The Collision of Innovation And Access In US Healthcare

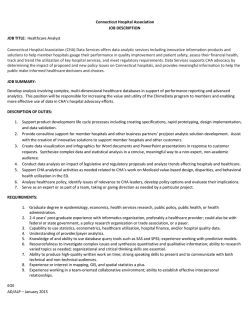

Jim Robinson is the President of Astellas Pharma US. These remarks were delivered during The RPM Report’s FDA/CMS Summit for Biopharma Executives on December 11 in Washington, D.C. The Collision of Innovation And Access In US Healthcare The RPM Report’s FDA/CMS Summit for Biopharma Executives included sessions devoted to many issues that impact the biopharma industry and patient care. They raised essential questions about public policy and biopharma. But all are part of a much bigger question: How do we create and sustain real value in our healthcare system? By Jim Robinson Whether you are a payer or a provider, a patient or a biopharmaceutical company – almost all of our questions about health care eventually end up being about value. If I asked everyone here to define value in health care, I suspect we’d get broad agreement around one basic answer: Better patient outcome at lower costs. But as you know, there’s nothing easy about answering all the questions that come after. For example, what is a quality outcome and who decides? If you figure out what quality is, how do you determine what factors are responsible for that outcome? Is it a lifestyle change? A medicine? A surgery? If you can figure that out, how do we measure the impact of each intervention – and how do we pay for it? We simply have to find good answers to these value questions, and soon. Because our healthcare system is facing a fundamental challenge: Medical innovation is becoming increasingly complex and expensive at a time when payers are less willing to pay for it. These two opposing forces – the rising complexity and cost of innovation and the limits of payment and access – are colliding. The only way to reverse this collision is by delivering better value. But no single entity in the healthcare system can accomplish this goal on its own. Developing a more value-driven system in America can only be achieved with every stakeholder at the table. Unfortunately, I don’t think that’s happening. The RPM Report Even as science is leading us towards more personalized or precision medicine, our overall healthcare system is heading in the other direction – where patients and providers have less control over treatment decisions; and where top-down cost-cutting is undermining bottom-up innovation. With budgets shrinking and costs rising, I understand the impulse for payers to focus on cutting costs in the short-term. But I don’t believe this will lead to long-term value. At Astellas we understand that we have a special responsibility – because we develop products that, in some cases, can be the difference between life and death. And because of that, we have a commitment to ensuring that patients have access to our medicine -- whether it involves the government, private insurers or individuals paying for the medicine or, in some cases, Astellas providing it for free. We’re certainly not alone in this. Many of our peer companies think and act the same way. Now, there’s no disputing the fact that medicines – along with most other products and services in the healthcare system – are getting more expensive. And the question everyone wants to know is, “why?” To help address that question, I’d like you to think about something for a moment. Picture in your head a news headline running across your computer screen. And the headline says, “Scientists Discover Molecule That May Hold Key To Cancer Cure.” © 2015 Informa Business Information, Inc., an Informa company. | January 2015 1 POINTEDVIEW We have all seen it, and after seeing stories like this year after year, we have all probably wondered, “Why haven’t we cured cancer?” It’s a complicated question – and the answer is even more so. Earlier this year, Scientific American said that “taking a drug all the way from initial discovery to market is considered harder than putting a man on the moon.” Now, I don’t want to take anything away from the folks at NASA but that’s not far off. Diseases are complex – not monolithic. They are instead a group of conditions with different causes, pathways and targets. And diseases are smart. We can identify one pathway that works to fight a disease like cancer – which is incredibly complicated – only to see the cancer find an alternate pathway to evade our treatment. But for the biopharmaceutical industry, that is our business. Failure is simply inevitable. You’ve probably heard that the average cost to develop a new drug is just over a billion dollars. But that understates it. Last month, a new Tufts study pegged it at $2.6 billion. The science is getting tougher as we tackle intractable chronic diseases like cancer, MS and rheumatoid arthritis and various infectious diseases – and so are the economics. R&D Economics Daunting In fact, if you look across the industry, conducting research and development is now – on average – a money loser. Let that sink in for just a moment. Over the last few years, the cost of capital has been greater than the return on investment from R&D. That’s why some Wall Street analysts have been saying that R&D is a Astellas Pharma US President Jim Robinson Innovative Therapies Progress value-destroyer instead of a value-driver Despite the Odds for the biopharmaceutical industry. Despite these scientific challenges – and the economic chalNow, I don’t agree with that view. But it certainly gets your lenges that I’ll speak to in a moment – biopharmaceutical attention. And it provides new urgency to find real value researchers continue delivering life-saving and life-improving throughout the system. therapies. At Astellas, we’ve dealt with our share of failure. We’re all familiar with the headline grabbers, such as HIV/ We’ve spent years – and millions of dollars – developing AIDS deaths being down over 80%, or a 20% decrease in promising drugs that never made it to market. And even when cancer deaths. a drug gets to market, the odds of commercial success aren’t But there have been so many other notable developments. high. But the price of failure is worth paying if it leads to the For the first time in 50 years, we have seen the first new treat- promise of a life-saving medicine. ment for Lupus. We’ve seen the number of prostate cancer Take a medicine like Xtandi, a drug that we developed in medicines available on the market jump significantly. partnership with Medivation Inc. If you look at what the FDA is approving, these are not • Xtandi was approved by the FDA in 2012 to treat an ag“me-too” therapies. A recent study in Health Affairs found gressive form of prostate cancer after chemotherapy. that 40% of drug approvals in the last decade have been first• Then it was approved this past September for treatment in-class treatments. before chemo. But even with this progress, there is still so much left to • And now, it is being studied to treat other forms of cancer, learn about the human body – and so much distance to travel including breast cancer. between that promising headline and the development of a Developing and commercializing Xtandi wasn’t easy and it safe and effective medicine for patients. wasn’t cheap – but it was worth it. At each stage in the drug development process, there are Xtandi is providing hope to patients who didn’t have any scientific, economic, regulatory and manufacturing hurdles just a few years ago. And Xtandi is a signature example of to clear. These hurdles have always been high. Now they’re how the clinical value of a medicine can and does evolve getting higher. over time. Consider that nearly 90 percent of drug candidates enterOf course, anytime you discuss a promising new medicine, ing clinical trials fail. No other industry faces this challenge. the payment discussion isn’t far behind. Can you imagine if 90 percent of Apple’s consumer devices I won’t belabor the payment challenge. We all know the or Ford’s car designs never made it to market? That would deal. More people need healthcare benefits and there is less destroy their business. money available to pay for it. And with 8,000 Baby Boom- 2 January 2015 | www.PharmaMedtechBI.com The RPM Report POINTEDVIEW ers retiring every day in the U.S., the problem isn’t getting any easier. R&D Costs Can’t Be The Only Response As an example, I recently read a Forbes story where the writer Pressure On Payors, Counterproductive Responses wondered why the industry justified the price of medicines by talking primarily about the cost of development. I just did that Medicare, Medicaid and commercial insurers already can’t keep earlier: over $2.5 billion dollars to bring a new drug to market. up with the cost of care. For this reason, the federal governBut this didn’t quite make sense to the Forbes writer. He ment and private insurers are trying to take steps to decrease essentially said that you’d never pay more for a car because costs and increase value in the system. Ford wasted extra money on R&D We see some of it in the implementawithout results. You buy the car for the tion of the Affordable Care Act. And we result of that R&D – because it is safer, see it in the commercial market: faster, more efficient. And he said, it’s • Where payers are consolidating to “the same with drugs… we should pay build greater influence, and what they’re worth, not what it costs to “Our challenge is to get • Shifting the risk to providers and develop them.” the costs to patients. On balance, I think he’s right. everyone in the system So here is my concern: Some of the But we’ve got to do a better job as an pulling in the same steps payers are taking that are designed to industry and as a system of figuring out increase value may in fact decrease value. what “worth” or “value” really means direction to focus on More and more, payers are trying to and who decides. finding ways to put force price cuts on medicines with little If I have a drug that costs $80,000 to consideration of the value they provide value in instead of just cure a disease, that sounds expensive. for specific patient populations; or But what if that drug prevents $500,000 taking costs out.” they’re creating restrictive formularies in future medical costs? All of a sudden, that make specialized drugs – which that expensive medicine looks pretty often represent the most cutting-edge cost-effective because the patient and science – difficult for patients to access. the payer are saving over $400,000. Part of the problem is that we still This is not a hypothetical situation. don’t have consistent or reliable quality measures for many And it’s hardly the only one. There are countless examples diseases; and just as the quality measures are sometimes ill- where a medicine creates significant value for patients defined, so too are the financial incentives throughout our and society. And sometimes, these benefits don’t become healthcare system. clear until years after a drug reaches the market and new Providers are being rewarded or punished for meeting or not insights are gained through real-world patient use and meeting quality measures that often have little correlation to ongoing research. better outcomes for patients. And pharmacy benefit managers These distinctions between what constitutes real value are are incentivized to cut costs now, even if it will cost the health hardly just a matter of perception. insurance plans more later. When we recognize the true long-term value of medicines, Whatever the reason for this arbitrary cost cutting, it: and create the right incentivizes to develop better medicines, it • Puts the squeeze on patients, who have to pay a growing has a huge impact on improving patient outcomes and reducand unrealistic share of the costs for these medicines. ing downstream costs. It has a huge impact on how medicine • It also puts a squeeze on doctors, who can’t always is actually practiced. prescribe the medicine they think will be best for their And here too, I believe the biopharmaceutical industry has patients. an essential and growing role to play. • It puts a squeeze on R&D because companies are hesitant to invest in drugs that may not be adequately reimbursed. New Collaborations Critical • And it moves us closer to a low-cost healthcare system As you all know, the evolving economics of health care have when we need to be moving more towards a high-value forced significant changes in how providers are organized. system. Delivery systems are being consolidated. Previously indepenBut the blame for this worrying trend certainly doesn’t fall dent physicians are going to work for these systems. And as only on payers. My industry hasn’t done a good enough job a consequence, prescribing decisions aren’t just in the hands of doctors anymore. communicating the value of our medicines. The RPM Report © 2015 Informa Business Information, Inc., an Informa company. | January 2015 3 POINTEDVIEW Individual physicians are increasingly influenced by the protocols of whatever network they are a part of. And biopharmaceutical representatives – instead of taking their expertise from doctor’s office to doctor’s office – are now making their case to administrators, CFOs, and other C-Suite leaders of the integrated systems. So here’s another contradiction we are facing: At the same time that the practice of medicine is becoming more individualized and personalized, the payment and formulary decisions are becoming more centralized. For companies like ours, it’s sometimes hard to know who is really making the prescribing decisions, and on what basis. And it’s compounded by restrictions on communications between biopharmaceutical company representatives and many healthcare professionals. Despite these challenges, Astellas is partnering with healthcare delivery networks to figure out how to deliver real value for them and for their patients. For example, we recently launched a new Strategic Accounts Business Unit that works with leaders of health care systems in five cities to better understand their unique needs. Each unit features a multi-disciplinary team with complementary roles. Some teams focus on building relationships with clinical and non-clinical leadership, while others are tasked with engaging decision-makers on healthcare outcomes, quality and the economic burden of disease. Right now, Astellas is learning valuable lessons that we will implement throughout our organization. And we’re learning how to think more about value in everything we do. When it comes to R&D, we are trying to listen to the voice of our payers, our providers and our patients earlier in the drug development process. This can ensure that we have the right value measures and value proposition when we get to market. A great example of this type of partnership is one we have with Humana Inc. that brings together researchers and health care experts to reduce inefficiencies in the management of oncology, urology and immunology conditions. We are building a more collaborative partnership between the stakeholders who create, deliver and pay for medicine, which is good for the health of the patient and good for the health of the whole system. This collaboration enables the development of more targeted medicines, fewer unnecessary treatments and reduced costs; and ultimately, better care for patients. So in my opinion, if payers, providers, regulators and the biopharmaceutical industry can come together – as partners – I don’t see any reason why the United States can’t create a truly value-driven healthcare system. Our challenge – and it’s a big one – is to get everyone in the system pulling in the same direction to focus on finding ways to put value in instead of just taking costs out. I know some of you in this room are working to develop new payment models and incentives to measure quality and to deliver value. And I know those models have a common end goal: To enable providers to make treatment decisions not because they think an intervention will work, but because they have the right data and insight to know it will work. Now it’s not my place to take a position on the viability of one model over another, but what I do know is that every stakeholder in the healthcare system has to be involved in shaping these models. There’s no one-sized fits all solution that can be imposed. Instead, we need to look to the many partnerships that are being developed across the country as our laboratories of value – as the proving ground for which models really produce the best patient outcomes at lower cost. Because we all have valuable insights to add – and because collaboration is the only way to reform a healthcare system as complicated as ours. Astellas and the biopharmaceutical industry have a lot to contribute to this discussion, and I’m looking forward to working with many of you to build the value-driven healthcare system that is best for patients and for all of us. RPM Put Value In, Rather Than Take Cost Out Without question, we are being flexible. We are being nimble. And we are listening to patients, providers, payers and regulators. © Comments? E-mail the editor at [email protected] 2014 by Informa Business Information, Inc., an Informa company. All rights reserved. No part of this publication may be reproduced in any form or incorporated into any information retrieval system without the written permission of the copyright owner. 4 January 2015 | www.PharmaMedtechBI.com The RPM Report

© Copyright 2026