Content - Angel Backoffice

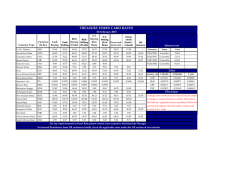

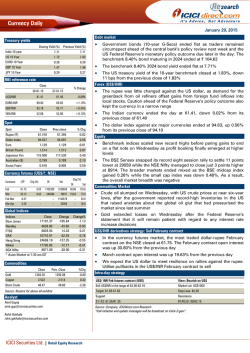

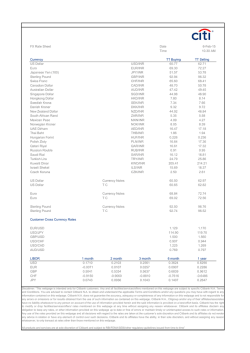

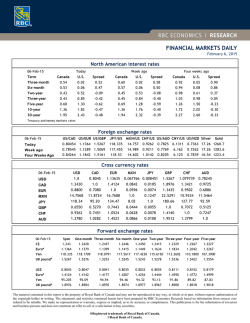

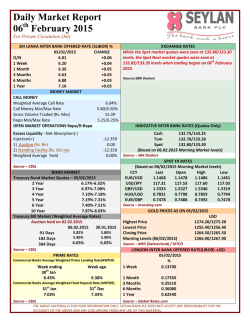

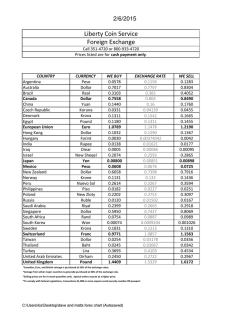

Currencies Daily Report Monday, February 02, 2015 Content Overview US Dollar Euro GBP JPY Economic Indicators Overview: Research Team Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500 Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from “Angel Broking Ltd”. Your feedback is appreciated on [email protected] www.angelbroking.com Currencies Daily Report Monday, February 02, 2015 Highlights US Advance GDP fell to 2.6 percent in the quarter ended Dec’14. China’s HSBC Final Manufacturing PMI fell to 49.7-mark in January. Euro zone’s CPI Flash Estimate declined by 0.6 percent in Jan’15. Asian markets are trading lower today as weak Chinese manufacturing data released over the weekend raised concerns about growth in the world's second-largest economy. China’s HSBC Final Manufacturing PMI fell to 49.7-mark in January from 49.8-mark in December. Market Highlights (% change) as on January 30, 2015 Prev. day WoW MoM YoY 8808.9 -1.6 -0.3 6.4 39.5 SENSEX 29183.0 -1.7 -0.3 6.1 59.6 DJIA 17165.0 -1.4 -2.9 -3.7 9.3 S&P 1995.0 -1.3 -2.8 -4.1 11.2 FTSE 20503.4 -0.4 17.4 13.0 5.4 KOSPI 1951.0 0.1 1.6 1.3 0.1 Last NIFTY US Dollar Index BOVESPA 58497.8 0.2 19.9 21.9 25.5 The US Dollar Index (DX) traded lower by 0.1 percent last week as weak business spending and a wider trade deficit pushed GDP lower in the last quarter of 2014. Also, speculation the victorious Syriza party in Greek elections will pursue its anti-austerity agenda without forcing an exit from the currency bloc coupled with mixed economic data from the nation acted as negative factors. NIKKEI 14506.3 0.2 -0.1 -14.1 66.3 44.53 0.2 -3.8 -16.4 -54.3 1278.50 1.9 -1.1 7.8 1.3 16.76 -7.3 -8.3 6.5 -12.3 5494.00 1.2 -0.5 -12.6 -23.1 104.7 0.1 0.1 1.1 2.9 However, sharp losses were cushioned against the other major currencies on Thursday, after the Federal Reserve signaled that interest rates could start to rise around mid-year. The currency touched a weekly low of 93.96 and closed at 95.00 on Friday. Nymex Crude $/bbl Comex Gold $/oz Comex Silver $/oz LME Copper (3 month) -$/tonne G-Sec -10 yr @7.8% - Yield Source: Reuters US Advance GDP fell to 2.6 percent in the quarter ended December from 5 percent in the prior quarter. Chicago PMI rose to 59.4-mark in January from 58.3 levels in December. US Dollar (% change) Dollar/INR The Indian Rupee depreciated by 0.9 percent last week owing to monthend dollar demand by importers. Also, dollar inflows from foreign institutional investors (FIIs) were being absorbed by state-owned banks. In addition, investors booked profits ahead of the expiry of January derivative contracts. as on January 30, 2015 Last Prev. day WoW MoM YoY Dollar Index 95.00 0.0 -0.1 4.8 19.6 US $ / INR (Spot) 62.01 -0.4 -0.9 1.6 0.9 US $ / INR Jan’15 Futures (NSE) US $ / INR Jan’15 Futures (MCX-SX) 62.19 0.02 1.2 -2.44 -1.22 62.20 0.00 1.2 -2.44 -1.18 Source: Reuters Technical Chart – USD/INR However, sharp losses were cushioned owing to fresh dollar selling by exporters tracking heavy foreign capital inflows amid strong equity market. The currency touched an weekly low of 62.02 and closed at 62.01 on Friday. For the month of January 2015, FII inflows in equities totaled at th Rs.1825.90 crores ($296.89 million) as on 30 January 2015. Year to date basis, net capital inflows stood at Rs.1825.90 crores ($296.89 million) as th on 30 January 2015. Outlook From the intra-day perspective, Indian Rupee will trade sideways today owing to consistent FII inflows as the Coal India OFS got approximately USD 1 billion of bids from these accounts will be supportive. While on the other hand, weakness in Asian markets along with steady dollar will be negative for the currency. Source: Telequote Technical Outlook US Dollar/INR Jan’15 (NSE/MCX-SX) valid for February 2, 2015 Trend Support Resistance Up 62.1/62 62.4/62.5 www.angelbroking.com Currencies Daily Report Monday, February 02, 2015 Euro (% change) Euro/INR The Euro gained 0.7 percent last week as investors are hopeful that the left-wing Syriza party leader, Alexis Tsipras, is willing to negotiate, easing concern that a confrontation with its international creditors could lead Greece to leave the Euro. Also, Germany's Federal Statistics Office said the number of unemployed people declined for the fourth consecutive month in January and unemployment rate hit a record-low 6.5% in January, down from 6.6% in December, in line with expectations. However, strength in the DX after the Federal Reserve’s policy-making committee signaled it would keep interest rates near zero at least until June exerted pressure. The Euro touched a weekly high of 1.1422 and closed at 1.1286 on Friday. as on January 30, 2015 Last Prev. day WoW MoM YoY Euro /$ (Spot) 1.1286 -0.3 0.7 -6.7 -17.4 Euro / INR (Spot) Euro / INR Jan’15 Futures (NSE) Euro / INR Jan’15 Futures (MCX-SX) 69.99 -0.1 -1.7 8.2 22.2 70.5 0.27 2.3 -8.97 -17.62 70.5 0.23 2.2 -8.98 -17.60 Source: Reuters Technical Chart – Euro Euro zone’s CPI Flash Estimate fell by 0.6 percent in January as against a decline of 0.2 percent in December. French Consumer Spending jumped by 1.5 percent in December as compared to a rise of 0.2 percent in November. German Retail Sales rose by 0.2 percent in December as against a rise of 0.9 percent in November. Outlook The Euro will trade lower today owing to uncertainty regarding Greece exit from the Euro Zone. Also, estimates of mixed economic data from the Euro Zone will act as a negative factor. Technical Outlook valid for February 2, 2015 Trend Support Resistance Sideways 70.5/70.3 70.8/70.9 Euro/INR Jan’15 (NSE/MCX-SX) GBP/INR The Sterling Pound gained 0.5 percent last week as Bank of England policy maker Kristin Forbes said an improving global economy may trigger interest-rate increases sooner than investors expect. Source: Telequote GBP (% change) as on January 30, 2015 Last Prev. day WoW MoM YoY 1.5066 0.01 0.5 -3.3 -9.1 GBP / INR Jan’15 Futures (NSE) 93.77 -0.24 1.94 -5.20 -9.48 GBP / INR Jan’15 Futures (MCX-SX) 93.77 -0.31 1.92 -5.24 -9.51 $ / GBP (Spot) Source: Reuters Technical Chart – Sterling Pound However, expectations that the Bank of England is likely to keep rates lower until well into 2016 and the Fed could become the first major central bank to lift interest rates later this year. Also, mixed economic data from the nation acted as a negative factor. The currency touched a weekly low of 1.5222 and closed at 1.5066 on Friday. Outlook The Sterling Pound will trade on a sideways note today as gradual rate hike indication will exert pressure. While on the other hand, estimates of favourable manufacturing data will restrict shrp downside. Technical Outlook GBP/INR Dec’14 (NSE/MCX-SX) valid for February 2, 2015 Trend Support Resistance Sideways 93.6/93.4 93.9/94.1 Source: Telequote www.angelbroking.com Currencies Daily Report Monday, February 02, 2015 JPY/INR JPY (% change) The Japanese Yen appreciated by 0.3 percent in the last week after Japan’s economy minister said neither the government nor the central bank has committed to a strict schedule for achieving 2 percent inflation. Also, rising risk aversion in the markets after the Federal Reserve was surprisingly bullish on the US economy while reiterating its pledge to take a patient approach to raising rates supported gains. The Yen touched a weekly low of 118.81 and closed at 117.44 on Friday. as on January 30, 2015 JPY / $ (Spot) Last Prev day WoW MoM YoY 117.44 -0.69 -0.3 -1.9 14.1 52.87 0.18 1.65 -0.82 -13.93 52.87 0.18 1.69 -0.86 -13.96 JPY 100 / INR Jan’15 Futures (NSE) JPY 100 / INR Jan’15 Futures (MCX-SX) Source: Reuters Technical Chart – JPY Outlook The Japanese Yen will trade higher today as worries about the health of the Chinese economy triggered risk off sentiment. Also, weak GDP data from the US will spur safe haven demand, thereby supporting the currency. Technical Outlook valid for February 2, 2015 Trend Support Resistance Source: Telequote JPY/INR Jan’15 (NSE/MCX-SX) Sideways 52.7/52.6 53/53.1 Economic Indicators to be released on February 2, 2015 Indicator Country Time (IST) Actual Forecast Previous Impact HSBC Final Manufacturing PMI China 7:15am 49.7 49.8 49.8 High Spanish Unemployment Change Euro 1:30pm - -32.4 -64.4 High Spanish Manufacturing PMI Euro 1:45pm - 54.2 53.8 Medium Italian Manufacturing PMI Euro 2:15pm - 49.3 48.4 Medium Manufacturing PMI UK 3:00pm - 52.9 52.5 High Core PCE Price Index m/m US 7:00pm - 0.0% 0.0% Medium Personal Spending m/m US 7:00pm - -0.1% 0.6% Medium ISM Manufacturing PMI US 8:30pm - 54.9 55.5 High www.angelbroking.com

© Copyright 2026