion Innovations Beecken Petty O’Keefe & Company Francisco Partners Behrman Capital Blue Chip Venture Company HLM Venture Partners Clayton, Dubilier & Rice Charter Life Sciences Invesco CortecGroup CID Capital Kearny Venture Partners Cowen Group Cressey & Company Palo Alto Investors Easton Capital Investment Group Kentucky Seed Capital Fund SV Life Sciences Foundation Medical Partners Medtronic Takeda Ventures Goldman Sachs Ohio TechAngels TPG Biotech Great Point Partners River Cities Capital Funds Vivo Capital Greatbatch SWMF Life Science Western Technology Investment Investor Growth Capital Angel Funds & Networks Thoma Bravo Thomas, McNerney & Partners Triathlon Medical Venture Partners Ampersand Capital Partners New Science Ventures Venture Investors Bain Capital Ventures North Peak Capital West Capital Advisors Boston Scientific Oak Investment Partners Capital Resource Partners OrbiMed Advisors CompuGroup Medical Psilos Group DSM Venturing Radius Ventures Excel Venture Management Sunrise Equity Partners Fidelity Biosciences Tenex Capital Fletcher Spaght Ventures Toucan Capital HealthCare Ventures Welsh, Carson, Anderson & Stowe *Cleveland-area biomedical investors listed separately South Austin Ventures EDG Partners Akron ARCHAngel Network Impact Angel Fund North Coast Angel Fund RMS Capital Second Generation Zapis Capital Group ExOxEmis Seed Funds Pappas Ventures Akron BioInvestments Funds Case Technology Ventures Cleveland Clinic Innovations GLIDE Fund JumpStart Life Sciences Capital Boston Heritage Group Jordan-Blanchard Capital Maverick Capital Mayport Venture Partners MB Venture Partners River Associates Investments Santé Ventures TriStar Technology Ventures MPM Capital Norwich Ventures Polaris Partners RA Capital Siemens Venture Capital Summit Partners Tekla Capital Management MSD Capital 36 85 medical capital Clinical & Research Institutions Critical Mass Internationally recognized clinical and research institutions provide the platform for Cleveland’s biomedical industry. Together these organizations conduct over $713 million in annual sponsored research and are nationally ranked in all medical specialty areas. The region’s industry collaborates closely with these institutions to advance innovation. Cleveland Clinic Nationally ranked in 13 specialties, including #1 heart and heart surgery for 20 years in a row; #1 in urology; #2 in diabetes & endocrinology, rheumatology, and nephrology* University Hospitals Nationally ranked in 12 specialties for third year in a row, including cancer, ear nose and throat, gastroenterology and GI surgery, and orthopedics* Summa Health System Nationally ranked in 2 specialties, including diabetes & endocrinology, and gastroenterology & GI surgery* Case Western Reserve School of Medicine ranked Top 23 in research; Biomedical Engineering department ranked Top 15* Northeast Ohio institutions have been awarded over $500 million to develop centers of innovation in cardiovascular therapies, biomaterials, neurostimulation, medical imaging, and regenerative medicine. *U.S. News & World Report, 2014-15 Global Center for Health Innovation The Global Center for Health Innovation showcases healthcare innovation, education, and commerce through state-of-the-art showrooms on four themed floors. The Global Center highlights the latest innovations of individual companies and also features collaboratively-executed themed multi-organizational spaces. Tenants include HIMSS, GE Healthcare, Philips Healthcare, Siemens, Cardinal Health, STERIS, and other global healthcare firms. HealthTech Corridor Located in the heart of Cleveland, the HealthTech Corridor is a 1,600 acre, three mile thoroughfare reserved for biomedical, healthcare and technology companies looking to take advantage of close proximity to world-class healthcare institutions, including Cleveland Clinic and University Hospitals, business incubators, academic centers, including Case Western Reserve University, and more than 120 high-tech companies engaged in the business of innovation. Access to world-class research, clinical facilities, and personnel has spurred an impressive biomedical industry in parallel to the institutions. Cleveland’s biomedical industry has grown from 300 companies in 2002 to over 700 companies in 2015. Medical device companies make up half of the total and include firms such as Philips, Hitachi, Steris, Siemens, and GE Healthcare. Biopharmaceutical companies Oakwood Labs, Ricerca, WIL Research Laboratories, and Affymetrix are located in the region. A growing number of healthcare IT and services companies, including Hyland Software, Explorys, COMS, CoverMyMeds, and Lexi-Comp complete the industry composite. Talent The strength of executive management leading Cleveland biomedical companies is a key driver of the region’s success. Entrepreneurial talent thrives in a network of deep assets and extensive resources within a culture of collaboration. Serial entrepreneurs leverage the region’s innovation platform of private and public funding, business assistance, and institutional collaboration. Clusters Imaging Cleveland is a global leader in medical imaging, the largest and fastest growing cluster within the region’s biomedical industry. Multinational imaging corporations - Siemens, Toshiba, Hitachi, Philips and GE, as well as more than 50 start-up companies, pioneer new imaging technologies in Northeast Ohio. Orthopedics Northeast Ohio is a hub of innovation and opportunity and a recognized leader in the orthopedics sector. Anchored by world-class research and clinical excellence, and augmented by local talent developed at early orthopedics companies, a nucleus of orthopedics start-ups have flourished. Successful exits include OrthoHelix Surgical Designs, acquired by Tornier NV, and The Theken Family of Companies, acquired by Integra. Neurostimulation Northeast Ohio is rich in neurostimulation research and clinical assets. Case Western Reserve University and Cleveland Clinic have spun out several neurodevice companies, including NDI Medical and its multiple spin outs, Neuros Medical, Neurotech’s “Most Promising Start Up,” and Intelect Medical, acquired by Boston Scientific. Regenerative Medicine Cleveland’s reputation in regenerative medicine stems from the 1980s when researchers conducted the first hematopoietic stem cell transplant in Ohio. That research eventually grew into the internationally recognized National Center for Regenerative Medicine and an emerging regenerative medicine industry that includes Athersys, Juventas Therapeutics, and the Cleveland Cord Blood Center. Biomaterials Anchored by world-class research and talent from University of Akron, Kent State University and Case Western Reserve University, and enriched by collaborations with polymer industry powerhouses Goodyear, Firestone and Goodrich, Northeast Ohio has tremendous expertise in developing biomaterials used to repair, restore or replace lost bodily function. Several Northeast Ohio corporations, exploring the business of biomaterials, have launched initiatives to take advantage of the growing industry. Parker Hannifin, for instance, recently founded a Polymer Innovation Center, and Lubrizol invested $30 million in an Advanced Materials facility expansion. Cardiovascular The excellence of Cleveland’s cardiovascular sector is understood worldwide. The sector is supported by one of the largest concentrations of prestigious research hospitals and academic institutions in the United States. The research and technologies discovered at these institutions have enabled a nascent industry that includes companies such as CardioInsight, Cleveland HeartLab and Arteriocyte. Biosensors Cleveland is home to an emerging biosensor industry, propelled by multiple public-private partnerships supporting innovation and commercialization. Intellirod Spine, Valtronic and Zin Technologies are a few examples of Northeast Ohio companies utilizing sensor technologies to detect, prevent and manage disease. Health IT Northeast Ohio has experienced rapid growth in the health information technology sector. In the past five years, more than $790 million has been invested in health IT and services companies in the Cleveland region. The health IT industry continues to produce a significant number of jobs and impact critical areas such as healthcare cost reduction and improvement of patient care. Cleveland’s biomed industry, a $5.6 billion sector, grew 59% from 2000-2014. Cleveland-area Biomedical Investors National Investors in Cleveland Companies Venture Capital & Growth Equity Funds Midwest West Coast New York Area Allos Ventures ABS Capital Partners Accipiter Capital Management Arboretum Ventures Arsenal Venture Partners Blue Point Capital Bridge Investment Fund Chrysalis Ventures Downing Partners Draper Triangle Ventures Early Stage Partners Edison Partners Edgewater Capital Everett Partners Frantz Medical Ventures Glengary Ventures Hopen Life Science Ventures Kadima Partners Kirtland Capital Partners Luxemburg Capital Morgenthaler Mutual Capital Partners NDI Healthcare Fund Primus Capital RIK Enterprises Riverside Company RiverVest Ventures Roulston Ventures Aspire Capital The Compass Group Aisling Capital Baird Capital Partners DW Healthcare Partners Amphion Innovations Beecken Petty O’Keefe & Company Francisco Partners Behrman Capital Blue Chip Venture Company HLM Venture Partners Clayton, Dubilier & Rice Charter Life Sciences Invesco CortecGroup CID Capital Kearny Venture Partners Cowen Group Cressey & Company Palo Alto Investors Easton Capital Investment Group Kentucky Seed Capital Fund SV Life Sciences Foundation Medical Partners Medtronic Takeda Ventures Goldman Sachs Ohio TechAngels TPG Biotech Great Point Partners River Cities Capital Funds Vivo Capital Greatbatch SWMF Life Science Western Technology Investment Investor Growth Capital Angel Funds & Networks Thoma Bravo Thomas, McNerney & Partners Triathlon Medical Venture Partners Ampersand Capital Partners New Science Ventures Venture Investors Bain Capital Ventures North Peak Capital West Capital Advisors Boston Scientific Oak Investment Partners Capital Resource Partners OrbiMed Advisors CompuGroup Medical Psilos Group DSM Venturing Radius Ventures Excel Venture Management Sunrise Equity Partners Fidelity Biosciences Tenex Capital Fletcher Spaght Ventures Toucan Capital HealthCare Ventures Welsh, Carson, Anderson & Stowe *Cleveland-area biomedical investors listed separately South Austin Ventures EDG Partners Akron ARCHAngel Network Impact Angel Fund North Coast Angel Fund RMS Capital Second Generation Zapis Capital Group ExOxEmis Seed Funds Pappas Ventures Akron BioInvestments Funds Case Technology Ventures Cleveland Clinic Innovations GLIDE Fund JumpStart Life Sciences Capital Boston Heritage Group Jordan-Blanchard Capital Maverick Capital Mayport Venture Partners MB Venture Partners River Associates Investments Santé Ventures TriStar Technology Ventures MPM Capital Norwich Ventures Polaris Partners RA Capital Siemens Venture Capital Summit Partners Tekla Capital Management MSD Capital 36 85 medical capital Clinical & Research Institutions Critical Mass Internationally recognized clinical and research institutions provide the platform for Cleveland’s biomedical industry. Together these organizations conduct over $713 million in annual sponsored research and are nationally ranked in all medical specialty areas. The region’s industry collaborates closely with these institutions to advance innovation. Cleveland Clinic Nationally ranked in 13 specialties, including #1 heart and heart surgery for 20 years in a row; #1 in urology; #2 in diabetes & endocrinology, rheumatology, and nephrology* University Hospitals Nationally ranked in 12 specialties for third year in a row, including cancer, ear nose and throat, gastroenterology and GI surgery, and orthopedics* Summa Health System Nationally ranked in 2 specialties, including diabetes & endocrinology, and gastroenterology & GI surgery* Case Western Reserve School of Medicine ranked Top 23 in research; Biomedical Engineering department ranked Top 15* Northeast Ohio institutions have been awarded over $500 million to develop centers of innovation in cardiovascular therapies, biomaterials, neurostimulation, medical imaging, and regenerative medicine. *U.S. News & World Report, 2014-15 Global Center for Health Innovation The Global Center for Health Innovation showcases healthcare innovation, education, and commerce through state-of-the-art showrooms on four themed floors. The Global Center highlights the latest innovations of individual companies and also features collaboratively-executed themed multi-organizational spaces. Tenants include HIMSS, GE Healthcare, Philips Healthcare, Siemens, Cardinal Health, STERIS, and other global healthcare firms. HealthTech Corridor Located in the heart of Cleveland, the HealthTech Corridor is a 1,600 acre, three mile thoroughfare reserved for biomedical, healthcare and technology companies looking to take advantage of close proximity to world-class healthcare institutions, including Cleveland Clinic and University Hospitals, business incubators, academic centers, including Case Western Reserve University, and more than 120 high-tech companies engaged in the business of innovation. Access to world-class research, clinical facilities, and personnel has spurred an impressive biomedical industry in parallel to the institutions. Cleveland’s biomedical industry has grown from 300 companies in 2002 to over 700 companies in 2015. Medical device companies make up half of the total and include firms such as Philips, Hitachi, Steris, Siemens, and GE Healthcare. Biopharmaceutical companies Oakwood Labs, Ricerca, WIL Research Laboratories, and Affymetrix are located in the region. A growing number of healthcare IT and services companies, including Hyland Software, Explorys, COMS, CoverMyMeds, and Lexi-Comp complete the industry composite. Talent The strength of executive management leading Cleveland biomedical companies is a key driver of the region’s success. Entrepreneurial talent thrives in a network of deep assets and extensive resources within a culture of collaboration. Serial entrepreneurs leverage the region’s innovation platform of private and public funding, business assistance, and institutional collaboration. Clusters Imaging Cleveland is a global leader in medical imaging, the largest and fastest growing cluster within the region’s biomedical industry. Multinational imaging corporations - Siemens, Toshiba, Hitachi, Philips and GE, as well as more than 50 start-up companies, pioneer new imaging technologies in Northeast Ohio. Orthopedics Northeast Ohio is a hub of innovation and opportunity and a recognized leader in the orthopedics sector. Anchored by world-class research and clinical excellence, and augmented by local talent developed at early orthopedics companies, a nucleus of orthopedics start-ups have flourished. Successful exits include OrthoHelix Surgical Designs, acquired by Tornier NV, and The Theken Family of Companies, acquired by Integra. Neurostimulation Northeast Ohio is rich in neurostimulation research and clinical assets. Case Western Reserve University and Cleveland Clinic have spun out several neurodevice companies, including NDI Medical and its multiple spin outs, Neuros Medical, Neurotech’s “Most Promising Start Up,” and Intelect Medical, acquired by Boston Scientific. Regenerative Medicine Cleveland’s reputation in regenerative medicine stems from the 1980s when researchers conducted the first hematopoietic stem cell transplant in Ohio. That research eventually grew into the internationally recognized National Center for Regenerative Medicine and an emerging regenerative medicine industry that includes Athersys, Juventas Therapeutics, and the Cleveland Cord Blood Center. Biomaterials Anchored by world-class research and talent from University of Akron, Kent State University and Case Western Reserve University, and enriched by collaborations with polymer industry powerhouses Goodyear, Firestone and Goodrich, Northeast Ohio has tremendous expertise in developing biomaterials used to repair, restore or replace lost bodily function. Several Northeast Ohio corporations, exploring the business of biomaterials, have launched initiatives to take advantage of the growing industry. Parker Hannifin, for instance, recently founded a Polymer Innovation Center, and Lubrizol invested $30 million in an Advanced Materials facility expansion. Cardiovascular The excellence of Cleveland’s cardiovascular sector is understood worldwide. The sector is supported by one of the largest concentrations of prestigious research hospitals and academic institutions in the United States. The research and technologies discovered at these institutions have enabled a nascent industry that includes companies such as CardioInsight, Cleveland HeartLab and Arteriocyte. Biosensors Cleveland is home to an emerging biosensor industry, propelled by multiple public-private partnerships supporting innovation and commercialization. Intellirod Spine, Valtronic and Zin Technologies are a few examples of Northeast Ohio companies utilizing sensor technologies to detect, prevent and manage disease. Health IT Northeast Ohio has experienced rapid growth in the health information technology sector. In the past five years, more than $790 million has been invested in health IT and services companies in the Cleveland region. The health IT industry continues to produce a significant number of jobs and impact critical areas such as healthcare cost reduction and improvement of patient care. Cleveland’s biomed industry, a $5.6 billion sector, grew 59% from 2000-2014. Cleveland-area Biomedical Investors National Investors in Cleveland Companies Venture Capital & Growth Equity Funds Midwest West Coast New York Area Allos Ventures ABS Capital Partners Accipiter Capital Management Arboretum Ventures Arsenal Venture Partners Blue Point Capital Bridge Investment Fund Chrysalis Ventures Downing Partners Draper Triangle Ventures Early Stage Partners Edison Partners Edgewater Capital Everett Partners Frantz Medical Ventures Glengary Ventures Hopen Life Science Ventures Kadima Partners Kirtland Capital Partners Luxemburg Capital Morgenthaler Mutual Capital Partners NDI Healthcare Fund Primus Capital RIK Enterprises Riverside Company RiverVest Ventures Roulston Ventures Aspire Capital The Compass Group Aisling Capital Baird Capital Partners DW Healthcare Partners Amphion Innovations Beecken Petty O’Keefe & Company Francisco Partners Behrman Capital Blue Chip Venture Company HLM Venture Partners Clayton, Dubilier & Rice Charter Life Sciences Invesco CortecGroup CID Capital Kearny Venture Partners Cowen Group Cressey & Company Palo Alto Investors Easton Capital Investment Group Kentucky Seed Capital Fund SV Life Sciences Foundation Medical Partners Medtronic Takeda Ventures Goldman Sachs Ohio TechAngels TPG Biotech Great Point Partners River Cities Capital Funds Vivo Capital Greatbatch SWMF Life Science Western Technology Investment Investor Growth Capital Angel Funds & Networks Thoma Bravo Thomas, McNerney & Partners Triathlon Medical Venture Partners Ampersand Capital Partners New Science Ventures Venture Investors Bain Capital Ventures North Peak Capital West Capital Advisors Boston Scientific Oak Investment Partners Capital Resource Partners OrbiMed Advisors CompuGroup Medical Psilos Group DSM Venturing Radius Ventures Excel Venture Management Sunrise Equity Partners Fidelity Biosciences Tenex Capital Fletcher Spaght Ventures Toucan Capital HealthCare Ventures Welsh, Carson, Anderson & Stowe *Cleveland-area biomedical investors listed separately South Austin Ventures EDG Partners Akron ARCHAngel Network Impact Angel Fund North Coast Angel Fund RMS Capital Second Generation Zapis Capital Group ExOxEmis Seed Funds Pappas Ventures Akron BioInvestments Funds Case Technology Ventures Cleveland Clinic Innovations GLIDE Fund JumpStart Life Sciences Capital Boston Heritage Group Jordan-Blanchard Capital Maverick Capital Mayport Venture Partners MB Venture Partners River Associates Investments Santé Ventures TriStar Technology Ventures MPM Capital Norwich Ventures Polaris Partners RA Capital Siemens Venture Capital Summit Partners Tekla Capital Management MSD Capital 47 Innovation EXITS SINCE 2002 Start-Up Activity An ever-growing pipeline of funded start-up companies demonstrates the vibrant biomedical environment in the region. Regional biomedical companies attract funding from venture capital, private equity, and strategic sources as well as state and federal programs. The rich pipeline has drawn the notice of larger strategic firms as shown by the increasing number of company exits in recent years. 40 43 35 33 31 25 28 22 21 13 16 135 125 68 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2014 2013 2012 2011 2010 2009 2007 2006 2008 companies funded Source: Midwest Healthcare Growth Capital Report 18 2013 2012 2011 2010 2009 2008 16 20 22 21 25 24 2007 2006 2005 18 20 23 19 2004 2003 15 76 74 72 91 73 72 82 84 21 47 55 68 50 20 25 27 23 19 19 22 23 2000 2001 34 13 15 Clayton Dubilier & Rice/Goldman Sachs Predictive Biosciences Hyland Software Mercer HealthPro Rehabilitation Carefx Edgepark Surgical Noteworthy Medical Homecare Collection Services Theken Spine NDI Medical (product line) Whole Health Management Invacare Integra LifeSciences Medtronic Walgreen 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 companies funded cleveland Biomedical Innovation Destination OncoDiagnostic Labs Computer Systems Company Innovative Process Administration Therapy Partners IntellisEPM (product line) 2009 CompuGroup 2005 Nuvasive RSB Spine (product line) 2004 Merry X-Ray SourceOne Healthcare Technologies 2003 Enpath Medical BIOMEC Cardiovascular Merge Healthcare RIS Logic Cardiac Sciences Complient 2002 GE Medical Systems St. Jude Medical Omnicare 2003 2002 2013 2012 2011 2010 2009 2008 2007 2006 2005 2010 Trek Diagnostics Cleveland BioLabs 3 2004 Amresco Lexi-Comp Trek Diagnostic Systems Intelect Medical Data Management Ganeden Biotech (product line) Cell Targeting 2006 Magellan Biosciences Initial Public Offering companies funded 6 7 14 VWR International Wolters Kluwer Thermo Fisher Scientific Boston Scientific MedData Schiff Nutrition BioTime MemberHealth Wellcorp Athersys USB BIOMEC Hygenic Corporation Over $200 Million and 800 Deals from Regional Tech Transfer 2003 2011 2007 Universal American Nationwide Initial Public Offering Affymetrix Greatbatch Cortec Group Source: National Institutes of Health 2002 Performance Health & Wellness Holdings OrthoHelix U.S. Endoscopy Research Organics 10 2012 2011 14 16 11 2010 2009 2008 2007 13 16 18 2006 13 2005 13 10 2004 2003 Gridiron Capital Tornier NV Steris Sigma-Aldrich 2008 Millions of Dollars 2001 2012 2013 Over $100 Million in SBIR Grants to Regional Start-Ups 2000 Ricerca ChanTest Directed Medical Systems MedData Simbionix Bedford Laboratories 50 398 227 203 242 165 171 87 61 2005 32 2004 2003 Millions of Dollars Source: Association for University Technology Managers Target 2014 Main Market Partners Charles River Labs COMS Interactive MEDNAX 3D Systems Hikma Pharmaceuticals 2013 TPG Envision Pharmaceutical Holdings Tenex Capital Management Roscoe Medical Cardinal Health AssuraMed Over $2 Billion Invested in 350 Start-up Companies Millions of Dollars Acquirer USA Instruments Cardiac Assist Devices NCS Healthcare 700 biomedical companies • 36 Cleveland-area biomedical investors • $2 billion invested in 350 start-up companies • 47 Exits • 85 national investors in Cleveland companies • $5.6 billion biomedical sector This Report is supported by the Fund For Our Economic Future, the Cleveland Foundation and the Burton D. Morgan Foundation. bioenterprise.com 216.658.3999 @BioECorp Linkedin.com/company/bioenterprise themedicalcapital.com @MedicalCaptial 47 Innovation EXITS SINCE 2002 Start-Up Activity An ever-growing pipeline of funded start-up companies demonstrates the vibrant biomedical environment in the region. Regional biomedical companies attract funding from venture capital, private equity, and strategic sources as well as state and federal programs. The rich pipeline has drawn the notice of larger strategic firms as shown by the increasing number of company exits in recent years. 40 43 35 33 31 25 28 22 21 13 16 135 125 68 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2014 2013 2012 2011 2010 2009 2007 2006 2008 companies funded Source: Midwest Healthcare Growth Capital Report 18 2013 2012 2011 2010 2009 2008 16 20 22 21 25 24 2007 2006 2005 18 20 23 19 2004 2003 15 76 74 72 91 73 72 82 84 21 47 55 68 50 20 25 27 23 19 19 22 23 2000 2001 34 13 15 Clayton Dubilier & Rice/Goldman Sachs Predictive Biosciences Hyland Software Mercer HealthPro Rehabilitation Carefx Edgepark Surgical Noteworthy Medical Homecare Collection Services Theken Spine NDI Medical (product line) Whole Health Management Invacare Integra LifeSciences Medtronic Walgreen 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 companies funded cleveland Biomedical Innovation Destination OncoDiagnostic Labs Computer Systems Company Innovative Process Administration Therapy Partners IntellisEPM (product line) 2009 CompuGroup 2005 Nuvasive RSB Spine (product line) 2004 Merry X-Ray SourceOne Healthcare Technologies 2003 Enpath Medical BIOMEC Cardiovascular Merge Healthcare RIS Logic Cardiac Sciences Complient 2002 GE Medical Systems St. Jude Medical Omnicare 2003 2002 2013 2012 2011 2010 2009 2008 2007 2006 2005 2010 Trek Diagnostics Cleveland BioLabs 3 2004 Amresco Lexi-Comp Trek Diagnostic Systems Intelect Medical Data Management Ganeden Biotech (product line) Cell Targeting 2006 Magellan Biosciences Initial Public Offering companies funded 6 7 14 VWR International Wolters Kluwer Thermo Fisher Scientific Boston Scientific MedData Schiff Nutrition BioTime MemberHealth Wellcorp Athersys USB BIOMEC Hygenic Corporation Over $200 Million and 800 Deals from Regional Tech Transfer 2003 2011 2007 Universal American Nationwide Initial Public Offering Affymetrix Greatbatch Cortec Group Source: National Institutes of Health 2002 Performance Health & Wellness Holdings OrthoHelix U.S. Endoscopy Research Organics 10 2012 2011 14 16 11 2010 2009 2008 2007 13 16 18 2006 13 2005 13 10 2004 2003 Gridiron Capital Tornier NV Steris Sigma-Aldrich 2008 Millions of Dollars 2001 2012 2013 Over $100 Million in SBIR Grants to Regional Start-Ups 2000 Ricerca ChanTest Directed Medical Systems MedData Simbionix Bedford Laboratories 50 398 227 203 242 165 171 87 61 2005 32 2004 2003 Millions of Dollars Source: Association for University Technology Managers Target 2014 Main Market Partners Charles River Labs COMS Interactive MEDNAX 3D Systems Hikma Pharmaceuticals 2013 TPG Envision Pharmaceutical Holdings Tenex Capital Management Roscoe Medical Cardinal Health AssuraMed Over $2 Billion Invested in 350 Start-up Companies Millions of Dollars Acquirer USA Instruments Cardiac Assist Devices NCS Healthcare 700 biomedical companies • 36 Cleveland-area biomedical investors • $2 billion invested in 350 start-up companies • 47 Exits • 85 national investors in Cleveland companies • $5.6 billion biomedical sector This Report is supported by the Fund For Our Economic Future, the Cleveland Foundation and the Burton D. Morgan Foundation. bioenterprise.com 216.658.3999 @BioECorp Linkedin.com/company/bioenterprise themedicalcapital.com @MedicalCaptial

© Copyright 2026