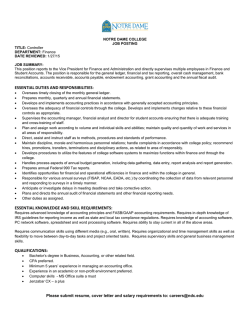

Real Estate and Financial Services Director

JOB POSTING DETROIT ECONOMIC GROWTH CORPORATION Title: FLSA: Salary Range: Reporting Relationship: General Summary Real Estate and Financial Services Director Exempt $80,000 -‐ $95,000 Executive Vice President To provide development planning and analysis, development finance analysis and general commercial real estate analysis. This position will assist in overseeing all financial, incentive and loan programs that are administered by the Detroit Economic Growth Corporation (DEGC) and its related entities. Principal Duties and Responsibilities 1) Oversees the Financial Services Team, making decisions and recommendations regarding overall financial programs. 2) Oversees Real Estate team regarding the disposition of most commercial properties that are owned by the City of Detroit. 3) Coordinate the disposition of the commercial properties with various City departments including the Detroit Building Authority, the Detroit Land Bank Authority, Planning Department and Mayor’s office 4) Underwrite specific loan requests for the various loan programs. 5) Update and comply with the Credit Policy Manual for the various loan portfolios. 6) Provide development and financial analysis for various projects. 7) Provide marketing and promotional assistance for prospective developers 8) Handle/coordinate business and real estate development/finance loan closings. 9) Assist the City of Detroit with reviewing commercial/financial matters. 10) Loan administration and portfolio management. 11) Develops and maintains appropriate relationships with the U.S. government agencies, State of Michigan, Michigan Economic Development Corporation, City of Detroit, Invest Detroit and other non-‐profit organizations and private sector that enable DEGC to function as an essential partner for the financing of projects located in the City of Detroit. 12) Others duties as maybe assigned. Knowledge, Skills and Abilities Required 1) A bachelor’s degree and preferably an advance degree in business, finance or related field. 2) Commercial real estate development, leasing and various development pro forma analysis. 3) Good working knowledge of sources of financing for commercial real estate projects including domestic and foreign banks, pension funds, savings and loan institutions, insurance companies, etc. Particular interest in candidates with working knowledge of creative blending of various public/private sources of development finance together to fill gaps in total development costs. 4) Successful management experience in economic development, business, government or a non-‐ profit organization. 5) Ability to successfully manage multiple and diverse projects simultaneously. 6) Understanding of and ability to work with individuals at many levels within business, labor, government and quasi-‐public institutions. 7) Excellent written and oral communication skills. 8) Knowledge of MS Office software.

© Copyright 2026